Filing a claim for vehicle insurance involves notifying your insurer about damages or losses related to your vehicle. The process typically requires submitting evidence such as photos, police reports, and repair estimates to support your claim. Timely and accurate documentation ensures a smoother settlement and faster reimbursement.

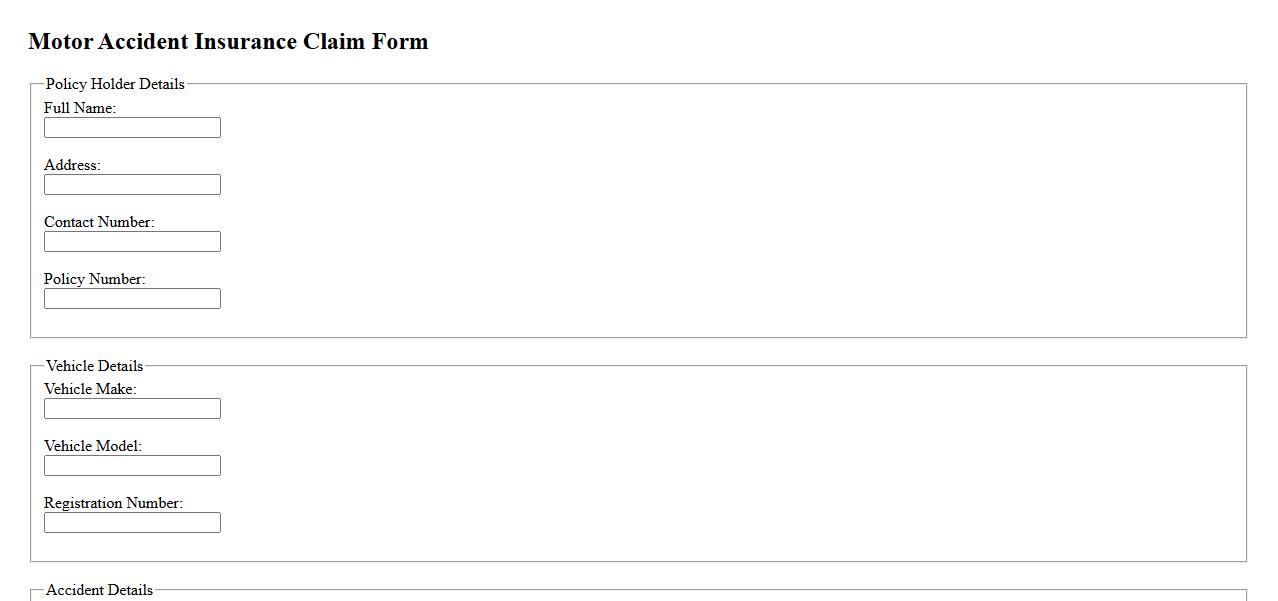

Motor Accident Insurance Claim

Filing a Motor Accident Insurance Claim is essential to receive compensation after a vehicle collision. This process involves submitting necessary documents and evidence to the insurance company for assessment. Timely and accurate claim filing ensures a smooth settlement and financial support for repairs and medical expenses.

