Filing a claim for identity theft insurance involves reporting unauthorized use of your personal information to your insurance provider. This process typically requires submitting documentation, such as police reports and proof of fraud, to support your claim. Prompt action helps ensure coverage for expenses related to restoring your identity and credit.

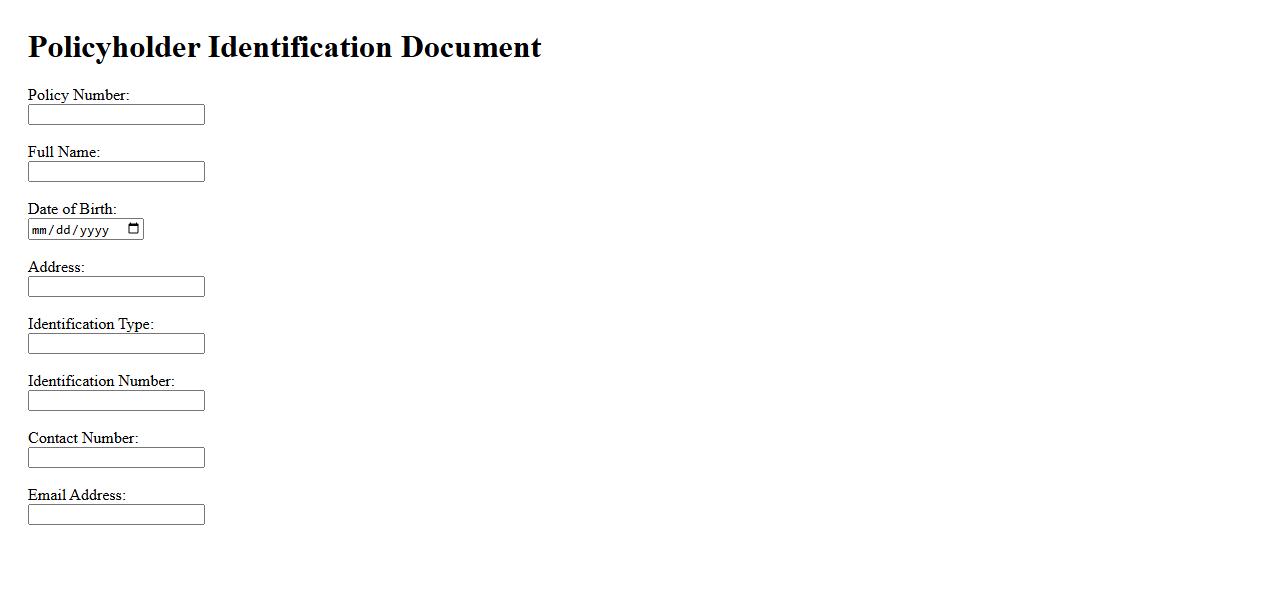

Policyholder Identification Document

The Policyholder Identification Document serves as an essential proof of identity for individuals holding an insurance policy. It contains crucial information to verify the policyholder's details and ensure secure access to policy benefits. This document is vital for claims processing and communication with the insurance provider.

