Filing a claim for automotive accident insurance involves reporting the incident to your insurance company and providing necessary documentation like the police report, photos, and medical bills. The insurer will assess the damage, verify the legitimacy of the claim, and determine the compensation based on your policy coverage. Quick and accurate filing helps ensure a smooth and timely resolution of your insurance claim.

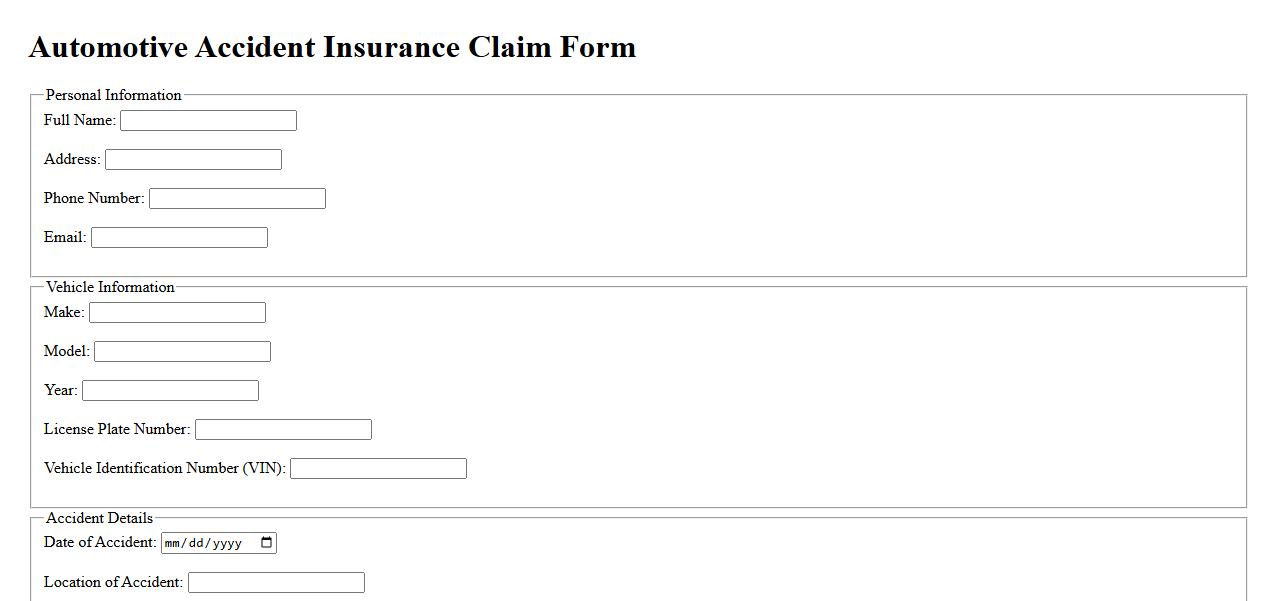

Automotive Accident Insurance Claim Form

The Automotive Accident Insurance Claim Form is a critical document used to report details of a vehicle collision to your insurance provider. It ensures accurate recording of accident information, helping to streamline the claims process. Promptly completing this form can expedite your claim settlement and repair authorization.

