A Claim for Student Loan Forgiveness involves submitting an application to the appropriate loan servicer or government agency to seek relief from repaying all or part of a student loan balance. Eligibility criteria often include working in specific public service jobs, meeting payment thresholds, or demonstrating financial hardship. Proper documentation and understanding of program requirements are essential to successfully navigate the claim for student loan forgiveness process.

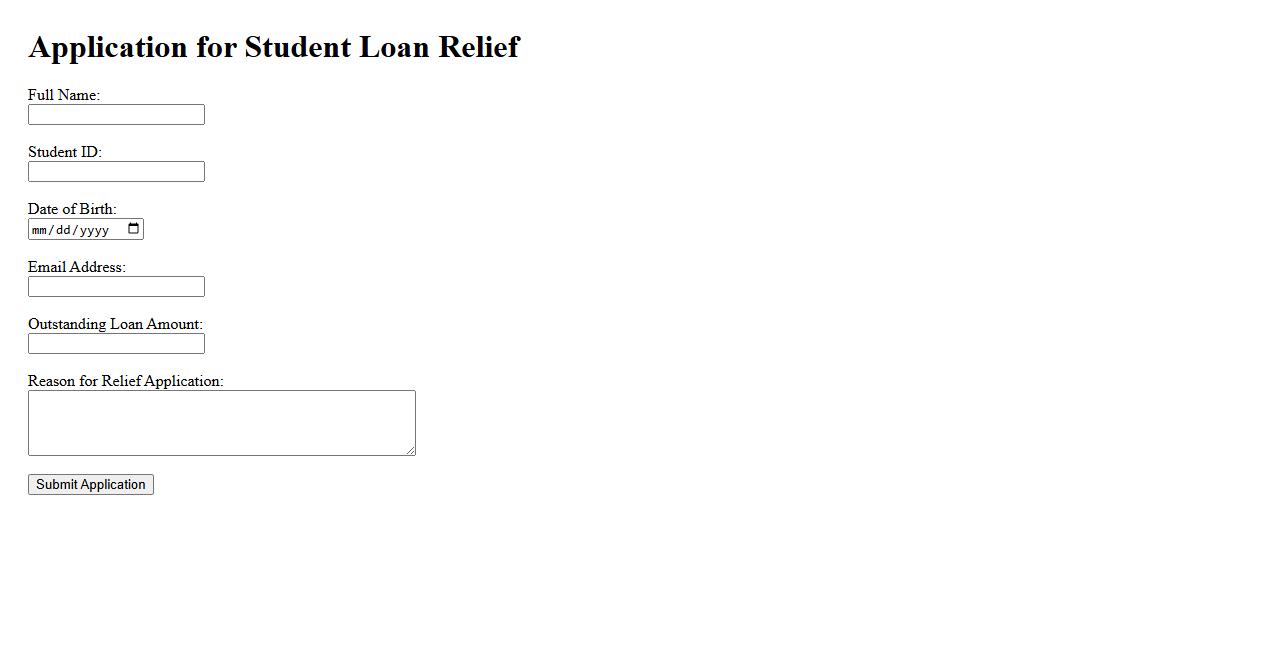

Application for Student Loan Relief

The Application for Student Loan Relief is designed to help borrowers reduce their financial burden by modifying loan terms or providing temporary payment suspension. This process ensures that students facing economic hardships can maintain their educational goals without the strain of overwhelming debt. Timely submission of the application is crucial for obtaining the necessary support and relief options available.

