A Declaration of Non-Filing of Taxes is an official document stating that an individual or entity did not have a filing requirement for a specific tax year. This declaration is often required by financial institutions, government agencies, or for immigration purposes to verify that no tax return was filed. It serves as proof that the taxpayer met their legal obligations despite the absence of a filed tax return.

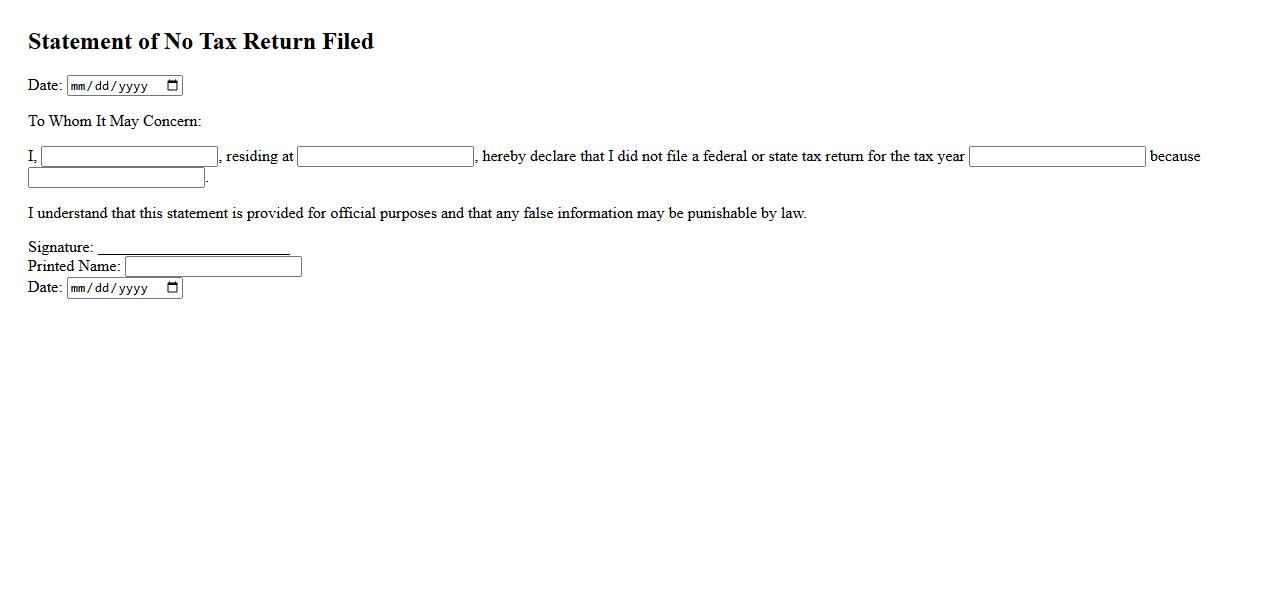

Statement of No Tax Return Filed

A Statement of No Tax Return Filed is a document used to confirm that an individual or entity did not submit a tax return for a specific period. It serves as proof that no income was earned or that the filing requirement was not applicable. This statement is often required by financial institutions or government agencies for verification purposes.

