To file a claim for travel insurance benefits, gather all necessary documentation such as receipts, proof of loss, and policy details. Submit the completed claim form to your insurance provider promptly to ensure timely processing. Keep copies of all correspondence and follow up regularly to track the status of your claim.

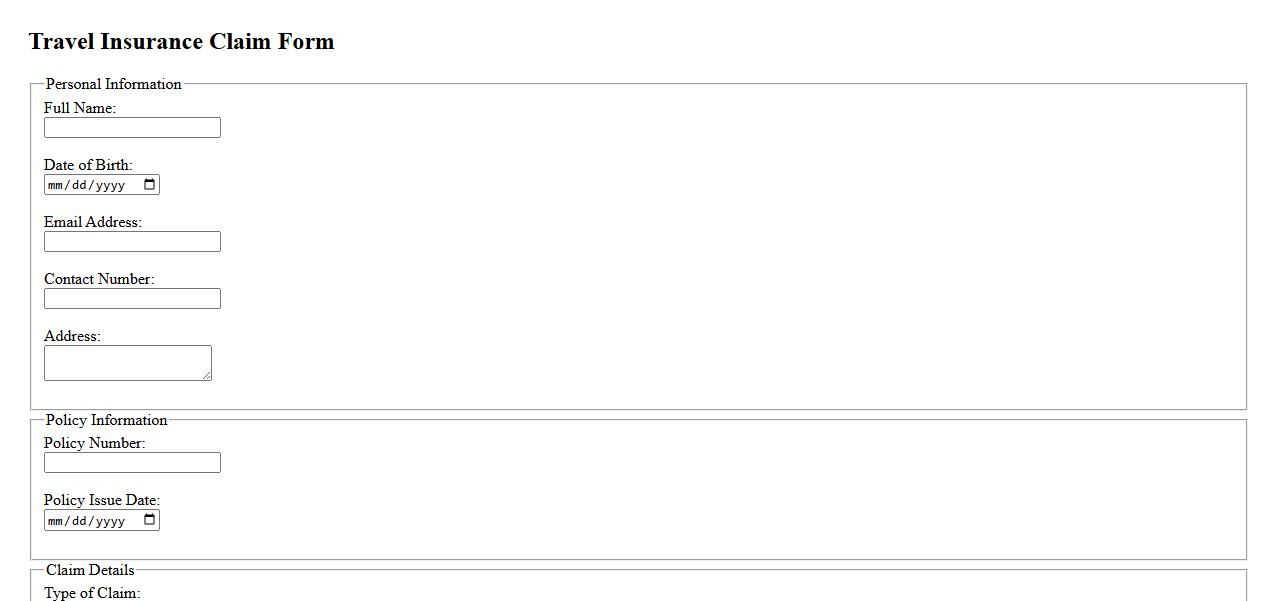

Travel Insurance Claim Form

The Travel Insurance Claim Form is a vital document for policyholders seeking reimbursement for covered expenses during their trip. It ensures that all necessary details and supporting evidence are submitted accurately to process the claim efficiently. Filling out this form correctly helps travelers receive timely financial assistance after an unexpected event.

