Filing a claim for vehicle insurance benefits involves notifying your insurer about an accident or damage to your vehicle to receive financial compensation. The process typically requires submitting detailed documentation, including a police report, photos of the damage, and repair estimates. Promptly initiating the claim ensures a smoother assessment and quicker reimbursement for repair or replacement costs.

Auto Insurance Claim Request

Filing an auto insurance claim request initiates the process of obtaining compensation for damages after a vehicle accident. It requires submitting accurate details about the incident and any supporting documents to the insurer. Promptly reporting claims helps ensure a faster resolution and recovery.

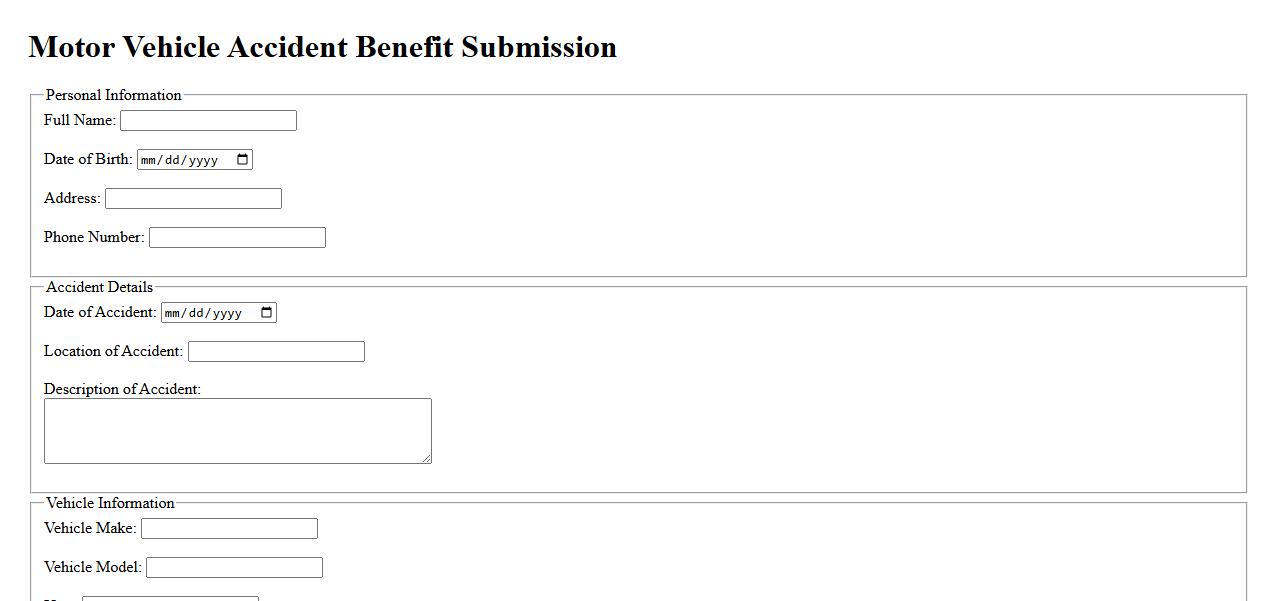

Motor Vehicle Accident Benefit Submission

The Motor Vehicle Accident Benefit Submission process involves submitting claims for injuries or damages sustained in a car accident. It ensures timely compensation and coverage under applicable insurance policies. Proper documentation and accurate details are essential for a successful benefit claim.

