A Declaration of Bankruptcy is a formal statement submitted by an individual or business indicating an inability to repay outstanding debts. This legal process initiates the assessment and distribution of assets to creditors under court supervision. It aims to provide a structured resolution for debt relief while protecting the debtor from further collection actions.

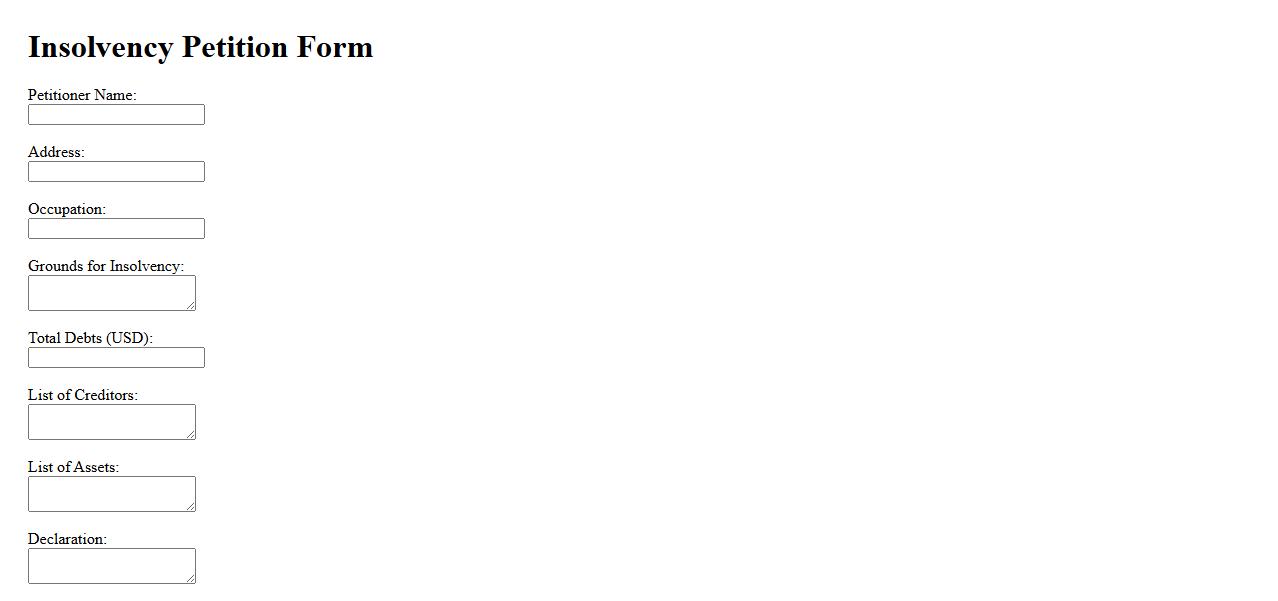

Insolvency Petition

An Insolvency Petition is a formal request submitted to the court seeking a declaration of bankruptcy or insolvency against an individual or company. It initiates legal proceedings to address unpaid debts and protect creditors' rights. This petition is a crucial step in resolving financial distress through structured insolvency processes.

