An Agreement for Personal Loan is a legally binding document outlining the terms and conditions between the lender and borrower. It specifies the loan amount, interest rate, repayment schedule, and any penalties for default. This agreement ensures clarity and protects both parties' rights throughout the loan tenure.

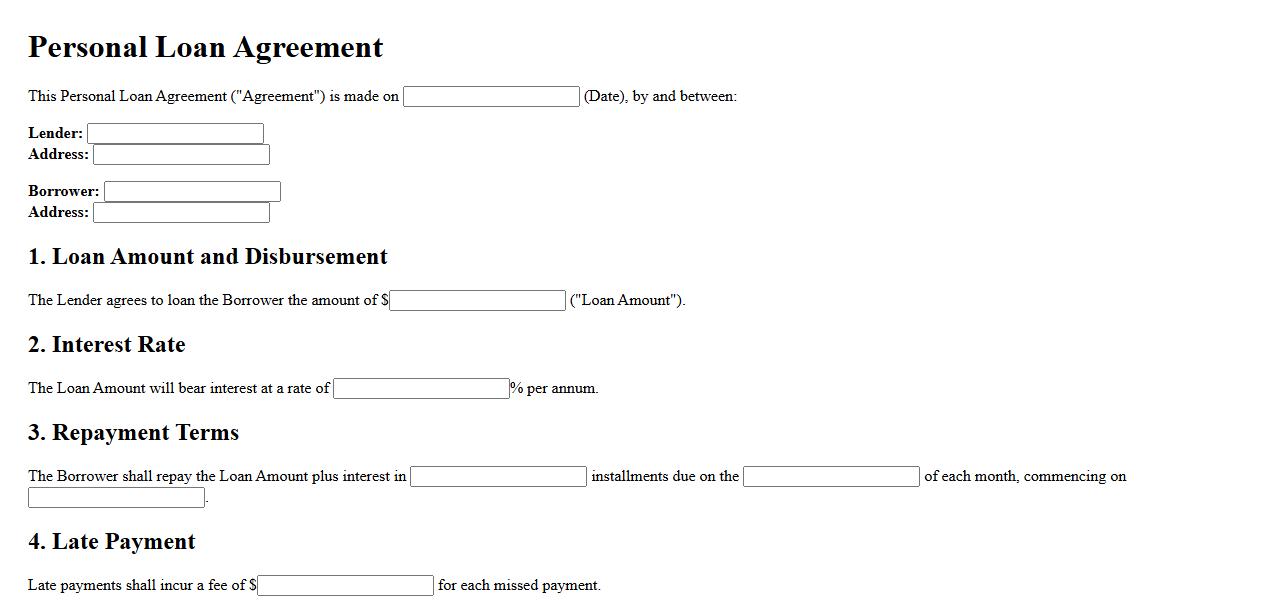

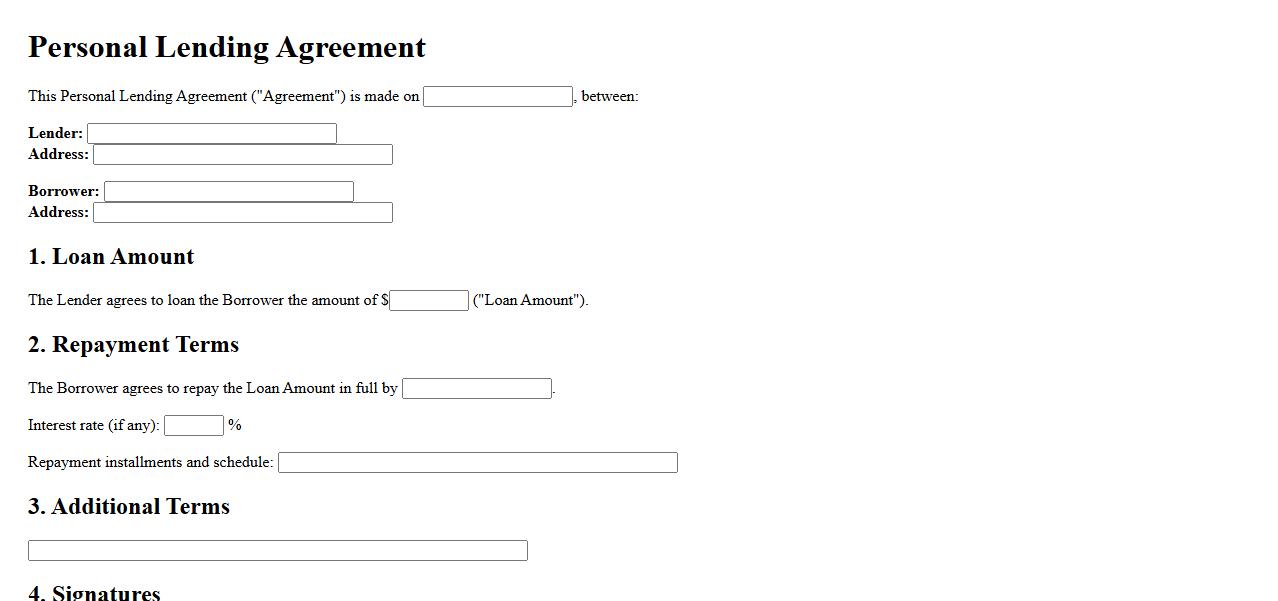