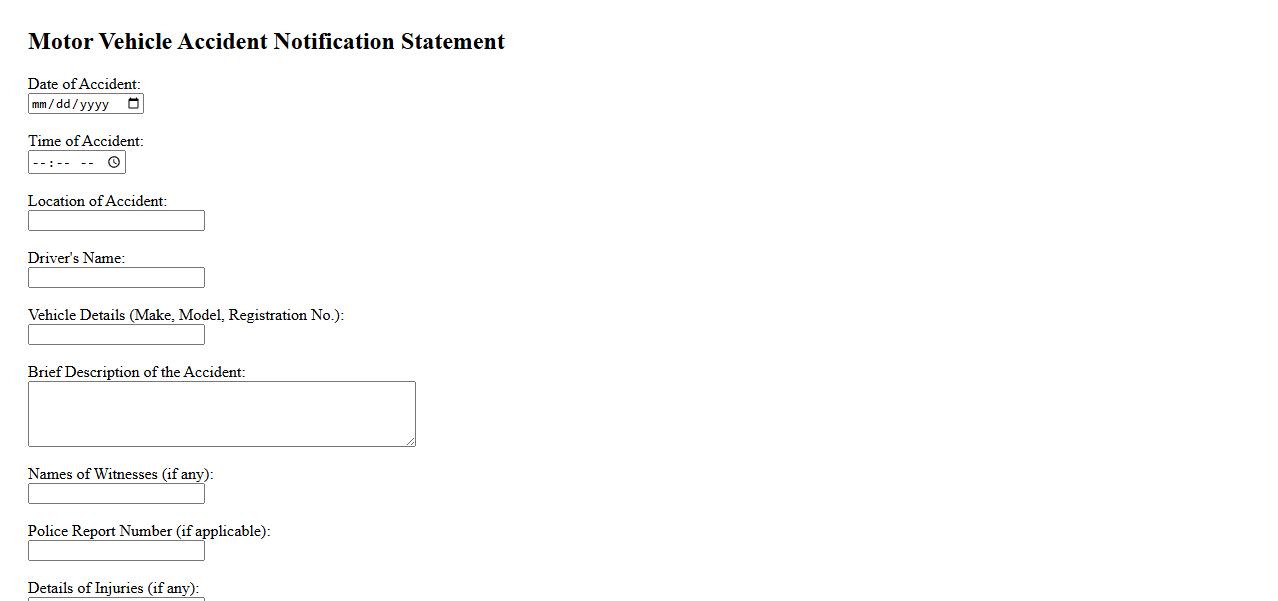

Motor Vehicle Accident Notification Statement

The Motor Vehicle Accident Notification Statement is a crucial document used to report details of a car accident accurately and promptly. It ensures that all parties involved provide consistent and clear information to insurance companies and authorities. Timely submission of this statement helps facilitate the claims process and legal procedures efficiently.

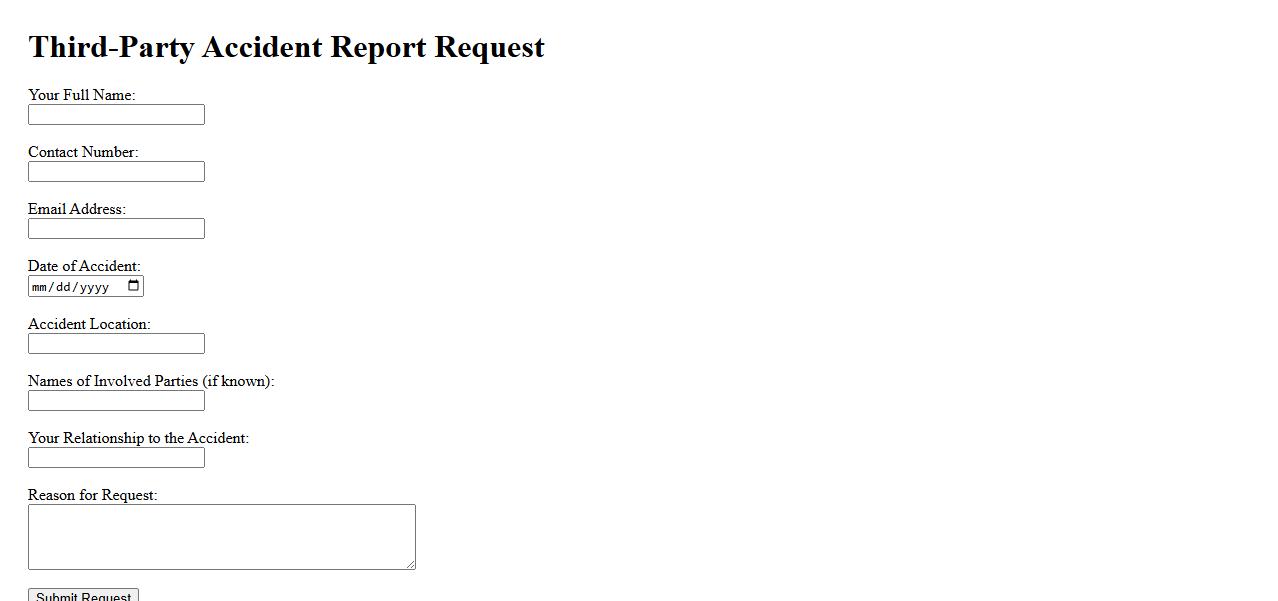

Third-Party Accident Report Request

Filing a Third-Party Accident Report Request allows individuals to obtain official documentation related to an accident involving another party. This report contains detailed information essential for insurance claims and legal proceedings. Ensuring accurate and timely access to third-party accident reports helps simplify dispute resolution and accountability assessment.

