A Claim for Death Benefit is a formal request made by the beneficiary to receive the proceeds from a life insurance policy or employee benefit following the policyholder's death. This process requires submitting necessary documents such as the death certificate and claim form to the insurer for verification. Timely filing of the claim ensures financial support to the beneficiaries during their period of loss.

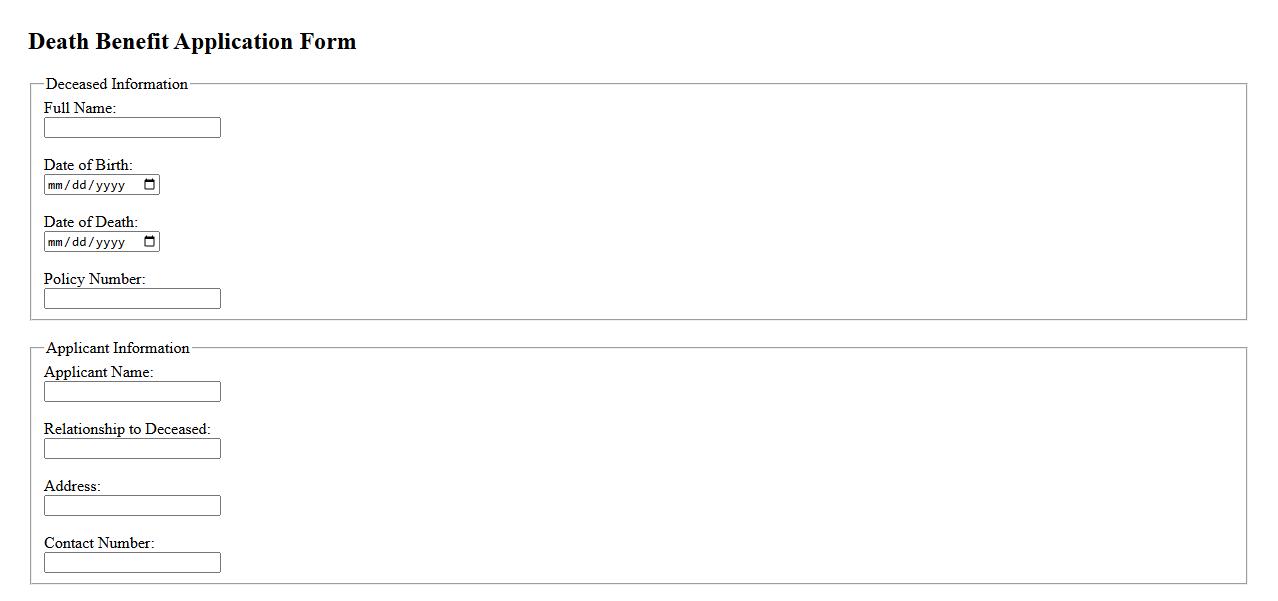

Death Benefit Application Form

The Death Benefit Application Form is a crucial document used to claim financial benefits following the passing of a policyholder. It requires accurate information to ensure timely processing and disbursement of funds. Submitting this form promptly helps beneficiaries receive the entitled support without unnecessary delays.

