A Declaration of Trust is a legal document that outlines the terms under which a trust is created and managed. It specifies the roles, rights, and responsibilities of the trustee and beneficiaries, ensuring clear ownership and control of the trust property. This document serves as essential evidence to establish the intent and conditions of the trust arrangement.

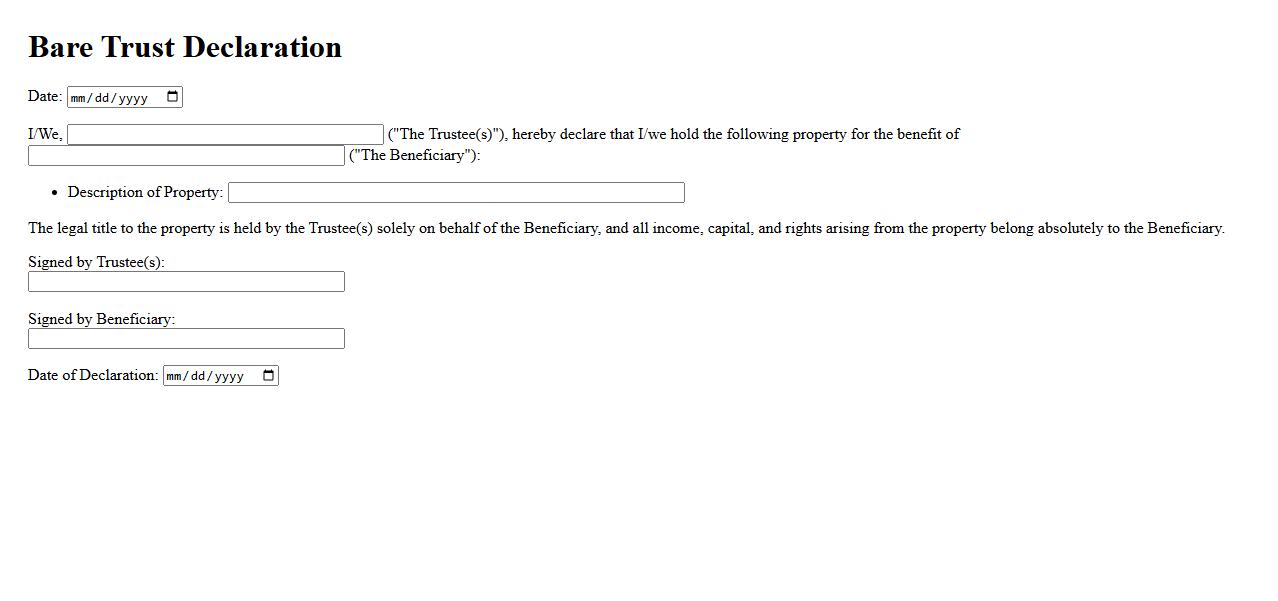

Bare Trust Declaration

A Bare Trust Declaration is a legal document that outlines the arrangement where a trustee holds assets on behalf of a beneficiary without any discretionary powers. It clearly defines the beneficiary's absolute ownership and control over the trust assets. This declaration ensures transparency and protects the rights of the beneficiary in the trust relationship.

