Filing a claim for long-term disability benefits involves submitting medical documentation and proof of disability to an insurance provider or employer-sponsored plan. The approval process requires demonstrating the inability to perform job duties due to a qualifying condition. Timely and accurate submission of all required information ensures a smoother review and potential approval of the benefits.

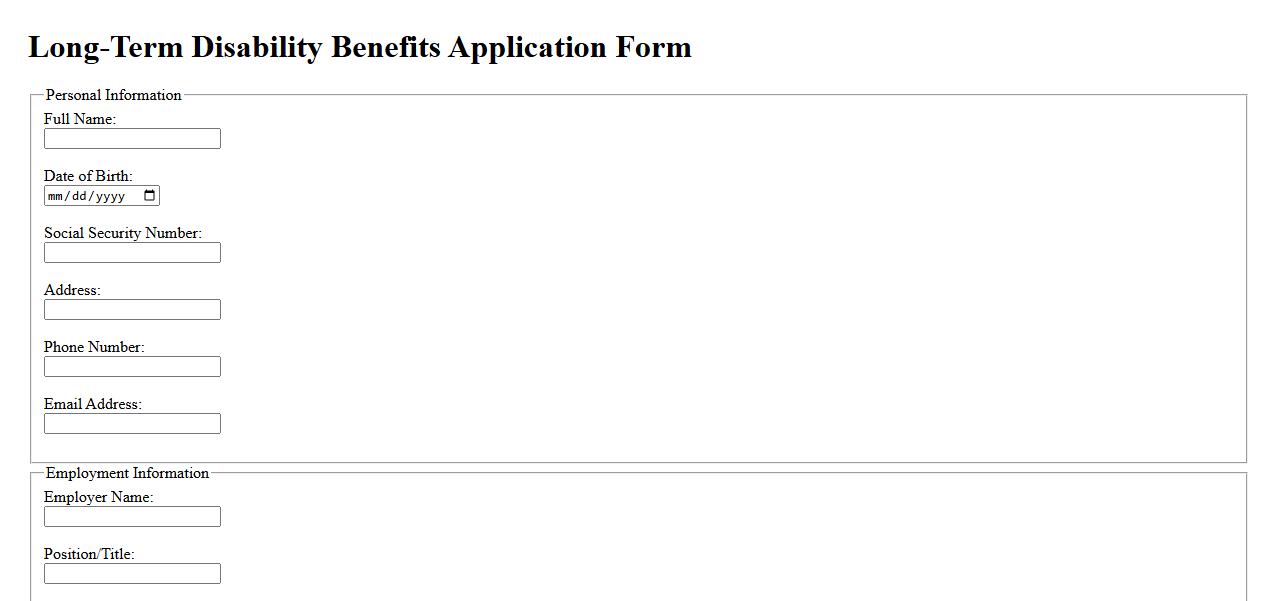

Long-Term Disability Benefits Application Form

The Long-Term Disability Benefits Application Form is a vital document used to apply for financial support when an individual is unable to work due to a prolonged illness or injury. This form collects essential personal, medical, and employment information to assess eligibility for disability benefits. Completing it accurately ensures timely processing and potential access to necessary financial assistance.

Employee Disability Statement

An Employee Disability Statement is a formal document used to communicate an employee's disability status to their employer. It helps ensure appropriate accommodations and compliance with workplace regulations. This statement supports an inclusive and accessible work environment for all employees.