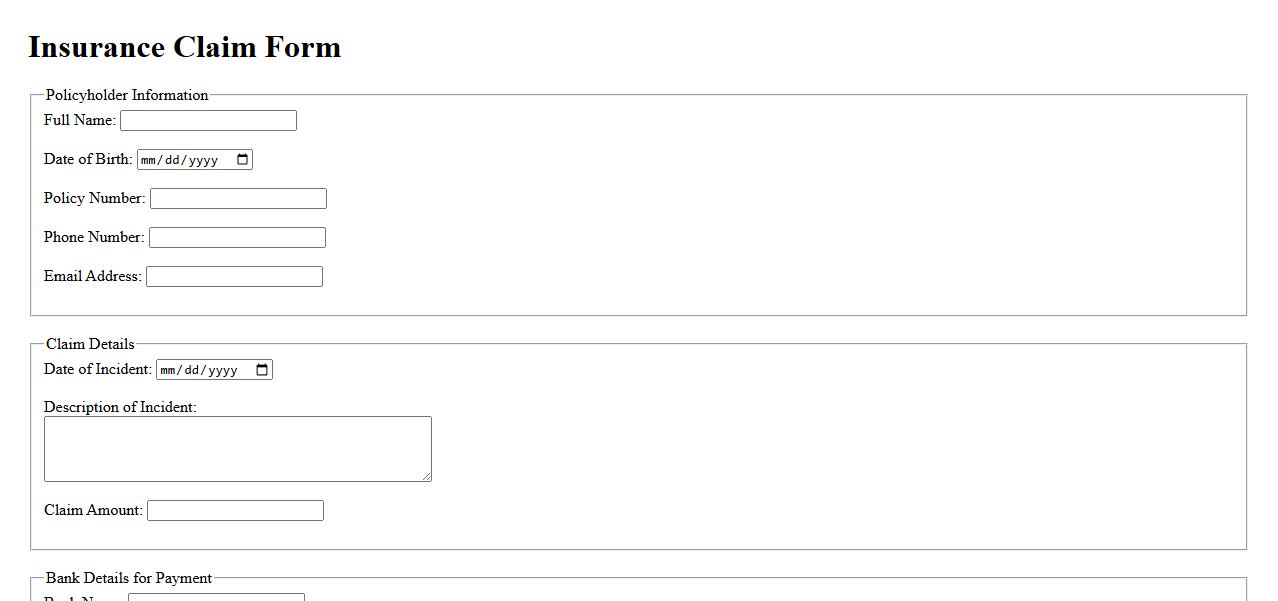

Insurance Claim Form

The Insurance Claim Form is a crucial document used to request compensation from an insurance company after a loss or damage. It collects essential information to process the claim efficiently and ensure timely reimbursement. Accurate completion of this form helps avoid delays and supports a smooth claims process.

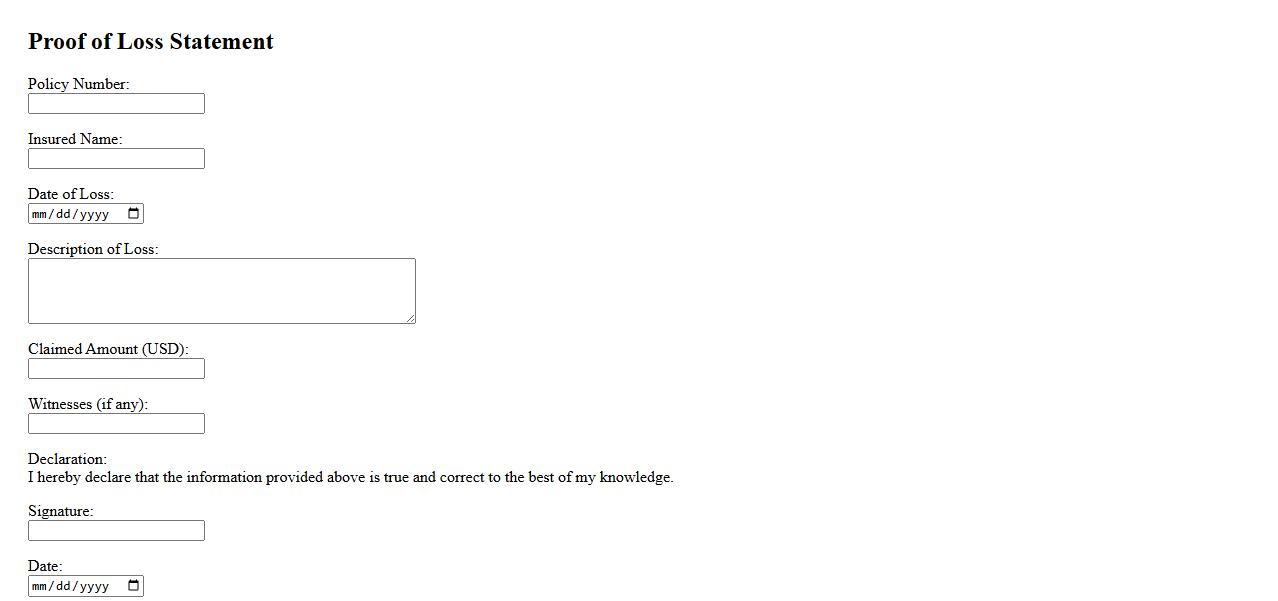

Proof of Loss Statement

A Proof of Loss Statement is a formal document submitted to insurance companies detailing the extent of a loss or damage. It provides essential information required to process and validate a claim efficiently. Timely and accurate completion of this statement ensures proper compensation for the insured event.