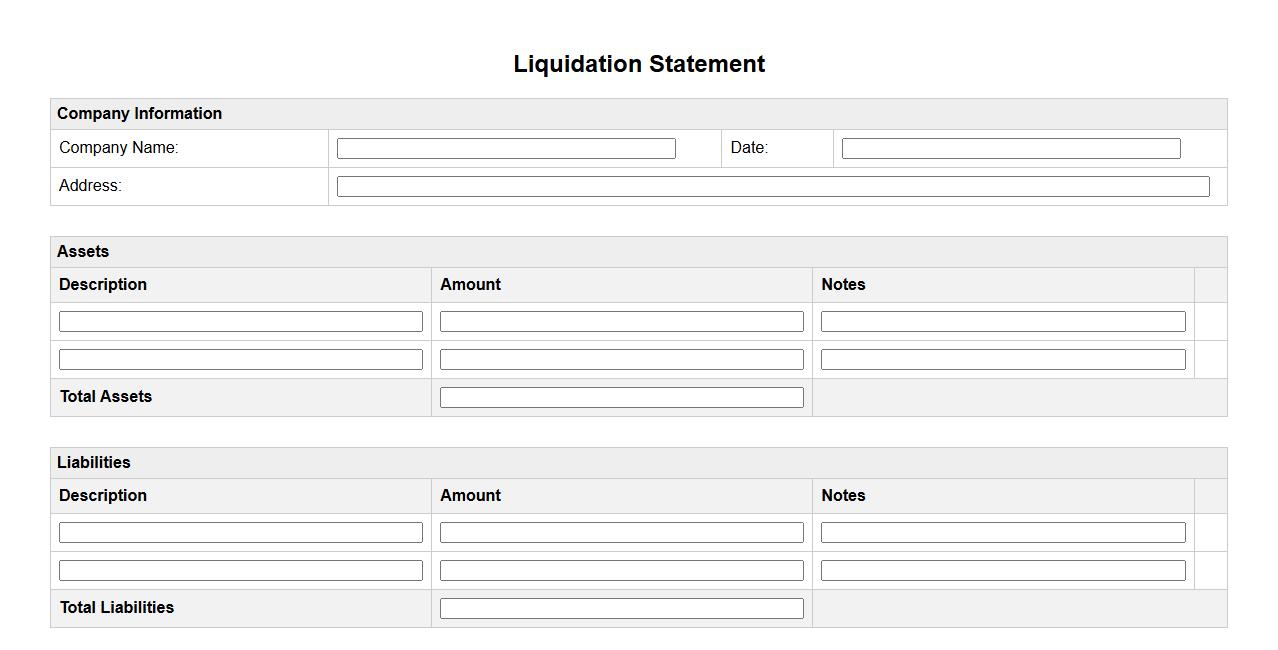

Liquidation Statement

A Liquidation Statement is a detailed document outlining the distribution of assets during the liquidation of a company. It provides transparency to creditors and stakeholders by summarizing the final amounts paid and settled. This statement is essential for ensuring an orderly and fair dissolution process.