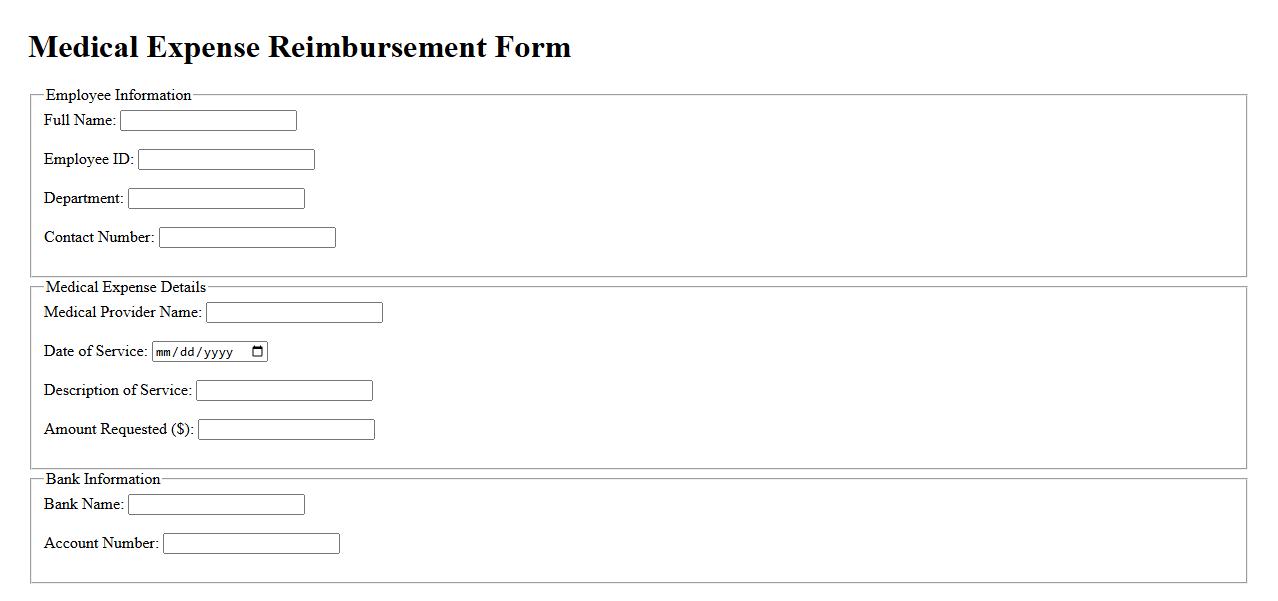

Medical Expense Reimbursement Form

The Medical Expense Reimbursement Form is a crucial document used to claim reimbursements for out-of-pocket healthcare expenses. It ensures that individuals can recover costs associated with medical treatments, prescriptions, and hospital visits. Proper completion of this form streamlines the reimbursement process and provides transparency between patients and healthcare providers.

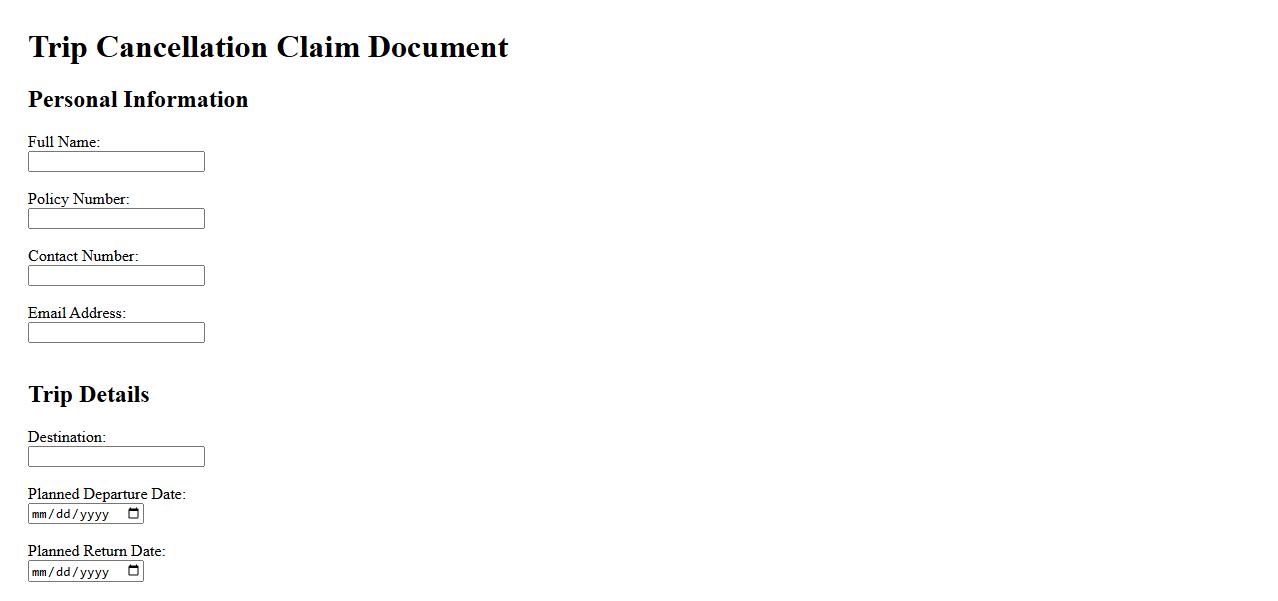

Trip Cancellation Claim Document

A Trip Cancellation Claim Document is essential for requesting reimbursement after a trip is canceled due to unforeseen events. This document typically includes proof of payment, the reason for cancellation, and any related correspondence. Properly submitting this paperwork ensures a smoother claims process with your travel insurance provider.

