Declaration of Voluntary Disclosure allows individuals or businesses to report previously undisclosed income or errors to tax authorities proactively. This process helps reduce penalties and avoid legal consequences by demonstrating good faith and transparency. Submitting a Declaration of Voluntary Disclosure can lead to negotiated payment terms and a resolution of outstanding tax obligations.

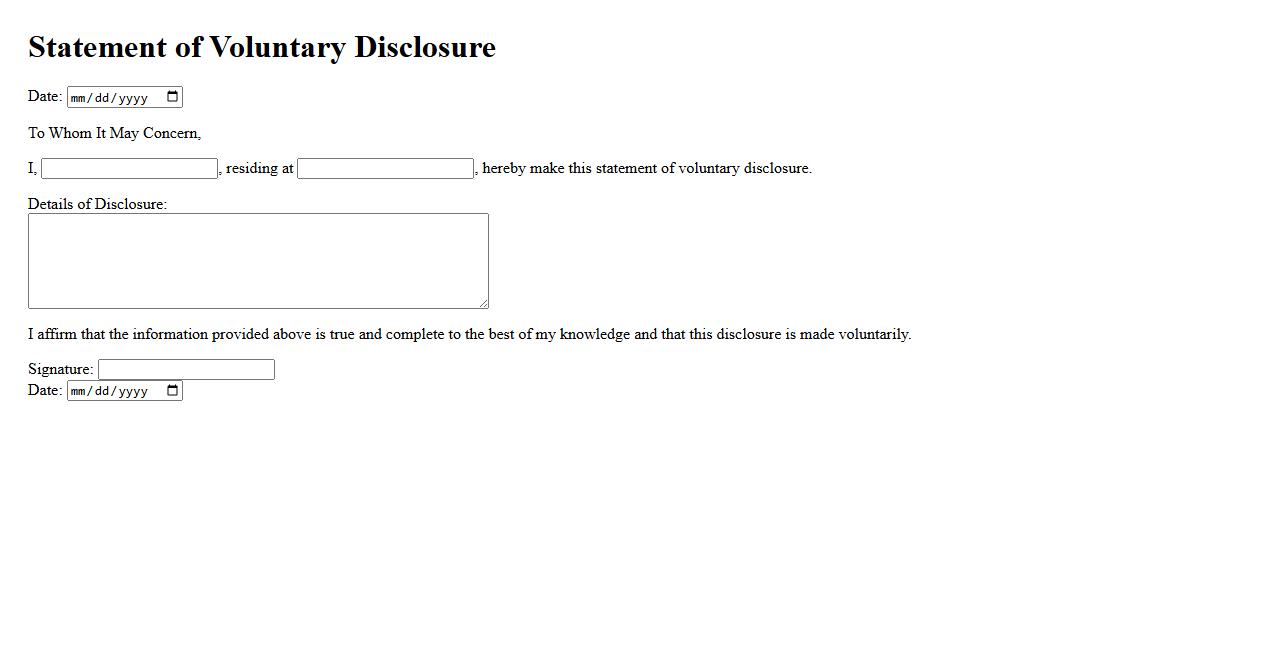

Statement of Voluntary Disclosure

A Statement of Voluntary Disclosure is a formal document submitted to tax authorities to report previously undisclosed income or errors. It allows taxpayers to rectify their tax filings proactively, often resulting in reduced penalties and interest. This disclosure fosters transparency and helps maintain compliance with tax regulations.

