Filing a Claim for Car Insurance Settlement involves notifying your insurer about damages or losses incurred from an accident or incident. The insurer evaluates the claim to determine the compensation based on your policy coverage and the extent of the damage. Timely and accurate documentation is essential to ensure a smooth and fair settlement process.

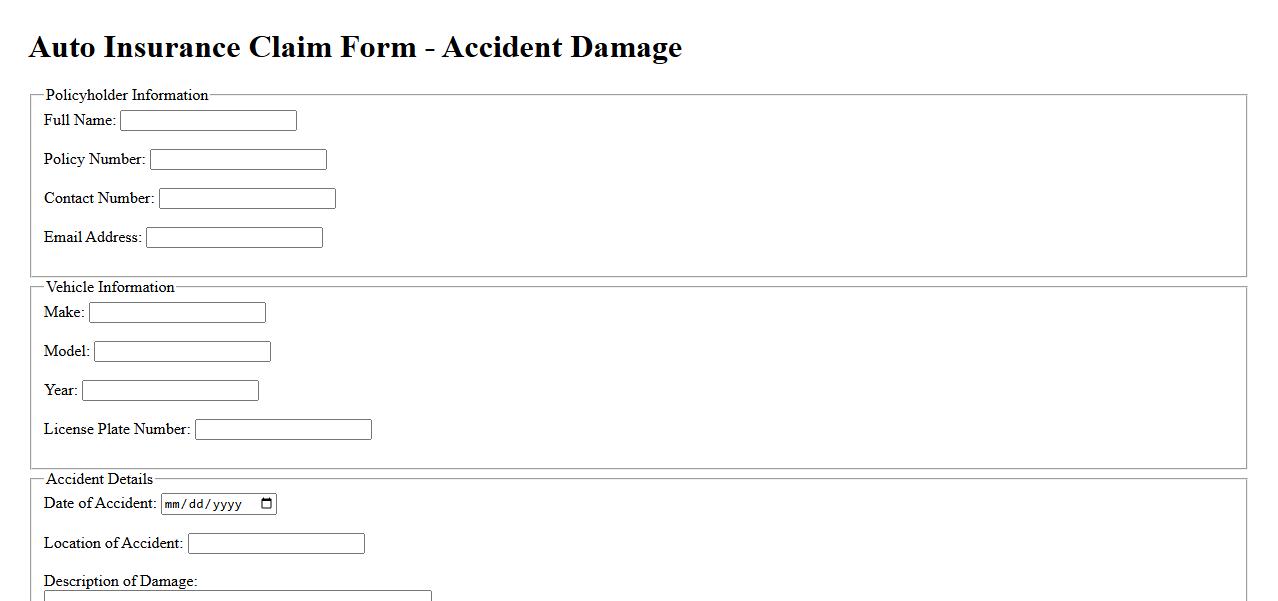

Auto Insurance Claim for Accident Damage

Filing an auto insurance claim for accident damage ensures you receive financial support to repair your vehicle. It's important to promptly report the incident and provide accurate documentation to the insurance company. This process helps protect your investment and facilitates a smooth recovery after the accident.

