An Agreement for Settlement of Debt is a legally binding document that outlines the terms under which a debtor agrees to pay off their outstanding debt, often at a reduced amount or within a specific timeframe. This agreement helps both parties avoid lengthy disputes or litigation by clearly defining payment obligations and conditions. It serves as proof of the negotiated resolution and protects the interests of both the creditor and debtor.

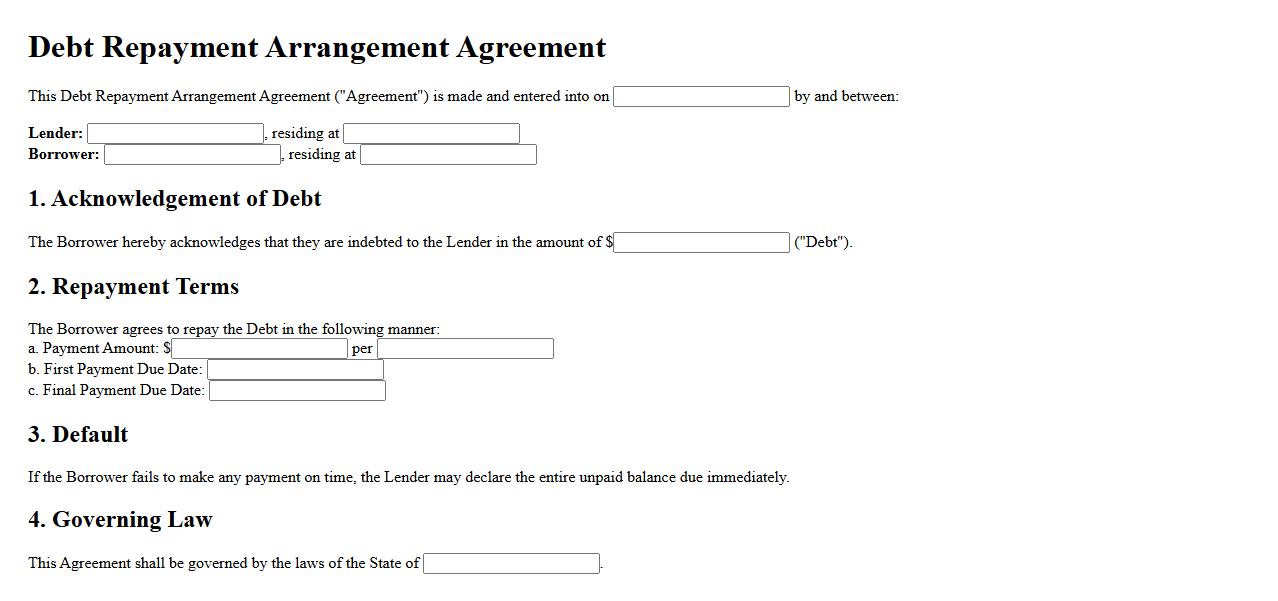

Debt Repayment Arrangement Agreement

A Debt Repayment Arrangement Agreement is a formal contract between a debtor and creditor outlining the terms for repaying outstanding debts. It specifies the payment schedule, amounts, and any interest or fees involved. This agreement helps both parties manage debt repayment in a structured and transparent manner.

