An Agreement for Debt Acknowledgment is a legal document in which a debtor formally admits the existence of a debt and agrees to the repayment terms. This agreement helps protect the creditor's rights by providing clear evidence of the debt and the debtor's commitment to repay. It often includes details such as the amount owed, payment schedule, and consequences of default.

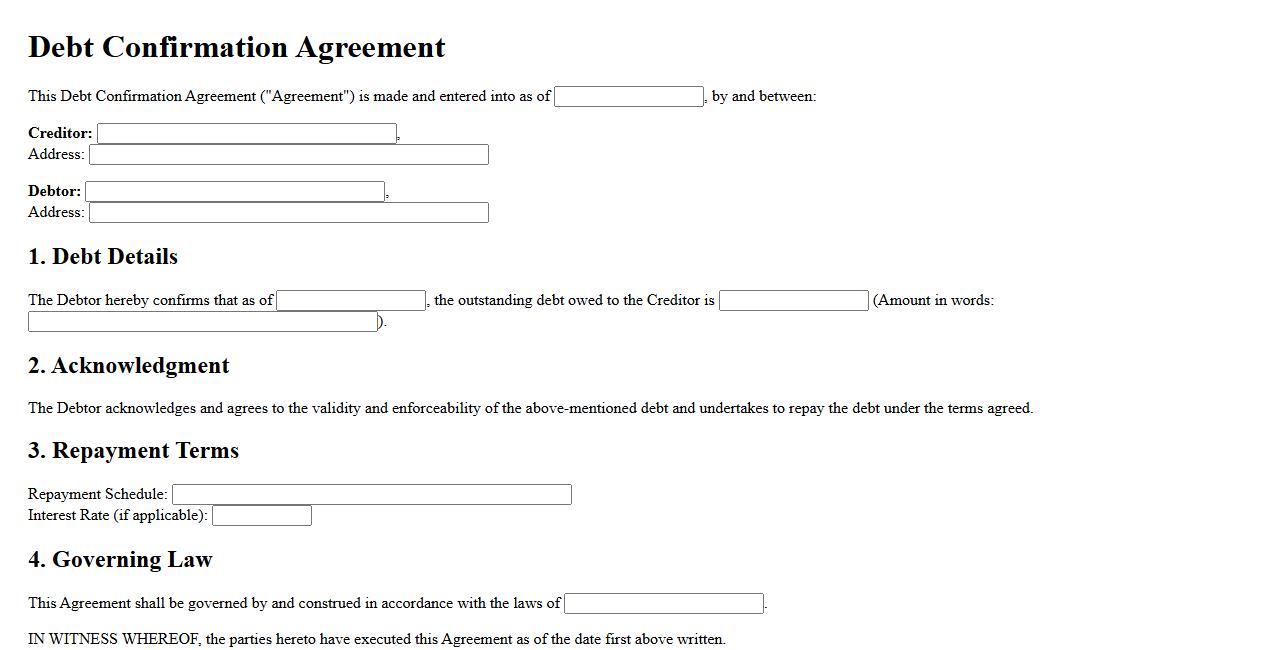

Debt Confirmation Agreement

A Debt Confirmation Agreement is a legal document that verifies the terms and existence of a debt between parties. It serves to prevent disputes by clearly outlining the amount owed, repayment schedule, and obligations. This agreement provides both creditor and debtor with documented assurance of the debt arrangement.

