A claim for life insurance proceeds involves the process by which a beneficiary requests payment from the insurance company after the policyholder's death. It requires submitting necessary documents such as the death certificate and completed claim forms to verify the claim. Prompt and accurate filing ensures timely access to the benefits intended for financial support.

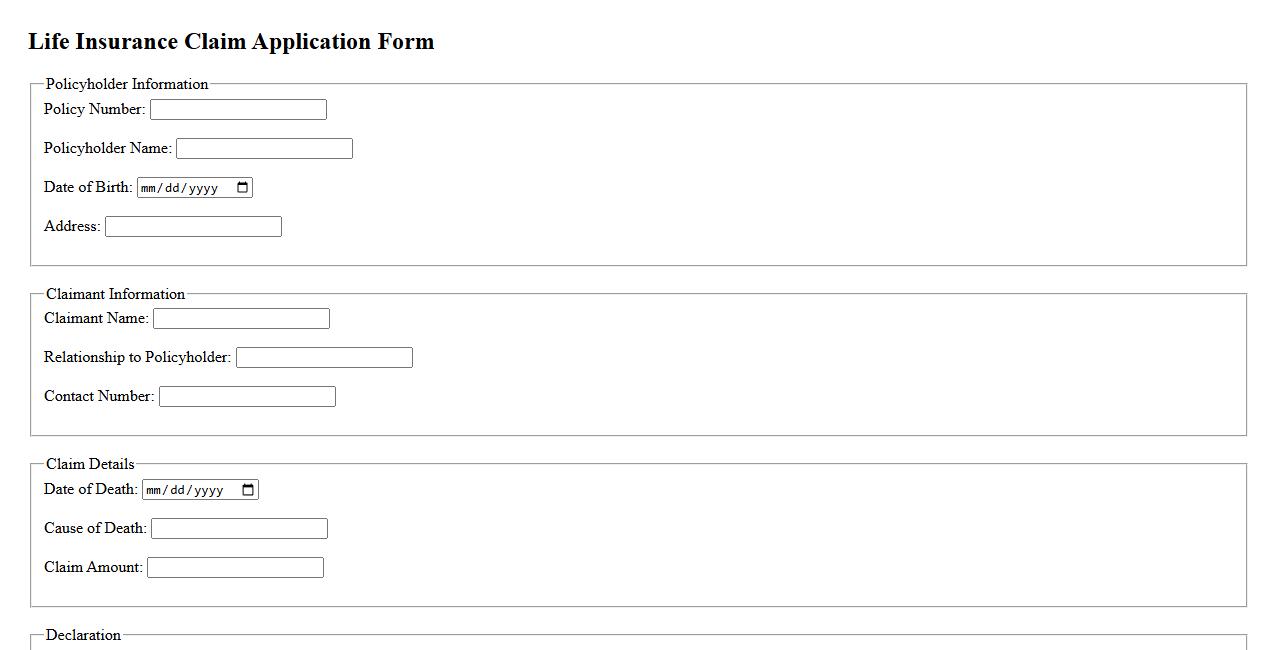

Life Insurance Claim Application Form

The Life Insurance Claim Application Form is a crucial document required to initiate the process of claiming the insurance benefits after the policyholder's demise. This form collects essential information about the policy, the claimant, and the circumstances of the claim. Accurate completion of the form ensures timely processing and disbursement of the insurance amount to the beneficiaries.