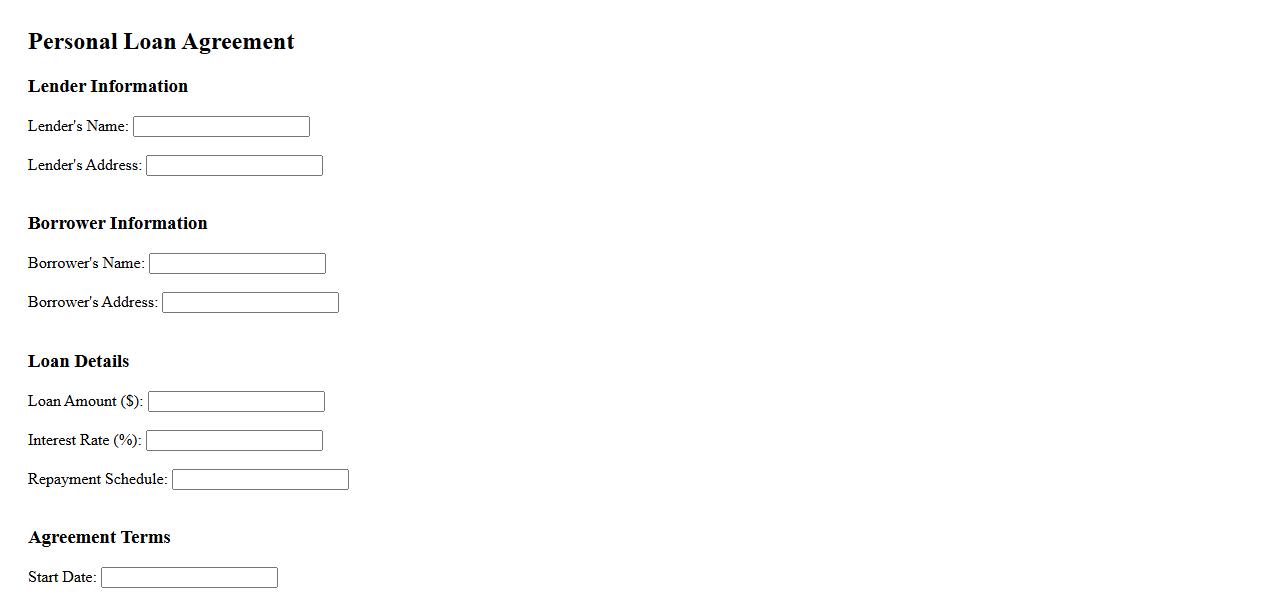

Personal Loan Agreement Template

A Personal Loan Agreement Template is a useful document that clearly outlines the terms and conditions between a lender and borrower. It helps protect both parties by specifying the loan amount, interest rate, repayment schedule, and any other important details. Using this template ensures a smooth and transparent lending process.

