The Declaration of Non-Resident Status is an official document used to confirm an individual's tax residency outside a specific country. This form allows non-residents to claim exemptions or reduced rates on certain taxes, such as withholding tax on income earned within the country. Proper submission of the Declaration of Non-Resident Status ensures compliance with international tax laws and avoids double taxation.

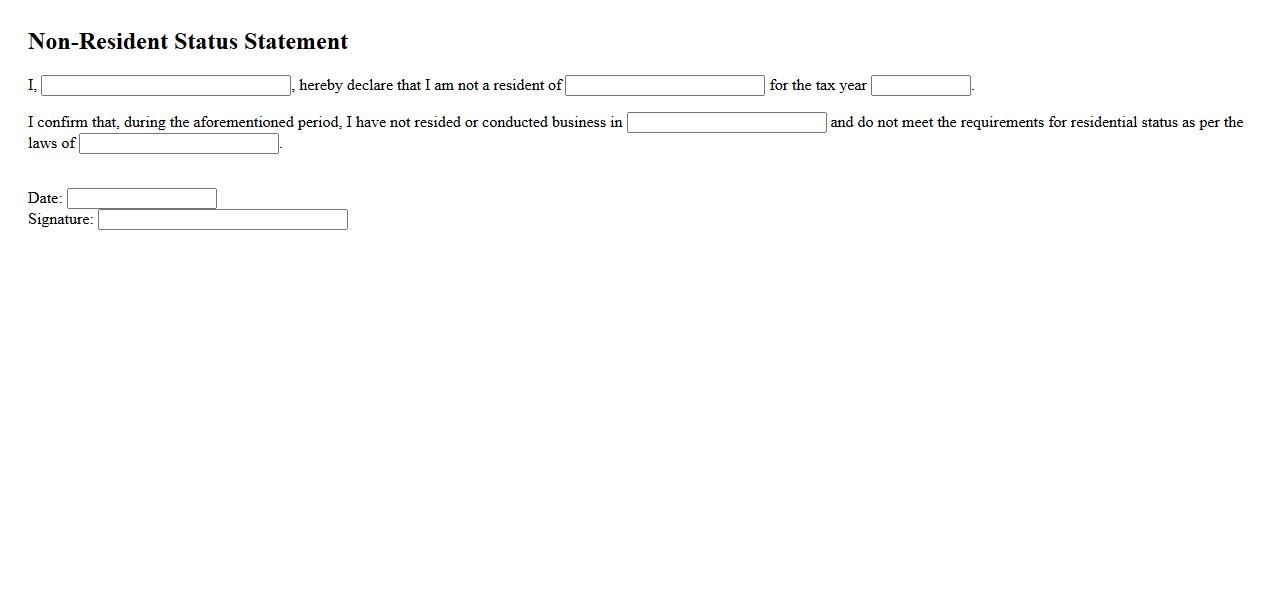

Non-Resident Status Statement

A Non-Resident Status Statement is a formal document confirming an individual's residency outside a particular country. This statement is often required for tax purposes, financial transactions, or legal matters to establish non-residency. It helps authorities determine applicable regulations and benefits based on residency status.

