Submitting a claim for tax refund allows taxpayers to recover overpaid taxes by providing necessary documentation to the tax authorities. Accurate record-keeping and timely filing are essential to ensure a smooth refund process. Understanding tax regulations and deadlines helps maximize the amount eligible for a claim for tax refund.

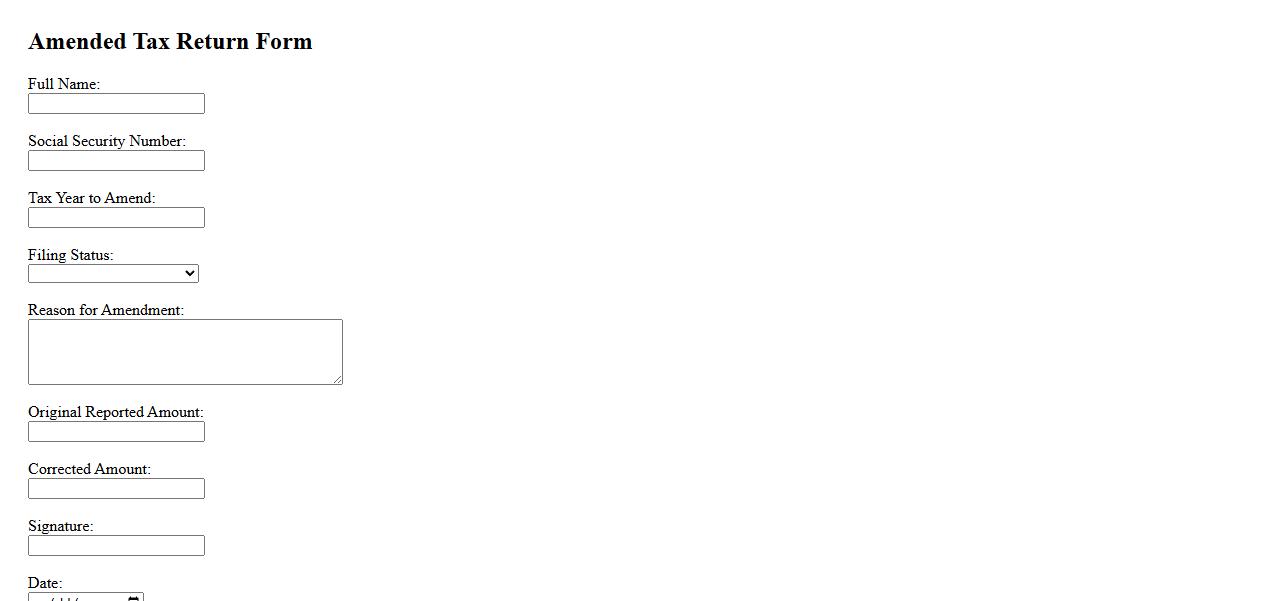

Amended Tax Return Form

An Amended Tax Return Form is used to correct errors or make changes to a previously filed tax return. This form allows taxpayers to update information such as income, deductions, or credits. Filing an amended return ensures accurate tax records and proper tax liability adjustment.

