Filing a claim for homeowners insurance involves reporting damage or loss to your insurer to receive financial compensation. It requires providing detailed documentation, such as photos and proof of ownership, to support the claim. The process helps homeowners recover costs from covered events like fire, theft, or natural disasters.

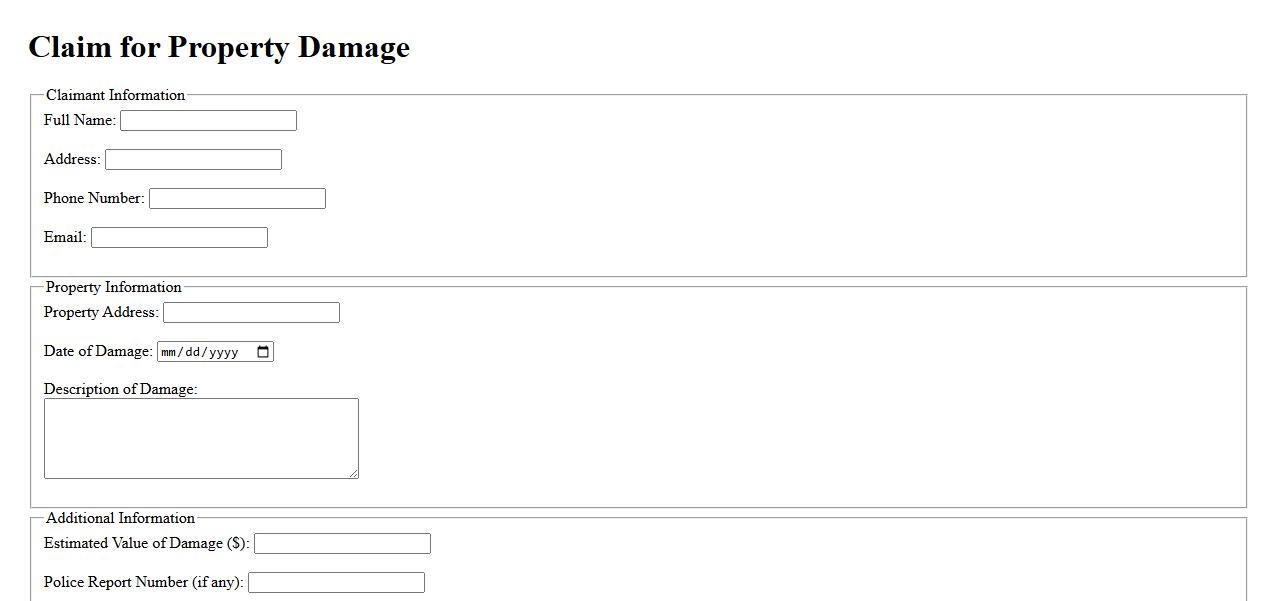

Claim for Property Damage

A claim for property damage is a formal request for compensation due to harm caused to personal or real property. It involves documenting the damage, assessing the loss, and submitting the claim to an insurance company or responsible party. Properly filing this claim ensures timely recovery and repair of the affected property.

