Claim for Travel Expenses allows employees or individuals to request reimbursement for costs incurred during work-related travel, such as transportation, accommodation, and meals. This process typically requires submitting detailed receipts and proof of travel within a specified timeframe. Proper documentation ensures accurate compensation and compliance with company policies or tax regulations.

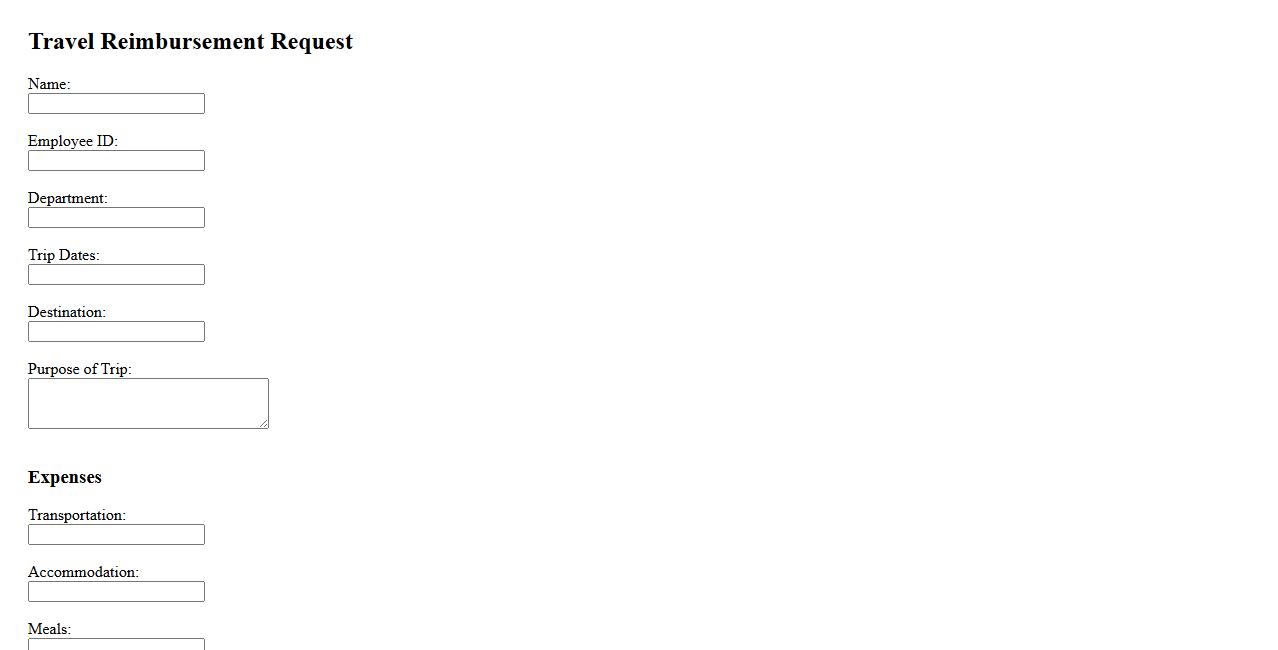

Travel Reimbursement Request

Travel Reimbursement Request is a formal procedure used to claim expenses incurred during business or official travel. It involves submitting receipts and documentation to verify costs such as transportation, lodging, and meals. This process ensures employees are compensated promptly and accurately for their travel-related expenditures.