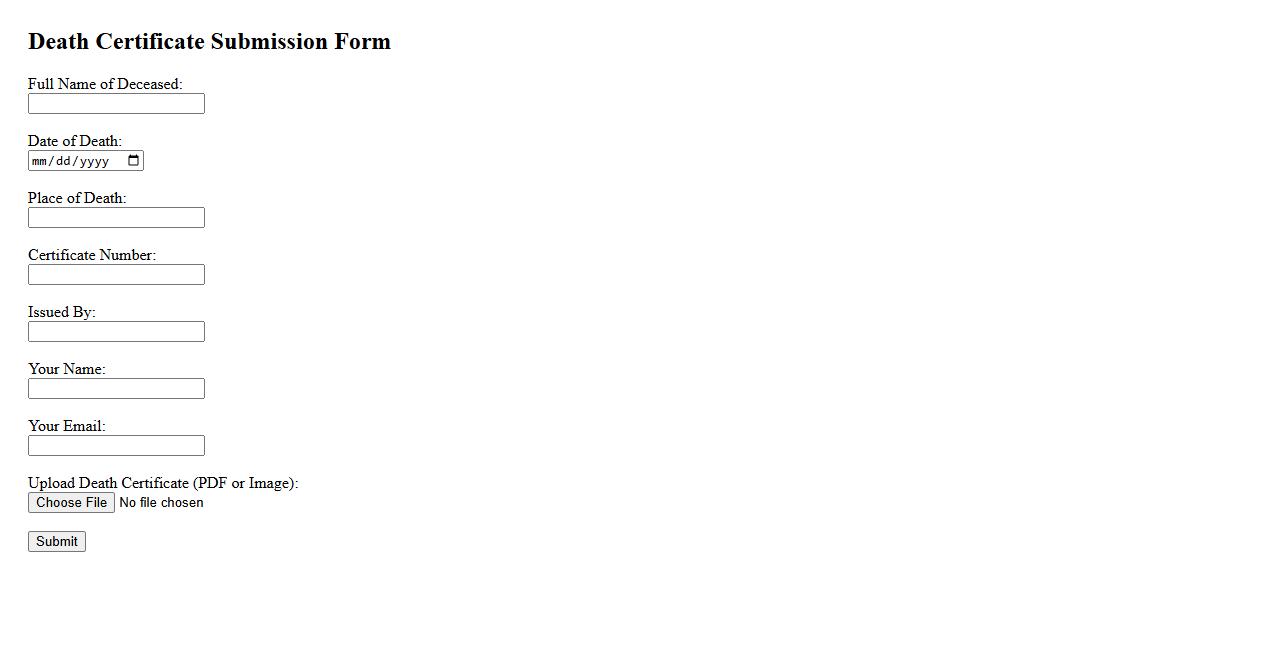

Death Certificate Submission Form

The Death Certificate Submission Form is used to formally submit a deceased person's death certificate to the relevant authorities. This document helps in verifying the death for legal, administrative, and healthcare purposes. Timely submission ensures proper record keeping and processing of related claims and benefits.

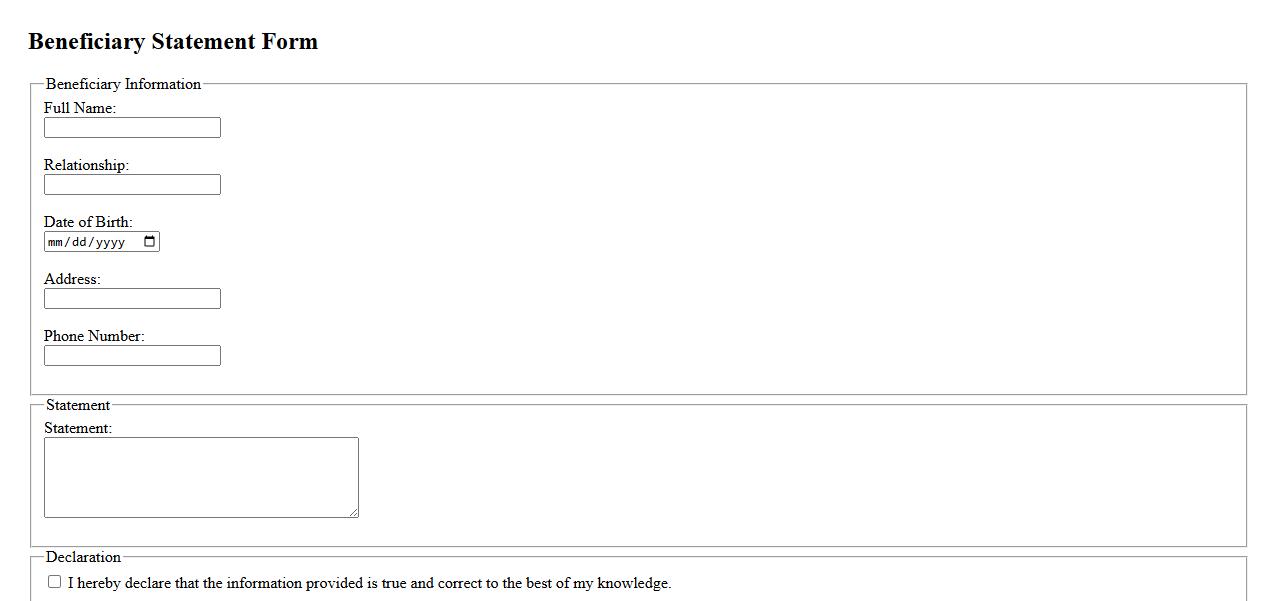

Beneficiary Statement Form

The Beneficiary Statement Form is a crucial document used to designate individuals entitled to receive benefits from a policy or account. This form ensures clear communication of beneficiary details to the institution managing the funds. Accurate completion of the form helps prevent disputes and facilitates timely distribution of assets.

