A Agreement for Purchase of Business is a legally binding contract that outlines the terms and conditions under which one party agrees to buy a business from another. It specifies critical details such as the purchase price, assets included, liabilities, and closing date. This agreement protects both buyer and seller by clearly defining each party's rights and responsibilities throughout the transaction.

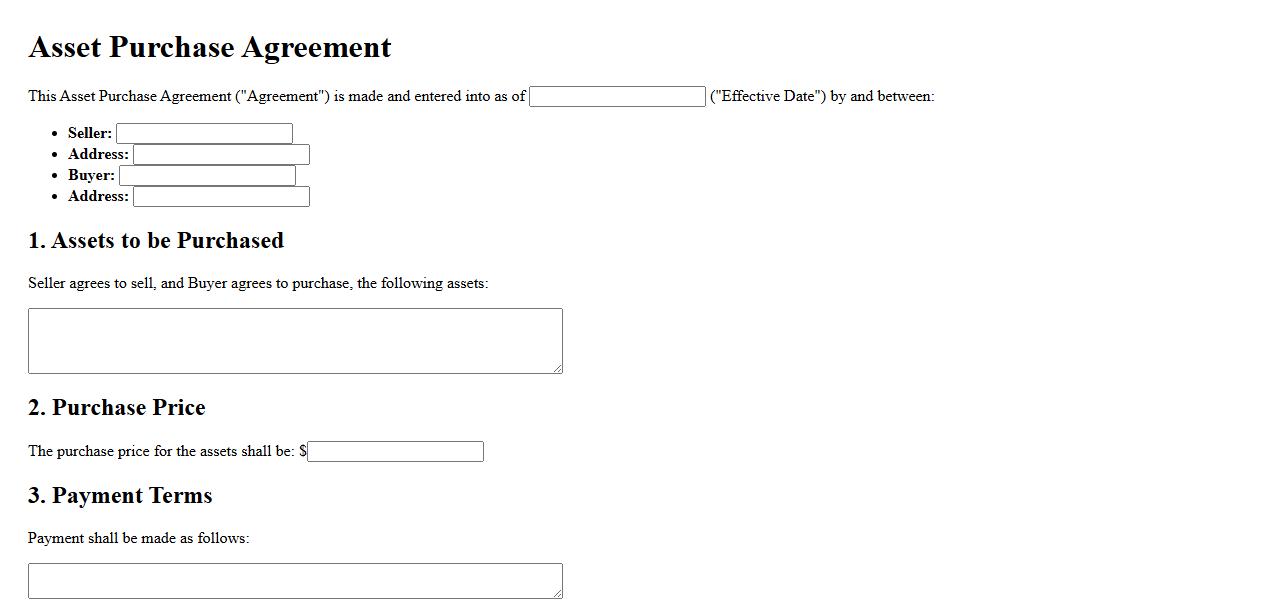

Asset Purchase Agreement

An Asset Purchase Agreement is a legal contract outlining the terms and conditions for the sale and transfer of assets from one party to another. It specifies the assets involved, purchase price, and any warranties or representations. This agreement is crucial for ensuring clear ownership and minimizing disputes during transactions.