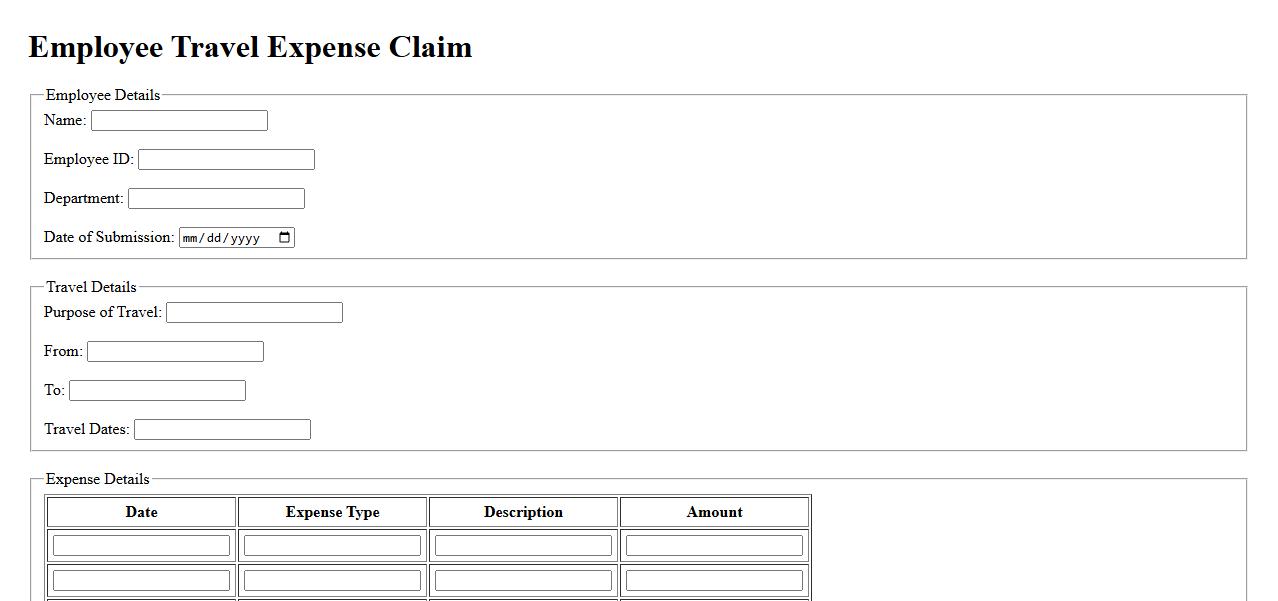

Employee Travel Expense Claim

An Employee Travel Expense Claim is a formal request submitted by employees to reimburse costs incurred during business trips. It includes documentation of travel-related expenses such as transportation, meals, and lodging. Properly managing these claims ensures accurate accounting and timely reimbursement.