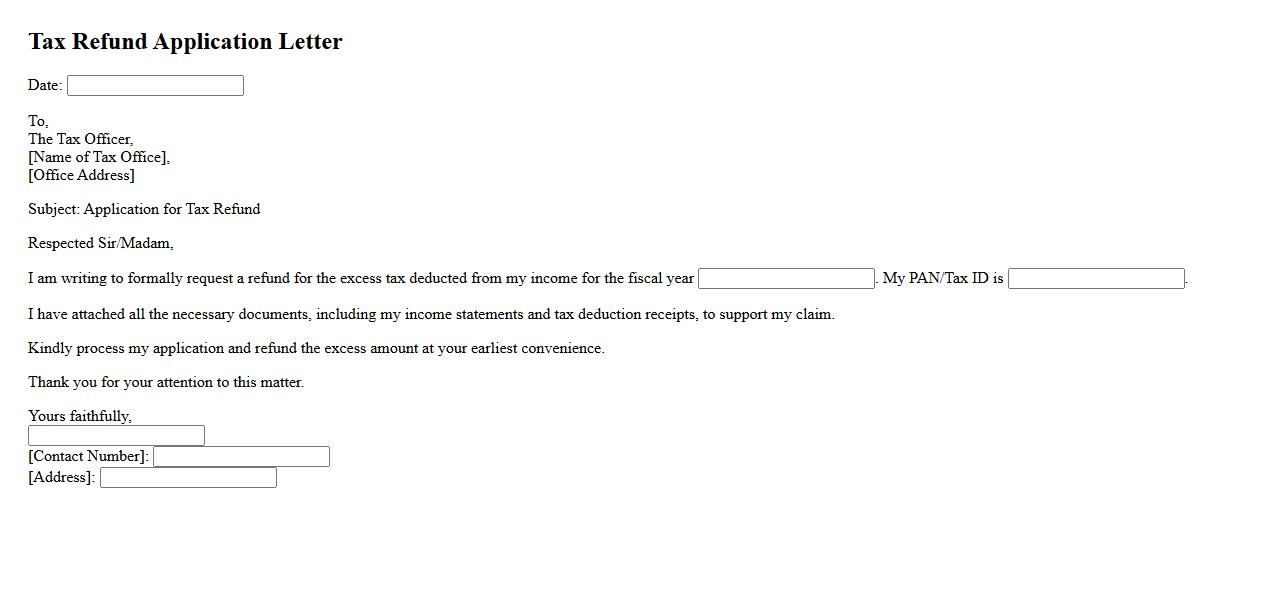

Tax Refund Application Letter

A Tax Refund Application Letter is a formal request submitted to the tax authorities to claim a refund on overpaid taxes. This letter usually includes essential details such as the taxpayer's information, the reason for the refund, and supporting documentation. Writing a clear and concise application letter helps ensure a smooth and timely refund process.

