Filing a Claim for Insurance Benefits involves submitting official documentation to an insurance company to request payment for a covered loss or expense. The process requires providing evidence of the incident and adhering to policy guidelines to ensure eligibility. Timely and accurate submission of all required forms can expedite the approval and disbursement of benefits.

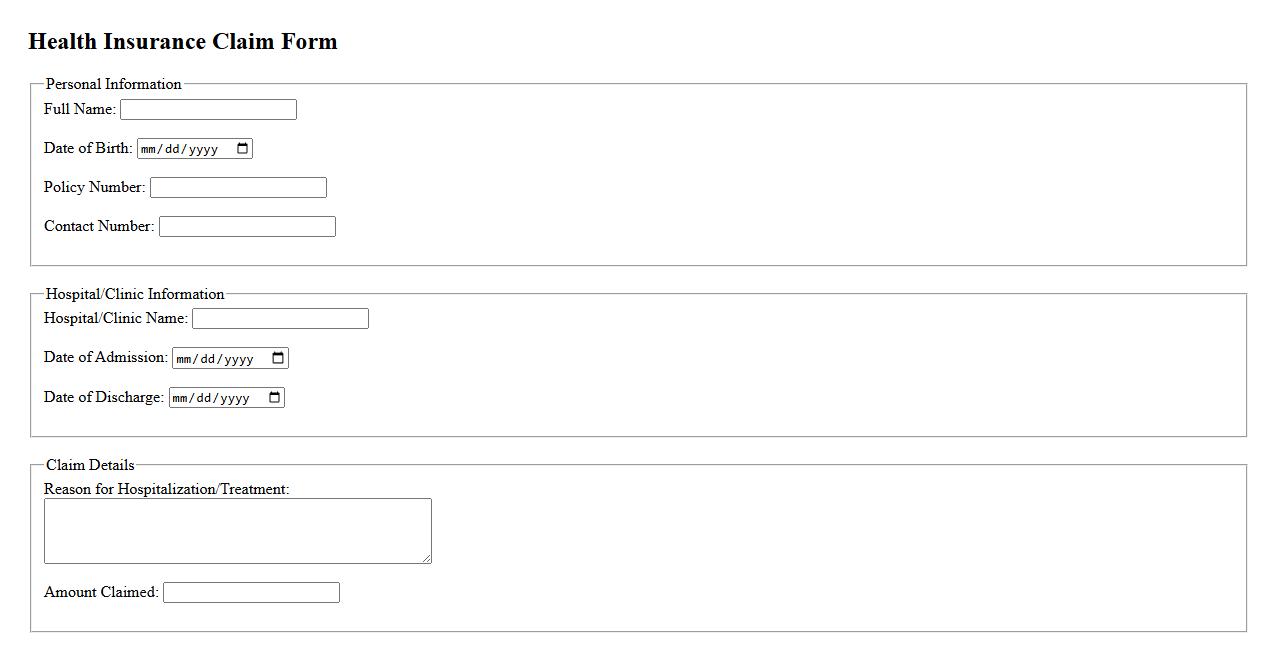

Health insurance claim form

The health insurance claim form is a crucial document used to request reimbursement for medical expenses. It gathers essential information about the insured, healthcare provider, and the treatment received. Properly completing this form ensures timely processing and payment by the insurance company.