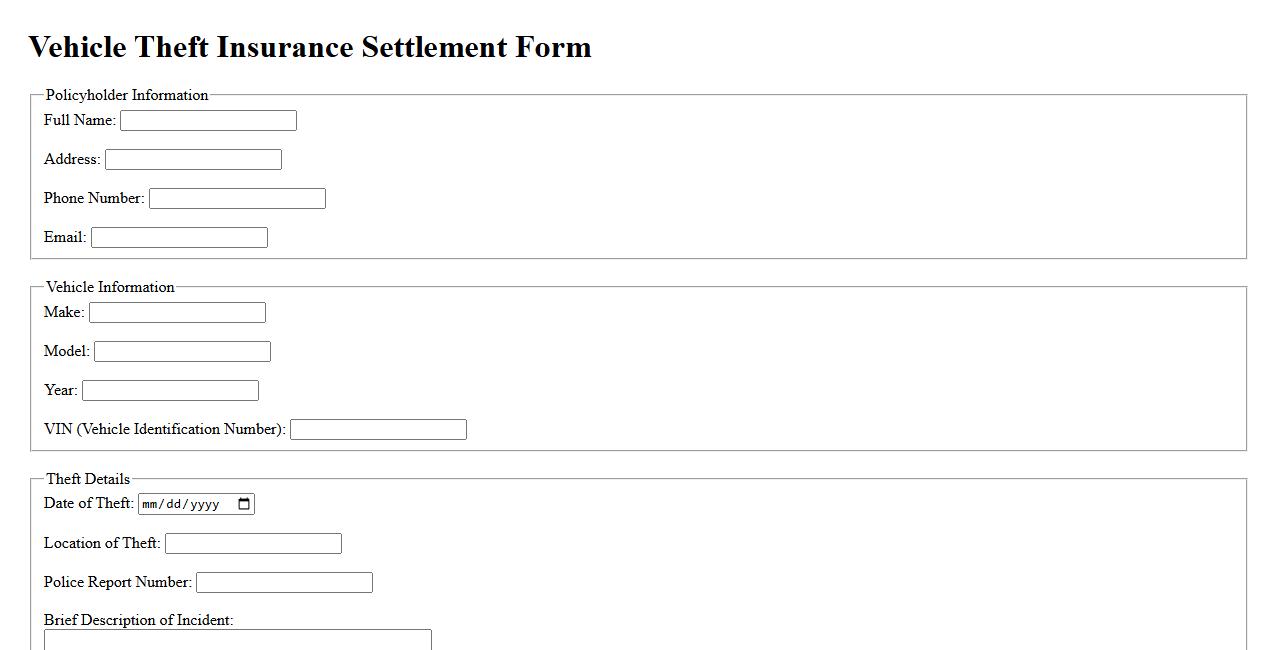

Vehicle Theft Insurance Settlement Form

The Vehicle Theft Insurance Settlement Form is a crucial document used to initiate the claim process after your vehicle has been stolen. It gathers essential details about the incident and the insured vehicle to facilitate a swift and accurate settlement. Completing this form promptly helps ensure timely compensation from the insurance provider.

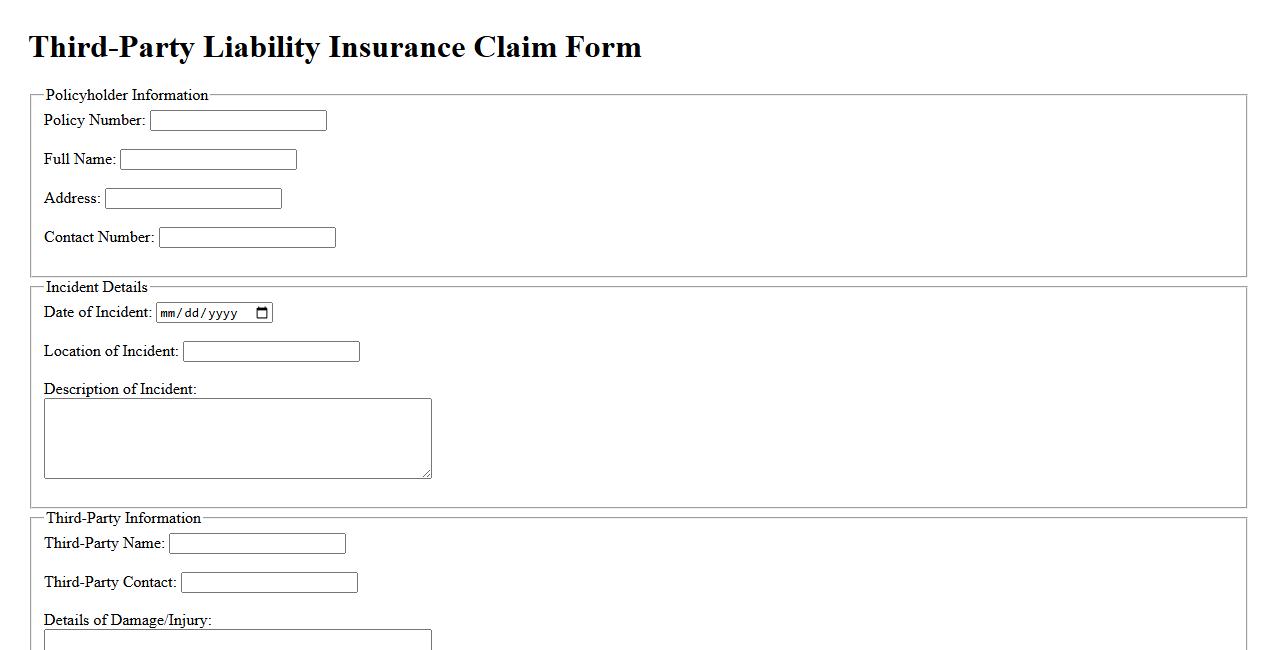

Third-Party Liability Insurance Claim

Third-Party Liability Insurance Claim refers to a formal request made by an individual or entity seeking compensation for damages or injuries caused by the policyholder to a third party. This insurance protects the policyholder from financial loss arising due to legal claims made by the affected third party. It is essential for covering legal costs and settlements in case of accidents or negligence.