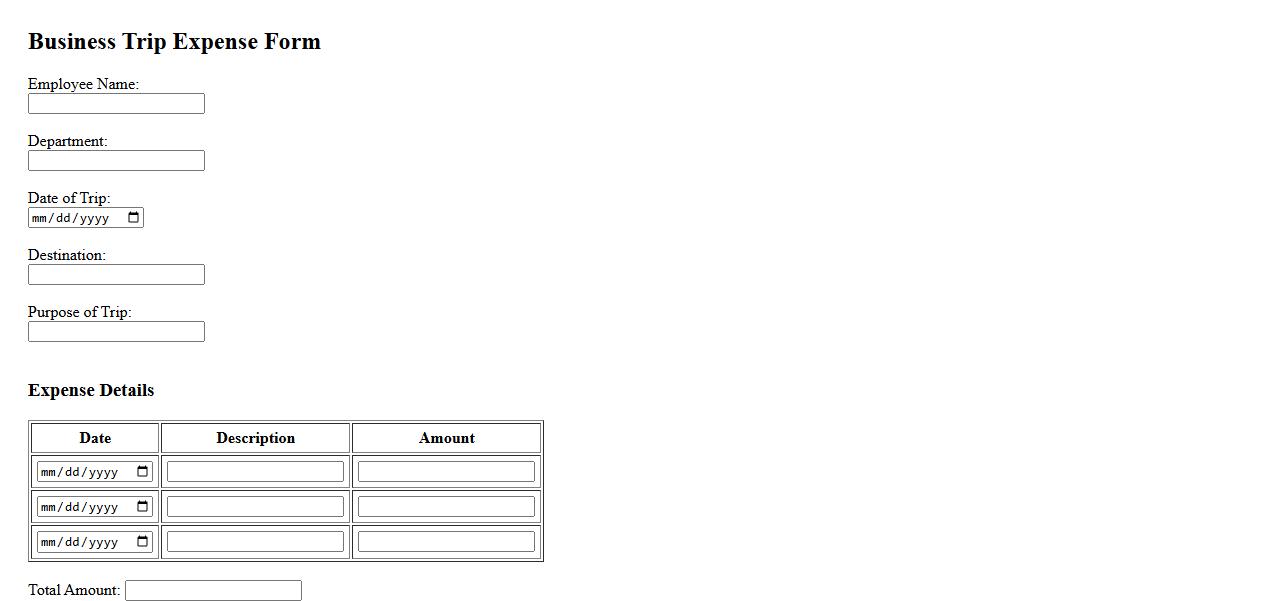

Business Trip Expense Form

The Business Trip Expense Form is designed to streamline the process of reporting and reimbursing travel-related costs. It helps employees accurately document expenses such as transportation, accommodation, and meals. This form ensures transparency and compliance with company policies during business travel.

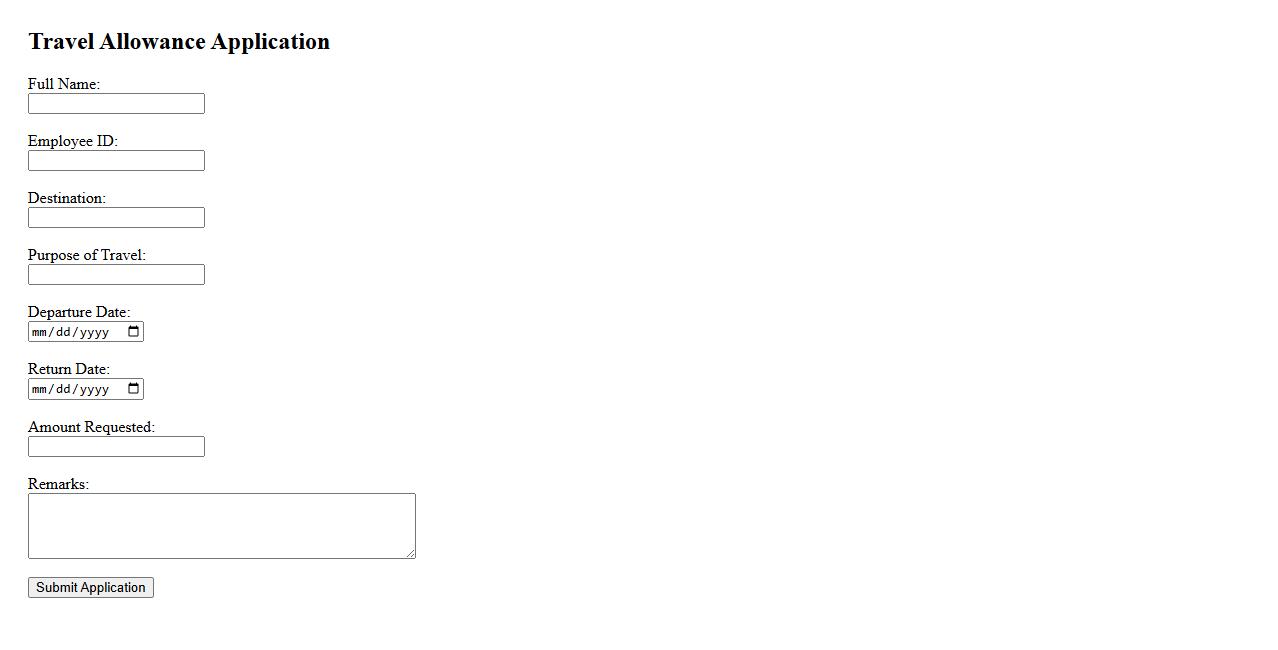

Travel Allowance Application

The Travel Allowance Application streamlines the process of requesting funds for work-related travel expenses. It ensures accurate reimbursement by documenting trip details and estimated costs. This application simplifies approval workflows, making travel management efficient and transparent.