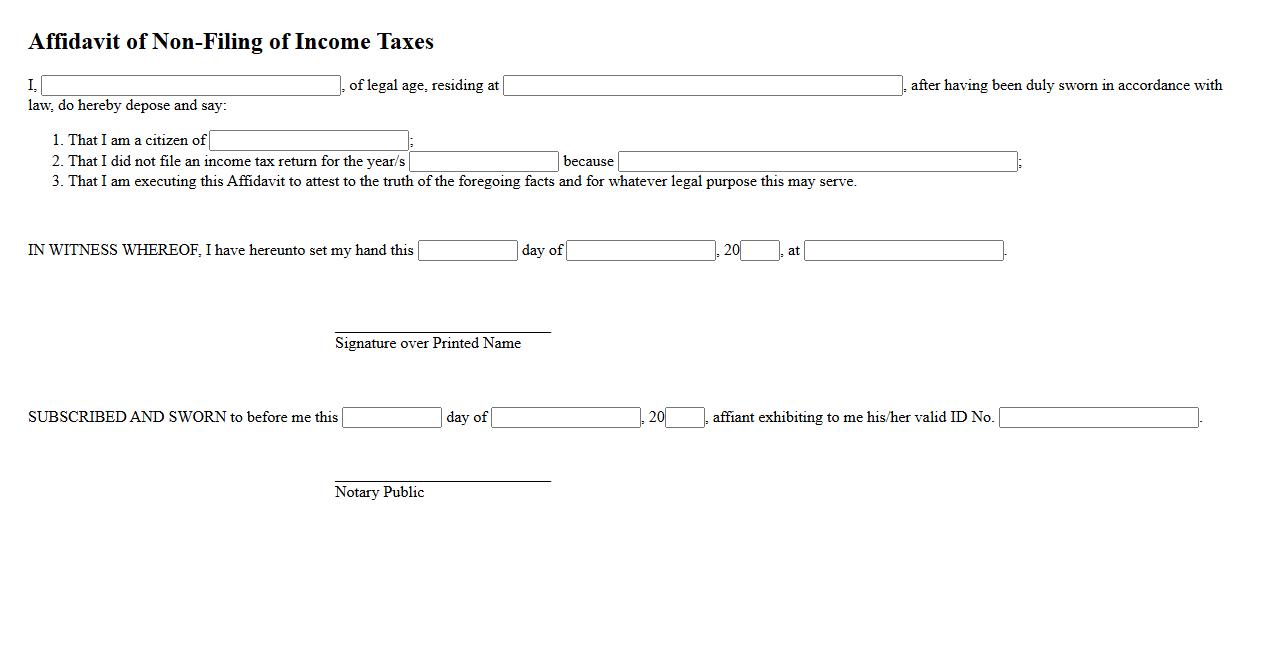

Affidavit of Non-Filing of Income Taxes

An Affidavit of Non-Filing of Income Taxes is a sworn statement confirming that an individual has not submitted a tax return for a specific period. This document is often required for financial aid applications, loan processing, or legal matters to verify the absence of income tax filings. It ensures transparency and compliance when tax records are unavailable or unnecessary.

