Submitting a claim for travel insurance reimbursement requires providing proof of eligible expenses such as medical bills, trip cancellations, or lost luggage receipts. Timely submission of all necessary documentation ensures faster processing and increases the likelihood of approval. Understanding your policy coverage details helps avoid rejected claims and maximizes your reimbursement benefits.

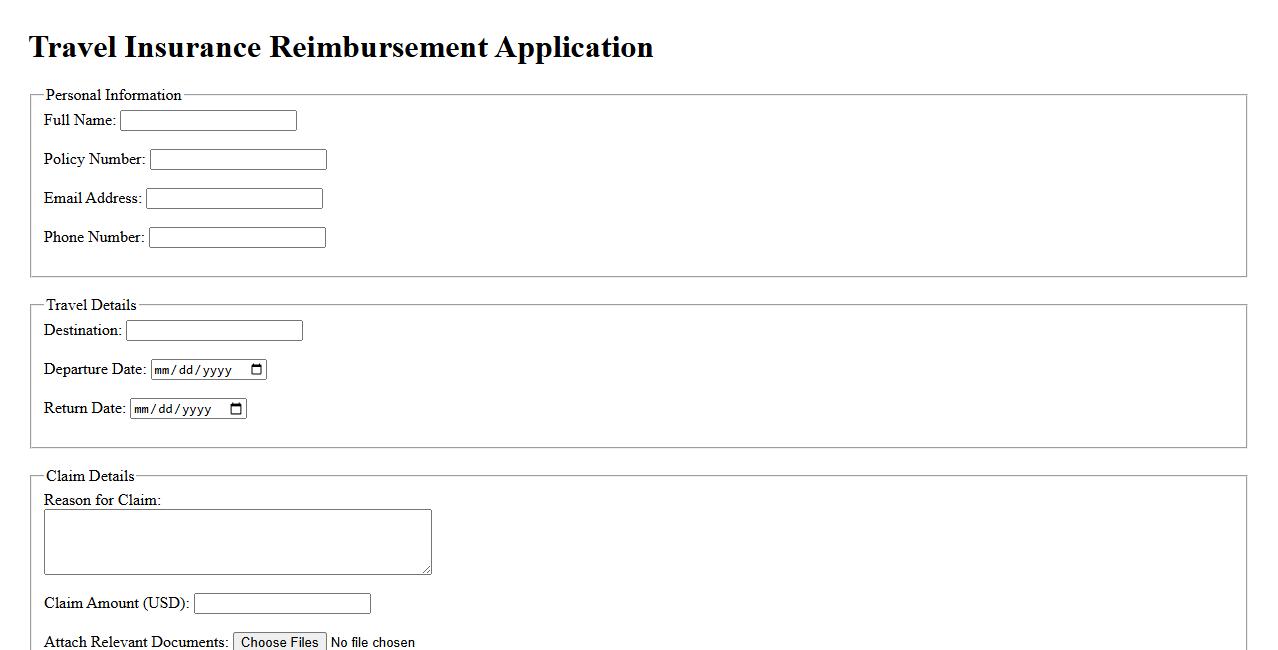

Travel Insurance Reimbursement Application

Filing a Travel Insurance Reimbursement Application helps you recover expenses from unexpected trip disruptions. This process ensures you receive compensation for covered losses such as cancellations, delays, or medical emergencies. Submitting accurate documentation is essential for a smooth claim experience.