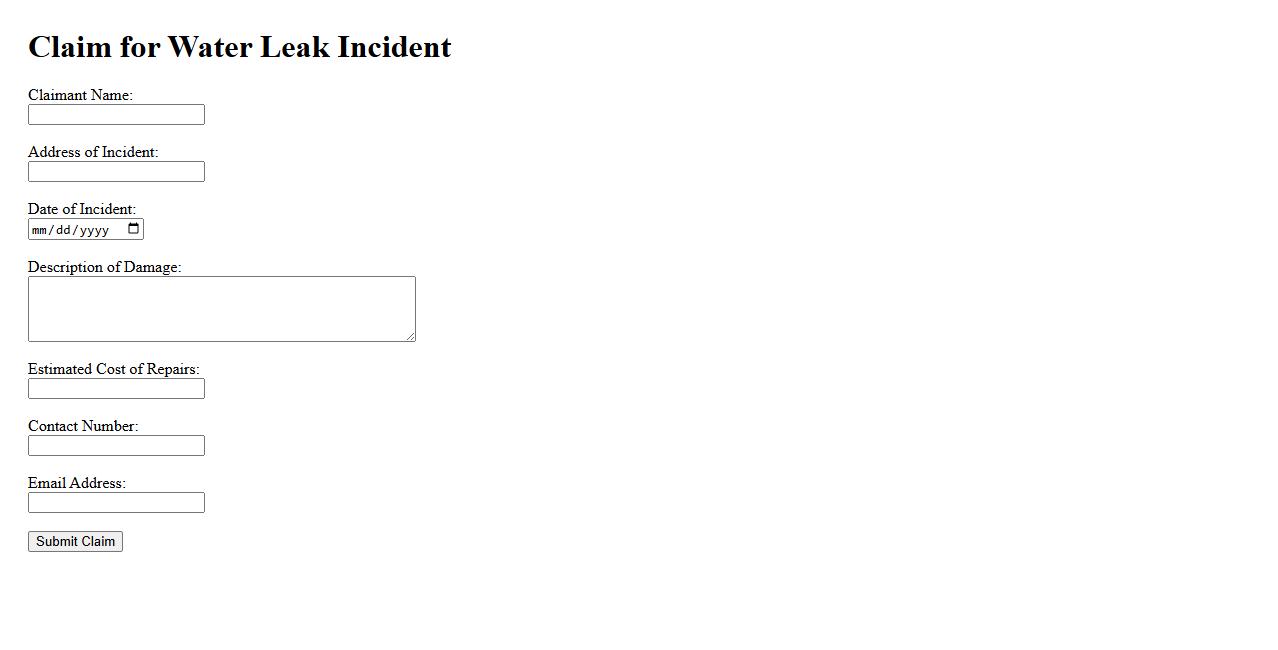

Claim for Water Leak Incident

A Claim for Water Leak Incident involves reporting and seeking compensation for damages caused by accidental water leaks. It is essential to document the incident thoroughly and notify your insurance provider promptly. Proper handling ensures timely resolution and coverage for repair costs.