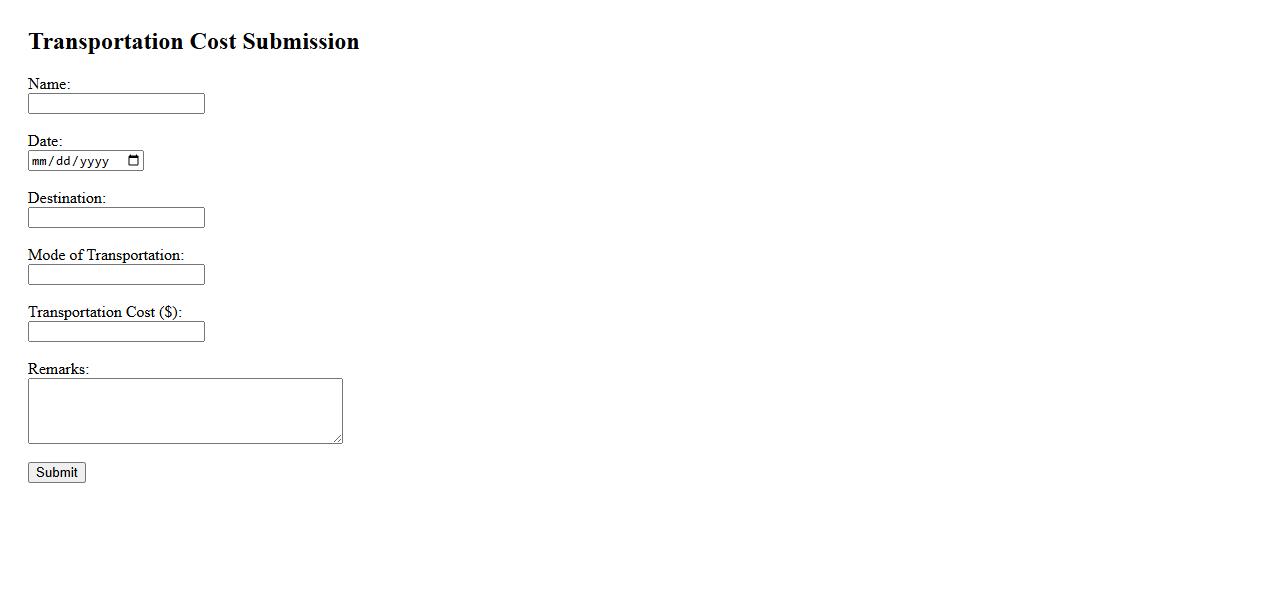

Transportation Cost Submission

The Transportation Cost Submission process ensures accurate reporting of expenses related to logistics and delivery services. It streamlines budget tracking and facilitates timely reimbursement. Efficient submission helps maintain transparency and cost control within transportation management.

Journey Expense Declaration

The Journey Expense Declaration is a formal document used to report and claim travel-related expenses incurred during business trips. It ensures accurate reimbursement and financial tracking by detailing costs such as transportation, accommodation, and meals. Submitting this declaration promptly helps maintain transparency and accountability in corporate travel management.