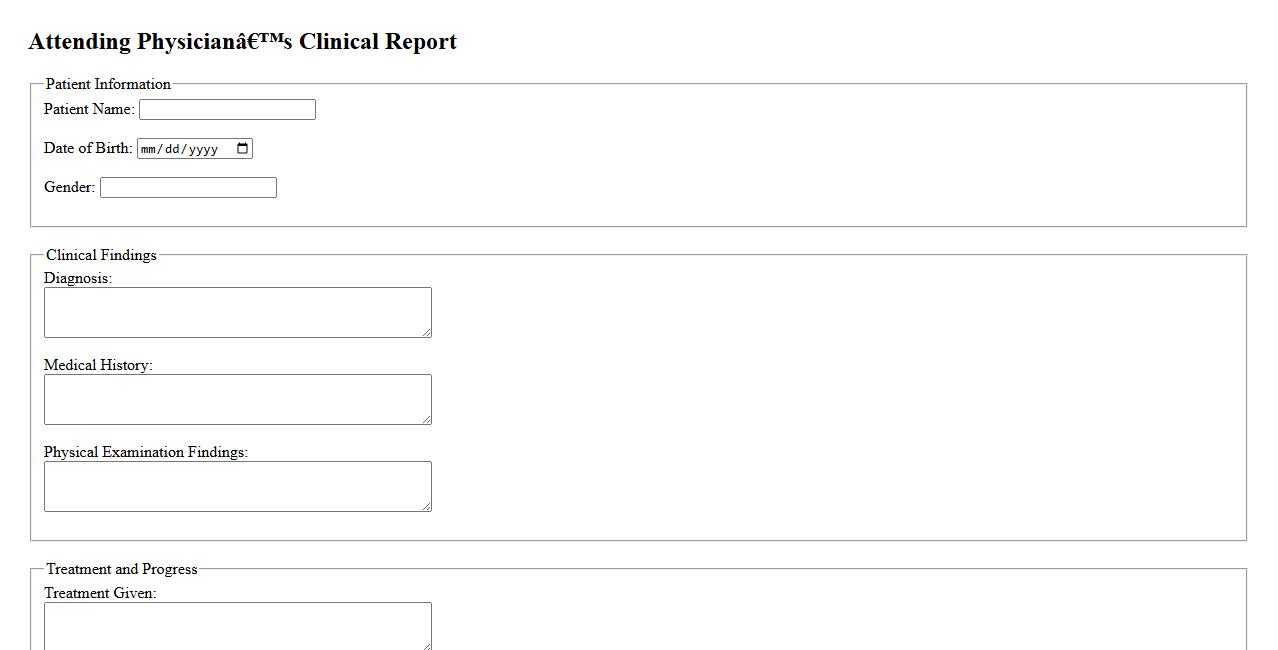

Attending Physician’s Clinical Report

The Attending Physician's Clinical Report provides a detailed summary of a patient's medical condition and treatment during their hospital stay. This report is essential for ensuring continuity of care and effective communication between healthcare providers. It includes observations, diagnosis, treatments administered, and recommendations for follow-up care.

