Filing a Claim for Tax Credit Refund involves submitting required documentation to the tax authority to recover overpaid taxes or eligible credits. Accurate records and proof of eligibility are essential to ensure a smooth refund process. Taxpayers should review all guidelines carefully to maximize their refund potential.

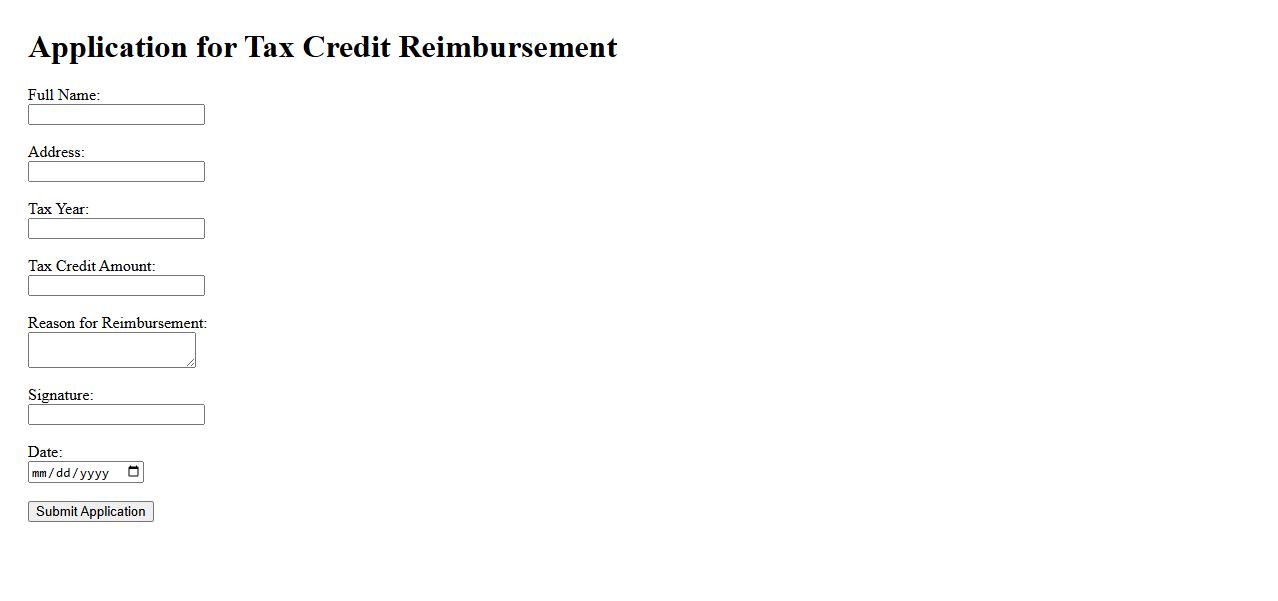

Application for Tax Credit Reimbursement

The Application for Tax Credit Reimbursement is a formal request submitted by eligible taxpayers to recover claimed tax credits. This process ensures that individuals or businesses receive the financial benefits owed through tax incentives. Proper completion and timely submission of the application are essential for successful reimbursement.