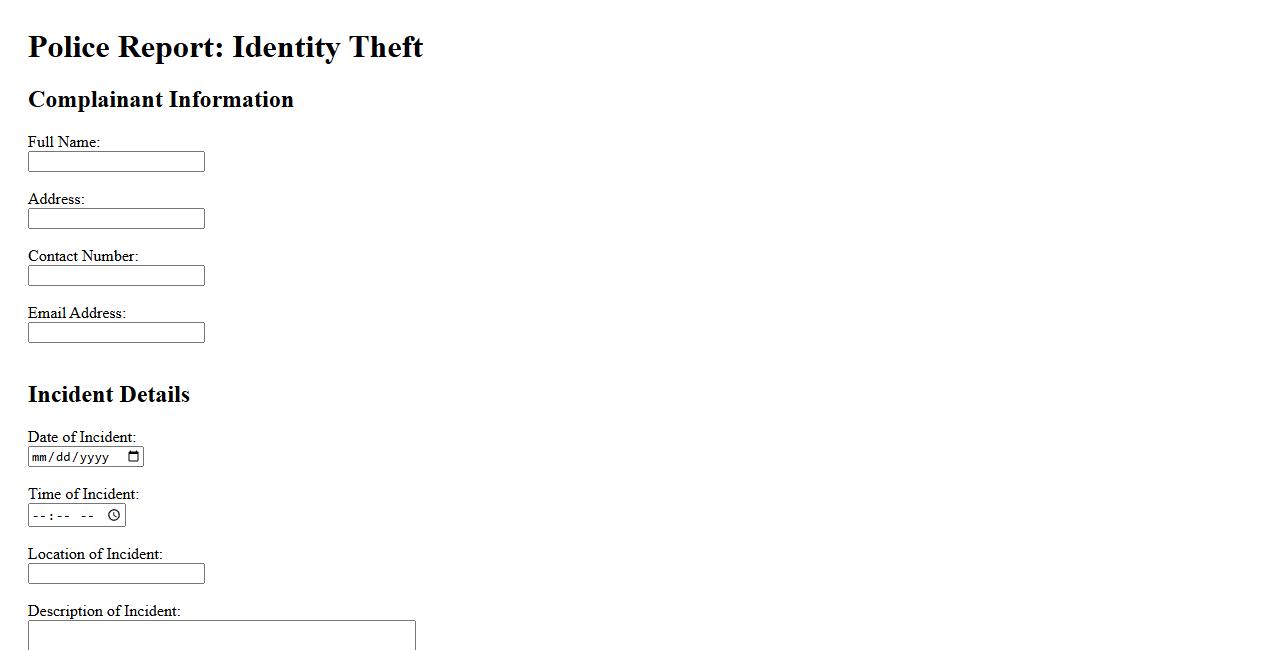

Police Report on Identity Theft

A police report on identity theft is a formal document filed to record the unauthorized use of someone's personal information. It serves as crucial evidence when disputing fraudulent activities and helps law enforcement in their investigation. This report is often required by financial institutions and credit bureaus to initiate recovery processes.