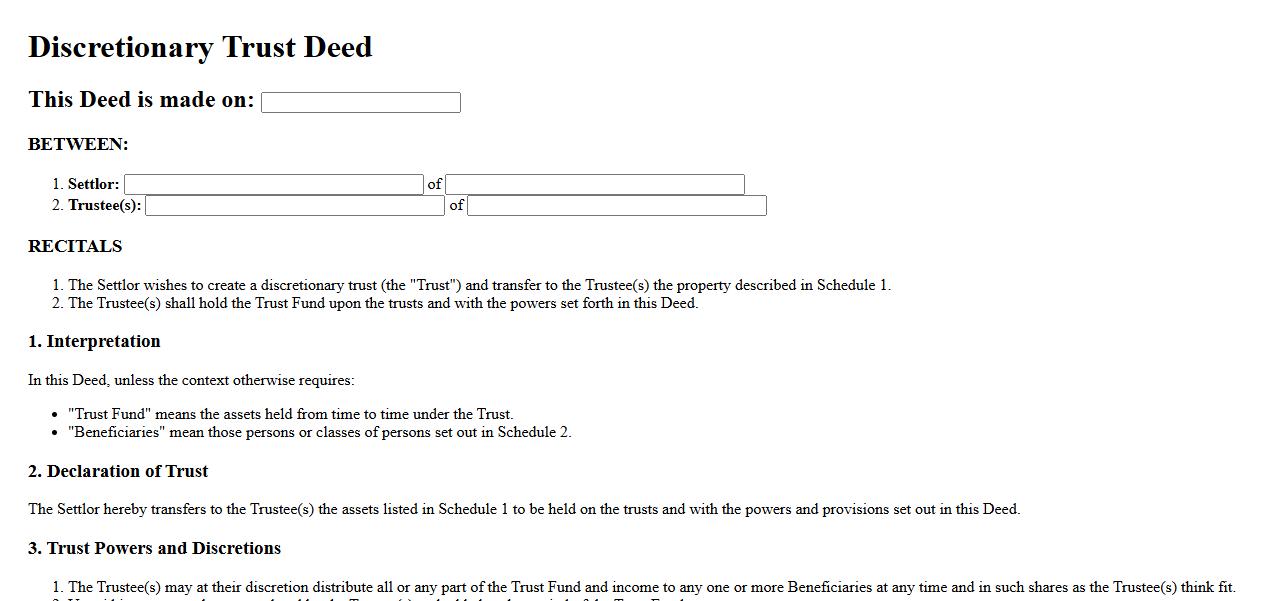

Discretionary Trust Deed

A Discretionary Trust Deed is a legal document that establishes a trust where trustees have the authority to decide how the trust income and capital are distributed among beneficiaries. This flexibility allows trustees to adapt distributions based on beneficiaries' needs and circumstances. It is commonly used for asset protection and estate planning purposes.