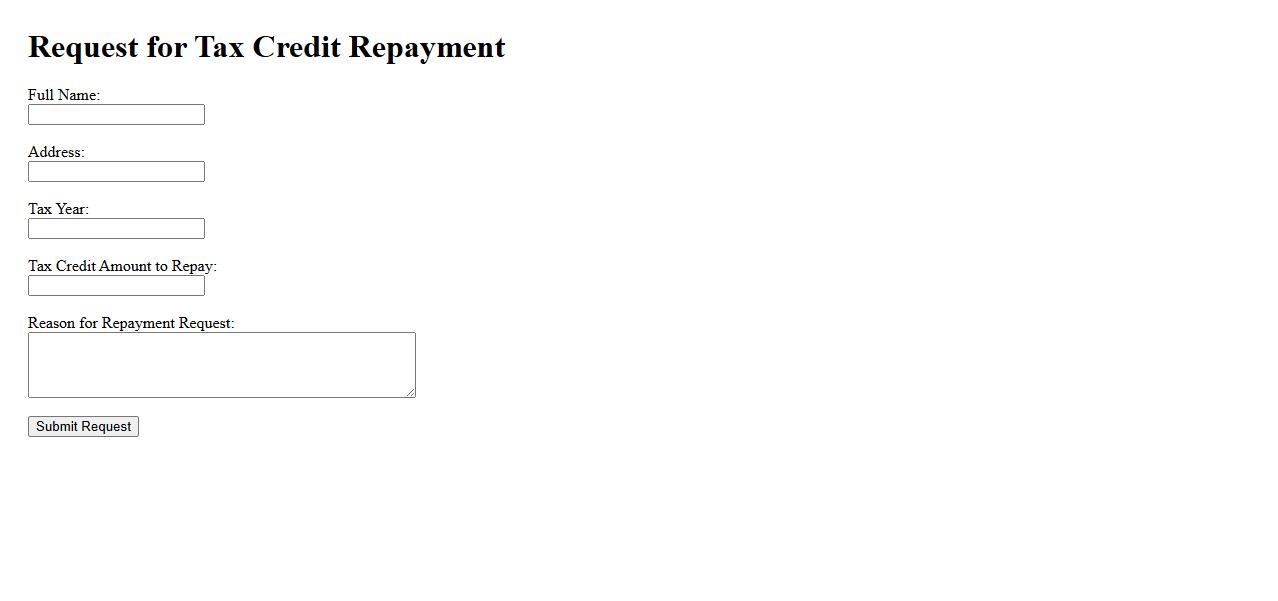

Request for Tax Credit Repayment

The Request for Tax Credit Repayment is a formal process used by taxpayers to return overclaimed or erroneously received tax credits to the tax authorities. This ensures compliance with tax laws and prevents potential penalties or interest charges. Timely submission of the repayment request helps maintain accurate tax records and avoids complications in future filings.

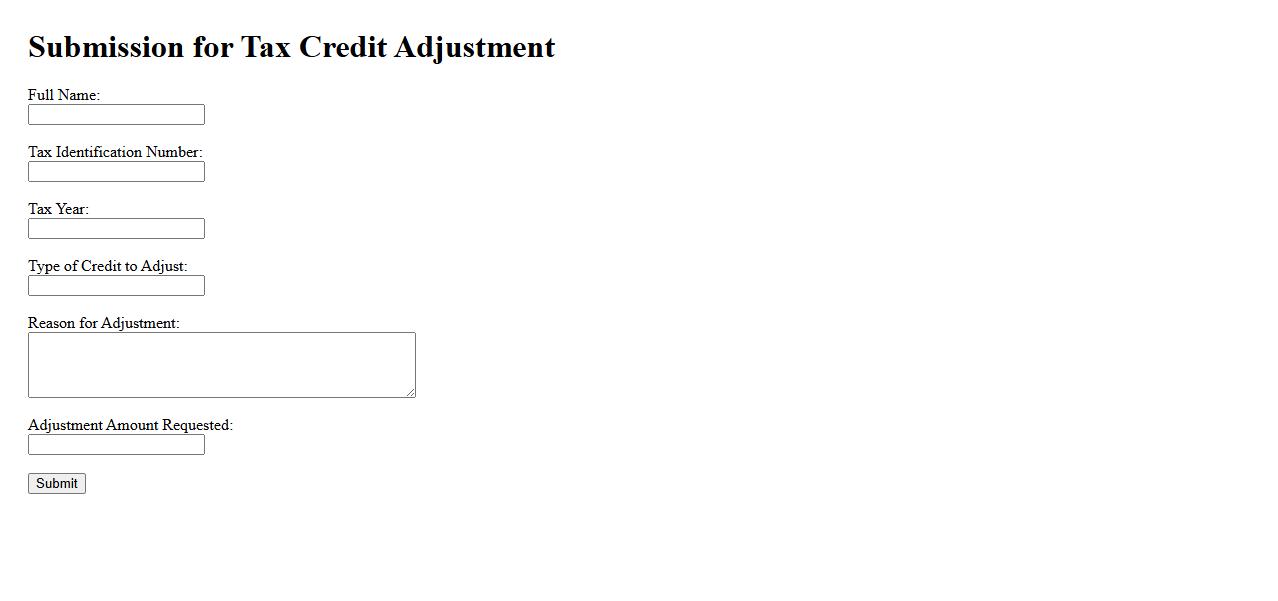

Submission for Tax Credit Adjustment

Submitting a Tax Credit Adjustment request ensures that any changes in your eligible tax credits are accurately reflected in your tax filings. This process helps in correcting errors or updating information to maximize your tax benefits. Timely submission is crucial to prevent delays in processing and receiving the correct credit amount.