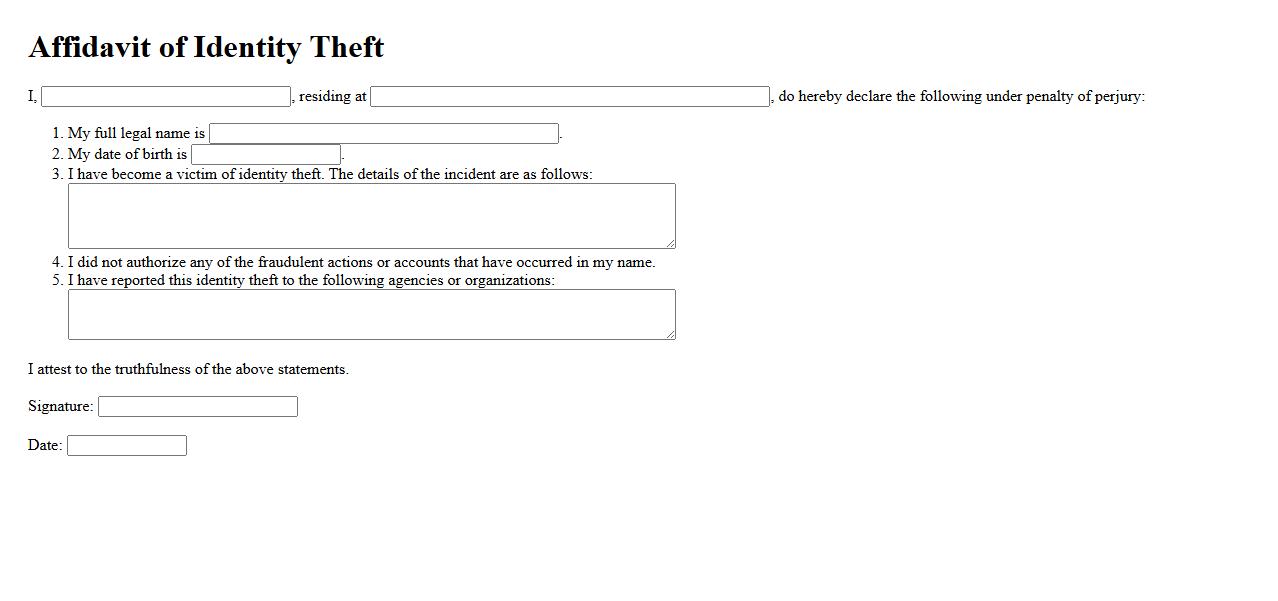

Affidavit of Identity Theft

An Affidavit of Identity Theft is a legal document used to report and confirm that an individual's personal information has been stolen and used fraudulently. This affidavit helps victims initiate identity theft investigations and protects them from further unauthorized use of their identity. It is often required by financial institutions and law enforcement to take corrective action.

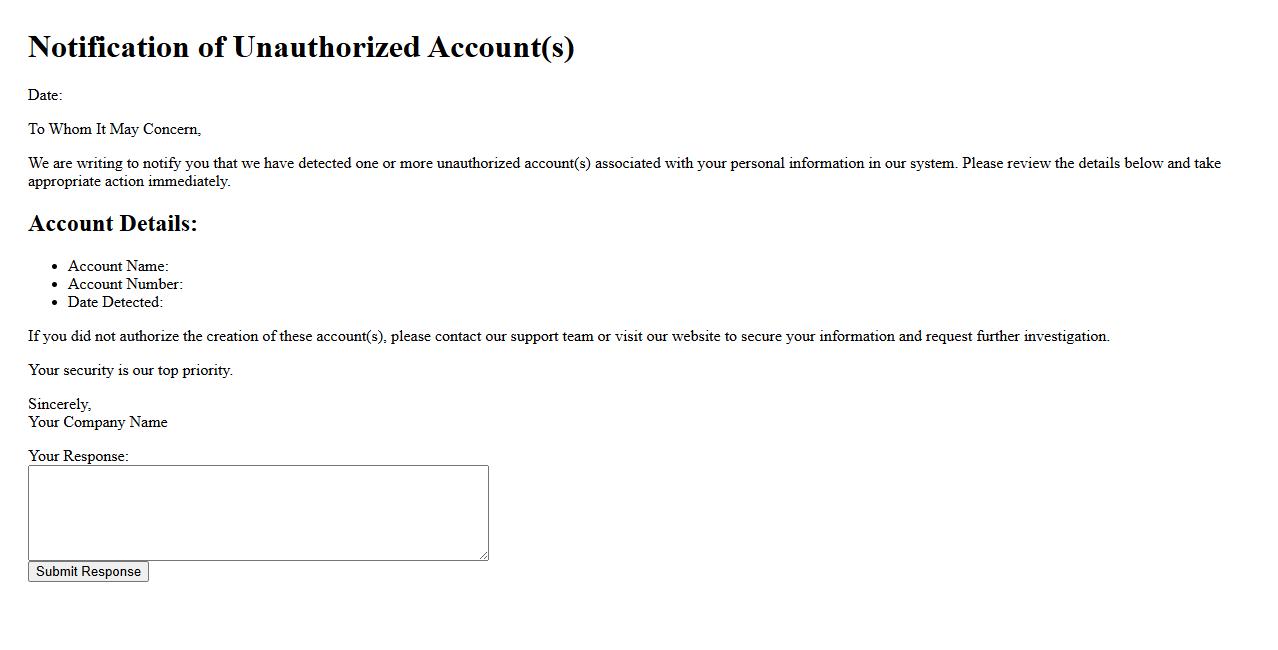

Notification of Unauthorized Account(s)

Notification of Unauthorized Account(s) alerts users to any accounts opened or accessed without their consent. This important message helps protect personal information and prevents potential fraud. Prompt action upon receiving such a notification is essential to secure your financial safety.