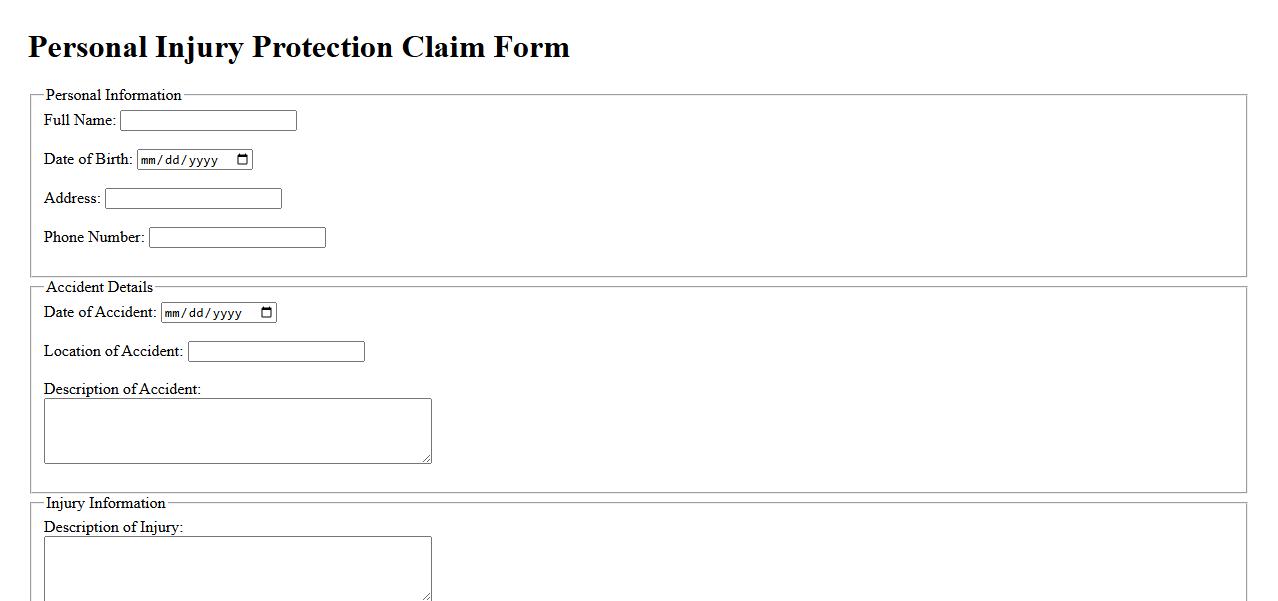

Personal Injury Protection Claim Form

The Personal Injury Protection Claim Form is essential for filing medical and related expenses after an accident. It helps streamline the reimbursement process for injured parties. Submitting this form promptly ensures timely compensation and coverage verification.

