Filing a claim for car insurance involves reporting an accident or damage to your vehicle to your insurance company to receive compensation or repairs. The process typically requires providing detailed information about the incident, including photos and a police report if applicable. Timely submission and accurate documentation are crucial for a smooth and successful claim experience.

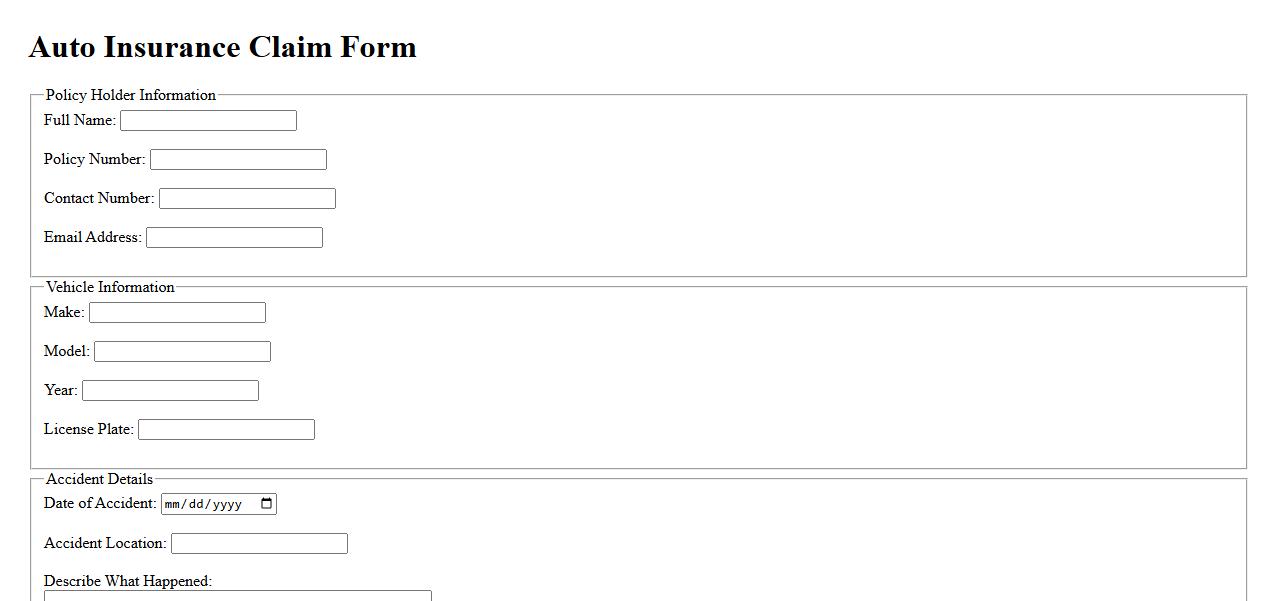

Auto Insurance Claim Form

The Auto Insurance Claim Form is a vital document used to report accidents and damages to your insurance provider. It gathers essential information about the incident, vehicle, and parties involved to process your claim efficiently. Prompt and accurate completion ensures faster resolution and compensation.