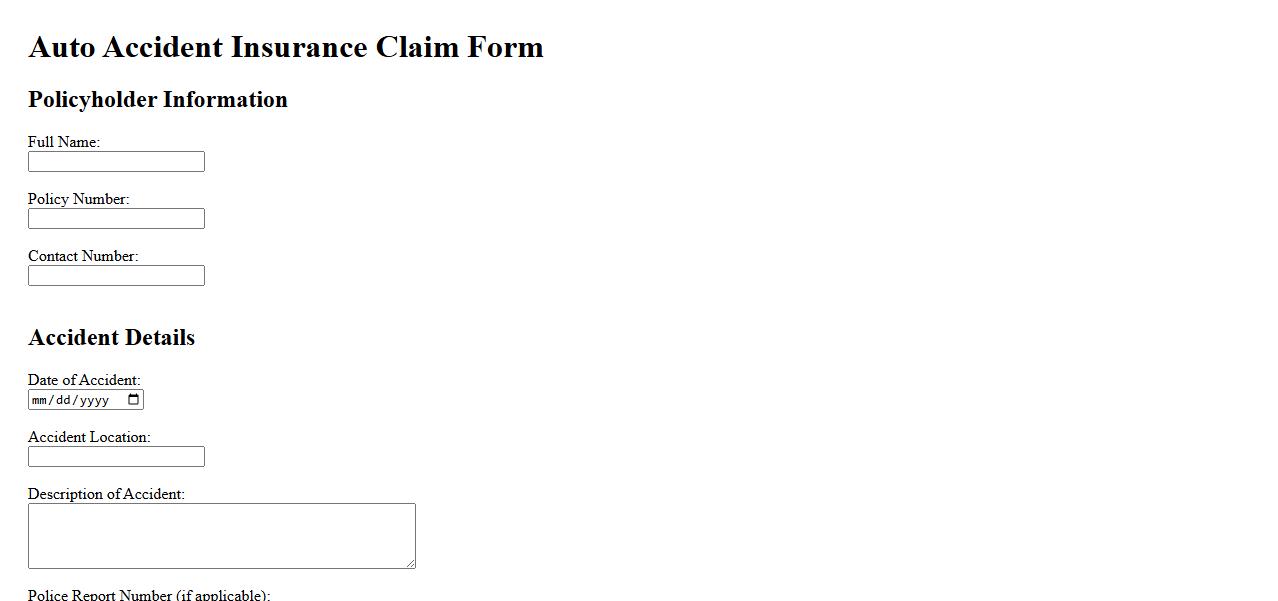

Auto accident insurance claim

Filing an auto accident insurance claim is essential to recover damages after a collision. It involves notifying your insurance company, providing accident details, and submitting necessary documentation. Prompt and accurate claims ensure a smoother compensation process for repairs and medical expenses.