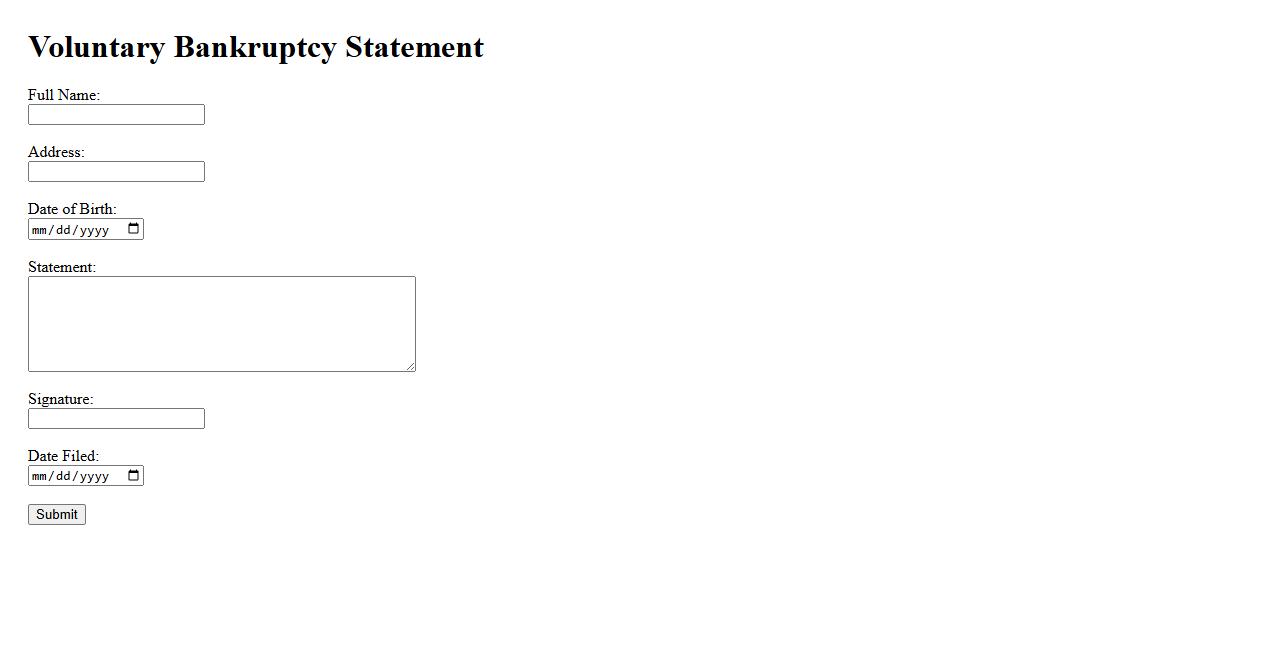

Voluntary Bankruptcy Statement

The Voluntary Bankruptcy Statement is a legal document filed by an individual or business choosing to initiate bankruptcy proceedings. It outlines the debtor's financial situation, including assets and liabilities, to facilitate the fair resolution of debts. This statement is essential for transparent communication with creditors and the court.

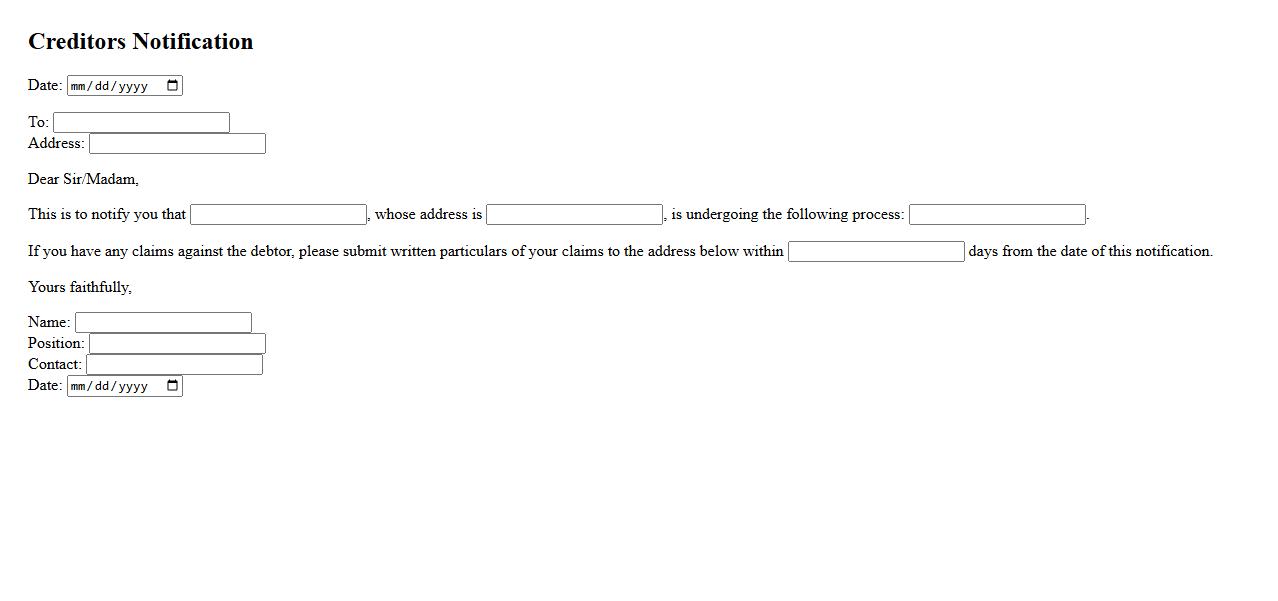

Creditors Notification

Creditors Notification is a formal announcement informing creditors about important updates related to financial matters or company changes. It ensures transparency and timely communication, enabling creditors to take necessary actions or raise concerns. This process is crucial for maintaining trust and legal compliance in financial dealings.