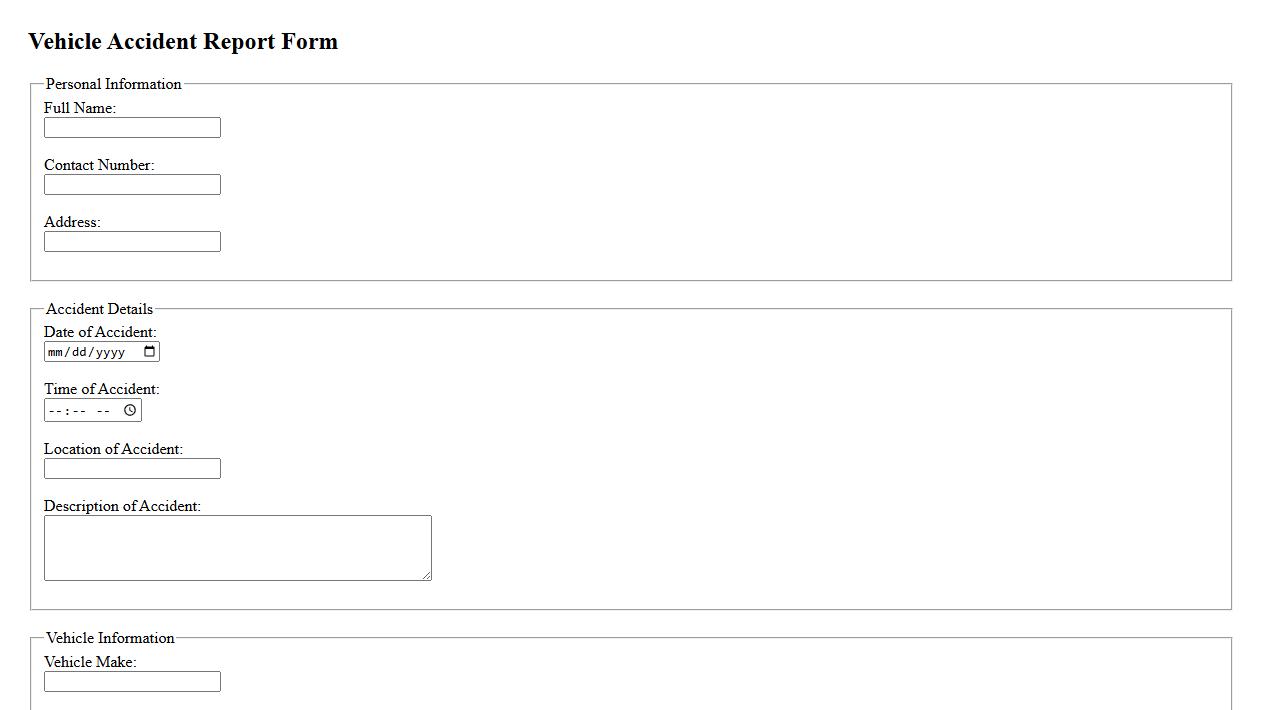

Vehicle Accident Report Form

The Vehicle Accident Report Form is a crucial document used to record details of a car accident for insurance and legal purposes. It includes information about the vehicles involved, driver details, accident location, and witness statements. Proper completion of this form ensures accurate and timely processing of claims and investigations.

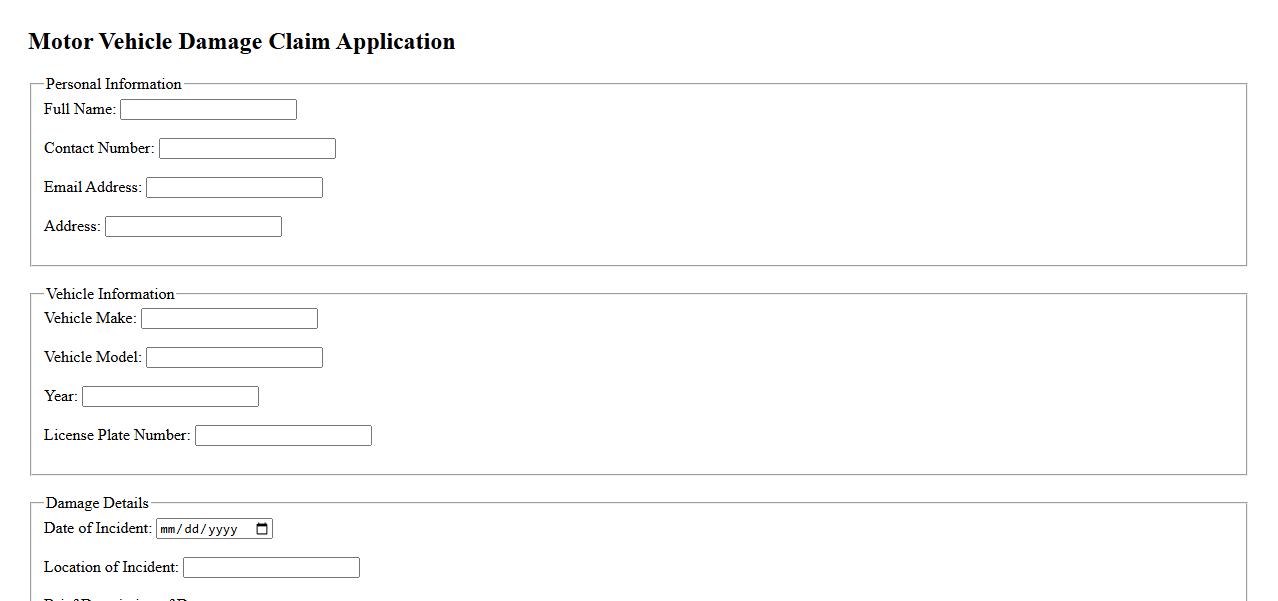

Motor Vehicle Damage Claim Application

The Motor Vehicle Damage Claim Application is a formal process used to report and request compensation for damages sustained by a vehicle. It requires detailed information about the incident, the extent of the damage, and supporting documentation. This application ensures a structured and efficient way to handle claims with insurance providers.