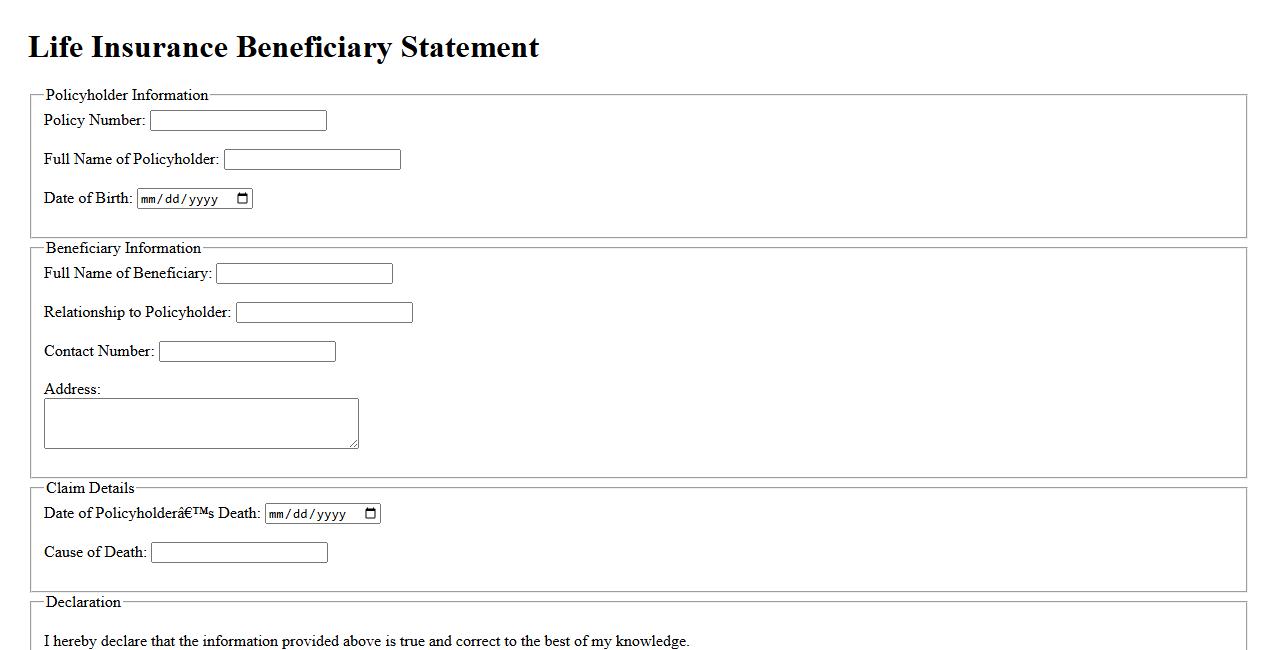

Life insurance beneficiary statement

A life insurance beneficiary statement is a document that outlines the designated individual(s) or entity to receive the policy's death benefit. It ensures that the proceeds are distributed according to the policyholder's wishes. Keeping this statement updated is crucial for accurate and timely claims processing.