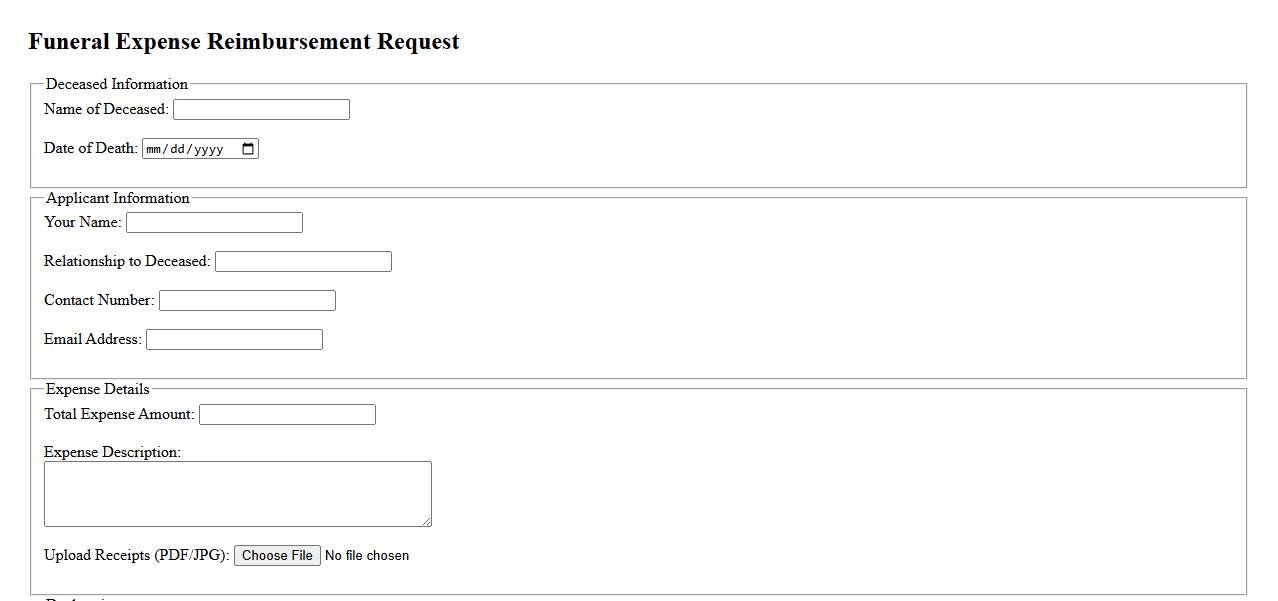

Funeral Expense Reimbursement Request

A Funeral Expense Reimbursement Request is a formal application submitted to recover costs associated with funeral services. It typically includes documentation of expenses and proof of payment. This request helps alleviate financial burdens during a difficult time.