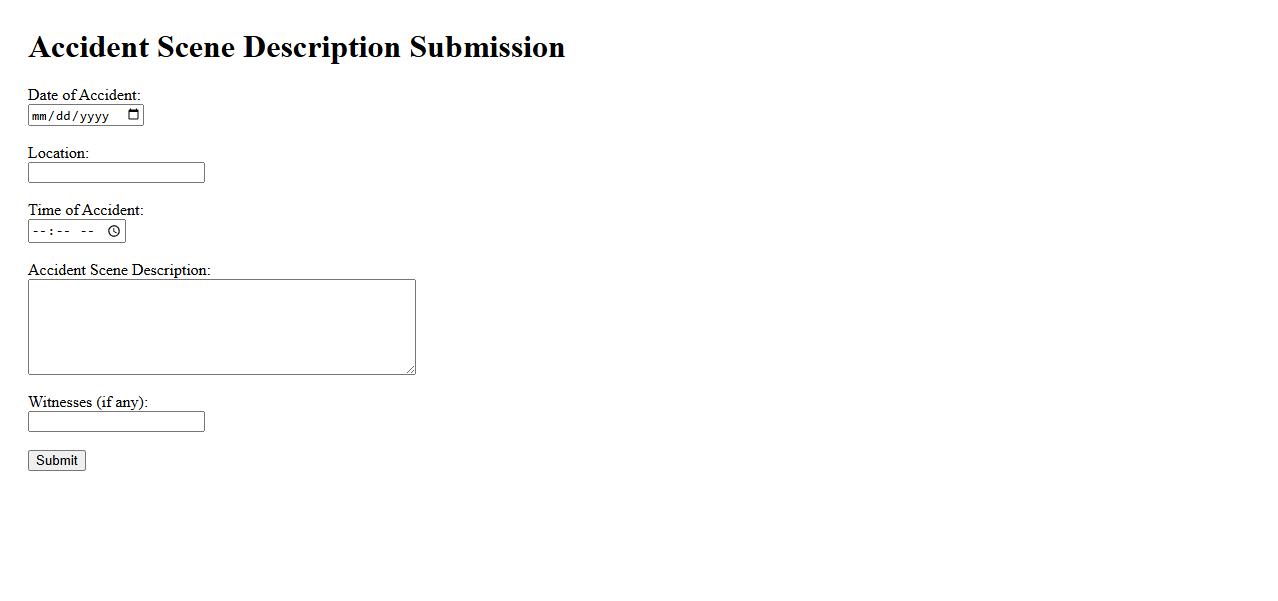

Accident Scene Description Submission

Submit a detailed Accident Scene Description to ensure accurate documentation of the event. Include key factors like location, time, and involved parties to support investigations. Clear descriptions help improve safety and inform insurance claims efficiently.