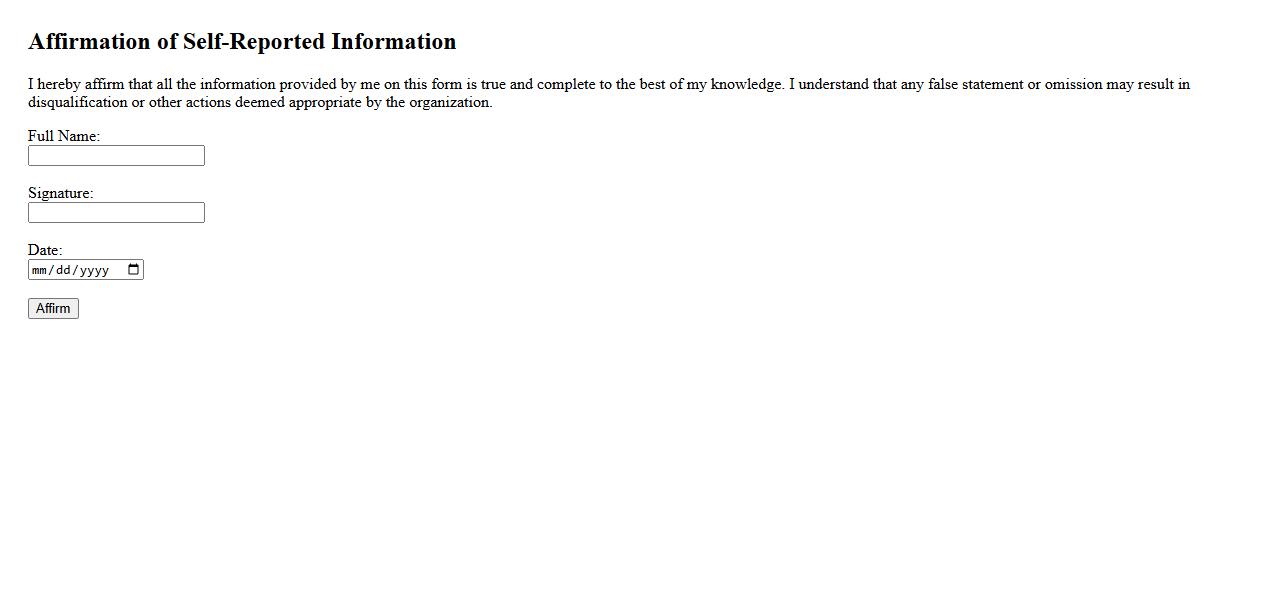

Affirmation of Self-Reported Information

An Affirmation of Self-Reported Information is a formal declaration confirming the accuracy and truthfulness of details provided by an individual. It serves as a commitment to honesty in sharing personal or professional data. This affirmation is crucial in processes requiring trust and accountability.

