A Claim for Business Interruption Insurance helps businesses recover lost income and cover ongoing expenses during periods when operations are disrupted due to insured events like natural disasters or fires. This insurance compensates for revenue loss and fixed costs, ensuring financial stability while repairs or recovery take place. Proper documentation and prompt filing are essential to maximizing claim approval and payout.

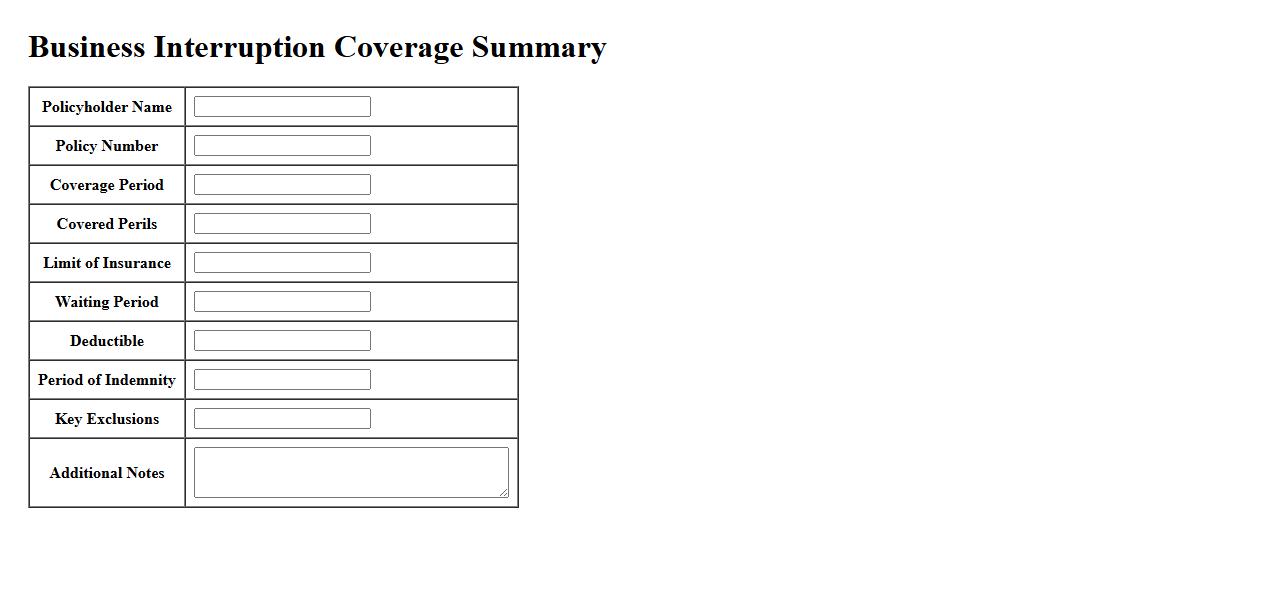

Business Interruption Coverage Summary

Business Interruption Coverage provides financial protection to companies facing unexpected disruptions that halt operations. This insurance helps cover loss of income and operating expenses during the downtime. It ensures businesses can recover swiftly and maintain stability despite unforeseen events.

