A Declaration of Residency for Tax Purposes is an official document used to confirm an individual's or entity's residency status for taxation. It helps tax authorities determine the applicable tax obligations and rates based on the declared residence. Accurate completion of this declaration ensures compliance with local and international tax regulations.

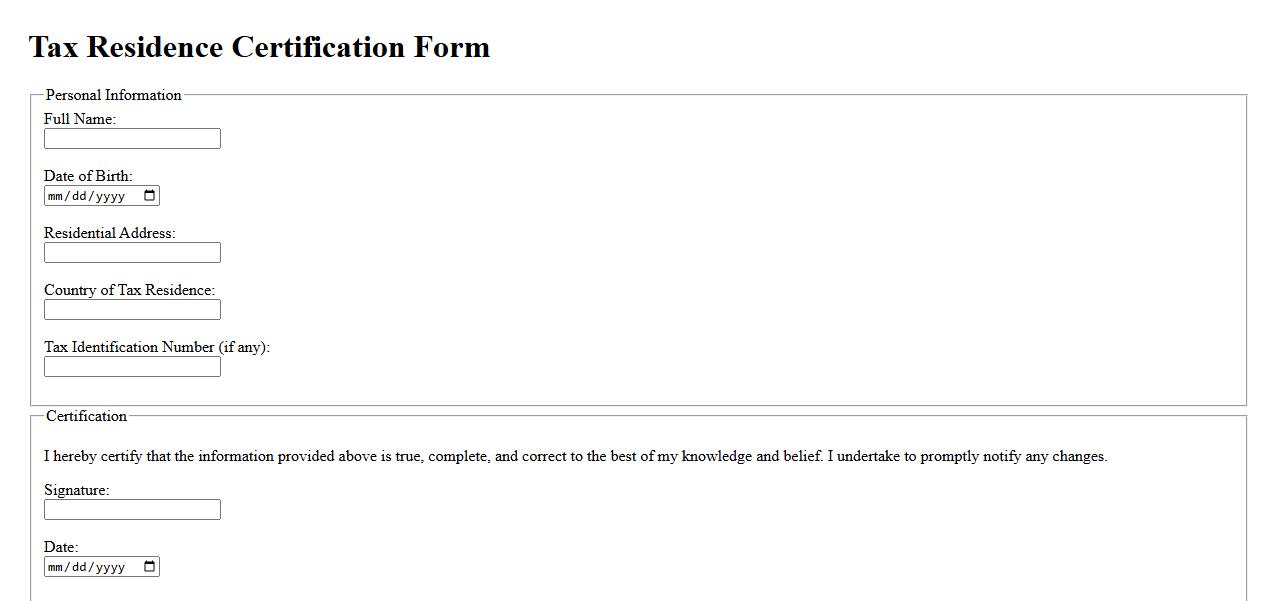

Tax Residence Certification Form

The Tax Residence Certification Form is an essential document used to verify an individual's or entity's tax residency status in a particular country. It helps prevent double taxation and ensures compliance with international tax treaties. Submitting this form accurately is crucial for tax withholding and reporting purposes.