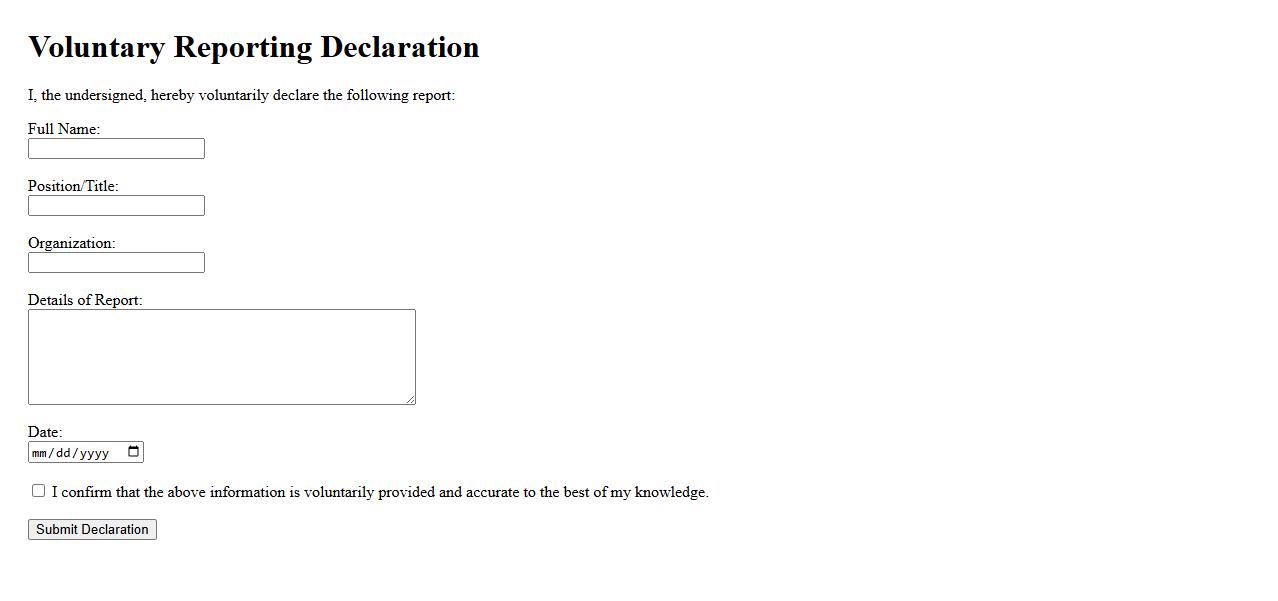

Voluntary Reporting Declaration

The Voluntary Reporting Declaration is a formal statement allowing organizations or individuals to report specific information voluntarily. It enhances transparency and accountability by encouraging proactive disclosure. This declaration supports compliance with regulatory standards and fosters trust within the community.

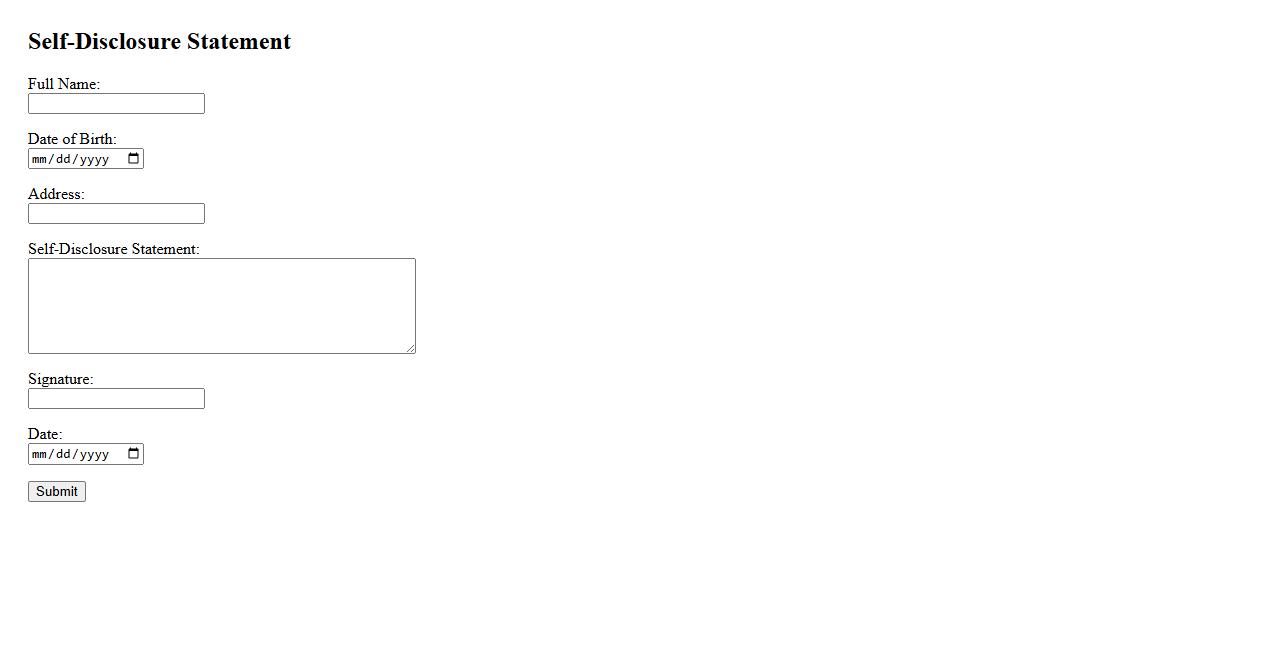

Self-Disclosure Statement

A Self-Disclosure Statement is a document where individuals reveal personal information voluntarily, often related to their background or experiences. It promotes transparency and trust in various settings such as employment, education, or therapy. This statement helps assess suitability and addresses potential conflicts of interest effectively.

