Filing a claim for accident insurance benefits requires providing detailed evidence of the accident and related injuries to the insurance company. This process ensures that policyholders receive appropriate financial compensation for medical expenses, lost wages, and other damages. Prompt and accurate submission of necessary documents can expedite the approval and payment of benefits.

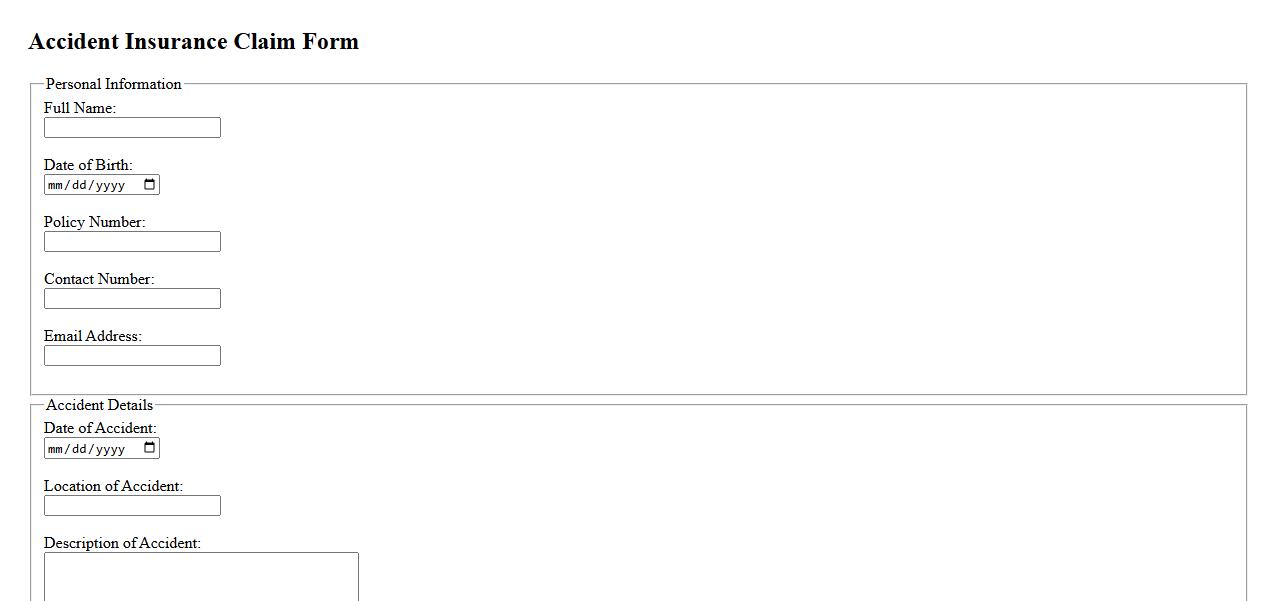

Accident Insurance Claim Form

The Accident Insurance Claim Form is a vital document used to report and process claims related to accidents. It collects essential information about the incident, policyholder, and damages to ensure accurate and timely compensation. Submitting a completed form promptly helps streamline the claim approval process.