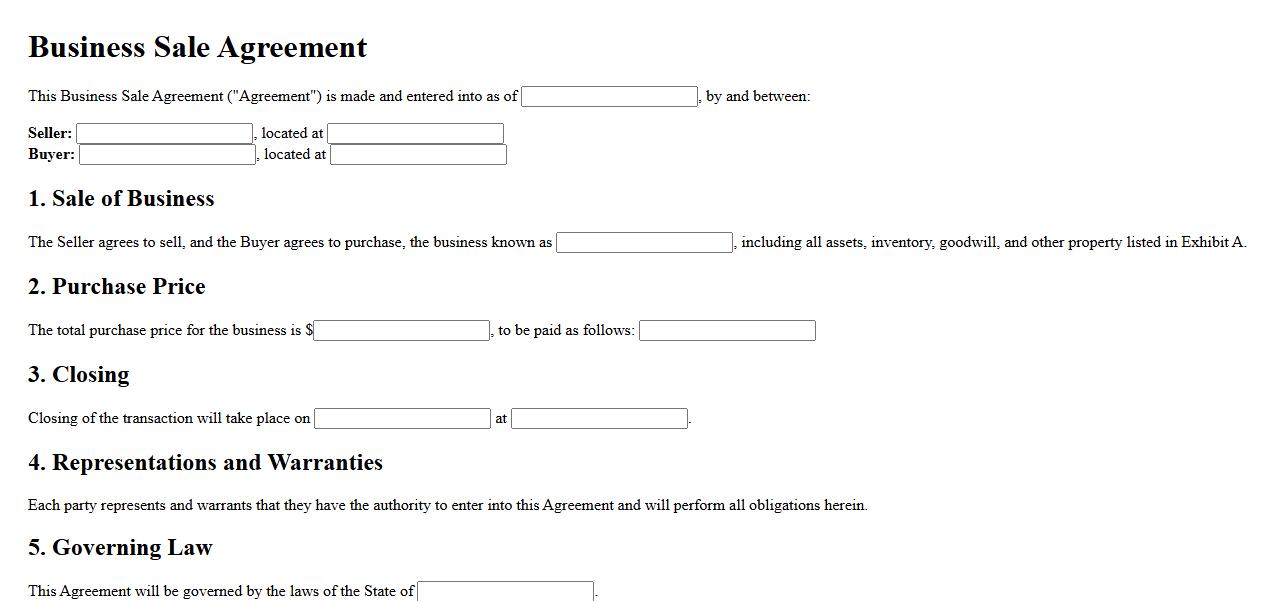

Business Sale Agreement

A Business Sale Agreement is a legally binding contract that outlines the terms and conditions for the transfer of ownership of a business. It ensures clear understanding between the buyer and seller regarding assets, liabilities, and payment details. This document protects both parties and facilitates a smooth transaction.

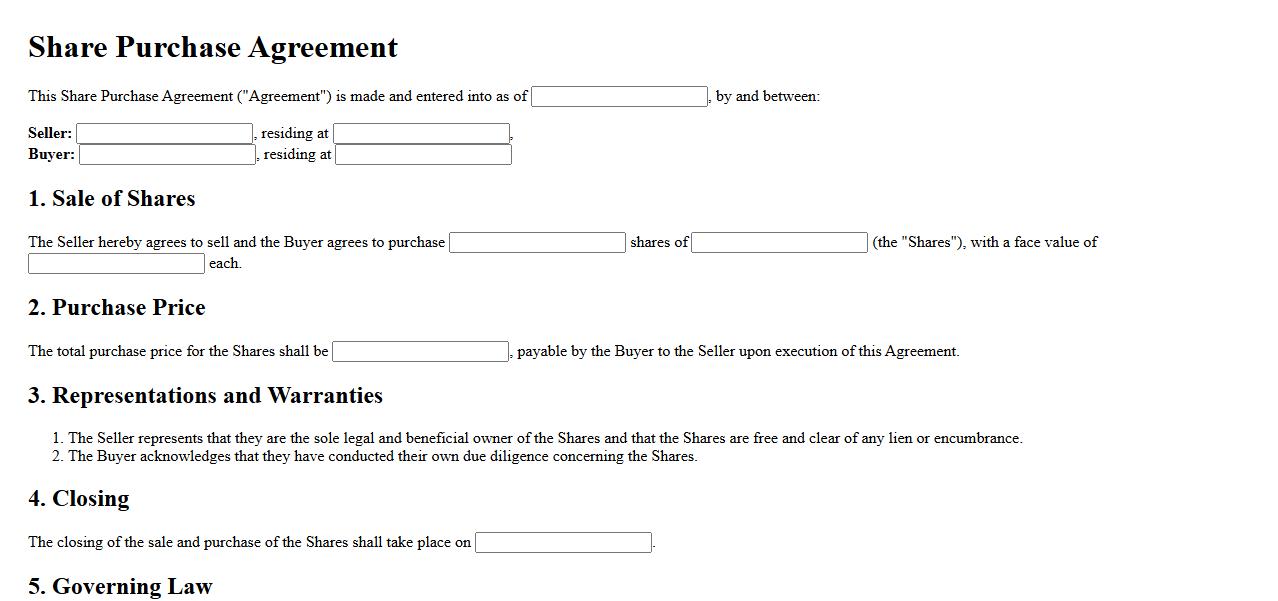

Share Purchase Agreement

A Share Purchase Agreement is a legally binding contract between a buyer and a seller outlining the terms and conditions for the transfer of shares in a company. This agreement specifies the purchase price, representations, warranties, and obligations of both parties. It ensures clarity and protection throughout the transaction process.