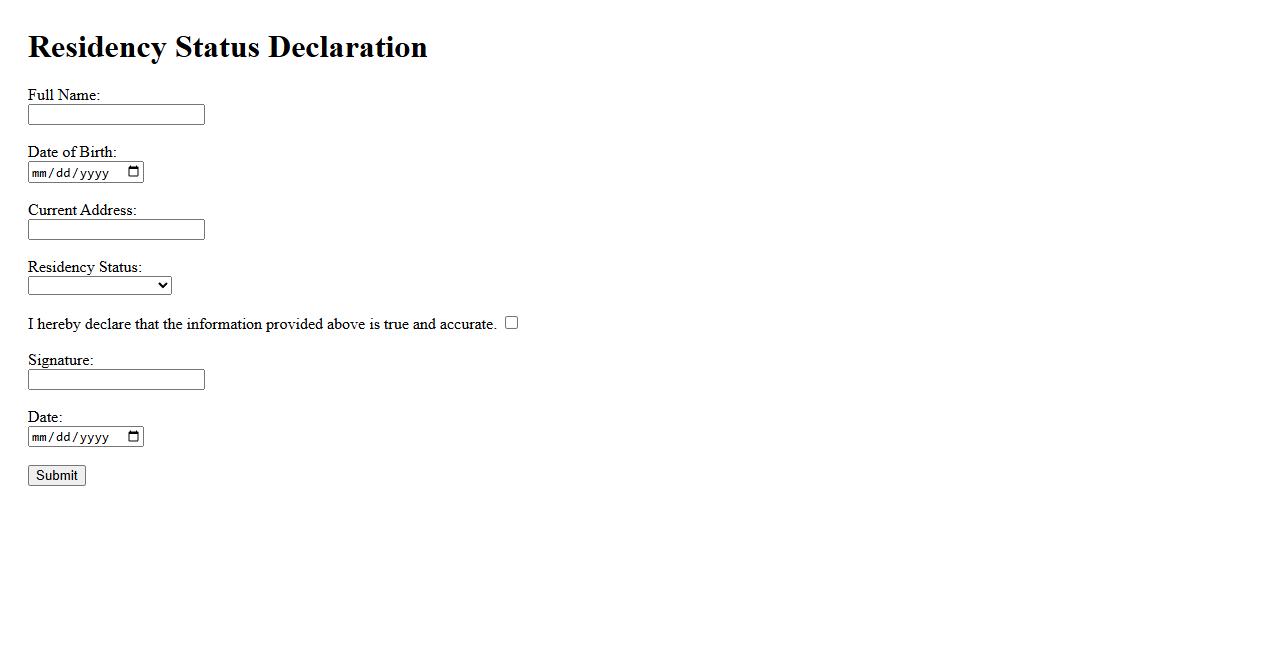

Residency Status Declaration

The Residency Status Declaration is a formal document used to confirm an individual's or entity's residency status for legal, tax, or administrative purposes. It ensures accurate application of relevant laws and regulations based on residency. Completing this declaration helps avoid misunderstandings and penalties related to residency classifications.