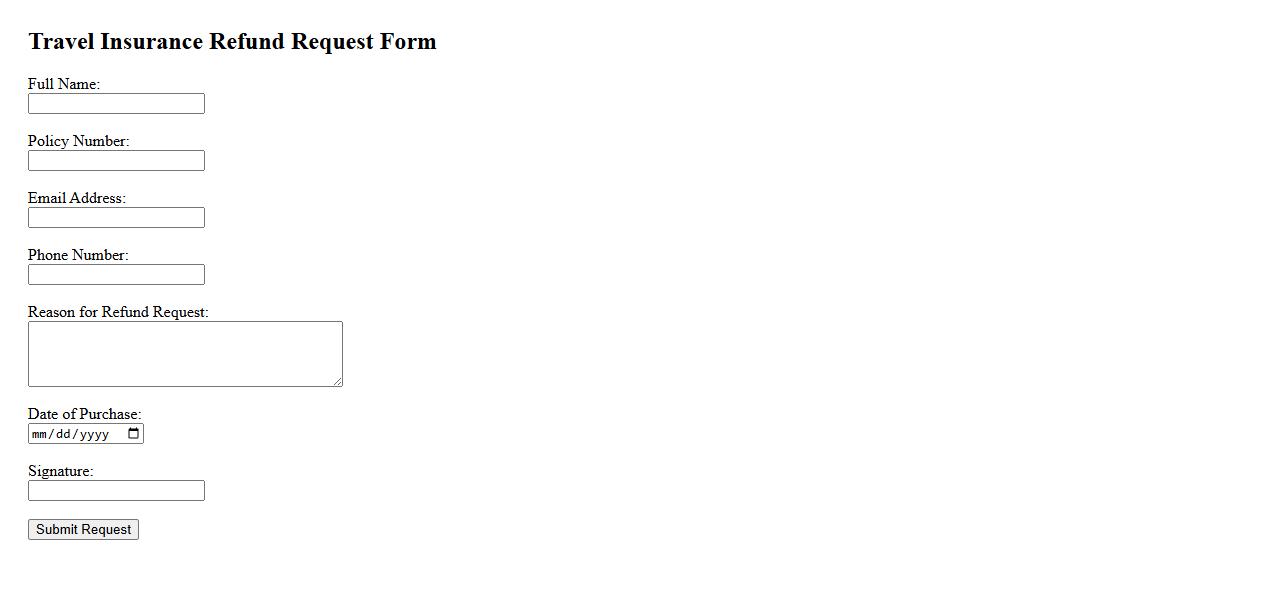

Travel Insurance Refund Request Form

The Travel Insurance Refund Request Form allows travelers to conveniently apply for reimbursement of premiums paid for canceled or interrupted trips. This form ensures a streamlined process by collecting essential information needed to verify claims. Completing it accurately helps expedite the refund and provides peace of mind during travel disruptions.

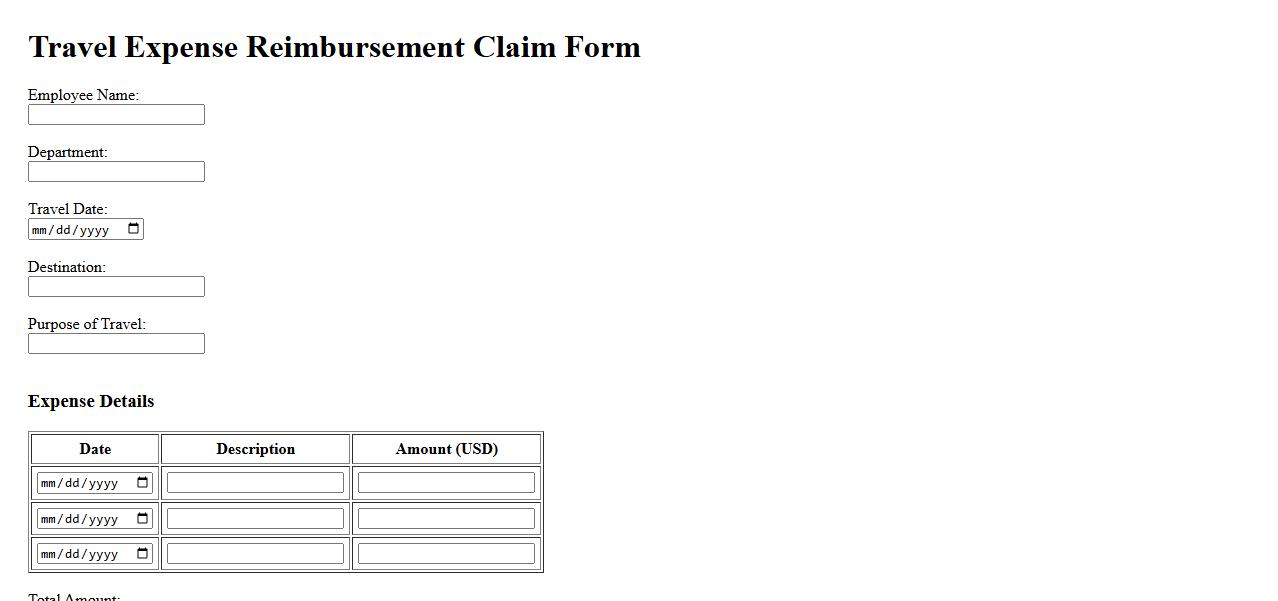

Travel Expense Reimbursement Claim

The Travel Expense Reimbursement Claim is a formal request submitted by employees to recover costs incurred during business trips. It ensures accurate tracking of expenses such as transportation, meals, and lodging. Timely submission of this claim facilitates prompt reimbursement and maintains financial transparency.