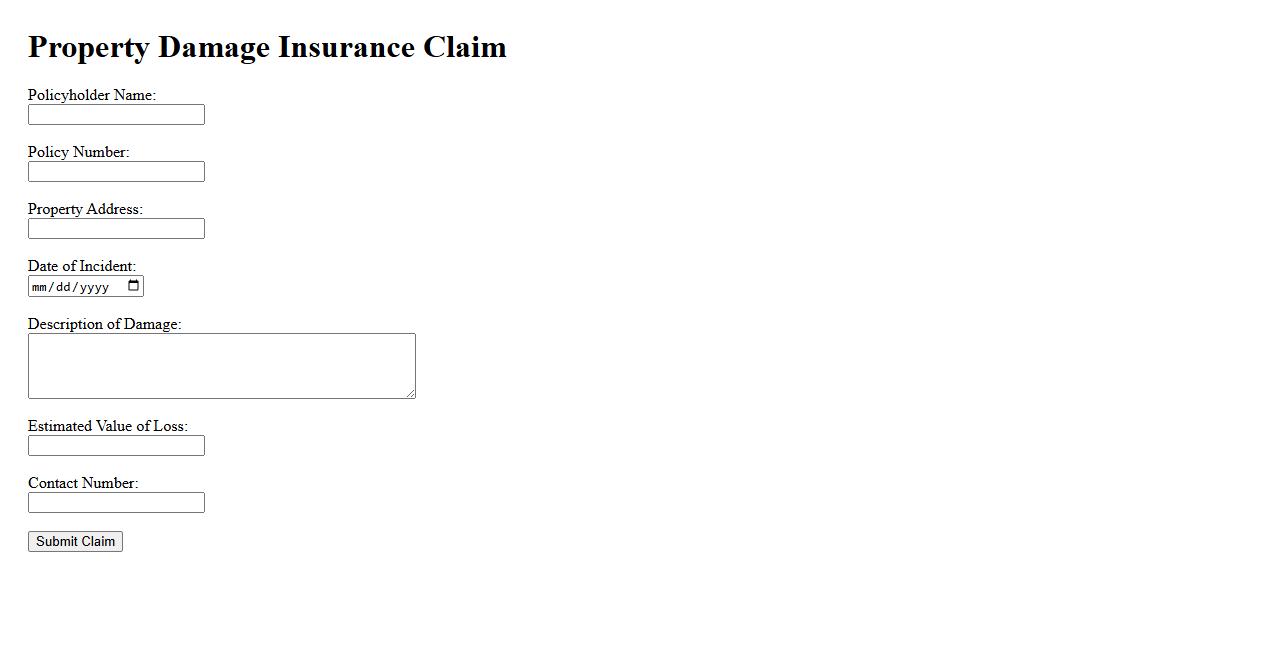

Property damage insurance claim

A property damage insurance claim is a formal request made to an insurance company to cover repairs or replacement of property damaged by events like fire, storms, or vandalism. This claim helps policyholders recover financially from unexpected losses by assessing the damage and validating the extent of coverage. Proper documentation and timely filing are essential for a smooth claims process and prompt compensation.

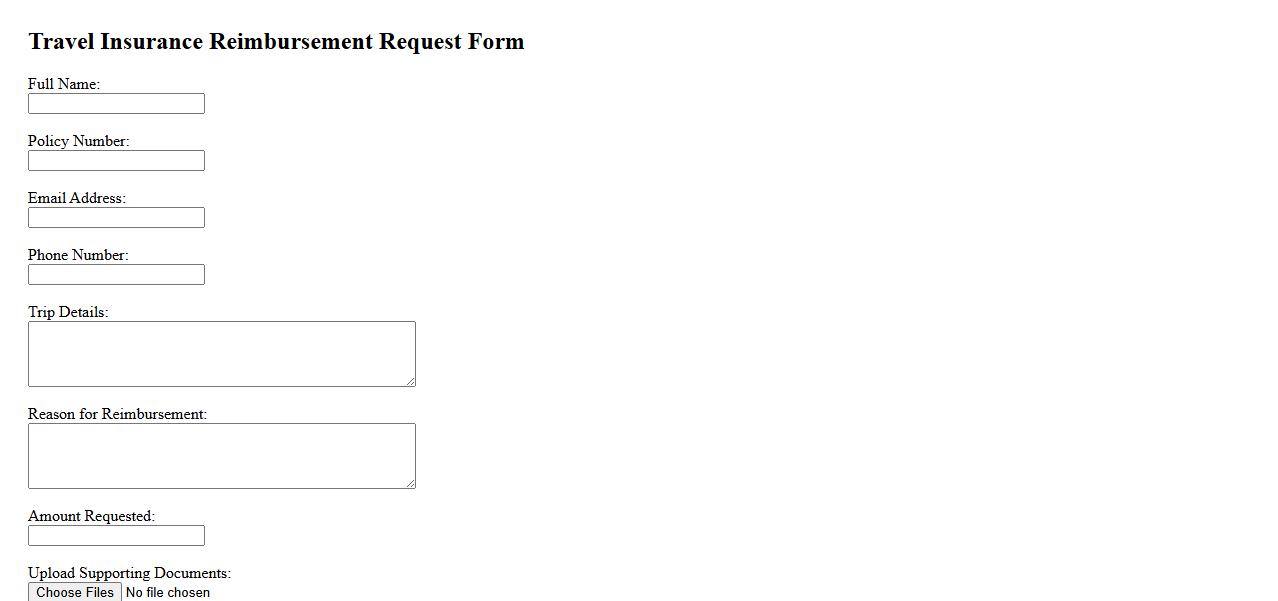

Travel insurance reimbursement request

Filing a travel insurance reimbursement request is essential for recovering costs related to trip cancellations, medical emergencies, or lost luggage. Ensure all necessary documents, such as receipts and claim forms, are submitted accurately to expedite the process. Promptly submitting your claim can help secure timely compensation for covered expenses.