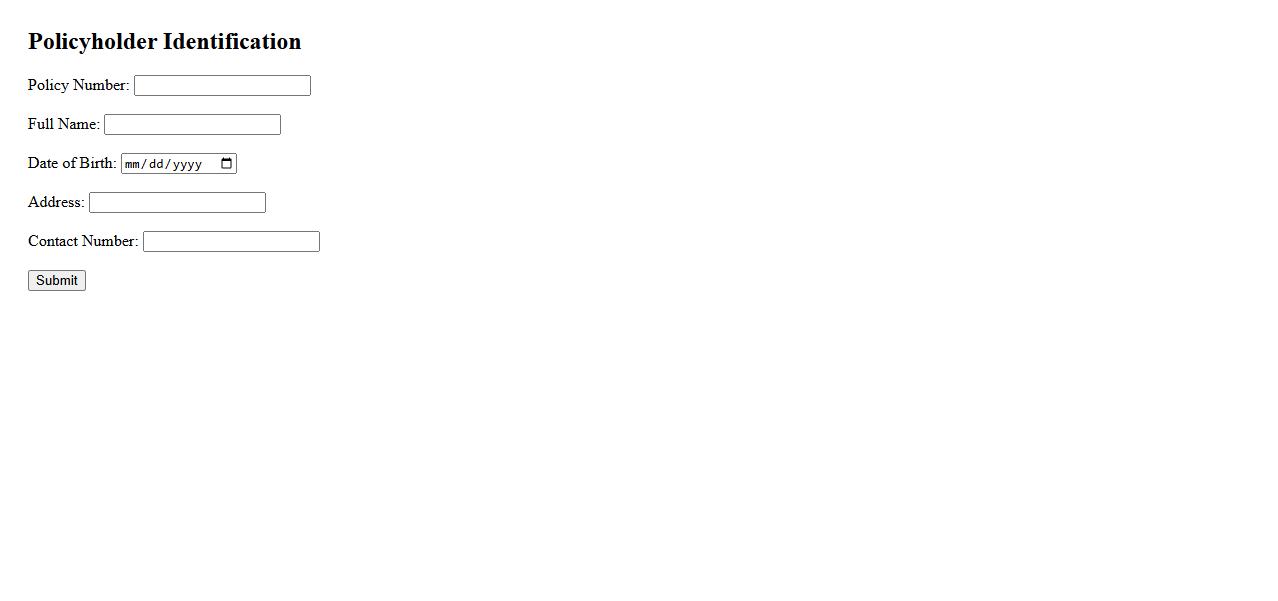

Policyholder Identification

Policyholder Identification is the process of verifying the identity of an individual who holds an insurance policy. This ensures accurate record-keeping and prevents fraudulent claims. Proper identification is essential for maintaining trust and security in insurance transactions.

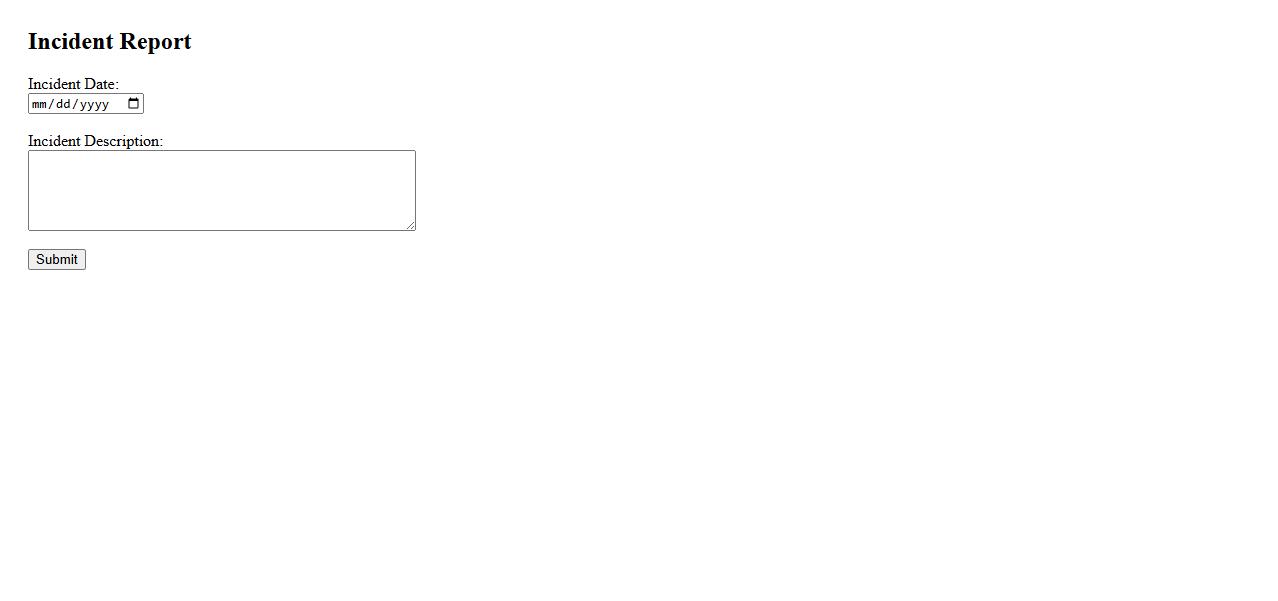

Incident Date and Description

The Incident Date and Description provide essential details about when and what occurred during an event. Accurate recording of the incident date ensures proper timeline tracking, while a clear description helps in understanding the context and impact. This information is crucial for effective analysis and resolution.