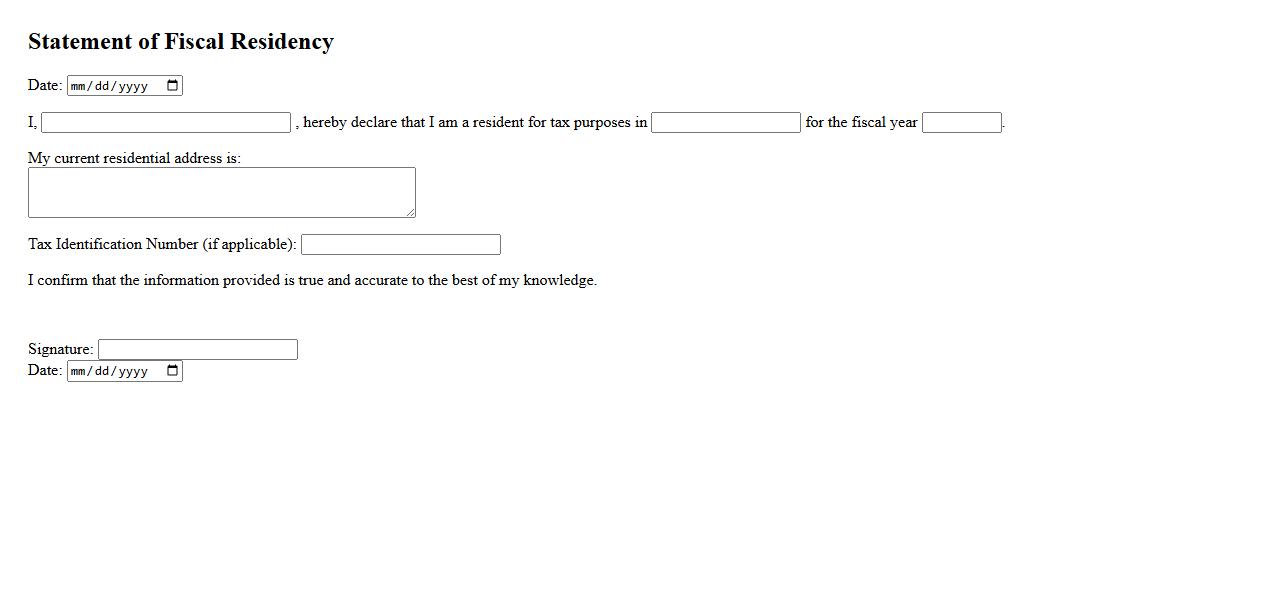

Statement of Fiscal Residency

The Statement of Fiscal Residency is an official document used to verify an individual's or entity's tax domicile. It ensures compliance with tax regulations by confirming the country where fiscal obligations are primarily fulfilled. This statement is essential for accurate tax reporting and avoiding double taxation.

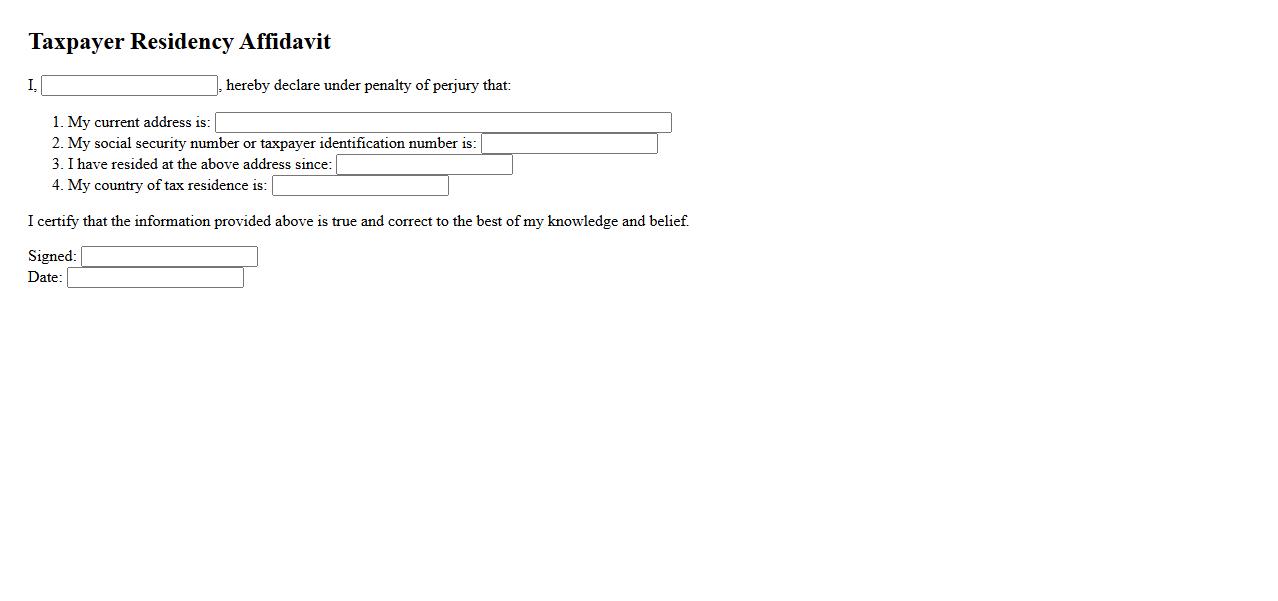

Taxpayer Residency Affidavit

The Taxpayer Residency Affidavit is a legal document used to certify an individual's residency status for tax purposes. It helps authorities determine tax obligations based on the declared residency. This affidavit ensures proper compliance with tax regulations by providing verified residency information.