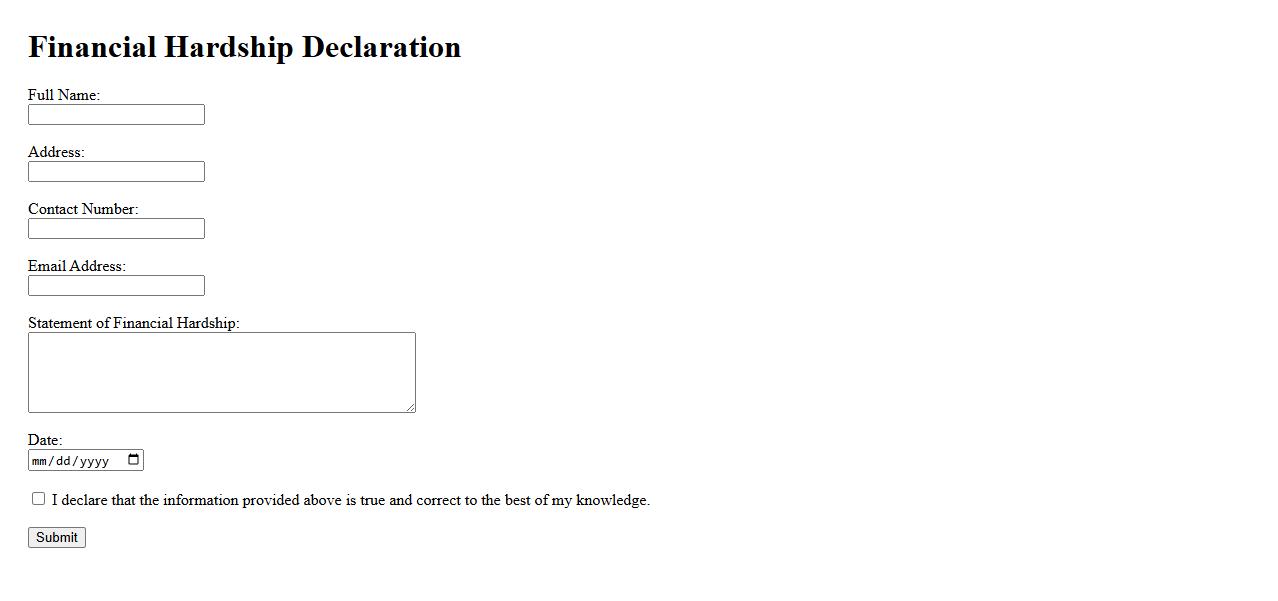

Financial Hardship Declaration

A Financial Hardship Declaration is a formal statement that individuals submit to explain their current economic difficulties. It is often required by institutions to assess eligibility for assistance or flexible payment plans. This declaration helps provide transparency and supports requests for financial relief.