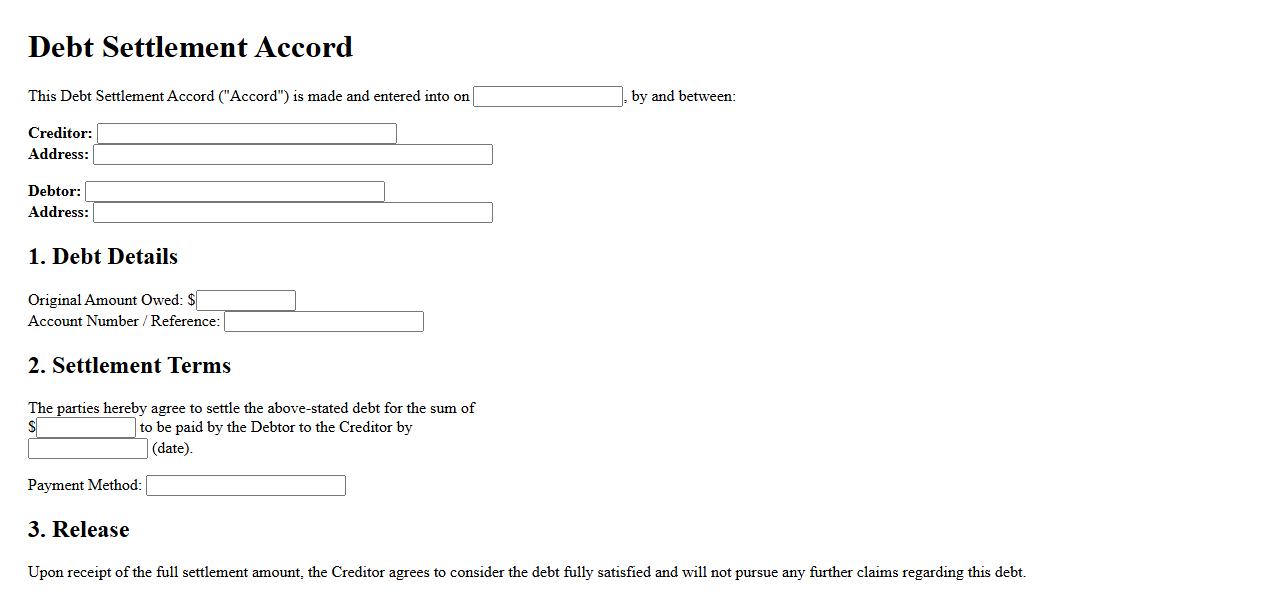

Debt Settlement Accord

The Debt Settlement Accord is a legally binding agreement between a debtor and creditor to reduce the total amount of debt owed. It provides a structured plan for debt repayment, often helping individuals avoid bankruptcy. This accord is designed to offer financial relief while satisfying creditor requirements.