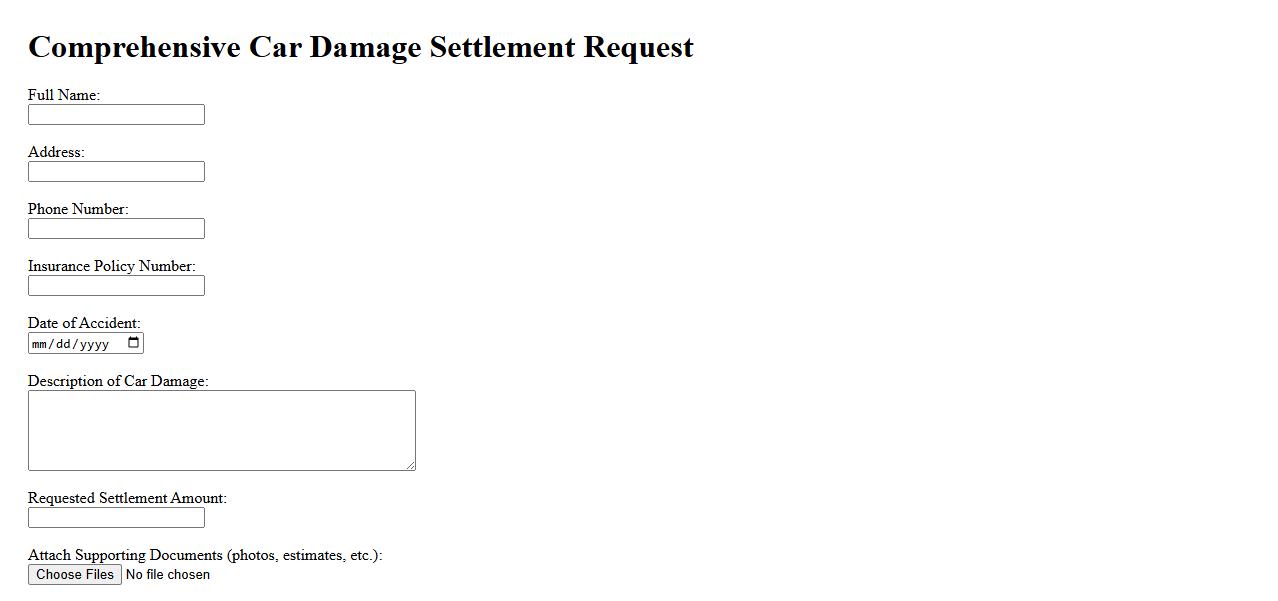

Comprehensive Car Damage Settlement Request

Submit a Comprehensive Car Damage Settlement Request to ensure a smooth and efficient resolution for your vehicle repairs. This process involves documenting all damages thoroughly and providing necessary evidence to support your claim. Timely and accurate submission helps expedite the compensation and repair procedures.

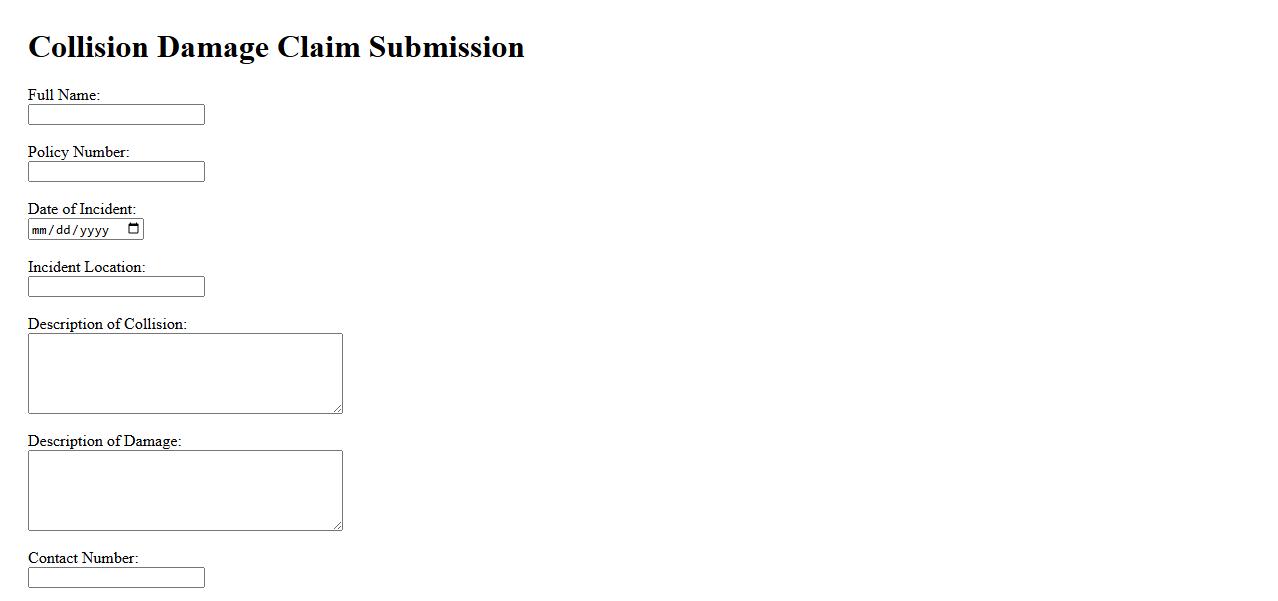

Collision Damage Claim Submission

Submitting a collision damage claim involves reporting the details of an accident to your insurance provider. This process ensures that the damages to your vehicle are evaluated and covered according to your policy. Timely and accurate claim submission helps expedite repairs and reimbursement.