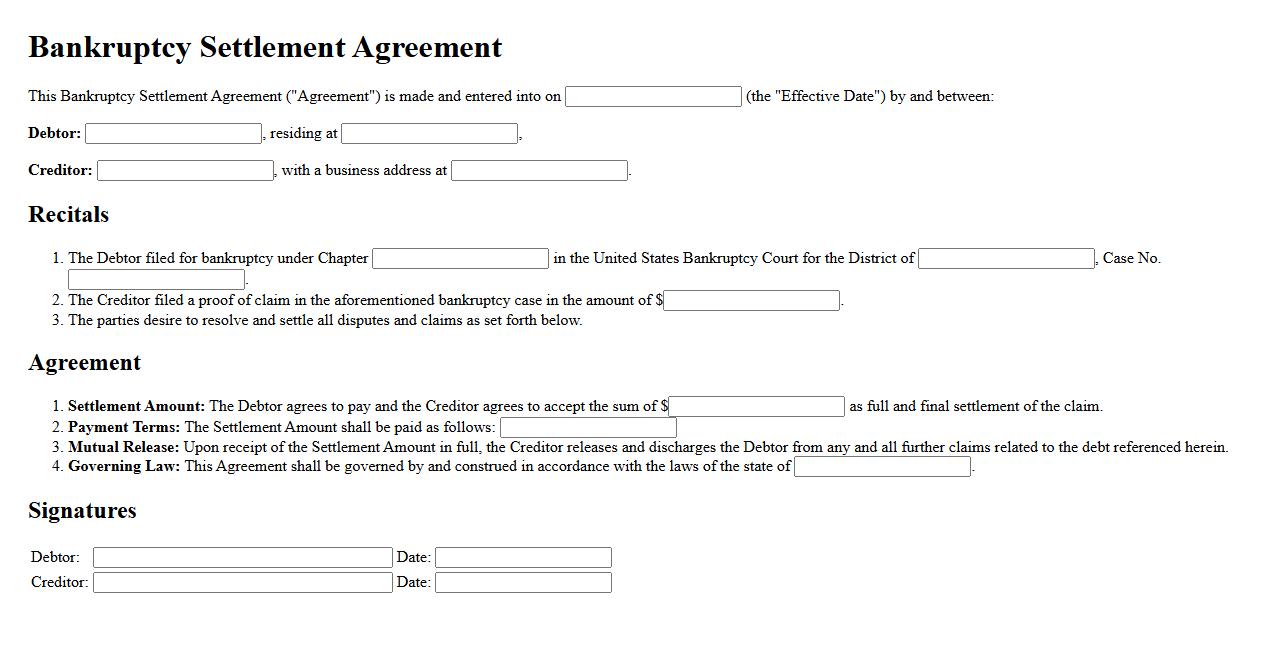

Bankruptcy Settlement Agreement

A Bankruptcy Settlement Agreement is a legal contract between a debtor and creditors to resolve outstanding debts during bankruptcy proceedings. It outlines the terms and conditions for repayment or discharge of debts, helping to avoid prolonged litigation. This agreement ensures fair treatment of creditors while providing the debtor with a structured path to financial recovery.