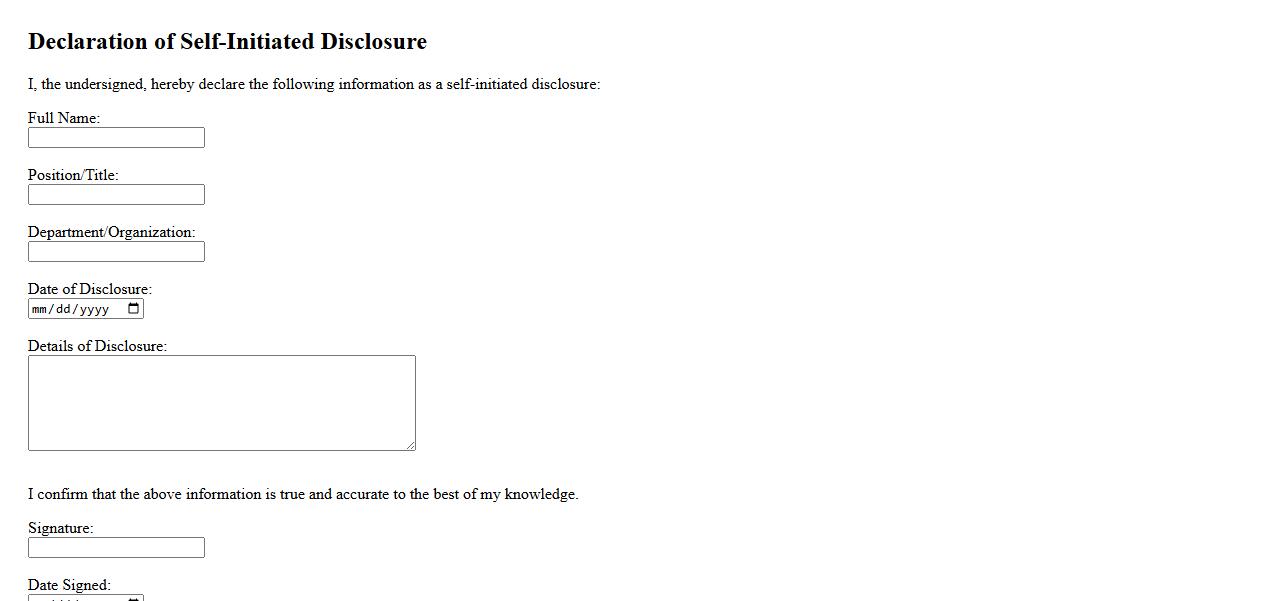

Declaration of Self-Initiated Disclosure

The Declaration of Self-Initiated Disclosure is a formal statement made voluntarily to reveal previously undisclosed information. This declaration is crucial in maintaining transparency and integrity, especially in legal or regulatory contexts. It helps organizations or individuals address issues proactively and demonstrate accountability.