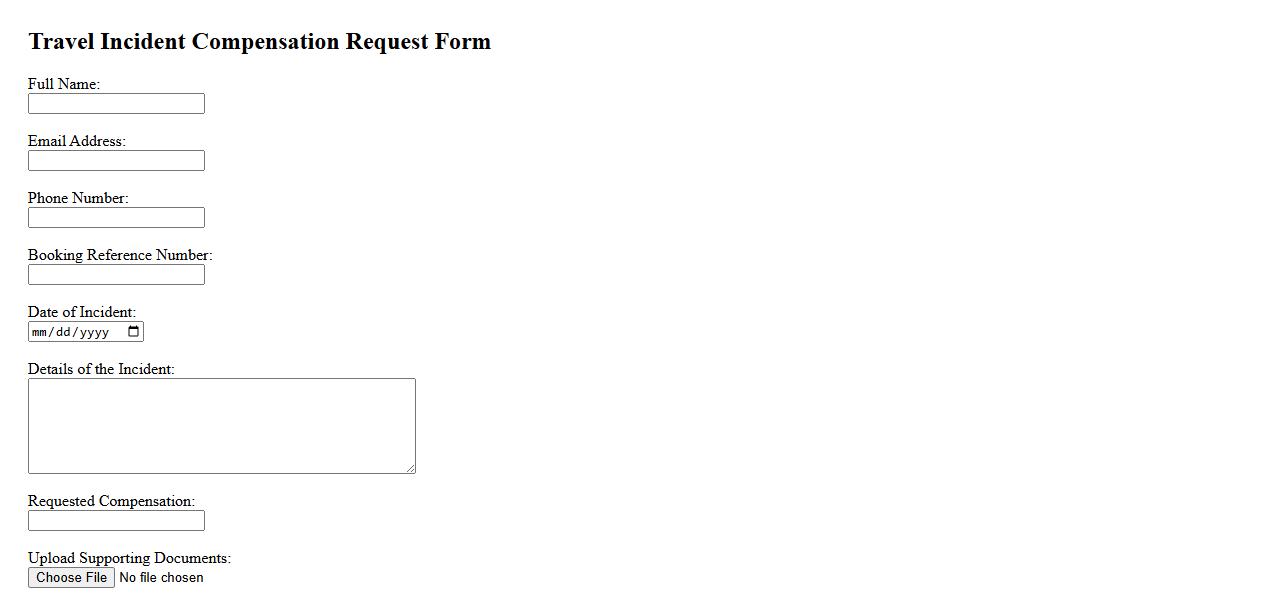

Travel Incident Compensation Request

If you have experienced delays, cancellations, or other issues during your trip, you can file a Travel Incident Compensation Request to seek reimbursement or compensation. This process ensures that travelers are fairly treated and compensated for any inconvenience caused. Proper documentation and timely submission of the request increase the chances of a successful claim.