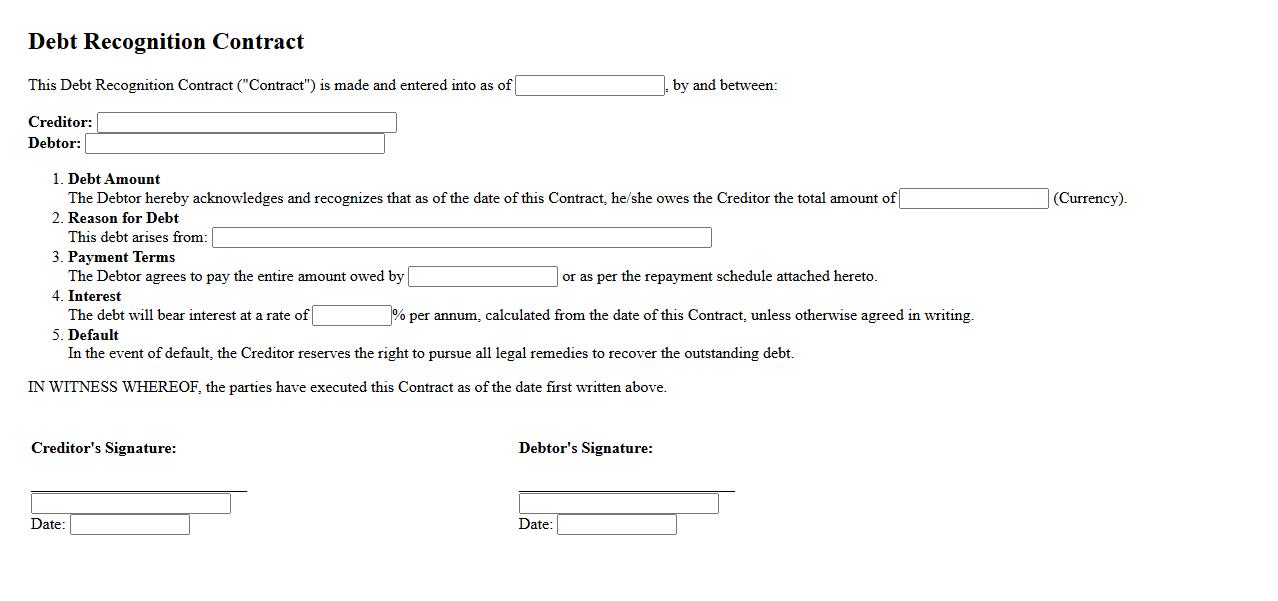

Debt Recognition Contract

A Debt Recognition Contract is a legal agreement where a debtor formally acknowledges their obligation to repay a specified debt. It serves as evidence of the debt's existence and the terms agreed upon by both parties. This contract helps prevent disputes and ensures clear communication regarding repayment responsibilities.