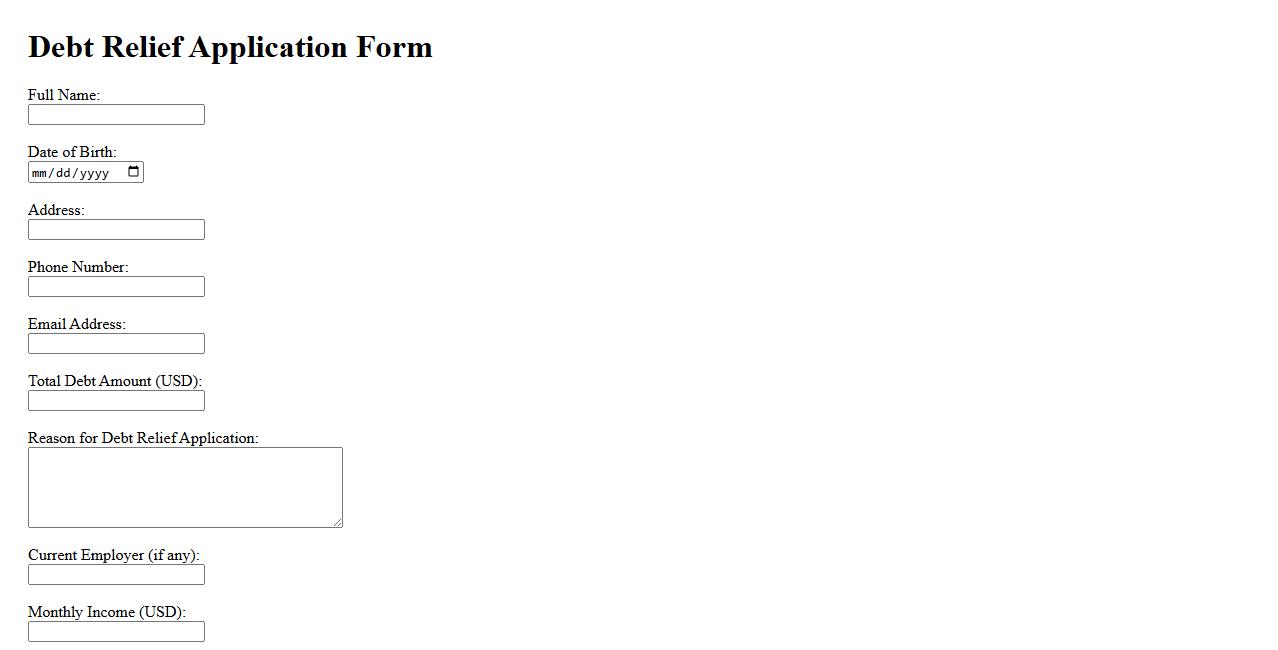

Debt Relief Application

The Debt Relief Application is designed to help users manage and reduce their financial burdens efficiently. By providing personalized plans and support, it enables individuals to regain control over their debts. This tool simplifies the process of debt consolidation and repayment.

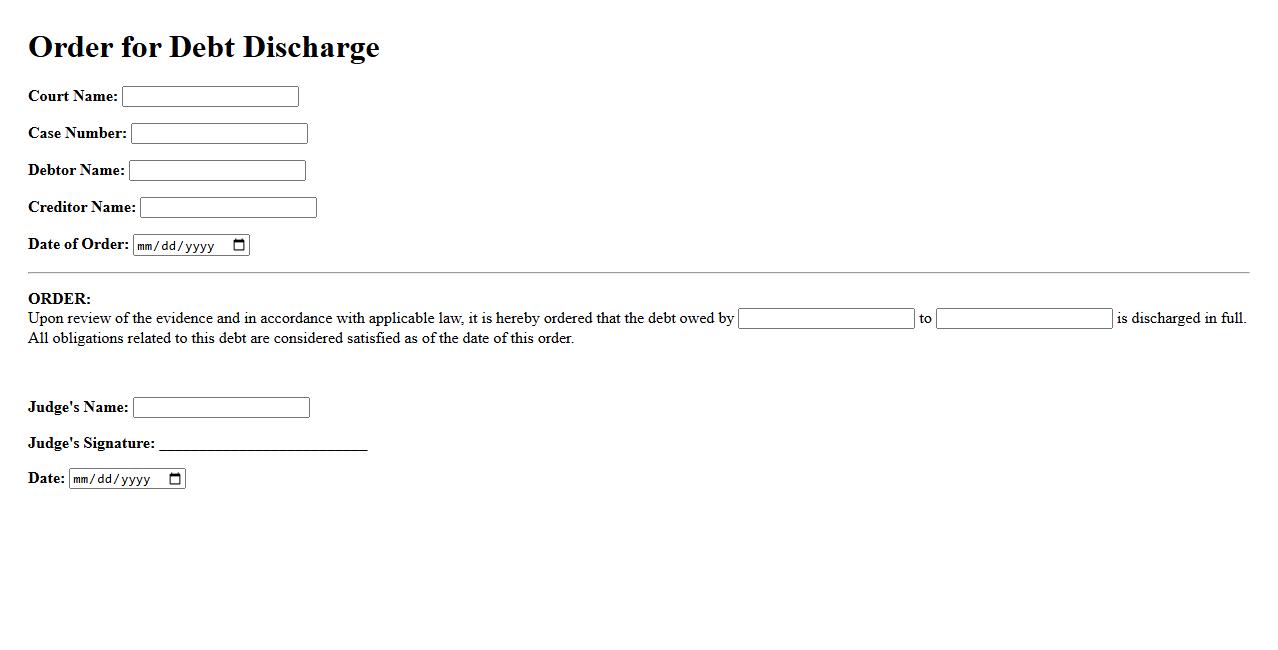

Order for Debt Discharge

An Order for Debt Discharge is a legal directive issued by a court that forgives a borrower's obligation to repay a specified debt. This order typically occurs after the debtor has met certain conditions or completed a bankruptcy process. It provides financial relief and resets the individual's credit standing.