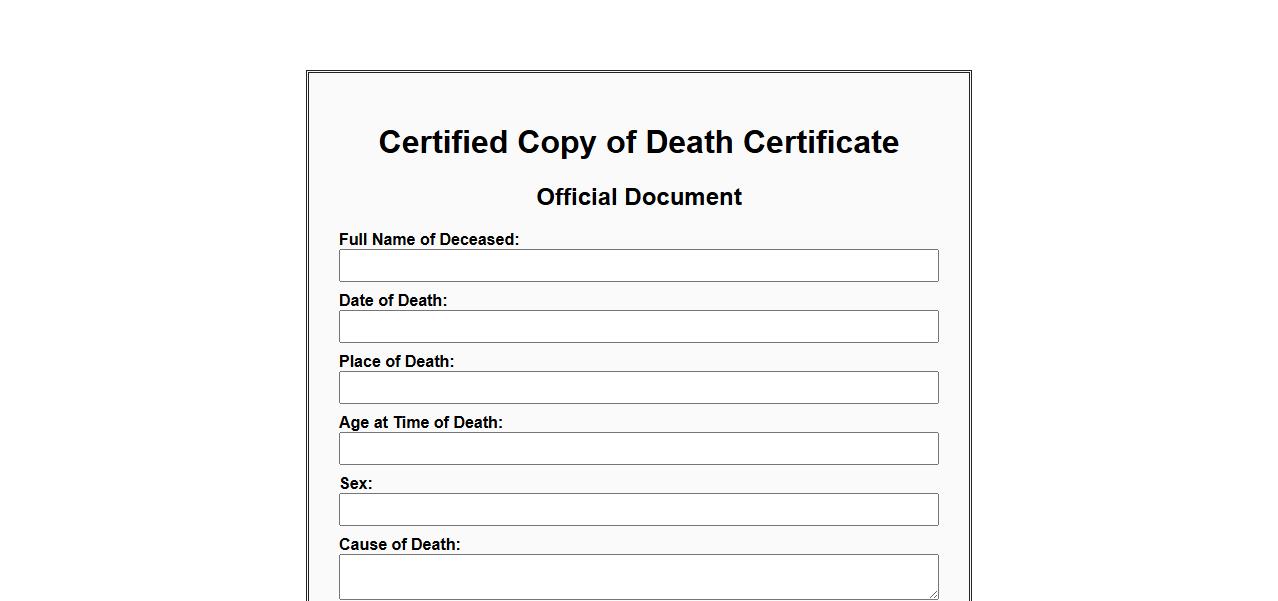

Certified Copy of Death Certificate

A Certified Copy of Death Certificate is an official document issued by government authorities that verifies the death of an individual. It contains essential information such as the deceased's name, date of death, and cause of death. This document is often required for legal, insurance, and estate settlement purposes.

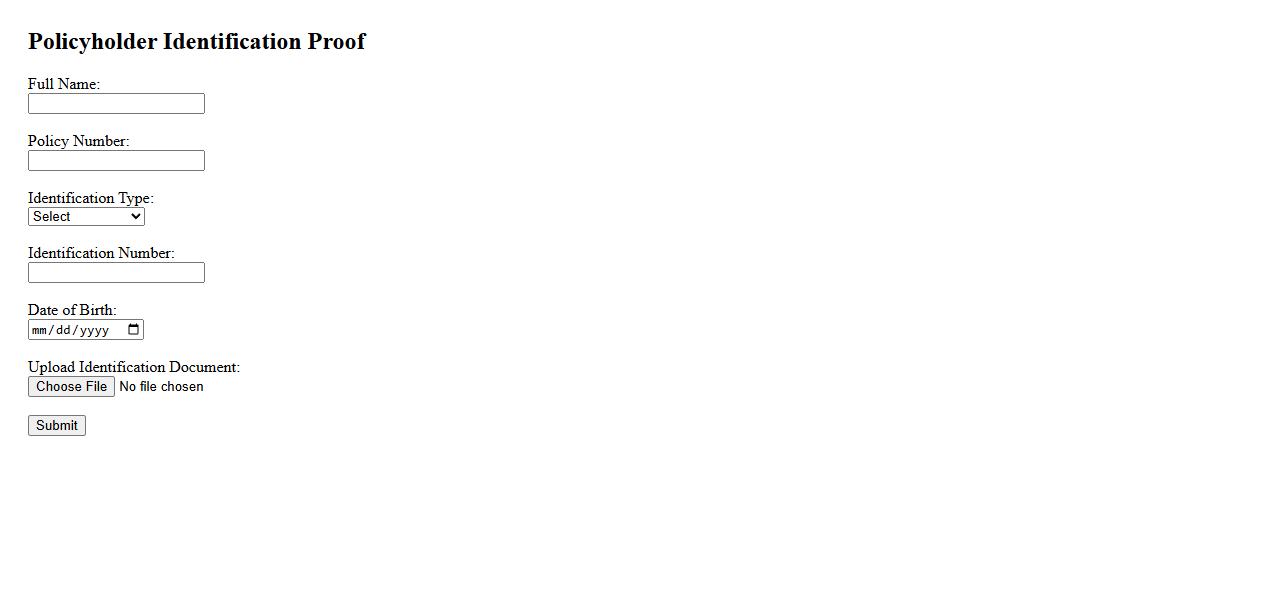

Policyholder Identification Proof

Policyholder Identification Proof is a crucial document that verifies the identity of the insurance policyholder. It ensures accurate and secure processing of claims and policy management. Common forms include government-issued IDs like passports, driver's licenses, or national ID cards.