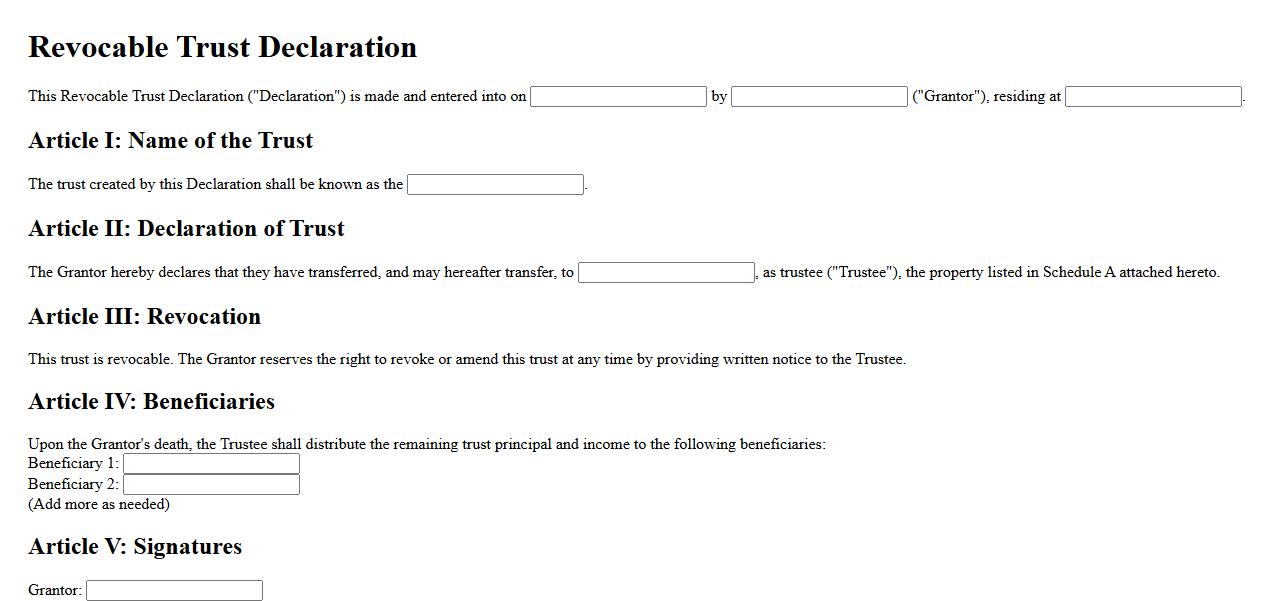

Revocable Trust Declaration

A Revocable Trust Declaration is a legal document that allows an individual to establish a trust they can modify or revoke during their lifetime. It provides flexibility in managing and distributing assets while avoiding probate. This type of trust ensures control over property and protects beneficiaries' interests.

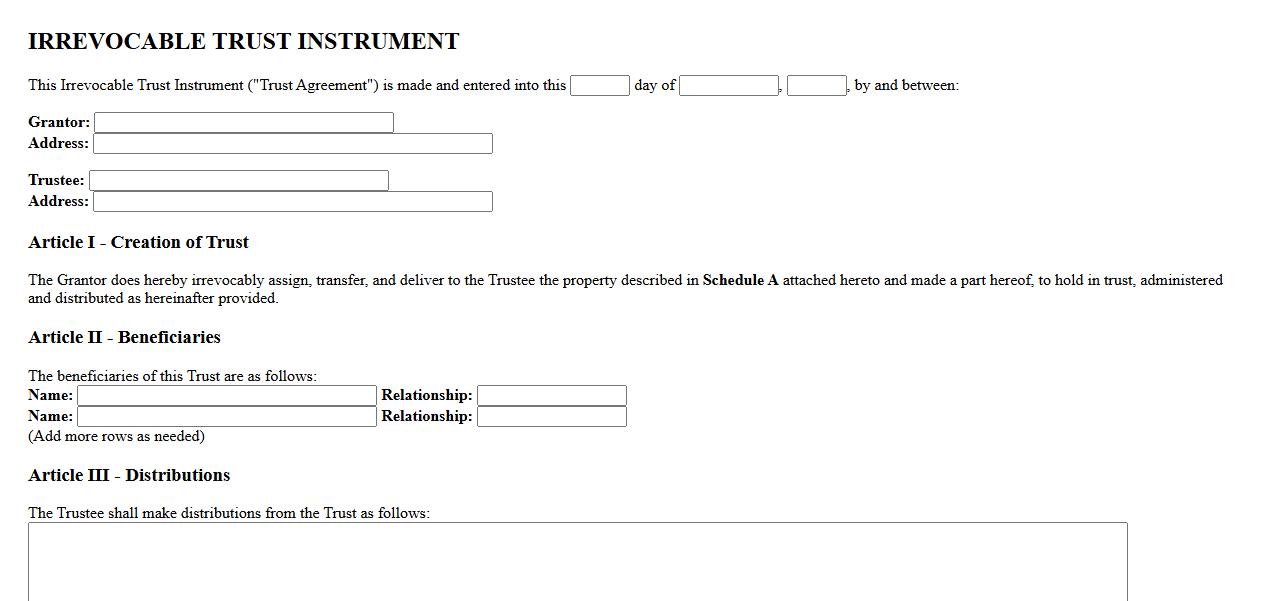

Irrevocable Trust Instrument

An Irrevocable Trust Instrument is a legal document that establishes a trust where the grantor permanently relinquishes control over the assets placed within it. This type of trust provides protection from creditors and can offer estate tax benefits. Once created, the terms and terms cannot be altered or revoked without the beneficiary's consent.