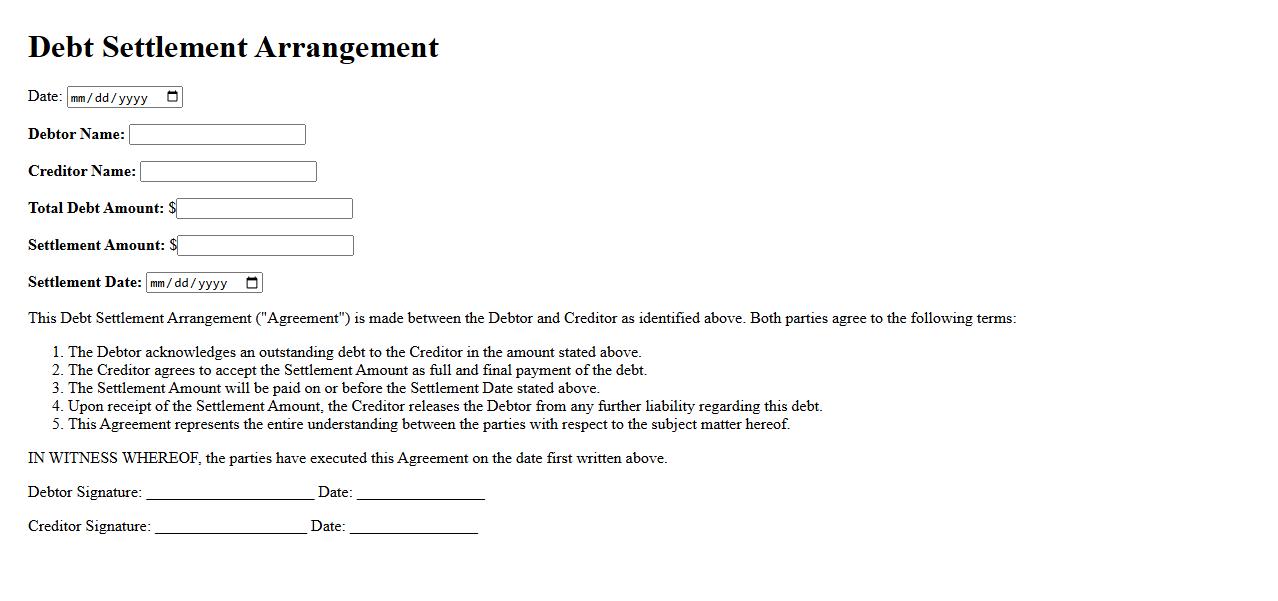

Debt Settlement Arrangement

A Debt Settlement Arrangement is a financial agreement where a borrower negotiates with creditors to reduce the total amount owed. This approach helps individuals manage and resolve debts more effectively by setting a manageable payment plan. It is a practical solution for those facing financial difficulties and seeking relief from overwhelming debt.

Acknowledgment of Liability

The Acknowledgment of Liability is a formal statement recognizing responsibility for a specific action or event. It serves as a legal admission that confirms accountability. This document is essential for clarifying obligations and ensuring transparency in commitments.

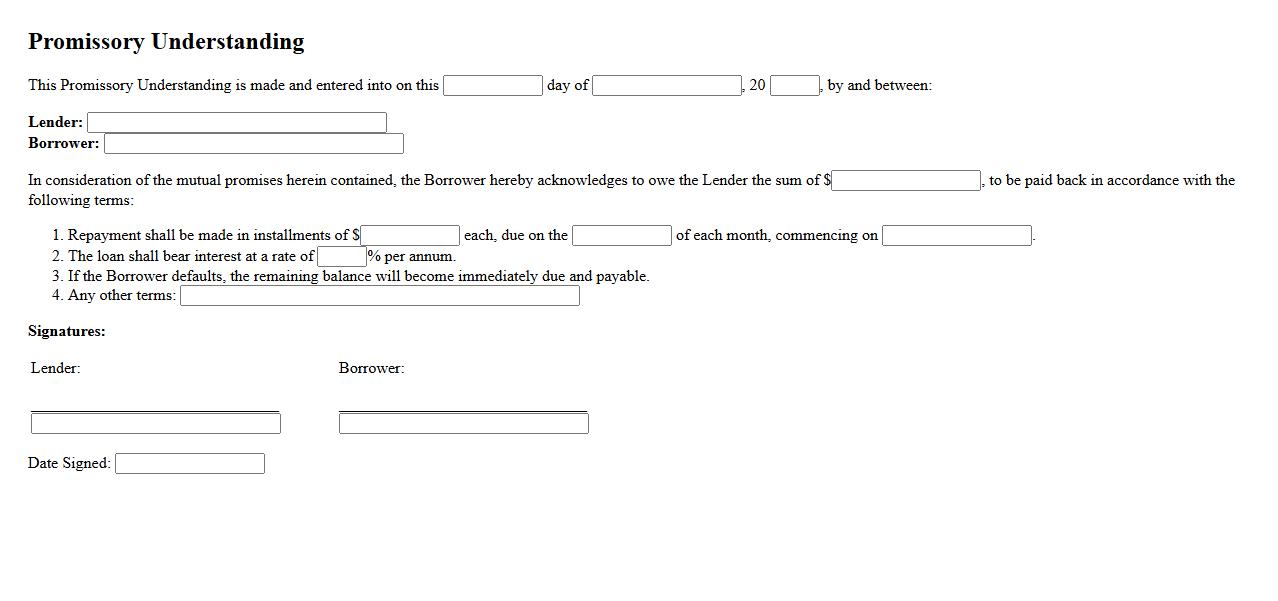

Promissory Understanding

A Promissory Understanding is a clear commitment between parties outlining agreed-upon promises or obligations. It ensures transparency and mutual trust by defining expectations in a concise manner. This understanding helps prevent disputes by formalizing intentions before final agreements.