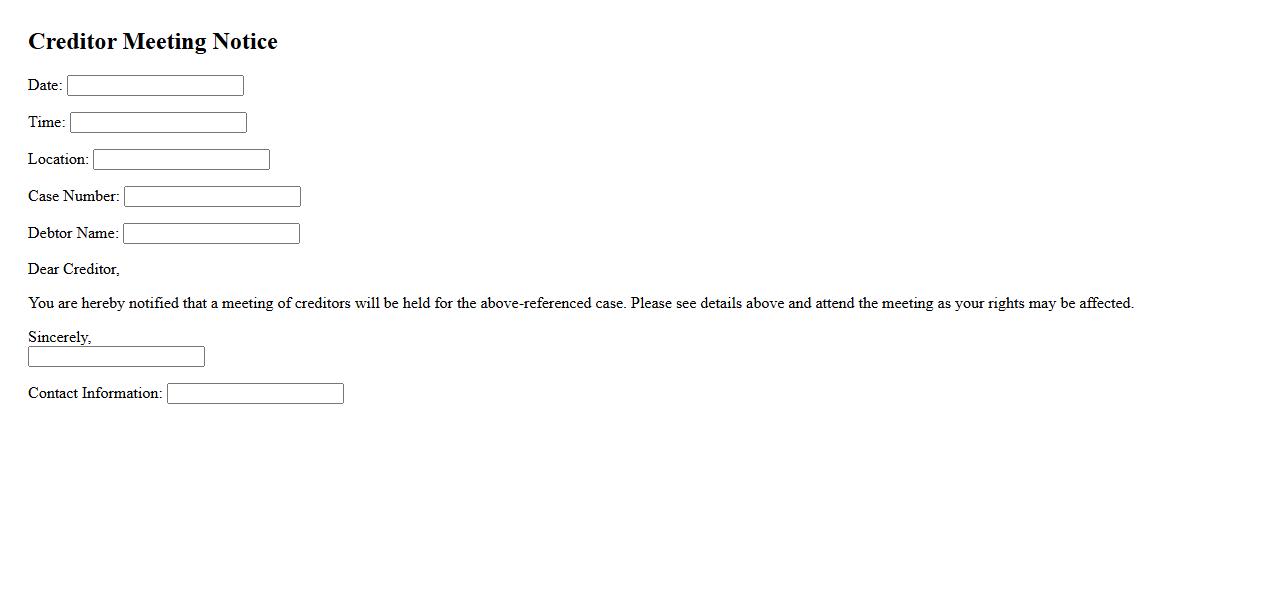

Creditor Meeting Notice

The Creditor Meeting Notice informs all creditors about the scheduled meeting where they can discuss and review the debtor's financial situation. This notice includes essential details such as the date, time, and location of the meeting. Timely attendance ensures creditors can protect their interests and participate in important decisions.