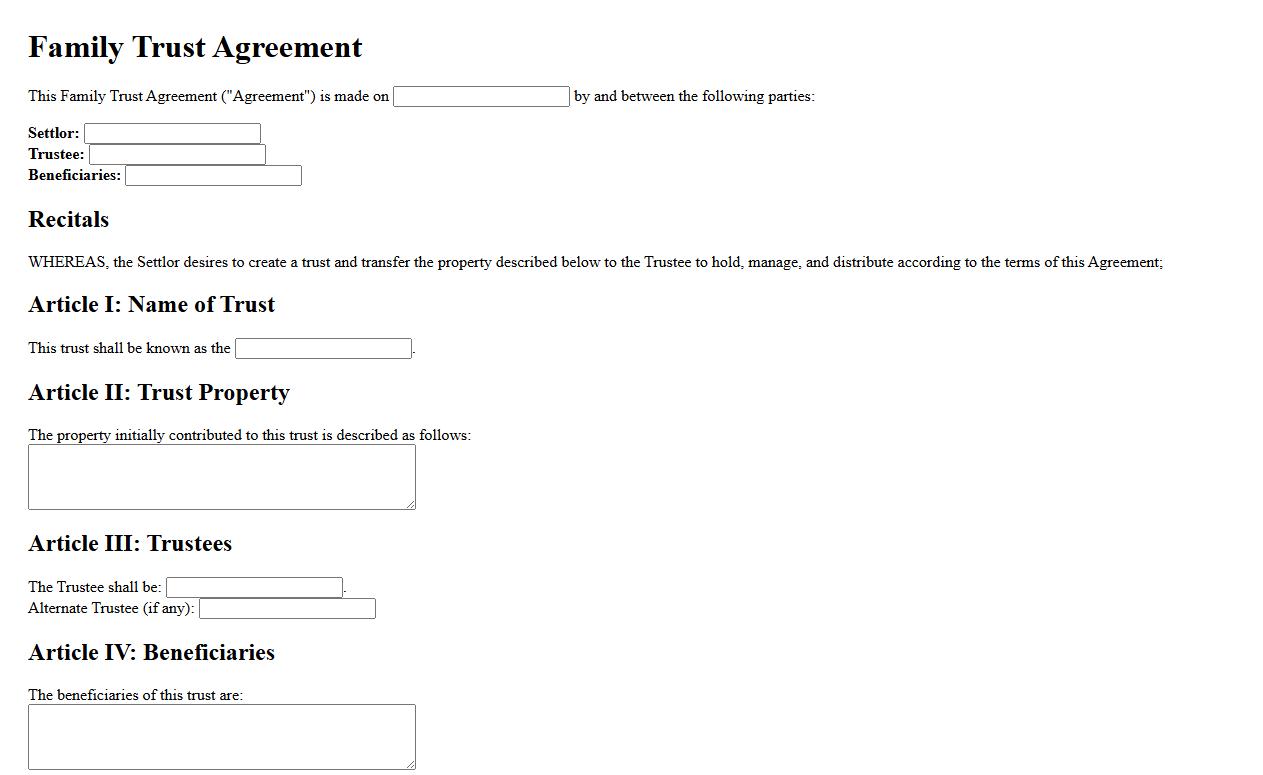

Family Trust Agreement

A Family Trust Agreement is a legal document that establishes a trust to manage and protect family assets. It outlines the roles of trustees and beneficiaries, ensuring the smooth transfer of wealth across generations. This agreement helps in minimizing taxes and avoiding probate delays.