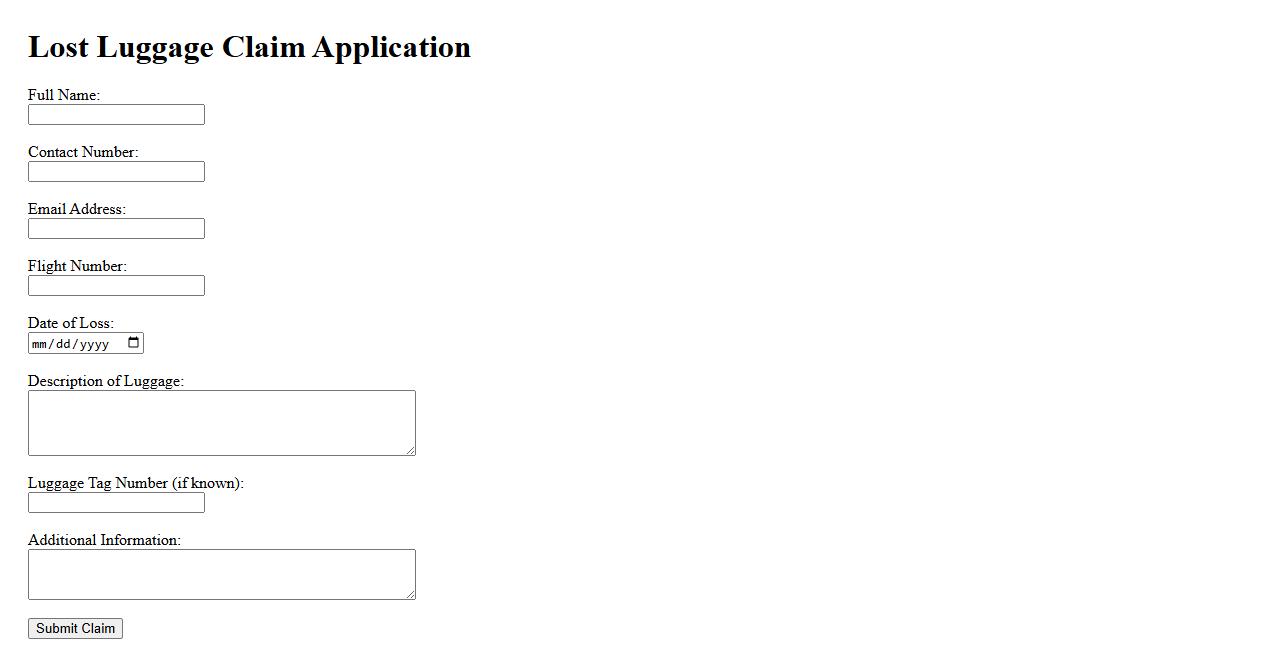

Lost Luggage Claim Application

Filing a Lost Luggage Claim Application is essential when your baggage goes missing during travel. This process helps you notify the airline and ensures that your lost items can be tracked or compensated. Submitting accurate details promptly increases the chances of recovering your belongings efficiently.