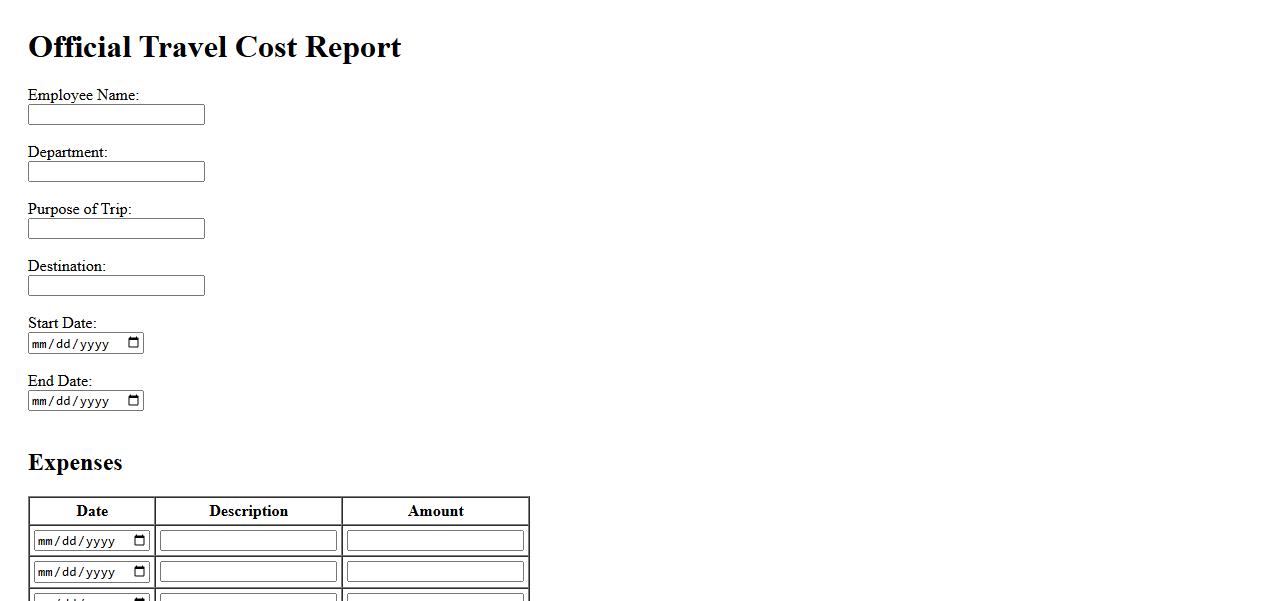

Official Travel Cost Report

The Official Travel Cost Report provides a comprehensive summary of expenses incurred during official trips. It ensures transparency and accountability in travel budgeting. This report is essential for financial auditing and reimbursement processes.