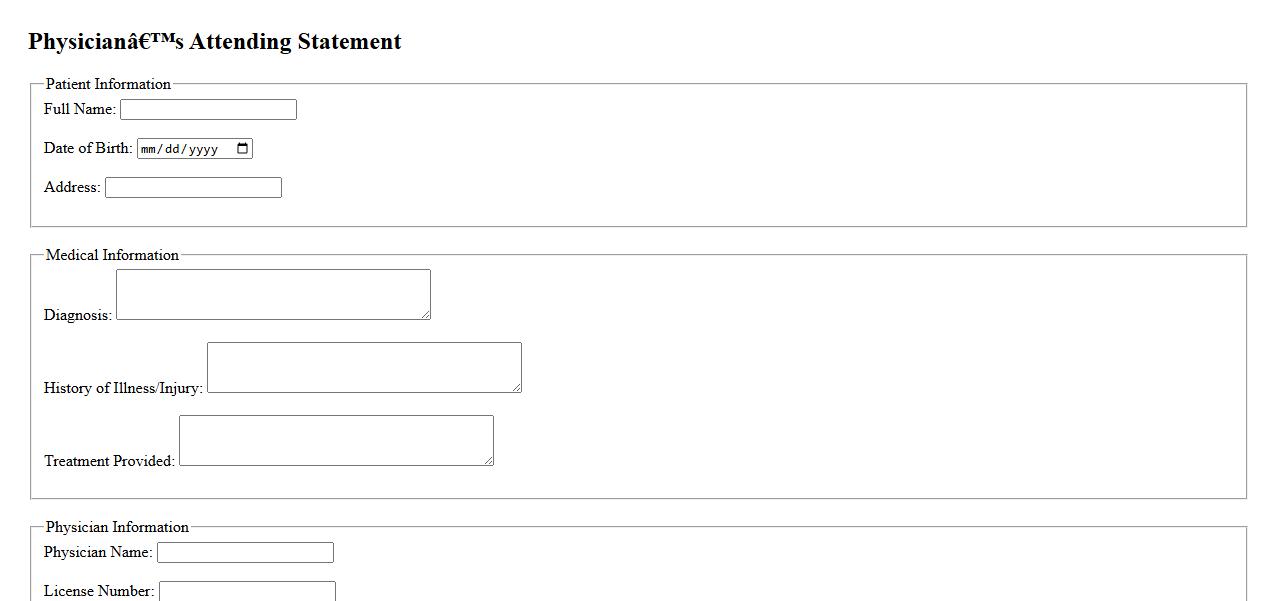

Physician’s Attending Statement

The Physician's Attending Statement is a critical document completed by a healthcare provider to detail a patient's medical condition and treatment history. It aids insurance companies and medical professionals in assessing claims and making informed decisions. This statement ensures clear communication between the physician and relevant parties involved in the care process.

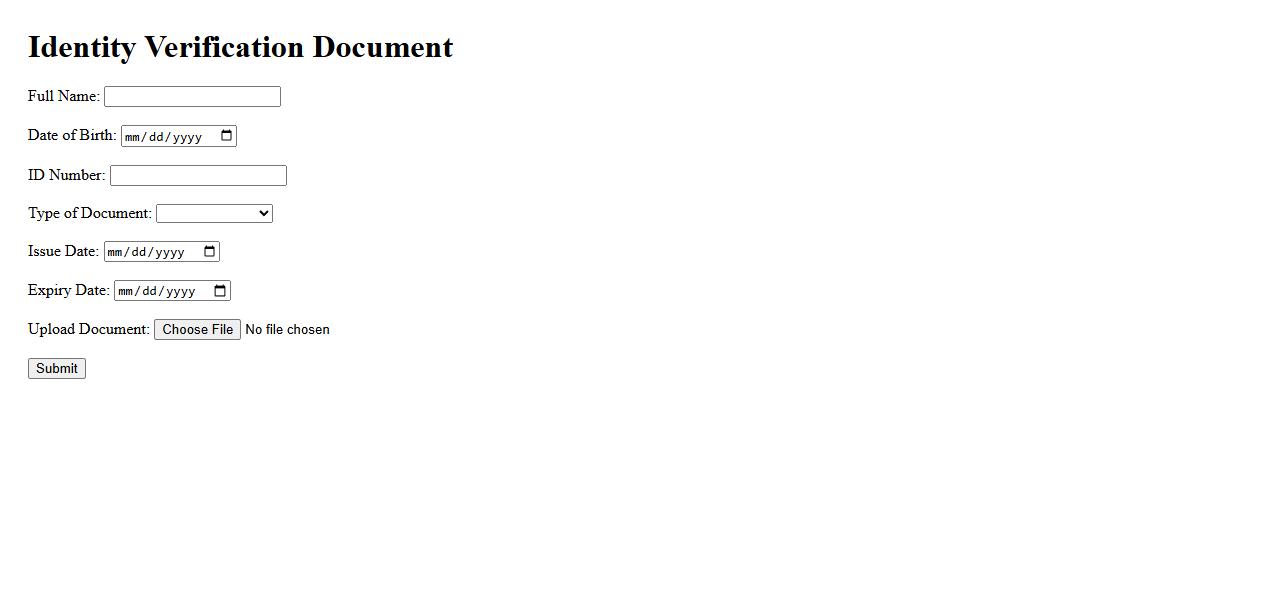

Identity Verification Document

Identity Verification Document is a critical tool used to confirm an individual's identity in various transactions and processes. These documents often include passports, driver's licenses, or national ID cards, ensuring security and trustworthiness. Proper identity verification helps prevent fraud and unauthorized access to sensitive information.