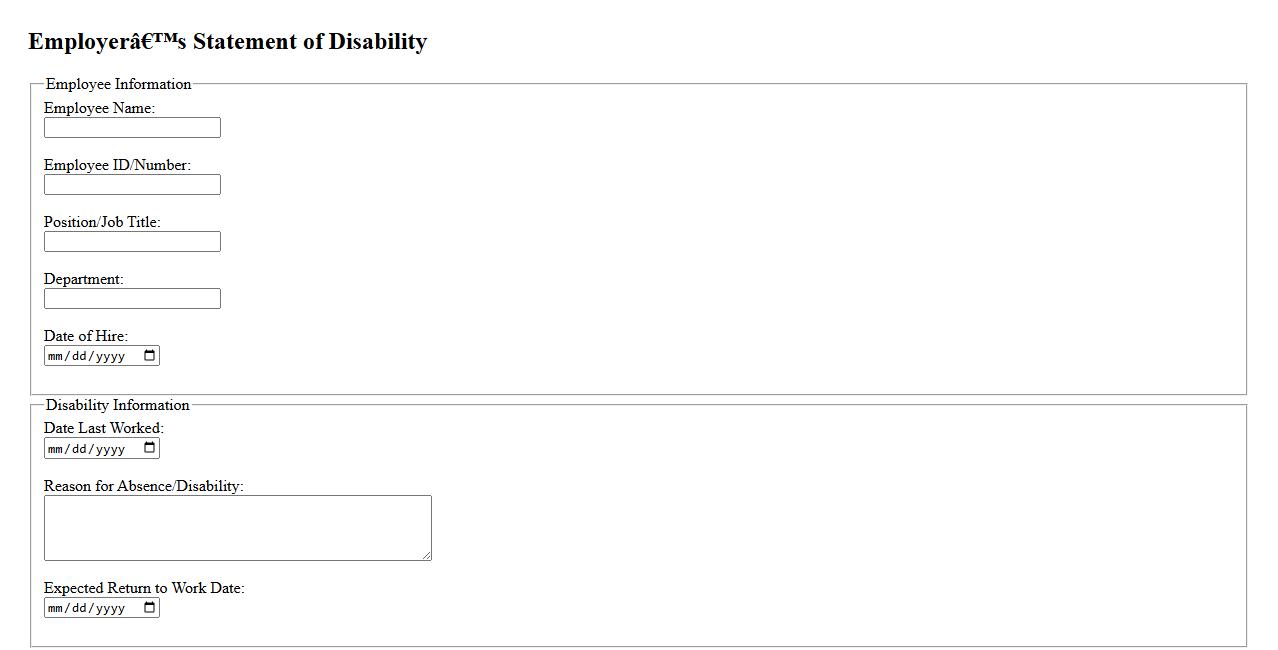

Employer’s Statement of Disability

The Employer's Statement of Disability is a critical document used to verify an employee's inability to work due to illness or injury. It provides essential information about the nature and duration of the disability, helping insurance companies and human resources manage claims efficiently. This statement ensures clear communication between employers, employees, and healthcare providers regarding work limitations and support needed.

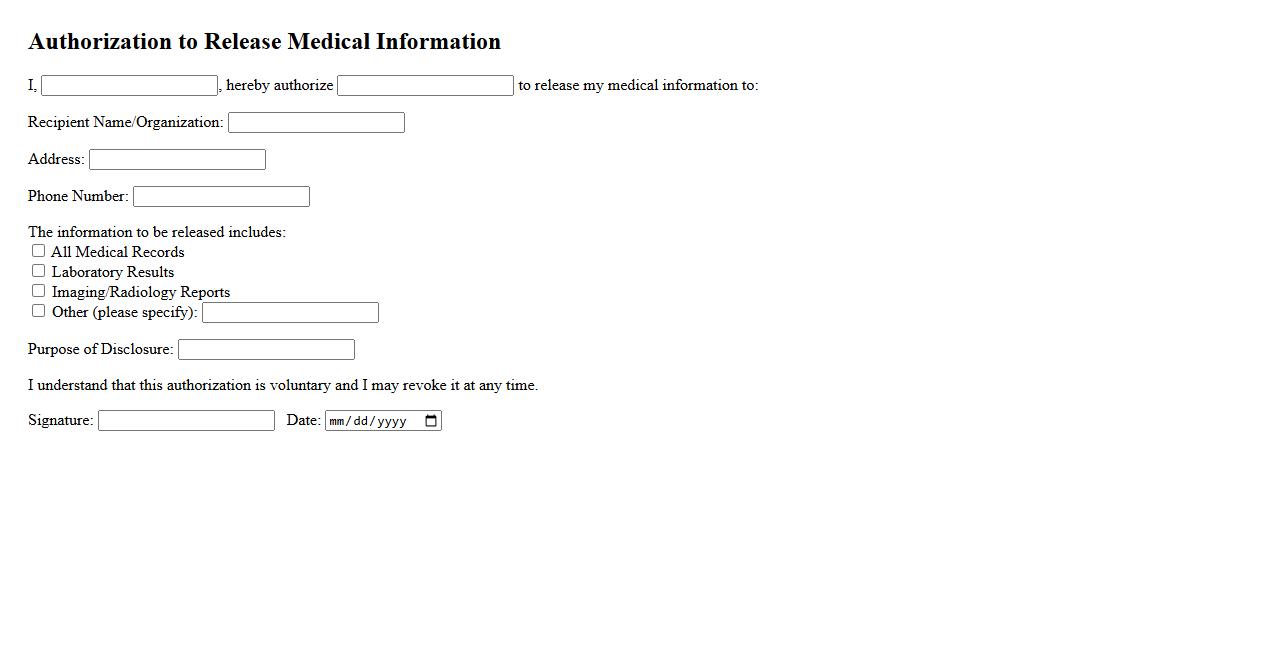

Authorization to Release Medical Information

Authorization to Release Medical Information is a legal document that allows healthcare providers to share a patient's medical records with specified individuals or organizations. This authorization ensures the confidentiality and privacy of sensitive health information while facilitating communication between relevant parties. Patients must provide explicit consent for their information to be disclosed, protecting their rights under privacy laws.