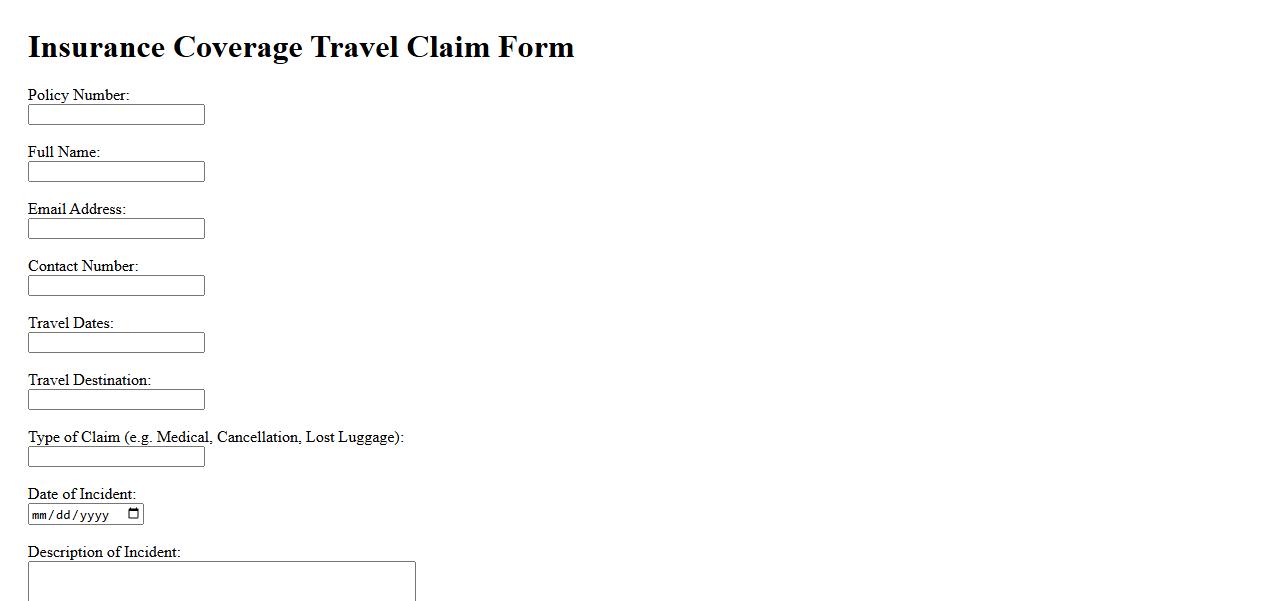

Insurance Coverage Travel Claim

Filing an Insurance Coverage Travel Claim ensures you receive compensation for unexpected trip interruptions or losses. It protects you against unforeseen events such as cancellations, medical emergencies, and lost baggage. Understanding your policy details is crucial for a smooth and successful claim process.

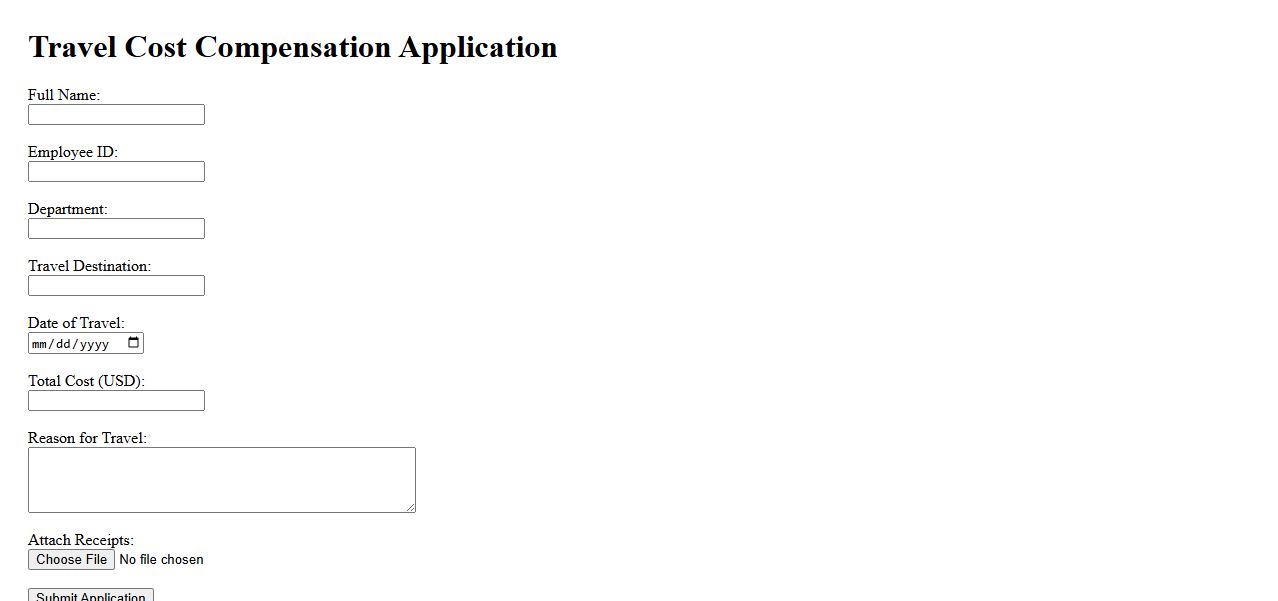

Travel Cost Compensation Application

The Travel Cost Compensation Application simplifies the reimbursement process by allowing users to easily submit their travel expenses. It ensures accurate and timely compensation for business trips and travel-related costs. This application enhances efficiency and transparency in managing travel reimbursements.