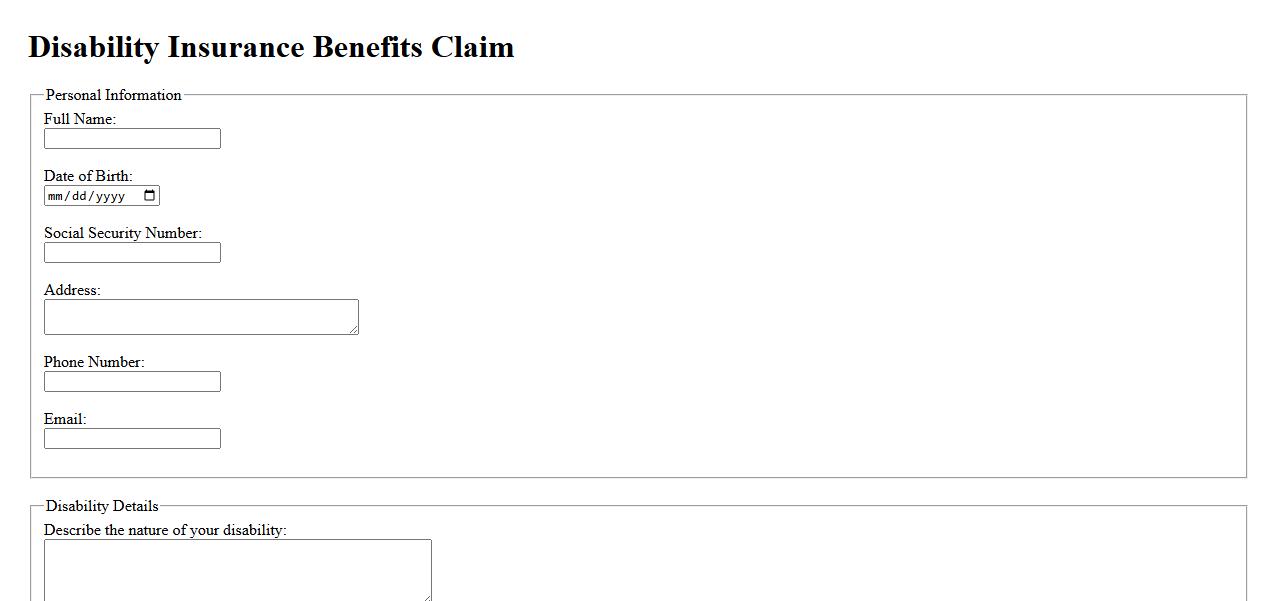

Disability insurance benefits claim

Filing a disability insurance benefits claim ensures financial support when an illness or injury prevents you from working. This process involves submitting medical documentation and completing specific forms to verify your eligibility. Understanding the claim requirements can help expedite the approval and secure your benefits promptly.