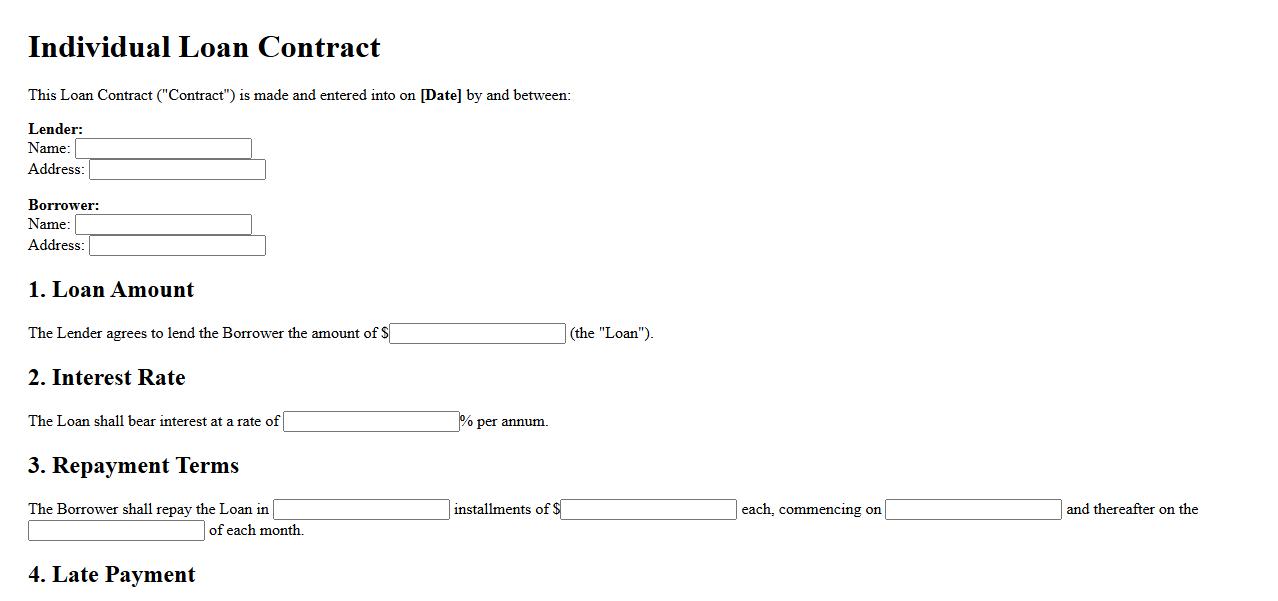

Individual Loan Contract Sample

An Individual Loan Contract Sample serves as a formal agreement between a lender and borrower, outlining the terms and conditions of the loan. It clearly specifies the loan amount, interest rate, repayment schedule, and any penalties for default. This document is essential for ensuring transparency and protecting the rights of both parties involved.