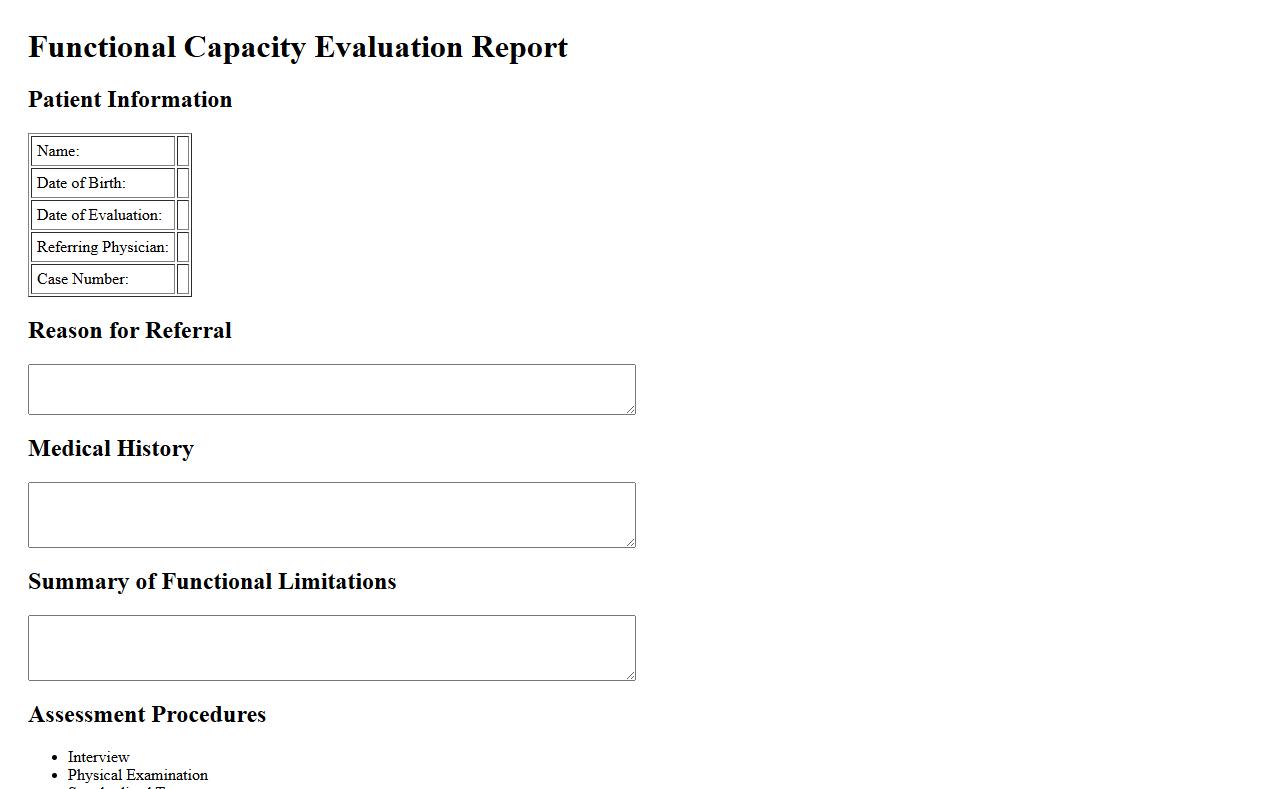

Functional Capacity Evaluation Report

The Functional Capacity Evaluation Report provides a comprehensive assessment of an individual's physical abilities related to work tasks. It helps determine the level of function and readiness for job duties after injury or illness. This report is essential for rehabilitation planning and return-to-work decisions.