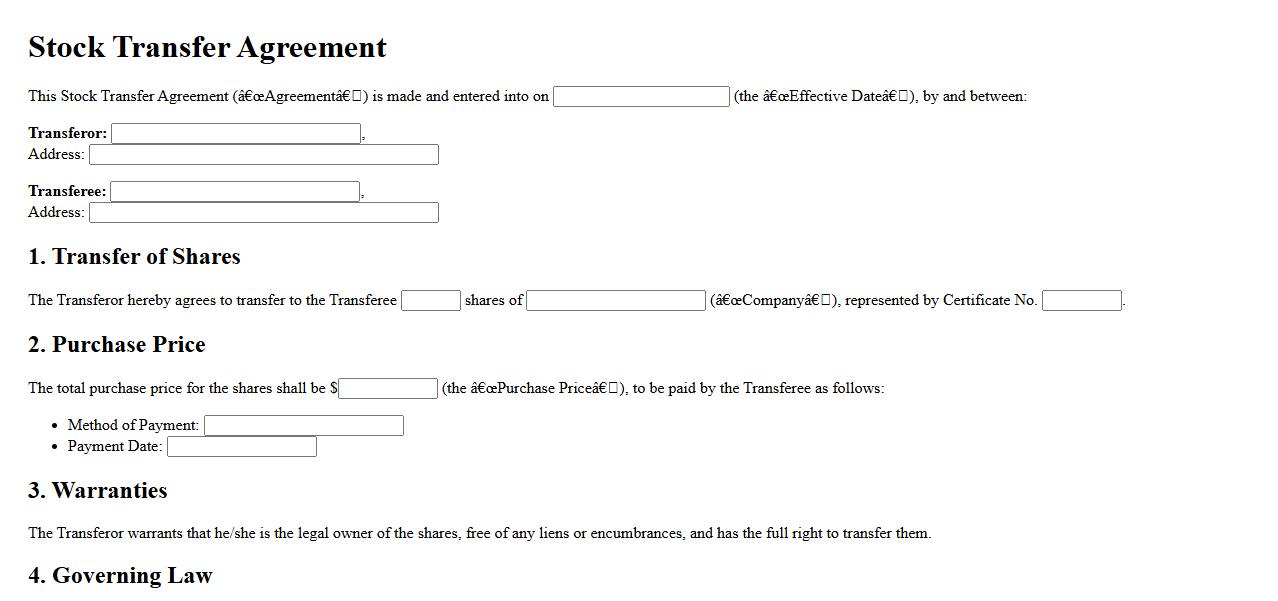

Stock Transfer Agreement

A Stock Transfer Agreement is a legal document that outlines the terms and conditions for transferring ownership of shares between parties. It ensures clarity and protection for both the seller and buyer during the transaction. This agreement helps prevent disputes by specifying the rights, obligations, and transfer process.