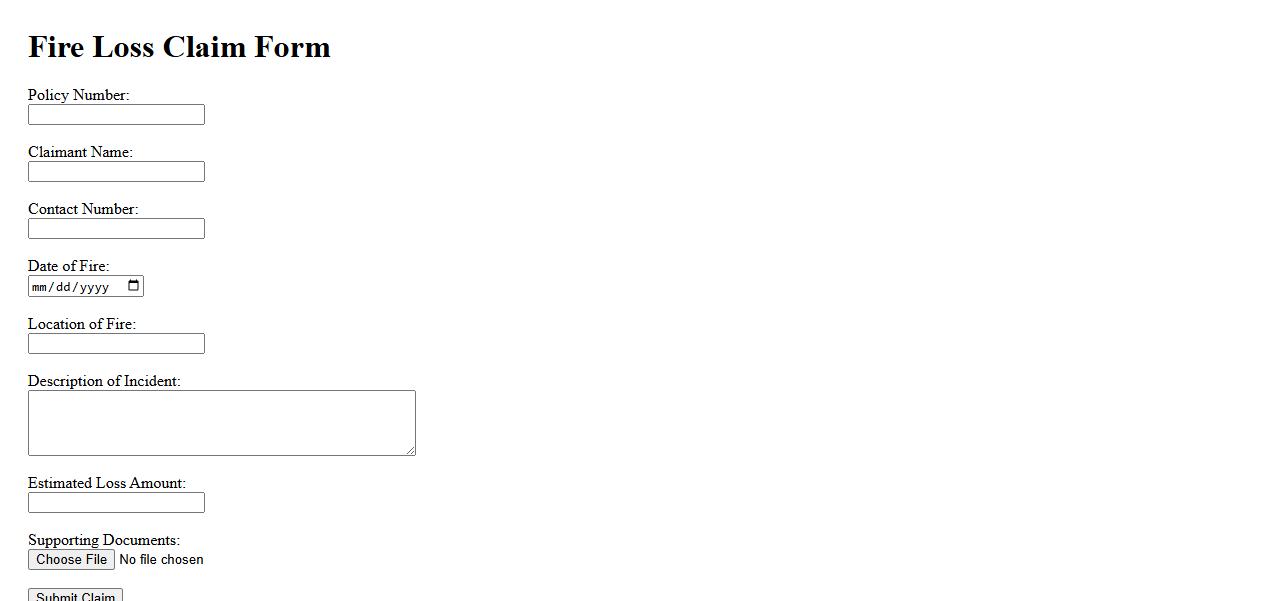

Claim for Fire Loss

A Claim for Fire Loss is a formal request made to an insurance company seeking compensation for damages caused by a fire. This process involves documenting the extent of the fire damage and submitting necessary evidence to support the claim. Timely and accurate filing is crucial to ensure adequate reimbursement for losses incurred.

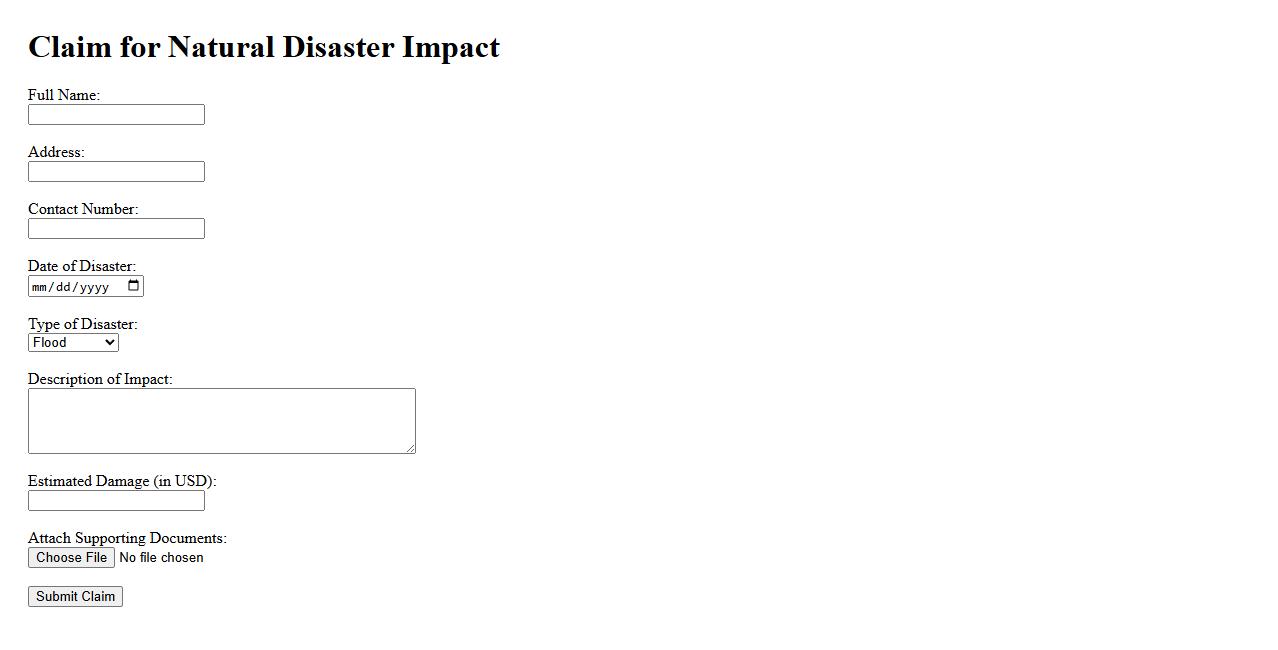

Claim for Natural Disaster Impact

Filing a claim for natural disaster impact helps individuals and businesses recover losses caused by events such as hurricanes, floods, or wildfires. This process ensures timely financial assistance to repair damages and restore normalcy. Accurate documentation and prompt submission are crucial for a successful claim.