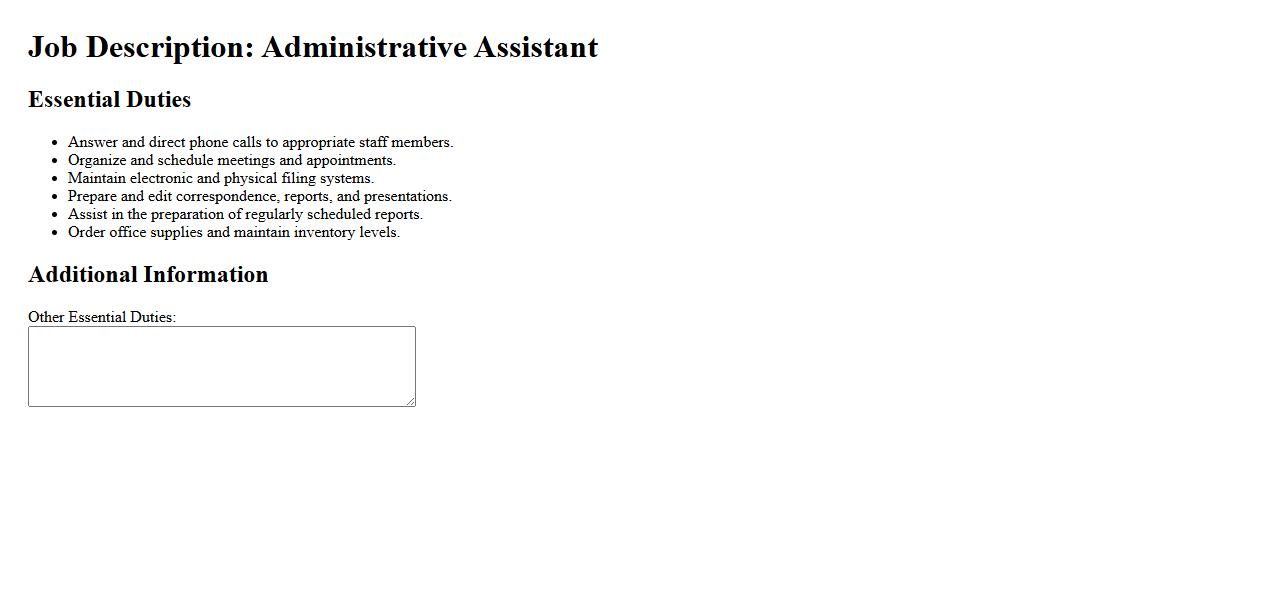

Job Description with Essential Duties

The Job Description with Essential Duties clearly outlines the primary responsibilities and tasks required for a specific role. It serves as a guide for both employers and employees to understand key expectations and performance standards. This document ensures alignment and effective job performance within the organization.

