Filing a claim for rental car insurance involves submitting necessary documentation to your insurance provider or rental company after an incident. It typically requires evidence such as the rental agreement, police report, and photos of the damage. Understanding the terms of your coverage helps ensure a smooth and efficient claims process.

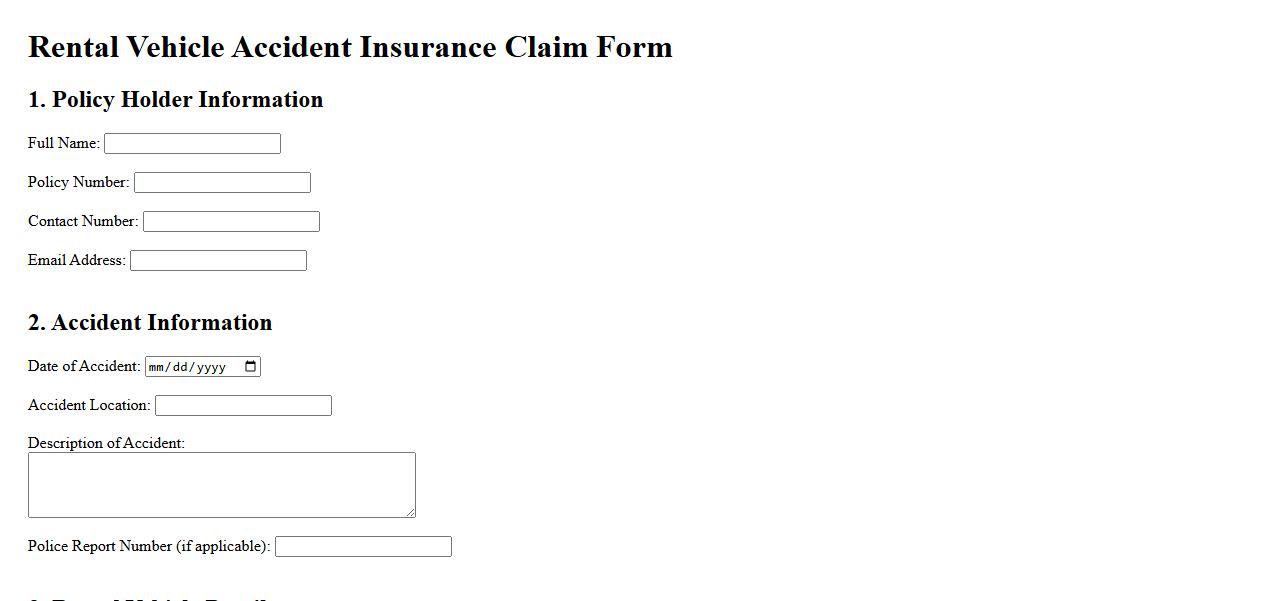

Rental Vehicle Accident Insurance Claim

Filing a rental vehicle accident insurance claim ensures you are protected against damages and liabilities after an accident with a rented car. It is essential to promptly notify the rental company and your insurance provider to start the claim process. Proper documentation and timely communication help in a smooth resolution and minimize financial impact.