Nominee Identification Proof

Nominee Identification Proof is a crucial document required to verify the identity of a nominee in various legal and financial matters. It ensures that the rightful person receives benefits or assets designated to them. This proof typically includes official ID cards, passports, or other government-issued identification documents.

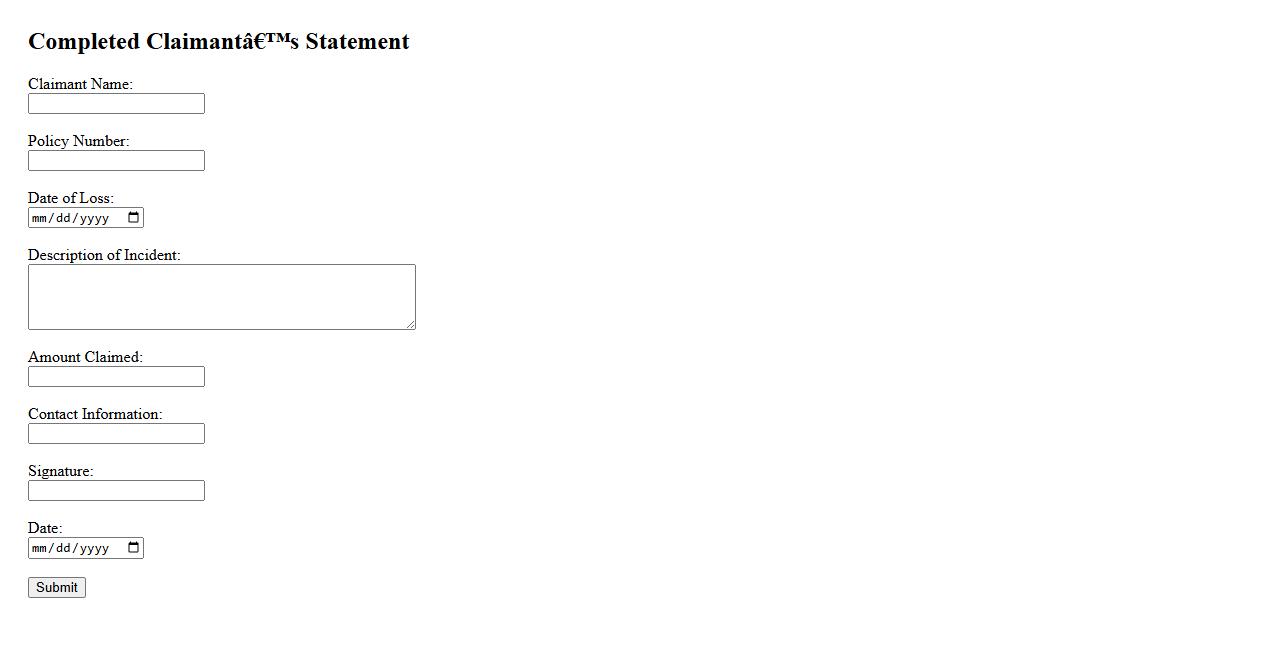

Completed Claimant’s Statement

The Completed Claimant's Statement is a crucial document that provides detailed information about an individual's claim. It helps streamline the review process by offering clear, accurate details necessary for assessment. Ensuring the statement is thorough and complete accelerates claim approval.