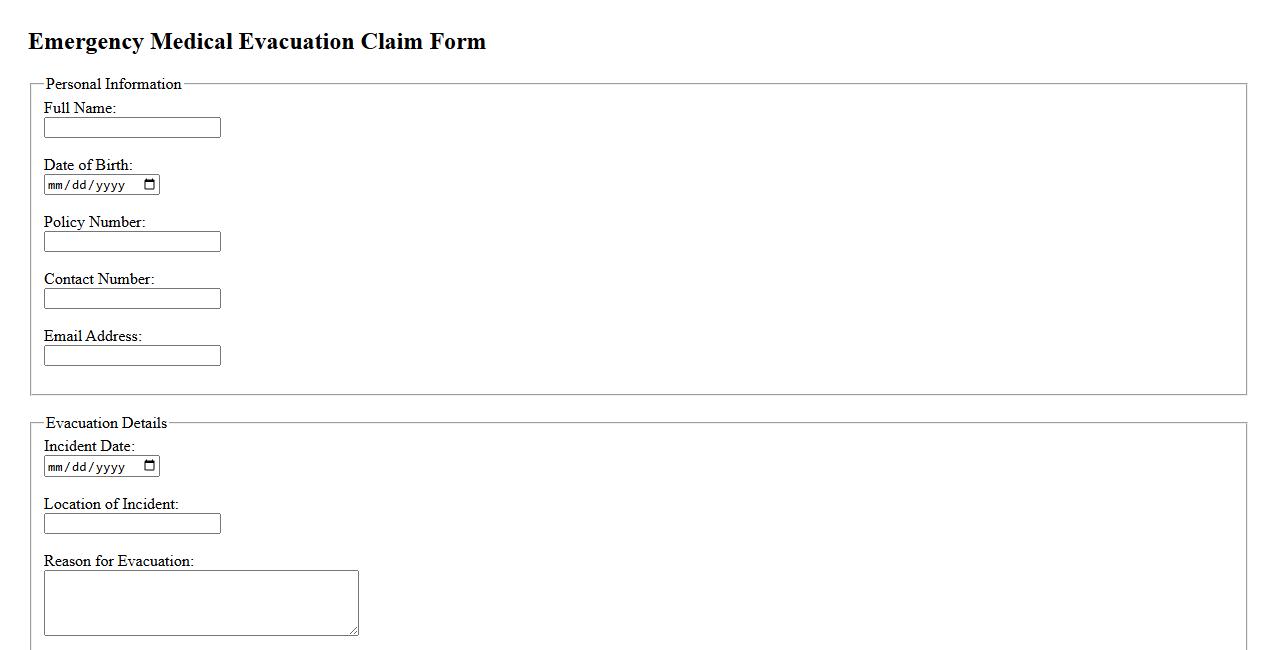

Emergency Medical Evacuation Claim

An Emergency Medical Evacuation Claim involves requesting reimbursement or coverage for urgent medical transport services needed during a health crisis. This claim ensures that individuals receive immediate transfer to appropriate medical facilities when local treatment options are insufficient. Timely submission of accurate documentation is essential for successful claim processing.

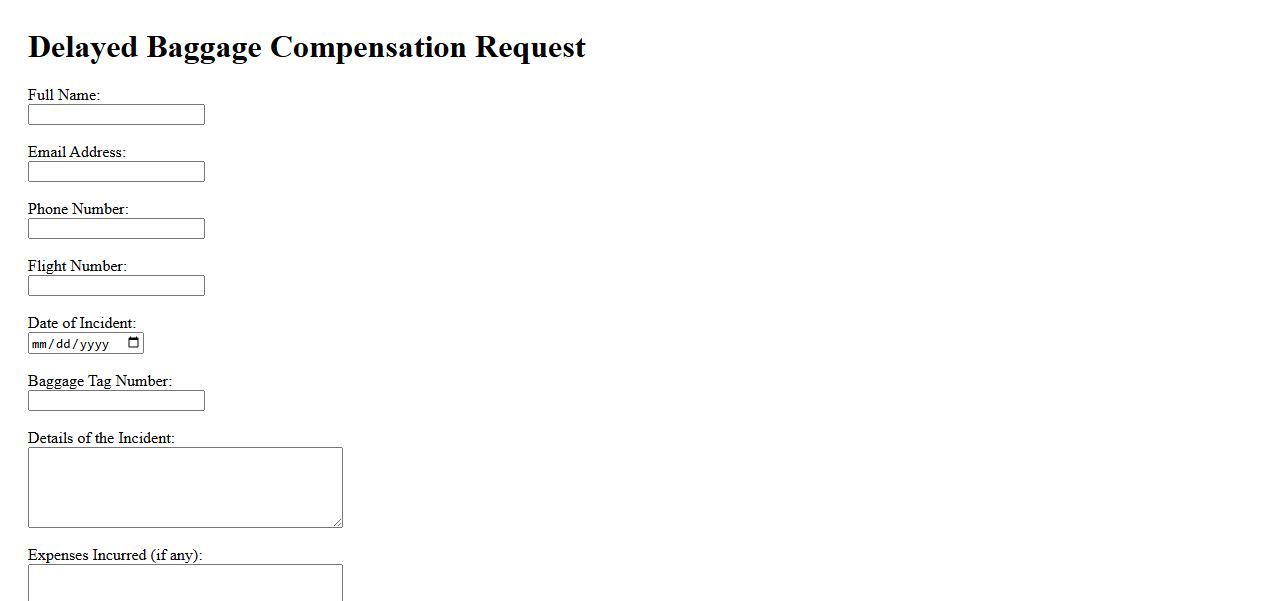

Delayed Baggage Compensation Request

If your luggage arrives late, you have the right to file a Delayed Baggage Compensation Request to recover expenses incurred. This process ensures airlines take responsibility for the inconvenience caused by travel disruptions. Prompt submission with all required documents improves the chances of a successful claim.