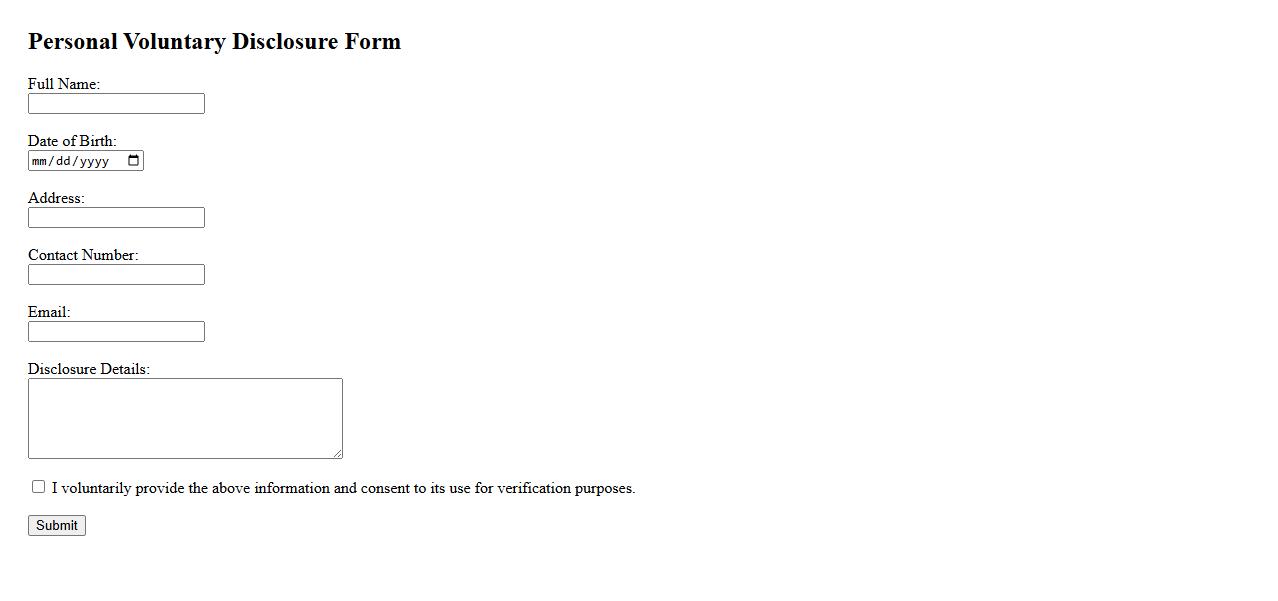

Personal Voluntary Disclosure Form

The Personal Voluntary Disclosure Form allows individuals to report previously undisclosed financial information to tax authorities. This form facilitates transparency and compliance while potentially reducing penalties. Submitting the form ensures proper documentation of voluntary disclosures for tax purposes.