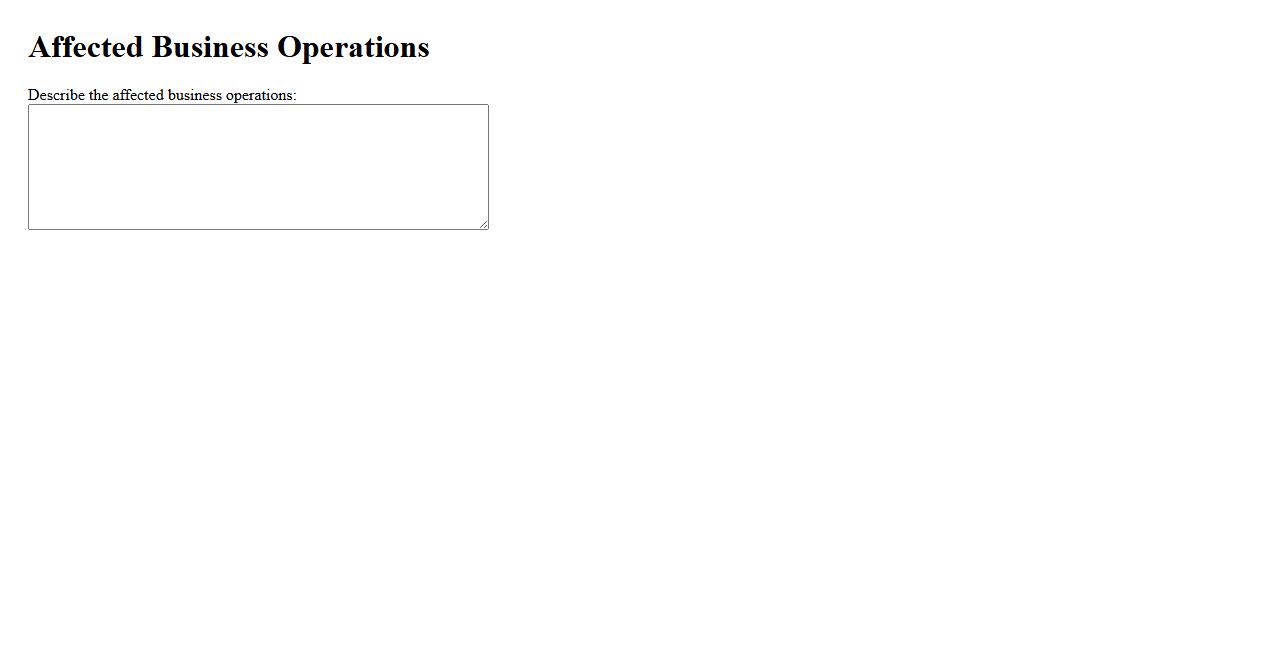

Affected Business Operations

Affected Business Operations refer to the various functions and processes within a company that experience disruptions due to internal or external factors. These disruptions can impact productivity, customer service, and overall revenue generation. Understanding affected business operations is crucial for developing effective recovery and continuity plans.