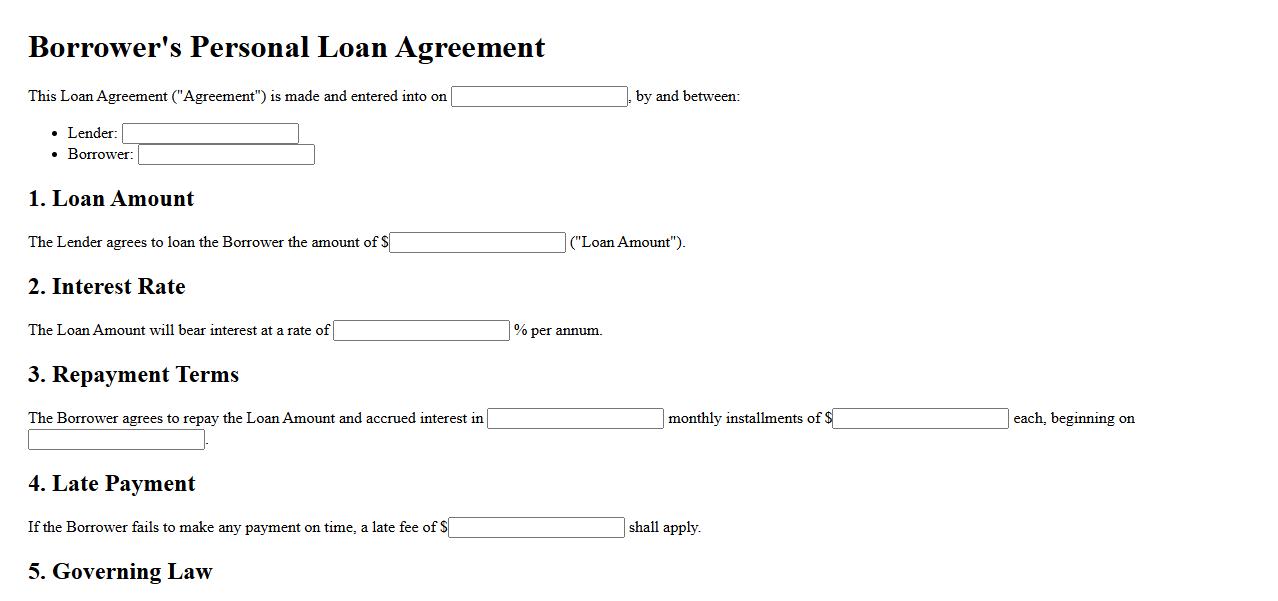

Borrower's Personal Loan Agreement

A Borrower's Personal Loan Agreement is a legal document outlining the terms and conditions between the borrower and lender. It specifies the loan amount, interest rate, repayment schedule, and responsibilities of both parties. This agreement protects the rights of both sides and ensures clarity throughout the loan process.

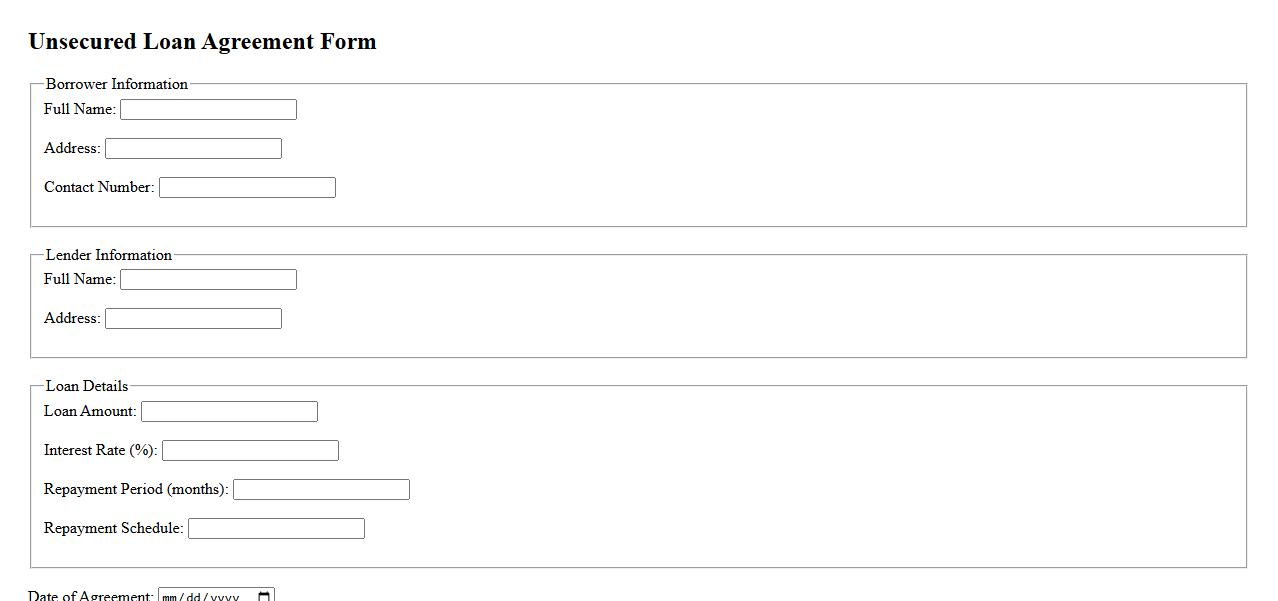

Unsecured Loan Agreement Form

An Unsecured Loan Agreement Form is a legal document outlining the terms and conditions between a lender and borrower without requiring collateral. It clearly specifies the loan amount, repayment schedule, and interest rate to protect both parties. This form ensures transparency and helps avoid disputes during the loan tenure.

Personal Lending Agreement Example

A Personal Lending Agreement Example provides a clear template outlining the terms and conditions between a lender and a borrower. It ensures both parties understand their obligations, including repayment schedules and interest rates. Using a well-structured example helps prevent disputes and promotes transparency in personal loans.