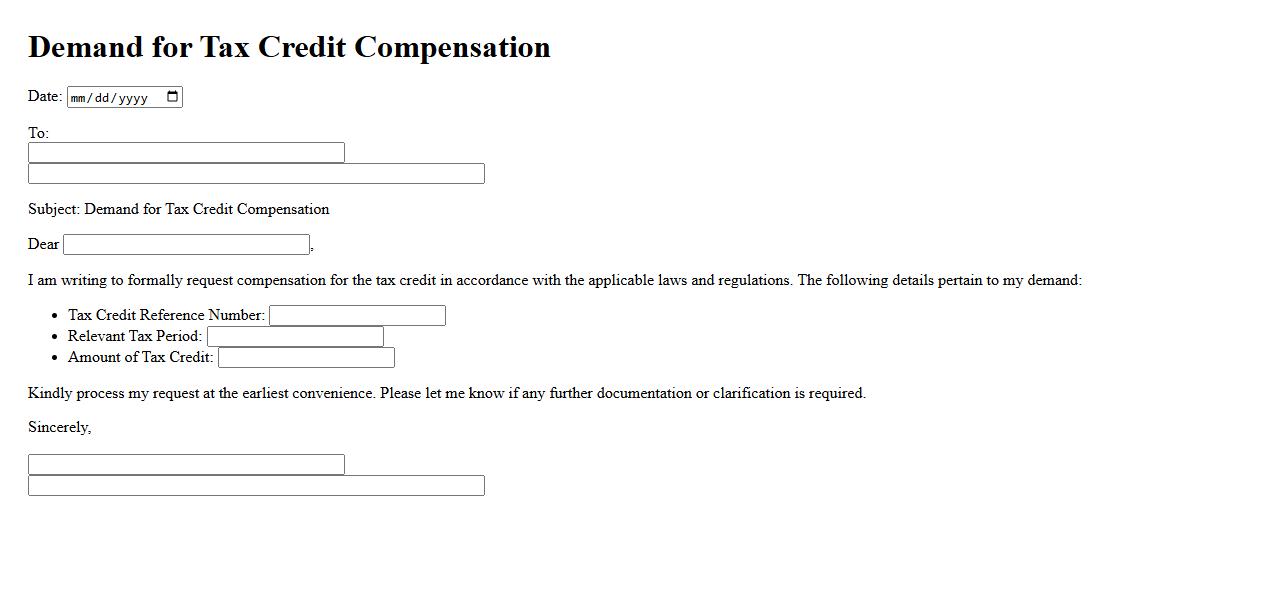

Demand for Tax Credit Compensation

The demand for tax credit compensation has increased significantly as businesses seek financial relief and incentives. This compensation helps offset costs related to eligible expenses, promoting economic growth. Understanding eligibility and application processes is crucial to maximize these benefits.