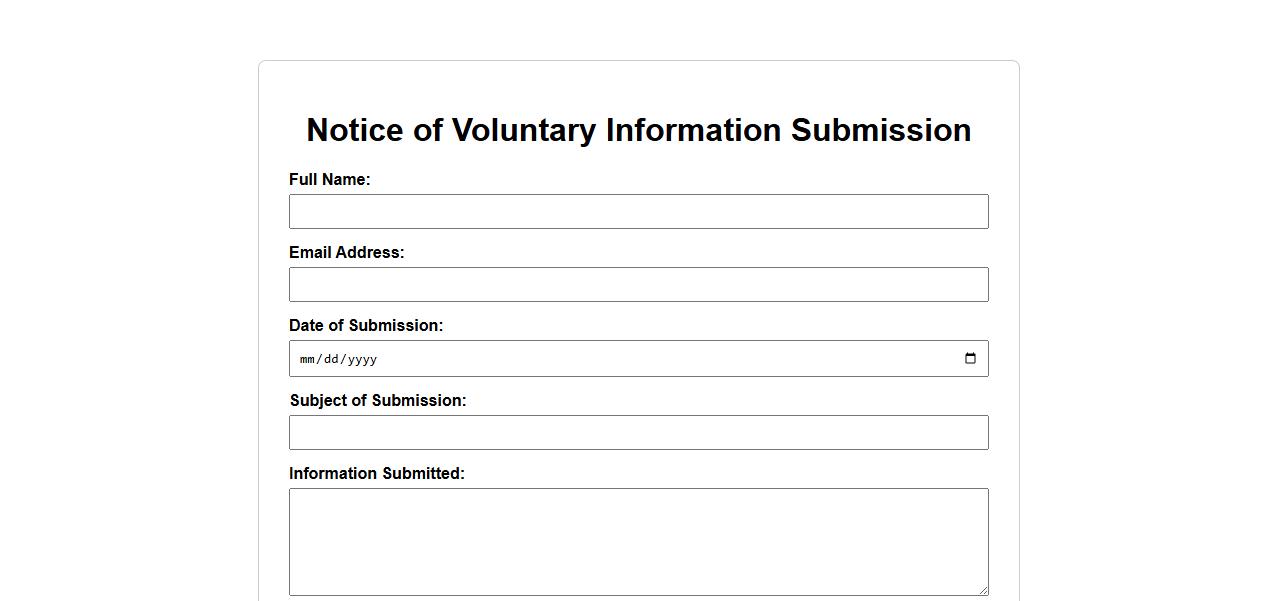

Notice of Voluntary Information Submission

The Notice of Voluntary Information Submission is a formal declaration allowing individuals or organizations to provide information willingly. This notice ensures transparency and encourages proactive communication with relevant authorities. It helps in maintaining accurate records and facilitates compliance with regulatory requirements.

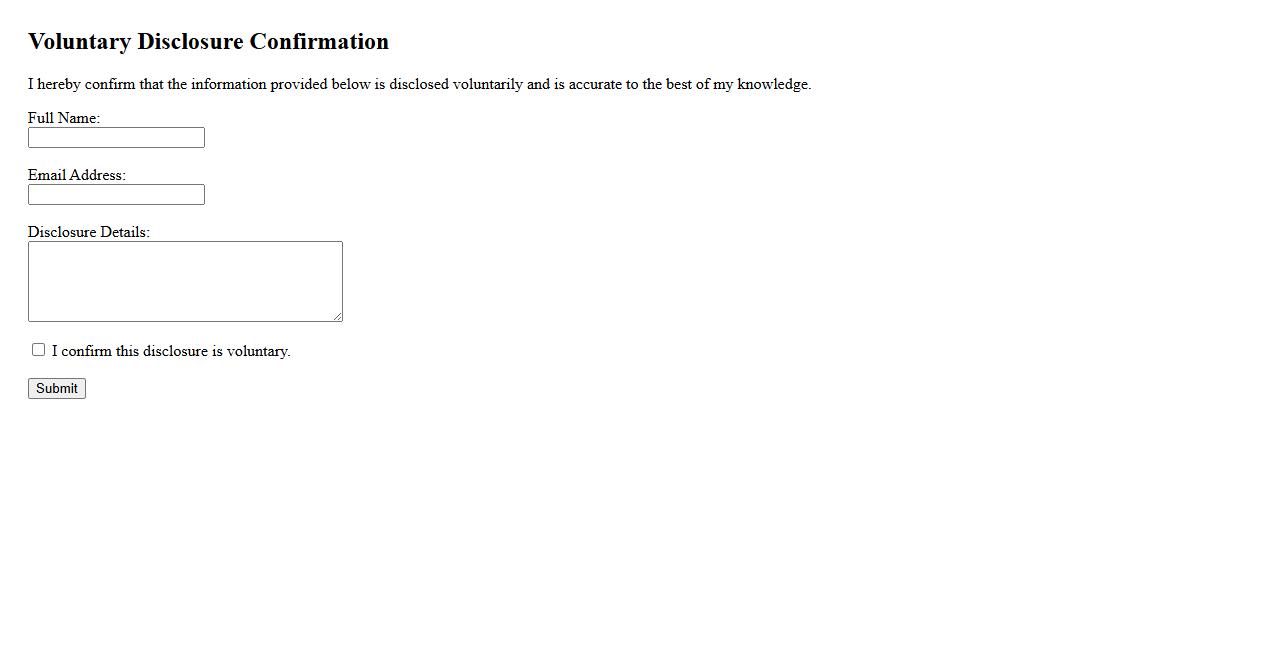

Voluntary Disclosure Confirmation

Voluntary Disclosure Confirmation is a crucial process where individuals or businesses proactively report previously undisclosed information to authorities. This confirmation helps in ensuring transparency and can potentially reduce penalties or legal consequences. Timely and accurate voluntary disclosure fosters trust and compliance with regulatory requirements.