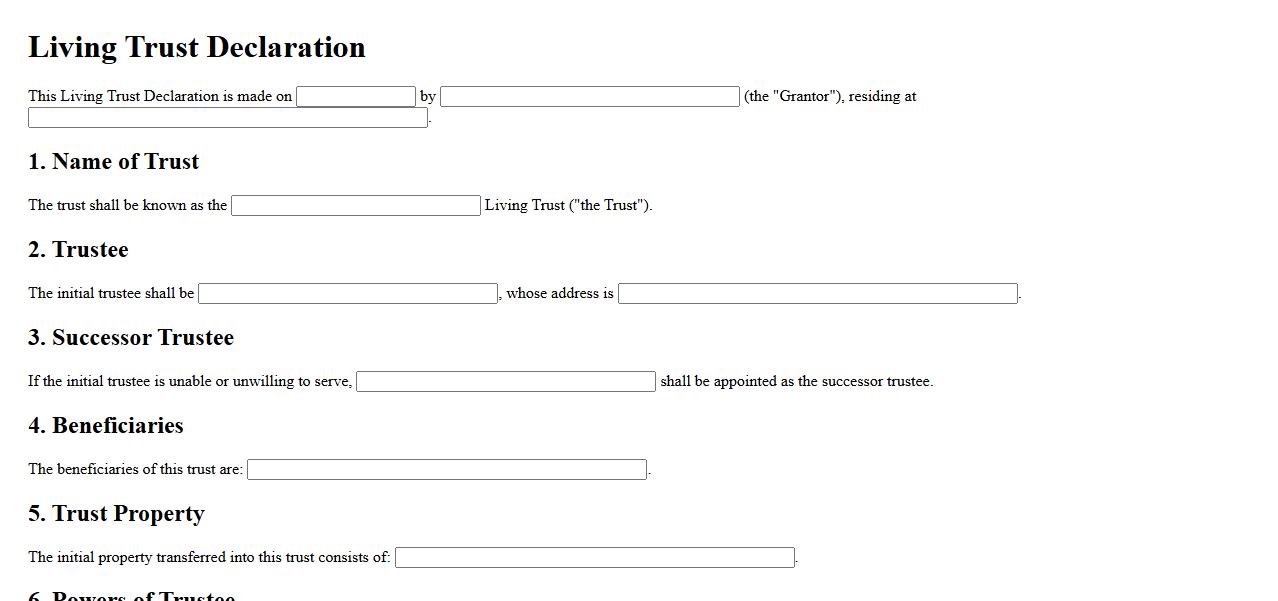

Living Trust Declaration

A Living Trust Declaration is a legal document that outlines the terms and conditions for managing and distributing an individual's assets during their lifetime and after their death. It helps avoid probate, ensuring a smoother transfer of property to beneficiaries. This declaration provides flexibility and privacy while protecting the grantor's interests.