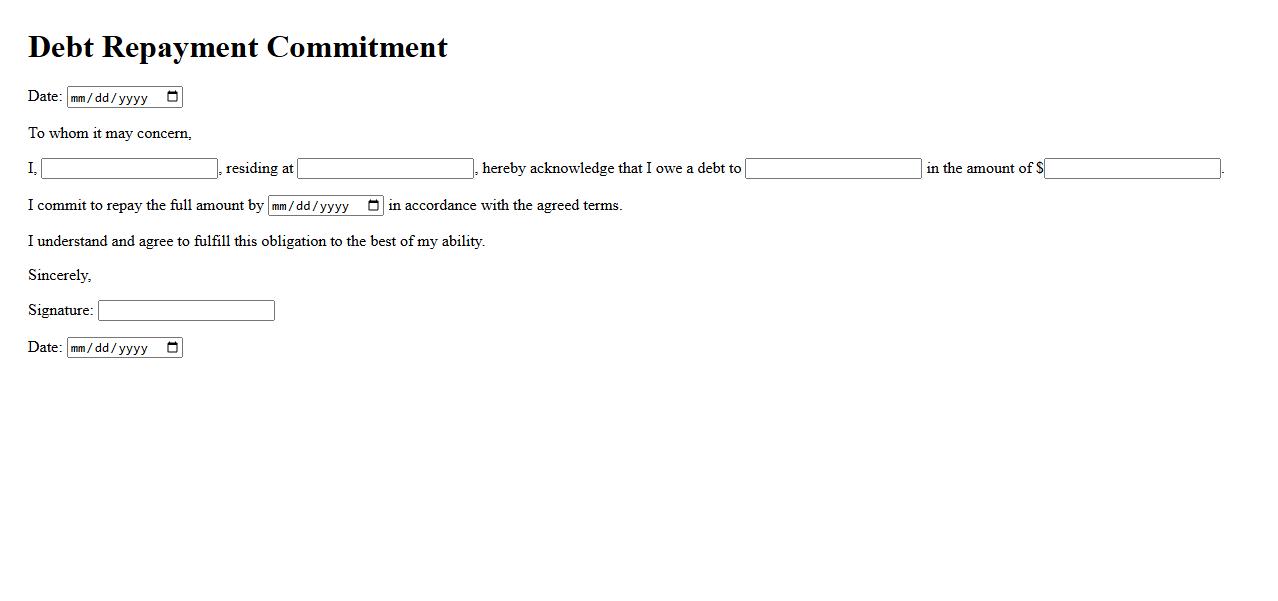

Debt Repayment Commitment

Debt Repayment Commitment refers to a borrower's dedication to fulfill their financial obligations by consistently making scheduled payments. This commitment helps maintain a positive credit history and avoids penalties or increased interest rates. Demonstrating a strong debt repayment commitment is crucial for financial stability and future borrowing opportunities.