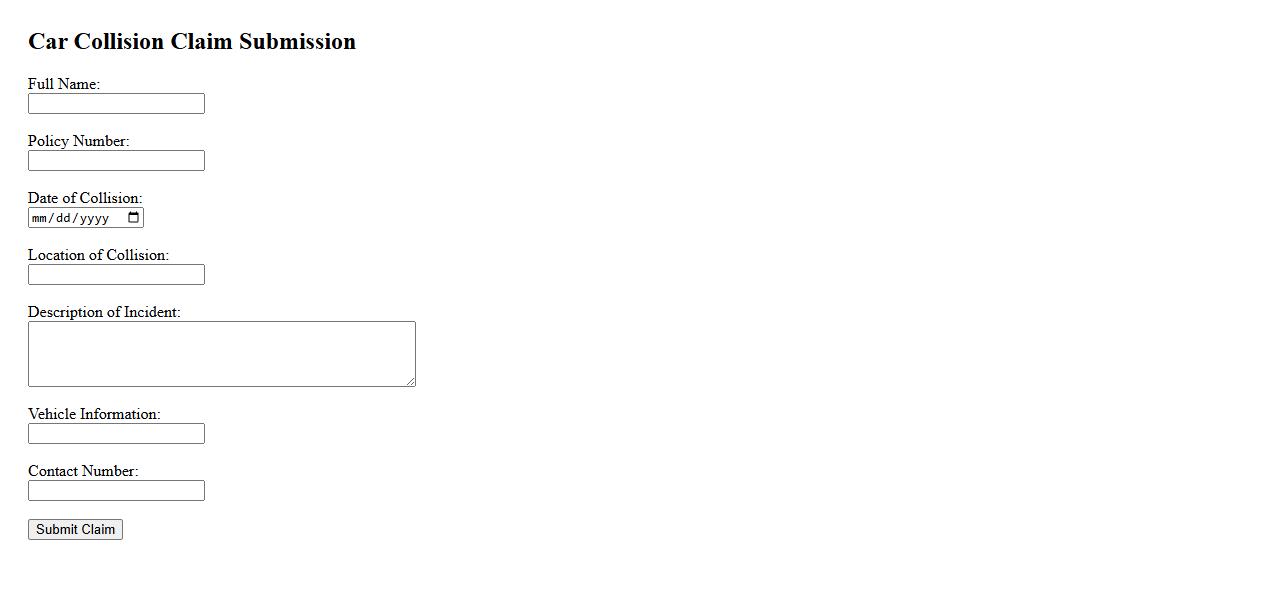

Car Collision Claim Submission

Filing a car collision claim submission promptly ensures you receive the necessary compensation for damages and injuries. Accurate documentation and timely reporting are essential steps in the claims process. Always provide detailed information to facilitate a smooth and efficient resolution.