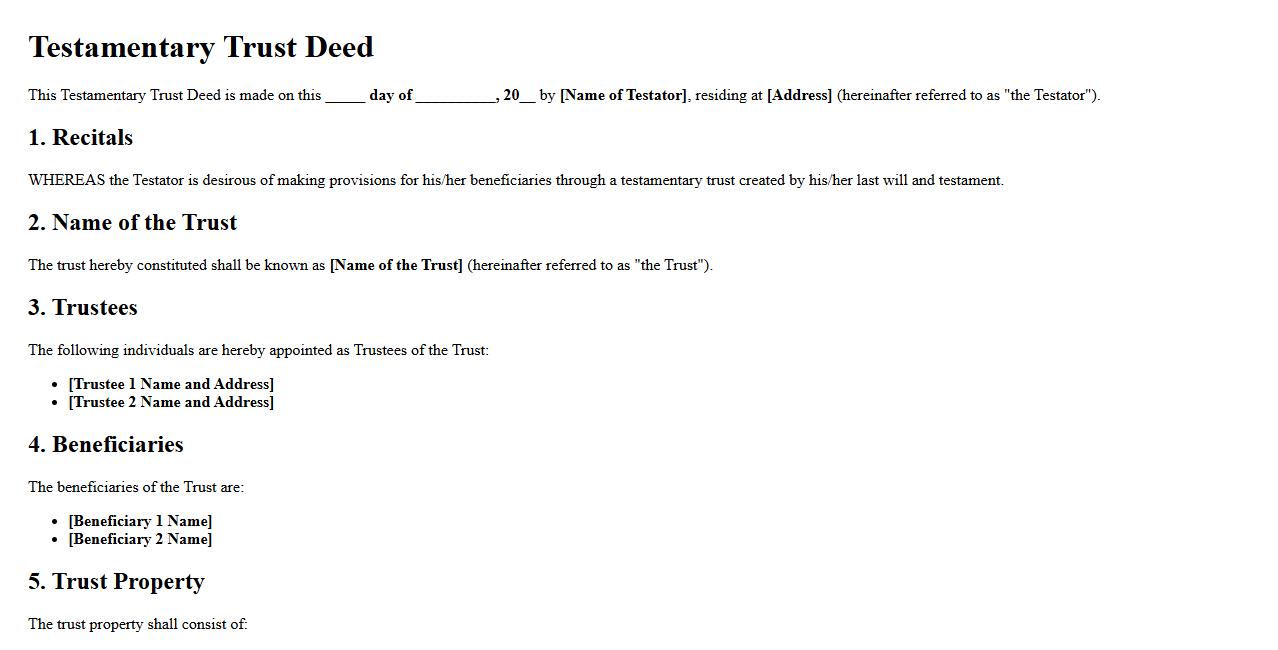

Testamentary Trust Deed

A Testamentary Trust Deed is a legal document created within a will that establishes a trust to manage assets after the testator's death. It provides specific instructions on how the trust's property should be handled and distributed to beneficiaries. This ensures proper management and protection of the estate according to the testator's wishes.

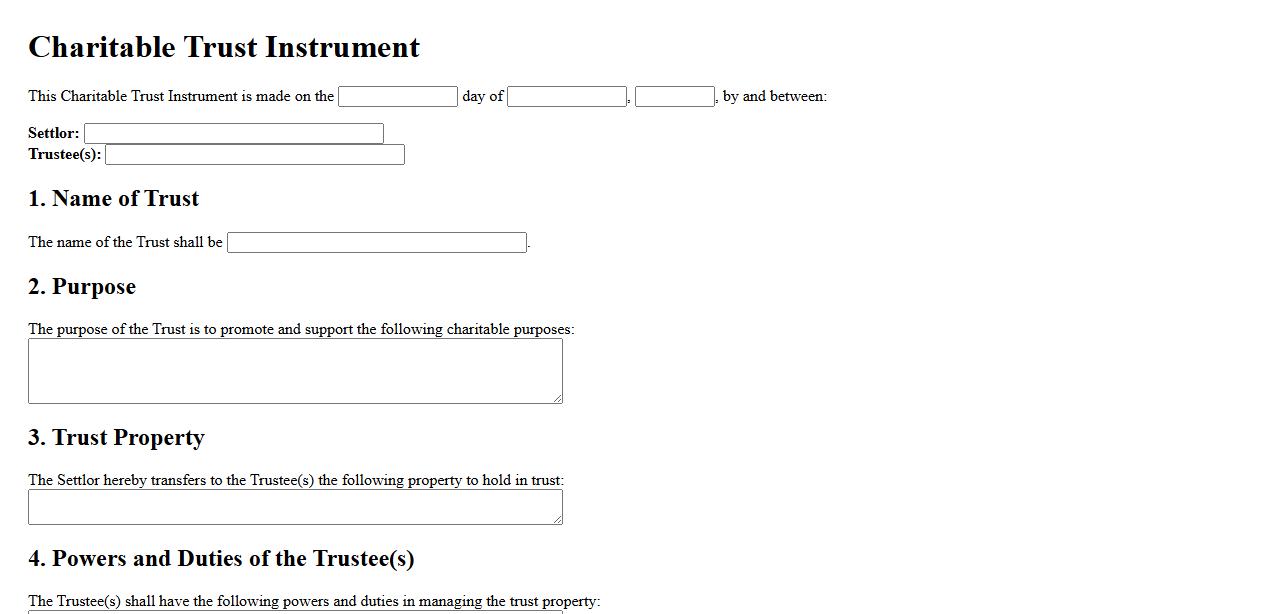

Charitable Trust Instrument

A Charitable Trust Instrument is a legal document establishing a trust dedicated to philanthropic purposes. It outlines the trust's objectives, management, and beneficiaries, ensuring proper use of funds for charitable activities. This instrument provides a clear framework for trustees to operate transparently and effectively.