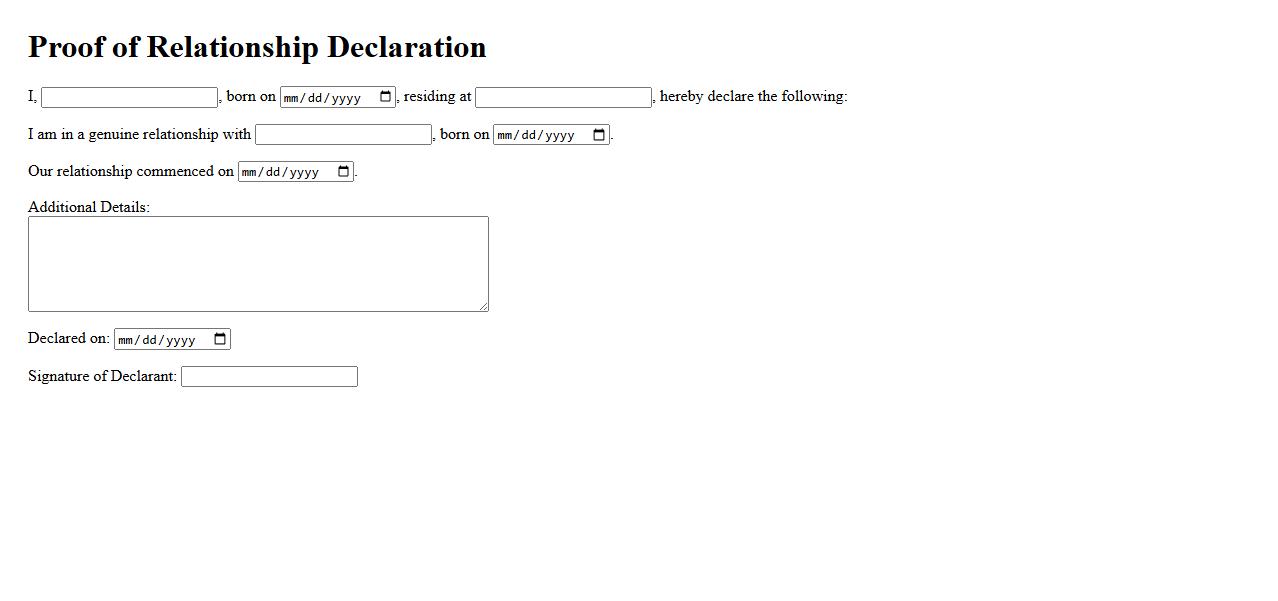

Proof of Relationship Declaration

The Proof of Relationship Declaration is a crucial document that confirms the genuine connection between individuals, often used for legal or immigration purposes. It provides official evidence to support claims of familial or personal relationships. This declaration helps authorities verify identities and maintain the integrity of applications.