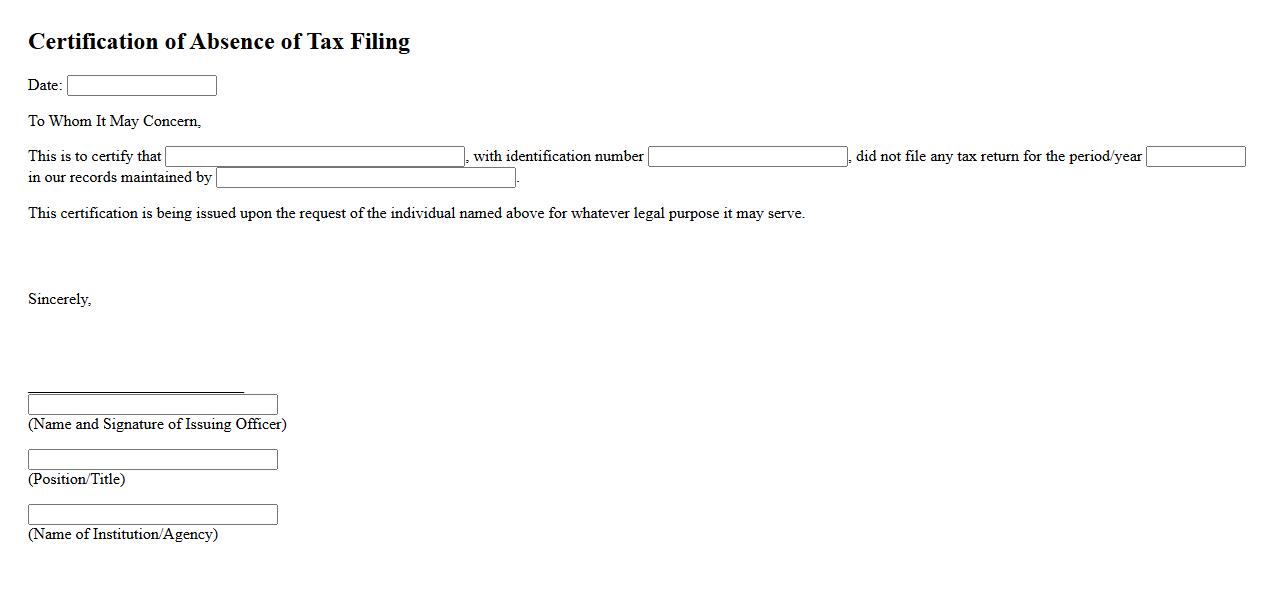

Certification of Absence of Tax Filing

The Certification of Absence of Tax Filing is an official document confirming that an individual or entity has not submitted a tax return for a specific period. This certification is often required for legal or financial purposes to verify compliance with tax regulations. It provides assurance to authorities or institutions that no tax filing has been made during the stated timeframe.

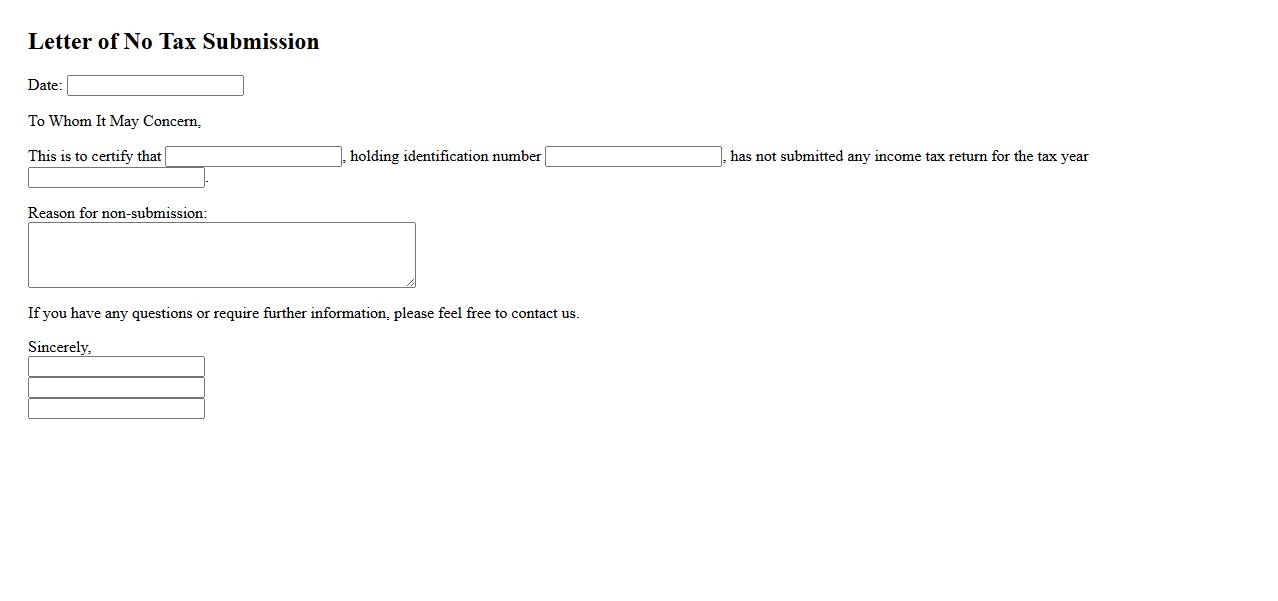

Letter of No Tax Submission

A Letter of No Tax Submission is an official document issued to certify that an individual or entity has not filed any tax returns for a specific period. This letter is often required for legal, financial, or administrative purposes to prove compliance with tax regulations. It helps clarify the taxpayer's status with the tax authority.