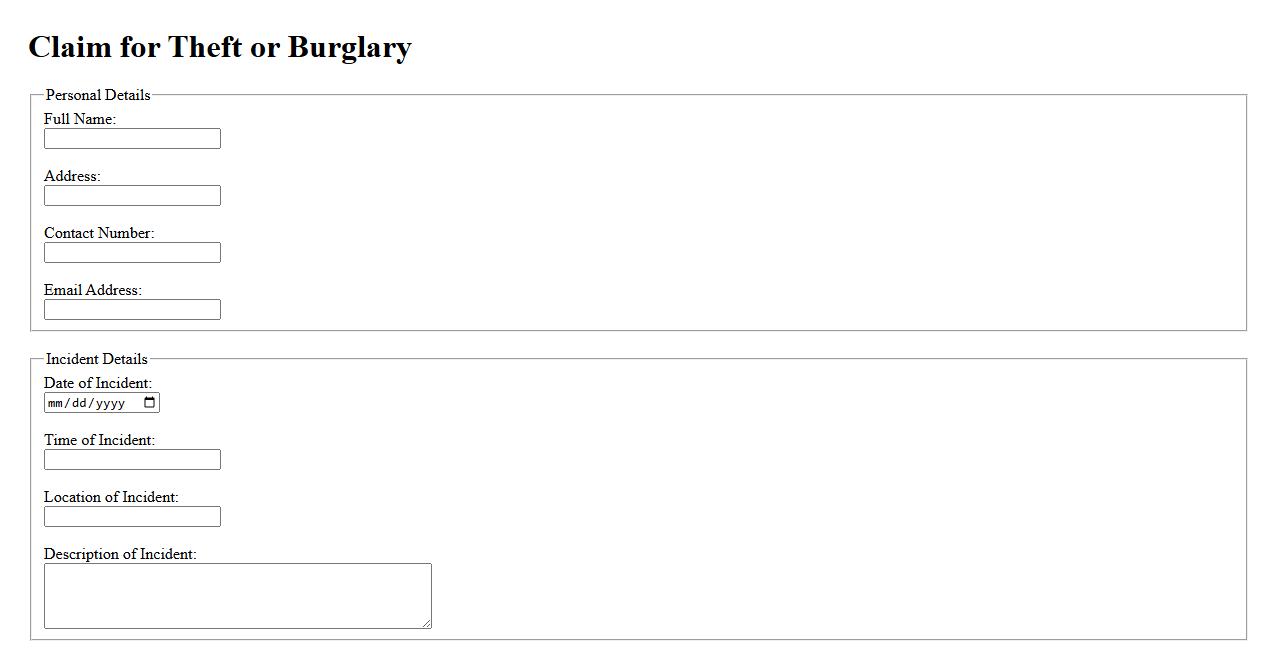

Claim for Theft or Burglary

A claim for theft or burglary involves reporting the loss or damage of property due to unlawful entry or stealing. It requires providing evidence and documentation to the insurer to receive compensation. Prompt filing and accurate details increase the chances of a successful claim.