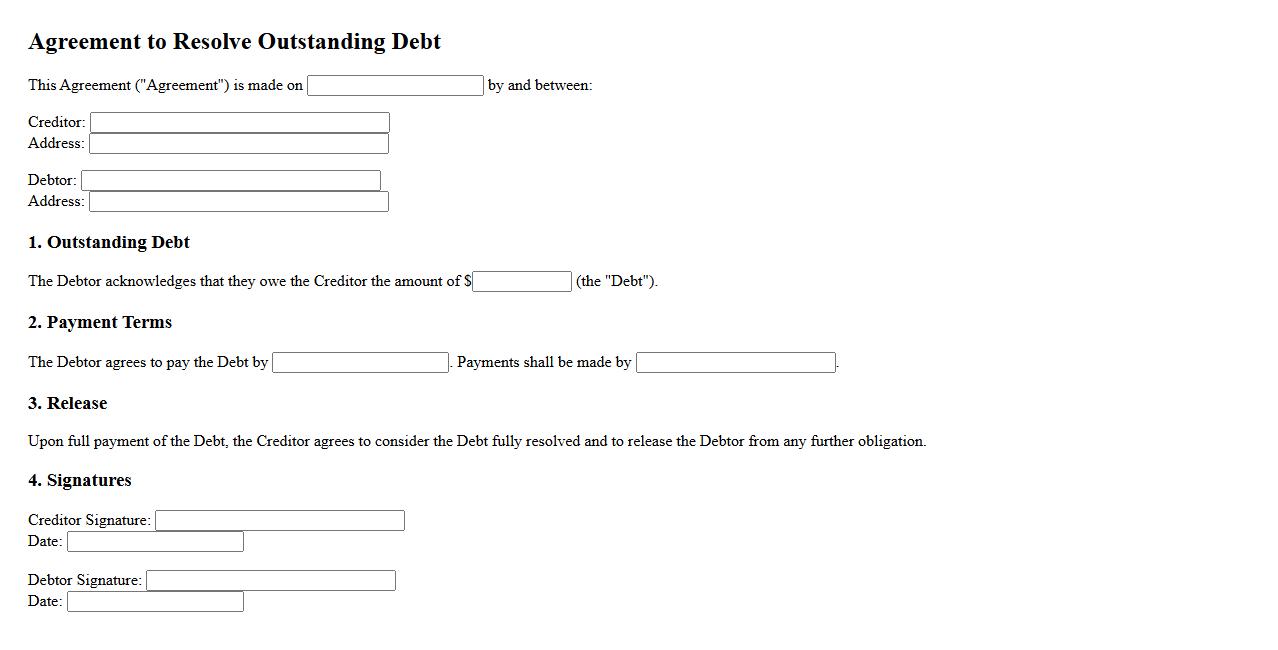

Agreement to Resolve Outstanding Debt

An Agreement to Resolve Outstanding Debt is a formal contract between a debtor and creditor outlining the terms for settling unpaid obligations. It specifies payment schedules, amounts, and conditions to clear the debt. This agreement helps avoid legal action and provides a clear resolution path for both parties.

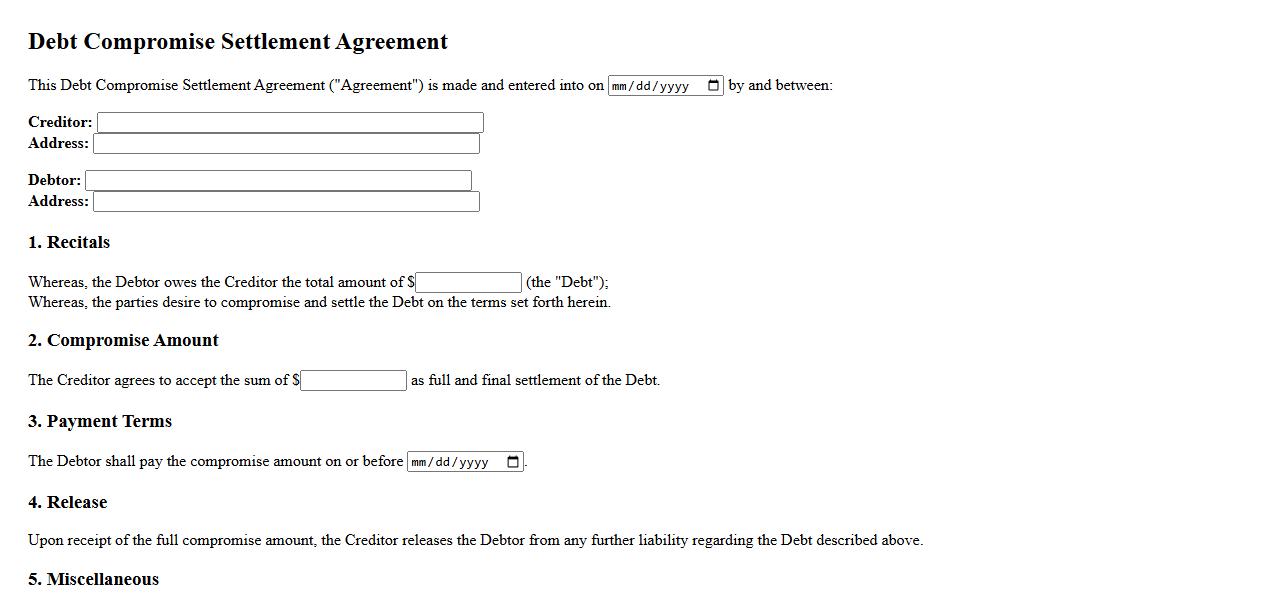

Debt Compromise Settlement Agreement

The Debt Compromise Settlement Agreement is a legally binding document that outlines the terms for resolving outstanding debts between a creditor and debtor. It typically includes agreements on reduced payment amounts, deadlines, and conditions for debt forgiveness. This agreement helps both parties avoid lengthy litigation and reach a mutually beneficial resolution.