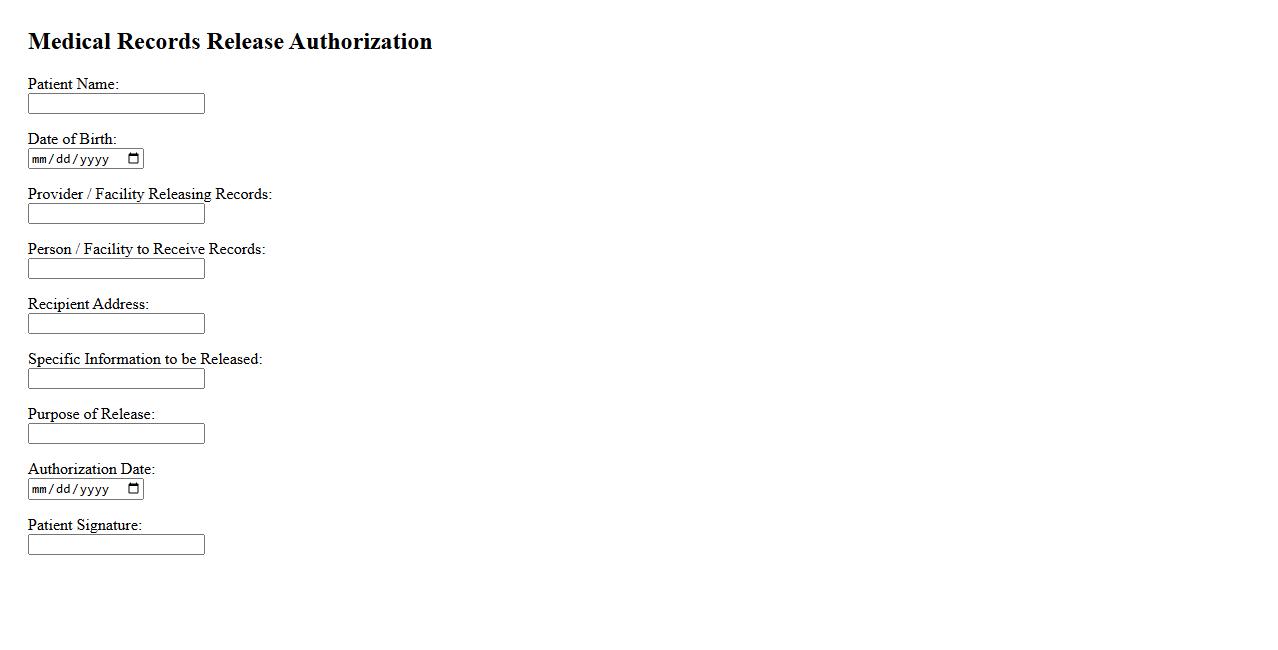

Medical Records Release Authorization

The Medical Records Release Authorization is a crucial document that permits healthcare providers to share a patient's medical history with authorized individuals or organizations. This authorization ensures compliance with privacy regulations while facilitating the transfer of important health information. Patients must carefully review and sign this form to allow access to their medical records.

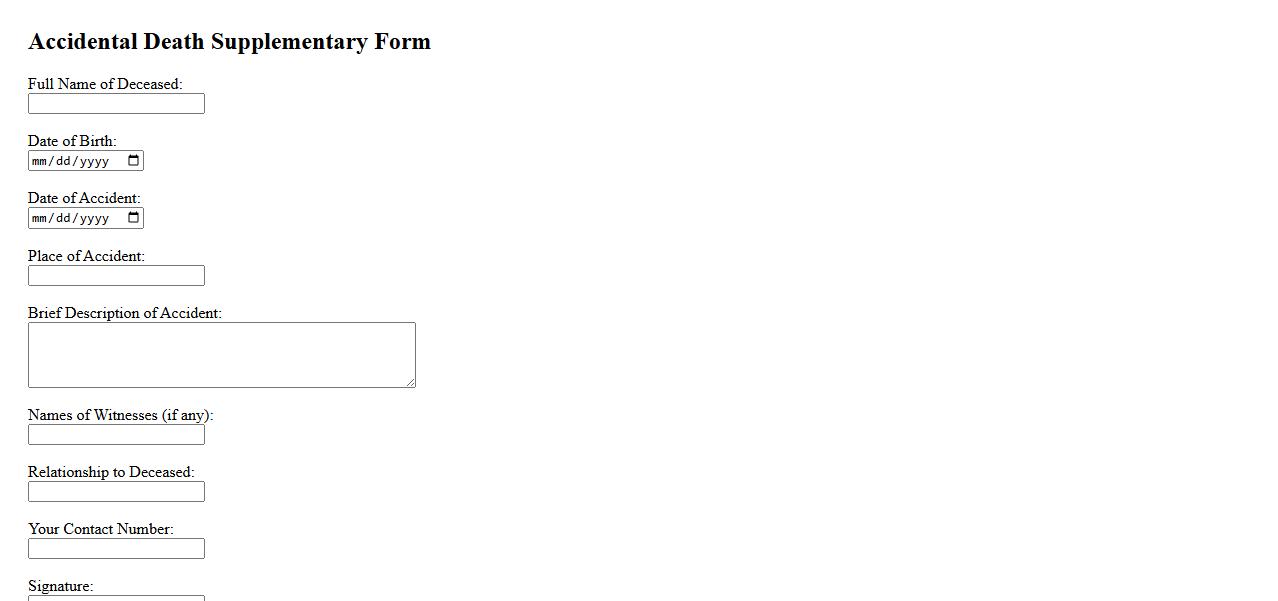

Accidental Death Supplementary Form

The Accidental Death Supplementary Form is a crucial document used to provide additional details related to a policyholder's accidental death claim. This form ensures accurate processing by capturing specific information beyond the standard claim form. Completing it thoroughly helps expedite claim approval and benefits disbursement.