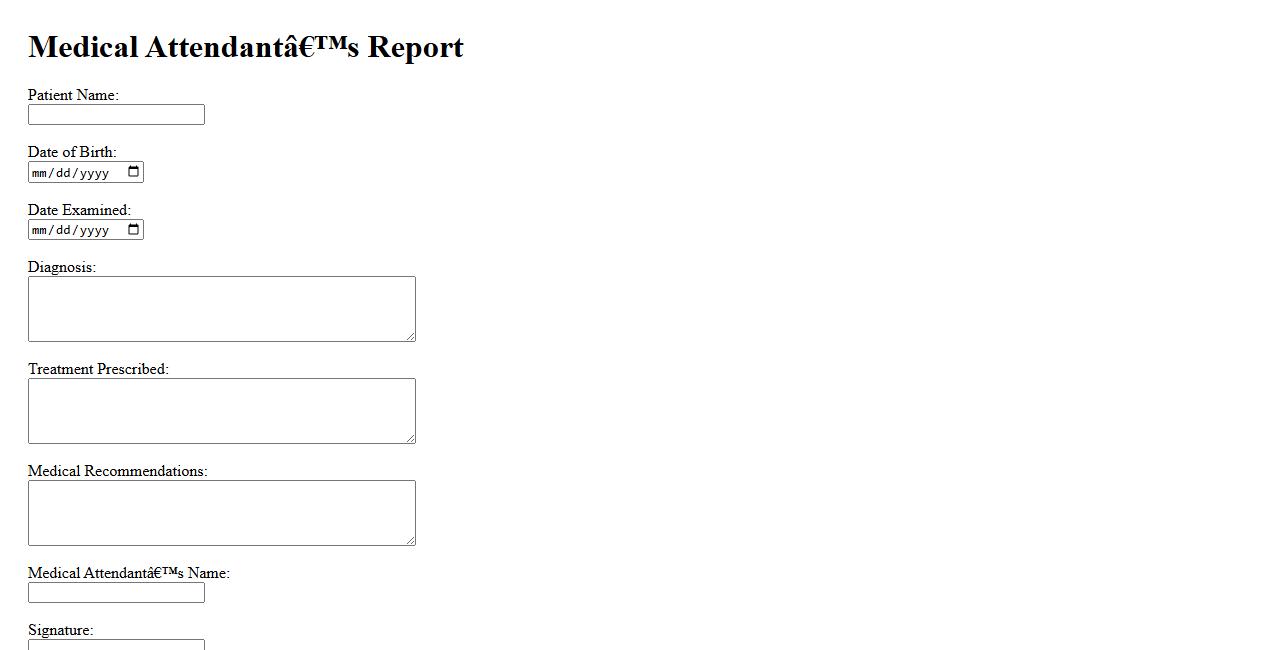

Medical Attendant’s Report

The Medical Attendant's Report provides a detailed account of a patient's condition and treatment administered by a healthcare professional. It includes vital signs, symptoms observed, and medical interventions performed during care. This report is essential for continuity of care and accurate medical record-keeping.