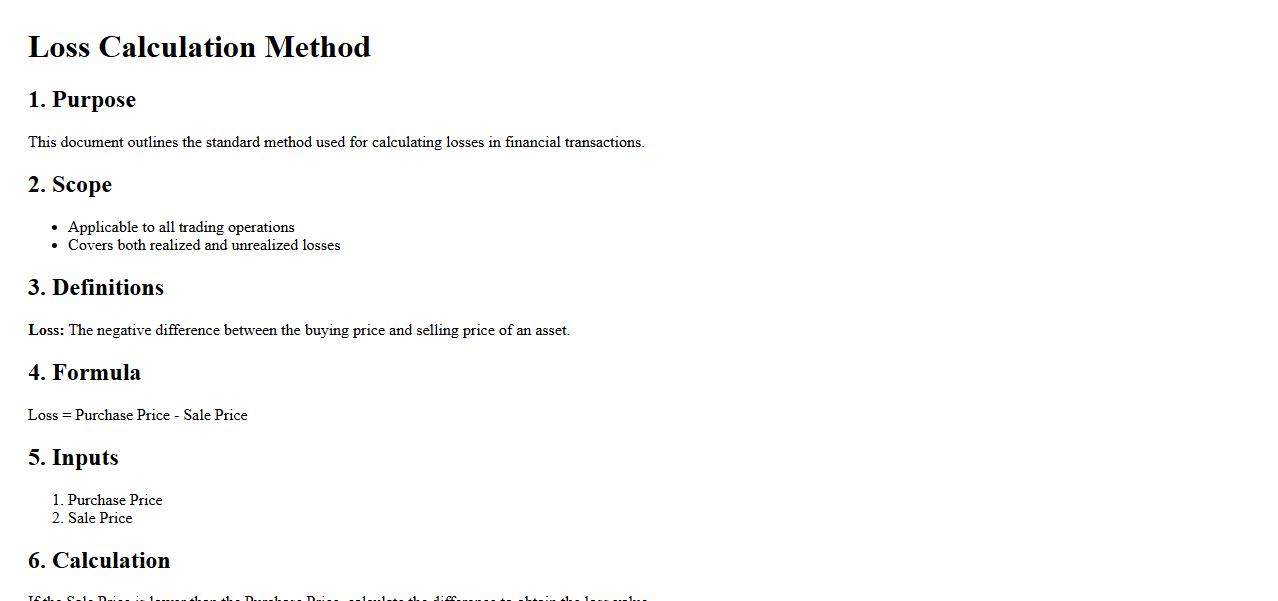

Loss Calculation Method

The Loss Calculation Method is a systematic approach used to determine the amount of loss incurred in various contexts, such as finance, insurance, or manufacturing. It involves analyzing relevant data, applying appropriate formulas, and assessing risk factors to provide accurate results. This method ensures informed decision-making and effective risk management.