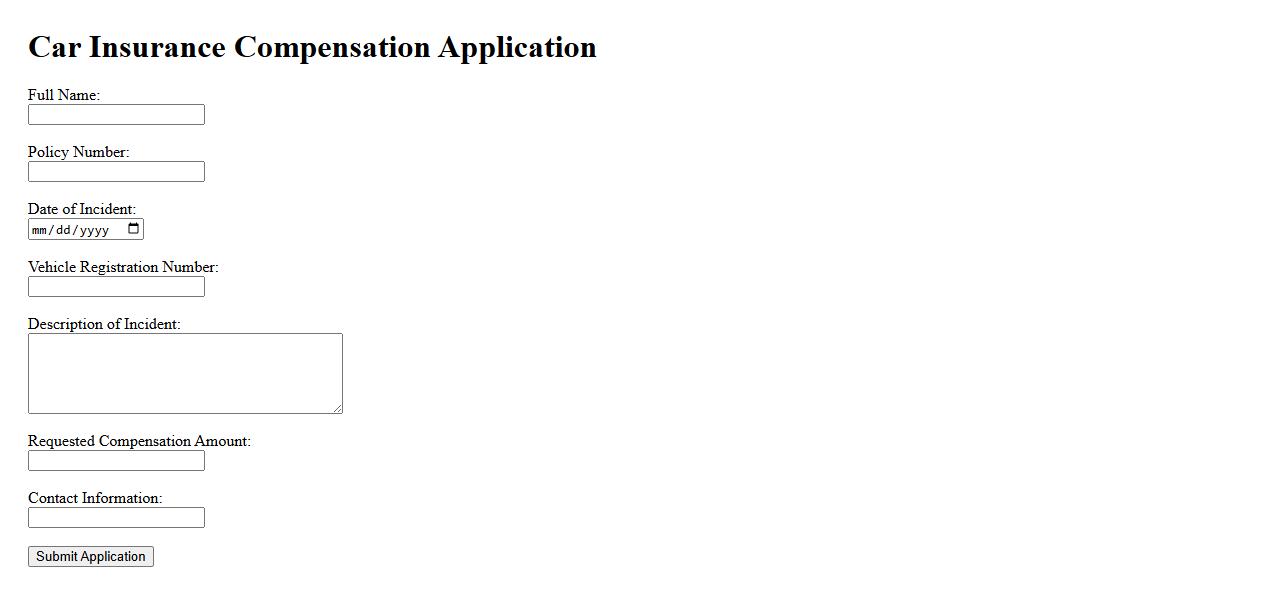

Car Insurance Compensation Application

Filing a Car Insurance Compensation Application ensures you receive the financial support needed after an accident or damage. This process involves submitting necessary documents and claims to your insurance provider. Timely and accurate applications help speed up compensation and repair procedures.