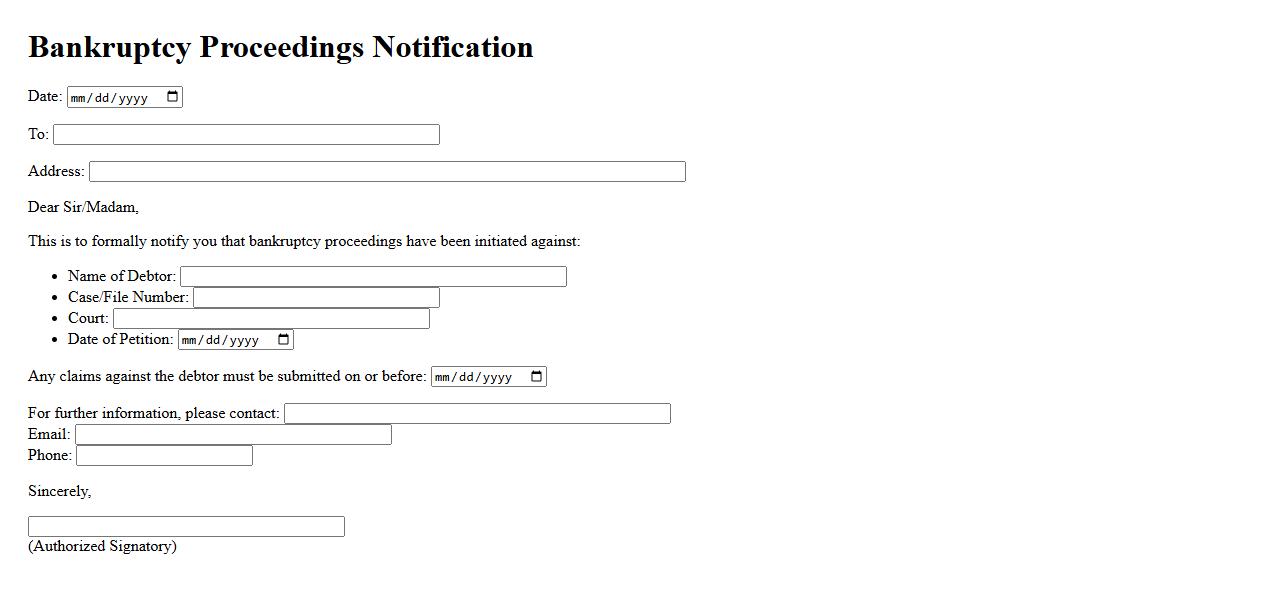

Bankruptcy Proceedings Notification

The Bankruptcy Proceedings Notification serves as a formal alert to creditors and stakeholders about the initiation of bankruptcy processes. It ensures transparency and provides critical information regarding deadlines and claims submissions. This notification is essential for maintaining legal compliance and facilitating orderly debt resolution.

What is the primary purpose of a Declaration of Bankruptcy?

The primary purpose of a Declaration of Bankruptcy is to provide legal protection to individuals or entities unable to meet their financial obligations. It aims to fairly distribute the debtor's assets among creditors and prevent further legal actions. This process also facilitates a structured resolution for insolvent parties under court supervision.

Which parties are legally enabled to file a Declaration of Bankruptcy?

Legally enabled parties to file a Declaration of Bankruptcy include individuals, businesses, and corporations facing insolvency. Additionally, creditors may initiate bankruptcy proceedings against a debtor to recover owed amounts. The law stipulates specific eligibility criteria for each type of filer.

What key financial conditions typically trigger a Declaration of Bankruptcy?

The most common financial conditions triggering a Declaration of Bankruptcy are sustained insolvency and inability to pay debts as they become due. Overwhelming liabilities exceeding assets and persistent cash flow problems also prompt filings. Courts evaluate these conditions to determine eligibility for bankruptcy protection.

How does a Declaration of Bankruptcy affect existing creditor claims and legal proceedings?

Upon filing a Declaration of Bankruptcy, a legal stay is imposed, halting ongoing creditor claims and lawsuits against the debtor. Creditors must submit claims within the bankruptcy process to seek repayment. This ensures an equitable distribution of the debtor's estate and prevents individual creditors from gaining unfair advantage.

What are the legal consequences and obligations for an individual or entity after filing a Declaration of Bankruptcy?

After filing a Declaration of Bankruptcy, the debtor faces restrictive legal consequences such as asset liquidation and limitations on financial activities. Debtors are obligated to disclose all assets and cooperate fully with the bankruptcy trustee. Moreover, bankruptcy can impact credit ratings and future borrowing capabilities significantly.