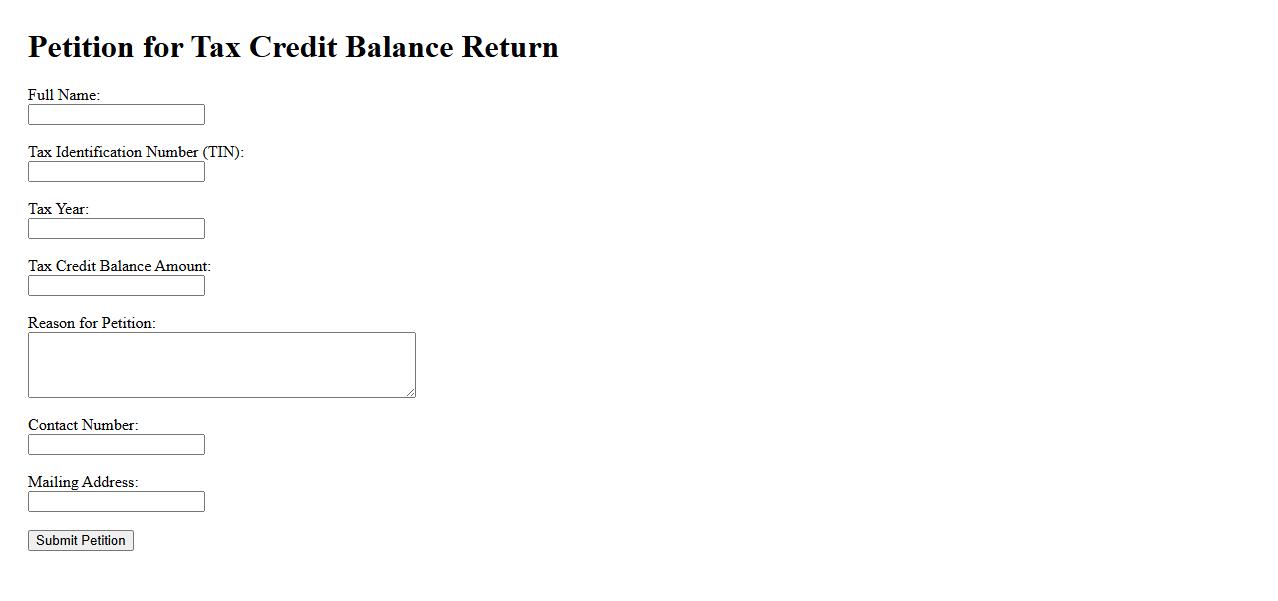

Petition for Tax Credit Balance Return

A Petition for Tax Credit Balance Return allows taxpayers to request the refund or transfer of unused tax credits. This process ensures that individuals or businesses can maximize their financial benefits efficiently. Filing the petition requires proper documentation and adherence to tax authority guidelines.

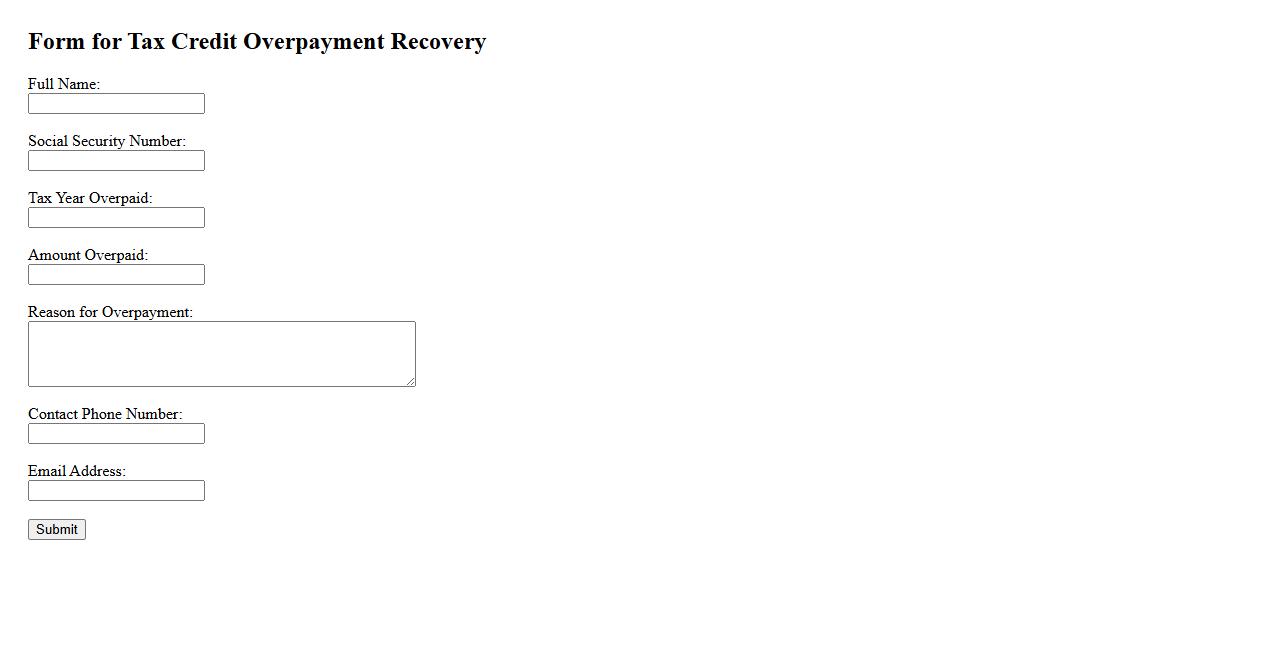

Form for Tax Credit Overpayment Recovery

Use this Form for Tax Credit Overpayment Recovery to request a refund or adjustment for any excess tax credit payments made. It ensures accurate handling of overpayments and expedites the recovery process. Complete the form with your details to initiate the claim efficiently.