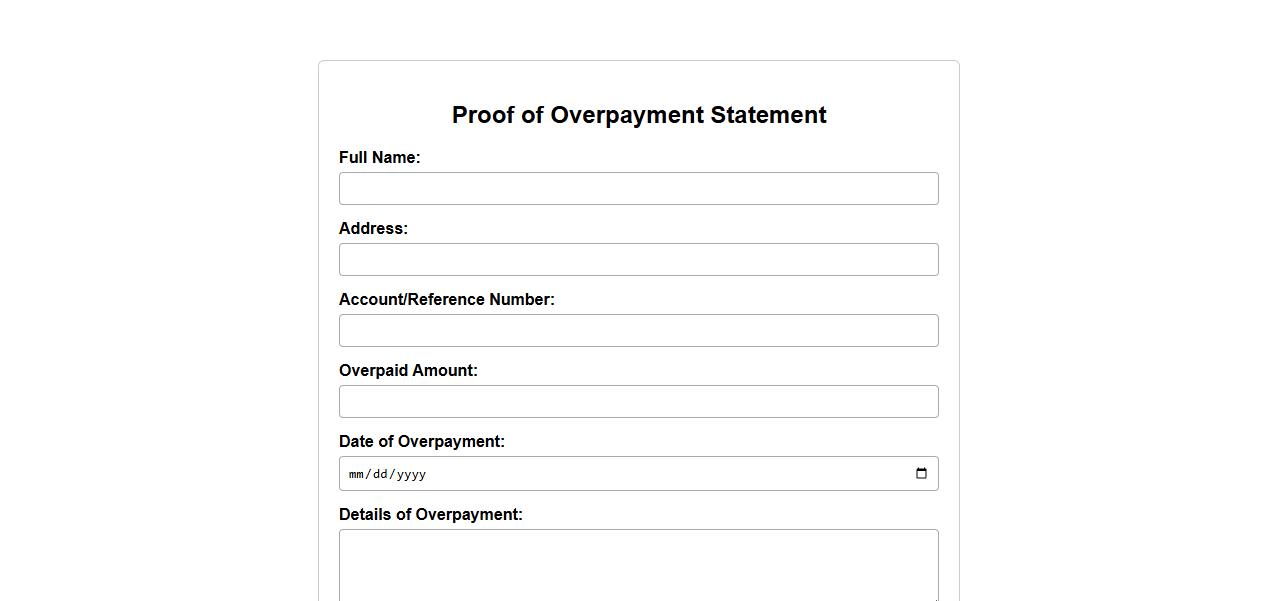

Proof of Overpayment Statement

A Proof of Overpayment Statement is a formal document that verifies the excess amount paid by a customer or client. It serves as evidence for requesting a refund or adjustment from the company or organization. This statement typically includes transaction details, payment dates, and amounts to clarify the overpayment situation.

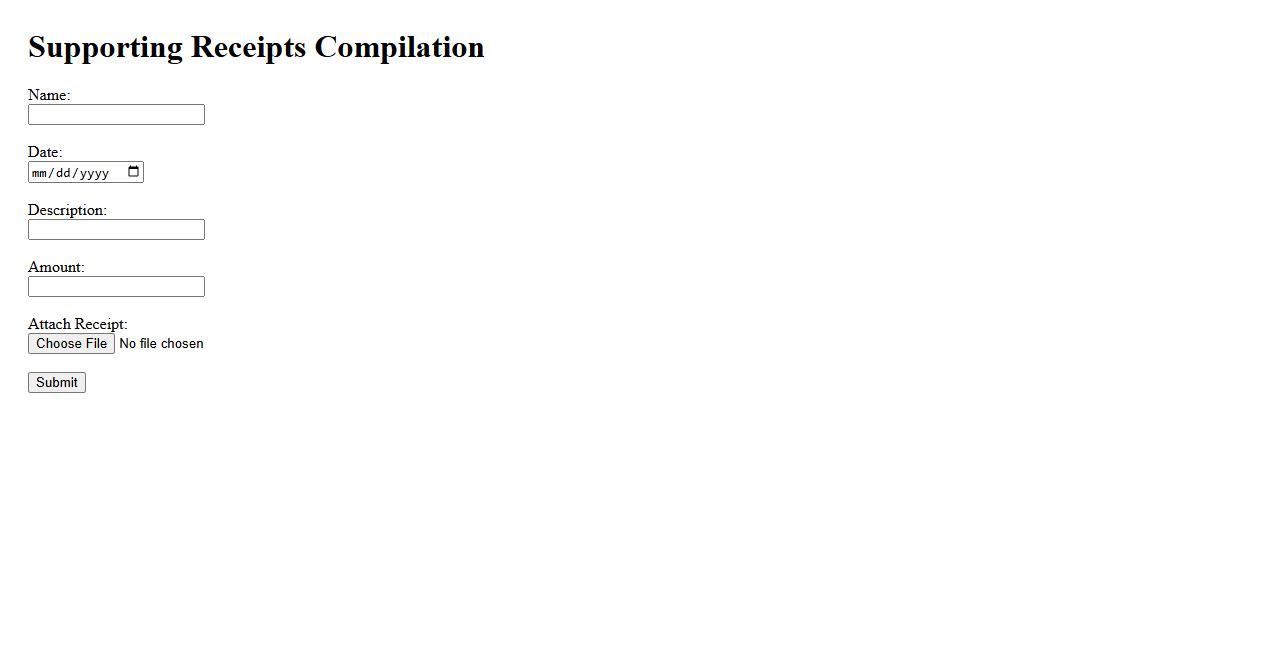

Supporting Receipts Compilation

Efficient Supporting Receipts Compilation ensures accurate record-keeping and financial transparency. This process involves gathering and organizing all relevant receipts to verify expenses and transactions. Proper compilation aids in smooth audits and simplifies financial management.