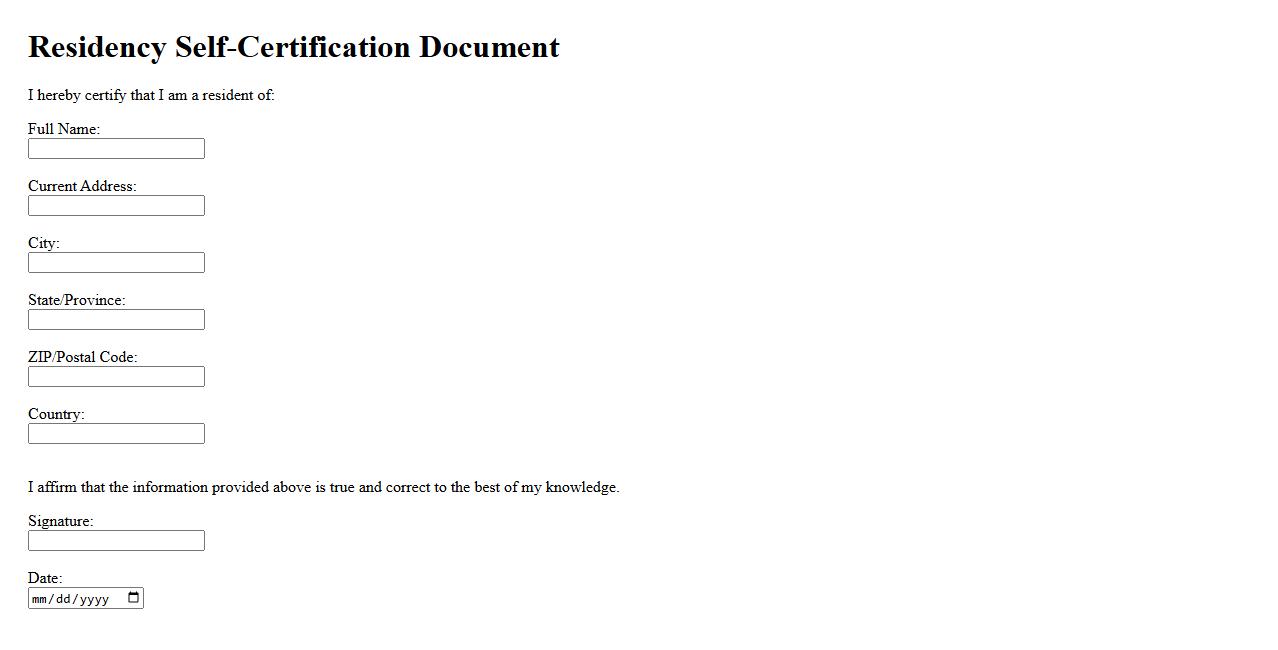

Residency Self-Certification Document

The Residency Self-Certification Document is a formal statement used to confirm an individual's place of residence. It serves as proof for legal, administrative, or financial purposes without requiring additional verification. This document helps streamline processes by allowing self-declaration of residency status.