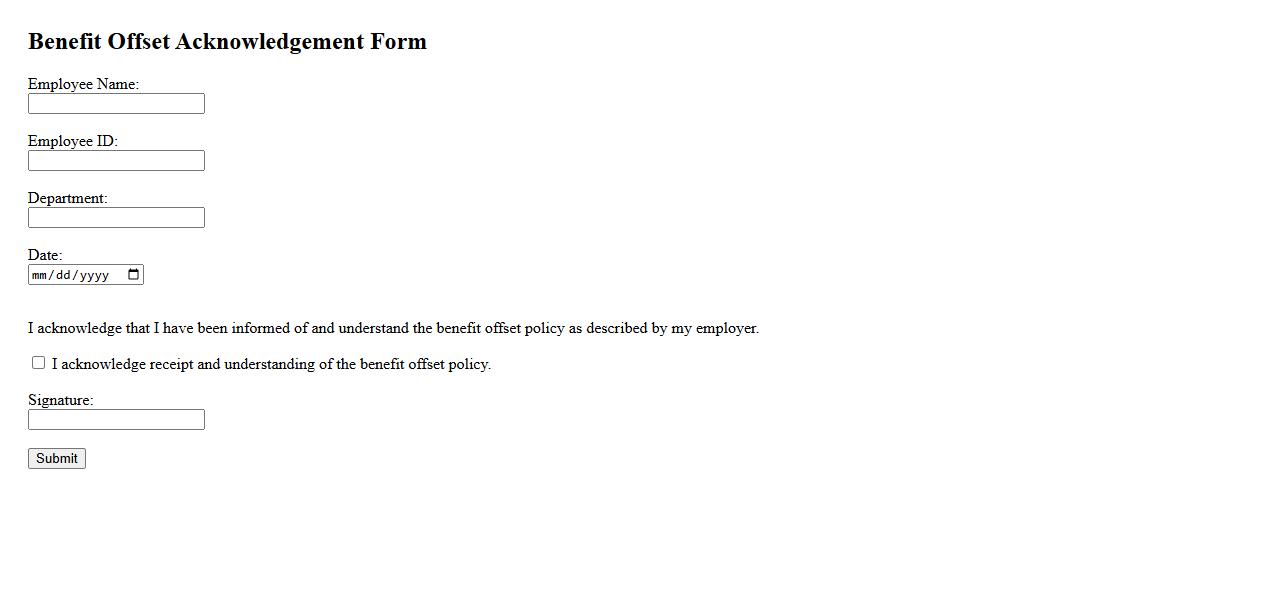

Benefit Offset Acknowledgement Form

The Benefit Offset Acknowledgement Form is a critical document used to confirm understanding of adjusted benefits due to offset policies. It ensures that recipients are aware of any reductions applied to their payments because of other income sources. Completing this form helps maintain transparent communication between the provider and beneficiary.

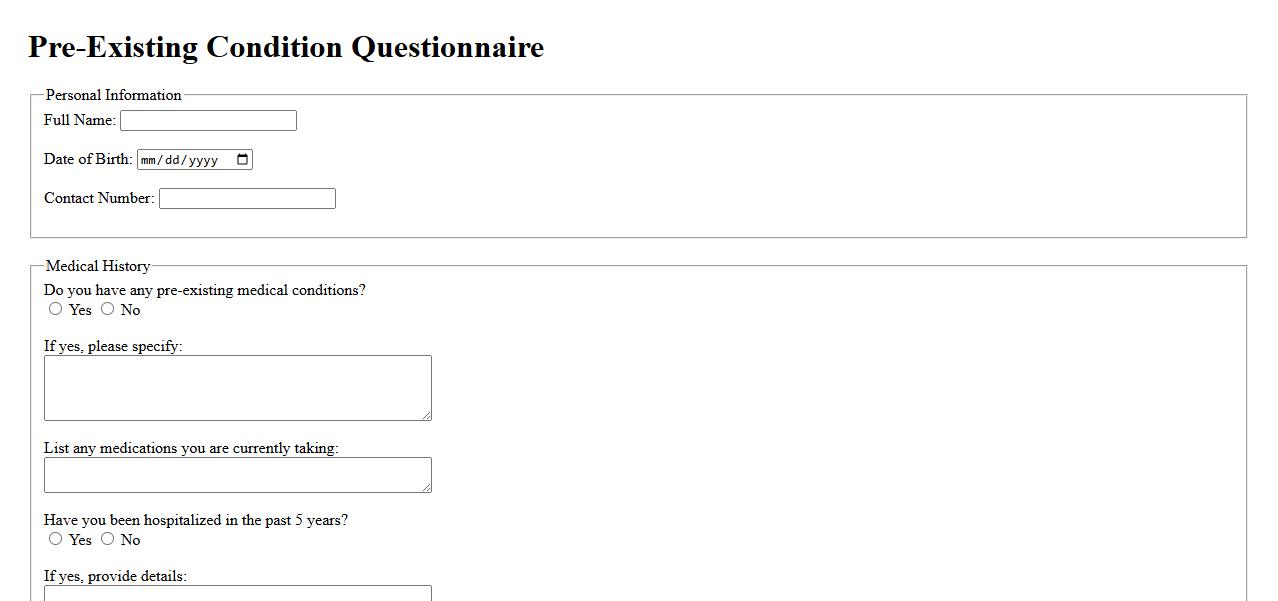

Pre-Existing Condition Questionnaire

The Pre-Existing Condition Questionnaire is a vital tool used by healthcare providers to assess a patient's health history before treatment. It helps identify any existing medical conditions that could affect diagnosis or therapy choices. Completing this questionnaire ensures personalized and effective medical care.