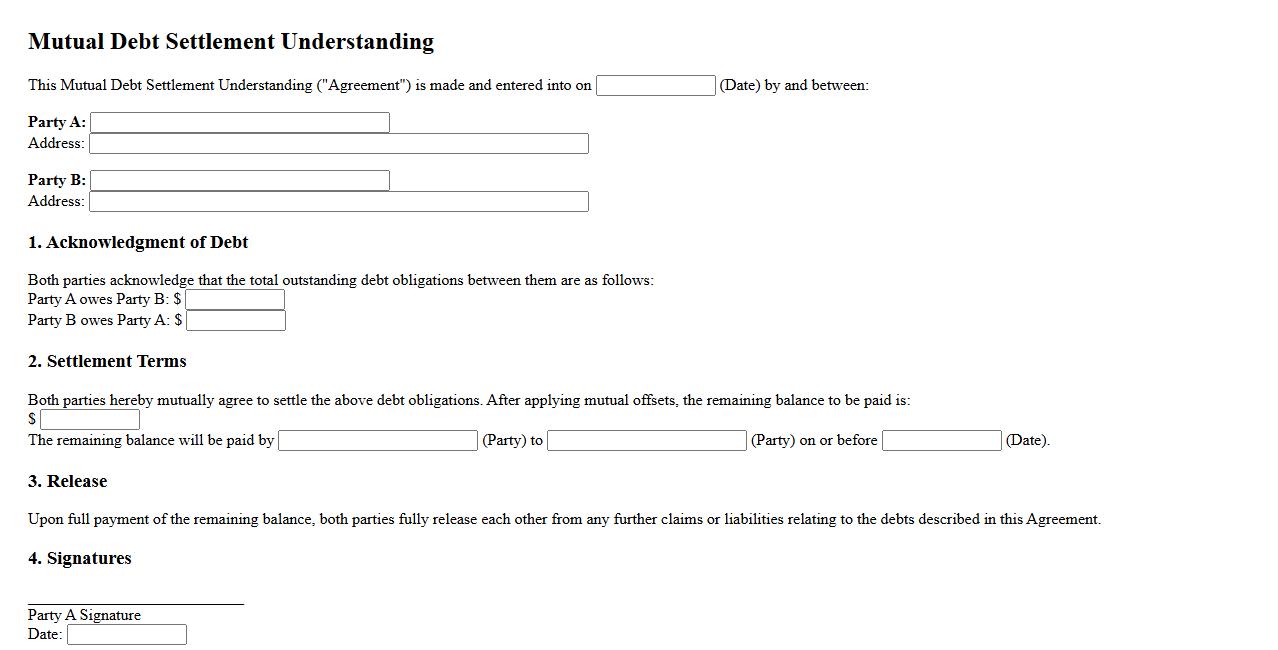

Mutual Debt Settlement Understanding

The Mutual Debt Settlement Understanding is an agreement between parties to resolve outstanding debts amicably. It outlines the terms and conditions for debt repayment, ensuring clarity and mutual consent. This understanding helps prevent disputes and promotes financial cooperation.