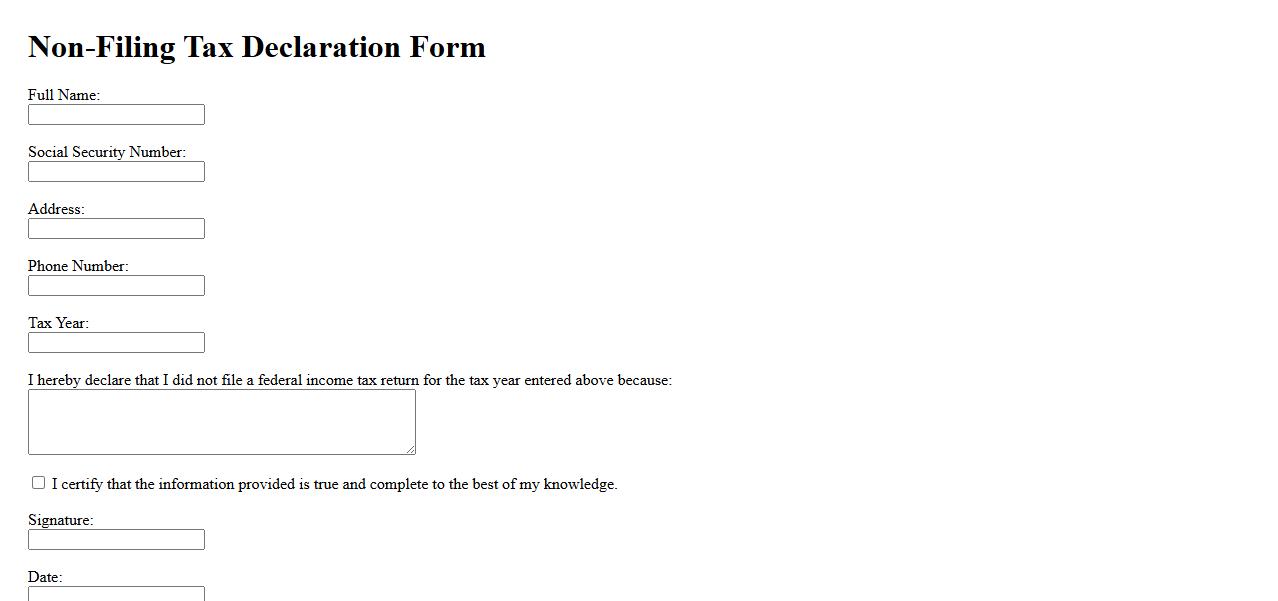

Non-Filing Tax Declaration Form

The Non-Filing Tax Declaration Form is a document used to certify that an individual or entity has not earned taxable income within a given period. This form is essential for those who need to prove their non-filing status to government agencies or financial institutions. Submitting it helps ensure compliance with tax regulations and avoid unnecessary penalties.