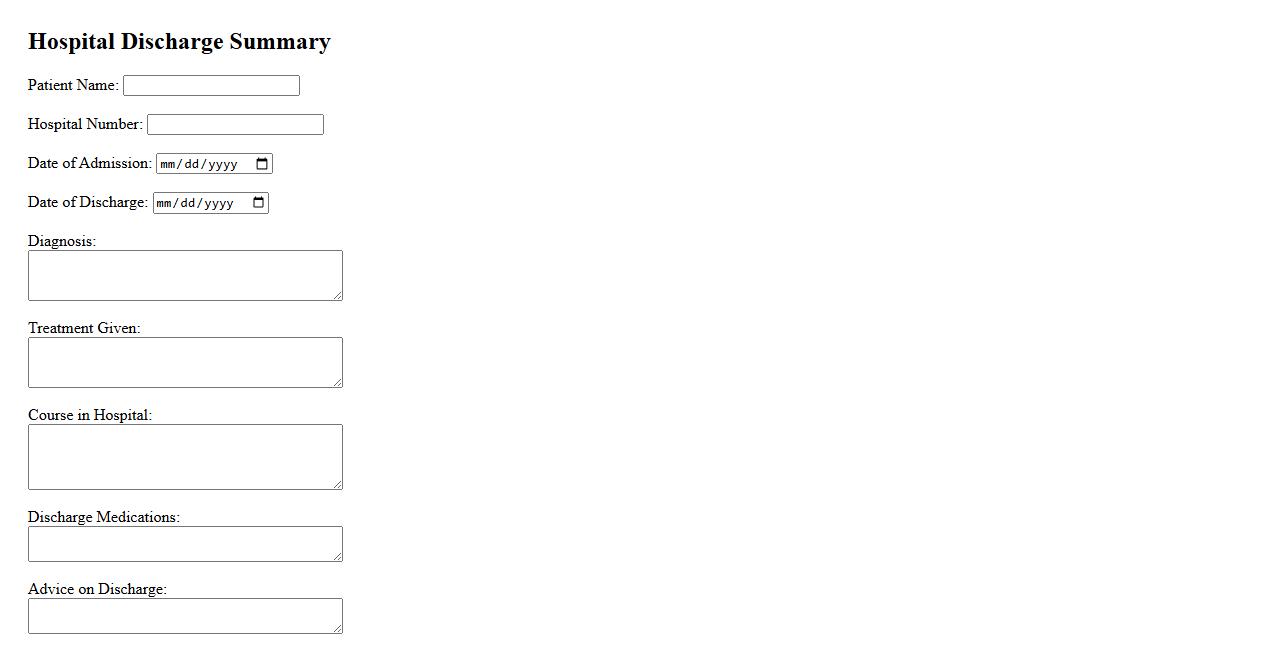

Hospital Discharge Summary

A Hospital Discharge Summary is a comprehensive document outlining a patient's medical condition, treatment received, and instructions for post-hospital care. It ensures continuity of care by providing essential information to healthcare providers and the patient. This summary is crucial for effective recovery and follow-up management.

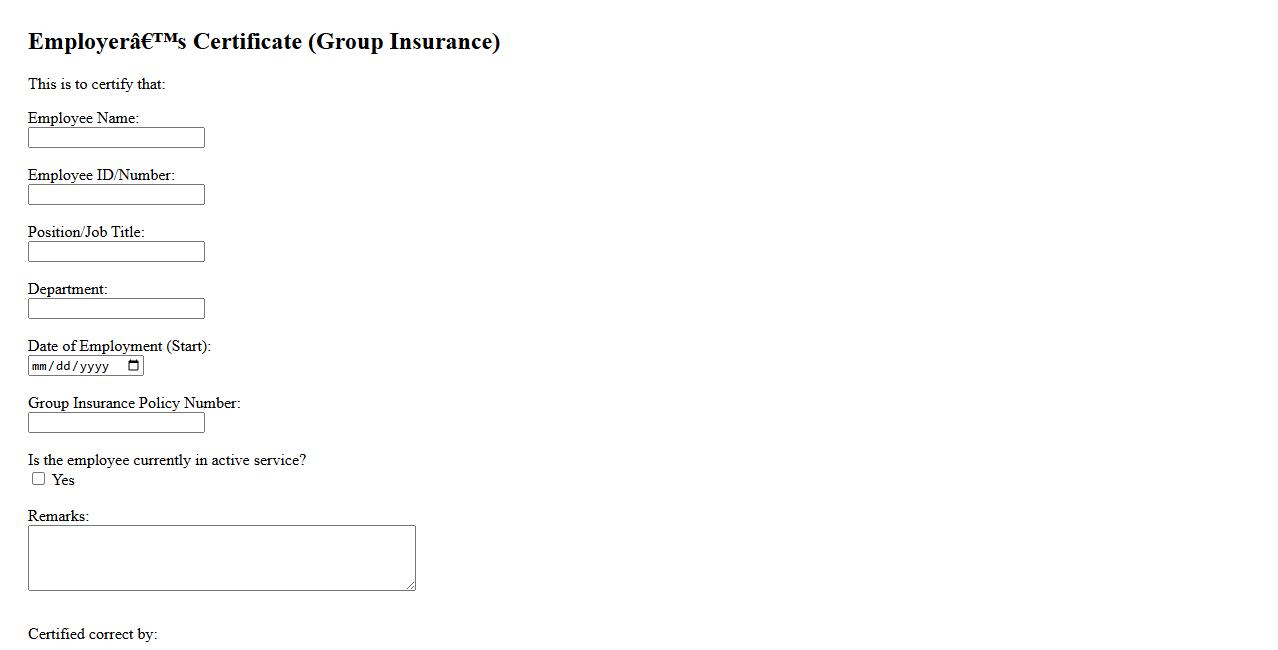

Employer’s Certificate (if group insurance)

An Employer's Certificate is a vital document required for group insurance applications, confirming the employee's enrollment and eligibility. It provides detailed information about the employer and the insured group, ensuring accurate risk assessment. This certificate helps streamline the insurance process by validating group coverage details.

Cause of Death Statement

A Cause of Death Statement is an official document issued by a medical professional that specifies the medical reason or condition leading to an individual's death. This statement is essential for legal and statistical purposes, providing clarity on the circumstances surrounding the death. It ensures accurate recording for public health records and family documentation.