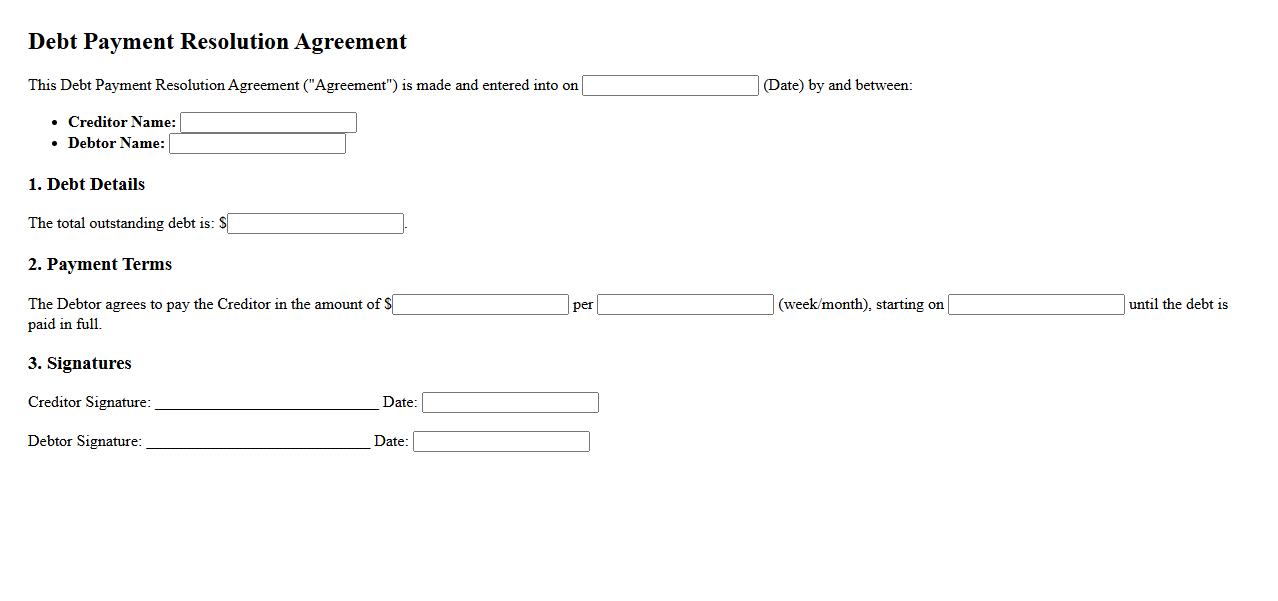

Debt Payment Resolution Agreement

The Debt Payment Resolution Agreement is a legally binding document that outlines the terms and conditions for settling outstanding debts between a debtor and creditor. It provides a clear repayment plan, helping both parties avoid lengthy litigation and financial uncertainty. This agreement ensures a structured approach to resolving debt efficiently and amicably.