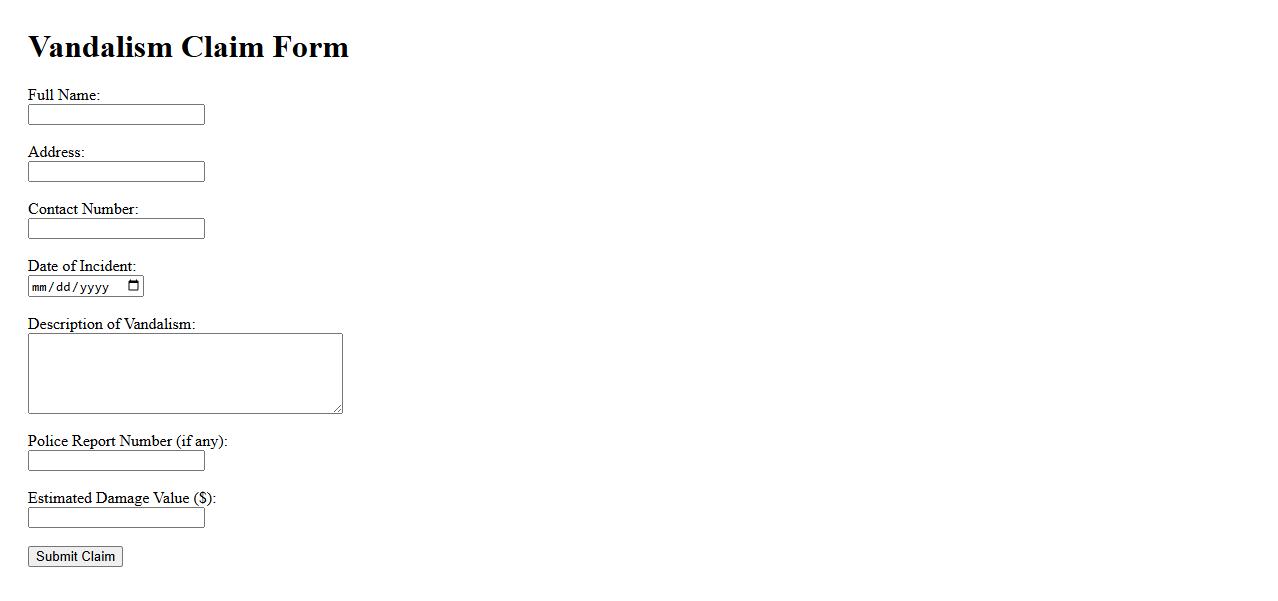

Claim for Vandalism

A claim for vandalism involves seeking compensation for damage caused intentionally to property. This process requires documenting the damage and providing evidence to support the claim. Timely reporting to the insurance company is essential to ensure proper evaluation and reimbursement.

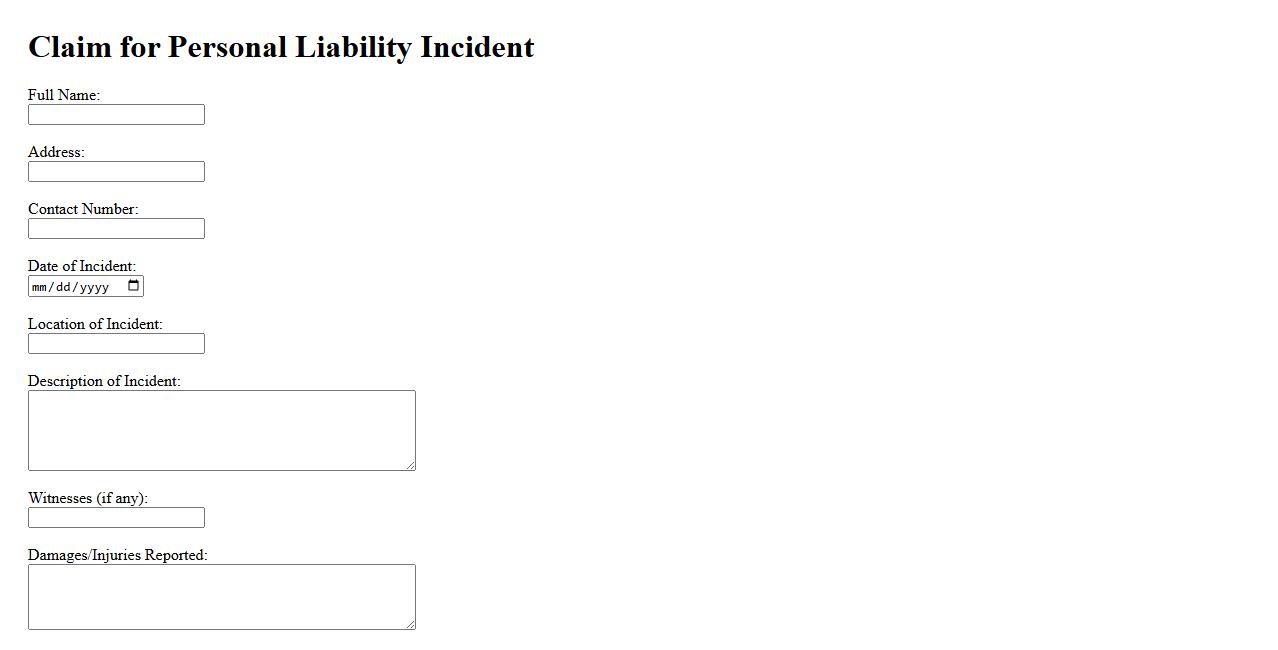

Claim for Personal Liability Incident

A claim for personal liability incident arises when an individual seeks compensation for damages or injuries they are legally responsible for causing to others. This type of claim typically involves accidents, property damage, or bodily harm resulting from negligence. Proper documentation and timely reporting are essential to resolve the liability effectively.