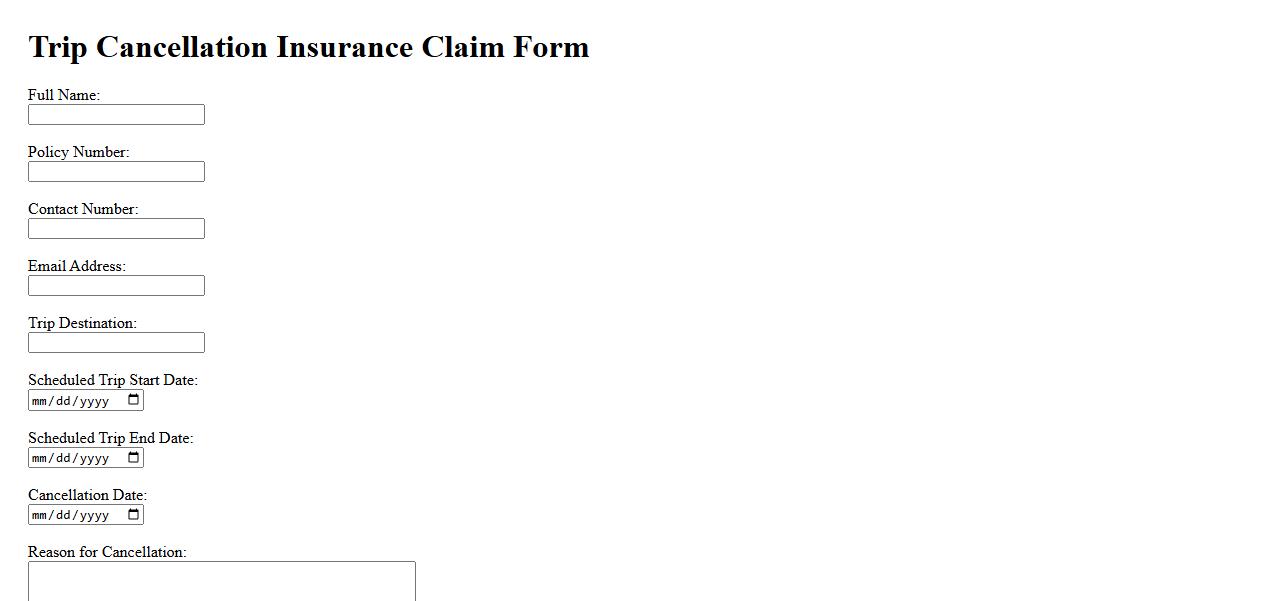

Trip Cancellation Insurance Claim

Trip Cancellation Insurance Claim protects travelers from financial losses incurred due to unforeseen trip cancellations. It covers non-refundable expenses like flights, accommodations, and tours when cancellations are caused by specified reasons such as illness or emergencies. Filing a claim typically requires submitting proof of cancellation and relevant documentation to the insurance provider.