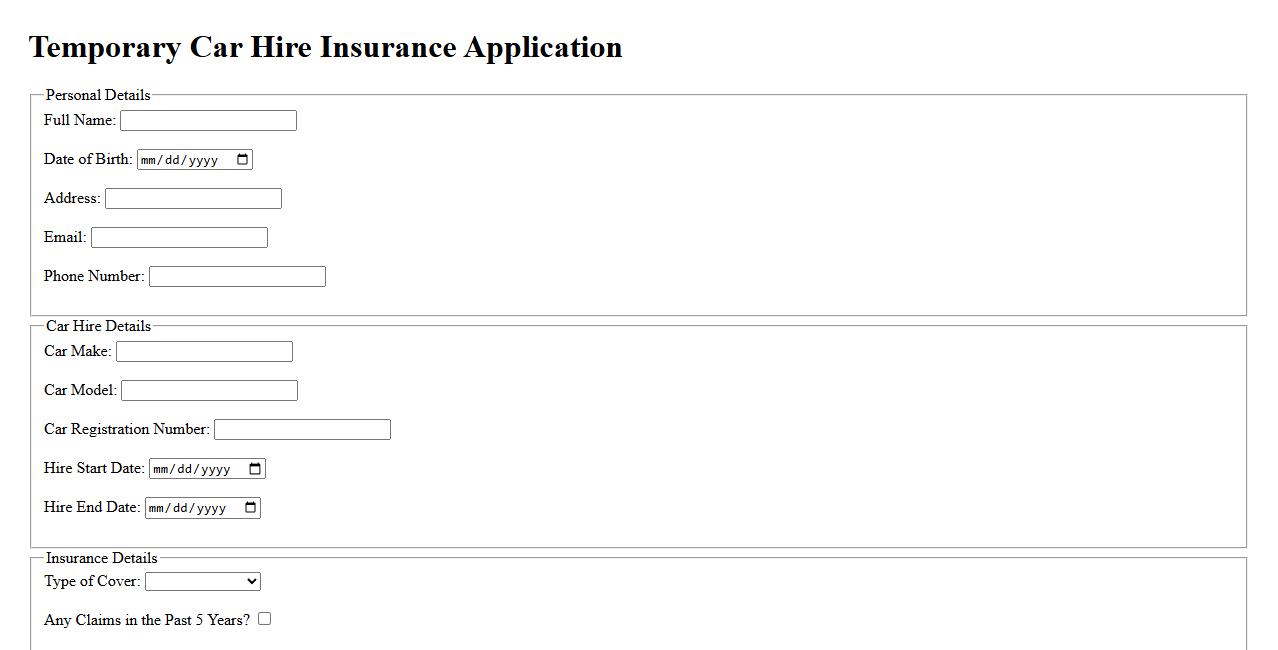

Temporary Car Hire Insurance Application

Applying for Temporary Car Hire Insurance is a straightforward process designed to provide short-term coverage for rental vehicles. This insurance protects you against potential damages or accidents during the hire period. Ensure you complete the application accurately to enjoy peace of mind while driving.

