The Claim for Injured Spouse Allocation allows a spouse to recover their portion of a tax refund when it has been applied to their partner's past federal debts. This claim ensures that the injured spouse's share of the refund is protected from offset for debts such as unpaid federal taxes or child support. Filing Form 8379 with the IRS is necessary to request this allocation and safeguard your refund.

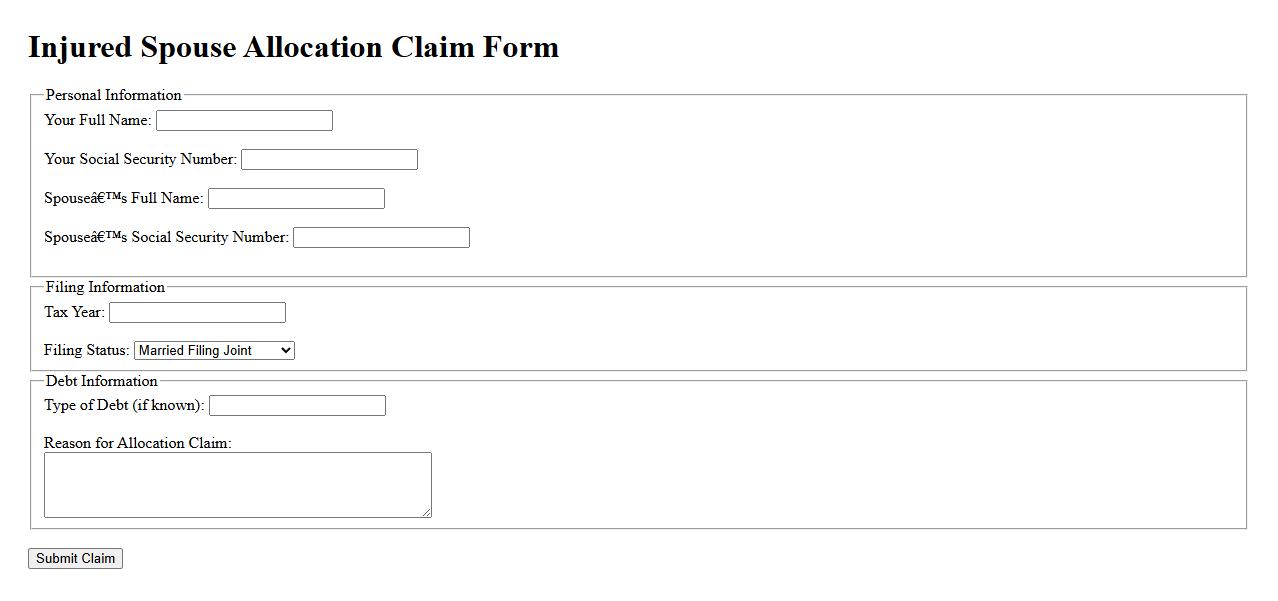

Injured Spouse Allocation Claim Form

The Injured Spouse Allocation Claim Form allows taxpayers to request a refund when their tax refund is applied to another spouse's past-due debts. This form ensures that the injured spouse can protect their portion of the joint tax refund. It's essential for individuals filing jointly who have encountered financial setbacks due to shared liabilities.