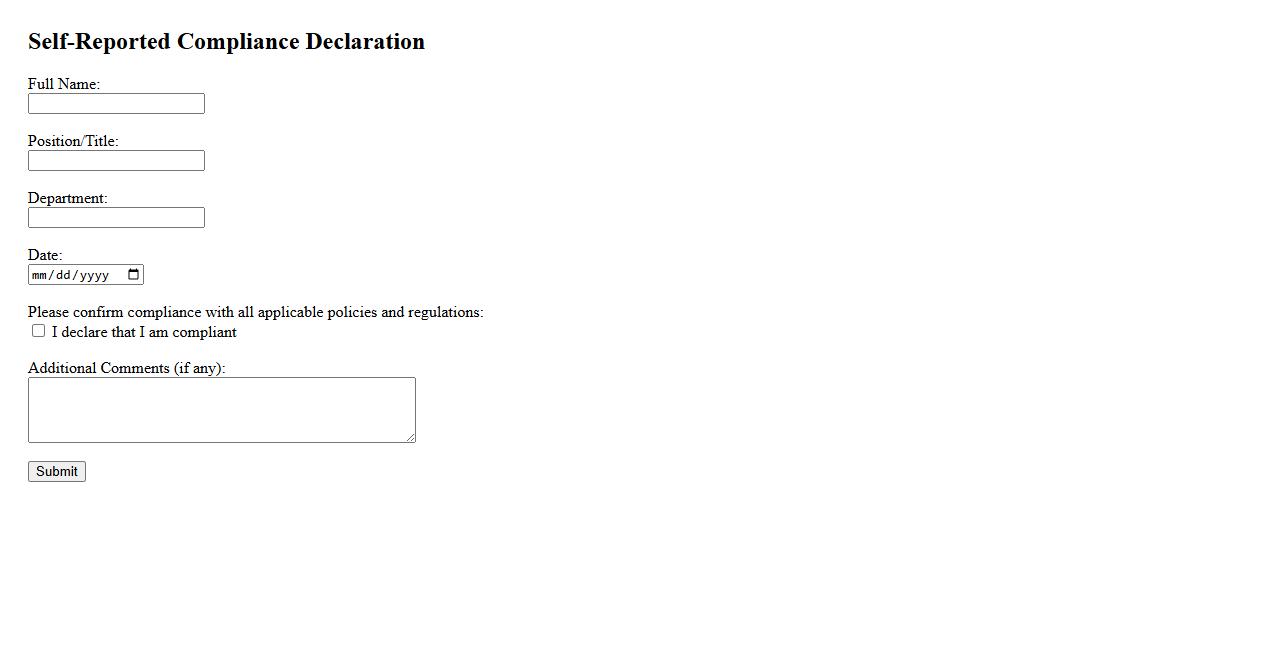

Self-Reported Compliance Declaration

The Self-Reported Compliance Declaration is a formal statement where individuals or organizations affirm their adherence to specified regulations or standards. This declaration helps ensure transparency and accountability without requiring immediate external verification. It serves as an important document in various regulatory and compliance processes.