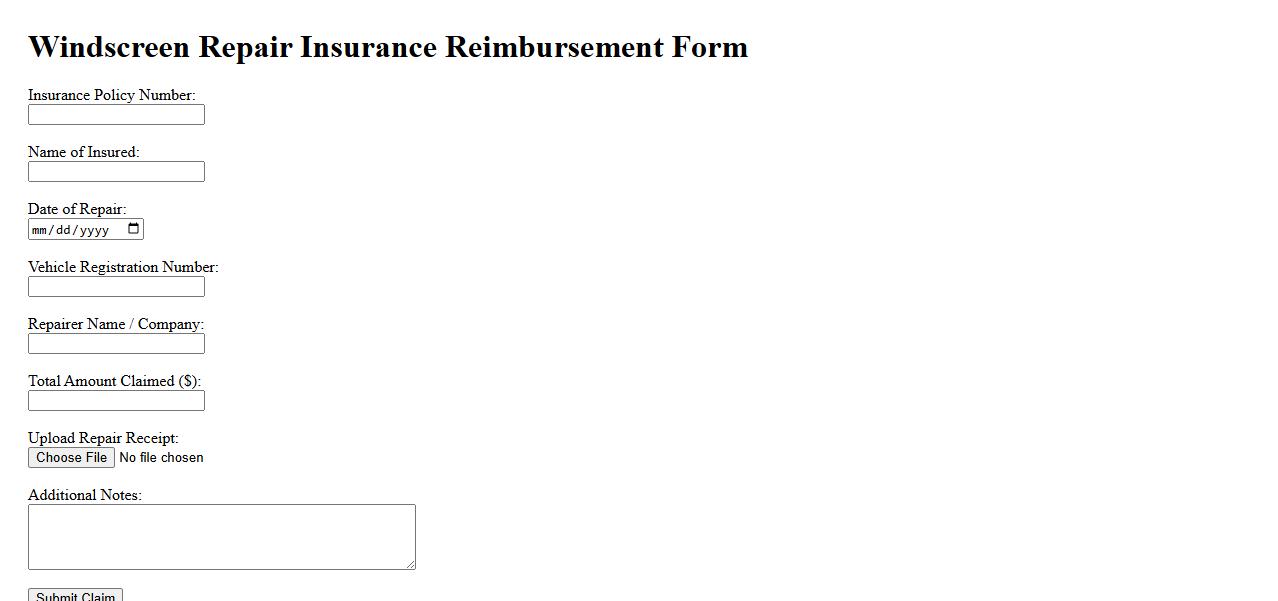

Windscreen Repair Insurance Reimbursement

Windscreen repair insurance reimbursement helps cover the costs of fixing chips and cracks in your vehicle's windscreen. This benefit ensures you can restore safety without paying out of pocket. Many insurance policies offer quick and convenient claims for prompt repairs.