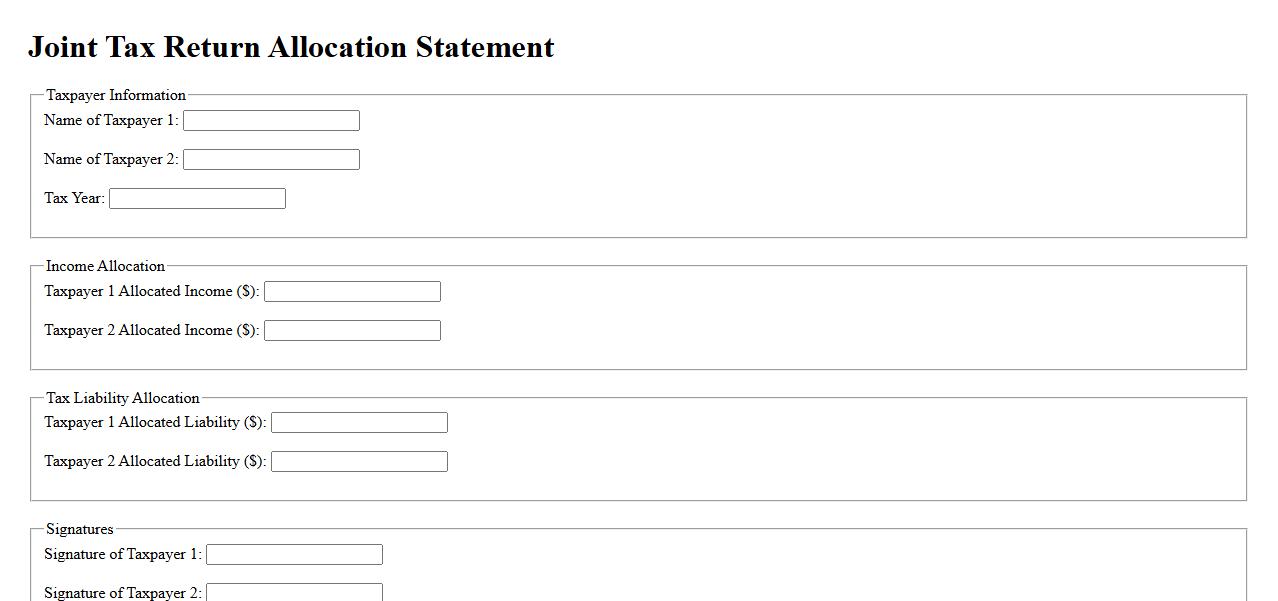

Joint Tax Return Allocation Statement

The Joint Tax Return Allocation Statement is a document used to distribute income, deductions, and credits between spouses when filing jointly. It ensures clarity and accuracy in reporting each individual's tax responsibilities. This statement helps prevent disputes and simplifies the preparation of separate tax filings if needed.

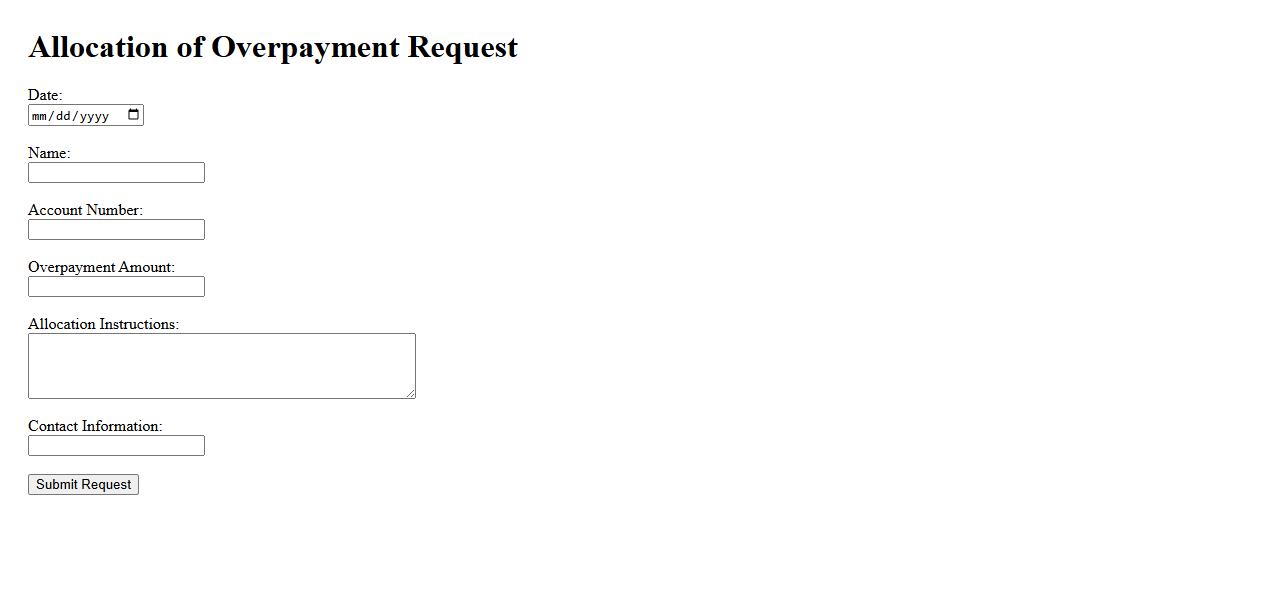

Allocation of Overpayment Request

The Allocation of Overpayment Request is a process used to accurately apply excess payments to the correct accounts or invoices. This ensures financial records remain precise and prevents discrepancies in billing or refunds. Proper allocation is essential for maintaining transparent and organized accounting practices.