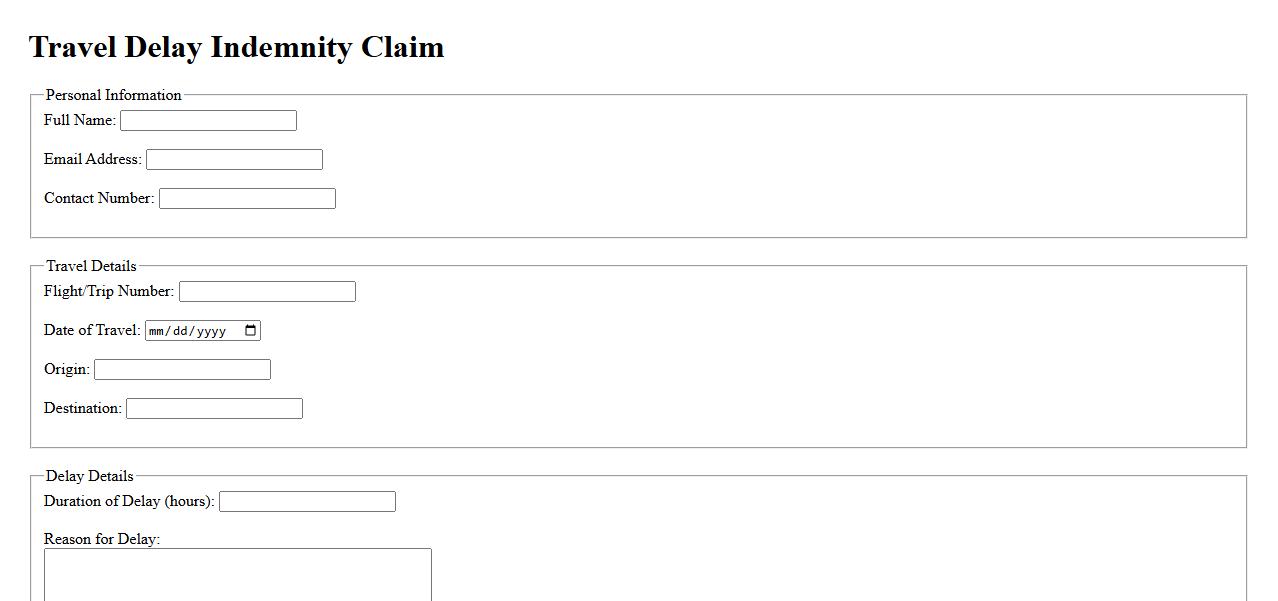

Travel Delay Indemnity Claim

A Travel Delay Indemnity Claim is a formal request for compensation due to unexpected disruptions during a trip. It helps travelers recover costs for delays caused by factors like weather, mechanical issues, or other unforeseen events. This claim ensures protection and financial support when your travel plans are interrupted.