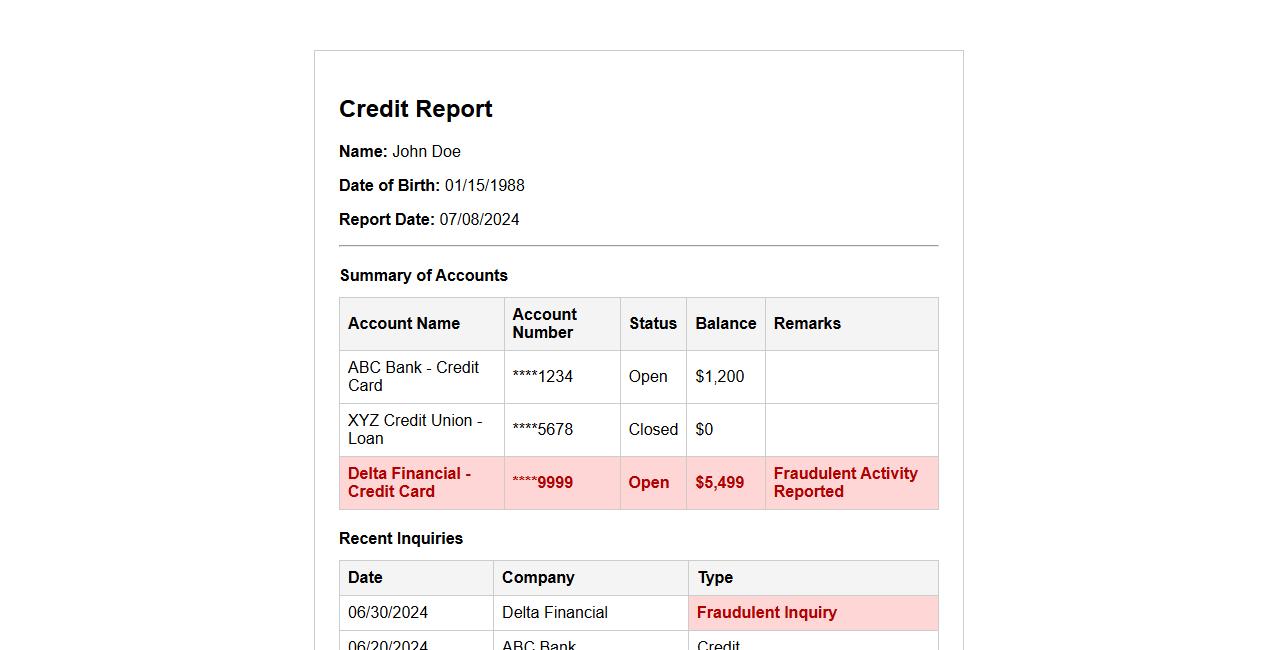

Credit Report Showing Fraudulent Activity

A credit report showing fraudulent activity indicates unauthorized transactions or accounts that can damage your financial reputation. Identifying and disputing these errors promptly is crucial to protect your credit score. Regularly reviewing your credit report helps detect suspicious behavior early and safeguards your finances.