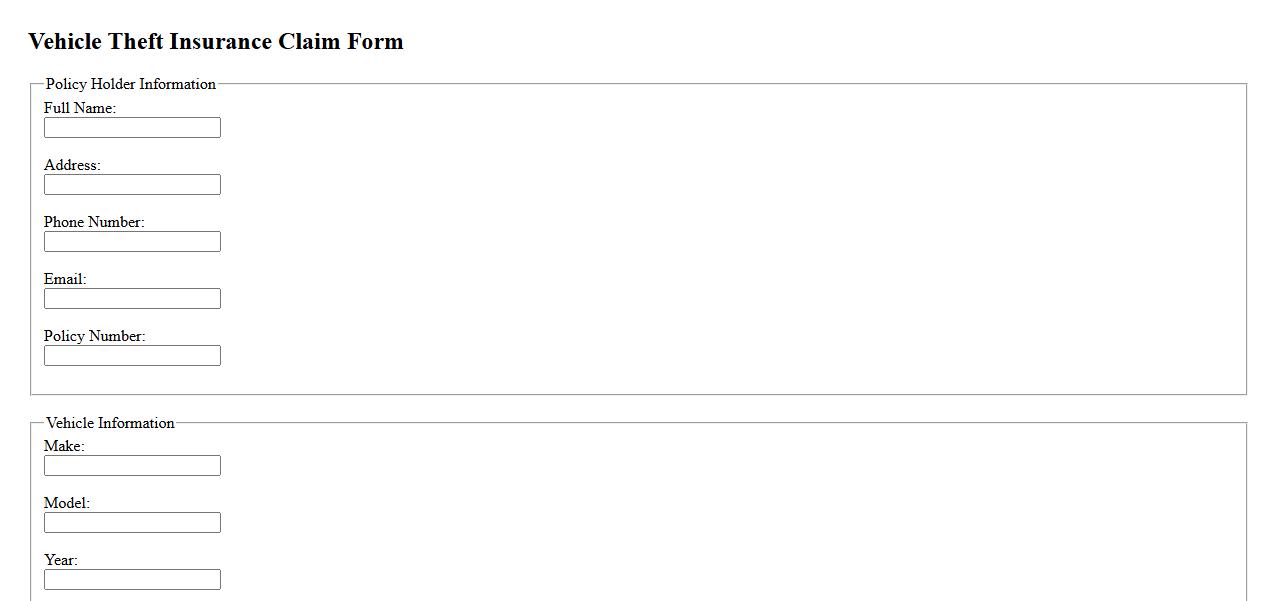

Vehicle Theft Insurance Claim

Filing a Vehicle Theft Insurance Claim ensures you receive compensation after your car is stolen. It requires timely reporting to authorities and your insurance provider with necessary documentation. This process helps mitigate financial loss and accelerates vehicle recovery or replacement.

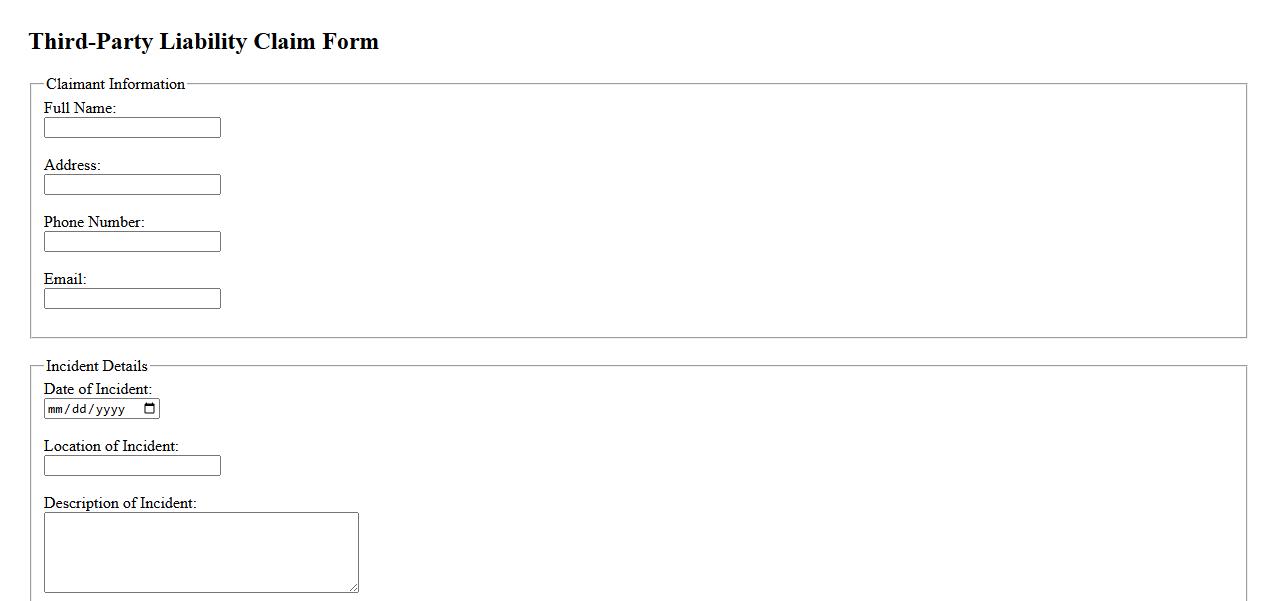

Third-Party Liability Claim

A Third-Party Liability Claim occurs when a person or entity seeks compensation from another party responsible for causing harm or damage. This type of claim involves a third party who is not directly involved in the initial contract but is considered liable for the injury or loss. Understanding the nuances of third-party liability is essential for effective legal and insurance resolutions.