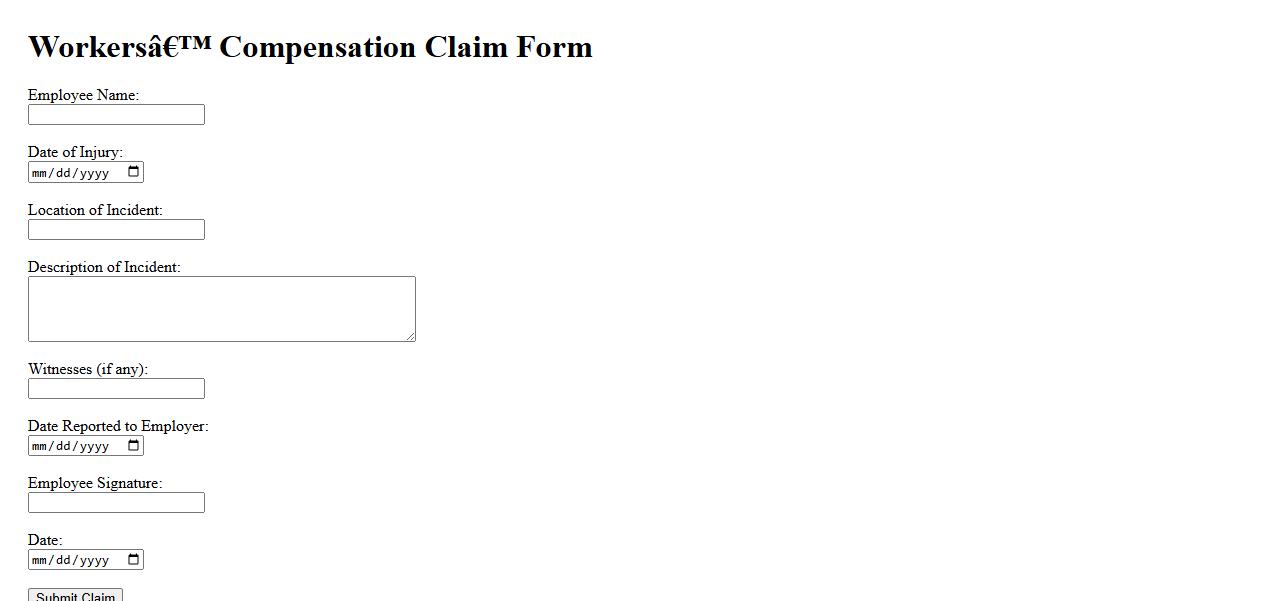

Workers’ compensation claim

A Workers' compensation claim is a formal request made by an employee seeking financial and medical benefits after sustaining a work-related injury or illness. This claim helps cover medical expenses and lost wages during recovery. Employers typically have insurance to manage and resolve these claims efficiently.

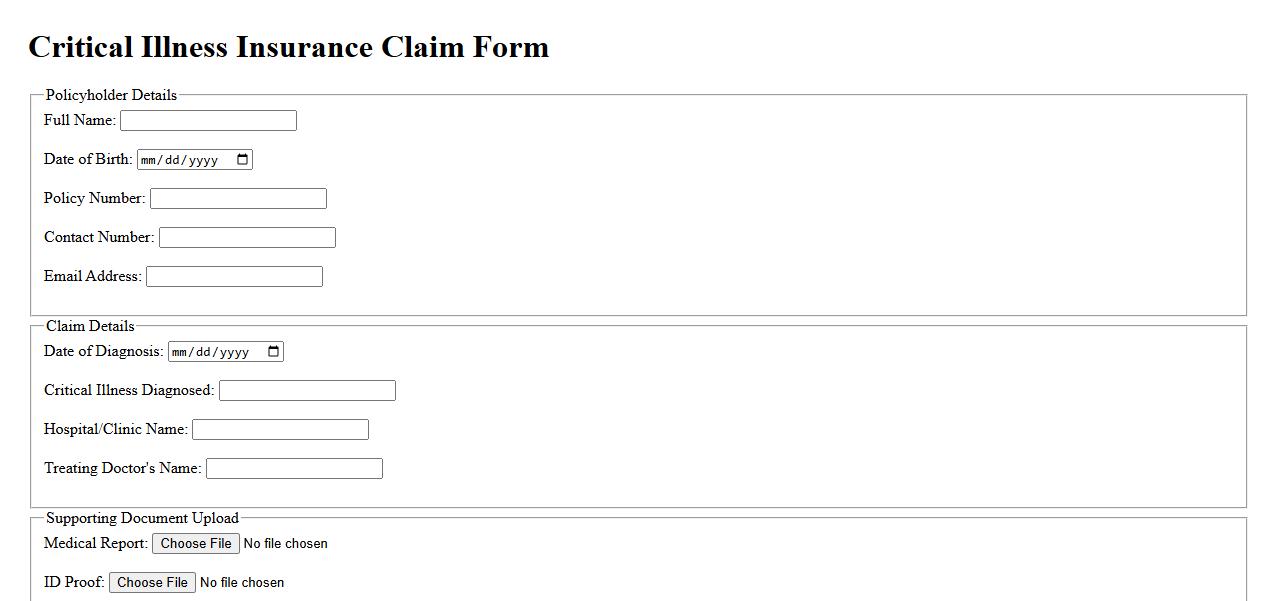

Critical illness insurance claim

Filing a critical illness insurance claim involves submitting relevant medical documents and proof of diagnosis to your insurer. This process ensures you receive the necessary financial support during challenging health circumstances. Timely and accurate claim submission is essential to avoid delays in benefit payouts.