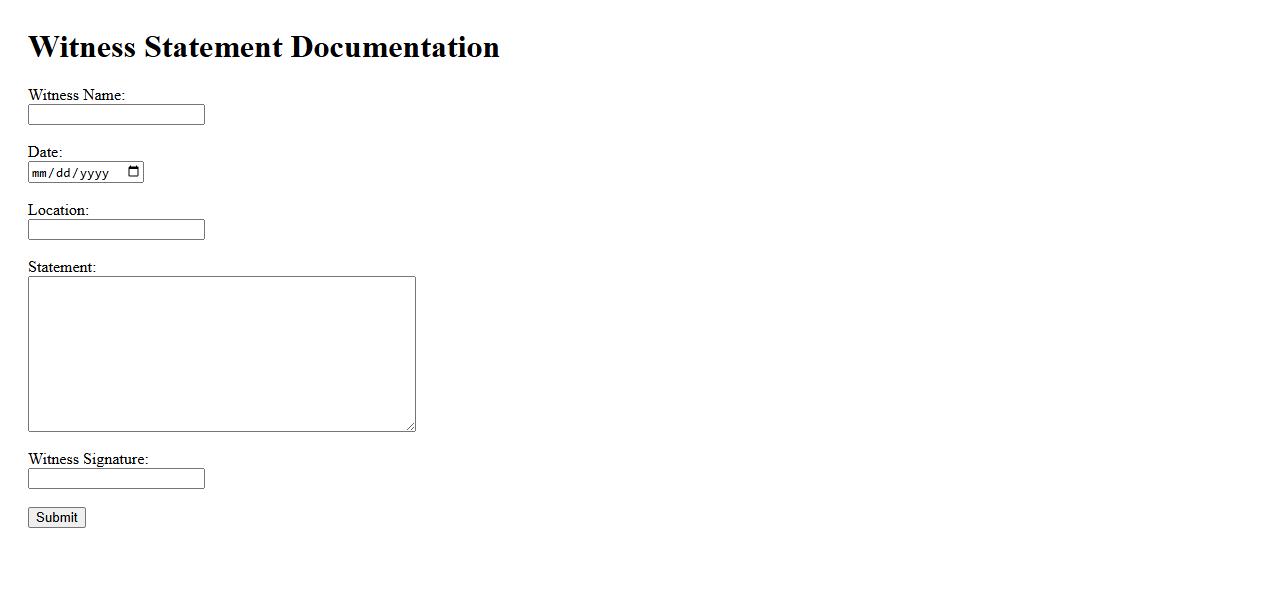

Witness Statement Documentation

Witness Statement Documentation is a critical process in legal and investigative contexts, providing a detailed account of events from an eyewitness perspective. It ensures the accuracy and reliability of testimonies used in court proceedings or internal investigations. Proper documentation helps to verify facts and support the resolution of disputes effectively.

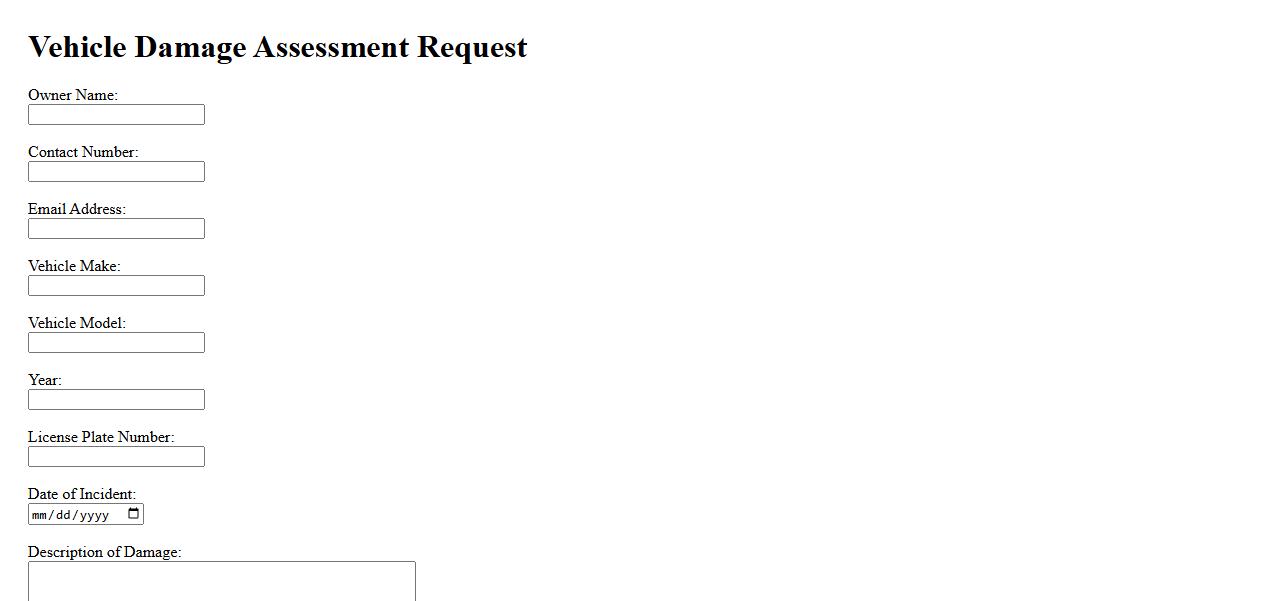

Vehicle Damage Assessment Request

Submit a Vehicle Damage Assessment Request to accurately evaluate the extent of damage after an accident. This process ensures proper documentation and facilitates insurance claims efficiently. Qualified assessors provide detailed reports to help determine repair costs and next steps.