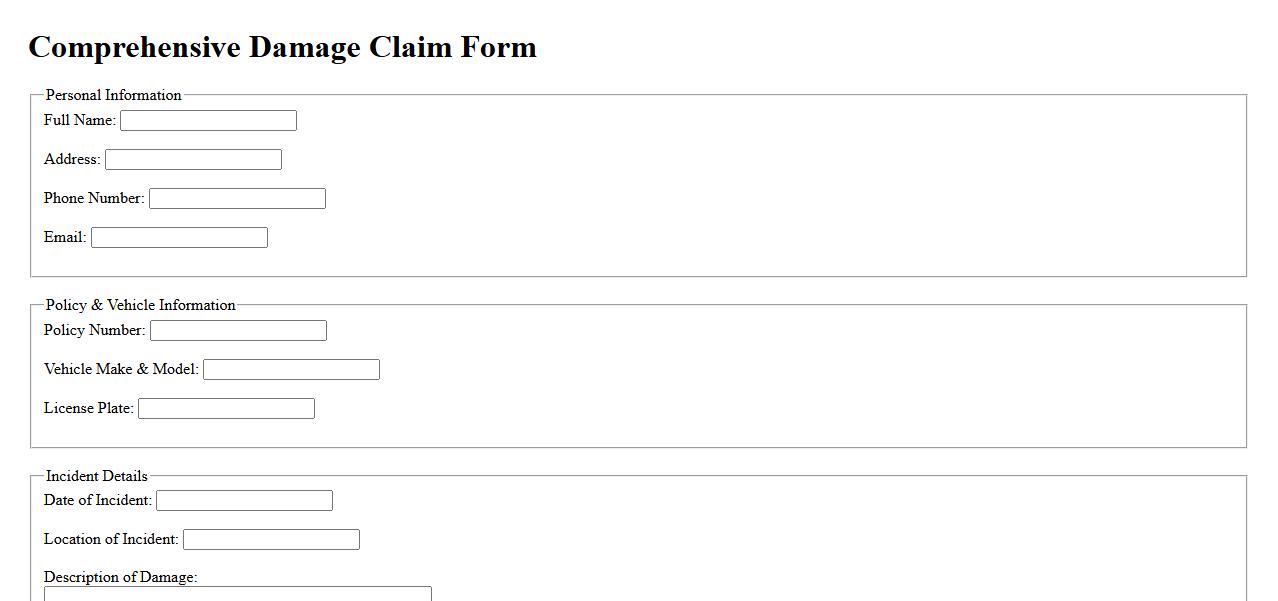

Comprehensive Damage Claim

Filing a Comprehensive Damage Claim ensures you receive full compensation for damages not caused by collisions, such as theft, vandalism, or natural disasters. This claim covers repair costs and associated expenses, protecting your vehicle investment. Understanding the process helps expedite resolution and enhances your financial security.