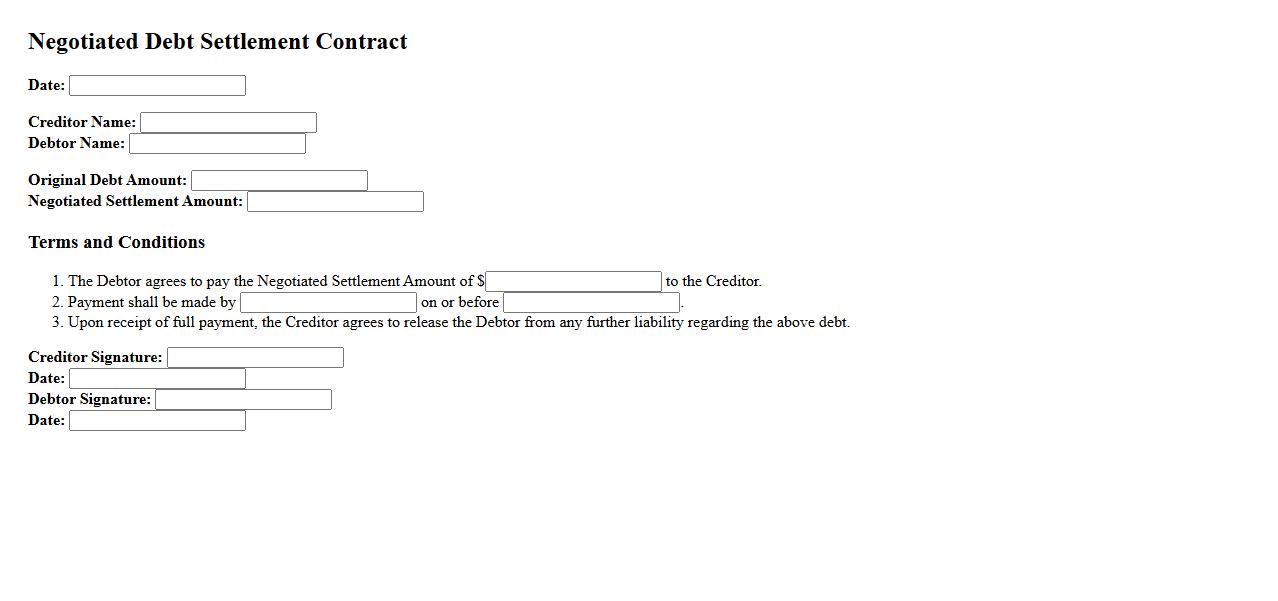

Negotiated Debt Settlement Contract

A Negotiated Debt Settlement Contract is a legally binding agreement between a debtor and creditor outlining terms to reduce the total debt owed. It details the settlement amount, payment schedule, and other conditions agreed upon to resolve the debt. This contract helps both parties avoid lengthy disputes and provides a clear path to financial resolution.

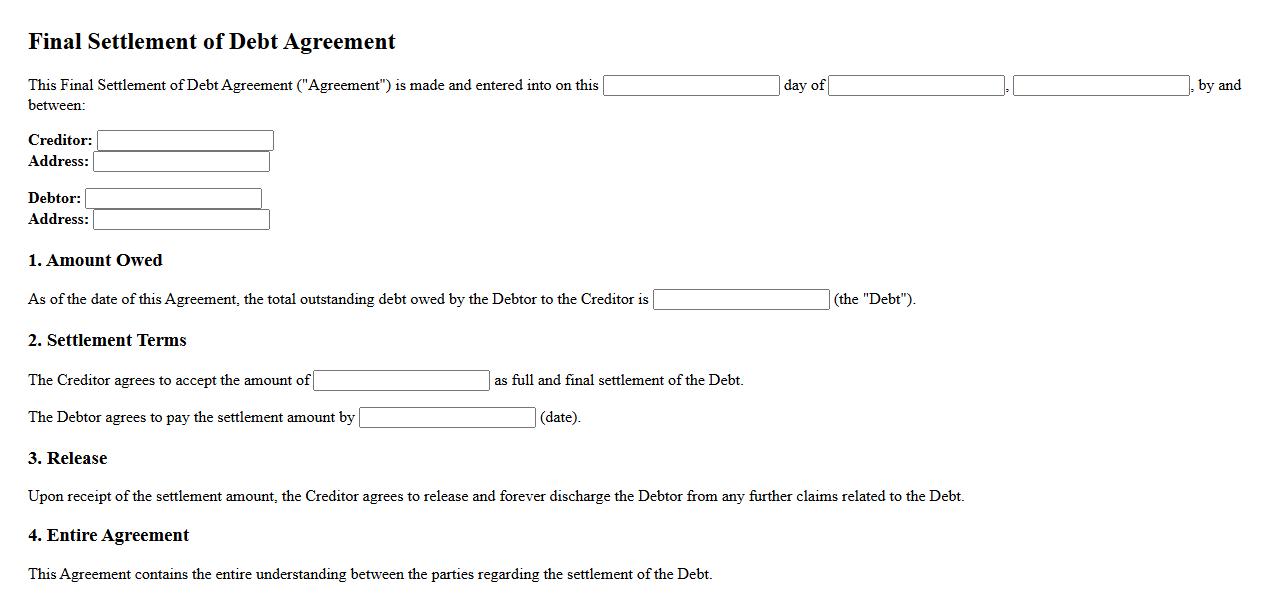

Final Settlement of Debt Agreement

The Final Settlement of Debt Agreement is a legally binding arrangement between a debtor and a creditor to resolve outstanding debts. It often involves negotiating reduced payment terms to satisfy the debt fully. This agreement ensures clarity and closure for both parties, avoiding future disputes.