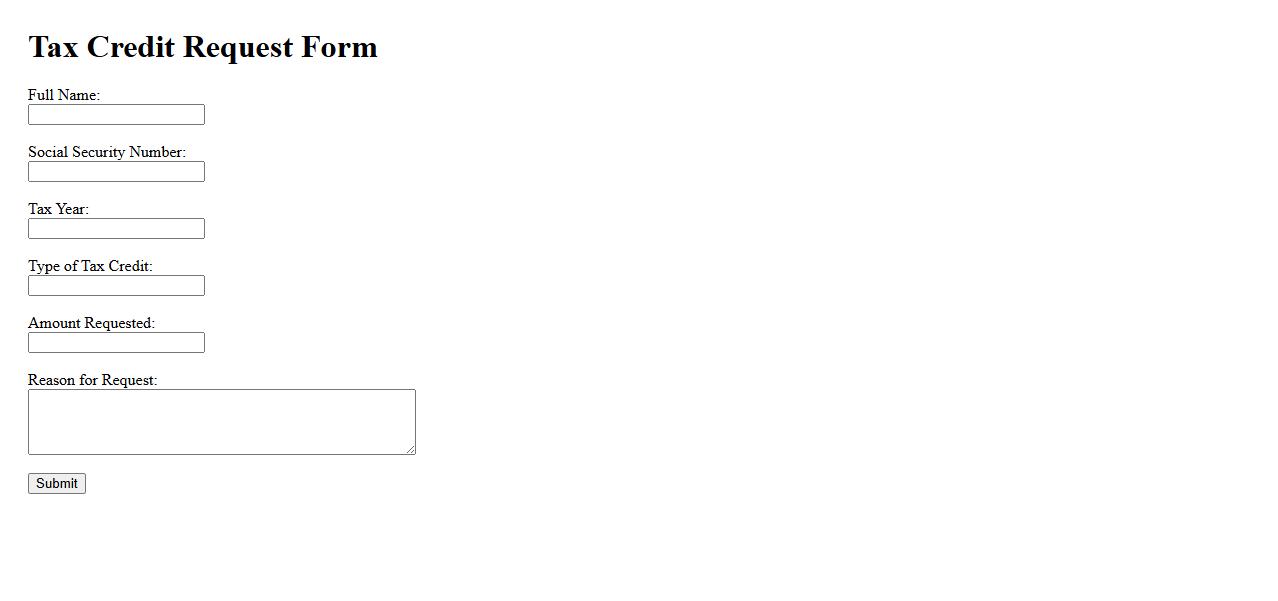

Tax Credit Request Form

The Tax Credit Request Form is a crucial document used to apply for eligible tax credits efficiently. It ensures accurate reporting of income and deductions to optimize potential savings. Completing this form correctly can significantly reduce your tax liability.