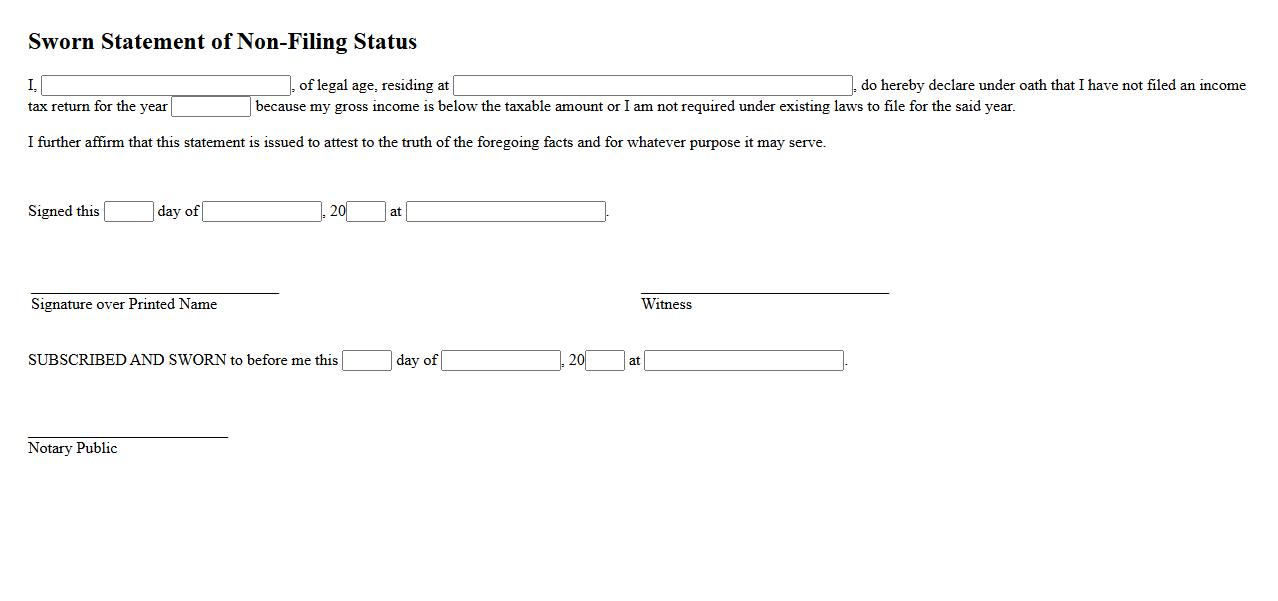

Sworn Statement of Non-Filing Status

A Sworn Statement of Non-Filing Status is a formal declaration confirming that an individual or entity has not filed a tax return for a specific period. This document is often required by lenders or government agencies to verify income status when tax returns are unavailable. It provides an official statement to support financial or legal processes.