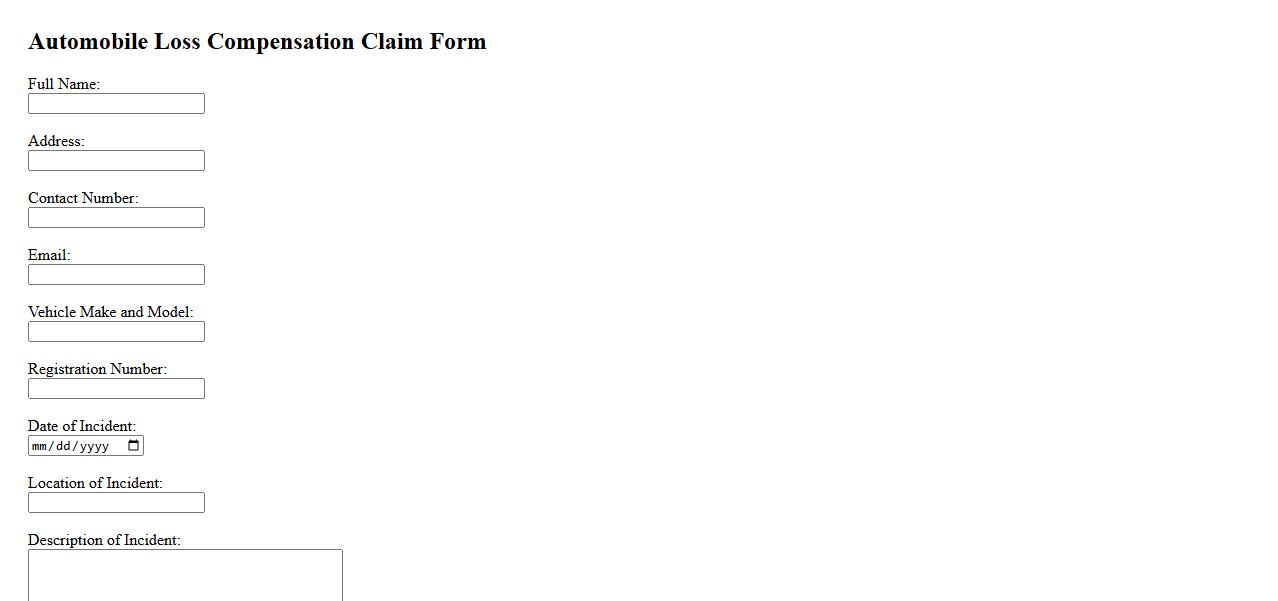

Automobile Loss Compensation Claim

Filing an Automobile Loss Compensation Claim ensures that vehicle owners receive financial reimbursement for damages incurred in accidents. This process involves submitting relevant documents and evidence to the insurer for evaluation. Timely claims help restore your vehicle and mitigate financial burdens efficiently.

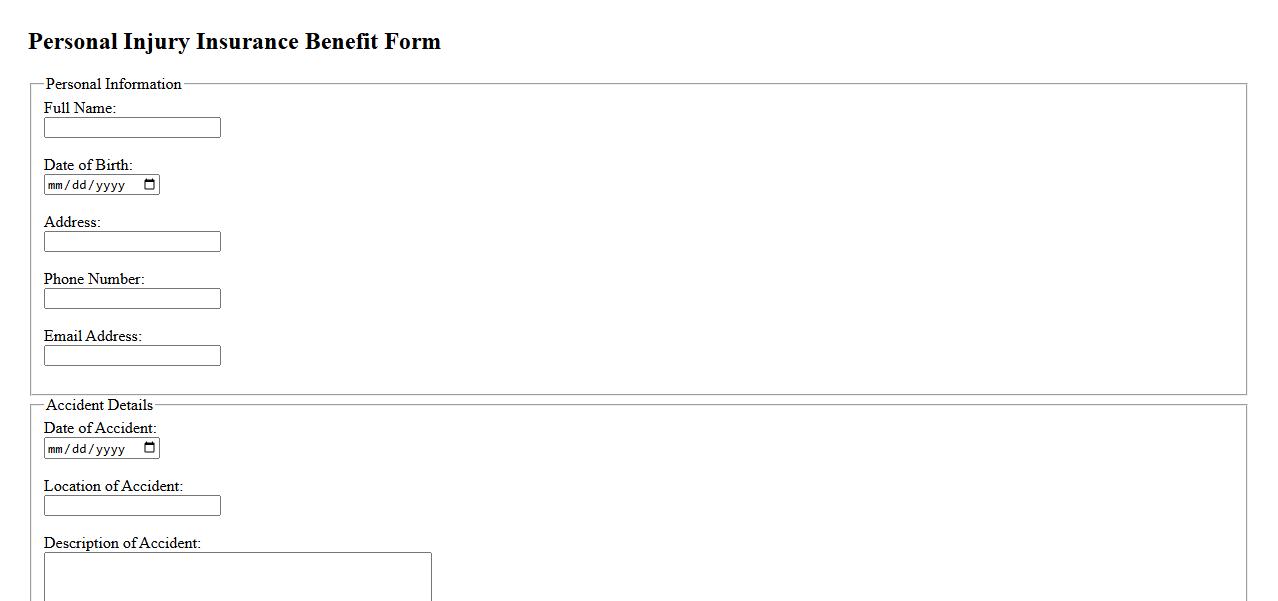

Personal Injury Insurance Benefit Form

The Personal Injury Insurance Benefit Form is a crucial document used to claim compensation for injuries sustained due to accidents. It facilitates the process of receiving insurance benefits by providing detailed information about the incident and medical treatment. Properly completing this form ensures timely and accurate processing of injury claims.