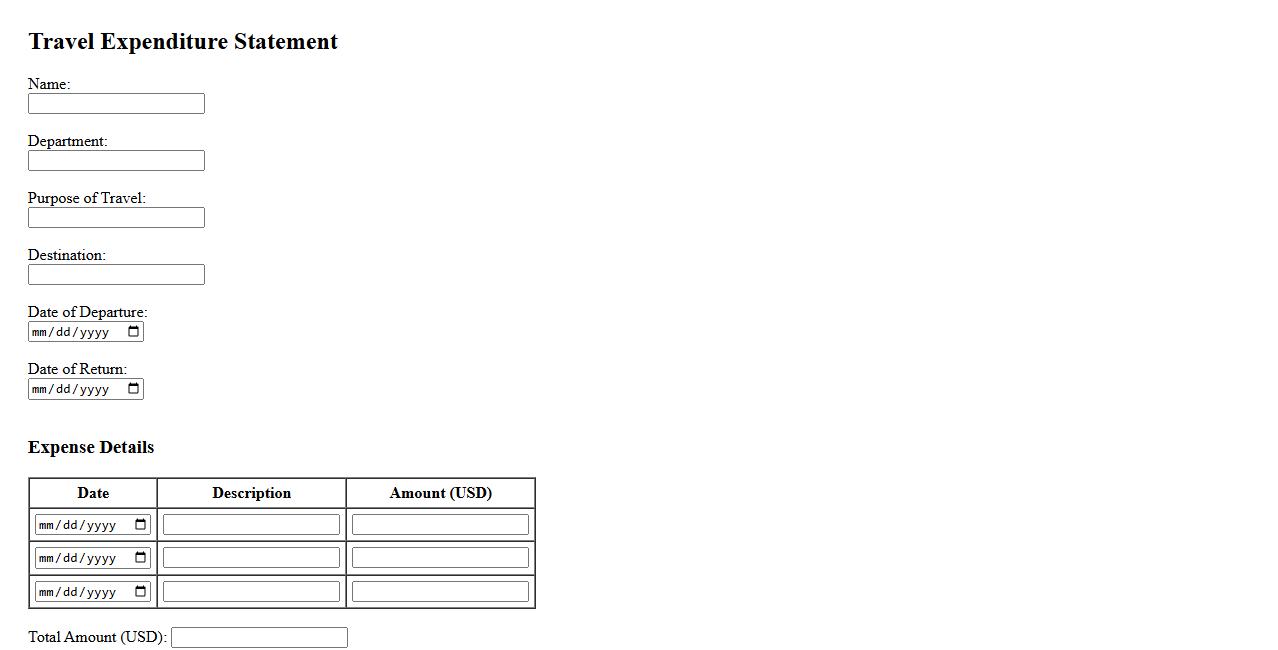

Travel Expenditure Statement

The Travel Expenditure Statement is a detailed report outlining all expenses incurred during a business trip. It helps organizations track and manage travel costs efficiently while ensuring compliance with company policies. This document typically includes transportation, accommodation, meals, and other related expenses.

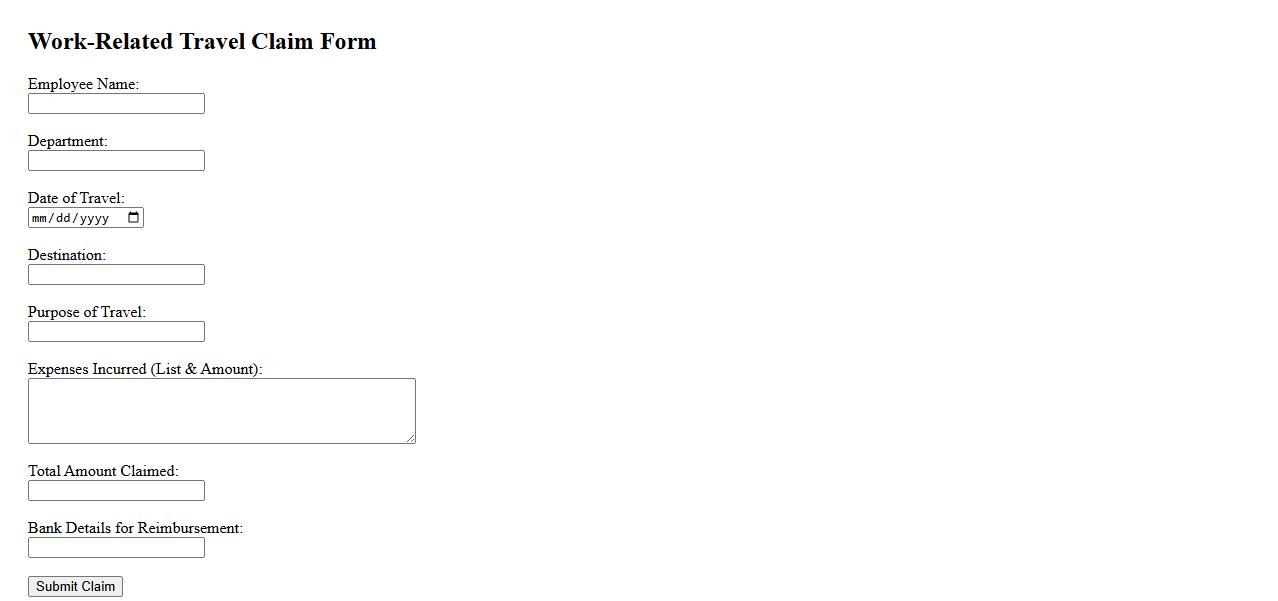

Work-Related Travel Claim

A Work-Related Travel Claim allows employees to request reimbursement for expenses incurred during business trips. These claims typically cover costs such as transportation, accommodation, and meals related to work duties. Proper documentation and adherence to company policies are essential for successful claims.