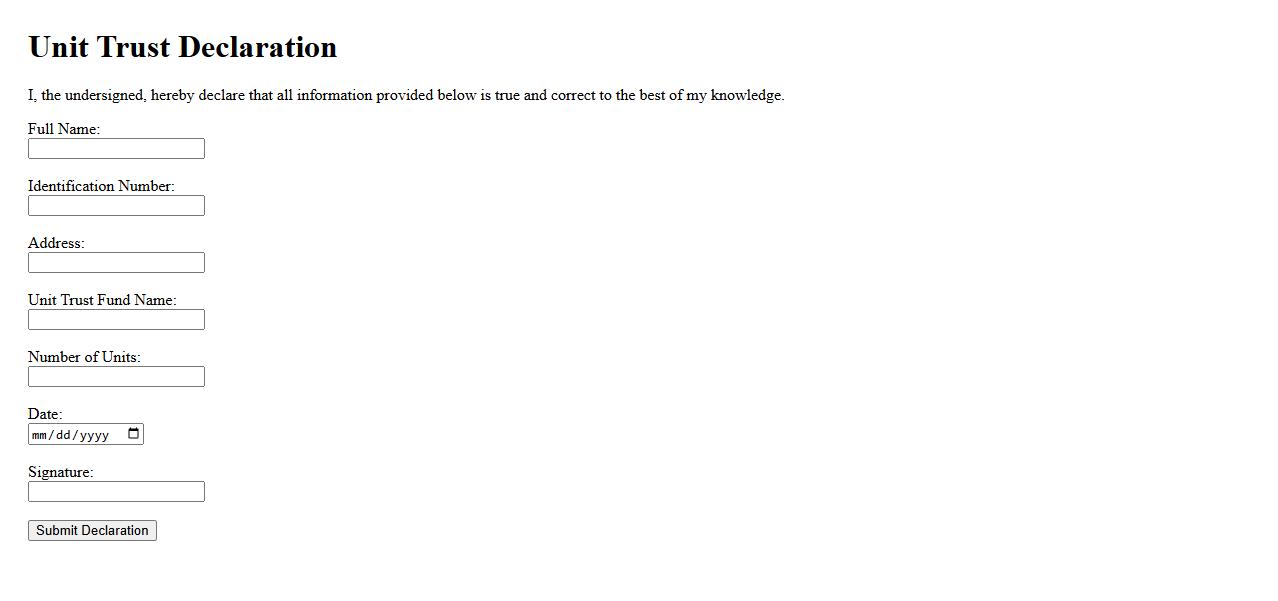

Unit Trust Declaration

The Unit Trust Declaration is a formal document outlining the terms and conditions of a unit trust scheme. It specifies the rights and responsibilities of the trustees, unit holders, and the fund manager. This declaration ensures transparency and legal compliance in the management of the trust's assets.