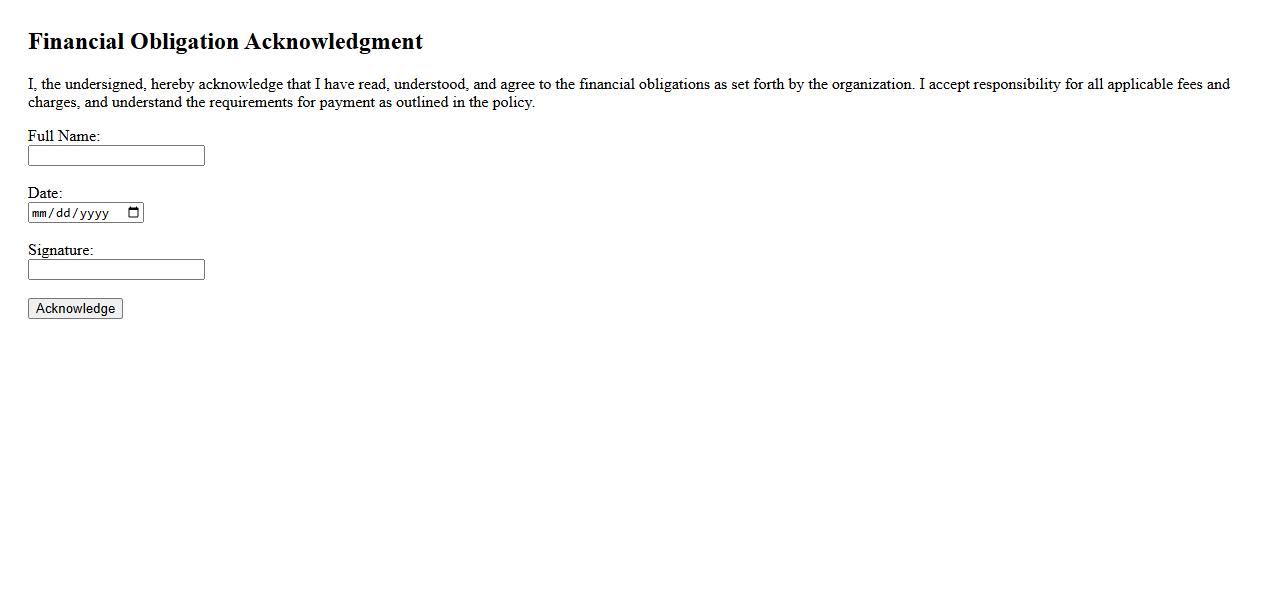

Financial Obligation Acknowledgment

The Financial Obligation Acknowledgment is a critical document that confirms an individual's commitment to meet specified payment responsibilities. It ensures clarity and mutual understanding between parties regarding financial duties. This acknowledgment protects all involved by clearly outlining obligations and expectations.