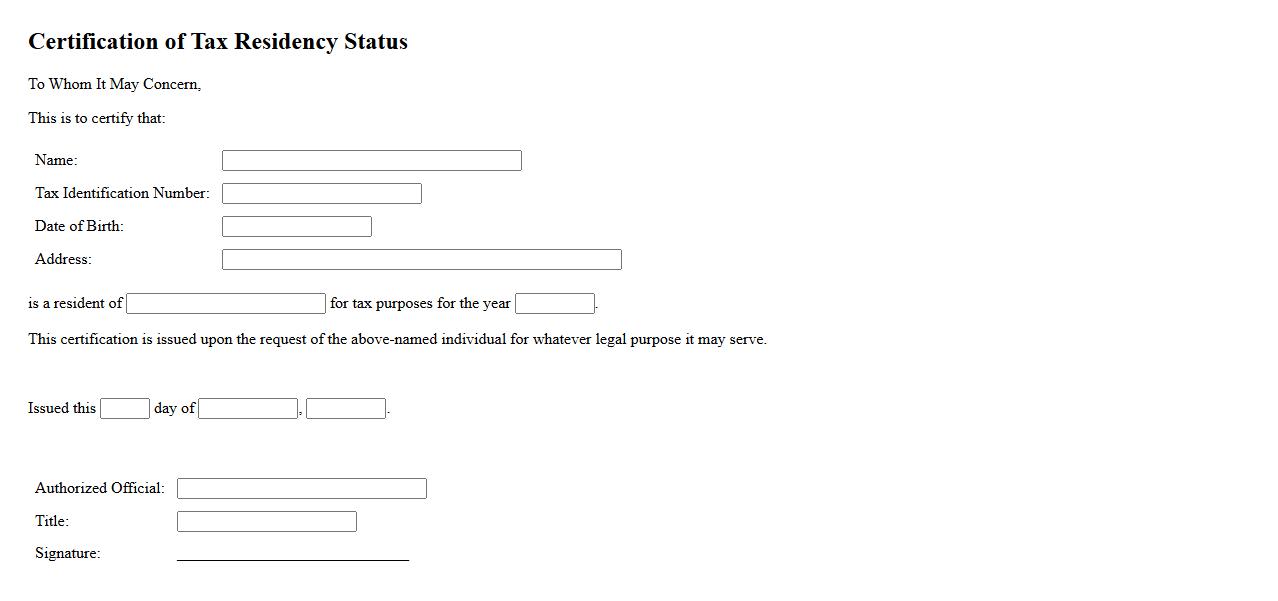

Certification of Tax Residency Status

The Certification of Tax Residency Status is an official document confirming an individual's or entity's tax residency in a specific country. It is essential for claiming tax benefits under international treaties and avoiding double taxation. This certification helps streamline tax compliance and facilitate cross-border financial transactions.