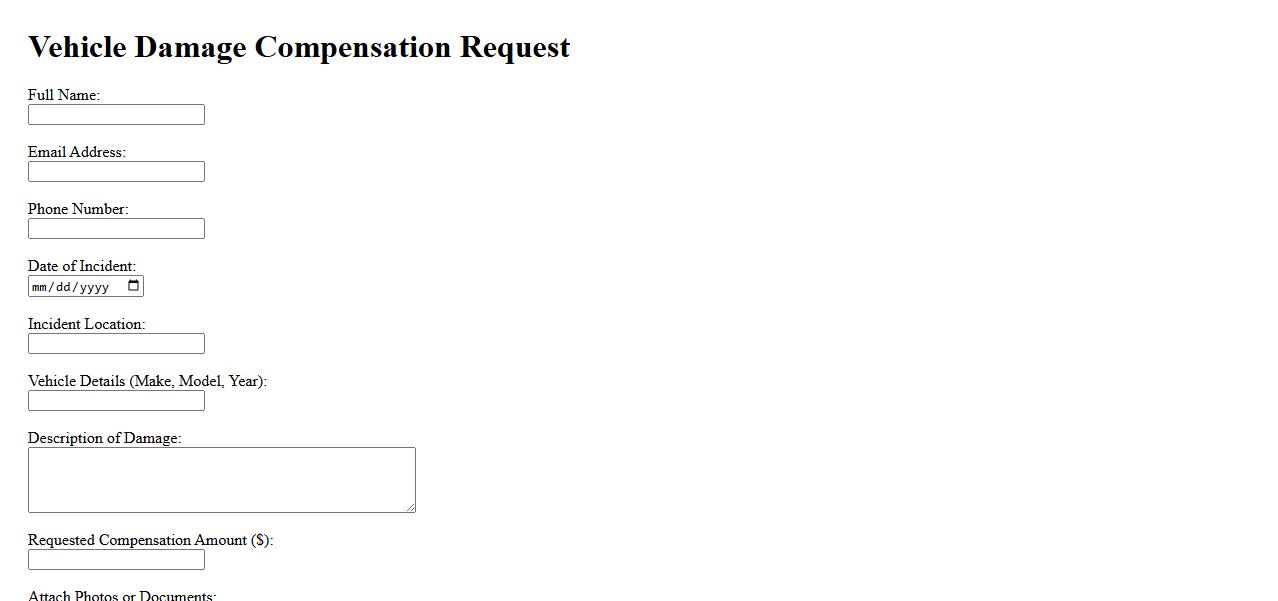

Vehicle Damage Compensation Request

If your vehicle has been damaged due to an accident or external factors, submitting a Vehicle Damage Compensation Request is essential to recover repair costs. This process involves providing detailed information about the incident and supporting documents to validate your claim. Timely submission ensures a quicker resolution and financial support for vehicle repairs.