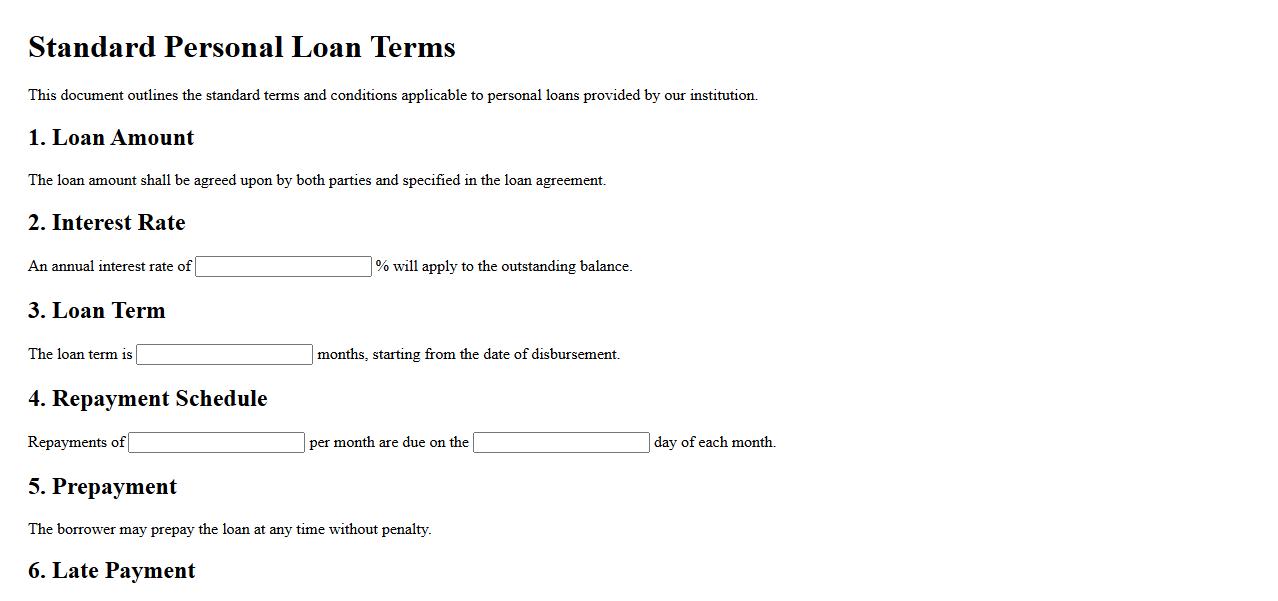

Standard Personal Loan Terms

Standard personal loan terms typically include fixed interest rates and repayment periods ranging from one to five years. Borrowers benefit from predictable monthly payments, making budgeting easier. Understanding these personal loan terms is essential for managing debt effectively.