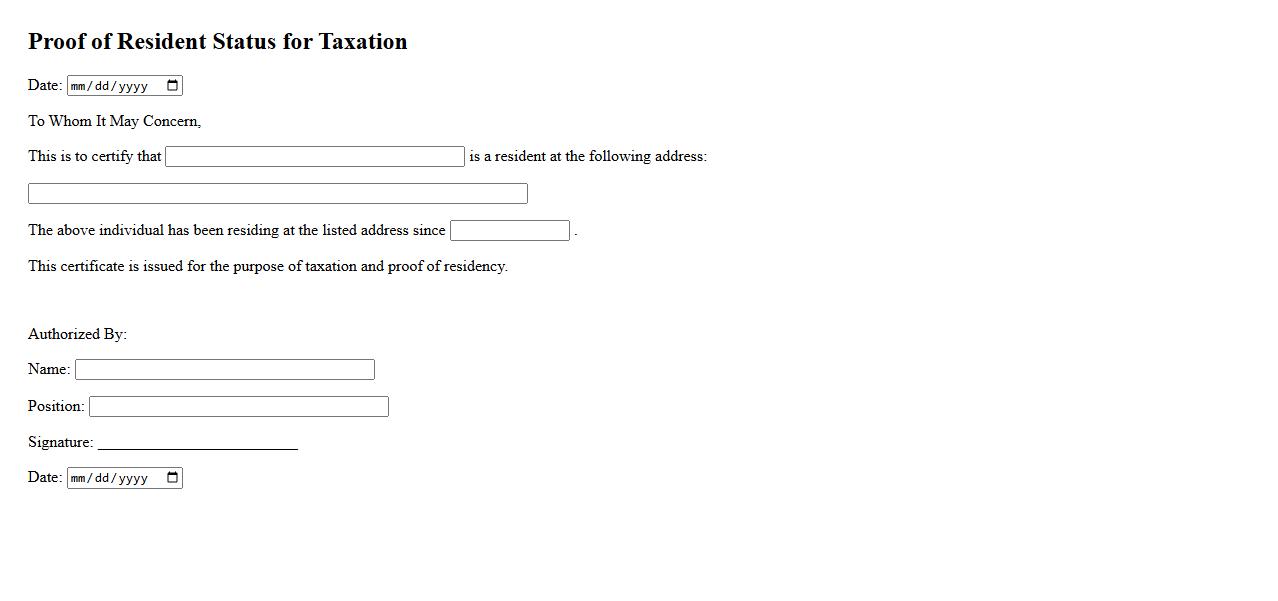

Proof of Resident Status for Taxation

Proof of Resident Status for taxation is a crucial document that verifies an individual's or entity's residency within a specific jurisdiction. It helps tax authorities determine the applicable tax obligations and eligibility for certain benefits. Providing accurate proof ensures compliance with local tax laws and avoids penalties.

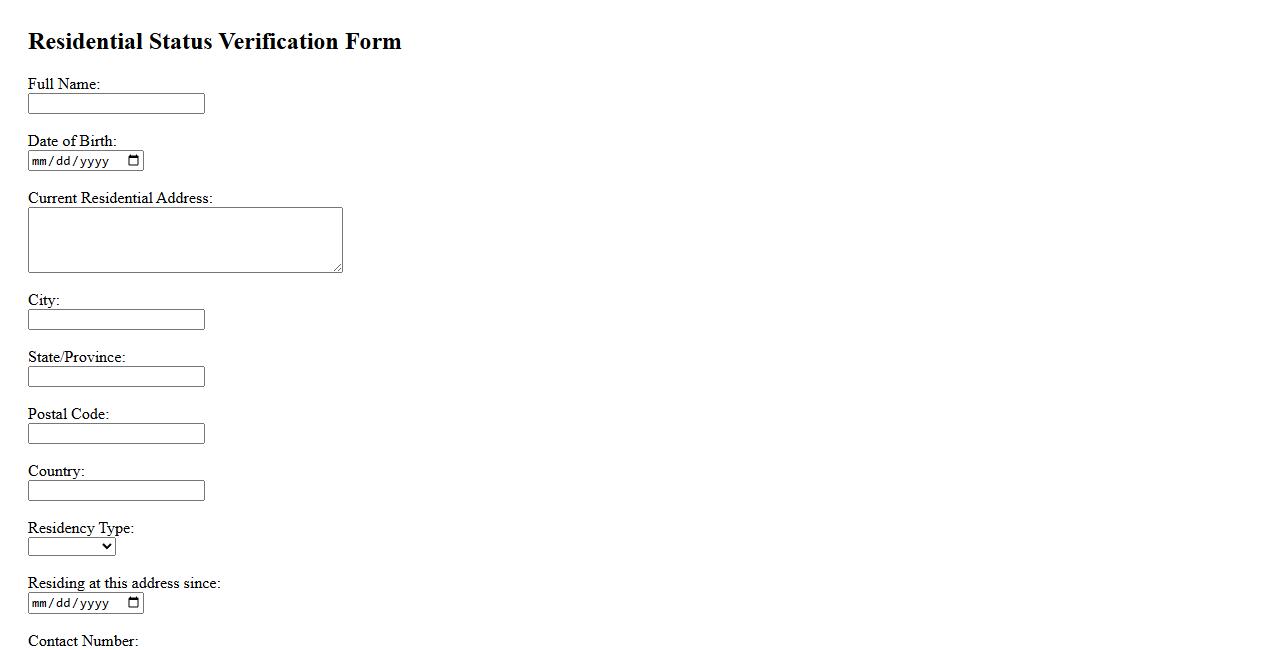

Residential Status Verification Form

The Residential Status Verification Form is used to confirm an individual's current living situation for official records. This document ensures accuracy in personal information and supports various legal and administrative processes. Completing the form helps verify residency details required by institutions and authorities.