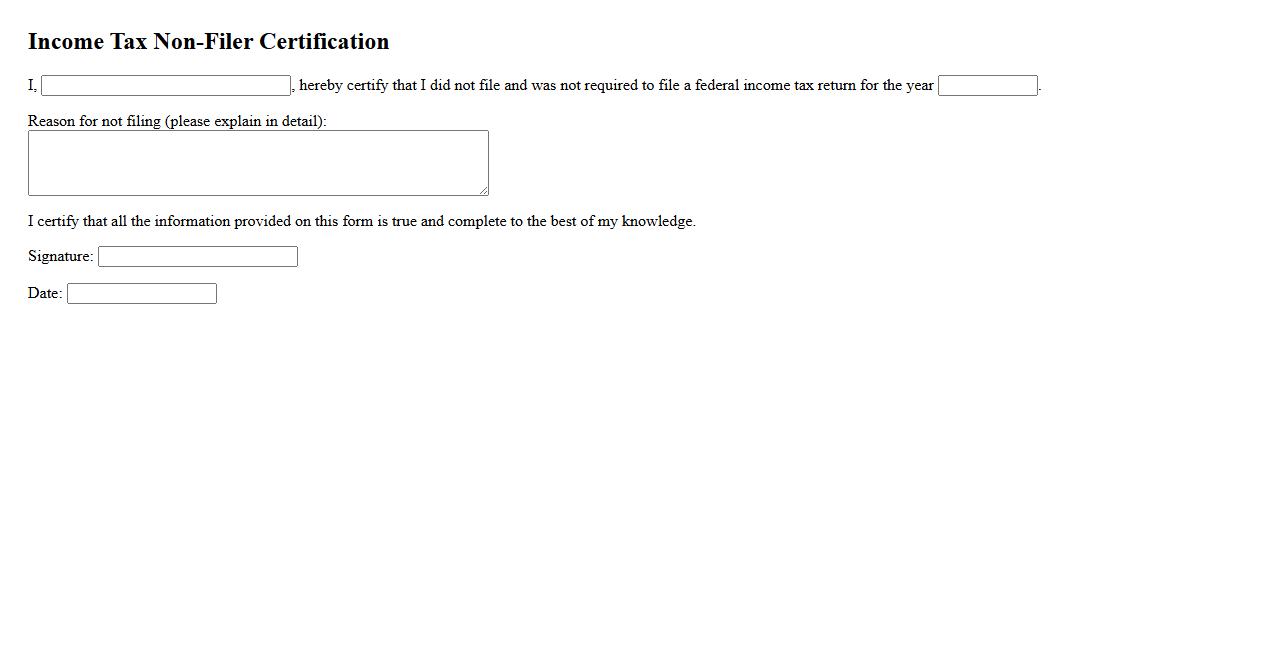

Income Tax Non-Filer Certification

The Income Tax Non-Filer Certification is an official document verifying an individual's non-filing status for income tax returns within a specified period. It is commonly required for various financial and legal transactions to confirm tax compliance. This certification helps streamline processes by providing proof of non-filing to relevant authorities and institutions.

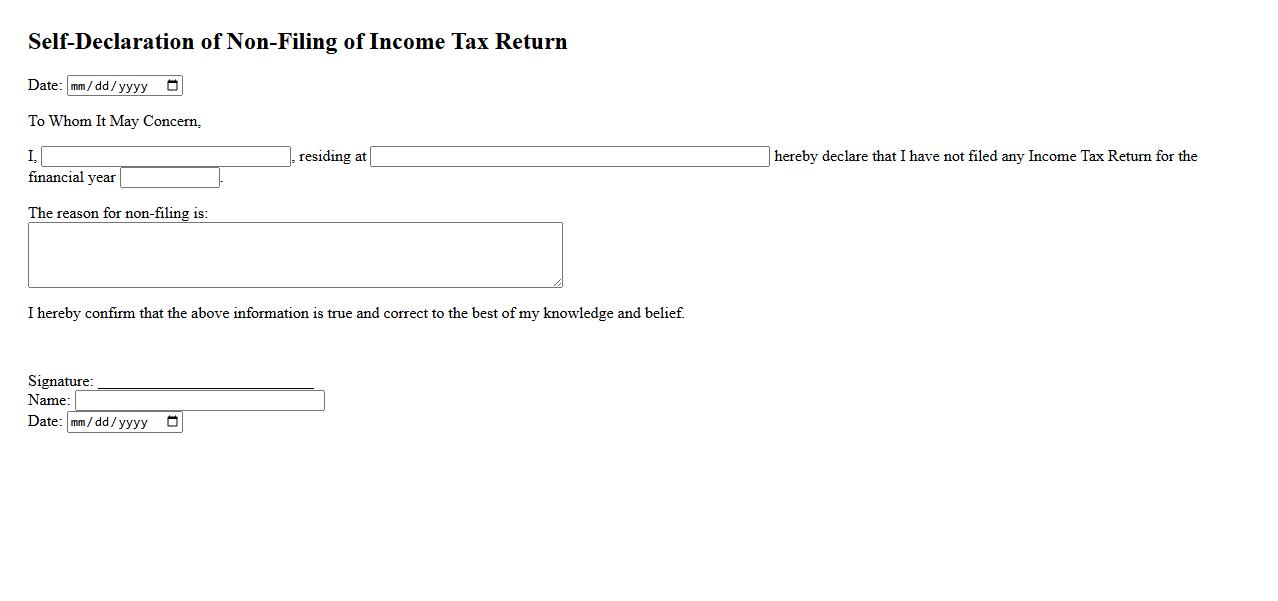

Self-Declaration of Non-Filing

The Self-Declaration of Non-Filing is a formal statement confirming that an individual has not filed a tax return for a specific financial year. This document is essential for verifying non-obligation to file taxes and is often required for financial or legal processes. It helps institutions ensure compliance with tax regulations without requiring official tax return submissions.