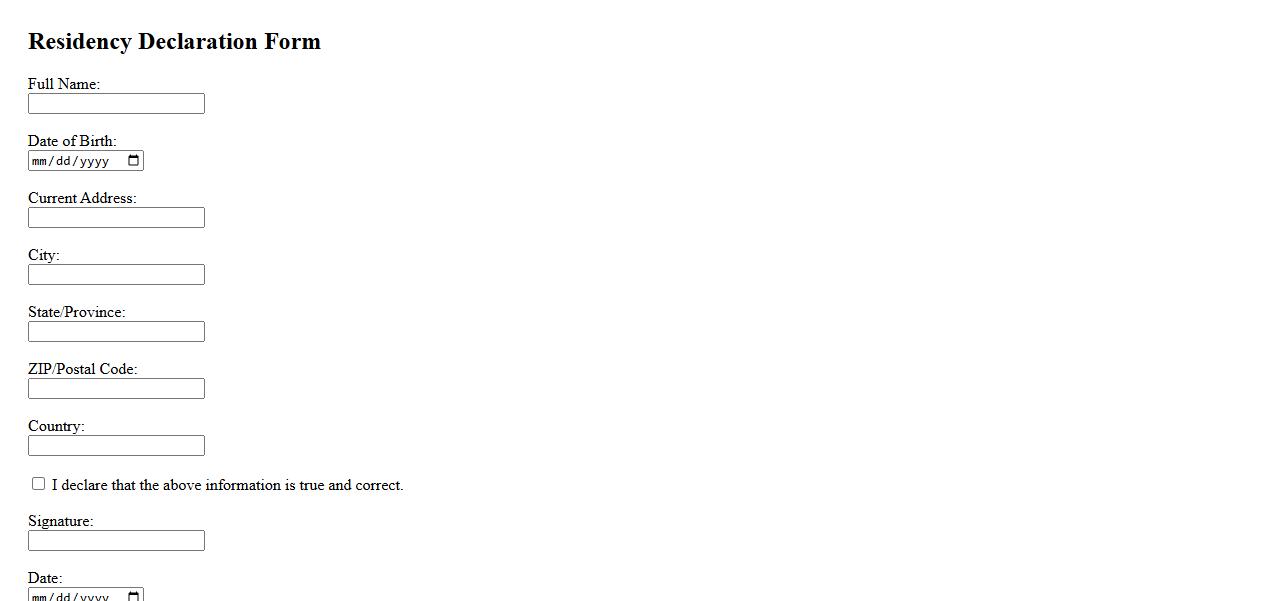

Residency Declaration Form

The Residency Declaration Form is a crucial document used to verify an individual's residency status for official purposes. It ensures accurate address records for legal, educational, or administrative requirements. Completing this form helps streamline processes such as enrollment, taxation, or service eligibility.