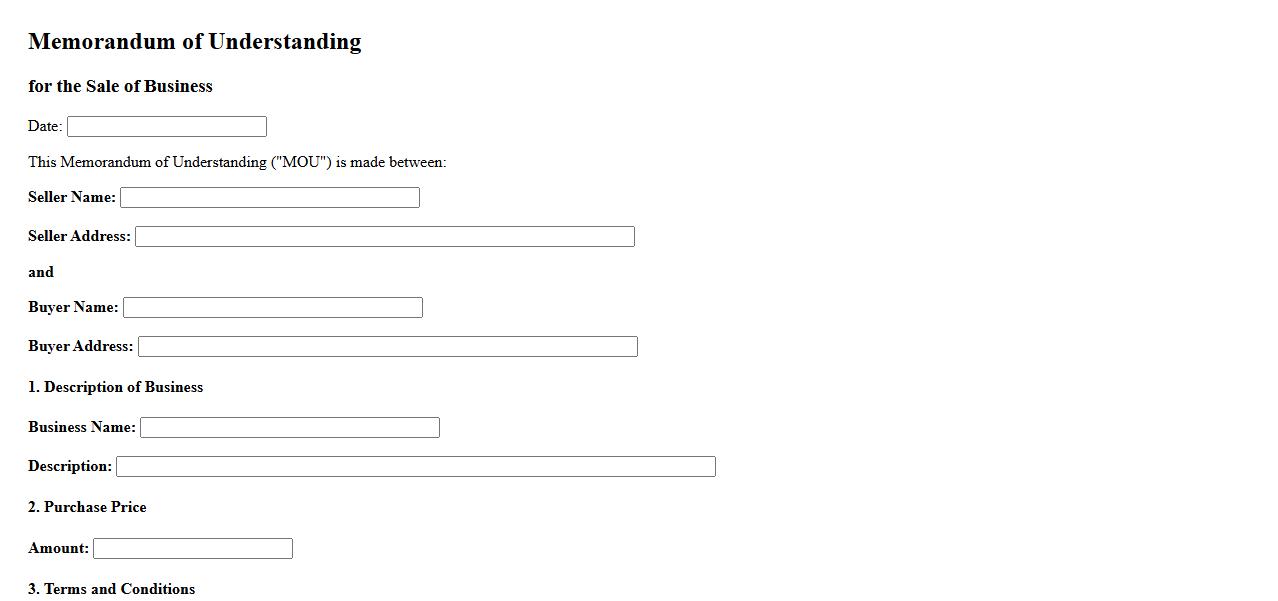

Memorandum of Understanding (Business Sale)

A Memorandum of Understanding (Business Sale) is a formal agreement outlining the preliminary terms between buyer and seller. It serves as a foundation for negotiation, ensuring both parties agree on key aspects before final contracts. This document helps prevent misunderstandings during the business sale process.

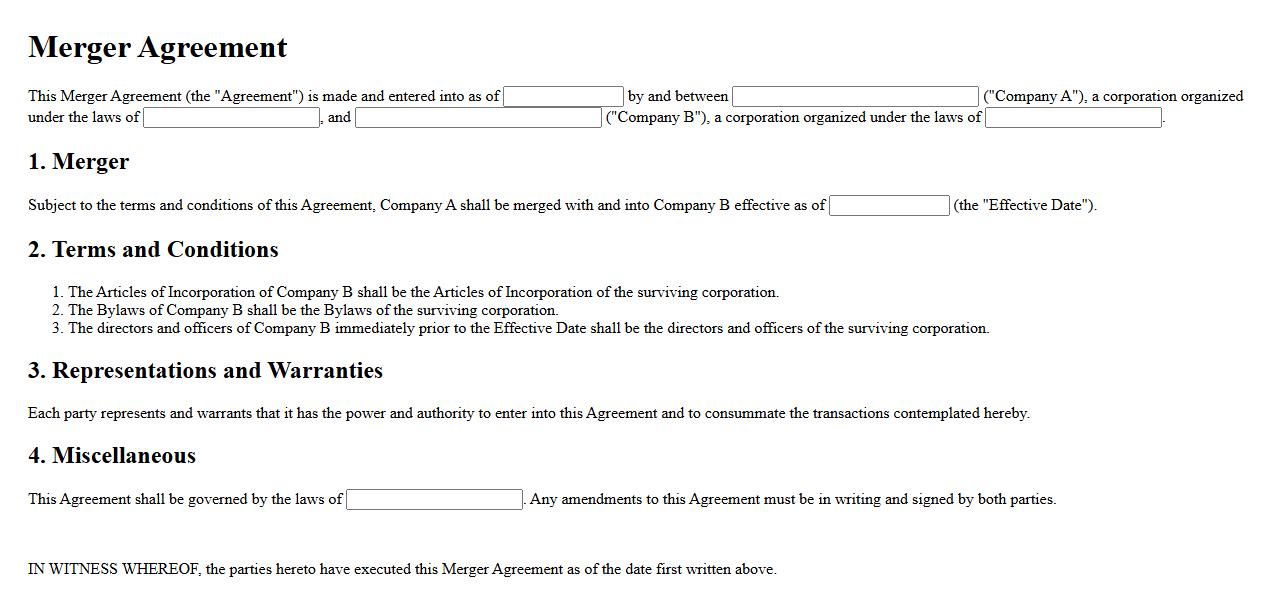

Merger Agreement

A Merger Agreement is a legally binding contract outlining the terms and conditions under which two companies agree to combine their assets and operations. It specifies the roles, responsibilities, and financial arrangements for both parties during the merger process. This document ensures clarity and protection for all stakeholders involved.