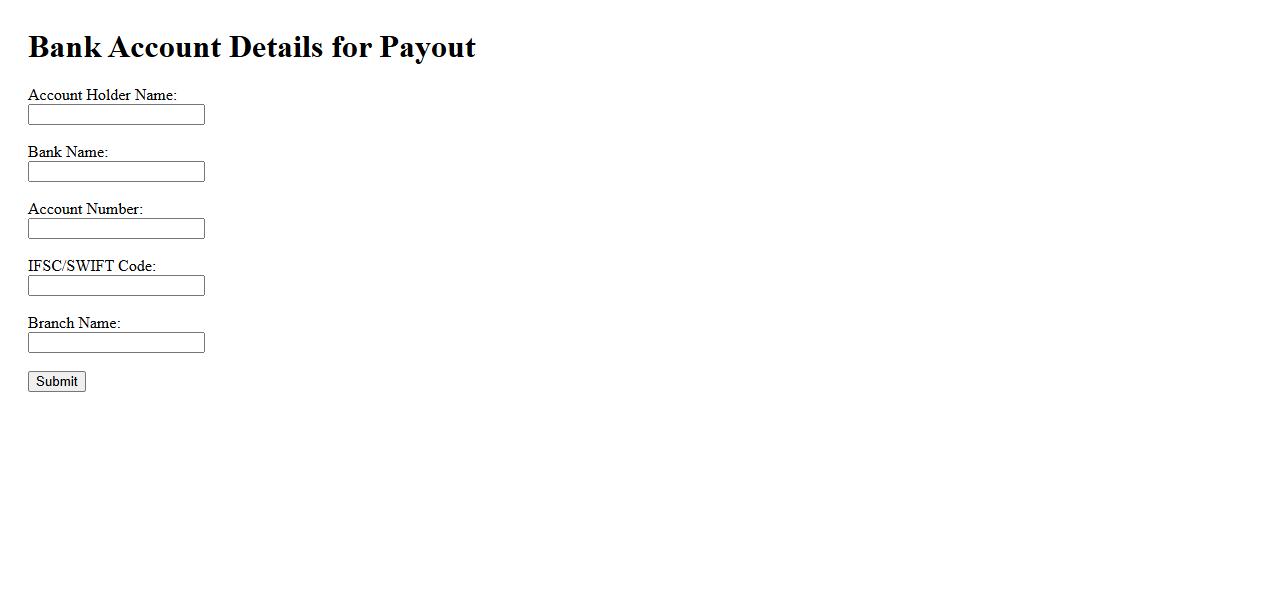

Bank Account Details for Payout

To receive your earnings seamlessly, please provide your accurate bank account details for payout. These details ensure timely and secure transfer of funds directly to your account. Always double-check the information to avoid any payment delays.

What are the required documents to process a death benefit claim?

To process a death benefit claim, essential documents include the original death certificate, policyholder's identification, and the beneficiary's proof of identity. Additional documents may include a claim form, proof of relationship, and any legal documents like a will or court order. These documents ensure the claim is valid and help the insurer verify the beneficiary's entitlement.

Who is eligible to file a claim for death benefits?

Eligible claimants typically include the named beneficiaries in the insurance policy or will. If no beneficiary is designated, the legal heirs or estate representatives may file the claim. Insurance companies require proper documentation to confirm the claimant's eligibility under the policy terms.

How should beneficiaries be identified and verified in the claim process?

Beneficiaries must be identified through official documents such as a government-issued ID, birth certificates, or legal certificates proving their relationship to the deceased. Verification may include cross-checking policy documents, wills, or court orders with the insurer's records. Accurate beneficiary identification is crucial to ensure correct benefit distribution.

What are the time limits or deadlines for submitting a death benefit claim?

Most insurers impose a time limit for submitting death benefit claims, often ranging from 30 days to six months after the insured's death. Failing to meet these deadlines can result in claim denial or delayed processing. It is vital for beneficiaries to contact the insurer promptly to understand and adhere to specific timelines.

How are disputes among multiple beneficiaries resolved during the claim process?

Disputes among multiple beneficiaries are generally resolved through mediation, legal intervention, or by following the insurer's dispute resolution procedures. The insurance company may require a court order before disbursing benefits if beneficiaries cannot agree. Clear documentation and legal advice are often necessary to settle conflicts effectively.