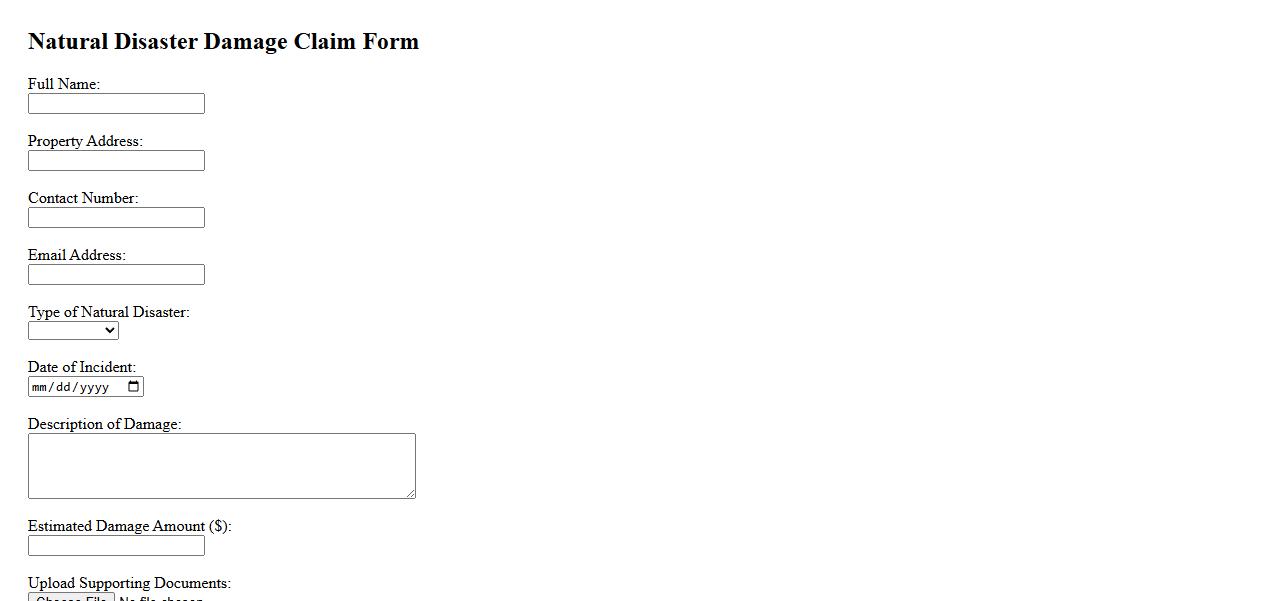

Natural Disaster Damage Claim

Filing a natural disaster damage claim is essential for recovering losses caused by events like floods, hurricanes, or earthquakes. This process involves documenting damage and submitting evidence to insurance providers for compensation. Prompt and accurate claims help ensure timely financial support for repairs and recovery.

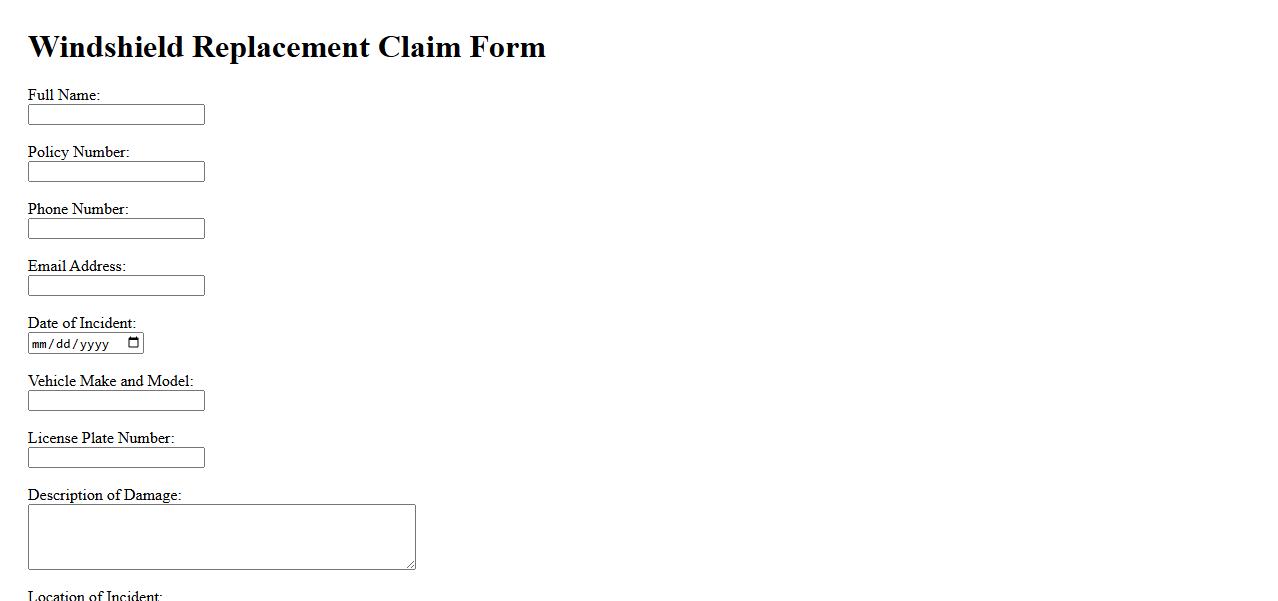

Windshield Replacement Claim

Filing a Windshield Replacement Claim ensures that damaged glass is safely replaced without out-of-pocket expenses. This process involves submitting necessary documents to your insurance provider for approval. Prompt claims help restore visibility and safety on the road quickly.