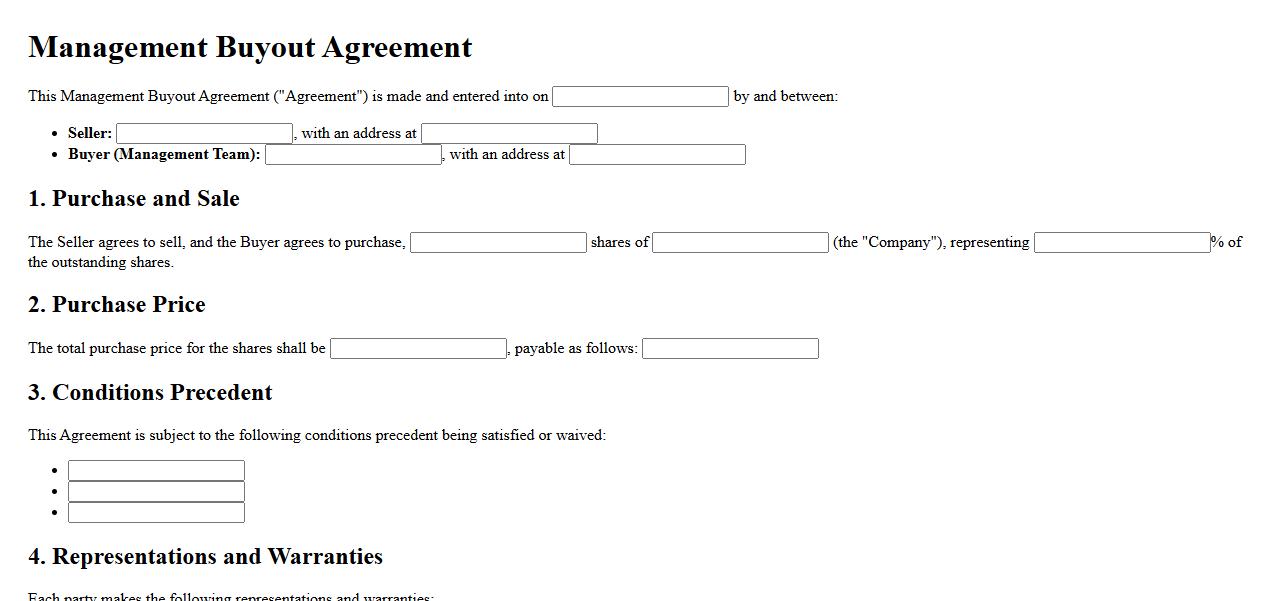

Management Buyout Agreement

A Management Buyout Agreement is a legal contract between a company's management team and the current owners, outlining the terms for the managers to purchase the business. This agreement details the sale price, financing arrangements, and responsibilities of both parties. It ensures a smooth transition of ownership while protecting the interests of all stakeholders involved.