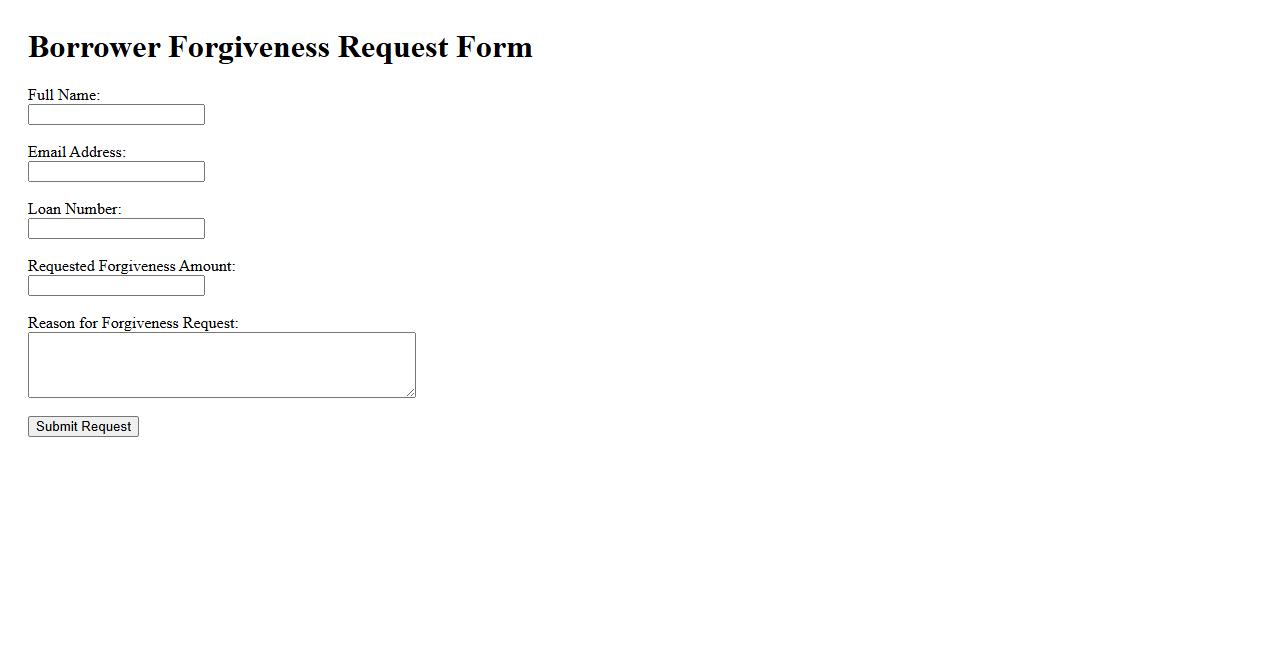

Borrower Forgiveness Request Form

The Borrower Forgiveness Request Form is a crucial document used to apply for loan forgiveness. It allows borrowers to officially request cancellation of their loan under qualifying programs. Submitting this form accurately ensures timely processing and potential relief from repayment obligations.