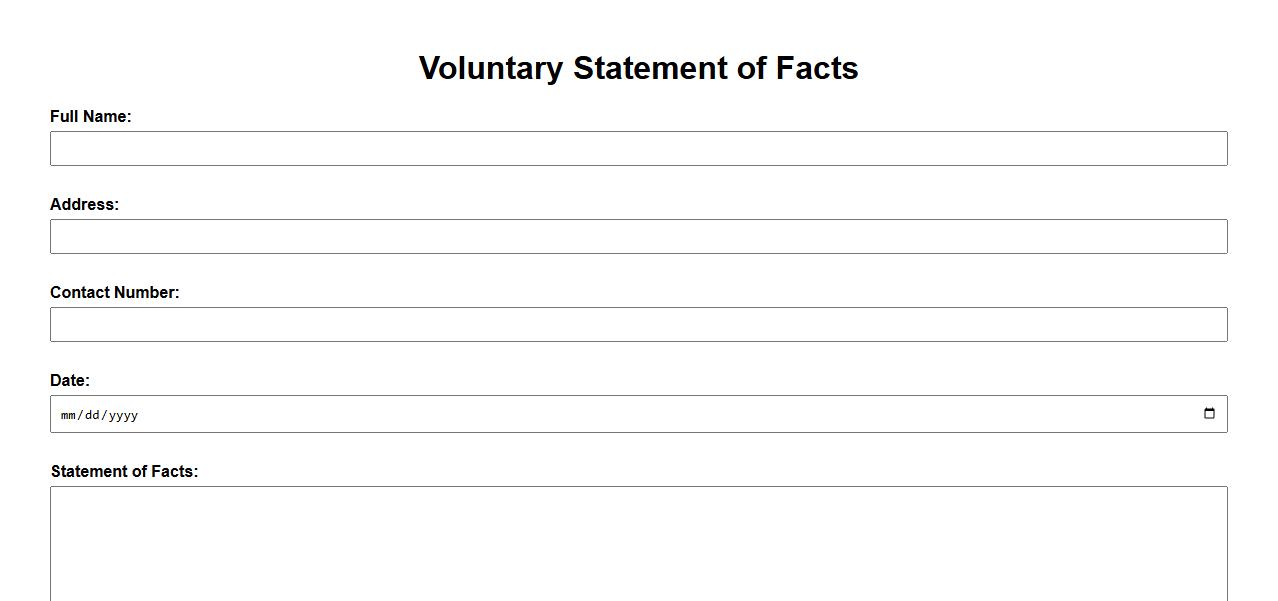

Voluntary Statement of Facts

A Voluntary Statement of Facts is a written document where an individual provides detailed and truthful information without any external compulsion. It is commonly used in legal or administrative processes to clarify circumstances or events. This statement helps ensure transparency and accurate understanding of a situation.

What information must be included in a Declaration of Voluntary Disclosure?

A Declaration of Voluntary Disclosure must include detailed information about the nature and extent of the undeclared or incorrect activity. It is essential to provide accurate data such as dates, amounts, and involved parties. This transparency ensures that authorities can properly assess and process the disclosure.

Who is authorized to submit a Declaration of Voluntary Disclosure?

Typically, the individual or entity responsible for the non-compliance is authorized to submit the Declaration of Voluntary Disclosure. This can be a taxpayer, business owner, or legal representative acting on behalf of the party involved. Proper authorization ensures the document's validity and procedural compliance.

What are the legal implications of filing a false Declaration of Voluntary Disclosure?

Submitting a false Declaration of Voluntary Disclosure can result in serious legal consequences, including fines, penalties, and potential criminal charges. Authorities treat fraudulent disclosures as attempts to evade legal responsibilities. Therefore, honesty and completeness are critical in filing these declarations.

Which types of non-compliance are eligible for the Declaration of Voluntary Disclosure process?

The Declaration of Voluntary Disclosure process usually applies to types of non-compliance such as tax underreporting, unreported income, or regulatory breaches. Eligibility often depends on disclosure timing and adherence to specific regulatory frameworks. Early voluntary disclosures are generally favored to encourage compliance.

What is the purpose of a Declaration of Voluntary Disclosure in regulatory or tax contexts?

The primary purpose of a Declaration of Voluntary Disclosure is to provide a mechanism for correcting past non-compliance without harsh penalties. It promotes transparency and cooperation between the disclosing party and regulatory authorities. This process helps maintain legal integrity and encourages voluntary compliance.