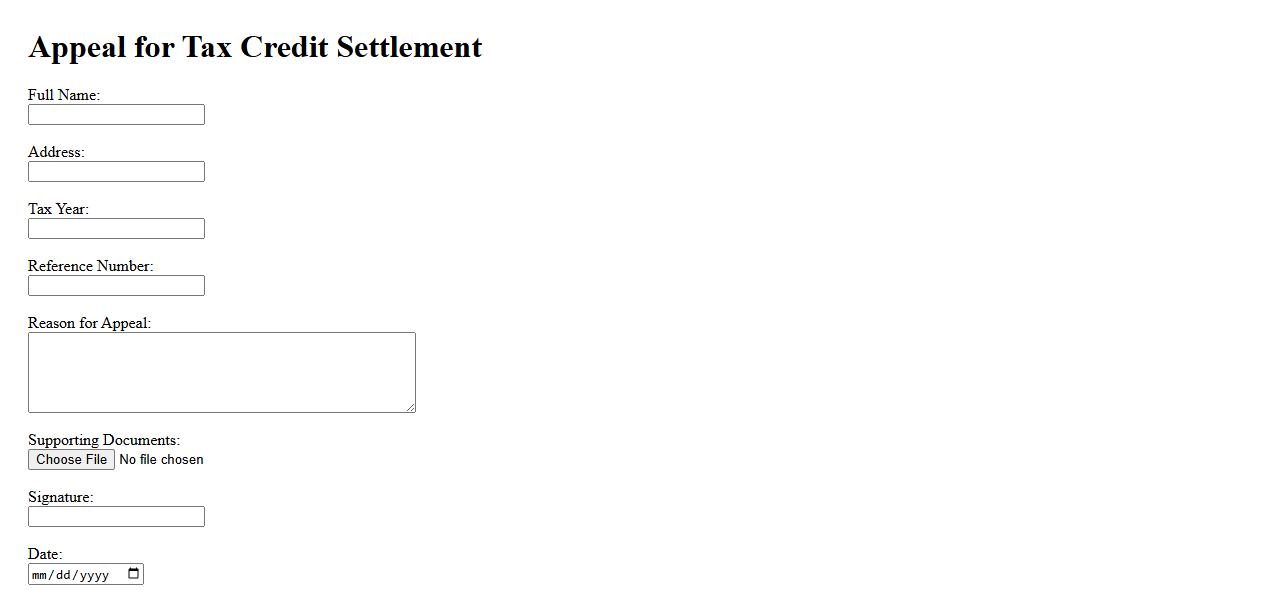

Appeal for Tax Credit Settlement

An Appeal for Tax Credit Settlement is a formal request to challenge a decision regarding tax credits. This process allows individuals or businesses to seek a review when they believe their tax credit claim has been incorrectly denied or reduced. Timely appeals can help secure the rightful credit and improve financial outcomes.