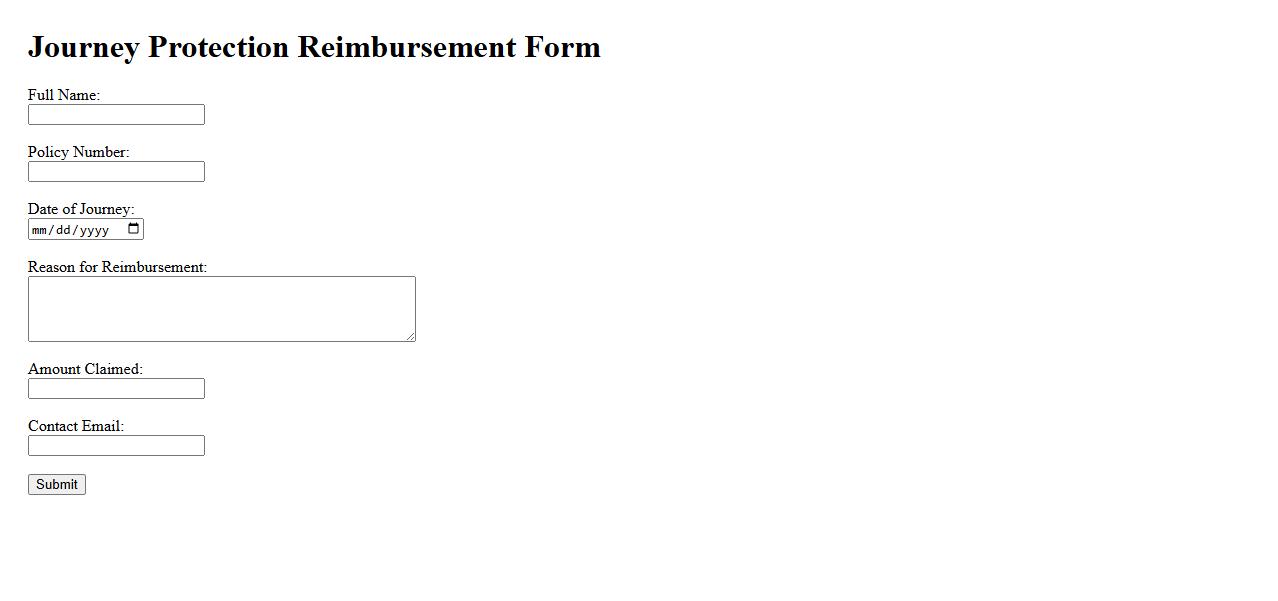

Journey Protection Reimbursement Form

The Journey Protection Reimbursement Form is designed to facilitate the process of claiming expenses incurred during unexpected travel disruptions. This form ensures travelers can efficiently request reimbursement for eligible costs related to cancellations, delays, or interruptions. Proper completion and timely submission of the form are essential for a smooth claims process.

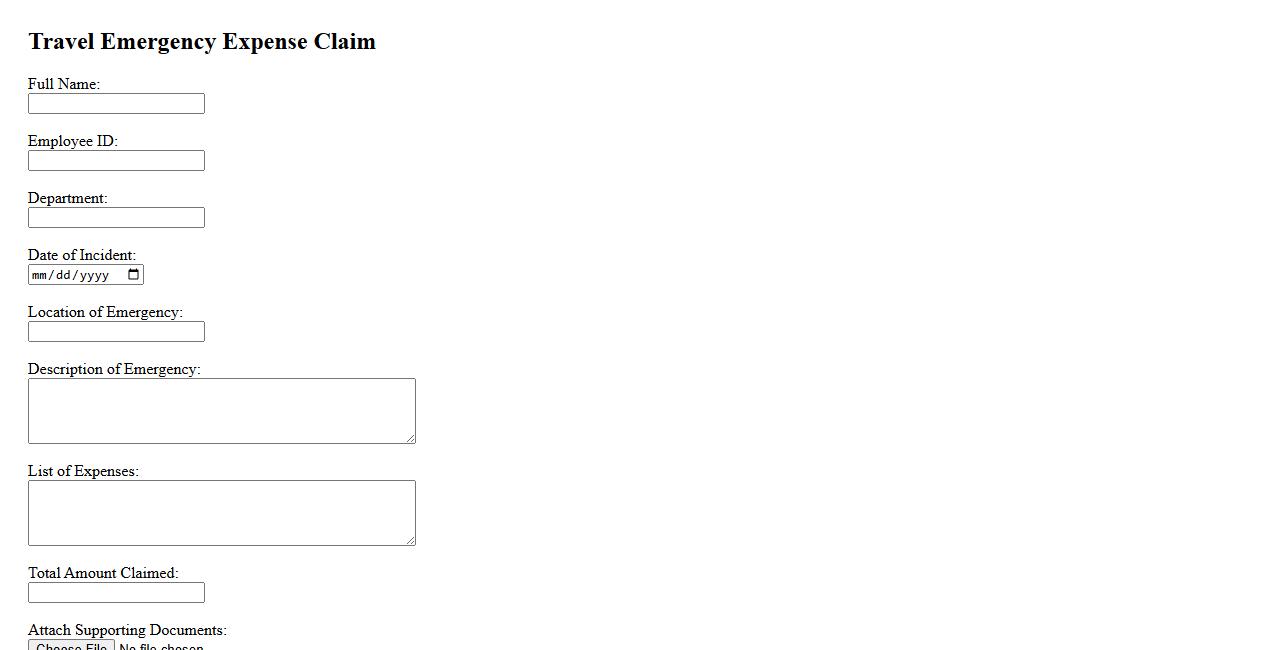

Travel Emergency Expense Claim

A Travel Emergency Expense Claim allows travelers to request reimbursement for unforeseen costs incurred during their trip due to emergencies. This process ensures swift financial support for urgent situations such as medical emergencies, trip cancellations, or lost belongings. Proper documentation and timely submission are essential for a successful claim.