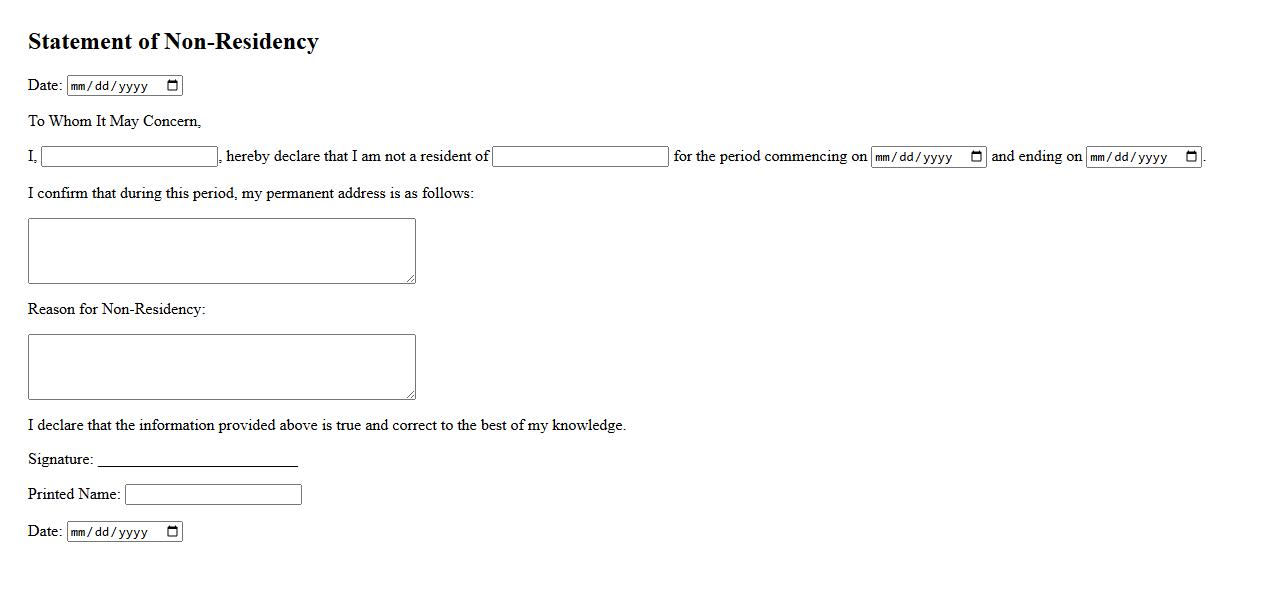

Statement of Non-Residency

A Statement of Non-Residency is an official document that confirms an individual or entity does not reside in a specific location or jurisdiction. It is often required for tax purposes, legal matters, or eligibility verification. This statement helps clarify residency status to avoid confusion or legal complications.

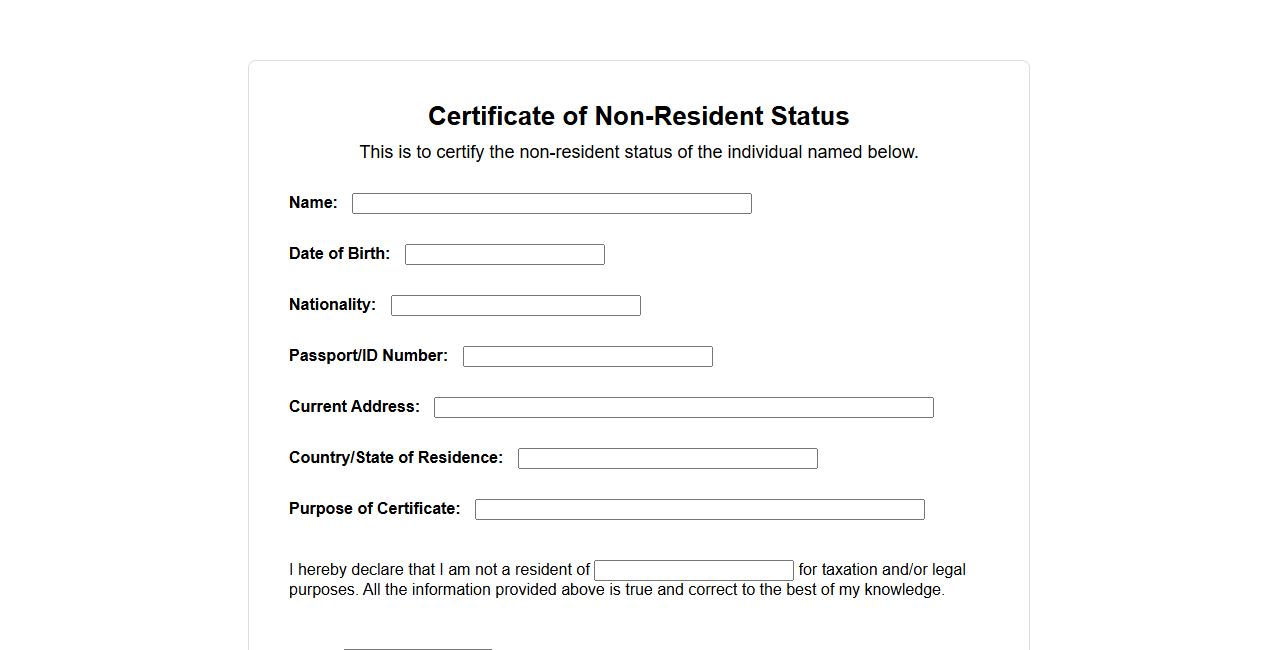

Certificate of Non-Resident Status

The Certificate of Non-Resident Status is an official document issued by tax authorities to individuals or entities confirming their non-residency status for tax purposes. This certificate helps in avoiding double taxation and establishing tax obligations in a specific country. It is essential for international transactions and cross-border investments.