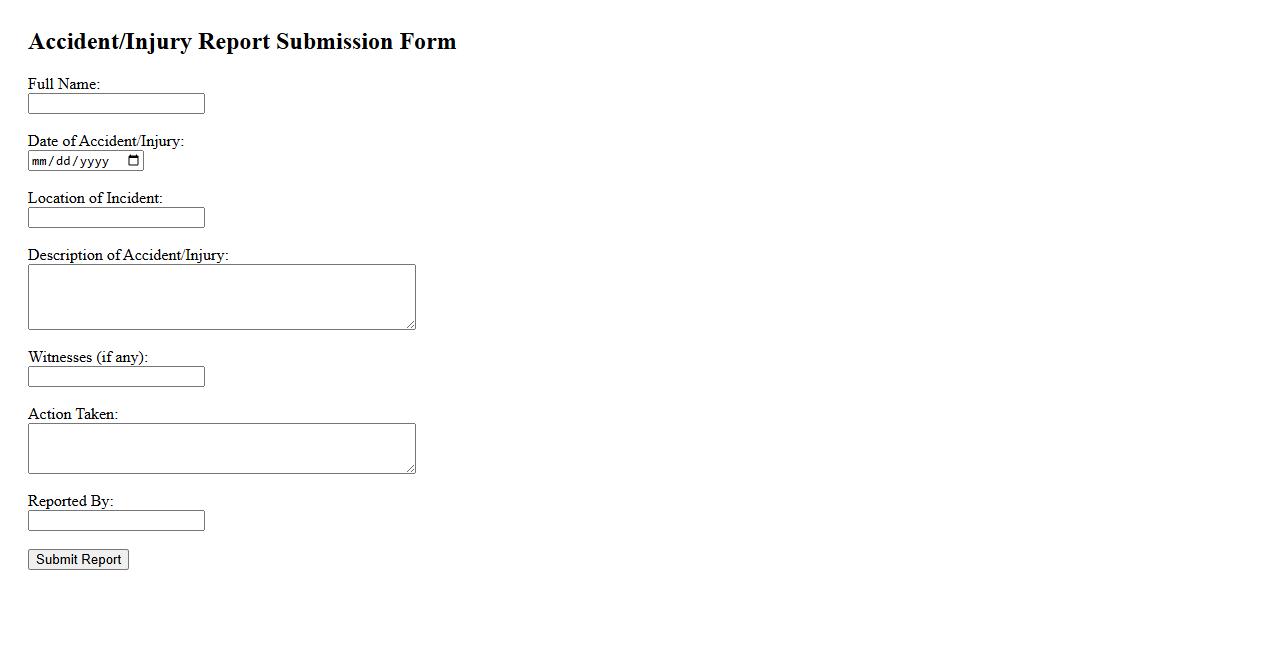

Accident/Injury Report Submission

The Accident/Injury Report Submission process ensures timely documentation of any workplace incidents to promote safety and compliance. Accurate reporting helps identify hazards and prevent future accidents. All employees are encouraged to submit detailed reports immediately after an incident occurs.

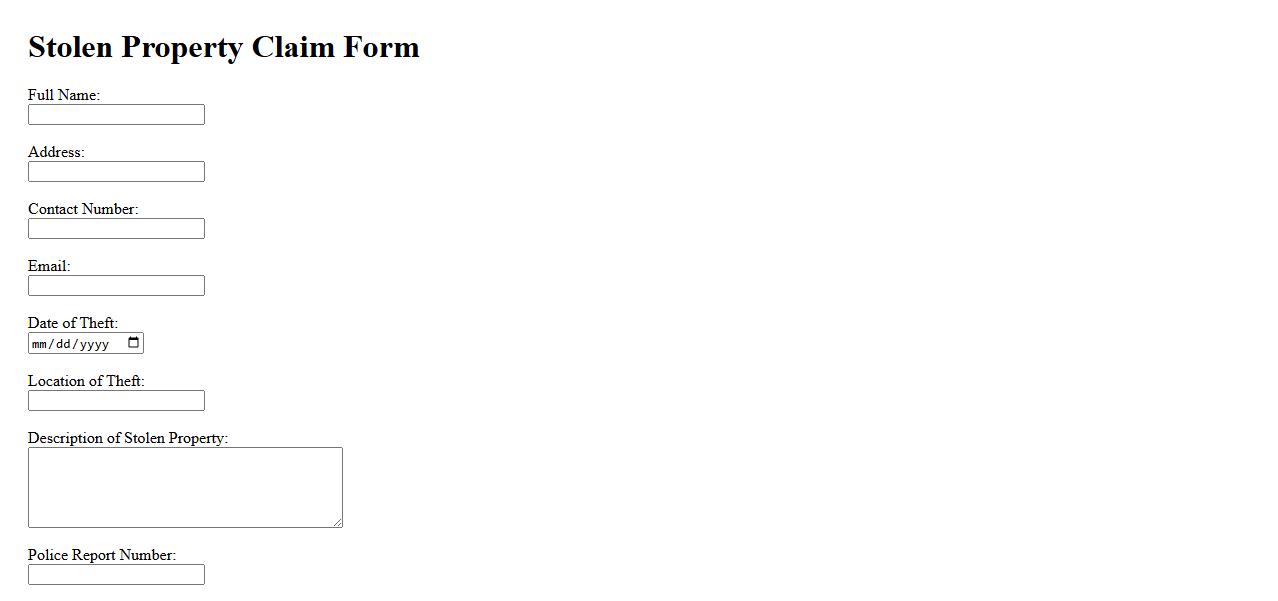

Stolen Property Claim Form

The Stolen Property Claim Form is a document used to report and request reimbursement for items that have been stolen. It ensures accurate processing of claims by providing essential details about the lost property. Submitting this form promptly helps facilitate a smoother resolution with insurance companies or authorities.