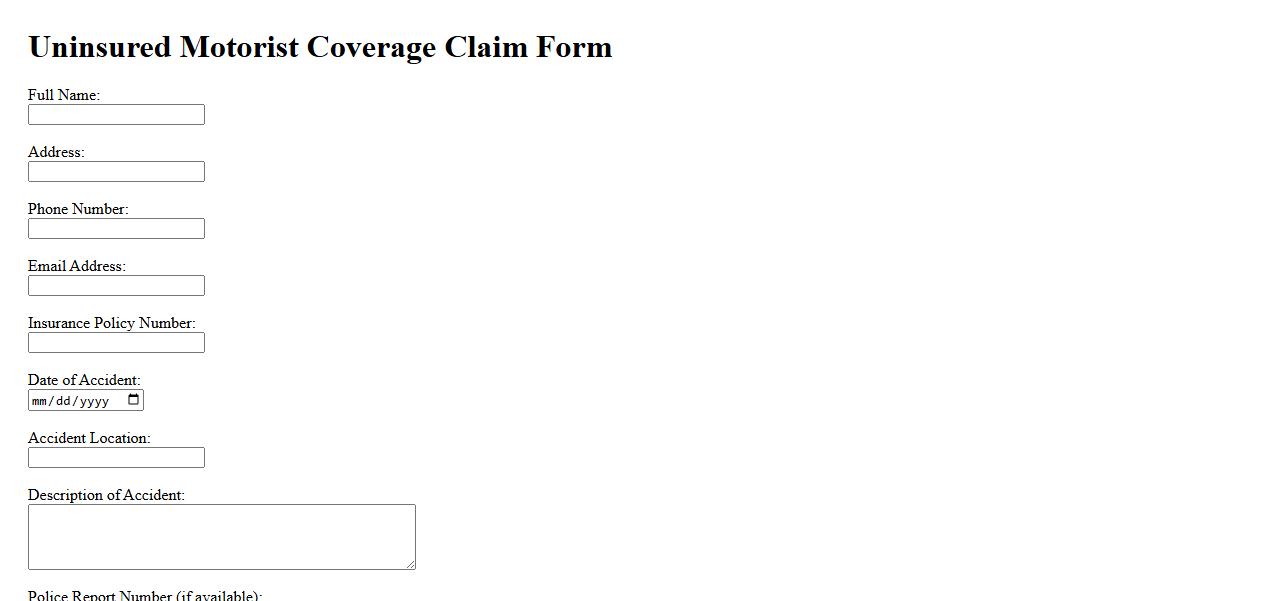

Uninsured Motorist Coverage Claim

Uninsured Motorist Coverage claim protects you financially if you're involved in an accident with a driver who has no insurance. This coverage ensures you receive compensation for medical expenses, lost wages, and vehicle damage when the at-fault party is uninsured. Filing a claim promptly helps secure the benefits you deserve and provides peace of mind on the road.

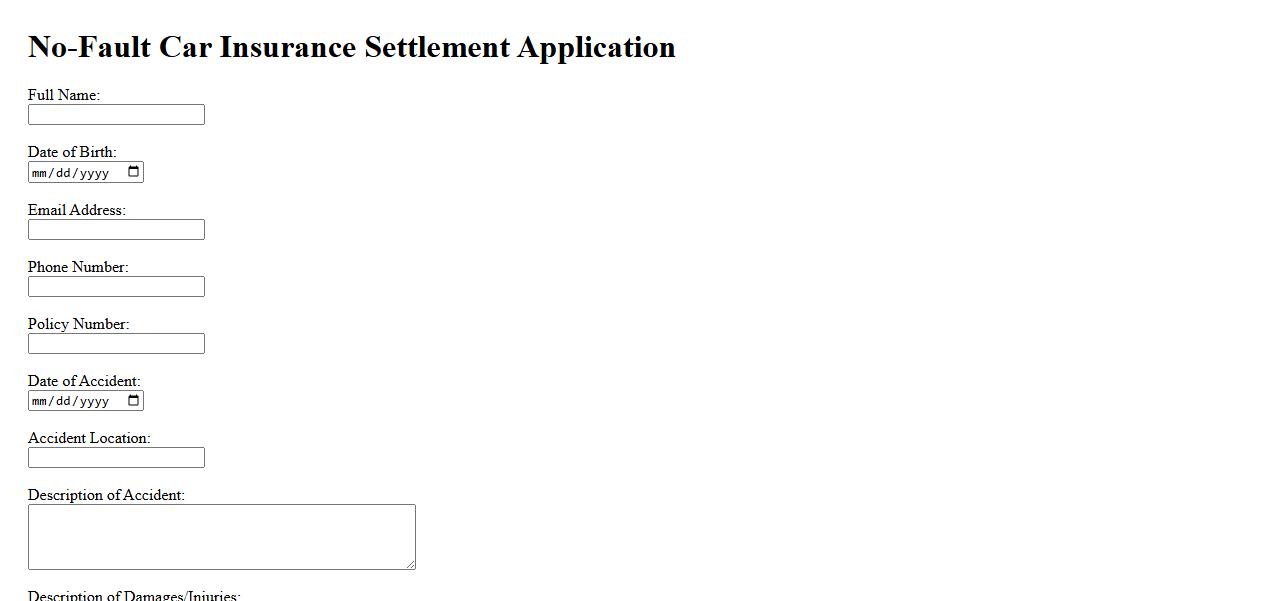

No-Fault Car Insurance Settlement Application

The No-Fault Car Insurance Settlement Application simplifies the claims process by allowing insured drivers to receive compensation without determining fault. This system ensures faster payouts and reduces legal disputes after accidents. It protects both drivers and insurance companies by streamlining the settlement procedure.