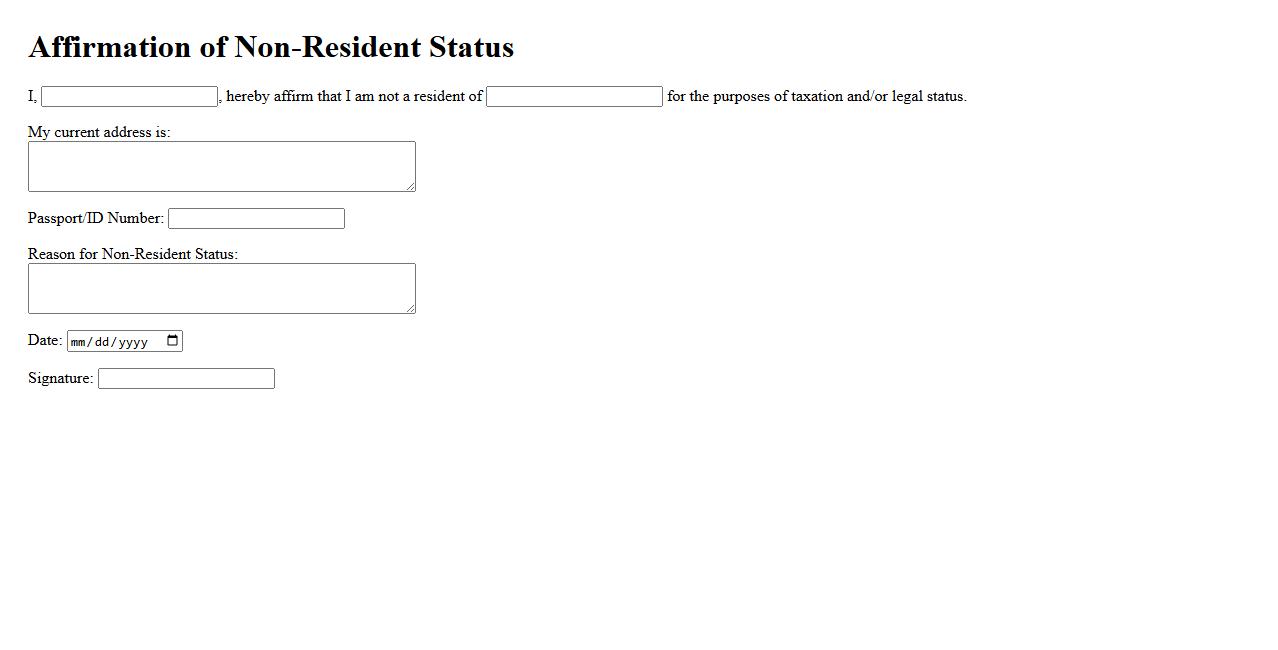

Affirmation of Non-Resident Status

An Affirmation of Non-Resident Status is a formal declaration used to confirm an individual's or entity's residency status outside a specific jurisdiction. This document helps organizations determine tax obligations and eligibility for certain benefits or exemptions. It is essential for complying with local regulations and avoiding unnecessary withholding taxes.