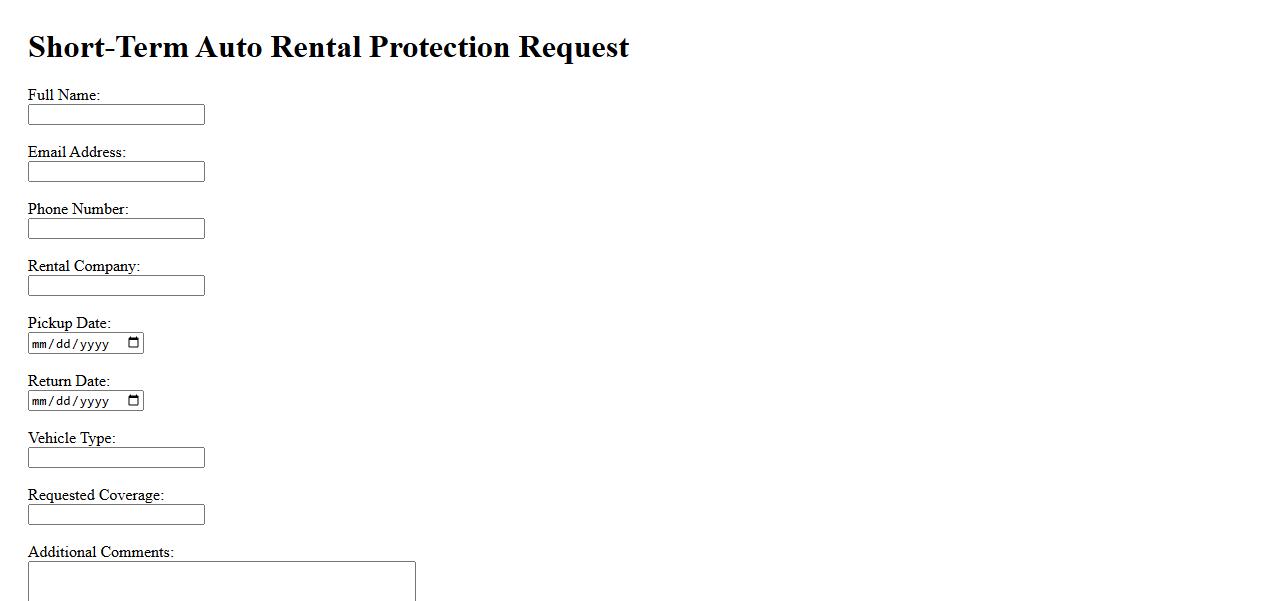

Short-Term Auto Rental Protection Request

When renting a vehicle, it's essential to consider Short-Term Auto Rental Protection to safeguard against potential damages or liabilities. This coverage provides peace of mind by offering financial protection for the duration of your rental period. Requesting this protection ensures you're prepared for unexpected incidents on the road.

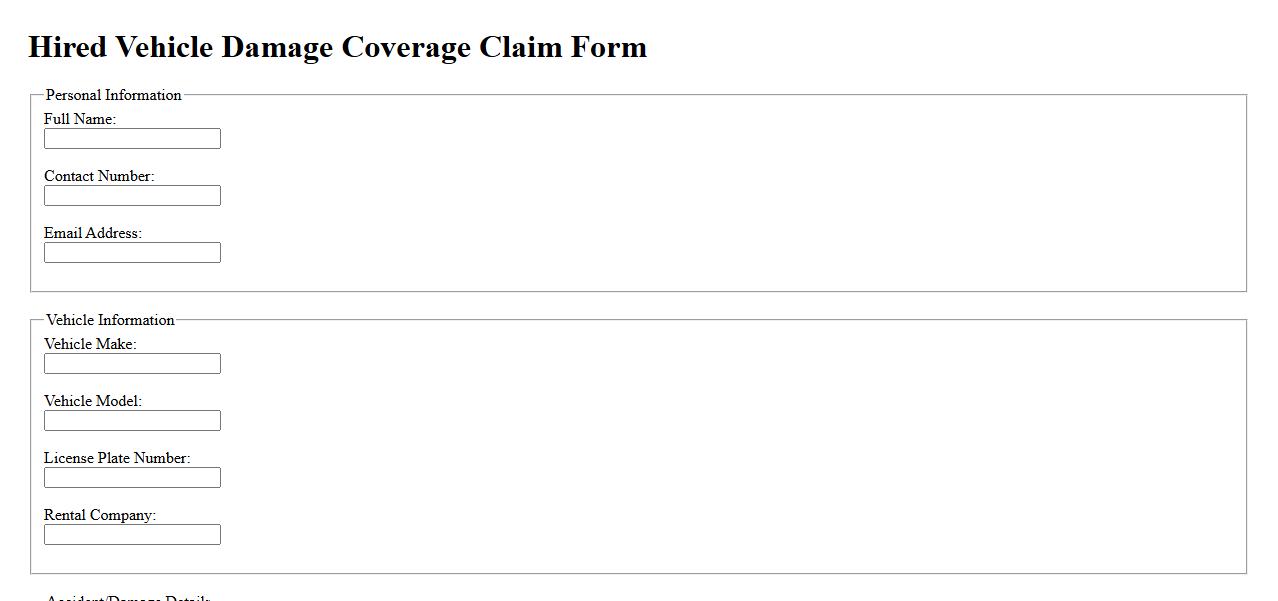

Hired Vehicle Damage Coverage Claim

Hired Vehicle Damage Coverage Claim protects renters against costs incurred from accidental damage to a hired vehicle. This claim ensures financial support for repairs, helping reduce out-of-pocket expenses. It is essential for those frequently renting vehicles to avoid unexpected liabilities.