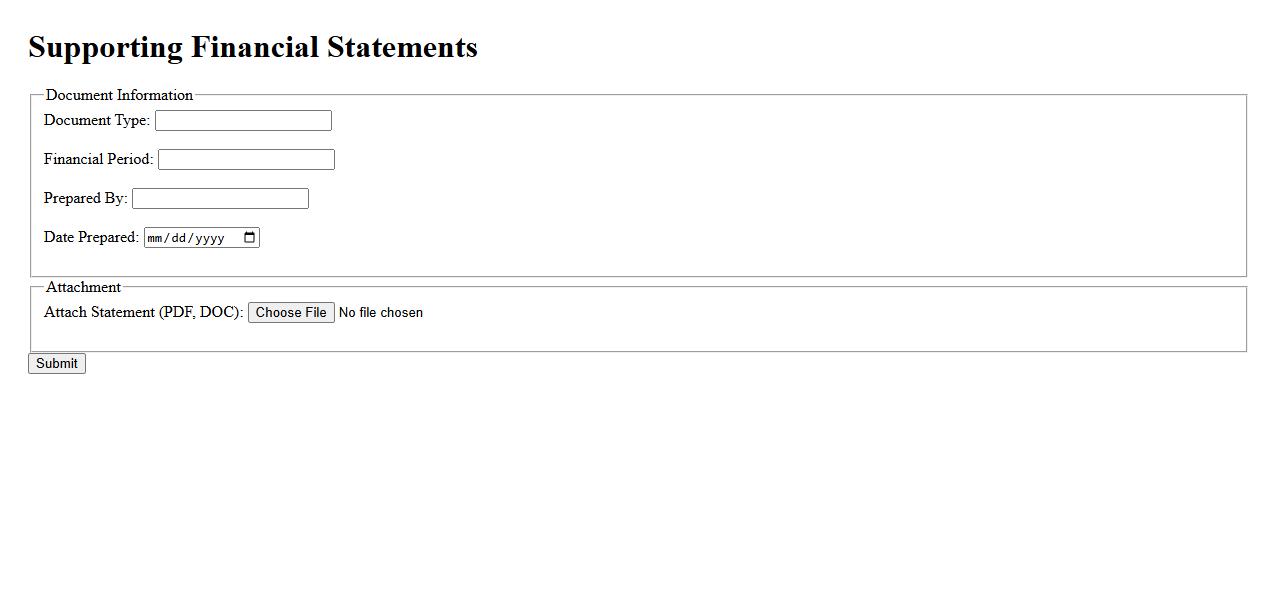

Supporting Financial Statements

Supporting Financial Statements provide detailed information that complements the primary financial statements, offering deeper insights into a company's financial health. These statements include notes, schedules, and supplementary data essential for accurate analysis and decision-making. They enhance transparency and help stakeholders understand the context behind the numbers.

Expense Documentation

Expense documentation is the process of recording and organizing receipts, invoices, and other financial records to verify business expenditures. Accurate documentation ensures compliance with tax regulations and facilitates efficient budgeting. Maintaining thorough expense records helps prevent discrepancies and supports financial audits.

Mitigation Actions Undertaken

Mitigation actions undertaken are strategic steps implemented to reduce risks and minimize the impact of potential hazards. These actions include preventive measures and interventions designed to protect lives, property, and the environment. Effective mitigation ensures resilience and sustainability in the face of challenges.

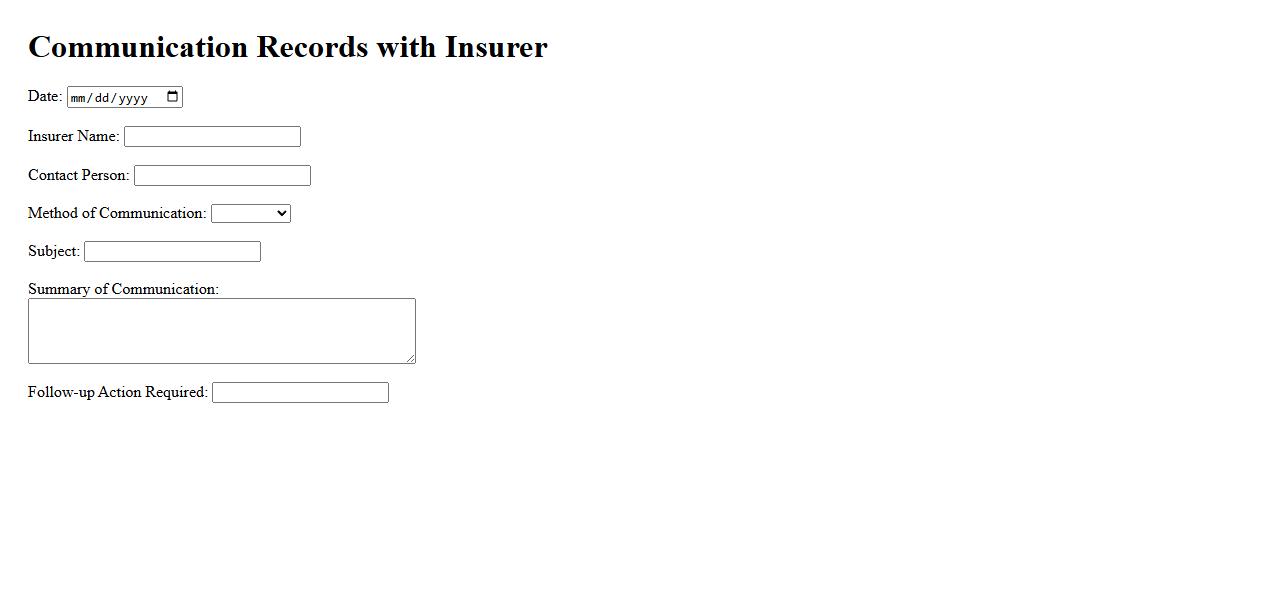

Communication Records with Insurer

Communication Records with Insurer are essential documents that detail all interactions between a policyholder and their insurance company. These records help ensure transparency and provide evidence during claims or disputes. Keeping accurate communication logs can simplify the resolution process and protect your rights.