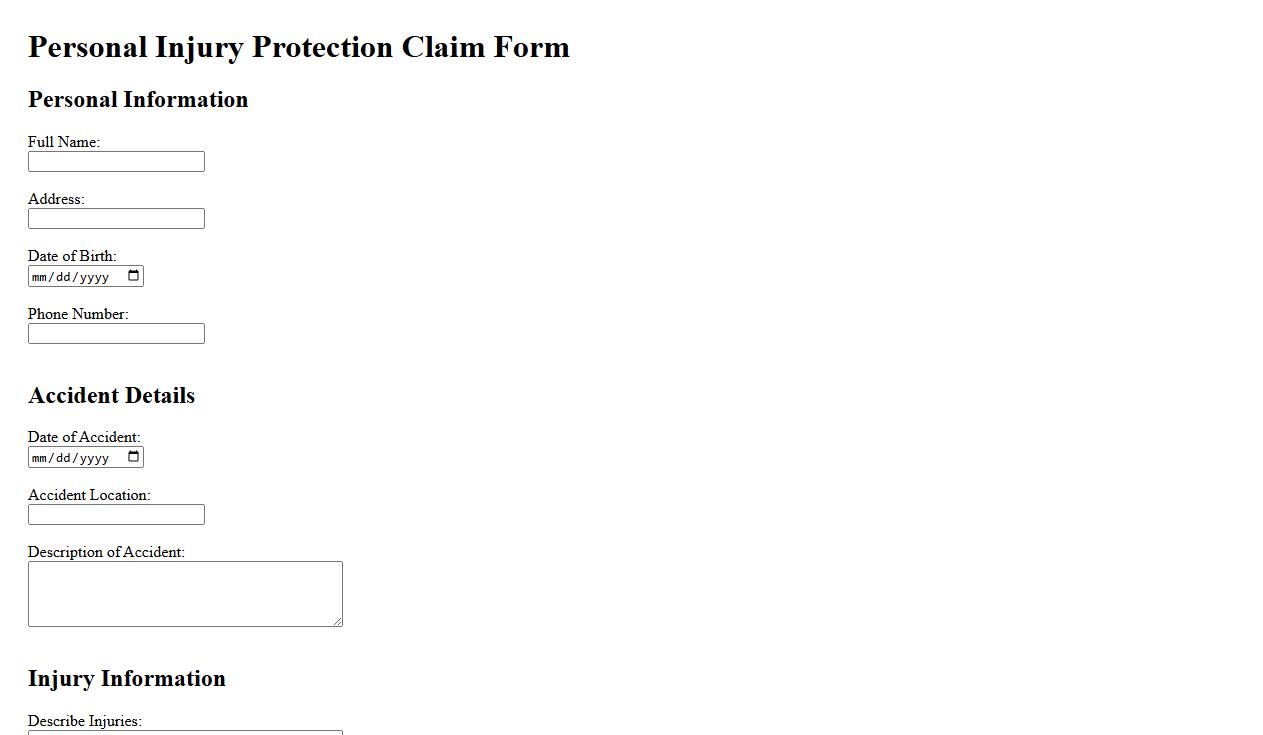

Personal Injury Protection Claim

Personal Injury Protection Claim is an insurance claim that covers medical expenses and lost wages resulting from an accident, regardless of who is at fault. It provides prompt financial assistance to help injured parties recover without delay. This protection ensures essential support during the healing process and reduces out-of-pocket costs.