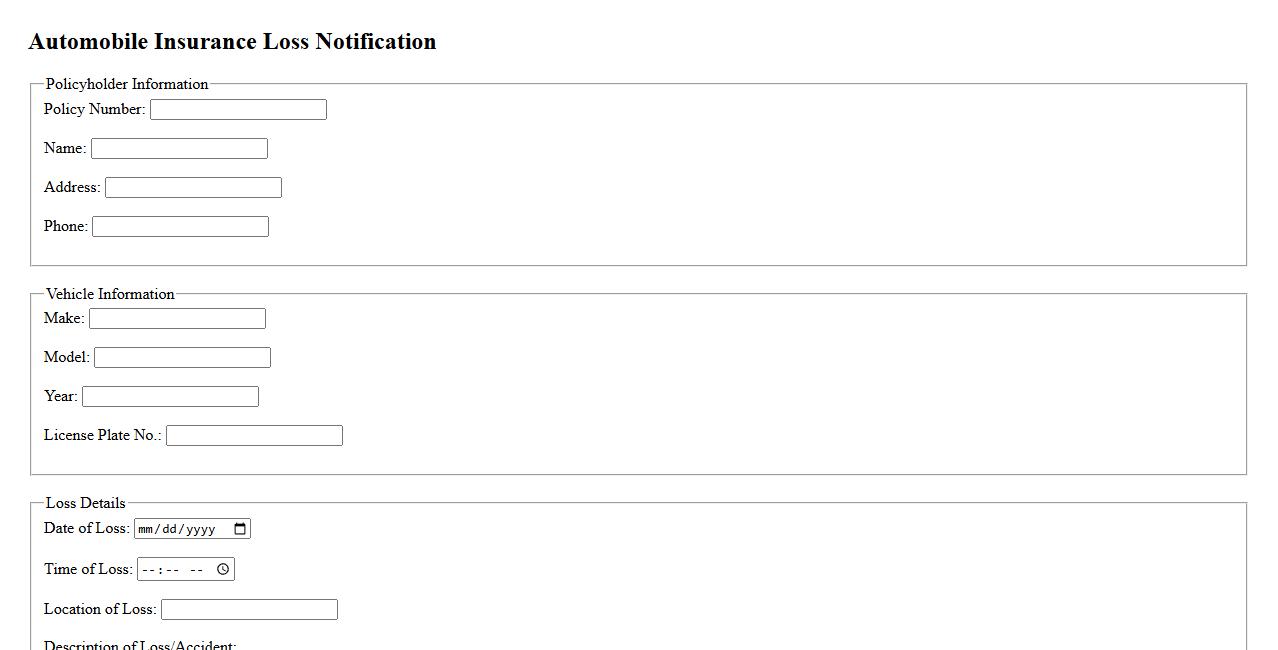

Automobile Insurance Loss Notification

Automobile Insurance Loss Notification is the process of informing your insurance company about an accident or damage involving your vehicle. Prompt notification ensures a quicker claim assessment and helps in timely repairs or compensation. It is crucial to report the loss to protect your rights and expedite the insurance process.

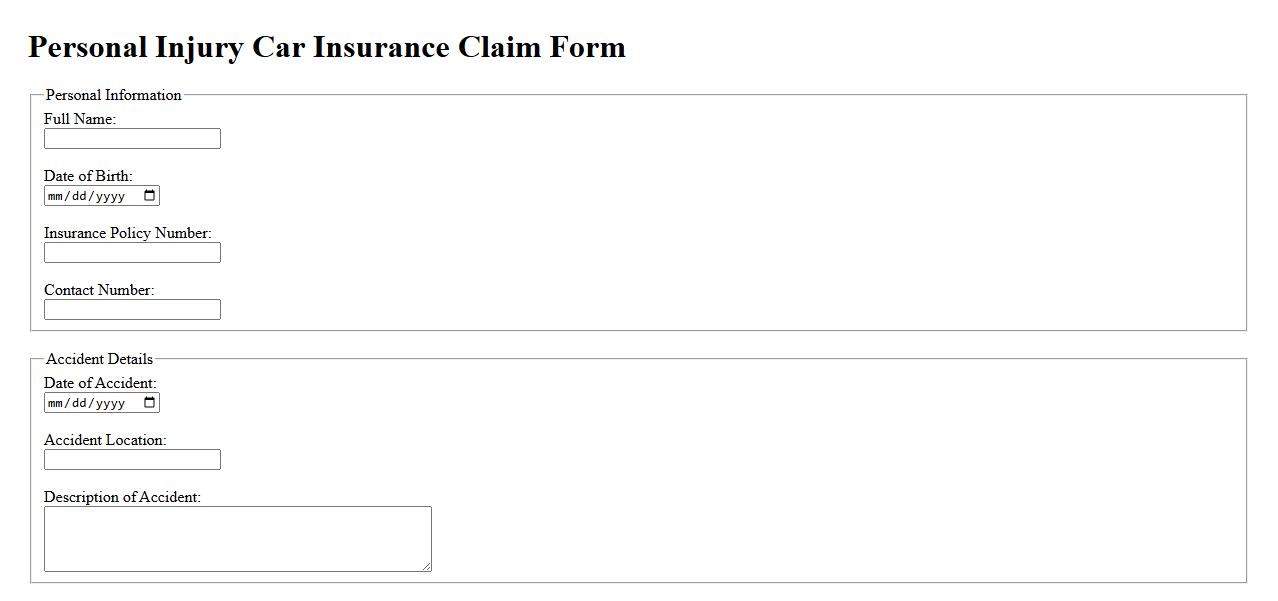

Personal Injury Car Insurance Claim

Filing a Personal Injury Car Insurance Claim involves reporting injuries sustained in a car accident to your insurance provider to seek compensation. It is crucial to document all medical treatments and damages thoroughly to strengthen your case. Promptly submitting your claim ensures timely support and potential coverage for medical expenses and lost wages.