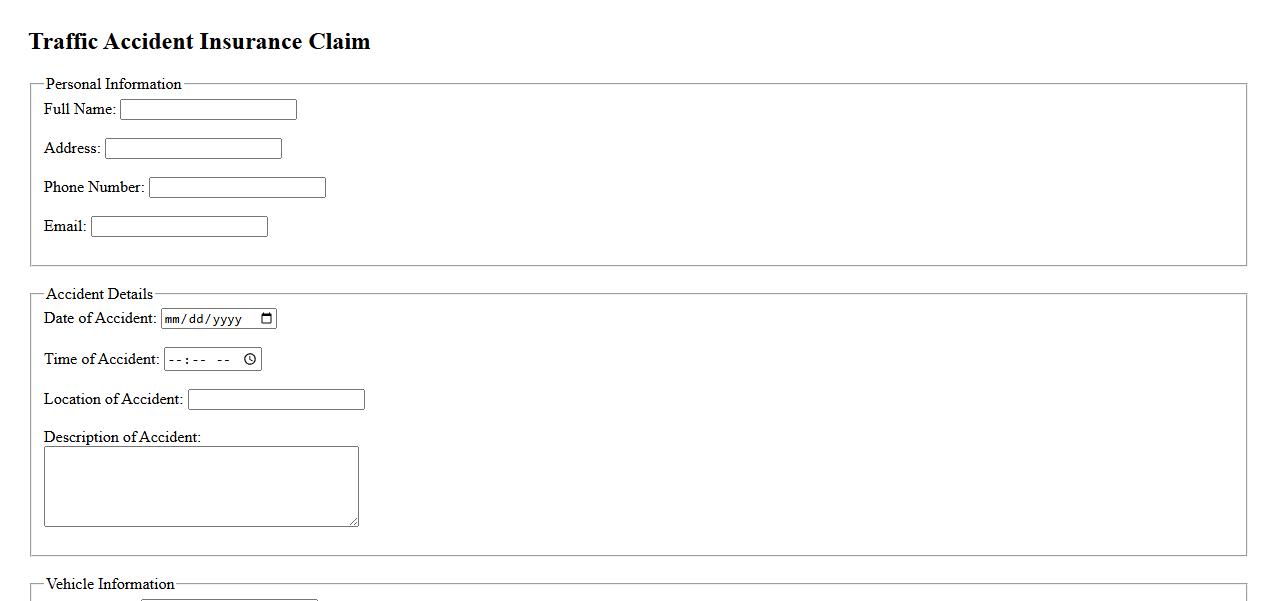

Traffic Accident Insurance Claim

Filing a Traffic Accident Insurance Claim is essential to recover damages after a vehicle collision. The process involves reporting the accident, providing necessary documentation, and working with your insurance company for compensation. Prompt and accurate claims help ensure timely repairs and medical coverage.

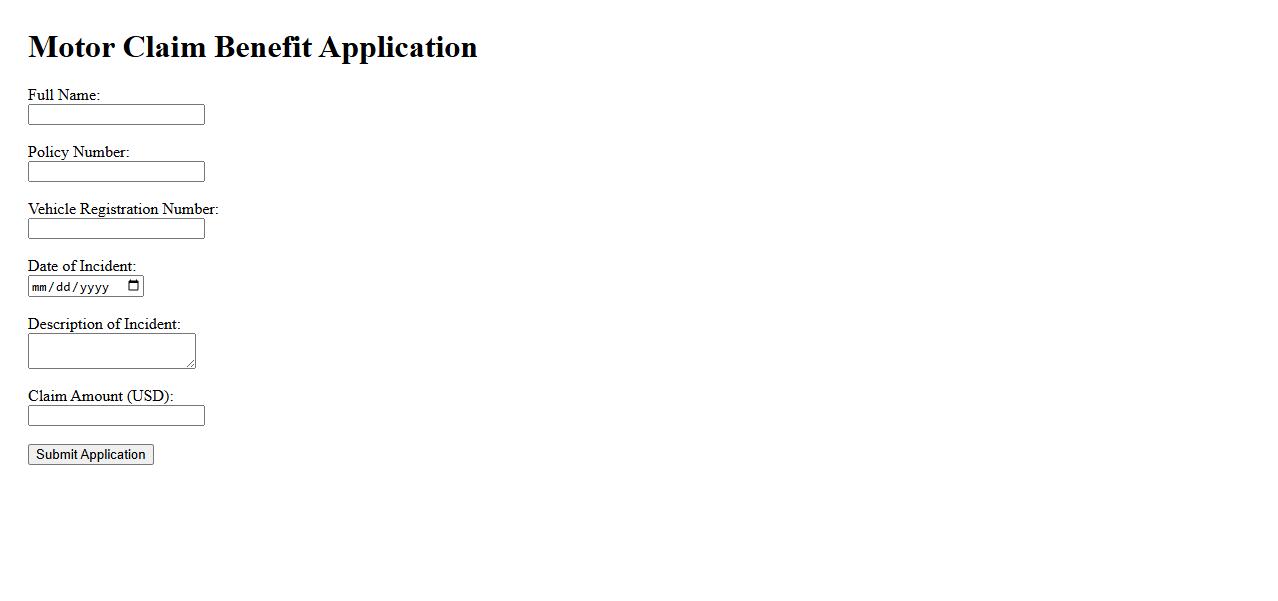

Motor Claim Benefit Application

The Motor Claim Benefit Application simplifies the process of filing claims for vehicle damage or loss. It allows policyholders to submit necessary documents electronically, ensuring faster assessment and approval. This convenient tool enhances the overall efficiency of managing motor insurance claims.