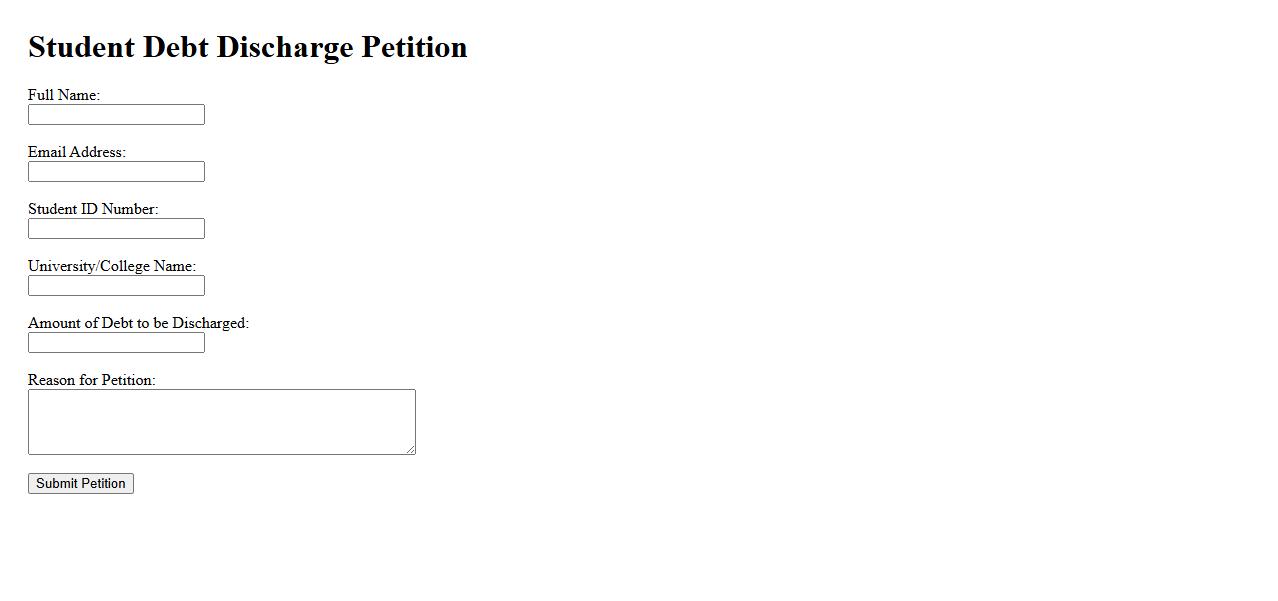

Student Debt Discharge Petition

The Student Debt Discharge Petition is a formal request allowing borrowers to seek relief from student loan obligations due to financial hardship or other qualifying circumstances. This process aims to provide debt forgiveness opportunities for eligible individuals. Understanding the petition requirements is crucial for successfully navigating student loan discharge options.

Loan Forgiveness Eligibility Statement

The Loan Forgiveness Eligibility Statement confirms whether a borrower qualifies for loan forgiveness programs based on specific criteria. It outlines the necessary conditions such as employment type, payment history, and loan status. This statement is essential for applicants seeking debt relief through forgiveness options.

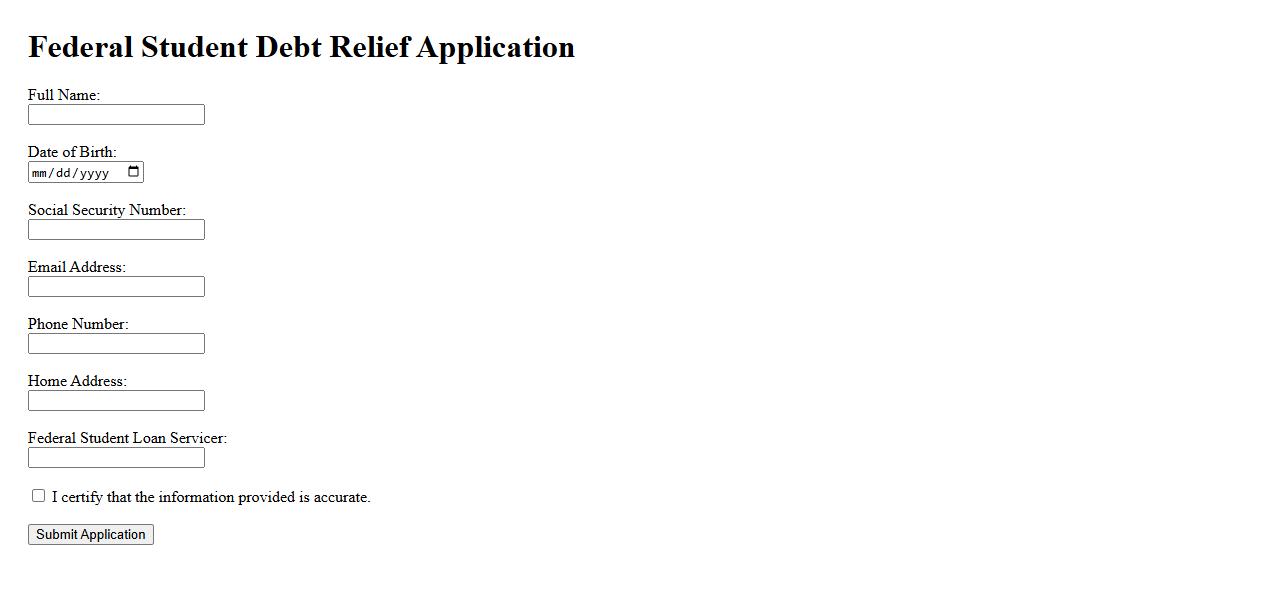

Federal Student Debt Relief Application

The Federal Student Debt Relief Application helps eligible borrowers reduce or eliminate their student loan debt through government programs. This streamlined process ensures individuals can access debt forgiveness, repayment plans, or financial counseling efficiently. Applying early increases the chances of relief and financial stability.