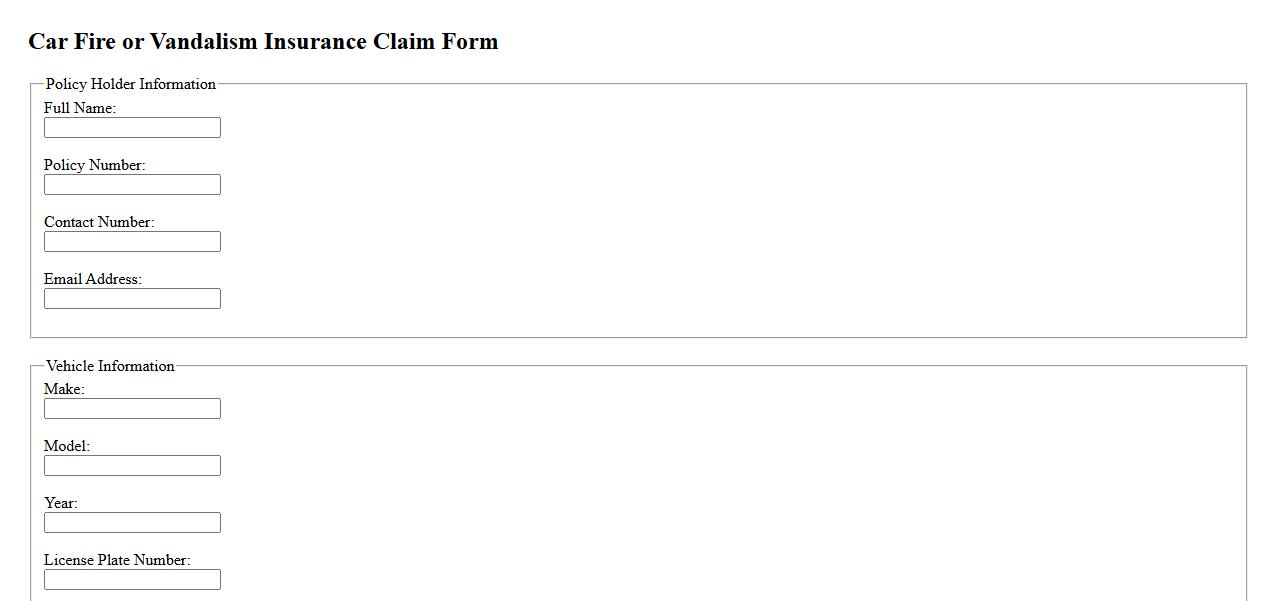

Car Fire or Vandalism Insurance Claim

Filing a Car Fire or Vandalism Insurance Claim ensures you receive compensation for damages caused by unexpected events. It is crucial to report the incident promptly and provide all necessary evidence to support your claim. Proper documentation helps expedite the process and protect your financial interests.

What details are required to verify the insured individual and vehicle in a car insurance claim document?

To verify the insured individual, the claim document must include the policyholder's full name, contact information, and policy number. For the vehicle, crucial details such as the vehicle identification number (VIN), registration number, and make and model of the car are required. Additionally, a copy of the insurance card and a valid driver's license may be included to confirm identity and ownership.

Which specific losses, damages, or incidents must be clearly documented for a valid car insurance settlement claim?

The claim must clearly document all damages to the vehicle, including dents, scratches, and mechanical defects. Any personal injuries sustained during the incident should also be reported. Furthermore, the claim should detail the specific incident or accident type, such as collision, theft, or vandalism, to validate the claim.

How does the policyholder establish the cause of the accident or loss in the claim documentation?

The policyholder needs to provide a detailed narrative account of the accident or loss, including the date, time, and location. Witness statements or third-party accounts can strengthen the cause determination. Additionally, official documents such as police reports often play a key role in confirming how the incident occurred.

What supporting evidence (photos, police reports, repair estimates) must be included to strengthen a car insurance settlement claim?

Photographs of the vehicle damage and accident scene are essential to visually corroborate the claim. Including a police report adds legal credibility and details about the incident. Repair estimates or invoices from authorized service centers provide financial validation for the claim amount.

How is the claimed compensation amount calculated and justified within the settlement documentation?

The compensation amount is calculated based on detailed repair costs or vehicle replacement values, supported by official estimates. Depreciation and policy terms like deductibles are factored into the final claim value. This calculation is then justified in the documentation through itemized cost breakdowns and insurer guidelines.