Car Rental Loss & Theft Insurance Submission

The Car Rental Loss & Theft Insurance Submission process ensures that customers are protected against financial liability in case of damage or theft during the rental period. This insurance coverage provides peace of mind by covering repair costs or replacement value. Submitting the necessary documentation promptly can facilitate smooth claims processing and avoid unexpected expenses.

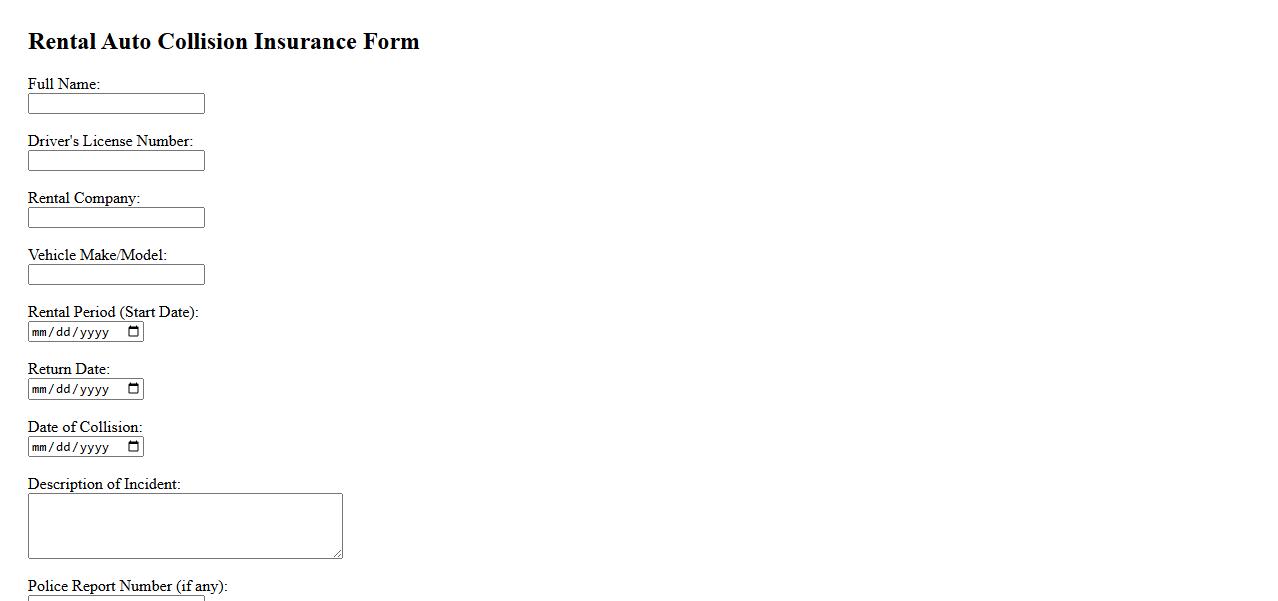

Rental Auto Collision Insurance Form

The Rental Auto Collision Insurance Form is a crucial document that outlines the coverage and terms for collision damage protection when renting a vehicle. It ensures that renters understand their financial responsibility and the insurance benefits offered during the rental period. Completing this form helps expedite claims and provides peace of mind while driving a rental car.