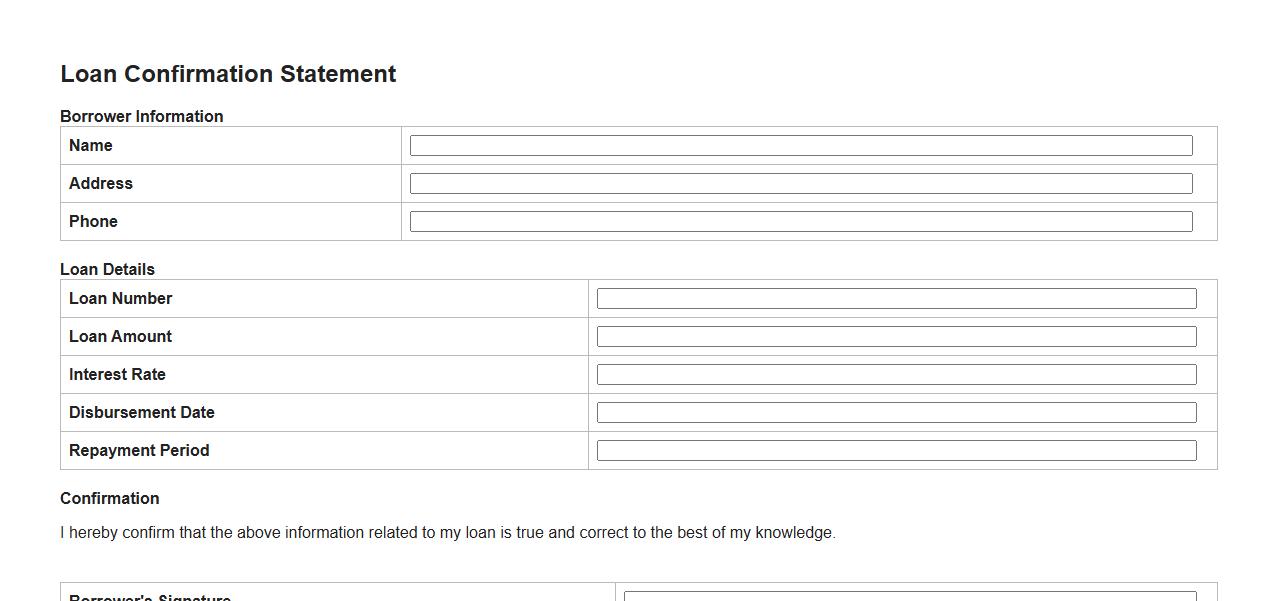

Loan Confirmation Statement

The Loan Confirmation Statement is a crucial document that verifies the details of a loan agreement between the borrower and lender. It outlines the loan amount, interest rate, repayment schedule, and other essential terms to ensure transparency. This statement helps both parties confirm their understanding and obligations before funds are disbursed.

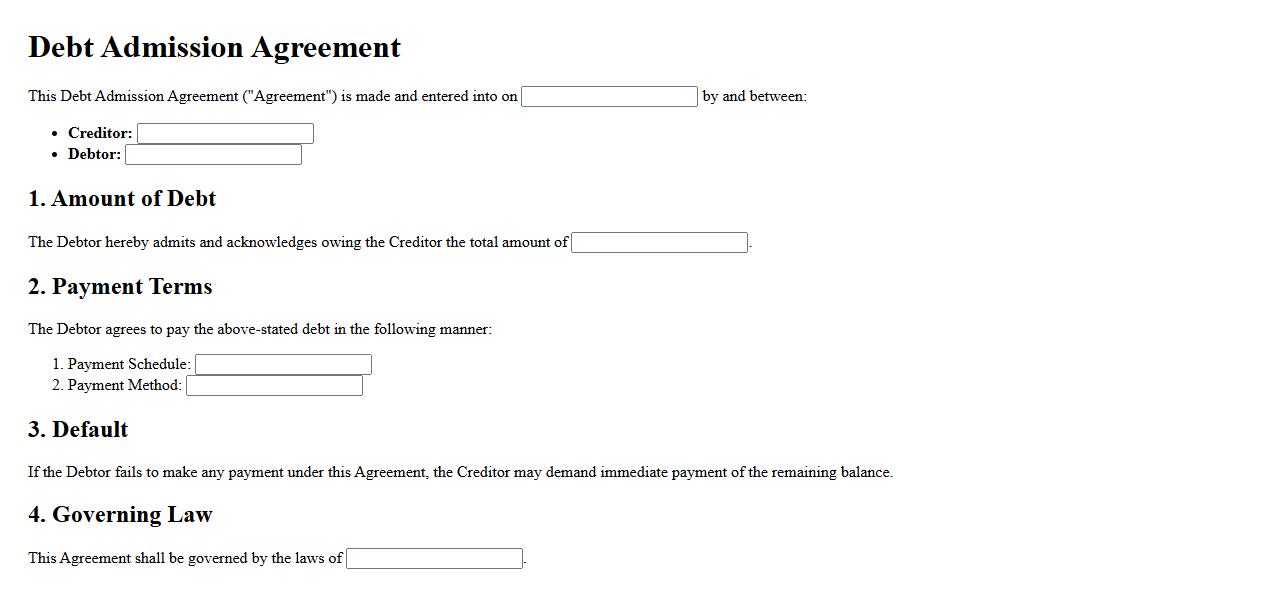

Debt Admission Agreement

A Debt Admission Agreement is a legal document where a debtor acknowledges the existence and amount of a debt owed to a creditor. This agreement helps clarify repayment terms and protects both parties by providing clear evidence of the debt. It is essential for resolving disputes and facilitating structured debt recovery.