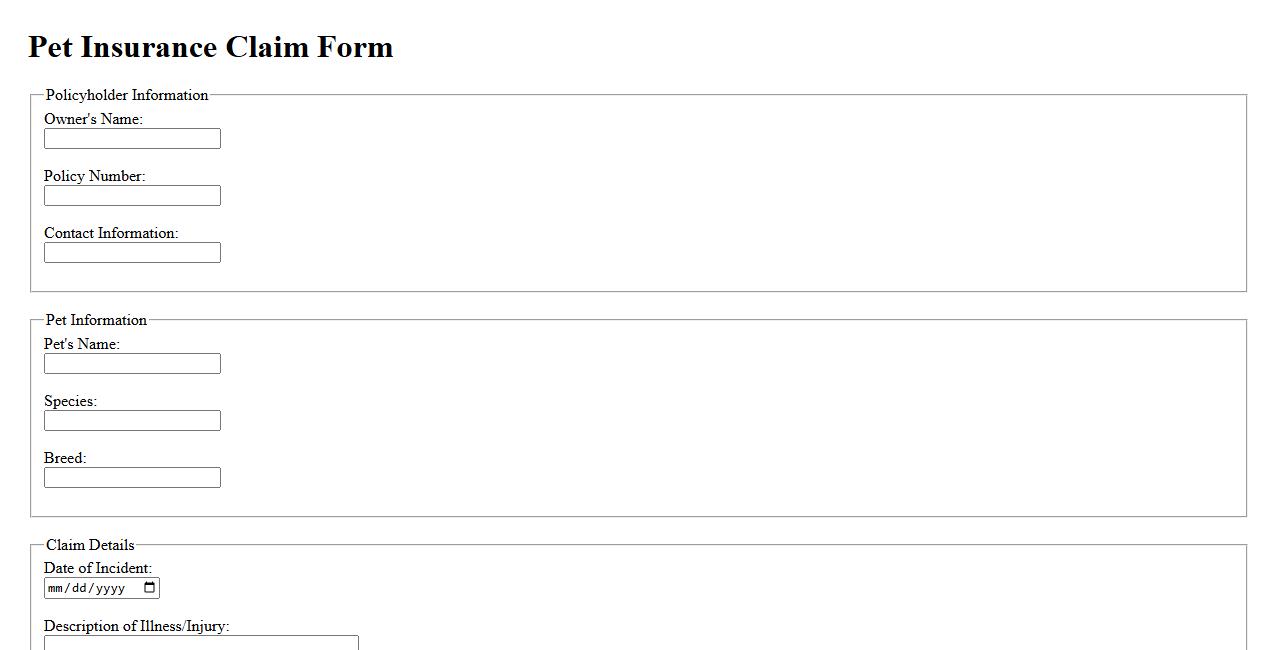

Pet insurance claim

Filing a pet insurance claim ensures that you receive reimbursement for eligible veterinary expenses, helping to manage the cost of your pet's healthcare. The process typically involves submitting detailed documentation of treatments and expenses to your insurer. Prompt and accurate claims can expedite the approval and payment, easing financial stress during your pet's recovery.