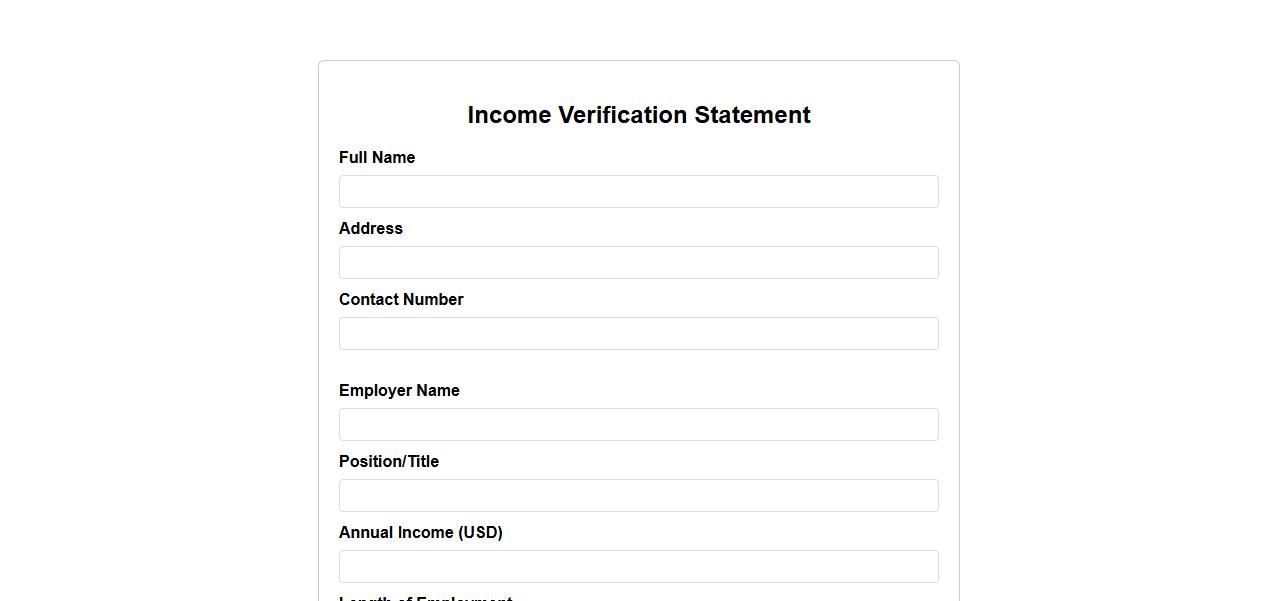

Income Verification Statement

An Income Verification Statement is an official document used to confirm an individual's earnings from employment or other sources. It is commonly required by lenders, landlords, or government agencies to assess financial stability. This statement ensures accurate verification of income for various applications.

What is the primary reason for submitting a long-term disability benefits claim?

The primary reason for submitting a long-term disability benefits claim is to receive income replacement when a policyholder is unable to work due to a serious illness or injury. These benefits provide financial stability during extended periods of disability. Claimants seek this support to maintain their living expenses when regular earnings are halted.

What documentation is required to support a long-term disability claim?

Supporting a long-term disability claim requires detailed medical reports from healthcare providers outlining the diagnosis and prognosis. Additionally, employment records that demonstrate the claimant's inability to perform job duties are essential. Accurate and timely submission of these documents expedites the claim approval process.

How is "disability" defined within the terms of the policy?

In a long-term disability policy, disability is typically defined as the inability to engage in any occupation or the claimant's own occupation due to a medical condition. The exact definition varies, often distinguishing between "own occupation" and "any occupation" standards. This definition directly impacts eligibility and benefit duration.

What is the waiting (elimination) period before long-term disability benefits begin?

The waiting period, also known as the elimination period, is the time frame between the onset of disability and when benefits commence. It commonly ranges from 60 to 180 days, depending on the policy terms. Claimants are responsible for their expenses during this interval, making the duration a crucial factor in financial planning.

How are benefit amounts calculated for approved long-term disability claims?

Benefit amounts for approved long-term disability claims are usually calculated as a percentage of the claimant's pre-disability earnings, often between 50% to 70%. Some policies include offsets for other income sources such as Social Security or workers' compensation. The calculation ensures a fair replacement income while balancing insurer risk.