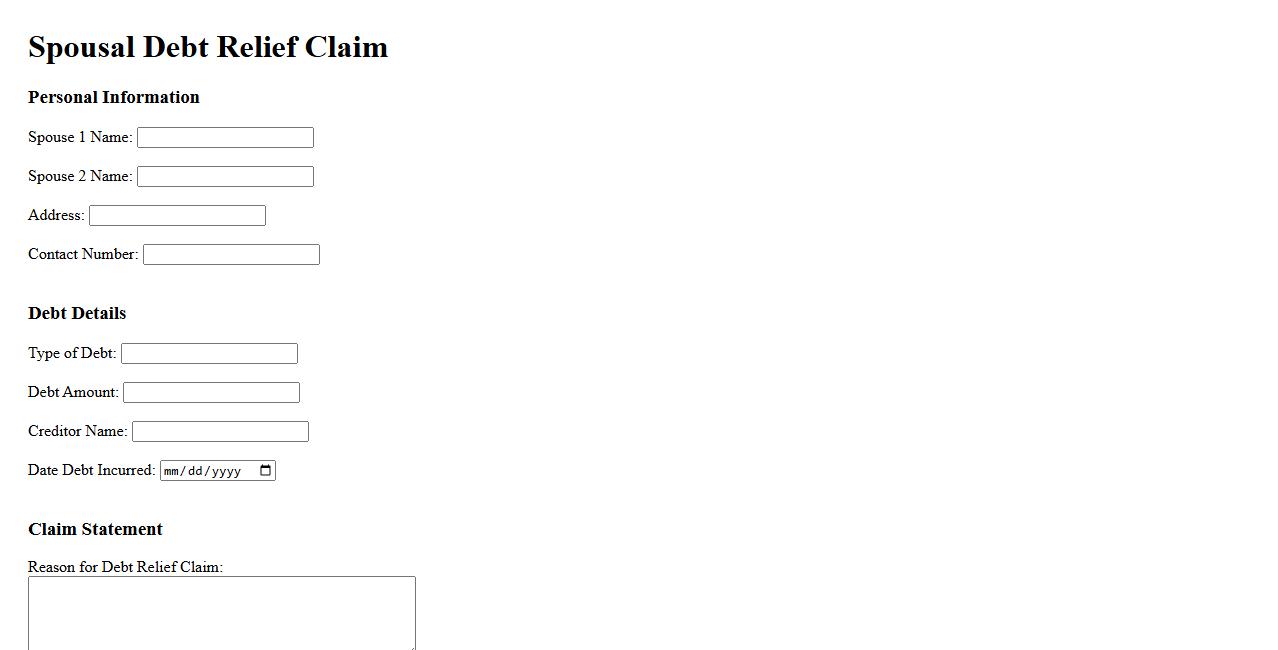

Spousal Debt Relief Claim

The Spousal Debt Relief Claim allows individuals to seek financial protection from debts incurred by their spouse. This legal provision helps in separating personal liabilities and shields the non-debtor spouse from undue financial burden. It is essential for ensuring fair debt management within marital relationships.