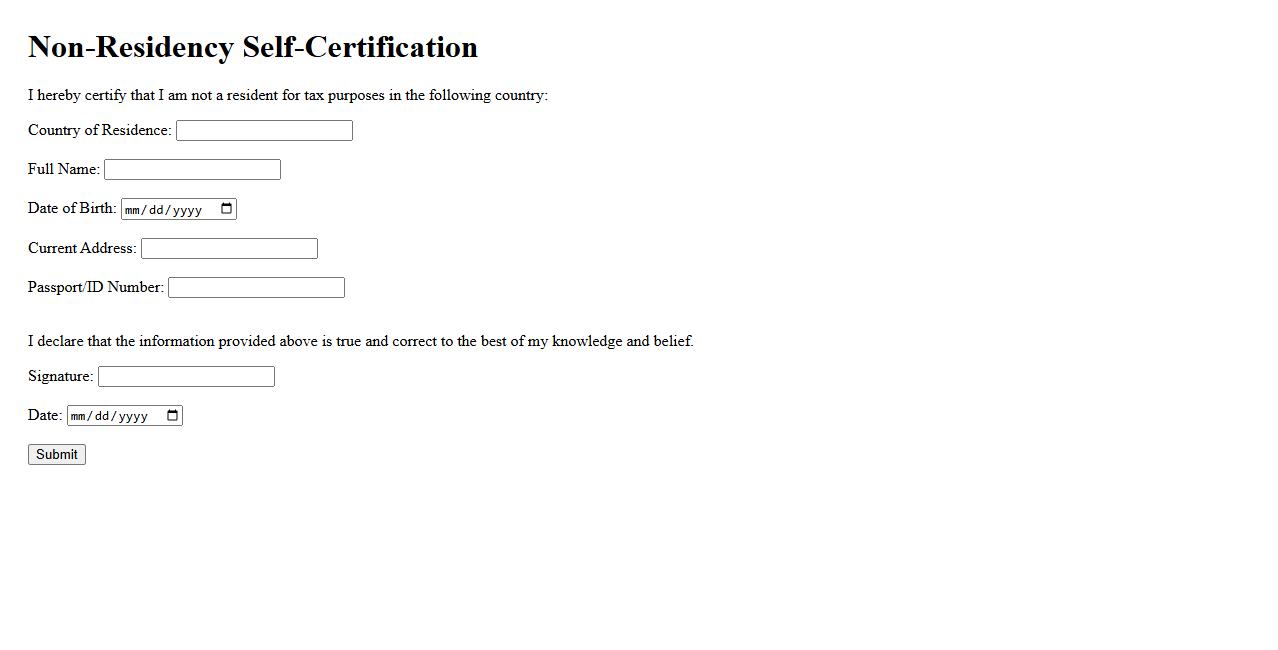

Non-Residency Self-Certification

Non-Residency Self-Certification is a process used to confirm an individual's tax residency status outside a particular country. This certification helps financial institutions comply with international tax regulations and reporting requirements. It ensures accurate identification for tax purposes and prevents double taxation or tax evasion.