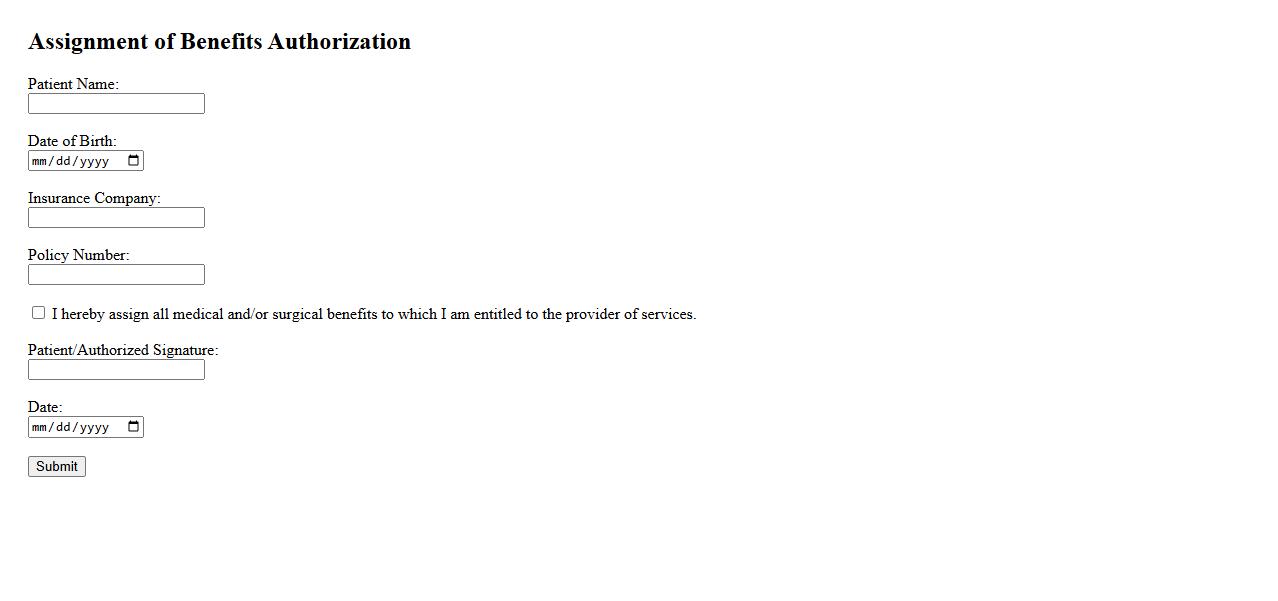

Assignment of Benefits Authorization

The Assignment of Benefits Authorization allows a policyholder to transfer their insurance claim rights directly to a third party. This authorization simplifies the payment process, enabling service providers to receive claims payments directly from the insurance company. It is essential for ensuring timely and efficient claim settlements.

What are the eligibility criteria for submitting a claim for life insurance proceeds?

To submit a claim for life insurance proceeds, the claimant must be a designated beneficiary listed in the policy or the policyholder's legal representative. The policy must be active and in force at the time of the insured's death. Additionally, the claimant needs to provide proof of death and adhere to the insurer's specific claim requirements.

Who can be recognized as a valid beneficiary in the life insurance claim process?

A valid beneficiary can be an individual, multiple people, or entities named in the policy, such as family members or trusts. Beneficiaries must be clearly identified in the insurance contract to avoid disputes. In cases without a named beneficiary, the proceeds usually pass to the estate of the deceased insured.

What key documents are required to support a claim for life insurance proceeds?

Essential documents include the original insurance policy, death certificate, and the completed claim form provided by the insurer. Additional paperwork may involve identity proof of the claimant and any medical records if cause of death is under review. Submitting accurate and complete documentation helps expedite claim approval.

What common reasons might lead to the denial or delay of a life insurance claim?

Claims may be denied or delayed due to incomplete documentation, non-disclosure, or suspected fraud. Contestability periods and discrepancies in the insured's medical history can also halt processing. Delays often occur when the insurer requires further investigation to validate the claim's legitimacy.

What is the standard procedure and timeline for processing life insurance claims?

The standard procedure involves claim submission, verification of documents, and validation of the insured's death. Typically, insurers process claims within 30 to 60 days, although complex cases may take longer. Prompt communication between the claimant and insurer is crucial for timely settlement of the proceeds.