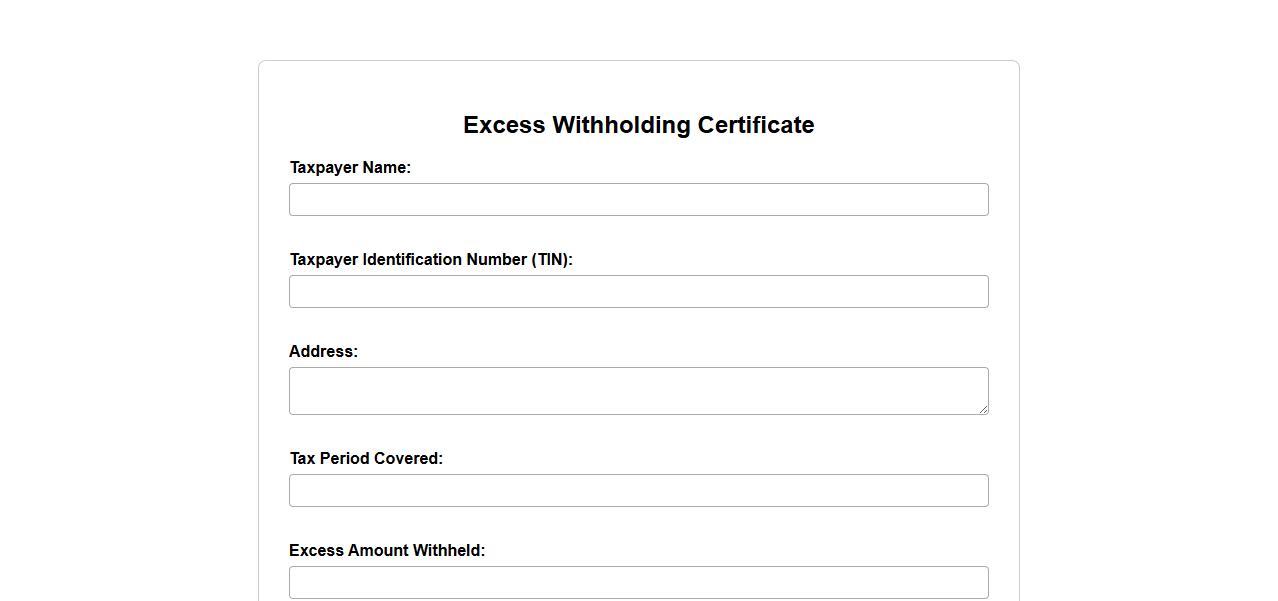

Excess Withholding Certificate

An Excess Withholding Certificate is a document issued to taxpayers who have had more tax withheld than necessary from their income. It allows individuals or entities to claim a refund or credit on the excess amount withheld by tax authorities. This certificate ensures accurate tax compliance and prevents overpayment on taxes.

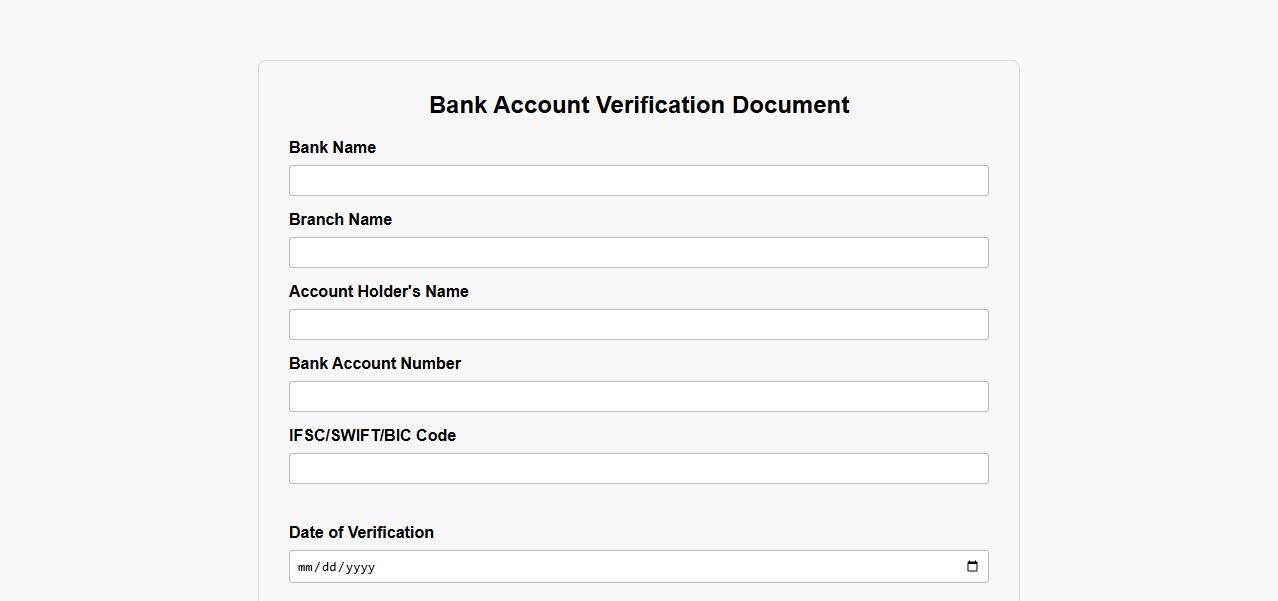

Bank Account Verification Document

A Bank Account Verification Document is an essential paper that confirms the ownership and details of a bank account. It is commonly required for financial transactions, loan applications, and identity verification. This document helps ensure secure and accurate processing of banking activities.