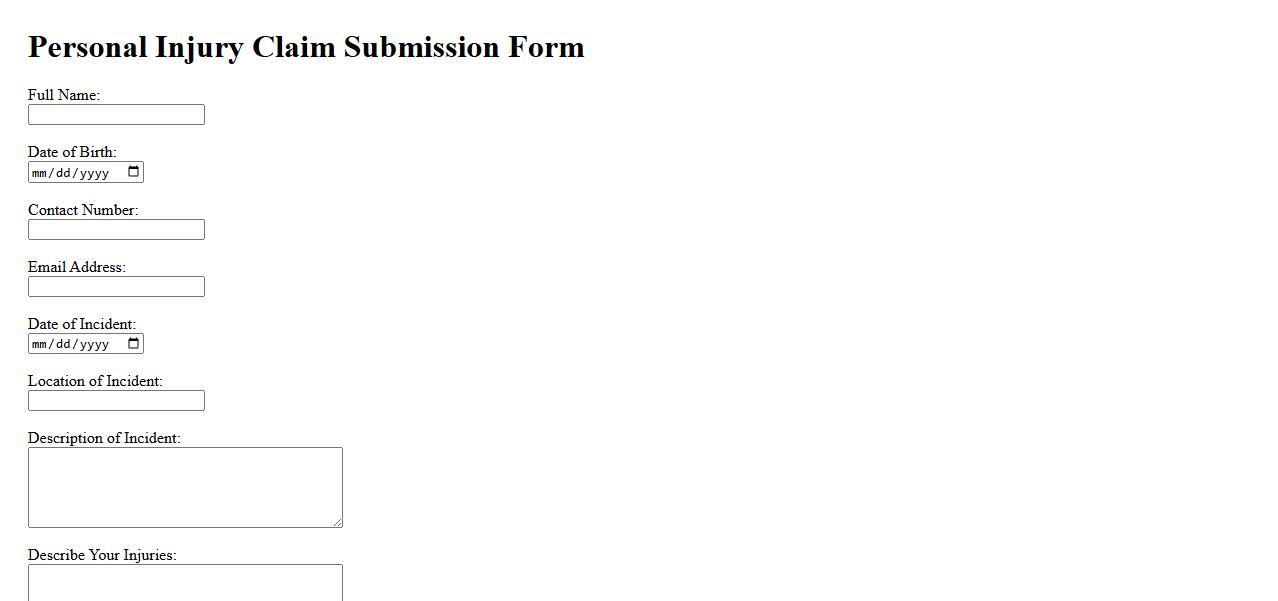

Personal Injury Claim Submission

Submitting a personal injury claim involves formally notifying the responsible party or their insurer about an injury caused by their negligence. This process initiates the legal steps required to seek compensation for damages such as medical expenses and lost wages. Timely and accurate claim submission is crucial to ensure proper handling and maximize the chance of a favorable outcome.

Accident Benefit Application

The Accident Benefit Application is a crucial process for individuals seeking financial support following an accident. This application helps claim compensation for medical expenses, lost income, and other related costs. Timely submission ensures prompt assistance and smoother claim processing.

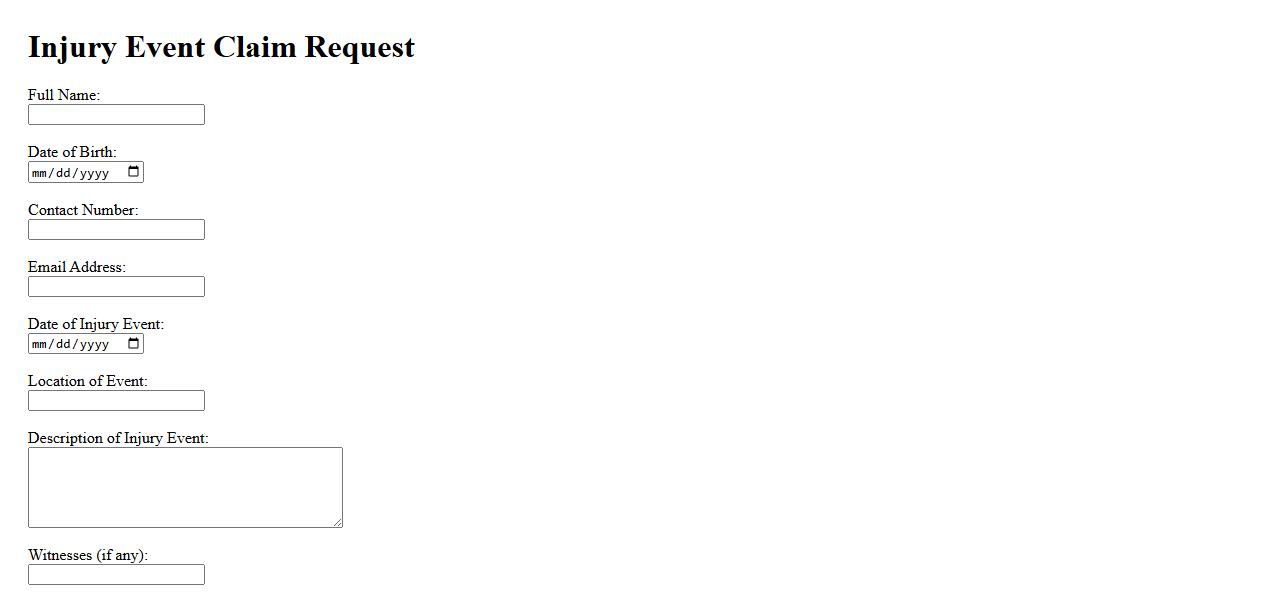

Injury Event Claim Request

An Injury Event Claim Request is a formal application submitted to report injuries sustained during an incident, seeking compensation or benefits. This process typically involves providing detailed information about the event, the nature of the injury, and any related medical documentation. Timely and accurate submission of the claim request is crucial for a smooth resolution and support.