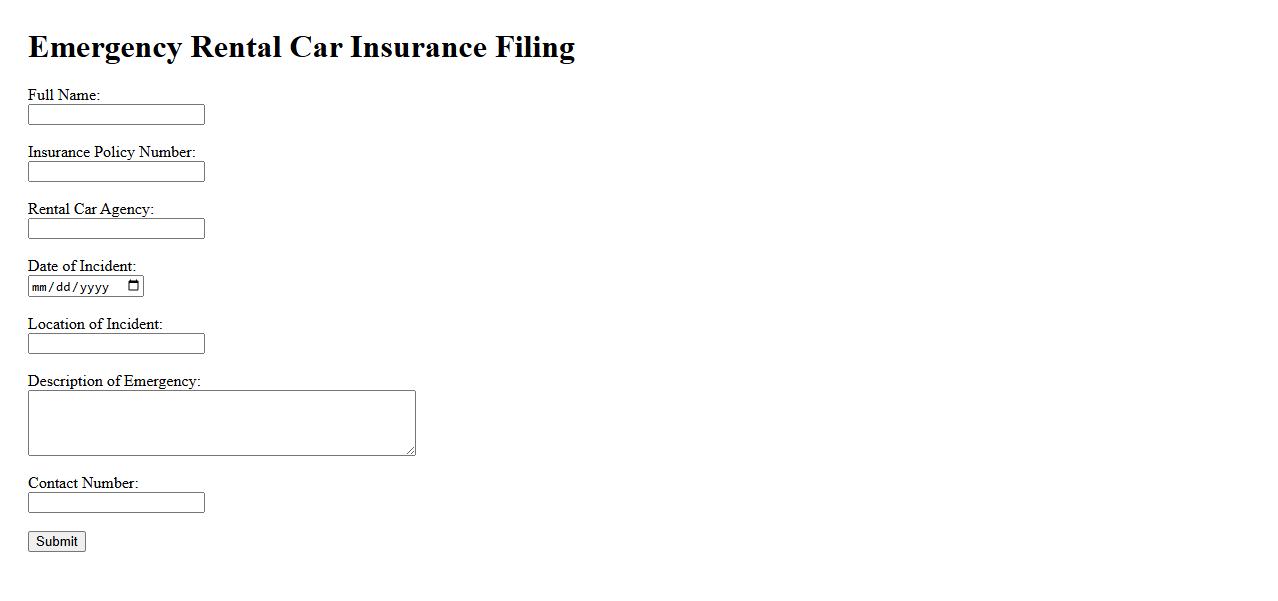

Emergency Rental Car Insurance Filing

If you find yourself in an unexpected situation, Emergency Rental Car Insurance Filing ensures a quick and hassle-free process to protect your rental vehicle. This service helps you file claims efficiently in case of accidents or damages during your rental period. Trust in comprehensive coverage to keep you secure while on the road.