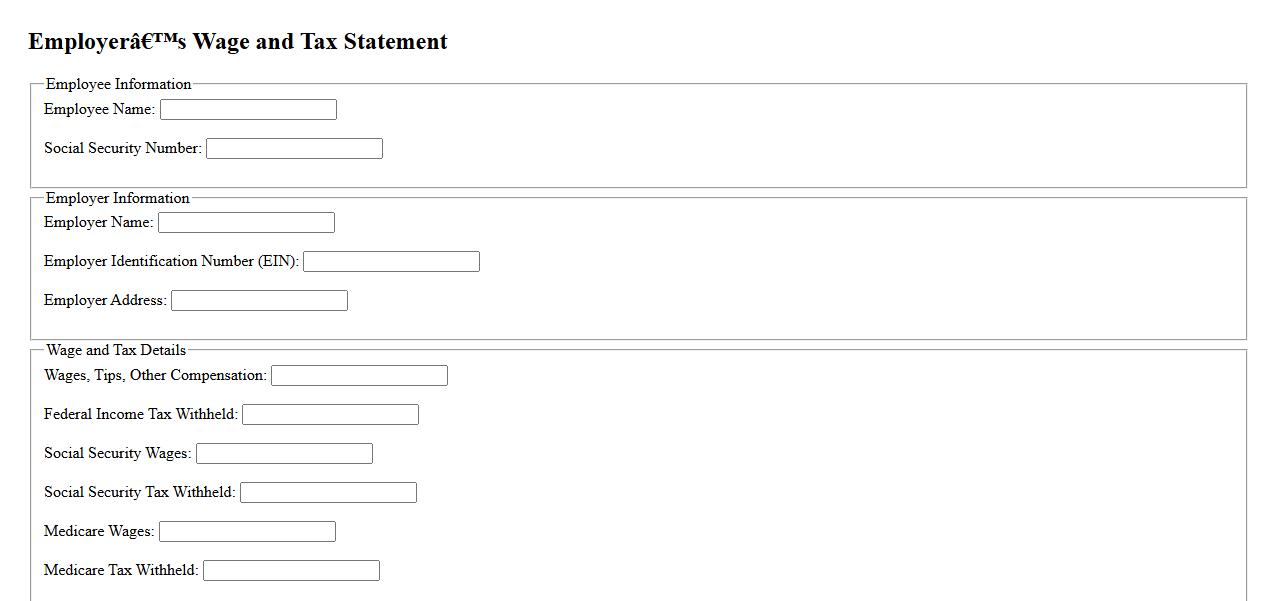

Employer’s Wage and Tax Statement

The Employer's Wage and Tax Statement is a crucial document that summarizes an employee's earnings and the taxes withheld during a specific tax year. It is used by both employees and tax authorities to ensure accurate reporting of income and tax obligations. This statement helps facilitate proper filing of individual income tax returns.