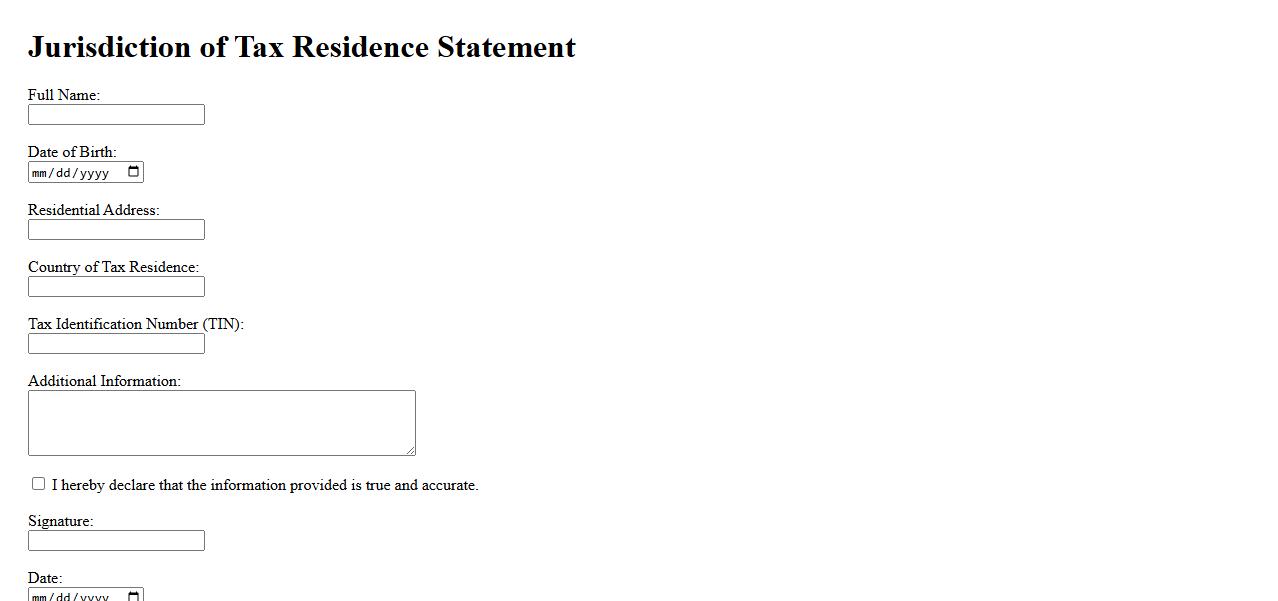

Jurisdiction of Tax Residence Statement

The Jurisdiction of Tax Residence Statement specifies the country or region where an individual or entity is recognized as a tax resident. This declaration is crucial for determining tax obligations and eligibility for tax treaties. Accurate jurisdiction information ensures compliance with international tax laws and avoids double taxation.