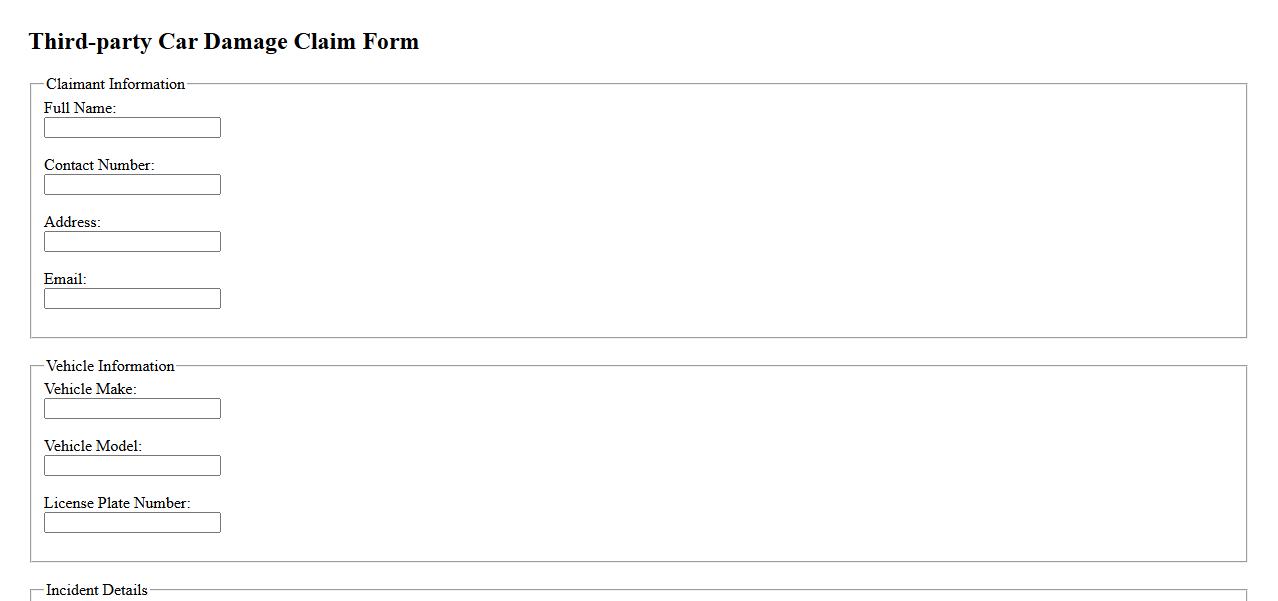

Third-party Car Damage Claim Form

The Third-party Car Damage Claim Form is a crucial document used to report and process damages caused by another driver's vehicle. It helps facilitate communication between insurance companies and ensures that the claim is handled efficiently. Completing this form accurately can expedite the compensation process for vehicle repairs.