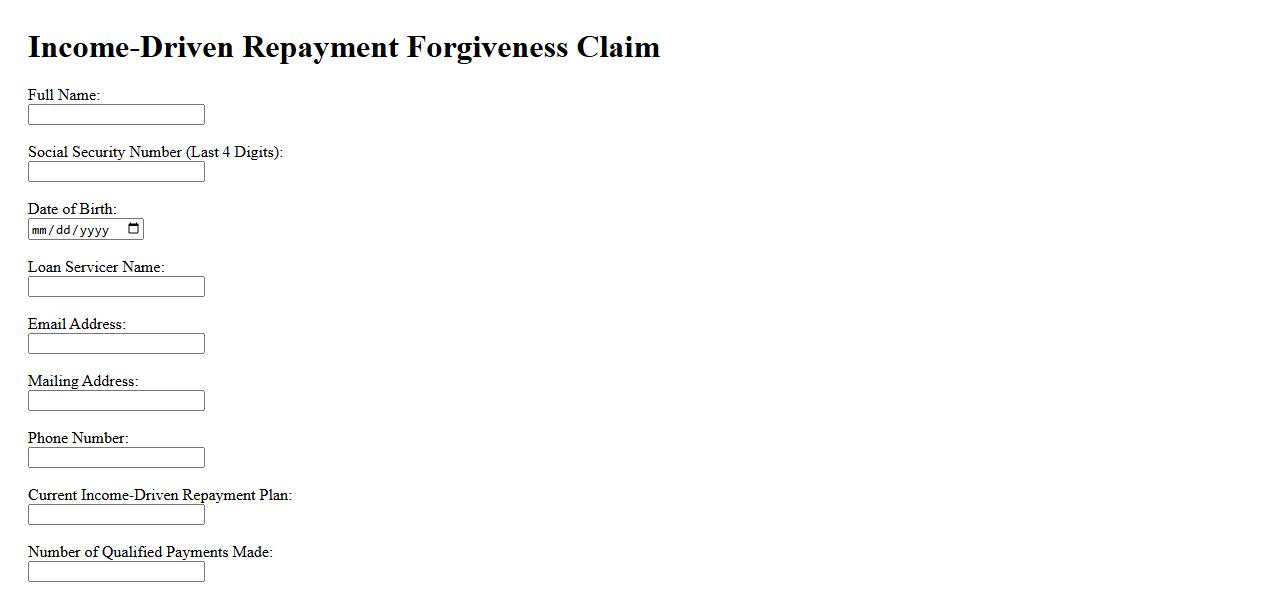

Income-Driven Repayment Forgiveness Claim

An Income-Driven Repayment Forgiveness Claim allows borrowers to have their remaining student loan balance forgiven after making qualifying payments under income-driven repayment plans. This program is designed to help those with lower incomes manage their debt more effectively. Eligibility and claim procedures vary by loan type and servicer.