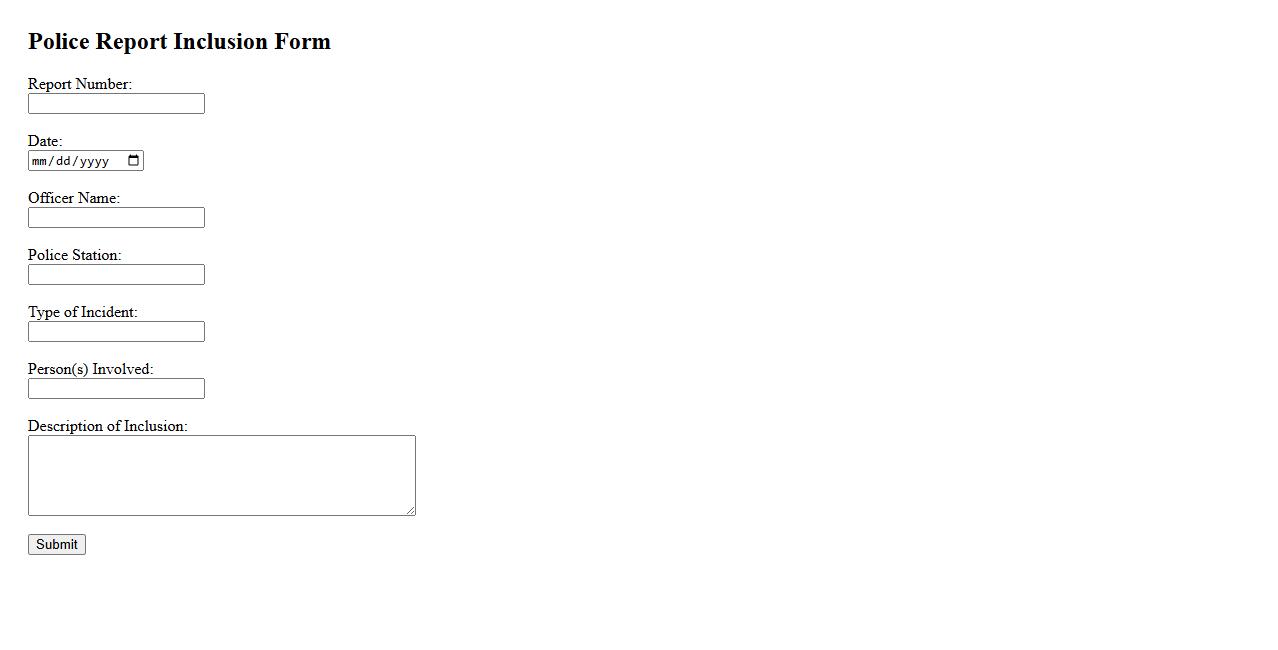

Police Report Inclusion Form

The Police Report Inclusion Form is a crucial document used to formally include detailed information from a police report into official records. It ensures accuracy and transparency by providing a standardized way to document incidents. This form is essential for legal processes and administrative reviews.