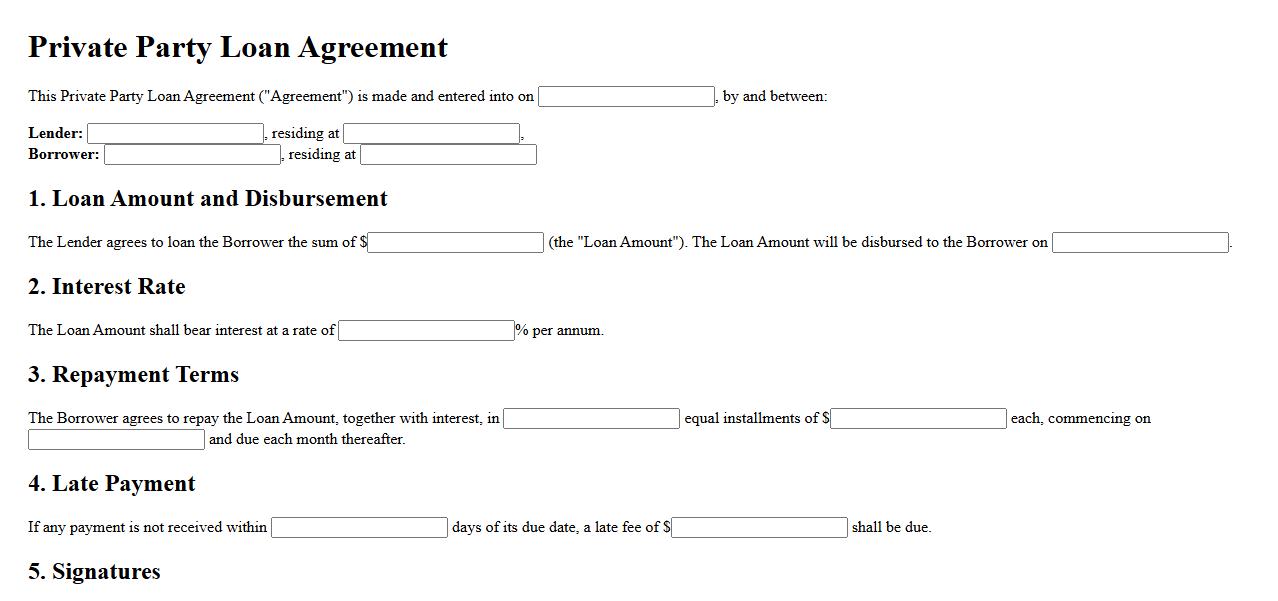

Private Party Loan Agreement

A Private Party Loan Agreement is a legally binding document between two individuals for lending money without involving financial institutions. It clearly outlines the terms, repayment schedule, and interest rate, ensuring transparency and protecting both parties. This agreement helps prevent disputes by documenting the loan conditions in writing.

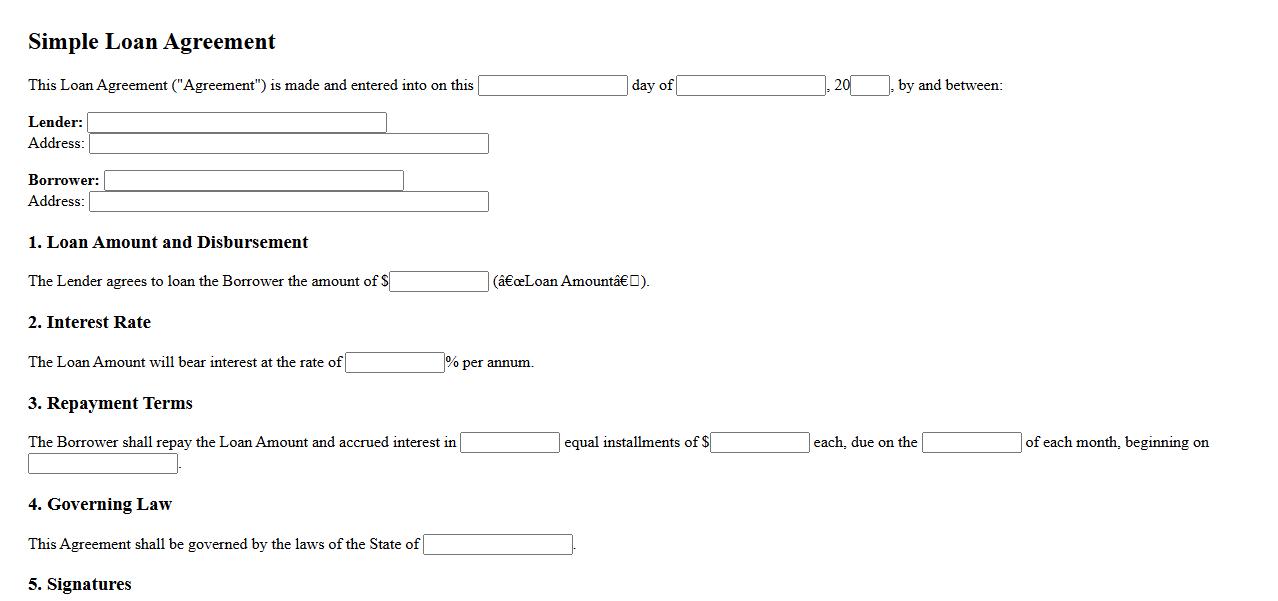

Simple Loan Agreement for Individuals

A Simple Loan Agreement for Individuals is a straightforward contract that outlines the terms between a lender and borrower. It clearly states the loan amount, repayment schedule, and any interest applied to ensure mutual understanding. This agreement helps protect both parties by providing written evidence of the loan arrangement.