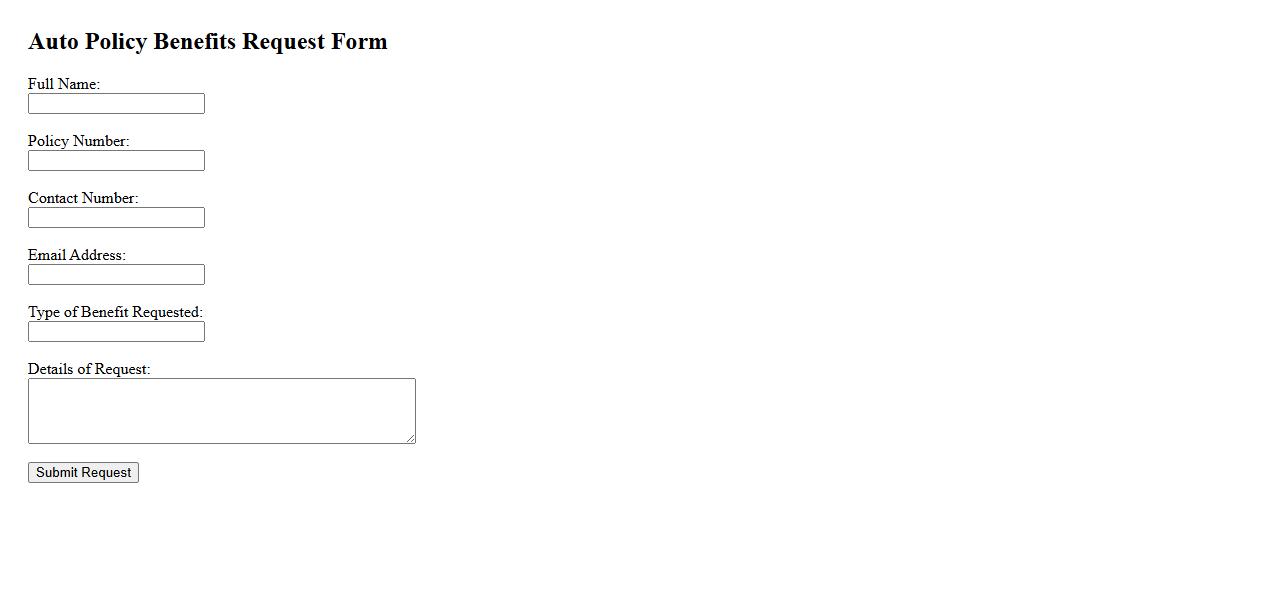

Auto Policy Benefits Request

Submitting an Auto Policy Benefits Request ensures you receive the maximum coverage and advantages available under your car insurance plan. This process helps clarify your entitlements and accelerates claim settlements. Understanding these benefits empowers policyholders to make informed decisions in case of an accident or vehicle damage.