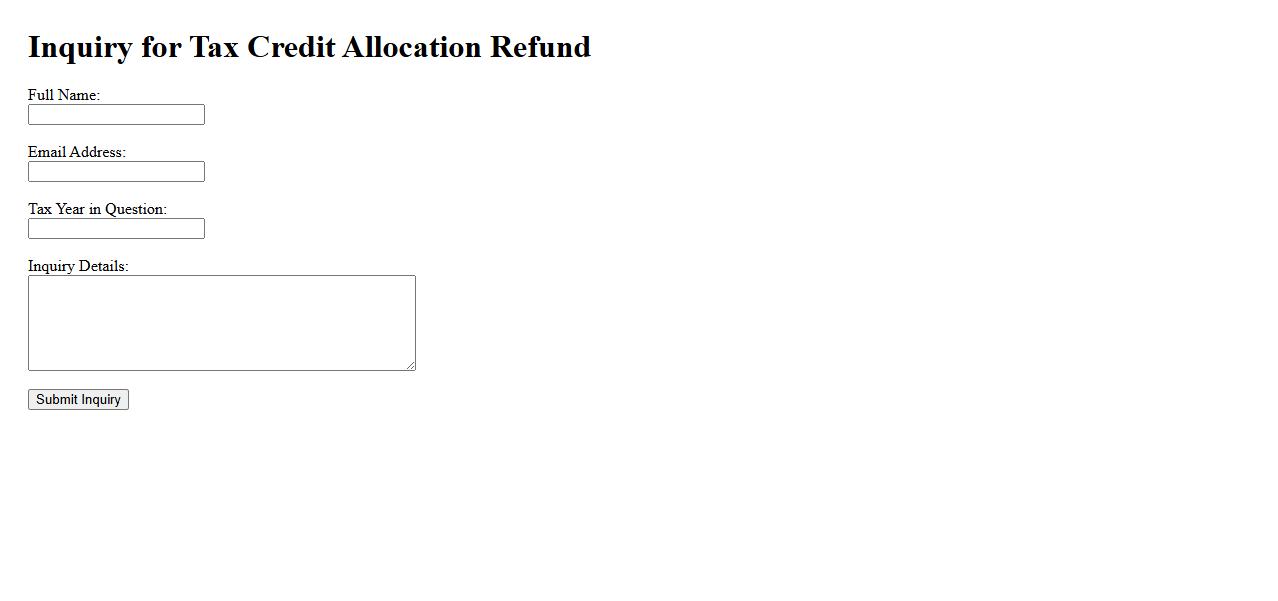

Inquiry for Tax Credit Allocation Refund

Submitting an Inquiry for Tax Credit Allocation Refund requires precise documentation and clear communication with the relevant tax authorities. This process ensures eligible taxpayers receive rightful refunds based on allocated tax credits. Timely inquiries help prevent delays and resolve any discrepancies efficiently.

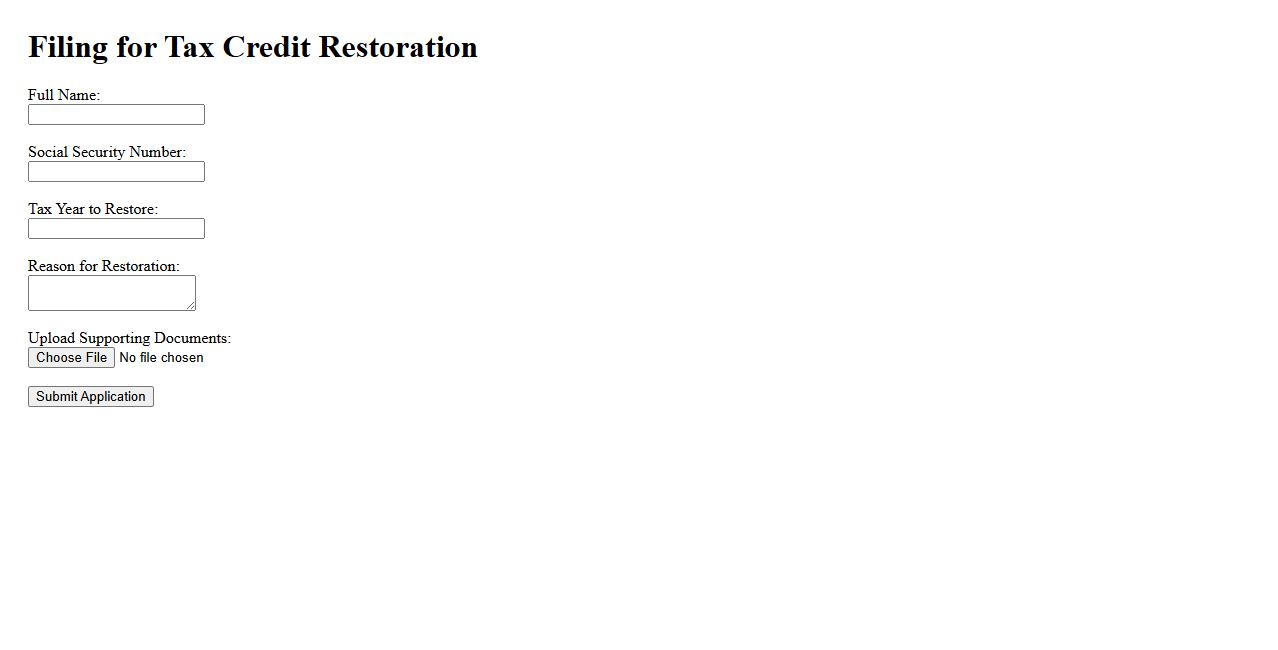

Filing for Tax Credit Restoration

Filing for Tax Credit Restoration helps individuals recover lost tax benefits due to prior errors or changes in their tax status. This process involves submitting necessary documentation to the appropriate tax authorities to reinstate credits. Accurate filing ensures you maximize your eligible refunds and reduce future tax liabilities.