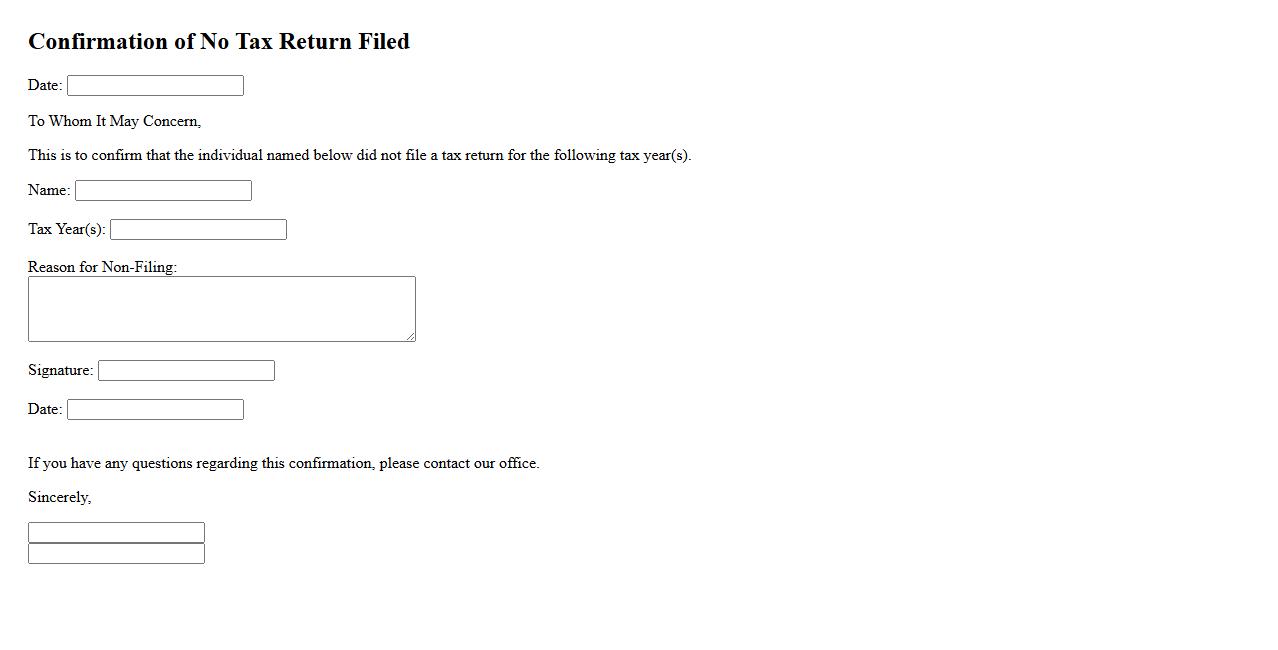

Confirmation of No Tax Return Filed

The confirmation of no tax return filed is an official statement verifying that an individual or entity has not submitted a tax return for a specific period. This document is essential for applications requiring proof of tax status or exemption. It ensures transparency and compliance with relevant tax authorities.