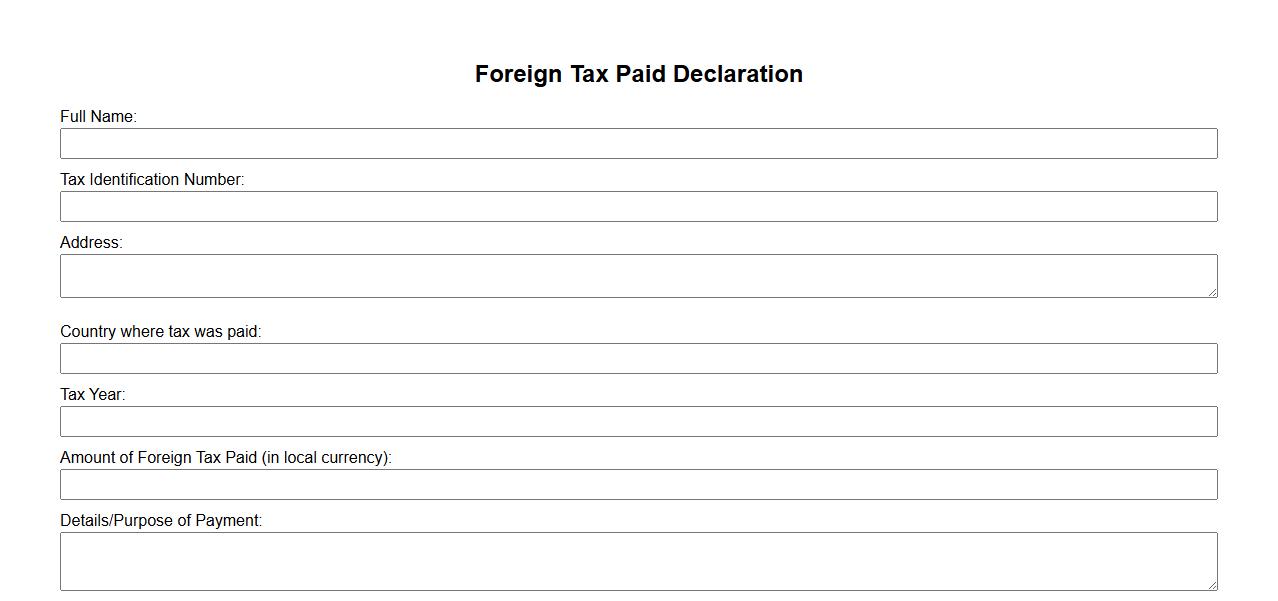

Foreign Tax Paid Declaration

The Foreign Tax Paid Declaration is a crucial document used to report taxes paid to foreign governments on income earned abroad. It helps avoid double taxation by providing proof of tax payments for tax credit claims. Ensuring accurate submission of this declaration is essential for compliance with international tax regulations.

Refund Justification Checklist

The Refund Justification Checklist is an essential tool designed to streamline the refund approval process by ensuring all necessary criteria are met. This checklist helps businesses maintain transparency and accuracy when handling refund requests. Utilizing it minimizes errors and enhances customer satisfaction by providing clear validation steps.

What is the primary purpose of a Claim for Tax Refund document?

The primary purpose of a Claim for Tax Refund document is to formally request the return of excess tax payments made to tax authorities. It serves as an official communication to initiate the refund process. This document ensures that taxpayers can recover funds that were overpaid or incorrectly charged.

Which key information must be provided to validate a refund claim?

To validate a refund claim, the document must include the claimant's identification details, such as name and tax identification number. Additionally, it should provide specific payment details like tax period, amount paid, and reasons for overpayment. Accurate documentation and evidence supporting the claim are critical for validation.

How does the document support proof of overpayment or erroneous tax payment?

The document typically requires submission of supporting evidence like receipts, payment confirmations, or tax returns highlighting discrepancies. These attachments act as proof of overpayment or incorrect tax calculations. This helps tax authorities verify the legitimacy of the refund request.

What are the typical reasons accepted for submitting a tax refund claim?

Common reasons include overpayment due to excess withholding, calculation errors, or taxes paid on exempt income. Refunds may also be claimed when tax credits or deductions were not properly applied. Each reason must be clearly documented to ensure acceptance.

What deadlines or time limits are associated with filing a Claim for Tax Refund?

Most jurisdictions require claims to be filed within a specific time limit, often ranging from one to five years after the tax payment. Filing beyond the deadline typically results in forfeiture of the refund right. Taxpayers should verify local laws to comply with all relevant deadlines.