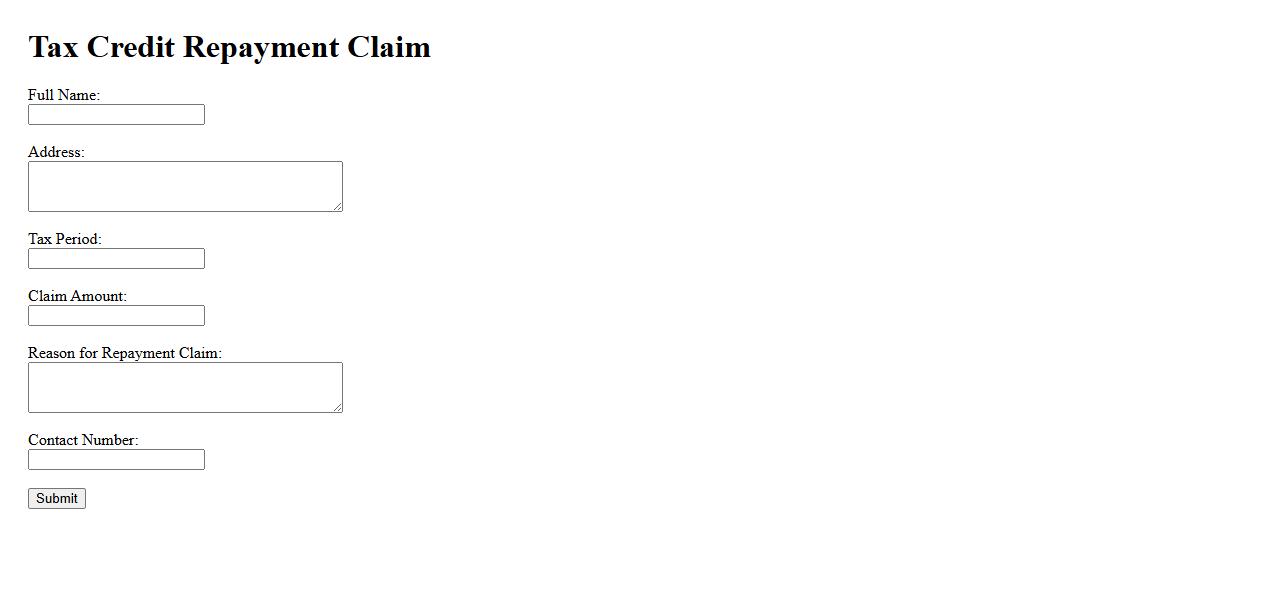

Tax Credit Repayment Claim

The Tax Credit Repayment Claim is a process used to request reimbursement for overpaid tax credits. It ensures taxpayers can recover funds paid in excess due to changes in income or circumstances. Accurate documentation is essential for a successful claim submission.

What specific tax credits are you claiming a refund for on this document?

This document is used to claim a refund for various tax credits such as the Earned Income Tax Credit (EITC), Child Tax Credit, and education credits. Identifying the specific credits helps the tax authority process your refund accurately. Ensure you list each tax credit you are claiming to avoid delays.

Which tax year does this claim for tax credit refund pertain to?

The claim for the tax credit refund pertains to the specific tax year indicated on the document, often the previous year or earlier. Correctly stating the tax year ensures your refund corresponds to the right filing period. Always verify the year before submitting your claim to avoid rejected claims.

What supporting documentation is required to substantiate your tax credit claim?

Supporting documentation such as W-2 forms, receipts, and proof of eligibility must accompany your tax credit claim. These documents validate your financial status and eligibility for each credit. Submitting complete and accurate paperwork speeds up the refund process.

Have you previously filed a claim for these tax credits for the same tax period?

It is important to disclose if you have previously filed a claim for the same tax credits for the relevant tax period. Multiple claims for the same credit can lead to delays or audits by tax authorities. Transparency helps maintain compliance and prevents unnecessary complications.

What method of refund (direct deposit, check, etc.) do you prefer for your tax credit refund?

You can choose your preferred refund method, commonly either direct deposit or a paper check. Direct deposit is faster and safer, reducing the risk of lost checks. Selecting a convenient refund option ensures you receive your tax credit refund without delay.