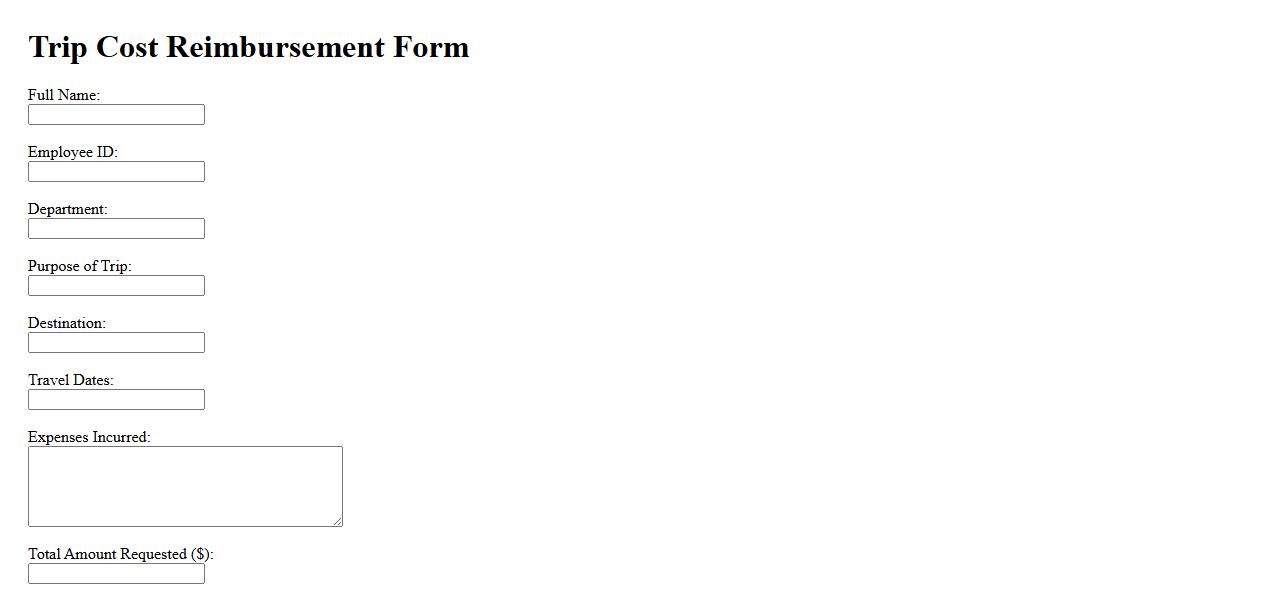

Trip Cost Reimbursement Form

The Trip Cost Reimbursement Form is designed to facilitate the process of claiming expenses incurred during official travel. This form ensures accurate documentation of all trip-related costs, streamlining reimbursement procedures. Proper submission helps organizations maintain clear financial records and supports timely compensation.

What qualifies as an eligible travel expense under this claim process?

Eligible travel expenses include transportation, lodging, and meals incurred during official business travel. Only costs that are necessary and reasonable for the trip are considered reimbursable. Personal expenses or luxury upgrades are excluded from eligibility under this claim process.

Which documents are required to support a claim for travel expenses?

Claimants must provide original receipts for all expenses such as airfare, hotel stays, and meals. A detailed travel itinerary or proof of travel purpose should accompany the receipts. Additionally, a completed travel expense form is mandatory to validate and process the claim.

What is the maximum reimbursable amount for each type of travel expense?

Each category of travel expense has a specified maximum reimbursement limit to ensure budget compliance. Transportation costs are capped based on economy fare rates, lodging has a fixed nightly rate limit, and per diem rates apply for meals. Exceeding these limits requires prior approval to qualify for reimbursement.

Who must review and approve the submitted travel expense claim?

The submitted travel expense claim must be reviewed and approved by the immediate supervisor or designated finance officer. This ensures that all expenses are accurate and justified before processing reimbursement. Final approval is then recorded to maintain transparency and accountability.

Within what timeframe must the travel expense claim be submitted after travel completion?

Travel expense claims must be submitted within 30 days of completing the travel to qualify for reimbursement. Timely submission ensures prompt processing and budget tracking. Late claims may be denied unless a valid reason for delay is provided.