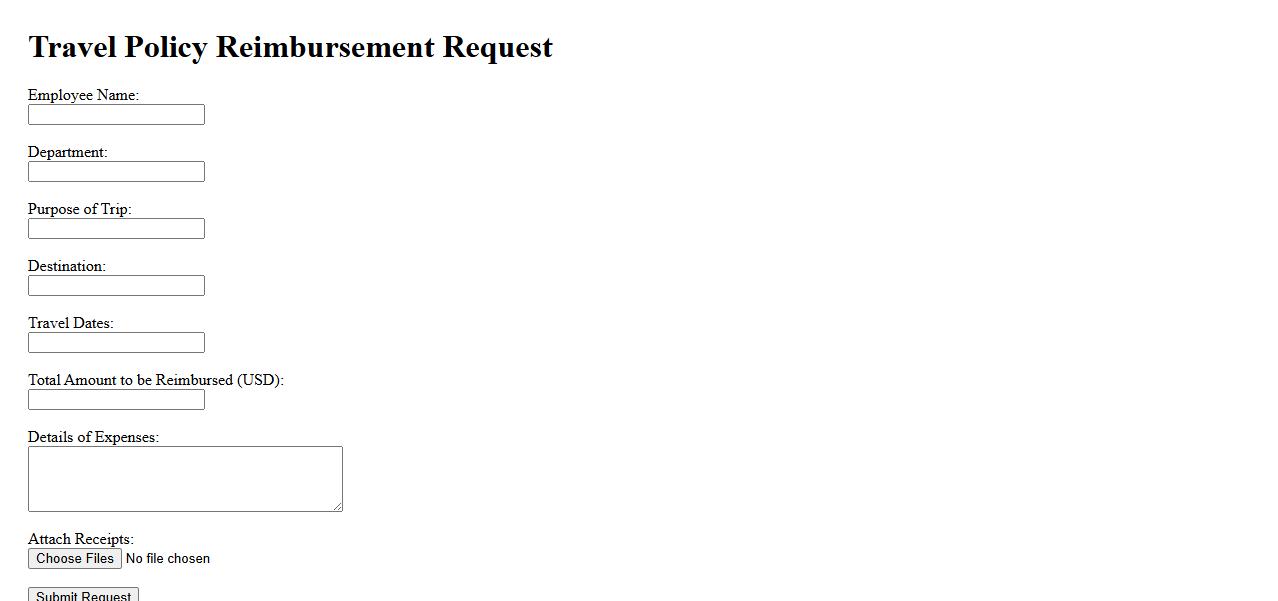

Travel Policy Reimbursement Request

A Travel Policy Reimbursement Request is a formal document submitted by employees to claim expenses incurred during business travel. It ensures compliance with company guidelines and accelerates the approval process. Proper documentation and adherence to the travel policy are essential for successful reimbursement.

What is the purpose of a travel insurance reimbursement claim document?

The primary purpose of a travel insurance reimbursement claim document is to formally request compensation for covered losses during a trip. It serves as proof that the insured has incurred eligible expenses due to unforeseen events. This document facilitates the insurer's evaluation and approval of the claim.

Which expenses are eligible for coverage under the travel insurance policy?

Eligible expenses typically include trip cancellations, medical emergencies, lost luggage, and travel delays. Coverage depends on the specific travel insurance policy terms and conditions. It is important to review the policy details to understand which expenses qualify for reimbursement.

What specific documentation is required to support a reimbursement claim?

Supporting documentation often includes receipts, medical reports, police reports, and proof of travel arrangements. These documents substantiate the claim's validity and demonstrate incurred losses. Accurate and complete paperwork helps speed up the claims process and approval.

Who is authorized to submit a travel insurance claim on behalf of the insured?

The insured traveler is typically authorized to submit the claim, but in cases of incapacity, a legally authorized representative may act on their behalf. This can include family members or legal guardians with proper authorization. The insurer may require proof of such authorization before processing the claim.

What is the standard process and timeline for evaluating and approving reimbursement claims?

The standard process involves submission of the claim form, review of supporting documents, and verification of coverage terms. Most insurance companies aim to evaluate and respond within 30 to 45 days after receipt of the complete claim. Timely submission of required documents can significantly reduce delays in approval.