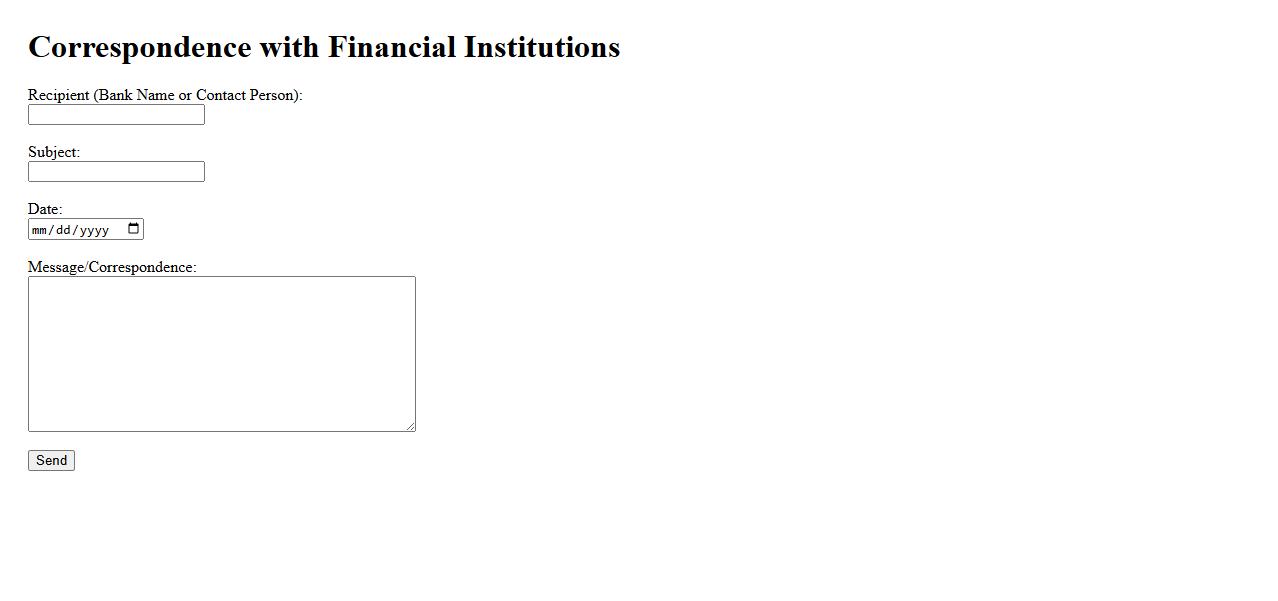

Correspondence with Financial Institutions

Correspondence with Financial Institutions involves the exchange of important information between individuals or businesses and their banks or other financial entities. This communication ensures accuracy in transactions, resolves discrepancies, and maintains a clear record for financial accountability. Effective correspondence supports smooth financial operations and trust between parties.

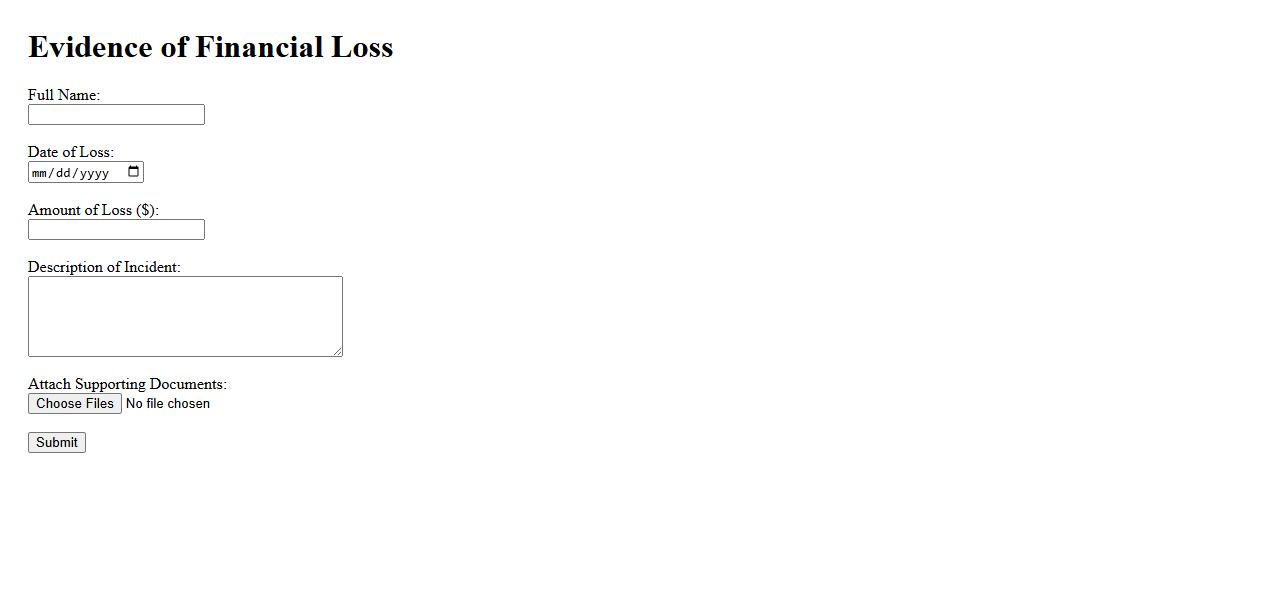

Evidence of Financial Loss

Evidence of financial loss is crucial in legal and insurance claims to substantiate the amount of monetary damage incurred. This documentation may include receipts, invoices, bank statements, and profit and loss records demonstrating the extent of the loss. Proper evidence ensures accurate compensation and supports the credibility of the claim.