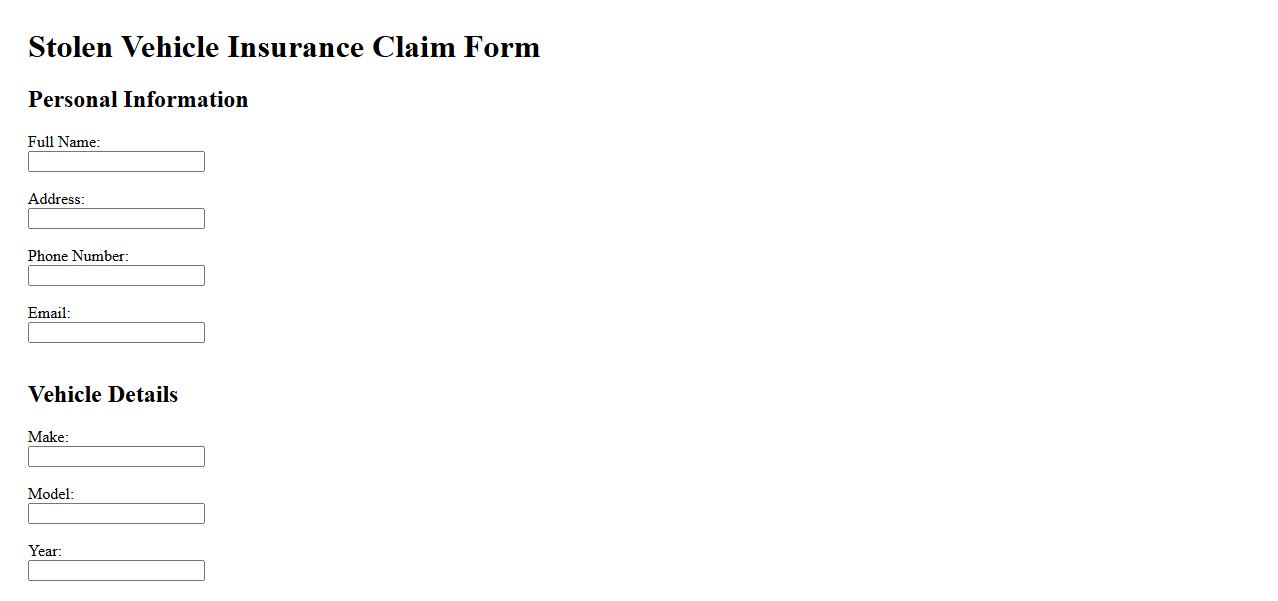

Stolen Vehicle Insurance Claim

Filing a stolen vehicle insurance claim ensures you receive compensation for your lost vehicle. Promptly reporting the theft and providing all necessary documentation accelerates the claims process. Understanding policy details helps maximize your claim benefits efficiently.

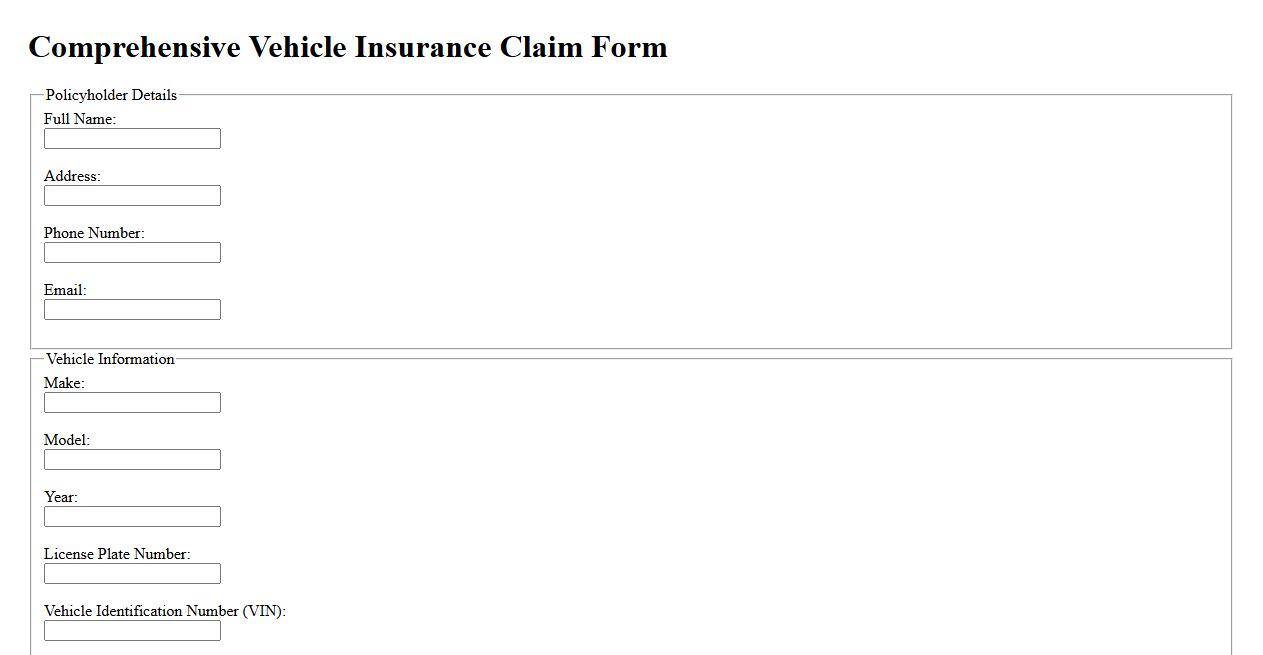

Comprehensive Vehicle Insurance Claim

Comprehensive Vehicle Insurance Claim provides extensive coverage for damages to your vehicle caused by incidents other than collisions, such as theft, fire, or natural disasters. This claim ensures you receive financial support for repairs or replacement, minimizing out-of-pocket expenses. It is essential for safeguarding your investment and maintaining peace of mind on the road.