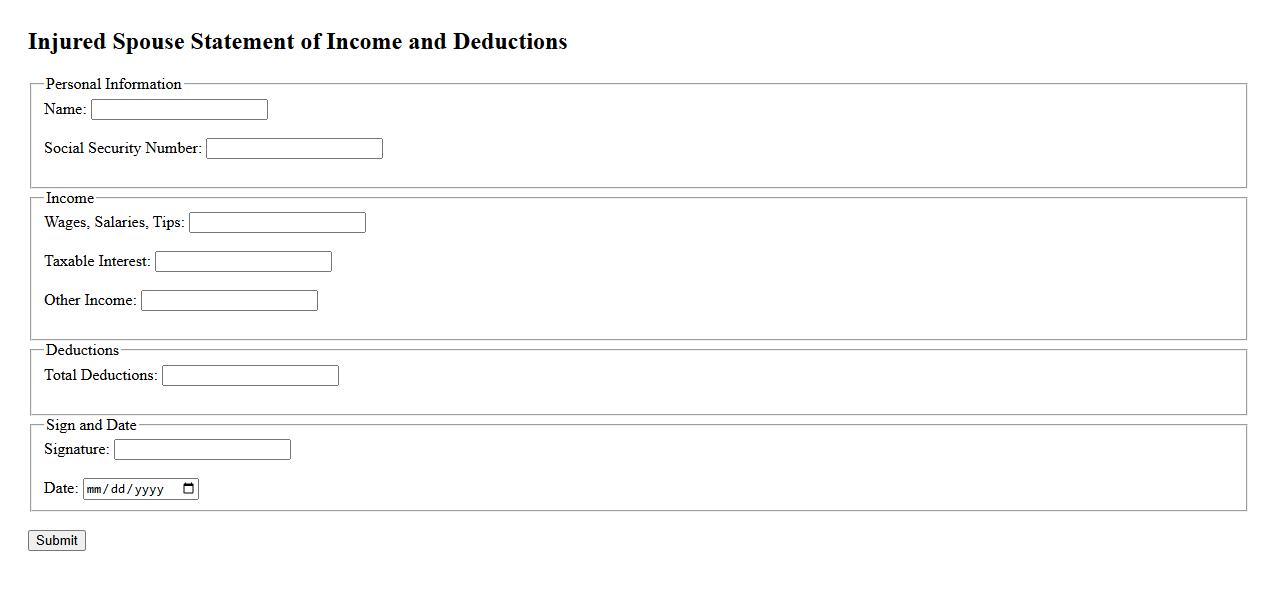

Injured Spouse Statement of Income and Deductions

The Injured Spouse Statement of Income and Deductions is a crucial IRS form used to protect a spouse's share of joint tax refunds from being seized for the other spouse's debts. This form requires detailed income and deduction information to ensure proper allocation of the refund. Timely submission helps injured spouses recover their rightful portion of any overpayment.

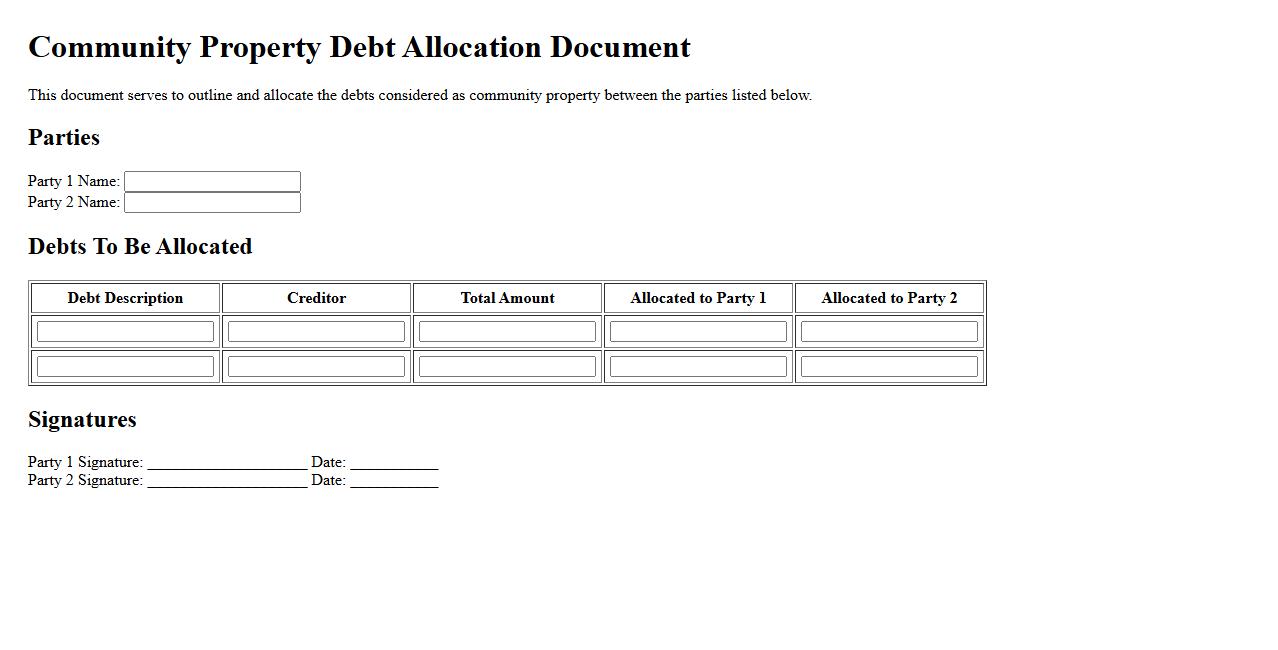

Community Property Debt Allocation Document

The Community Property Debt Allocation Document clearly outlines the division of debts between spouses in a community property state. It ensures each party understands their financial responsibilities, promoting transparency and fairness. This legal document is essential during separation or divorce proceedings to avoid future disputes.