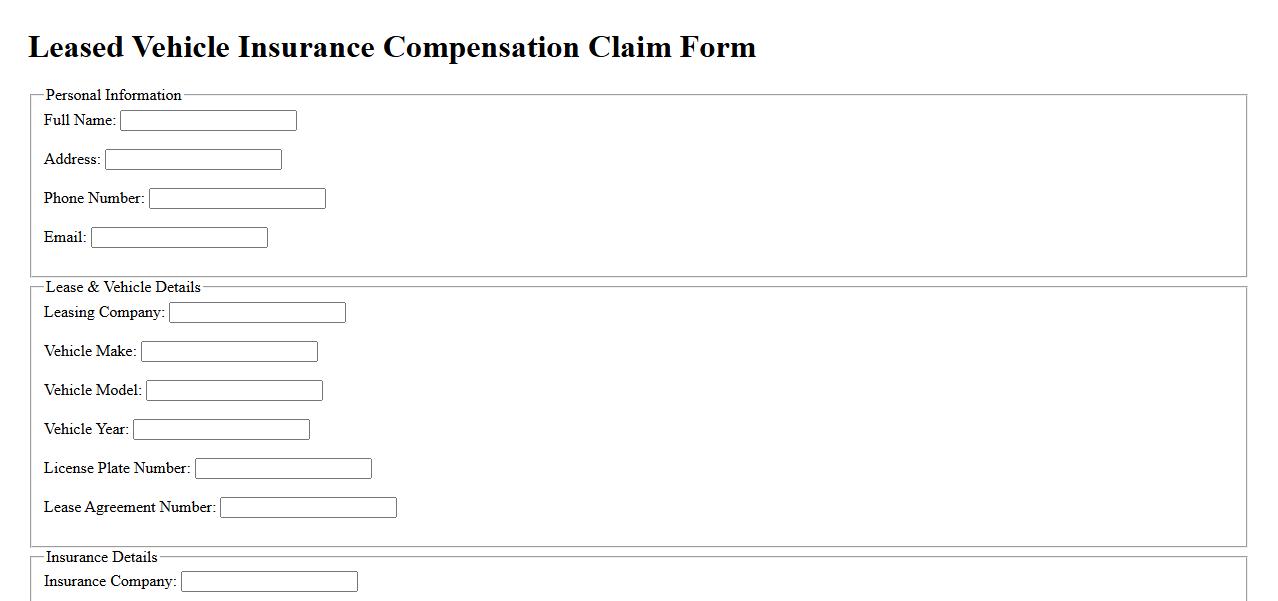

Leased Vehicle Insurance Compensation Claim

Filing a Leased Vehicle Insurance Compensation Claim is essential when seeking reimbursement for damages or losses involving a leased automobile. This process ensures that the lessee receives appropriate coverage under the insurance policy terms. Understanding the claim procedure helps expedite settlement and protect your financial interests.

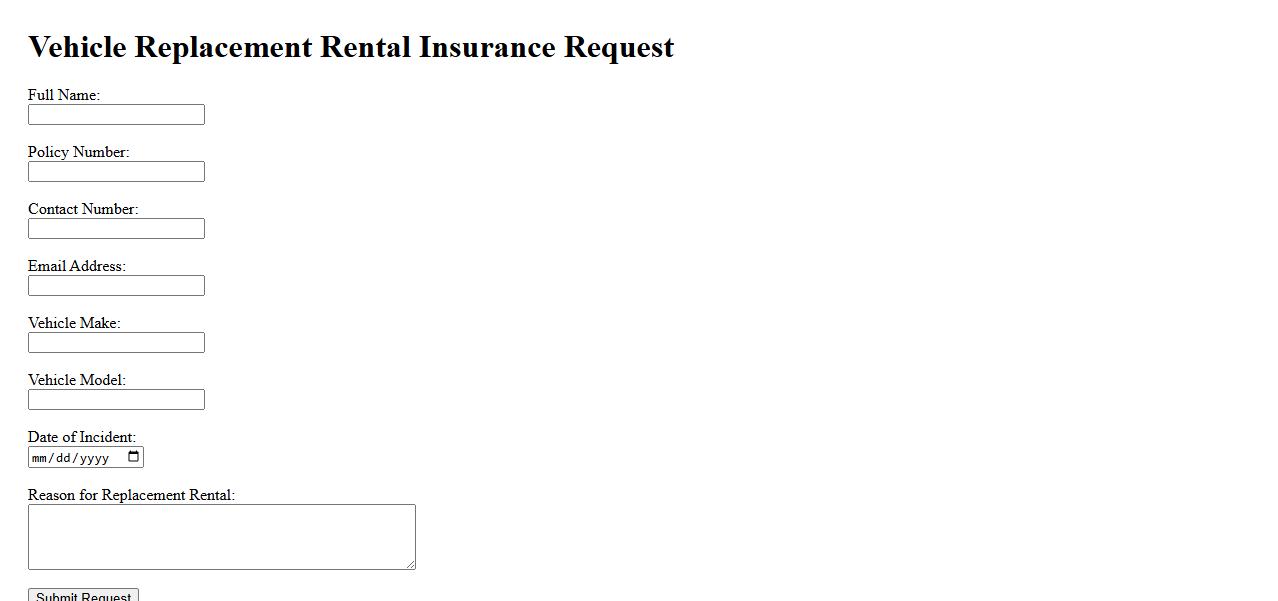

Vehicle Replacement Rental Insurance Request

When involved in an accident or experiencing a mechanical breakdown, a Vehicle Replacement Rental Insurance Request ensures you receive a temporary replacement vehicle while yours is being repaired. This insurance coverage helps maintain your mobility without additional financial burden during the repair period. Filing a request promptly can expedite the approval and rental process for your convenience.