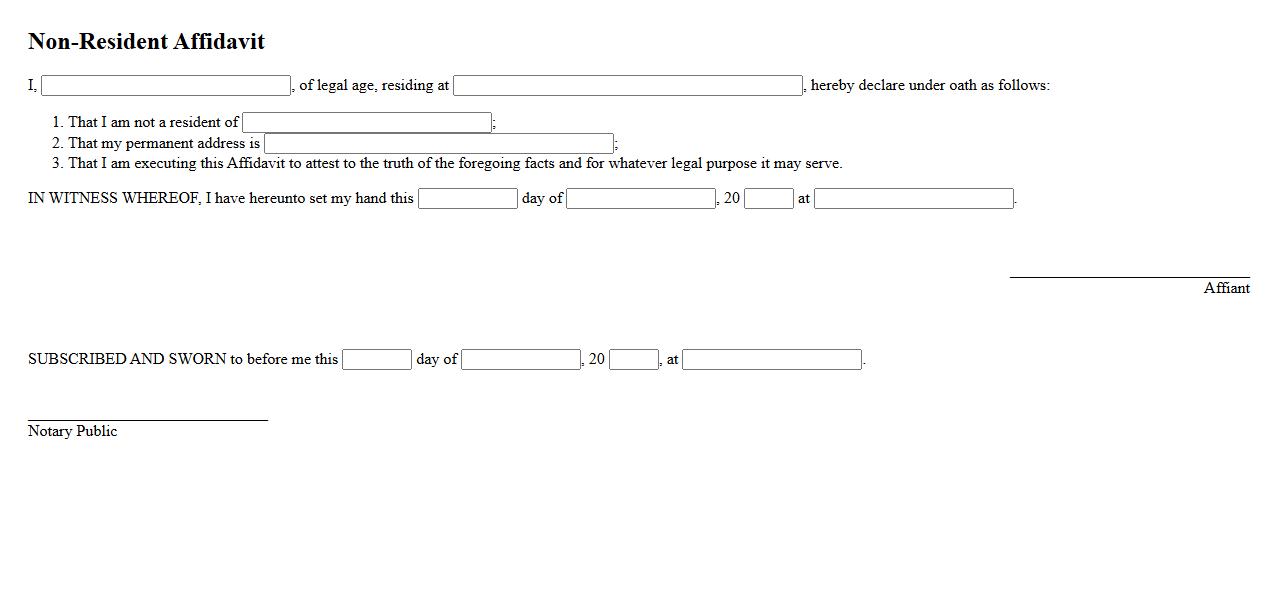

Non-Resident Affidavit

A Non-Resident Affidavit is a legal document used to verify an individual's residency status outside a specific jurisdiction. It often serves as proof for tax exemptions or educational benefits. This affidavit ensures non-residents meet necessary requirements without needing to provide traditional residency documentation.

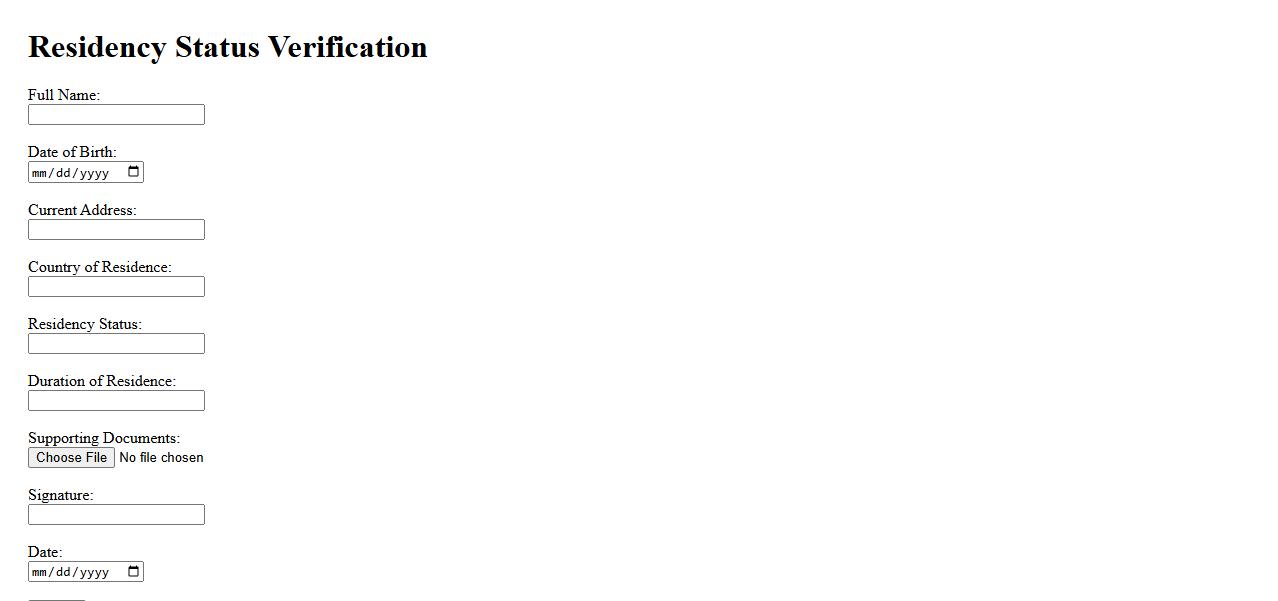

Residency Status Verification

Residency Status Verification is a crucial process used to confirm an individual's official place of residence for legal, tax, or administrative purposes. It ensures accuracy in record-keeping and compliance with relevant regulations. This verification helps institutions provide appropriate services based on the verified residency information.