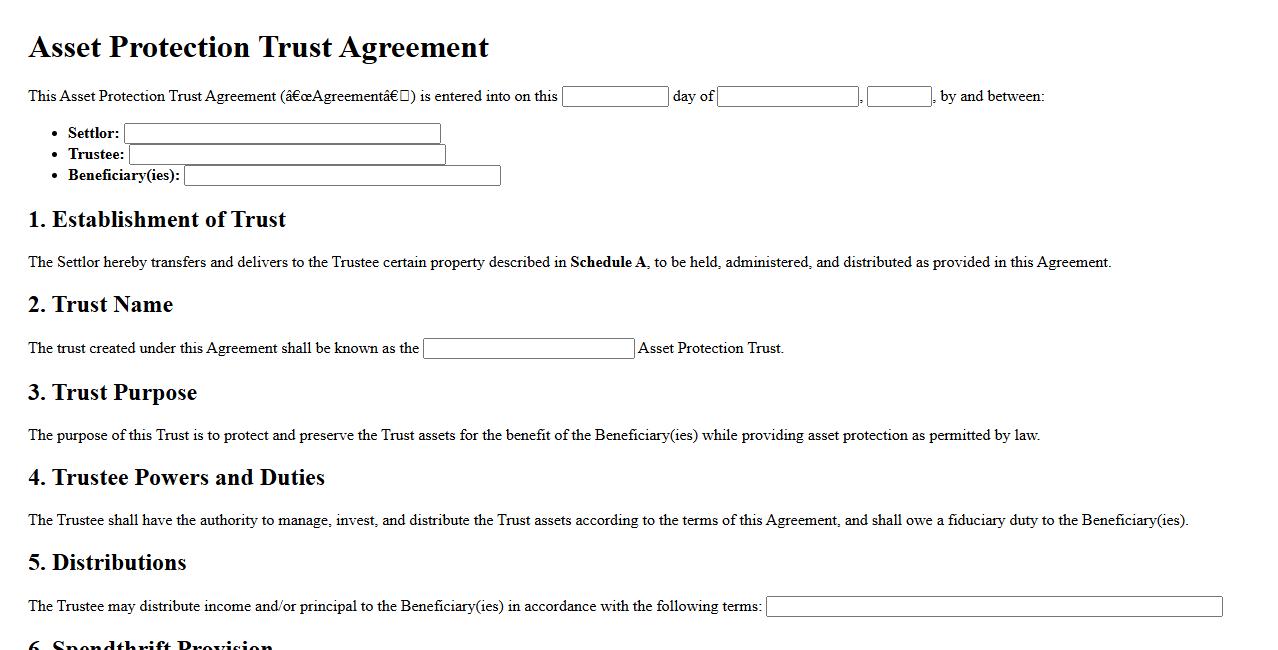

Asset Protection Trust Agreement

An Asset Protection Trust Agreement is a legal document designed to safeguard an individual's assets from creditors and legal claims. It establishes a trust that legally separates ownership, providing financial security and privacy. This agreement is essential for effective estate planning and wealth preservation.

What is the primary purpose of a Declaration of Trust?

The primary purpose of a Declaration of Trust is to formally outline the terms under which assets are held by one party for the benefit of another. It establishes clear legal ownership and responsibilities, protecting the interests of all involved. This document serves as proof of the agreed arrangement between the trustee and beneficiaries.

Who are the key parties involved in a Declaration of Trust?

The key parties in a Declaration of Trust are the trustee and the beneficiaries. The trustee holds legal ownership of the assets and manages them according to the trust terms. Beneficiaries are the individuals or entities entitled to benefit from the trust property.

How does a Declaration of Trust specify the rights and obligations of beneficiaries?

A Declaration of Trust explicitly defines the rights and obligations of beneficiaries by detailing how and when they can access the trust assets. It sets out their entitlement to income or capital and any conditions attached. This clarity helps prevent disputes and ensures fair treatment.

In what ways can a Declaration of Trust be amended or revoked?

A Declaration of Trust can be amended or revoked according to the conditions stated within the document or by mutual agreement of the parties. Amendments typically require written consent and may need to follow specific legal procedures. Revocation may be restricted to protect beneficiary rights or may involve transferring trust assets.

What assets or property does the Declaration of Trust specifically cover?

The Declaration of Trust specifically covers designated assets or property transferred into the trust arrangement. This can include real estate, shares, cash, or other valuable property. Clearly identifying these assets ensures proper management and protects their intended use for the beneficiaries.