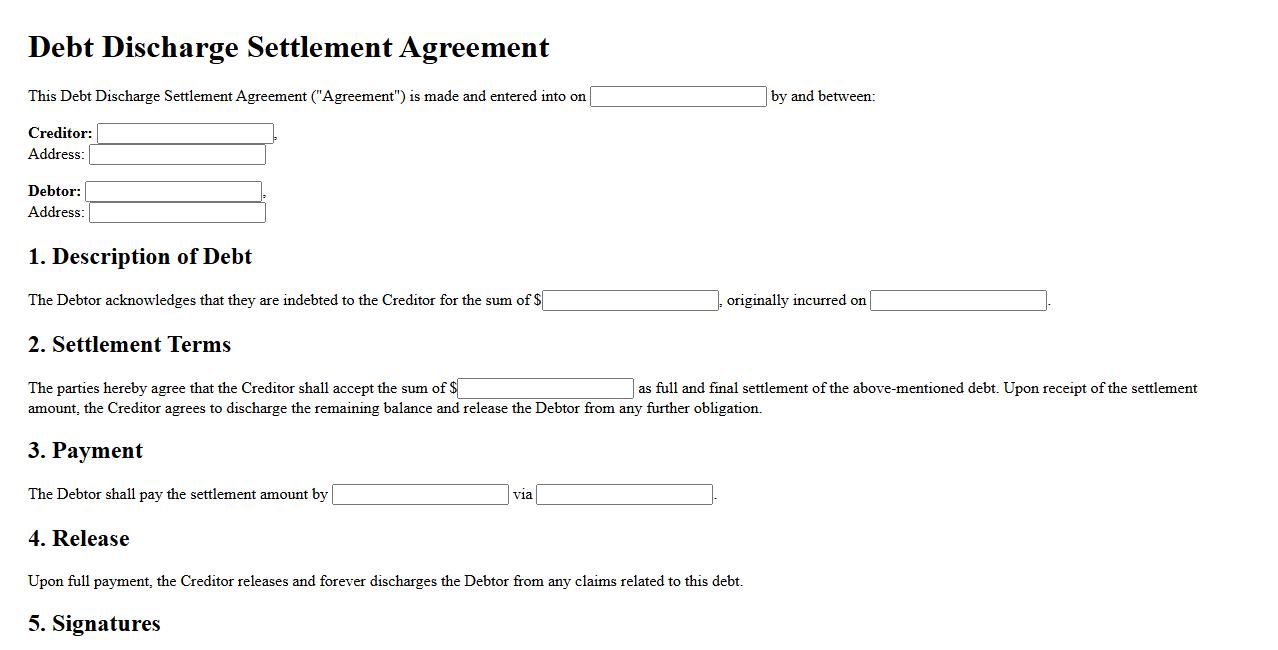

Debt Discharge Settlement Agreement

A Debt Discharge Settlement Agreement is a legally binding contract between a debtor and a creditor that outlines the terms for settling a debt for less than the full amount owed. This agreement helps both parties avoid lengthy litigation and provides a clear pathway to resolve outstanding financial obligations. It is crucial for individuals or businesses seeking to manage debt effectively and achieve financial relief.