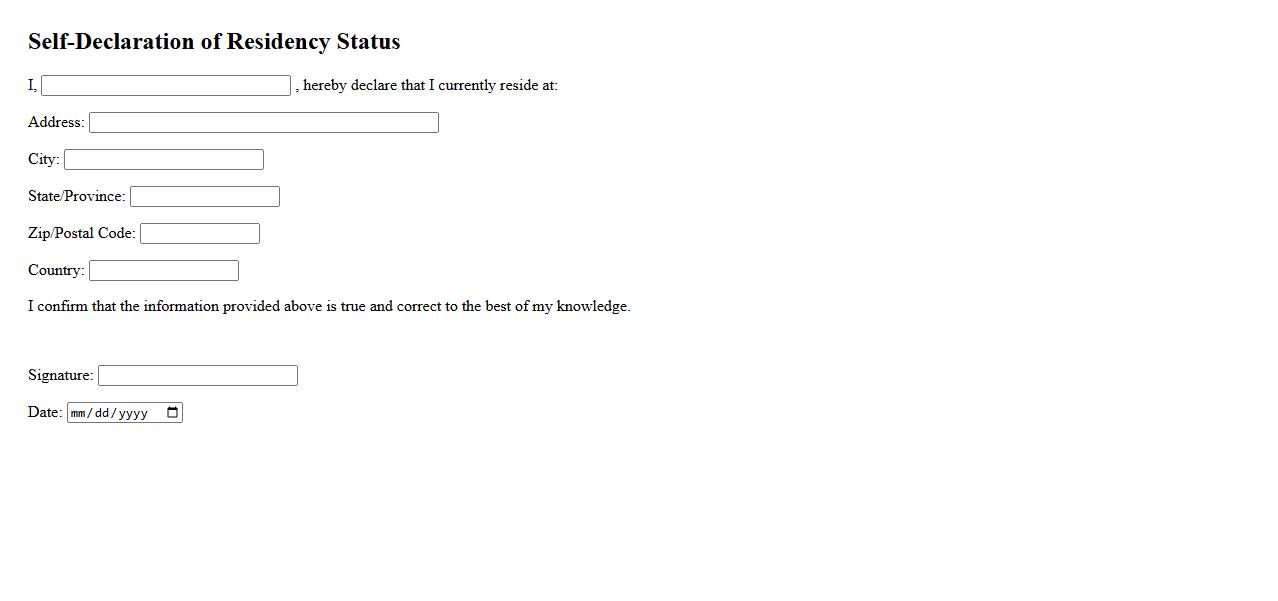

Self-Declaration of Residency Status

The Self-Declaration of Residency Status is a formal statement used to confirm an individual's place of residence for legal or official purposes. This declaration helps organizations verify eligibility for services, benefits, or compliance with regional regulations. It is often required in various administrative processes to ensure accurate residency records.