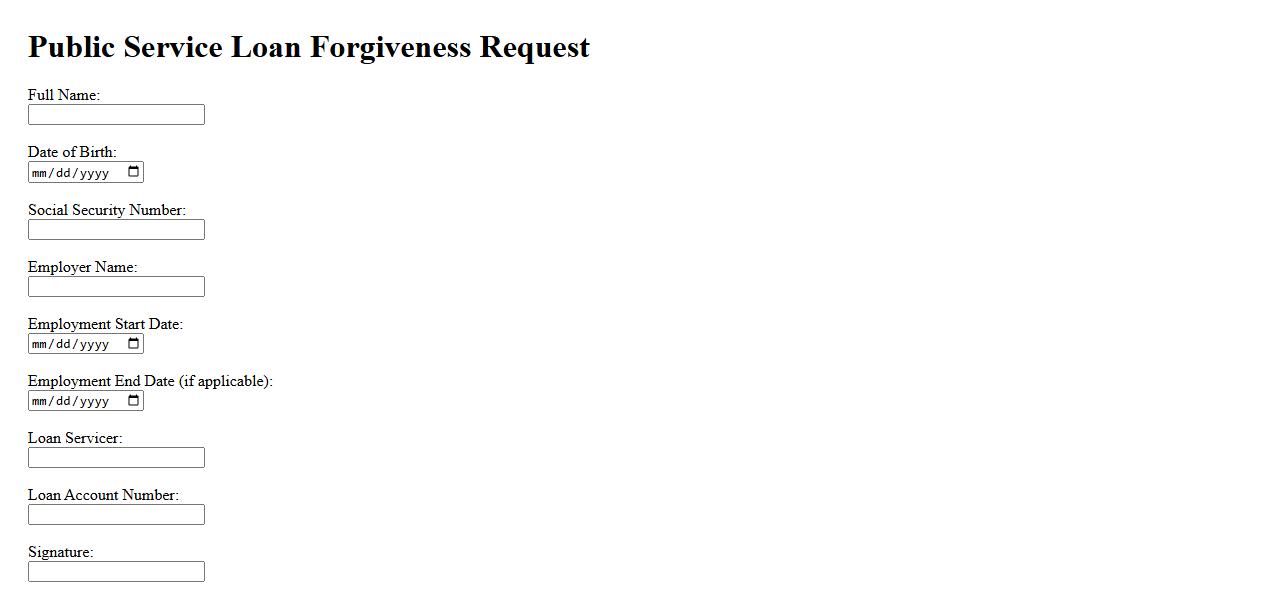

Public Service Loan Forgiveness Request

The Public Service Loan Forgiveness Request allows borrowers to apply for forgiveness of their federal student loans after making qualifying payments while working full-time in public service. This program aims to support individuals dedicated to public service careers by reducing their student loan burden. To be eligible, applicants must meet specific employment and payment criteria outlined by the U.S. Department of Education.