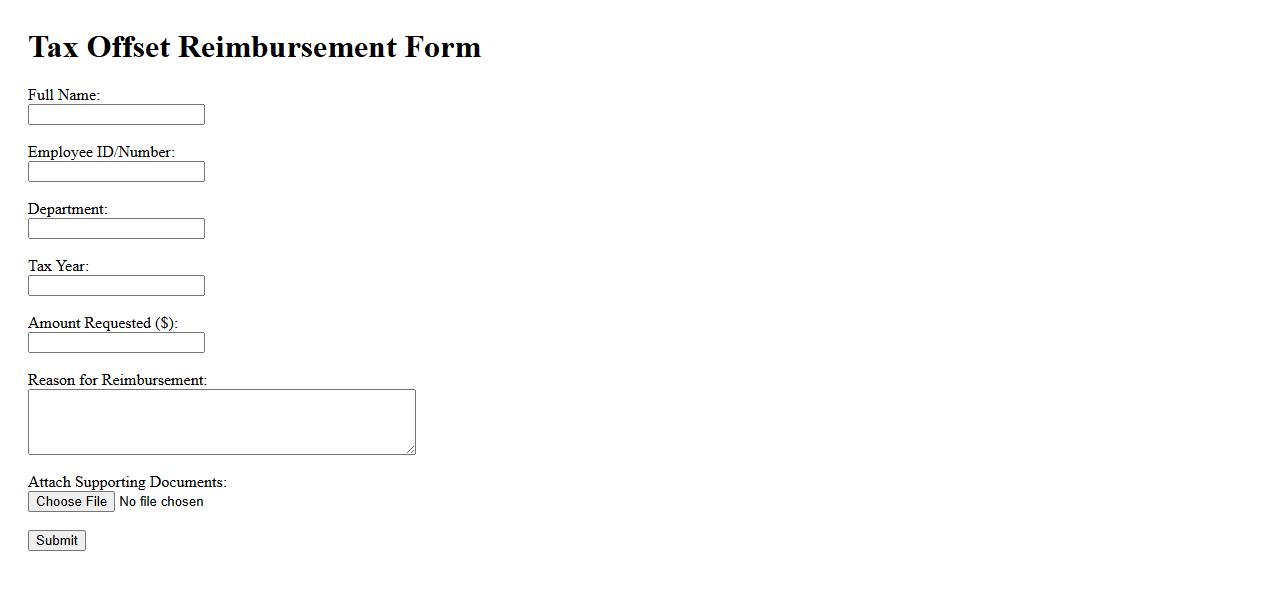

Tax Offset Reimbursement Form

The Tax Offset Reimbursement Form is used to claim a refund for taxes that have been incorrectly withheld or offset. This form helps individuals or businesses recover amounts deducted in error by tax authorities. Proper completion ensures timely reimbursement and accurate record-keeping.