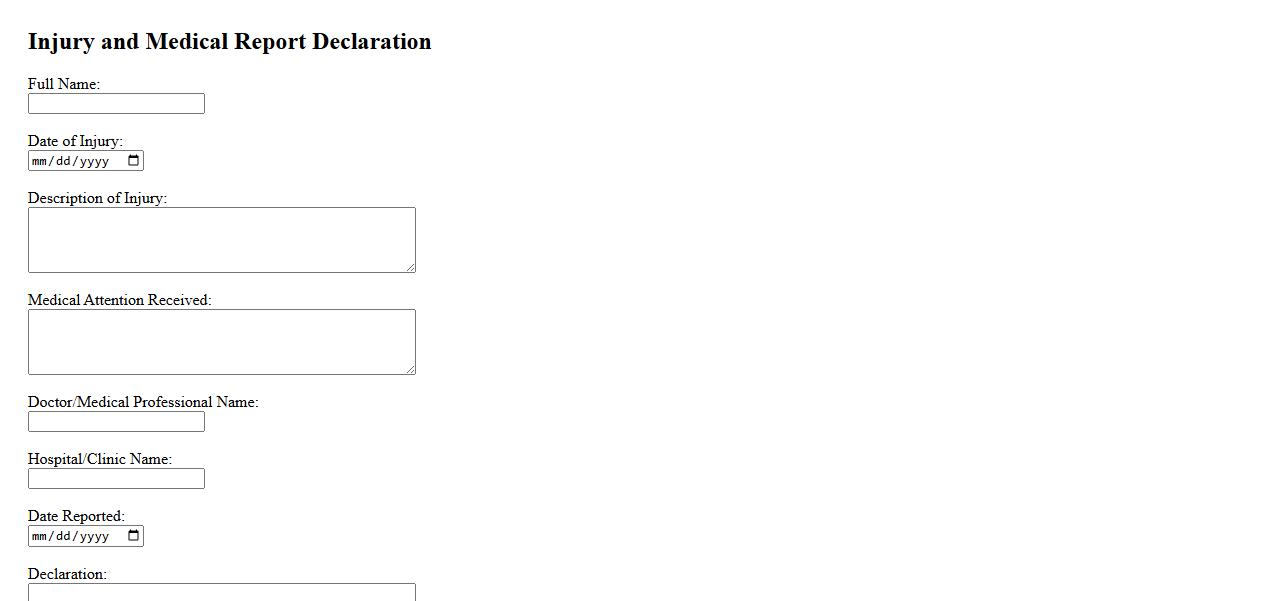

Injury and Medical Report Declaration

The Injury and Medical Report Declaration serves as a formal document detailing the circumstances and extent of an injury. It provides essential information for medical evaluation and legal purposes. Accurate reporting ensures proper treatment and facilitates compensation claims when applicable.

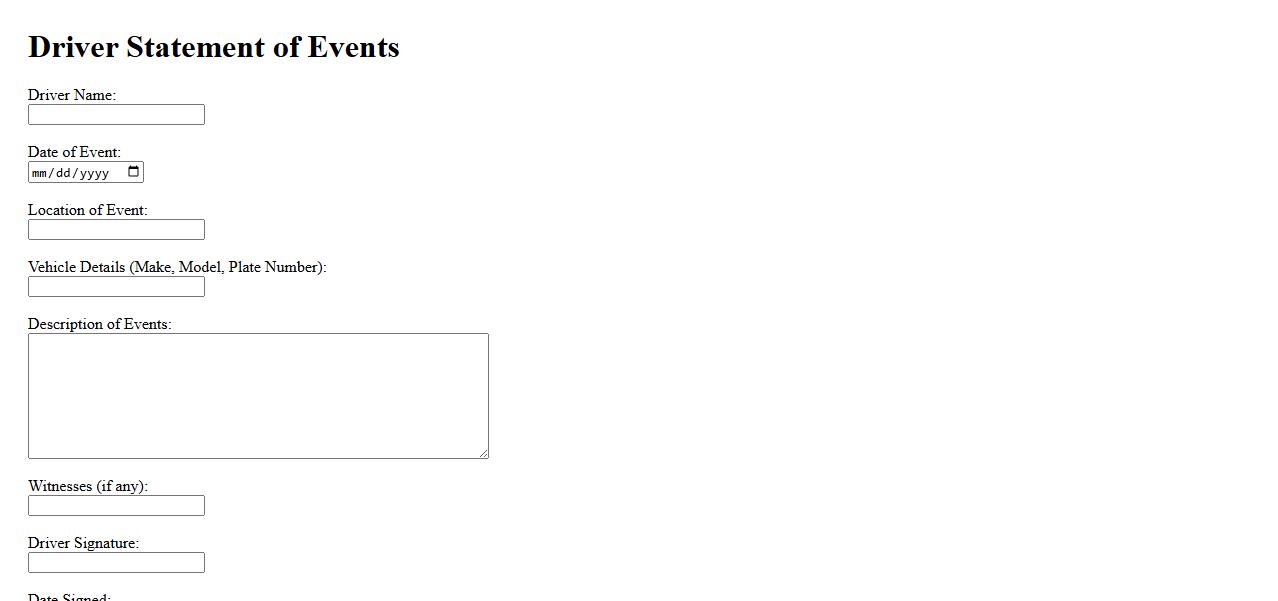

Driver Statement of Events

A Driver Statement of Events is a detailed account provided by a driver, outlining the circumstances and actions leading up to a specific incident or accident. This statement is crucial for insurance claims and legal proceedings, helping to establish fault and clarify events. Accurate and timely completion of the statement ensures a fair assessment of the situation.