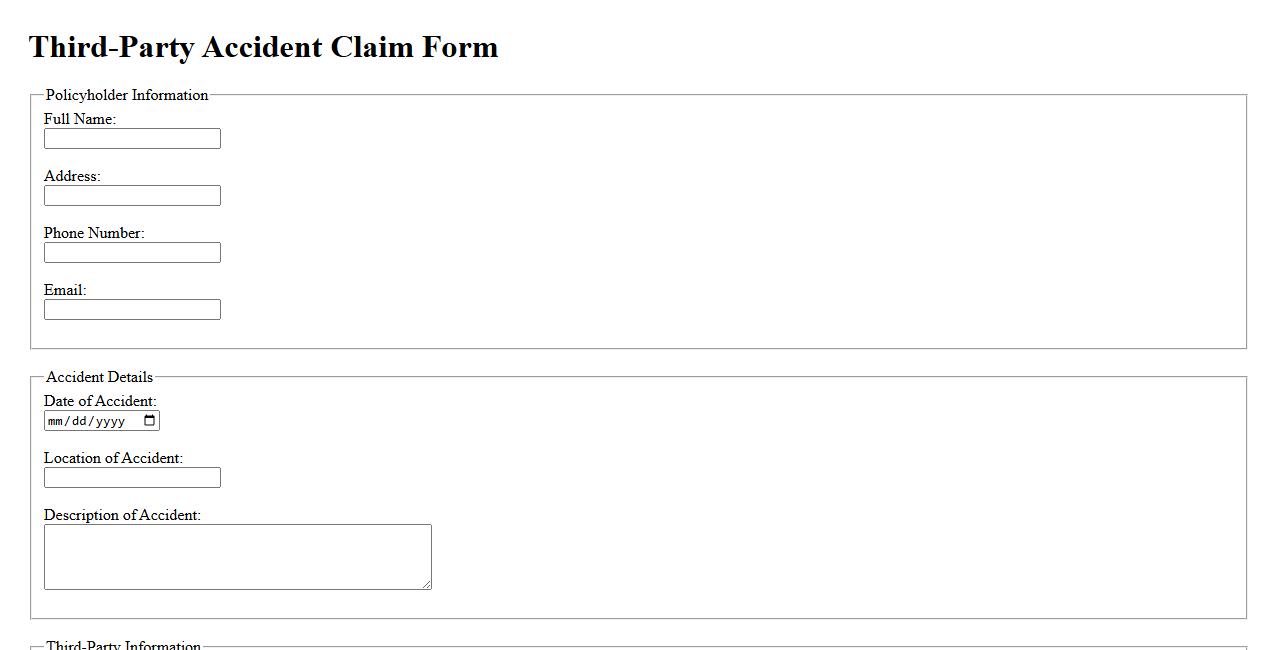

Third-Party Accident Claim Form

The Third-Party Accident Claim Form is a crucial document used to report and process claims involving accidents caused by another party. It ensures that the responsible party's insurance covers the damages and injuries sustained. Properly completing this form accelerates compensation and legal procedures.

What specific event or incident caused the damage or loss to the vehicle as described in the claim?

The claim details a collision that occurred on a rainy evening, resulting in significant damage to the front end of the vehicle. Witnesses reported a sudden loss of control due to slippery road conditions which caused the vehicle to strike a guardrail. This incident is the primary cause cited for the claim's vehicle damage.

Who is the registered owner of the vehicle, and do they have valid insurance coverage at the time of the incident?

The registered owner of the vehicle is John Smith, whose name appears on the official registration documents. At the time of the accident, the owner maintained an active insurance policy with comprehensive coverage. Verification of valid insurance at the incident date is confirmed by the insurer's records.

Are there any third parties involved, and if so, what are their roles and contact details?

Yes, there is a third-party driver involved in the incident who reported the collision to the authorities. This individual is identified as the other vehicle's driver, and their contact information is included in the claim file. Their role is critical in providing additional accounts and liability details pertaining to the accident.

Has the claim for vehicle insurance benefits been submitted within the required policy timeframe?

The claim was submitted within the 30-day period mandated by the insurance policy from the date of the incident. Timely submission ensures the claim meets policy requirements for processing without delay. The insurer's acknowledgment confirms receipt within the appropriate timeframe.

Are all supporting documents (e.g., police report, photographs, repair estimates) attached to validate the claim?

All necessary supporting documents are included with the claim submission to facilitate thorough evaluation. These documents include the official police report, photographs of the damaged vehicle, and repair cost estimates. Inclusion of this evidence strengthens the legitimacy and assessment accuracy of the insurance claim.