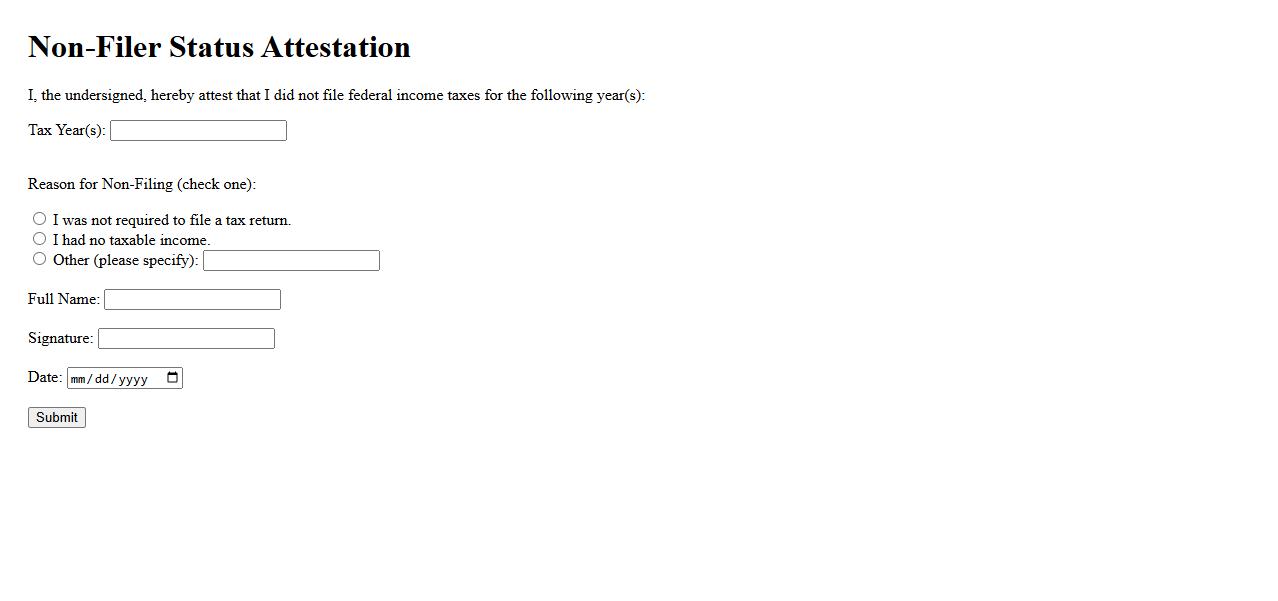

Non-Filer Status Attestation

The Non-Filer Status Attestation is a formal declaration used to confirm that an individual has not filed income tax returns for a specific period. This document is often required by financial institutions and government agencies to verify tax compliance status. It serves as proof for eligibility in various schemes and financial transactions where tax filing is mandatory.

What is the primary purpose of a Declaration of Non-Filing of Taxes?

The primary purpose of a Declaration of Non-Filing of Taxes is to formally state that an individual did not earn sufficient income to be required to file a tax return. This document serves as official proof of non-filing for government agencies or institutions. It is often used to comply with requirements for loans, scholarships, or other financial processes.

Under what circumstances is an individual required to submit a Declaration of Non-Filing of Taxes?

An individual must submit a Declaration of Non-Filing of Taxes when their income falls below the mandatory filing threshold set by tax authorities. This usually happens if they had no taxable income during the fiscal year or earned income exempt from taxation. It is important in situations where evidence of non-filing is needed for administrative or legal purposes.

Which personal details must be accurately included in a Declaration of Non-Filing of Taxes?

The Declaration must include the individual's full name, Tax Identification Number (TIN), and address. Additionally, the tax year for which the declaration is made must be clearly stated. Accurate and truthful personal details ensure the document is valid and accepted by relevant authorities.

What legal implications might arise from submitting false information in a Declaration of Non-Filing of Taxes?

Submitting false information in a Declaration of Non-Filing of Taxes can lead to serious legal consequences, including penalties and criminal charges. It constitutes tax fraud or misrepresentation under the law. Individuals may face fines, audits, or other enforcement actions by tax authorities as a result.

Which supporting documents, if any, are commonly attached to a Declaration of Non-Filing of Taxes?

Commonly attached supporting documents include affidavit forms or certification letters from employers confirming no income was earned. Sometimes, notices from tax authorities indicating no filing requirement are also provided. These attachments serve to validate the claim of non-filing and support the declaration's authenticity.