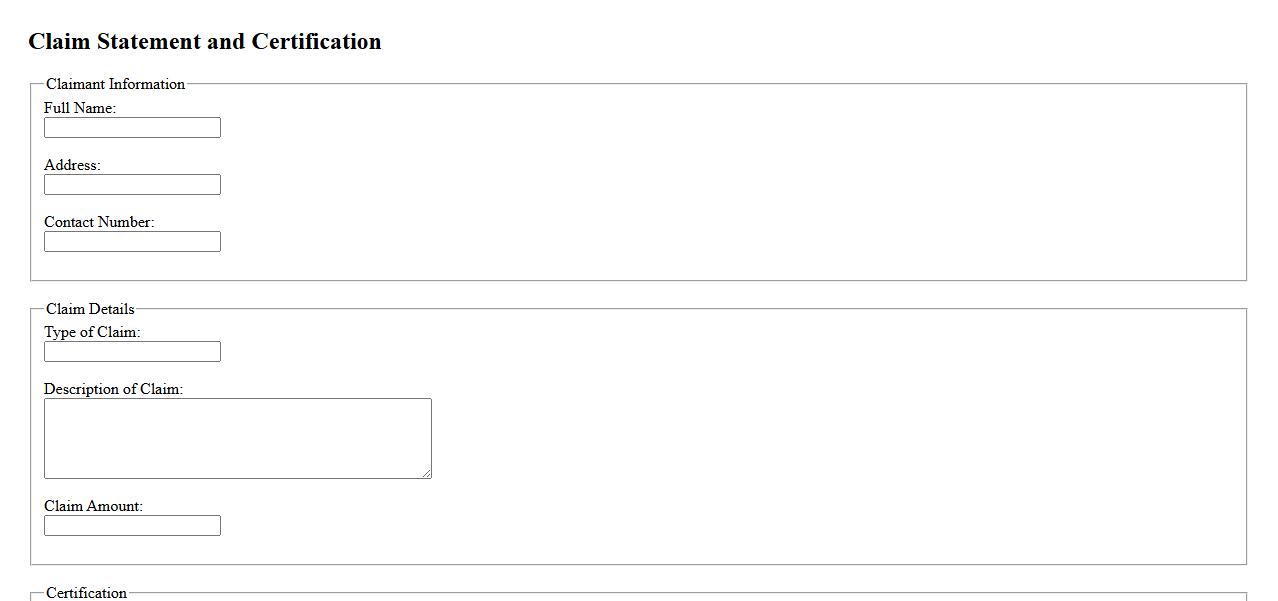

Claim Statement and Certification

The Claim Statement and Certification forms are essential documents used to validate and authorize submitted information. They ensure accuracy and compliance with relevant guidelines before processing. Proper completion of these documents safeguards the integrity of the claim process.

What specific event or circumstance triggered your claim for business interruption insurance?

The specific event that triggered the claim was the sudden closure of the business premises due to government-mandated lockdowns. This unforeseen circumstance directly impacted daily operations and revenue flow. Identifying the exact cause is crucial for validating the insurance claim.

What period of time did your business operations experience interruption or reduction in revenue?

The business operations experienced a significant interruption period lasting from March to June 2023. During this timeframe, the company faced both complete shutdowns and partial restrictions. Accurate documentation of this period is essential for calculating losses.

What losses or expenses are you claiming as a result of the business interruption?

The claim includes losses from lost revenue, ongoing fixed expenses like rent and salaries, and additional costs incurred to adapt operations. These claimed expenses reflect the financial impact due to the interruption. Detailed accounting supports the accuracy of these loss figures.

Are there any supporting documents or evidence verifying the cause and duration of the interruption?

Supporting documents include government orders, financial statements, and communication with suppliers and customers. These evidentiary materials substantiate both the cause and the length of the business interruption. Proper documentation strengthens the claim's credibility.

Does your insurance policy explicitly cover the event responsible for your business interruption?

The insurance policy explicitly covers government-mandated closures under the business interruption clause. It is vital to review the policy terms to confirm coverage of the specific triggering event. Clear policy language helps avoid disputes during claim processing.