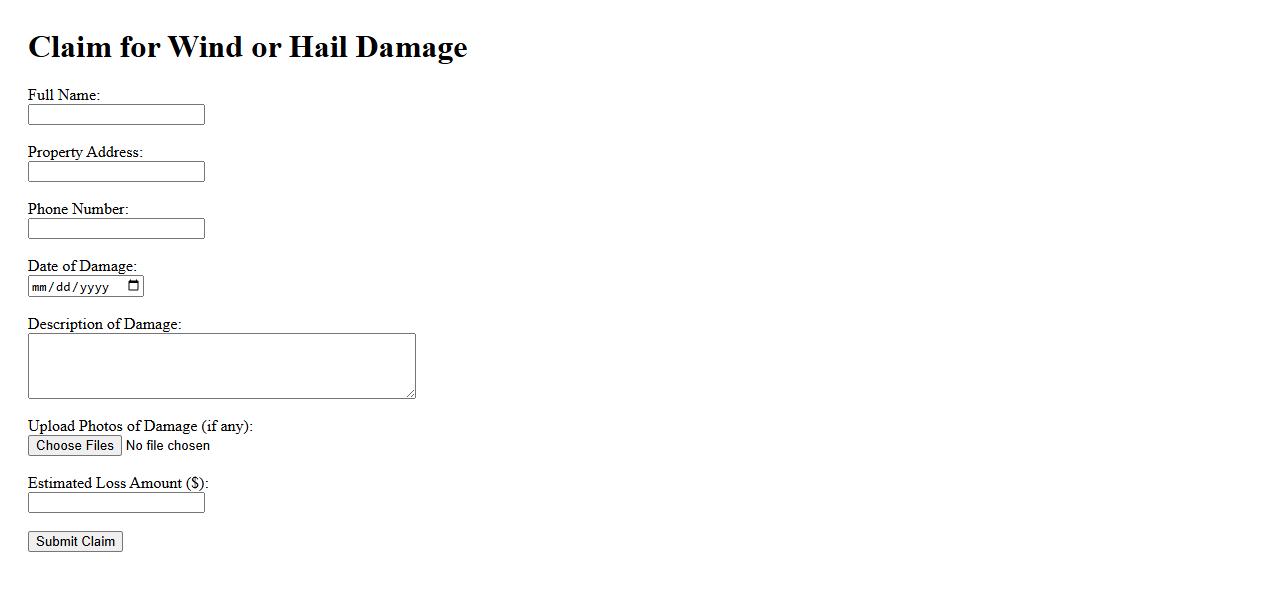

Claim for Wind or Hail Damage

Filing a claim for wind or hail damage is essential to recover costs from your insurance provider after a storm. This process involves documenting the damage, contacting your insurer promptly, and providing evidence such as photos and repair estimates. Timely and accurate claims help ensure you receive proper compensation to restore your property.