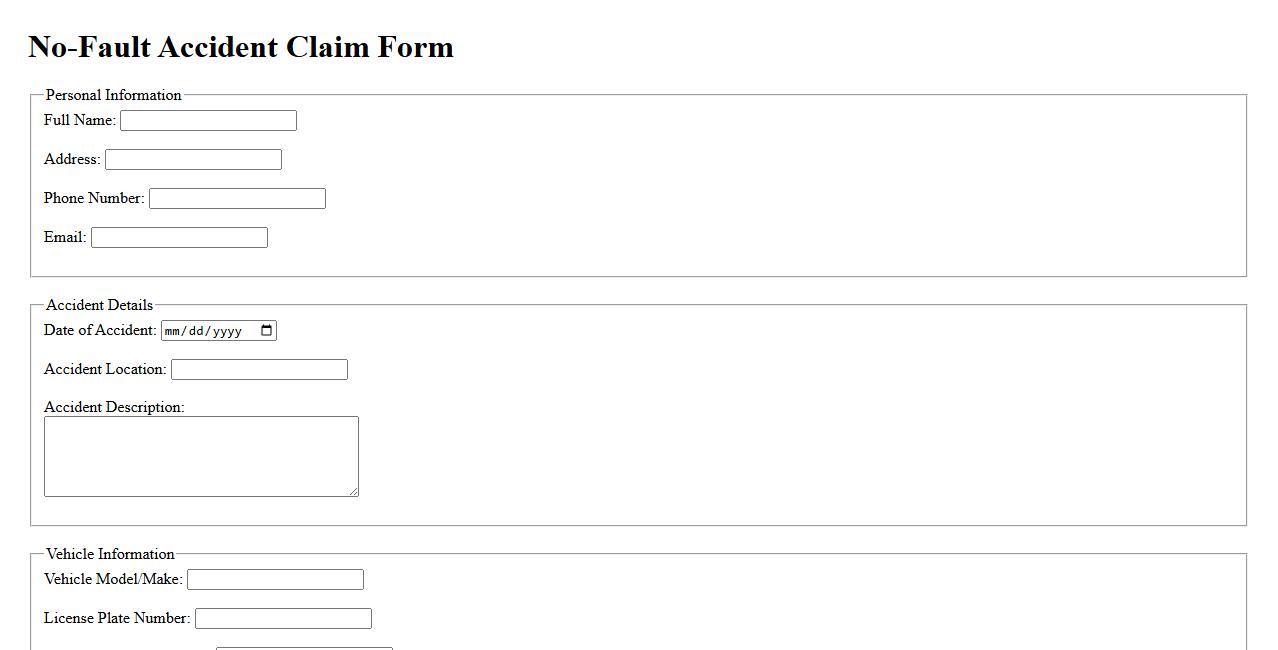

No-Fault Accident Claim

A No-Fault Accident Claim allows individuals to receive compensation for injuries and damages without proving who was at fault in the accident. This system simplifies the claims process and ensures quicker access to medical expenses and lost wages. It is designed to reduce litigation and provide prompt support for accident victims.

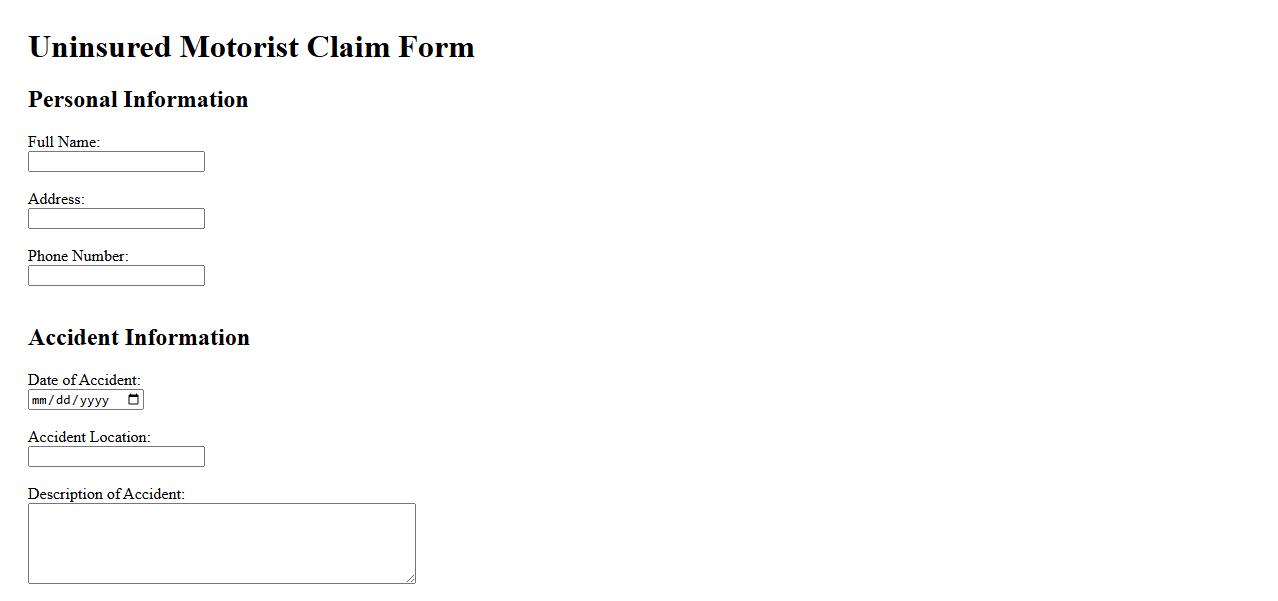

Uninsured Motorist Claim

An Uninsured Motorist Claim is a request for compensation when you are involved in an accident with a driver who does not have insurance. This claim helps cover medical expenses, property damage, and other losses resulting from the collision. It is essential to file promptly to ensure proper handling and maximize your benefits.