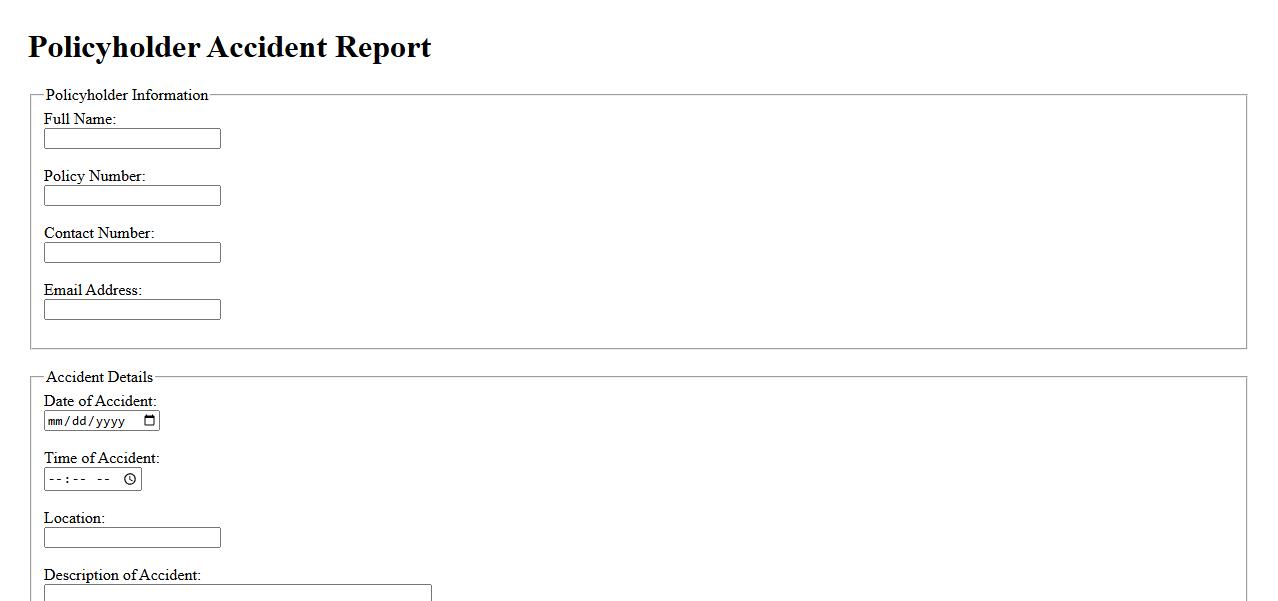

Policyholder Accident Report

The Policyholder Accident Report is a crucial document used to record detailed information about an incident involving an insured party. It helps insurance companies assess claims accurately by capturing facts, witness statements, and damage descriptions. Timely and precise completion of this report ensures efficient claim processing and support.