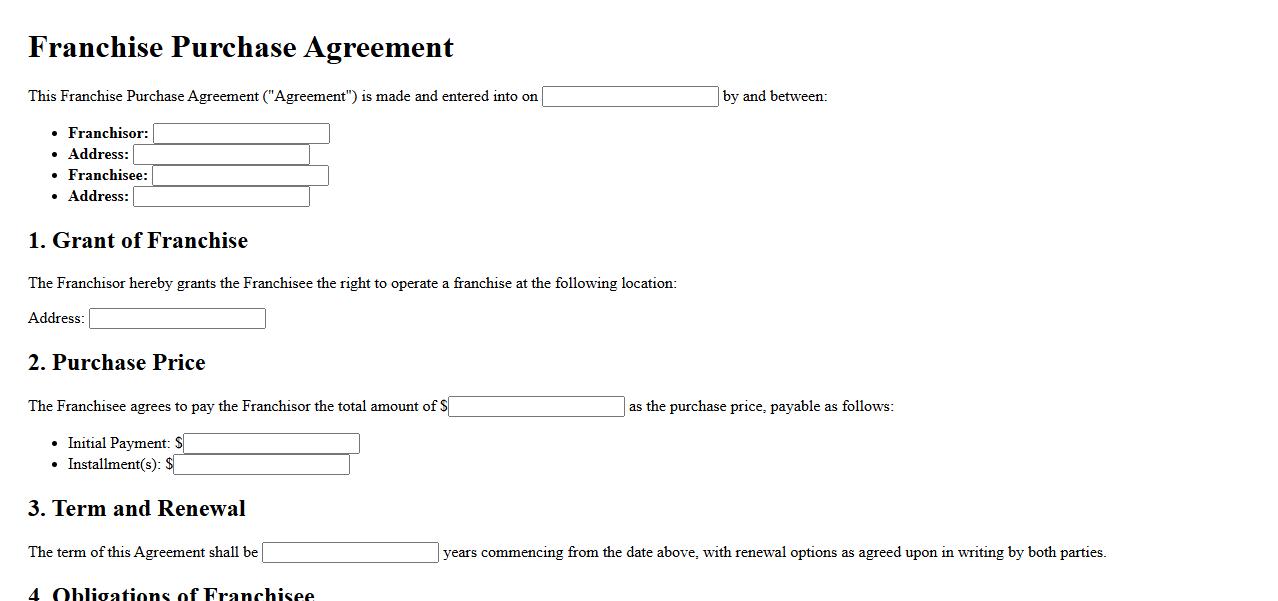

Franchise Purchase Agreement

A Franchise Purchase Agreement is a legally binding contract between a franchisor and a franchisee outlining the terms of purchasing a franchise. It details the rights and obligations of both parties, including fees, duration, and operational guidelines. This agreement ensures clarity and protection for both sides throughout the franchise relationship.

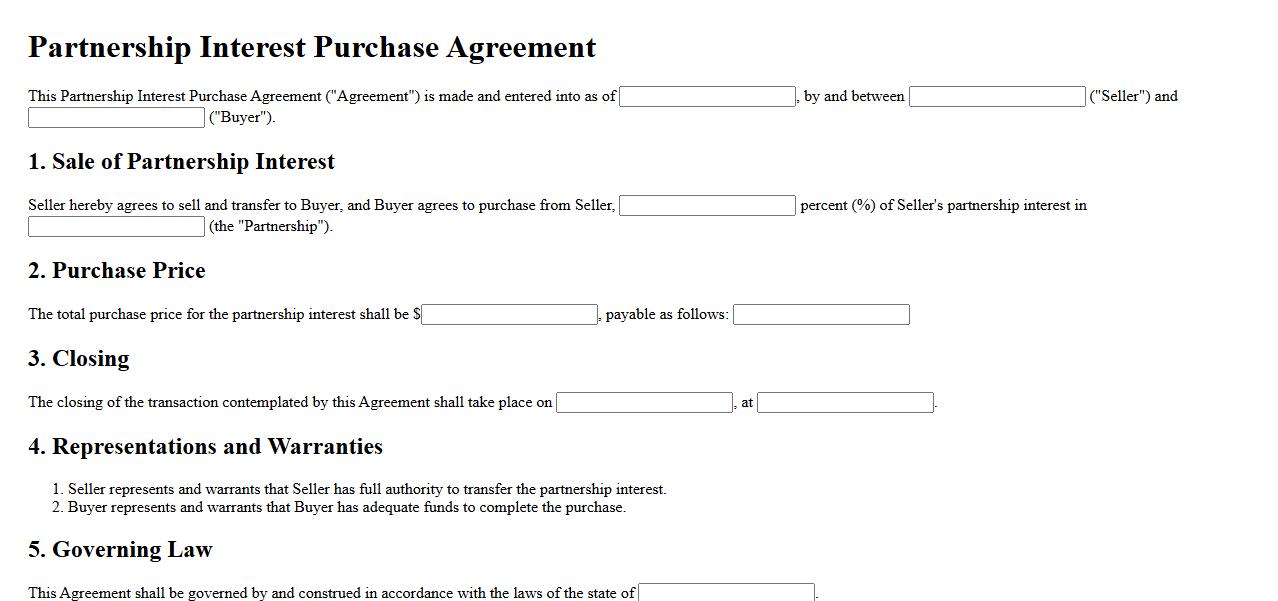

Partnership Interest Purchase Agreement

The Partnership Interest Purchase Agreement is a legal document that outlines the terms and conditions for the transfer of ownership interest between partners. It ensures clarity on the rights, responsibilities, and obligations of both the buyer and seller during the transaction. This agreement protects all parties involved by detailing the sale price, payment terms, and any relevant contingencies.