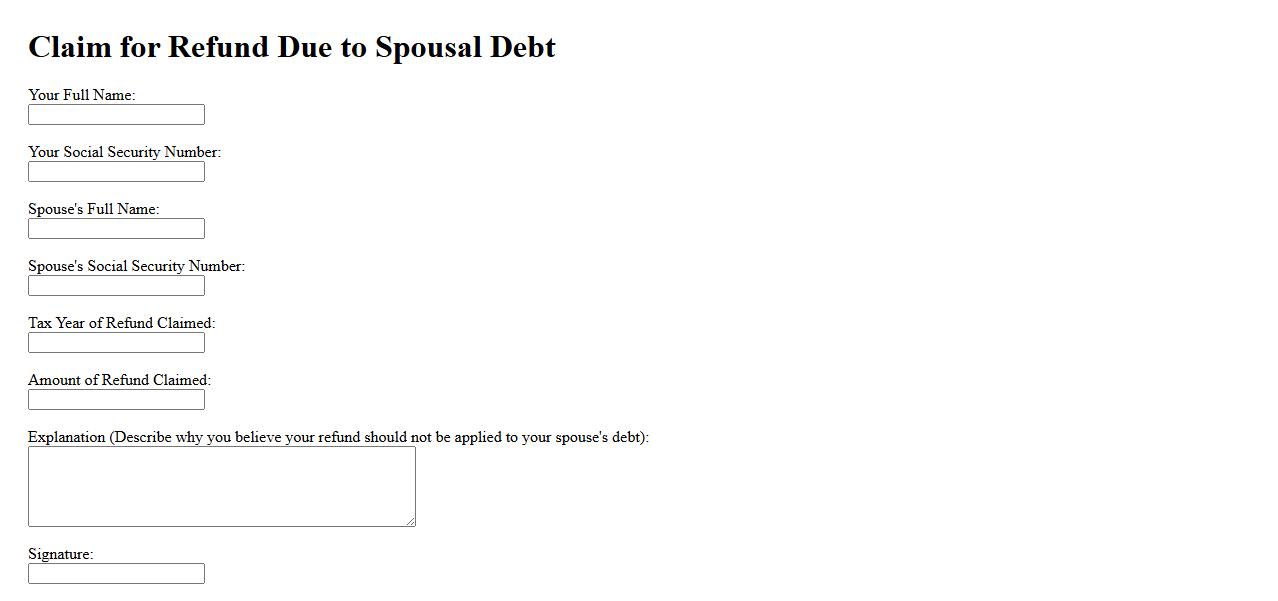

Claim for Refund Due to Spousal Debt

If you have incurred a financial loss because of your spousal debt, you may be entitled to file a claim for a refund. This process involves proving that the debt was unjustly imposed or that you have a legal right to reimbursement. Understanding your rights can help you recover funds and protect your financial stability.

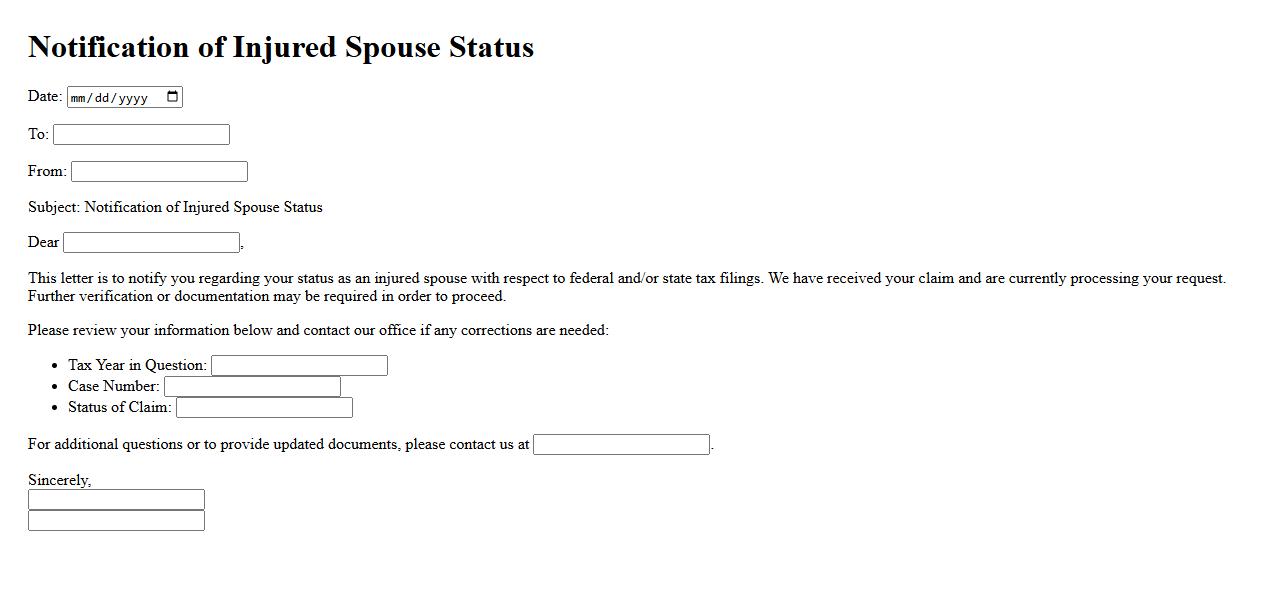

Notification of Injured Spouse Status

The Notification of Injured Spouse Status informs individuals when their tax refund has been offset due to another spouse's debts. This notification ensures the injured spouse is aware and can claim their rightful portion of the refund. It is an essential step for protecting spouses from financial loss caused by shared liabilities.