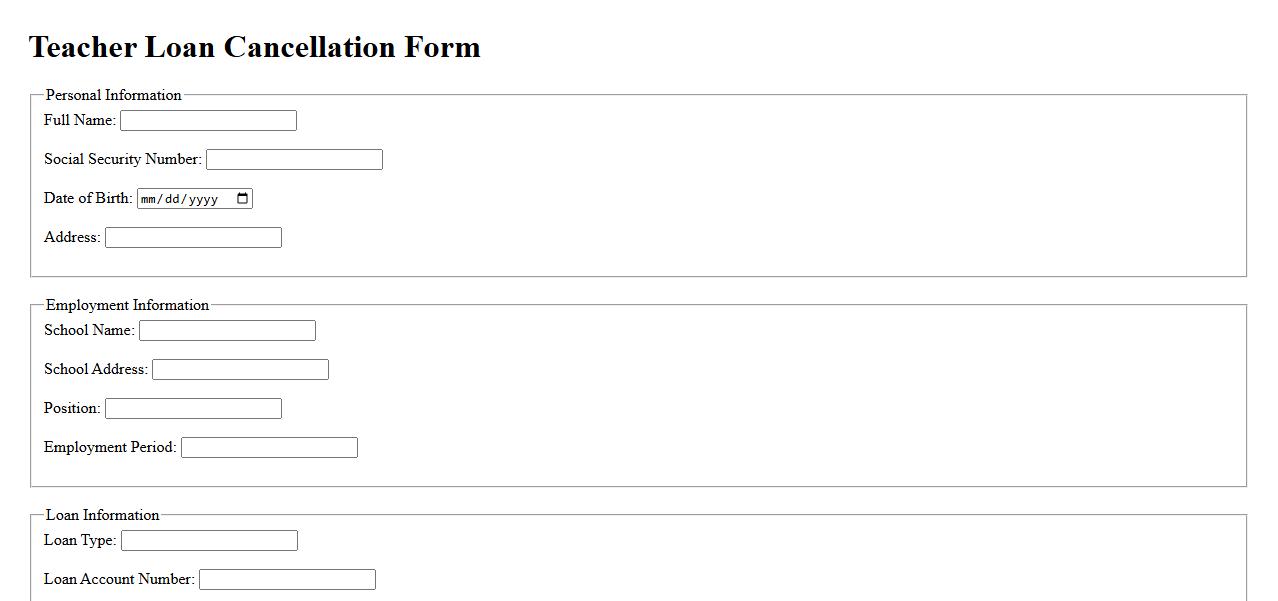

Teacher Loan Cancellation Form

The Teacher Loan Cancellation Form is a critical document that allows educators to apply for the forgiveness of their student loans. This form ensures that eligible teachers who serve in qualified schools or subject areas receive the financial relief they deserve. Completing the form accurately can lead to significant loan cancellation benefits.

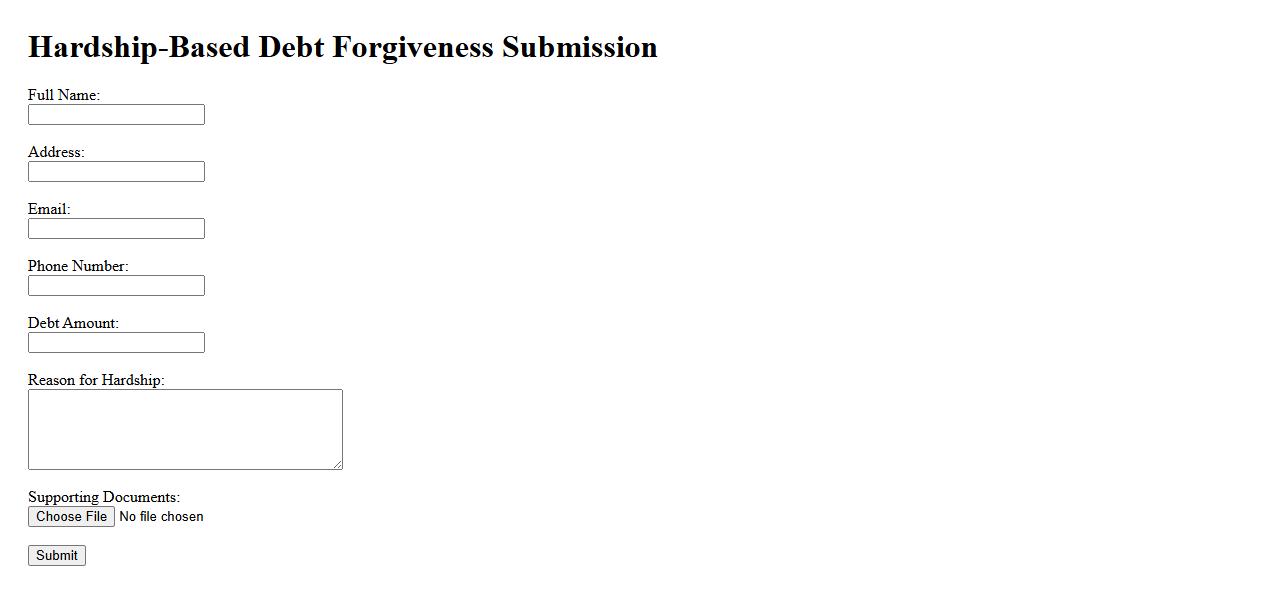

Hardship-Based Debt Forgiveness Submission

Hardship-Based Debt Forgiveness Submission allows individuals facing financial difficulties to request relief from their debts through a formal process. This option is designed to provide support during challenging times by reducing or eliminating outstanding balances. Understanding the hardship-based debt forgiveness submission process can help borrowers regain financial stability more quickly.