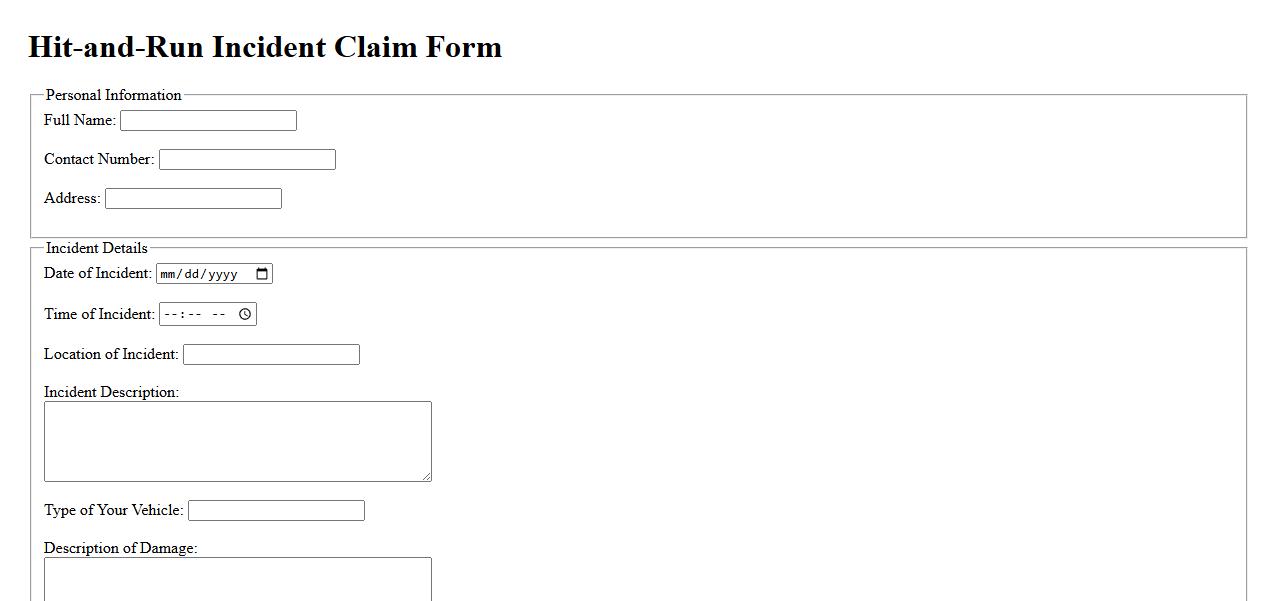

Hit-and-Run Incident Claim

A Hit-and-Run Incident Claim involves seeking compensation after a driver involved in an accident leaves the scene without providing contact information. It is crucial to gather as much evidence as possible to support the claim and notify the authorities promptly. This type of claim helps victims recover damages despite the fleeing driver's absence.

What information is required to validate the incident date in a vehicle insurance claim document?

To validate the incident date, the claim document must include the exact date and time when the vehicle accident or damage occurred. This date is essential to ensure the claim is filed within the policy period and is accurate for processing. Supporting evidence such as police reports or photographs with timestamps can also substantiate the incident date.

How does the document prove the policyholder's ownership of the insured vehicle?

The proof of ownership is typically verified through documents like the vehicle registration certificate or title. These documents must clearly state the policyholder's name, linking them to the insured vehicle. This validation is crucial for establishing the legitimacy of the claim under the insurance policy.

Which supporting evidence is necessary to establish the cause and extent of damages?

Detailed damage assessment reports, photographs of the vehicle, and repair estimates are required to demonstrate the cause and extent of damages. In some cases, witness statements or official accident reports provide additional clarity. These pieces of evidence help the insurer determine the claim's validity and the compensation amount.

What details are needed to confirm that the claim falls within the coverage period?

Confirming the claim falls within the coverage period requires checking the insurance policy start and end dates against the incident date. The claim form must clearly state the incident date for comparison with the active policy term. This ensures that the insurer only processes claims for covered timeframes.

How does the claim form address third-party involvement or liability?

The claim form includes sections to detail any third-party involvement, such as other vehicles or individuals responsible for the incident. It often requires information about the third party's insurance and contact details to manage liability and recovery claims. This allows insurers to determine fault and coordinate settlements effectively.