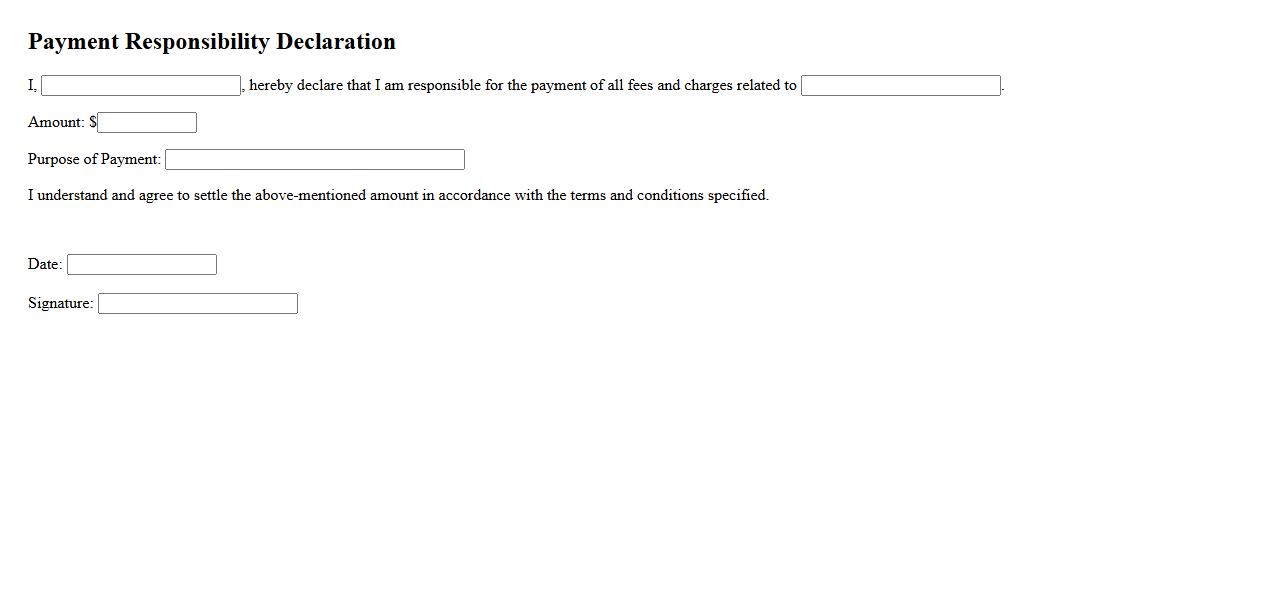

Payment Responsibility Declaration

The Payment Responsibility Declaration outlines the commitment of the individual or entity to fulfill all financial obligations related to a transaction or service. This document ensures clarity and accountability by specifying who is responsible for payment. It serves as a formal agreement to prevent disputes and facilitate smooth financial processing.

What is the total amount of debt being acknowledged in this agreement?

The total amount of debt acknowledged in this agreement is clearly stated to ensure transparency between parties. This amount represents the sum that one party owes to the other under specified conditions. Precise figures are used to avoid any misunderstandings or disputes about the debt value.

Who are the parties involved in the debt acknowledgment agreement?

The parties involved in the debt acknowledgment agreement typically include the debtor and the creditor. Both parties' legal names and roles are clearly identified within the document. This identification ensures accountability and enforces the terms of the agreement.

What are the specific terms and deadlines for repayment detailed in the document?

The agreement outlines the specific terms and deadlines for repayment to maintain clear expectations. It includes payment schedules, installment amounts, and final due dates. These detailed terms help both parties manage their financial responsibilities effectively.

What are the consequences if either party breaches the agreement?

The document specifies the consequences of breach to protect the rights of both parties. These typically include penalties, interest charges, or legal actions. Clearly defined repercussions encourage compliance and provide remedies if the agreement is violated.

Does the agreement specify any collateral or security for the acknowledged debt?

This agreement may include details about any collateral or security provided to secure the debt. Such provisions give the creditor assurance of repayment by reducing risk. If specified, the type and value of collateral are explicitly described in the document.