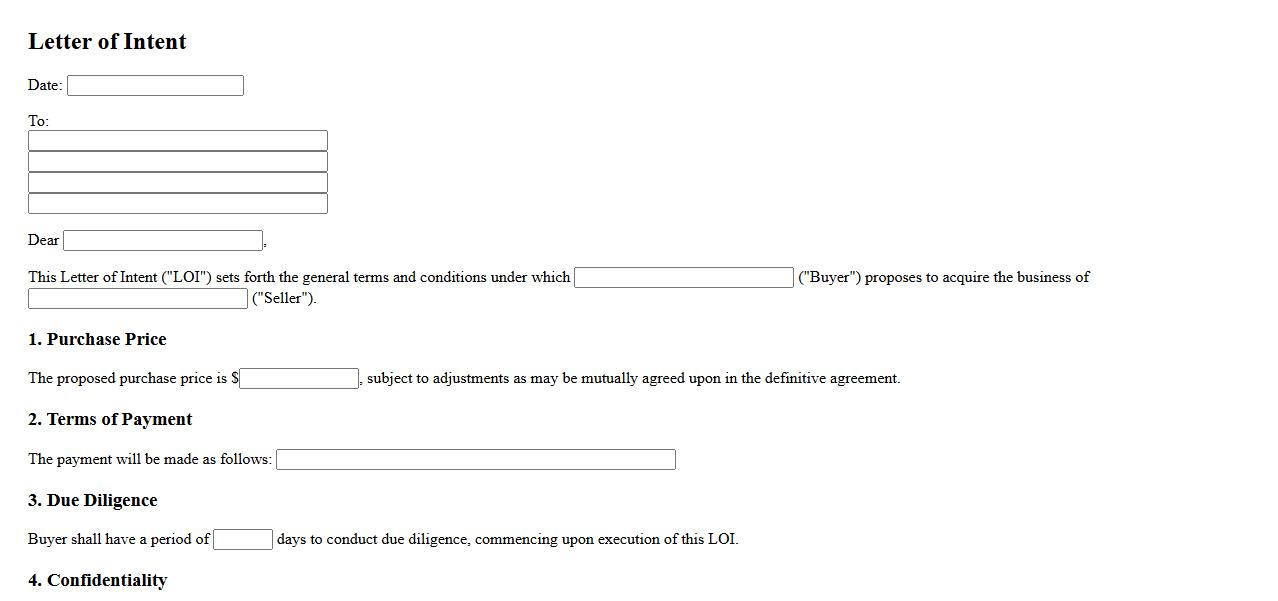

Letter of Intent (Business Acquisition)

A Letter of Intent for Business Acquisition is a preliminary document outlining the key terms and conditions agreed upon by the buyer and seller before finalizing a deal. It sets the framework for negotiations and due diligence while expressing the intent to proceed with the transaction. This letter helps establish mutual understanding and commitment during the acquisition process.

Defined Terms and Parties Involved in the Agreement for Purchase of Business

The Agreement for Purchase of Business specifies key terms such as "Buyer," "Seller," "Business," and "Closing Date" to ensure clarity. The parties involved typically include the legal entities or individuals engaging in the transfer of ownership. Clear identification of these parties and terms is crucial for legally binding commitments.

Specific Assets and Liabilities Included or Excluded

The agreement explicitly lists assets to be purchased, such as equipment, inventory, and intellectual property. It also identifies liabilities that will be assumed by the buyer and exclusions such as outstanding debts or undesired contracts. This precision helps prevent disputes by defining the scope of the transaction.

Payment Terms, Purchase Price, and Method of Payment

The purchase price is clearly stated and may include adjustments based on operational metrics or due diligence findings. Payment terms cover timing, whether upfront, installments, or escrow arrangements. Specifying the method of payment, such as wire transfer or certified check, ensures transactional clarity.

Representations, Warranties, and Indemnifications Required

Both buyer and seller provide representations and warranties attesting to the accuracy of information and legal authority to enter the agreement. Indemnifications protect each party from potential losses arising from breaches or undisclosed liabilities. These clauses establish mutual trust and risk allocation in the transaction.

Conditions, Timelines, and Procedures for Closing and Termination

The agreement outlines specific conditions precedent that must be met before closing, including regulatory approvals or financing. It also defines the timeline for closing and steps required to finalize the sale. Provisions for termination address possible breaches or failure to meet conditions, safeguarding both parties' interests.