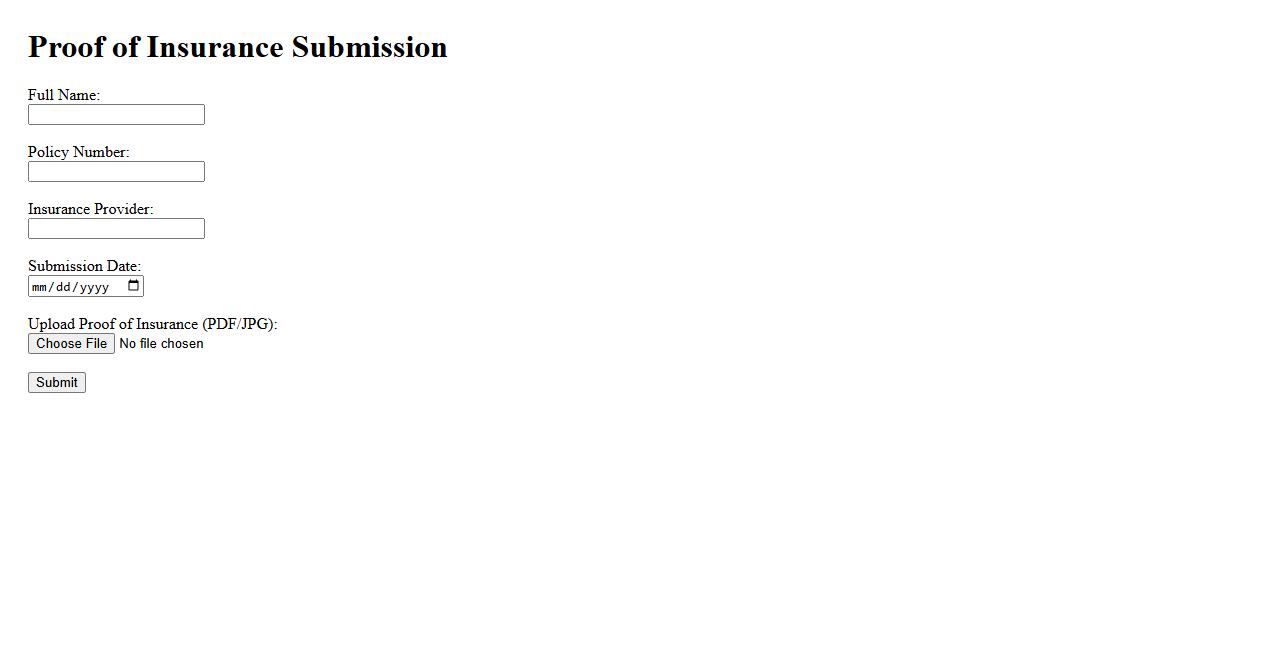

Proof of Insurance Submission

Submitting a Proof of Insurance is essential for confirming your coverage to relevant parties. This document verifies that you have active insurance protection, helping to avoid penalties or service interruptions. Ensure your proof is accurate and submitted promptly to maintain compliance.

What Information is Required to Validate the Insured's Identity on the Claim Document?

The claim document must include the insured's full name to ensure accurate identification. Additionally, the policy number is essential for cross-referencing with the insurance records. Contact details such as phone number or email further authenticate the insured's identity.

How is the Date and Location of the Accident Documented?

The date of the accident is explicitly recorded in the designated date field on the claim form. The location is detailed through an address or specific description of the accident site. Precise documentation helps in investigating and verifying the claim details.

What Evidence or Attachments Must Support the Description of Vehicle Damage?

Photographs of the damaged vehicle are the most crucial visual evidence attached to the claim. A detailed damage assessment report prepared by a qualified mechanic or inspector also supports the claim. These documents validate the extent and nature of the damage described.

Which Section of the Claim Form Captures Third-Party or Witness Details?

The claim form includes a specific section labeled Third-Party or Witness Information for recording relevant details. This part collects names, contact numbers, and statements of any individuals involved or witnessing the incident. Accurate witness data supports claim verification and dispute resolution.

How are Previous Insurance Claims Related to the Same Vehicle Disclosed in the Document?

Previous insurance claims are disclosed in a designated section titled Claim History on the form. This section requires details such as date, nature of the claim, and the amount paid previously. Transparent disclosure ensures proper assessment of the current claim's validity.