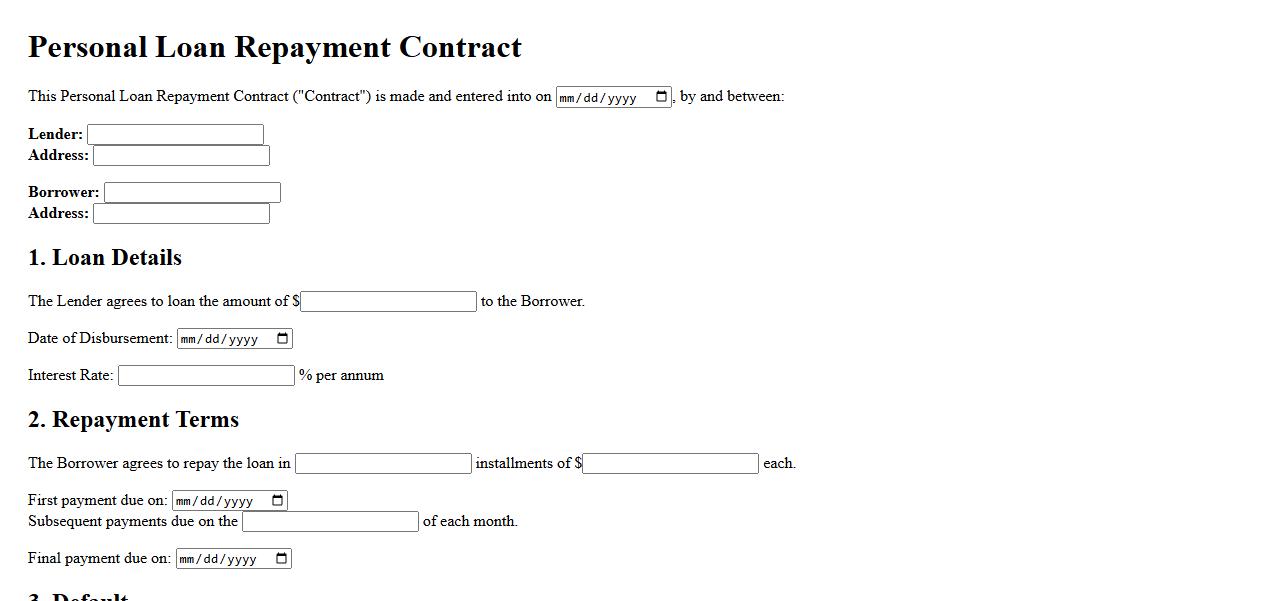

Personal Loan Repayment Contract

A Personal Loan Repayment Contract is a legally binding agreement that outlines the terms and conditions for repaying a borrowed sum. It specifies the repayment schedule, interest rates, and consequences of default. This document protects both the lender and borrower by clearly defining their obligations.

Customizable Personal Loan Agreement

A Customizable Personal Loan Agreement provides a flexible and clear contract tailored to individual borrowing and lending needs. It outlines terms such as loan amount, interest rate, repayment schedule, and obligations of both parties. This agreement ensures mutual understanding and legal protection throughout the loan process.

Main Obligations of the Borrower under the Personal Loan Agreement

The borrower is primarily obligated to repay the loan amount according to the specified terms. They must also adhere to all repayment schedules and notify the lender of any changes in their financial situation. Additionally, the borrower must comply with any reporting requirements outlined in the agreement.

Terms Specifying the Interest Rate and Repayment Schedule

The agreement clearly states the interest rate applicable to the loan, including whether it is fixed or variable. It also details the repayment schedule, including payment frequency and amounts. These terms ensure transparency and clarity on the financial obligations of the borrower.

Events Constituting a Default According to the Loan Agreement

Default events typically include failure to make timely payments as outlined in the agreement. Other defaults may involve breach of loan covenants or insolvency of the borrower. Recognizing these events is crucial for both parties to understand their rights and obligations.

Addressing Collateral or Security Requirements in the Agreement

The agreement may require the borrower to provide collateral as security for the loan. It specifies the type, value, and conditions related to the security interest. This provides protection for the lender by reducing the risk of non-repayment.

Legal Remedies Available to the Lender in Case of Non-Payment

In instances of non-payment, the lender is entitled to enforce legal remedies such as acceleration of the loan and foreclosure on collateral. The agreement also permits pursuing legal action to recover owed amounts. These measures ensure the lender's interests are safeguarded.