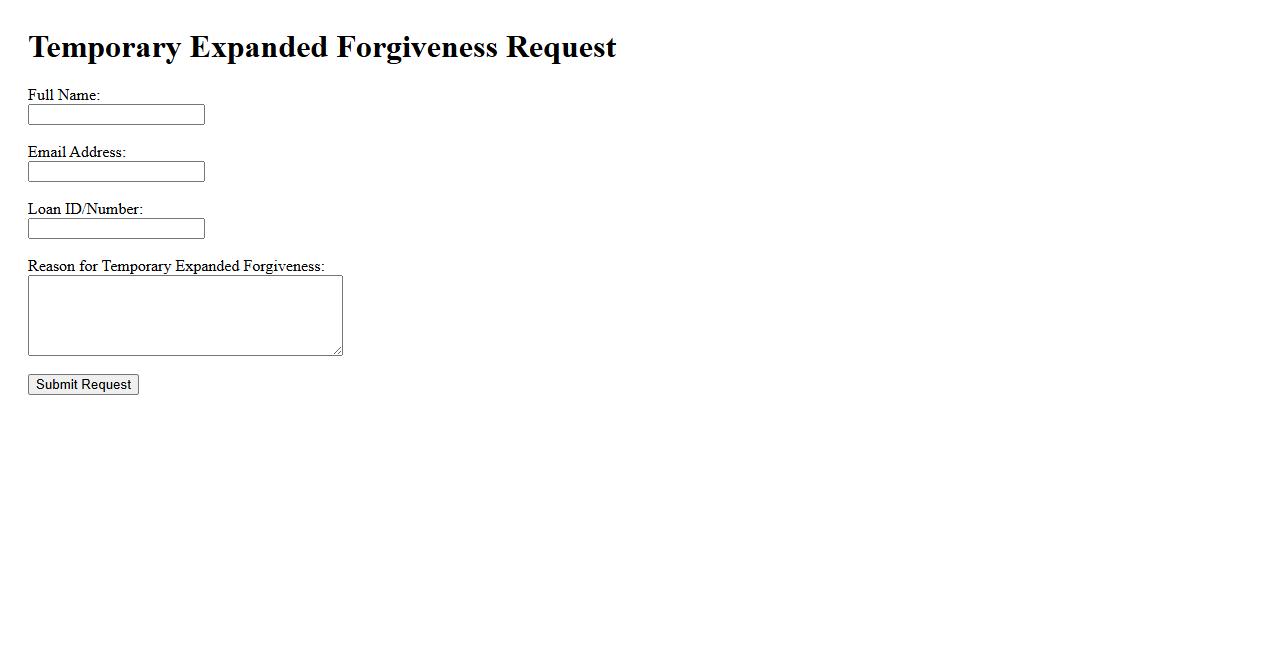

Temporary Expanded Forgiveness Request

The Temporary Expanded Forgiveness Request allows borrowers to seek additional relief by extending the forgiveness period for their loans. This option provides flexibility during periods of financial hardship, ensuring that repayment terms remain manageable. It is essential for individuals aiming to maximize their loan forgiveness benefits under temporary guidelines.

What are the eligibility criteria for submitting a claim for student loan forgiveness?

To submit a claim for student loan forgiveness, borrowers must meet specific employment and repayment requirements set by the program. Typically, eligibility includes making a certain number of qualifying payments while working in designated public service roles. Additionally, the loan must be federal and active under a qualifying repayment plan.

Which types of student loans qualify for forgiveness under this program?

Only certain federal student loans are eligible for forgiveness, including Direct Loans and some federal consolidation loans. Private loans and Parent PLUS loans generally do not qualify under most forgiveness programs. It's important to verify whether your loan type meets the specific criteria of your forgiveness program.

What specific documentation is required to support a claim for student loan forgiveness?

Applicants must provide proof of employment, such as certification forms signed by the employer, to validate qualifying work history. Additionally, loan statements and repayment records are necessary to confirm qualifying payments have been made. Accurate documentation ensures a smoother claim process and timely approval.

How does filing a claim for student loan forgiveness impact your loan repayment status?

Filing a claim can temporarily pause or adjust your repayment obligations while the application is reviewed. Once approved, your loan balance may be reduced or discharged depending on the program guidelines. It's essential to continue meeting all current repayment terms until forgiveness is officially granted to avoid penalties.

What are the key deadlines and timelines involved in the student loan forgiveness claim process?

Applicants must submit their claim within the program's specified deadline, often aligned with fiscal or programmatic timelines. Processing times can vary, typically ranging from several months to over a year depending on workload and documentation completeness. Staying informed and proactive ensures you meet all necessary deadlines to retain eligibility.