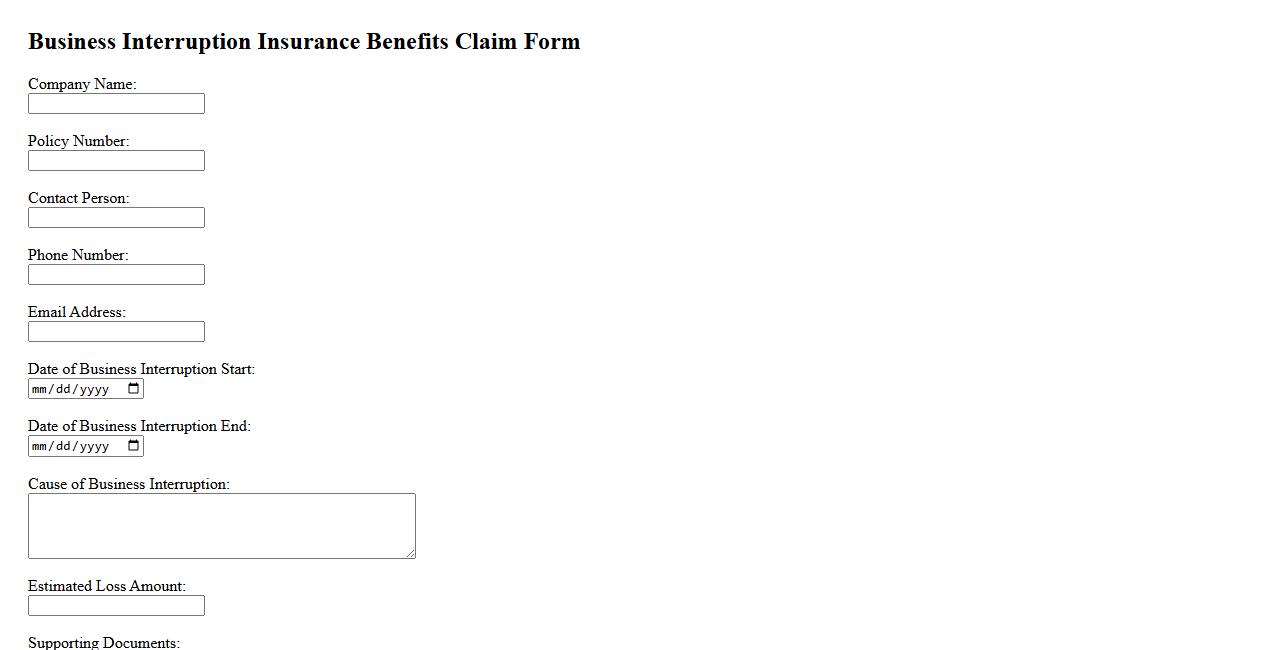

Business interruption insurance benefits claim

Business interruption insurance benefits claim provides financial support when unforeseen events disrupt normal operations. It helps cover lost income and ongoing expenses during downtime, ensuring business stability. Filing a claim promptly maximizes the chances of receiving timely compensation.

Specific Event or Loss Pertaining to the Claim

The claim for insurance benefits specifically pertains to the loss of property due to a recent fire incident. This event caused significant damage that falls under the coverage terms of the policy. The claim aims to address the financial repercussions of this unexpected occurrence.

Identity of the Claimant and Relationship to the Insured

The claimant is John Doe, who is the primary insured party under the policy. He holds a direct relationship as the policyholder responsible for the insured property. This relationship legitimizes his right to file the claim and seek benefits.

Relevant Policy Details for the Claim

The policy involved is numbered ABC123456, covering property damage for a term of 12 months. It includes comprehensive coverage for fire-related losses, which is pertinent to the current claim. These details are crucial to validate the claim's eligibility and scope.

Required Supporting Documents for Claim Processing

To process the insurance claim efficiently, submission of the fire incident report, property damage assessment, and proof of ownership is required. These documents provide verifiable evidence supporting the claim. Their accuracy ensures timely and fair claim evaluation.

Desired Outcome or Benefit Amount Requested

The claimant is requesting a benefit amount of $50,000 to cover the repair and replacement costs. This figure reflects the estimated financial impact of the fire damage. The outcome sought is full compensation as per the policy coverage limits.