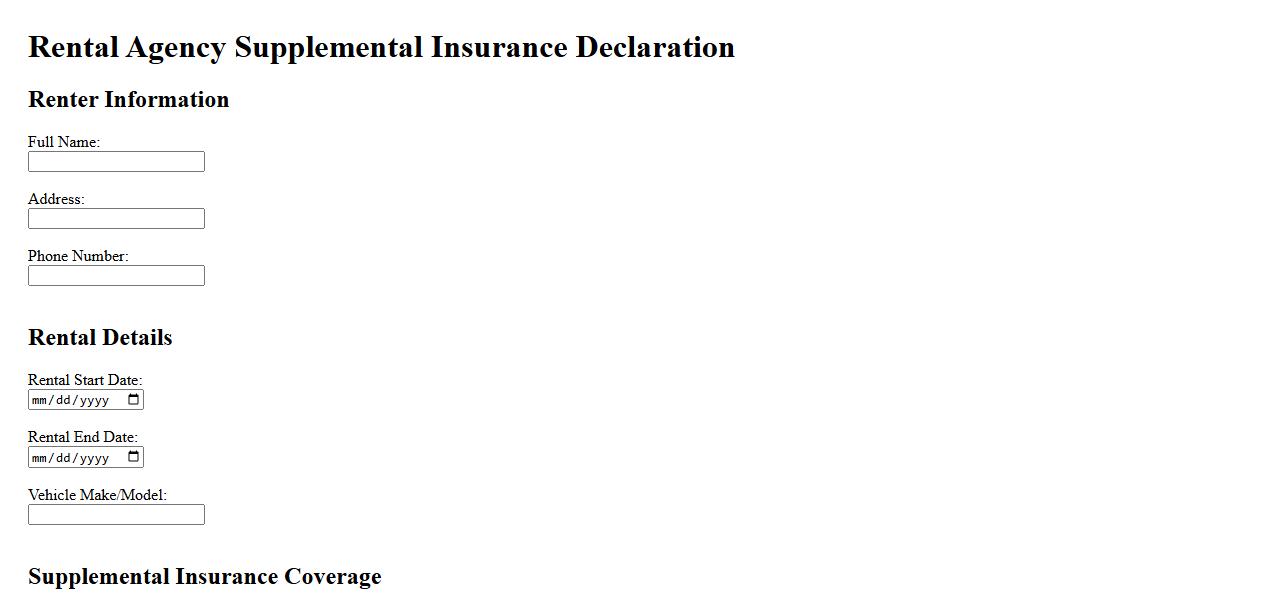

Rental Agency Supplemental Insurance Declaration

The Rental Agency Supplemental Insurance Declaration provides detailed information about additional insurance coverage available for rental properties. This document outlines the terms, conditions, and limits of the supplemental insurance offered to tenants. It helps ensure comprehensive protection during the rental period.

What is the primary purpose of a rental car insurance claim document?

The primary purpose of a rental car insurance claim document is to formally report damages or incidents involving the rental vehicle. It serves as official evidence required by the insurance company to process the claim. This document helps establish liability and ensures the renter receives appropriate compensation or coverage.

Which types of incidents or damages are typically covered by rental car insurance?

Rental car insurance typically covers damages resulting from collisions, theft, vandalism, and natural disasters. It may also include coverage for personal injuries and third-party liabilities. However, coverage varies based on policy terms and specific rental agreements.

What essential information must be included when submitting a rental car insurance claim?

When submitting a claim, it is crucial to include the rental agreement details, incident description, and photographic evidence of damages. Contact information for involved parties and any police reports should also be provided. Accurate and complete information expedites the claim processing.

How does rental period documentation impact the claim approval process?

Rental period documentation confirms that the incident occurred within the insured rental timeframe. This verification determines eligibility for coverage under the rental car insurance policy. Proper documentation reduces disputes and supports timely claim approval.

What are common reasons for denial of a rental car insurance claim?

Common causes for claim denial include violations of rental terms, undocumented damages, and incidents occurring outside the rental period. Claims may also be rejected if the renter was under the influence or driving without authorization. Understanding policy exclusions is essential to avoid claim denials.