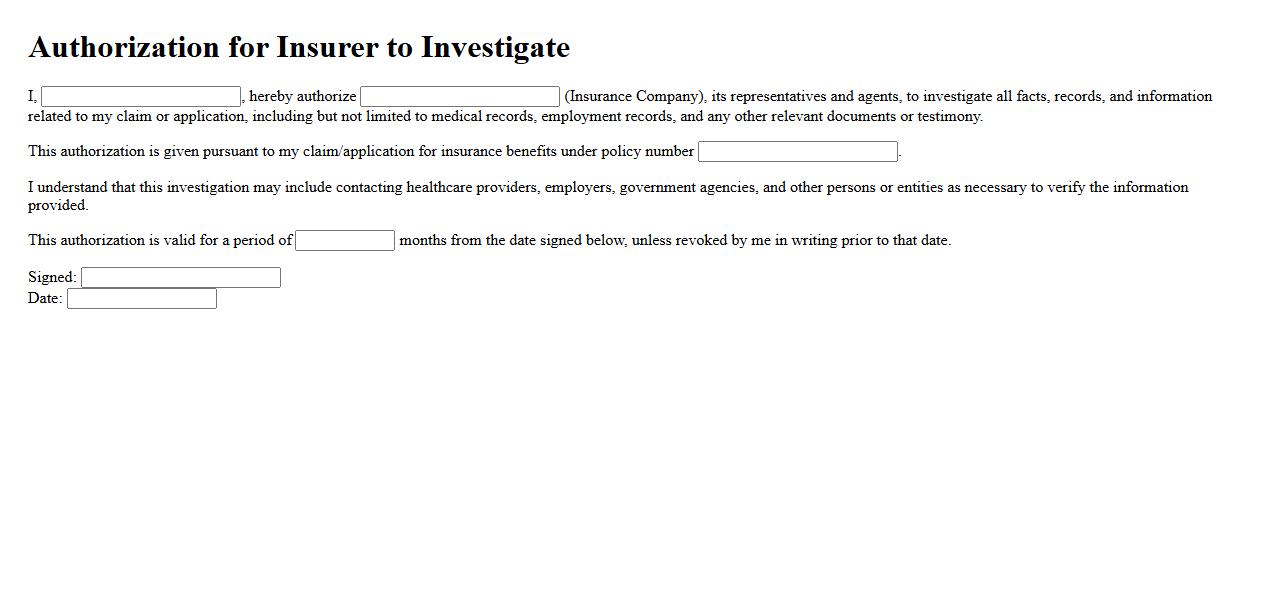

Authorization for Insurer to Investigate

The Authorization for Insurer to Investigate is a critical document that permits insurance companies to collect and verify information relevant to a claim. It ensures that the insurer can lawfully obtain data from third parties, such as medical providers or witnesses, to assess the validity of the claim. This authorization helps protect both the insurer and policyholder by facilitating a thorough and fair investigation process.

What specific personal information was compromised in the identity theft incident?

The identity theft incident involved the unauthorized access to my full name, social security number, and date of birth. Additionally, sensitive financial details such as bank account numbers and credit card information were compromised. This breach also exposed my home address and contact details to potential misuse.

When did you first become aware of the identity theft affecting your documents?

I first became aware of the identity theft when I noticed suspicious activity on my bank statements and unexpected charges on my credit card. This discovery occurred approximately two months after the initial unauthorized access. Prompt attention to unusual financial transactions helped identify the identity theft early.

Which official documents (e.g., passport, ID card, driver's license) are involved in your claim?

The claim involves multiple official documents, including my passport, national ID card, and driver's license. These documents were either copied or used fraudulently by the identity thief to facilitate illegal activities. Securing and reporting these documents is critical to resolving the issue.

What actions have you taken to report and mitigate the identity theft to relevant authorities?

I immediately reported the identity theft to the local police and filed a detailed report with the fraud department of my bank. Additionally, I notified the government agency responsible for issuing official identification documents. I have also placed fraud alerts with credit bureaus to prevent further misuse of my personal information.

Have you previously submitted any claims or received compensation for identity theft incidents?

This is my first claim regarding identity theft, and I have not received any prior compensation related to such incidents. I have been proactive in monitoring my accounts to avoid recurrence and to protect my personal information. Ensuring thorough documentation of this incident is part of my precautionary measures.