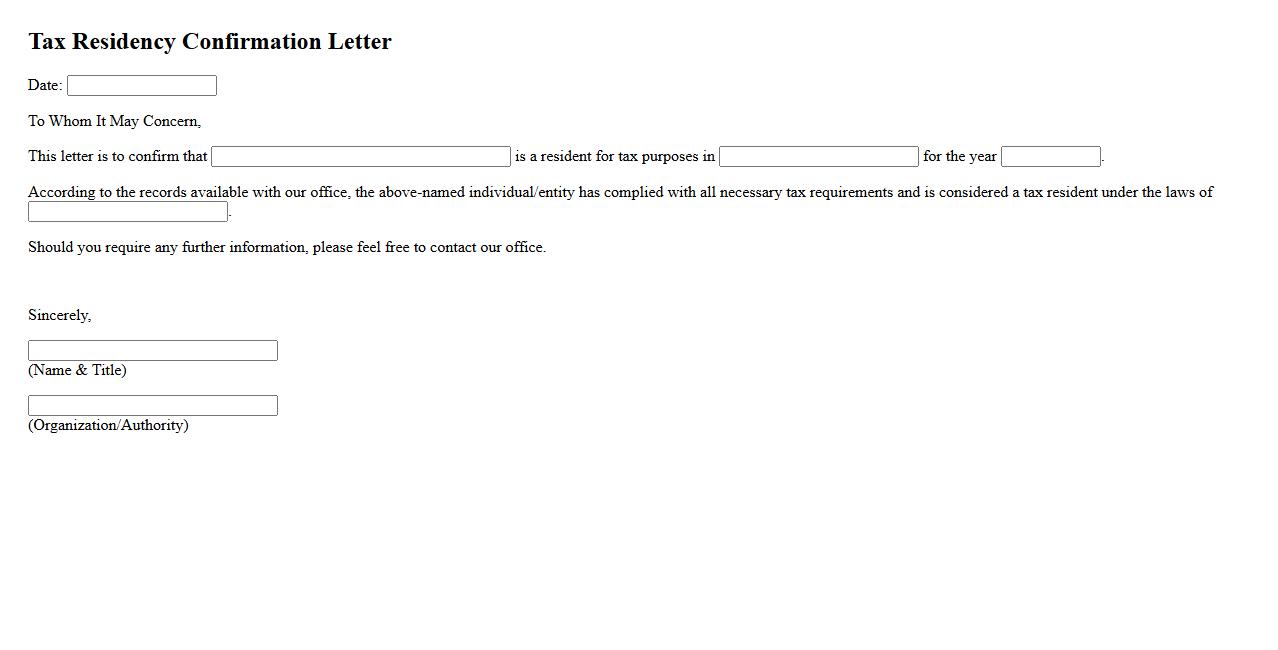

Tax Residency Confirmation Letter

A Tax Residency Confirmation Letter is an official document issued by tax authorities to certify an individual's or entity's tax residency status. This letter is often required for international tax compliance and to avoid double taxation. It helps confirm the country where the taxpayer is subject to tax obligations.

What information must be provided to establish residency status for tax purposes?

To establish residency status for tax purposes, individuals must provide their full name, date of birth, and current address. Additionally, details about the duration and purpose of their stay in the country are often required. Proof of residence such as utility bills, lease agreements, or employment contracts may also be necessary to validate residency.

How does the Declaration of Residency affect your tax withholding or reporting obligations?

The Declaration of Residency directly impacts how much tax is withheld from your income. Residents generally face different withholding rates compared to non-residents, affecting your net salary or payments. Moreover, it determines your tax reporting obligations, including eligibility for deductions and credits.

Which criteria determine whether an individual qualifies as a resident or non-resident for tax purposes?

Qualifying as a resident or non-resident for tax purposes depends on factors such as the length of stay, physical presence, and intention to reside. Many jurisdictions use the "183-day rule" to distinguish residents from non-residents. Other criteria include maintaining a permanent home or having a closer connection to the country.

What are the legal consequences of submitting false information on a Declaration of Residency?

Submitting false information on a Declaration of Residency can lead to severe legal consequences, including fines and penalties. It may also result in criminal charges such as tax fraud or evasion. Additionally, individuals risk losing eligibility for tax benefits and face audits or investigations by tax authorities.

How often must a Declaration of Residency for Tax Purposes be updated or renewed?

A Declaration of Residency typically must be updated or renewed annually or whenever significant changes occur in your residency status. Some jurisdictions require submission upon initial employment or income receipt and after changes, such as moving or extended travel. Timely updates ensure accurate tax withholding and compliance with local tax laws.