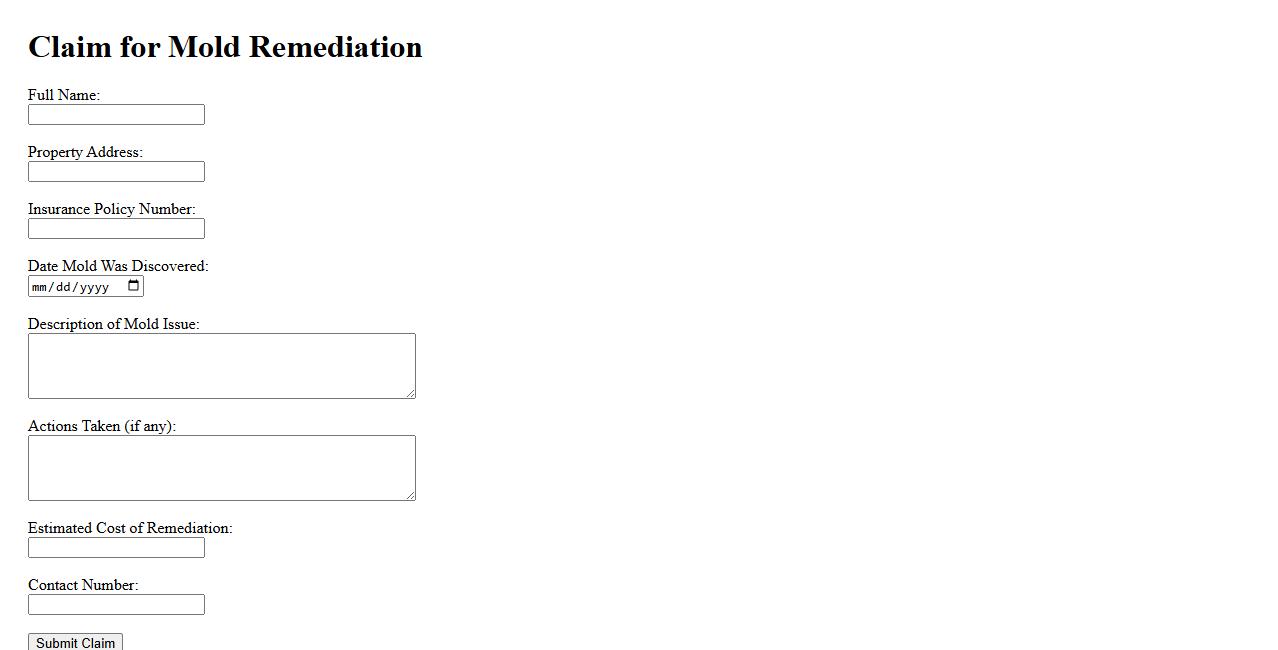

Claim for Mold Remediation

Filing a claim for mold remediation is essential to address and resolve mold damage in your property. This process involves assessing the extent of mold growth, documenting the damage, and submitting necessary evidence to your insurance provider. Prompt action helps ensure proper cleanup and restoration, protecting your health and property value.

Claim for Loss of Use

A Claim for Loss of Use is a legal request for compensation when property cannot be used due to damage or other issues. It typically applies to vehicles, homes, or equipment that are temporarily unusable. This claim helps recover costs related to the inconvenience and loss of functionality during the repair period.

What types of damages are covered under homeowners insurance in this document?

Homeowners insurance primarily covers property damages caused by events such as fire, theft, and natural disasters. It also includes protection against damages resulting from water leaks and vandalism. Additionally, the policy may cover personal liability for injuries occurring on the property.

What specific information is required to submit a claim?

To submit a claim, policyholders must provide their personal identification details and insurance policy number. Detailed descriptions of the incident causing the damage are essential along with the date and time of occurrence. Including contact information and any immediate steps taken to mitigate the damage is also mandatory.

What exclusions or limitations are mentioned in the insurance policy?

The insurance policy specifically excludes damages caused by wear and tear, neglect, and intentional acts. It does not cover losses due to flooding unless a separate flood insurance policy is in place. Certain high-value items may have coverage limits or require additional endorsements.

What is the process and timeline for claim assessment and approval?

Once a claim is submitted, the insurer assigns an adjuster to assess the damages and verify details within 7 to 10 business days. The evaluation includes inspections and review of submitted documentation. Claim approval or denial is communicated typically within 14 to 21 days after assessment.

What supporting documentation must accompany a claim submission?

Claim submissions must include photographs of the damage, police or incident reports if applicable, and repair estimates. Receipts for any temporary repairs or relevant expenses should also be attached. All documentation must be clear, accurate, and submitted promptly to avoid processing delays.