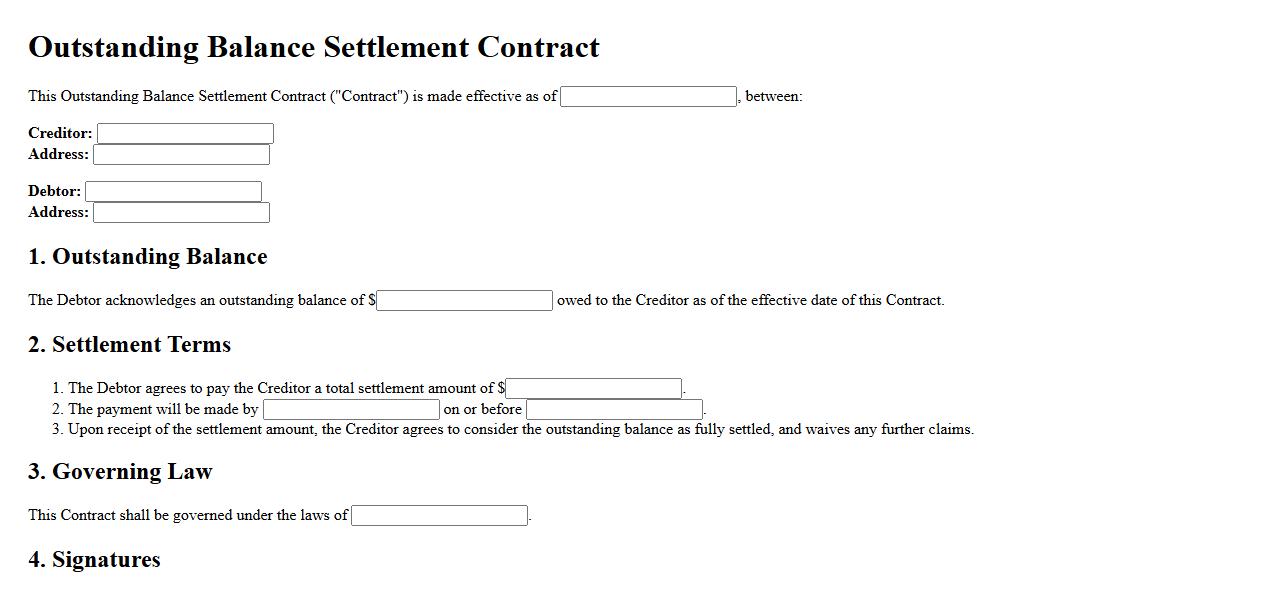

Outstanding Balance Settlement Contract

An Outstanding Balance Settlement Contract is a legal agreement between parties to resolve and finalize unpaid debts. It outlines the terms and conditions for payment, ensuring clear understanding and mutual consent. This contract helps avoid disputes by providing a structured settlement plan.

What are the essential parties involved in the Agreement for Settlement of Debt?

The essential parties in the Agreement for Settlement of Debt typically include the debtor and the creditor. The debtor is the individual or entity responsible for repaying the debt. The creditor is the party entitled to receive the repayment or settlement under the terms of the agreement.

What specific terms outline the amount and method of debt repayment?

The agreement should clearly define the amount of debt to be repaid or settled. It also specifies the method of repayment, such as lump sum payment, installments, or other agreed terms. Additionally, it includes the schedule or deadlines for payments to ensure compliance.

What conditions or events trigger a default under the agreement?

Default conditions are usually predefined events such as failure to make scheduled payments on time. Other triggers may include violation of any other material terms of the agreement. These conditions enable the creditor to pursue legal or contractual remedies upon default.

What legal remedies are available in case either party breaches the agreement?

The agreement often outlines specific legal remedies available, including the right to demand full repayment or claim damages. It may also allow for acceleration of debt or enforcement through litigation. These remedies protect parties' interests in the event of a breach.

How does the agreement address the waiver or modification of any original debt terms?

The agreement generally contains clauses related to the waiver or modification of original debt terms. It specifies that any changes must be in writing and mutually agreed upon by both parties. This ensures clarity and prevents unauthorized alterations to the settlement arrangement.