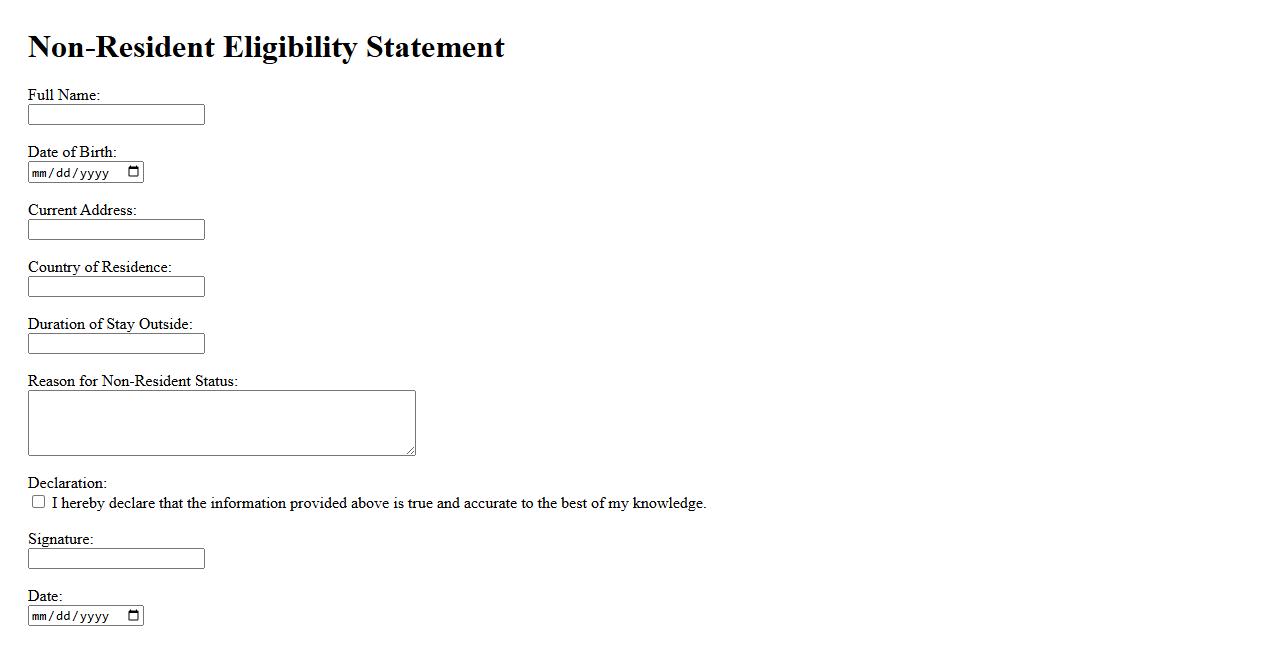

Non-Resident Eligibility Statement

The Non-Resident Eligibility Statement is a critical document used to verify an individual's qualification for certain benefits or services despite residing outside the primary jurisdiction. It ensures that non-residents meet specific criteria before accessing resources or opportunities. This statement helps organizations maintain compliance and accurate record-keeping.

What criteria must be met for an individual to qualify as a non-resident under this declaration?

To qualify as a non-resident, an individual must meet specific residency requirements set by the jurisdiction. Generally, this includes the number of days spent outside the country and the absence of significant ties such as a permanent home or family. Proof of residence in another country may also be required to confirm non-resident status.

How does declaring non-resident status affect tax obligations in the relevant jurisdiction?

Declaring non-resident status typically reduces or alters tax obligations in the jurisdiction. Non-residents may only be taxed on income sourced within the country rather than worldwide income. This declaration often leads to exemptions from certain local taxes or reduced tax rates.

What documentation is required to support a Declaration of Non-Resident Status?

Supporting documentation for a Declaration of Non-Resident Status usually includes proof of residence abroad, like utility bills, rental agreements, or foreign tax returns. Identification documents and official forms provided by the local tax authority are also essential. Some jurisdictions may require additional affidavits or testimonies verifying the non-residency claim.

What is the effective date of the declared non-resident status for legal and tax purposes?

The effective date of non-resident status generally corresponds to the date on which the declaration is filed or approved by the relevant authorities. This date determines when the individual's tax obligations under non-resident status begin. It is critical to file timely to ensure proper recognition and avoid retrospective tax liabilities.

Are there any potential penalties or consequences for falsely declaring non-resident status?

Falsely declaring non-resident status can result in severe penalties including fines, back taxes, and interest on unpaid amounts. Authorities may also impose legal actions or revoke the individual's privileges under the declaration. Accurate and truthful declarations are essential to avoid these serious consequences.