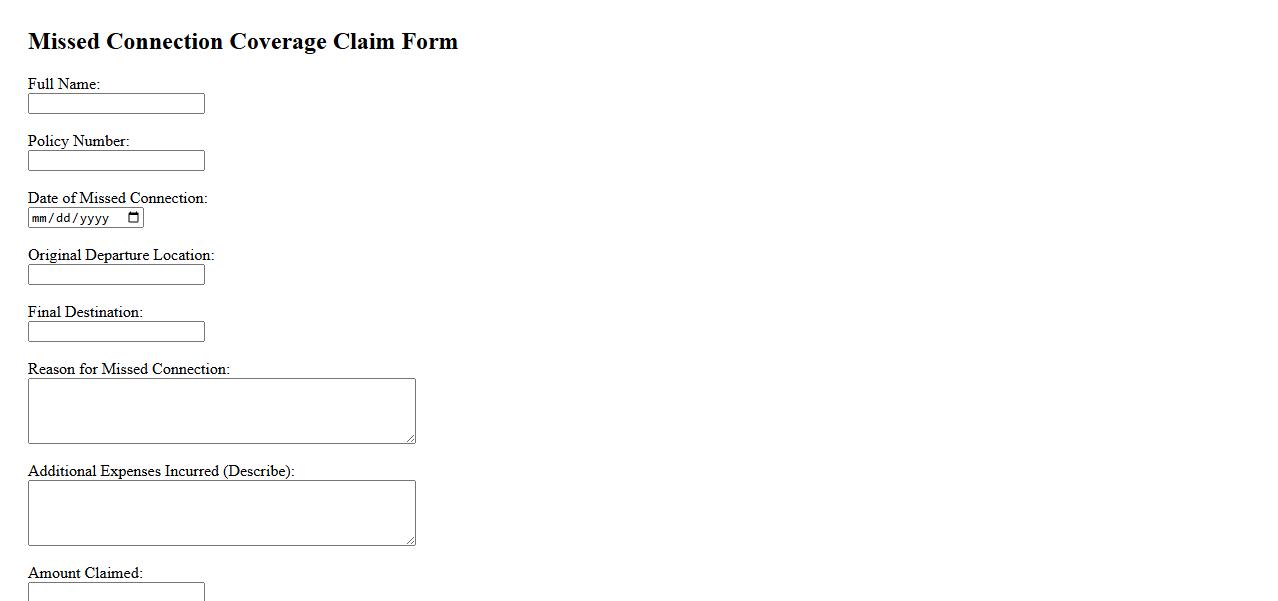

Missed Connection Coverage Claim

Missed Connection Coverage Claim provides financial protection when your travel plans are disrupted due to unforeseen delays causing you to miss a connecting flight or transportation. This insurance helps cover additional expenses such as accommodation, meals, and alternative travel arrangements. It ensures peace of mind by minimizing the impact of transit disruptions on your journey.

What is the purpose of submitting the Claim for Travel Insurance Benefits document?

The primary purpose of submitting the Claim for Travel Insurance Benefits document is to formally request reimbursement or compensation for covered travel-related losses. This document initiates the claims process with the insurance provider, allowing them to assess the validity of the claim. It serves as official evidence that the insured seeks to recover expenses or damages incurred during their trip.

Which specific event or incident is being claimed under the travel insurance policy?

The claimed event typically involves an unforeseen circumstance such as trip cancellation, medical emergencies, lost baggage, or travel delays. The specific incident must be directly covered under the insurance policy's terms. Accurate identification ensures that the claim is processed promptly and correctly.

Who is the insured person(s) listed on the travel insurance claim?

The insured person(s) are those individuals who purchased and are protected under the travel insurance policy. Their details, including names and policy numbers, must be accurately provided on the claim form. This information verifies eligibility for benefits according to the policy coverage.

What supporting documents or evidence are required for this particular claim?

Supporting documents often include receipts, medical reports, police reports, and travel itineraries relevant to the claim. These evidentiary materials validate the event causing the claim and substantiate the amount requested. Proper documentation is crucial to avoid delays or denial of the claim.

What coverage limits and exclusions apply to the claimed travel event?

Coverage limits define the maximum amount the insurer will pay for a particular event, while exclusions specify situations not covered by the policy. Understanding these policy limitations helps claimants set realistic expectations. Both factors are outlined in the insurance contract and are key to claim approval.