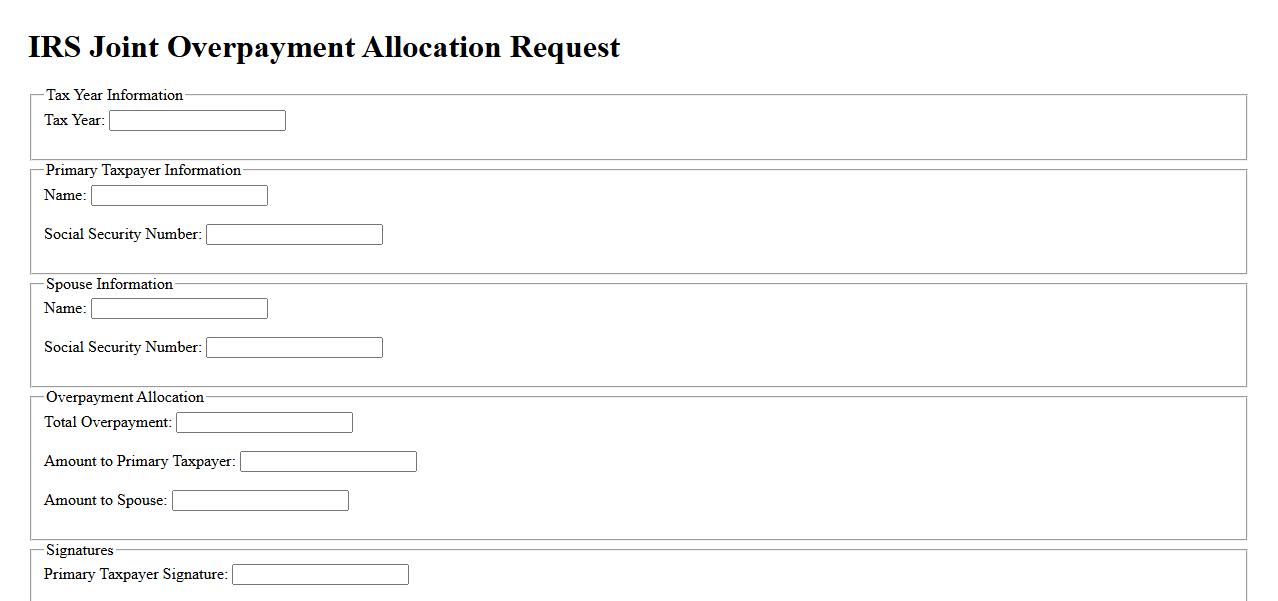

IRS Joint Overpayment Allocation Request

The IRS Joint Overpayment Allocation Request allows taxpayers to formally request the allocation of an overpayment made on a joint tax return. This process helps ensure that the excess payment is properly credited to the correct individual or tax period. Understanding this request is essential for accurate tax record management and potential refund processing.

What is the purpose of the Injured Spouse Allocation on a joint tax return?

The Injured Spouse Allocation protects a spouse's share of a joint tax refund when the refund is used to offset the other spouse's past debts. It ensures that one spouse does not lose their portion of the refund to debts unrelated to them. This allocation separates the spouses' tax liabilities to safeguard the innocent party's refund.

Which types of debts qualify for an Injured Spouse Allocation claim?

The claim applies when the refund is used to pay past-due federal tax, state income tax, child support, or federal non-tax debts like student loans. These debts must belong exclusively to one spouse for the injured spouse to seek protection. Debts unrelated to government agencies typically do not qualify for this allocation.

What filing status and forms are required when submitting a claim for Injured Spouse Allocation?

To submit a claim, taxpayers must file a joint return using either Form 1040, 1040-SR, or 1040-NR. Alongside the joint return, injured spouses fill out and attach Form 8379, Injured Spouse Allocation. Timely filing these forms is crucial to claim the allocation and protect the rightful refund share.

How does the IRS determine the separate income and payments of each spouse?

The IRS reviews the income, withholding, and refundable credits reported separately on the joint return for both spouses. They calculate the amount each spouse contributed to the withheld taxes and credits to identify the injured spouse's portion. This detailed analysis ensures accurate allocation of the joint refund between spouses.

In what situations would an Injured Spouse Allocation claim be denied or ineligible?

A claim may be denied if the refund was offset for debts jointly owed or not related to the other spouse's liabilities. Additionally, failing to file Form 8379 correctly or timely can lead to ineligibility. IRS restrictions apply if the injured spouse has no reported income or tax withholdings.