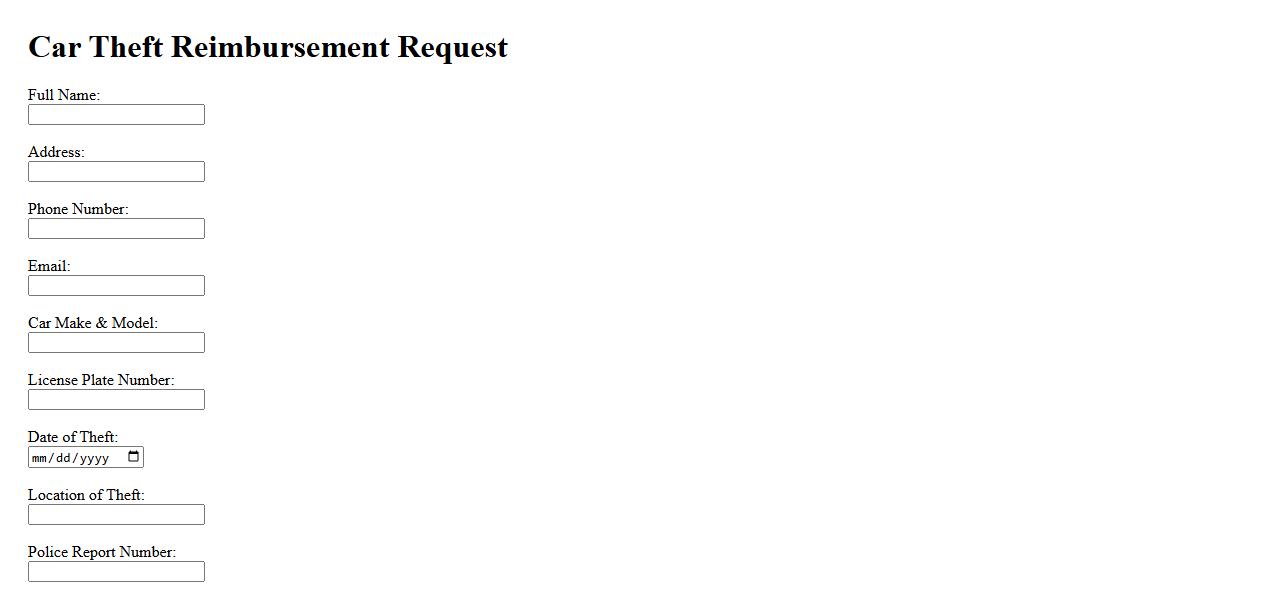

Car Theft Reimbursement Request

The Car Theft Reimbursement Request is a formal claim submitted to an insurance company to recover costs after a vehicle has been stolen. This process involves providing necessary documentation and proof of theft to validate the claim. Timely submission of this request ensures a smoother and faster compensation experience.

Cause and Date of the Incident

The cause of the incident detailed in the claim document is a collision with another vehicle. The accident occurred on March 15, 2024, as recorded in the claim form. This date is crucial for processing the claim within the policy terms.

Primary Policyholder Name

The primary policyholder listed in the car insurance claim document is John A. Smith. His name appears prominently as the insured individual responsible for the vehicle involved. Accurate identification ensures proper claim handling and communication.

Reported Damages or Losses

The claim form specifies damages including front bumper damage, broken headlights, and scratches along the driver-side door. Additionally, there is mention of personal property loss inside the vehicle. These details are essential for damage assessment and compensation.

Required Supporting Documents

The document lists several supporting documents necessary for claim processing, including a police report, repair estimates, and photographs of the damage. Proof of vehicle ownership and the driver's license copy are also required. Submission of these documents ensures a smooth evaluation process.

Claim Reference Number

The claim is identified by the reference number 2024-CA-789456. This unique identifier is used throughout the claims process to track progress and correspondence. It ensures accuracy and efficiency in managing the insurance claim.