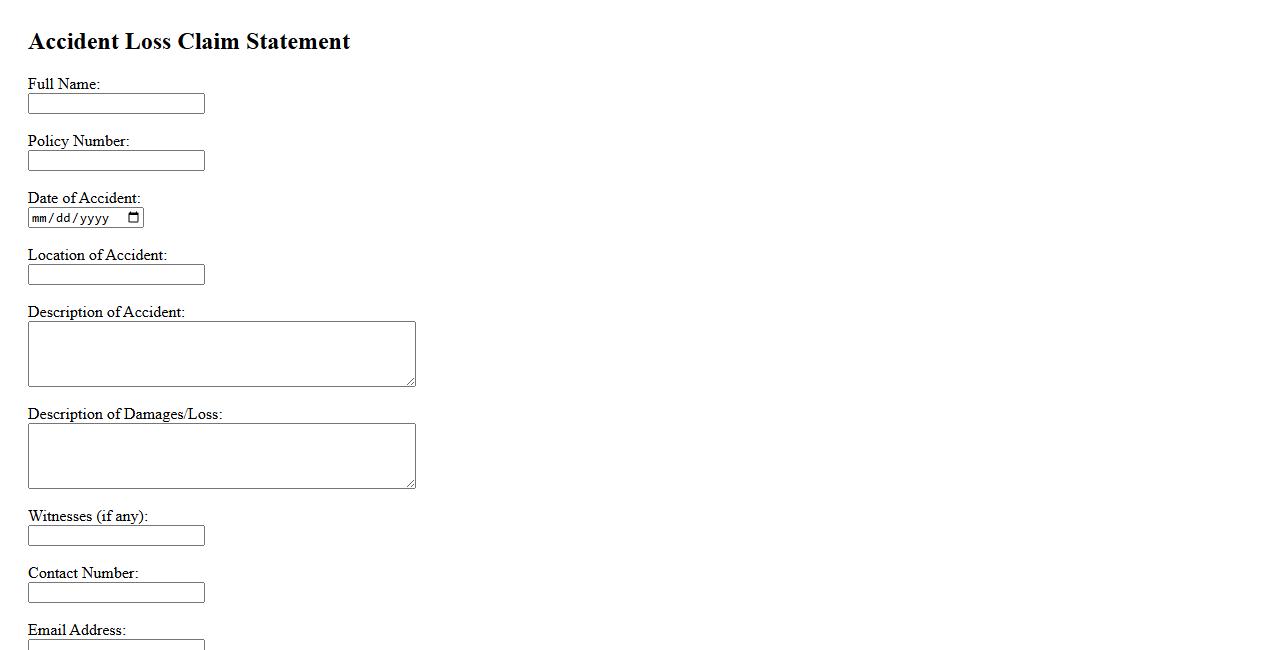

Accident Loss Claim Statement

An Accident Loss Claim Statement is a formal document used to detail the circumstances and damages resulting from an accident. It provides essential information to insurance companies for processing claims efficiently. Accurate and clear statements help ensure timely compensation for losses incurred.

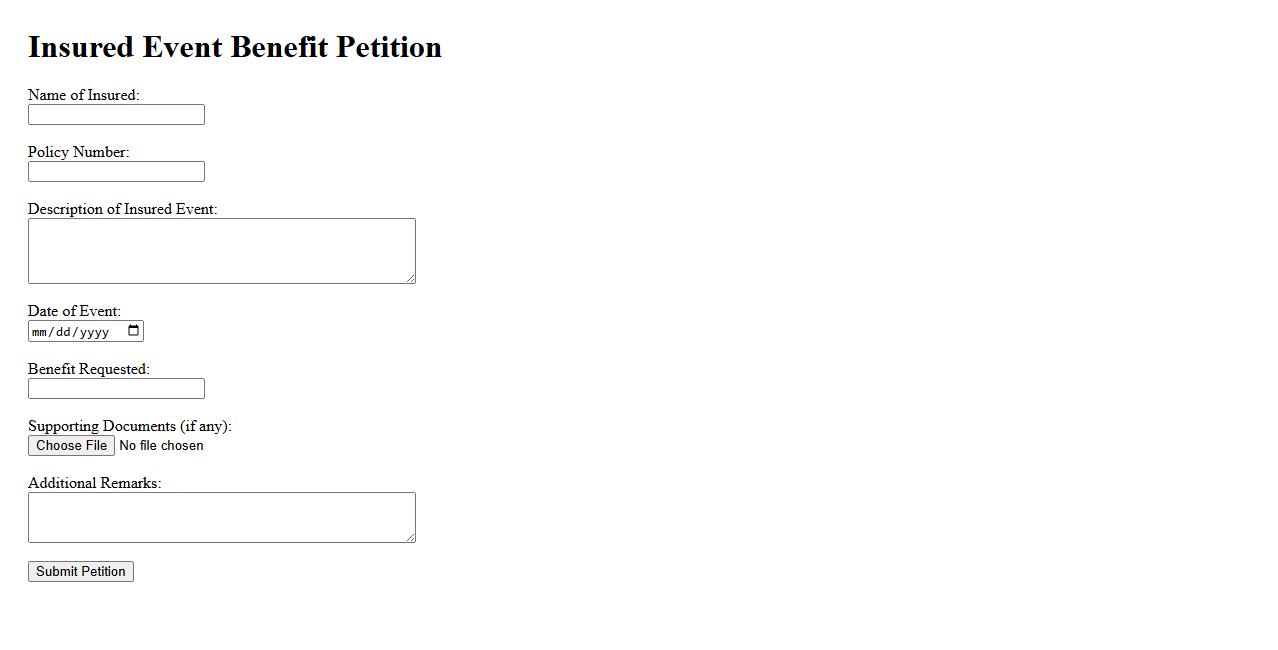

Insured Event Benefit Petition

The Insured Event Benefit Petition is a formal request submitted by policyholders to claim benefits after an insured event occurs. It ensures that individuals receive the financial support promised under their insurance coverage. Timely filing of this petition is crucial for a smooth claim process and quick disbursement of funds.

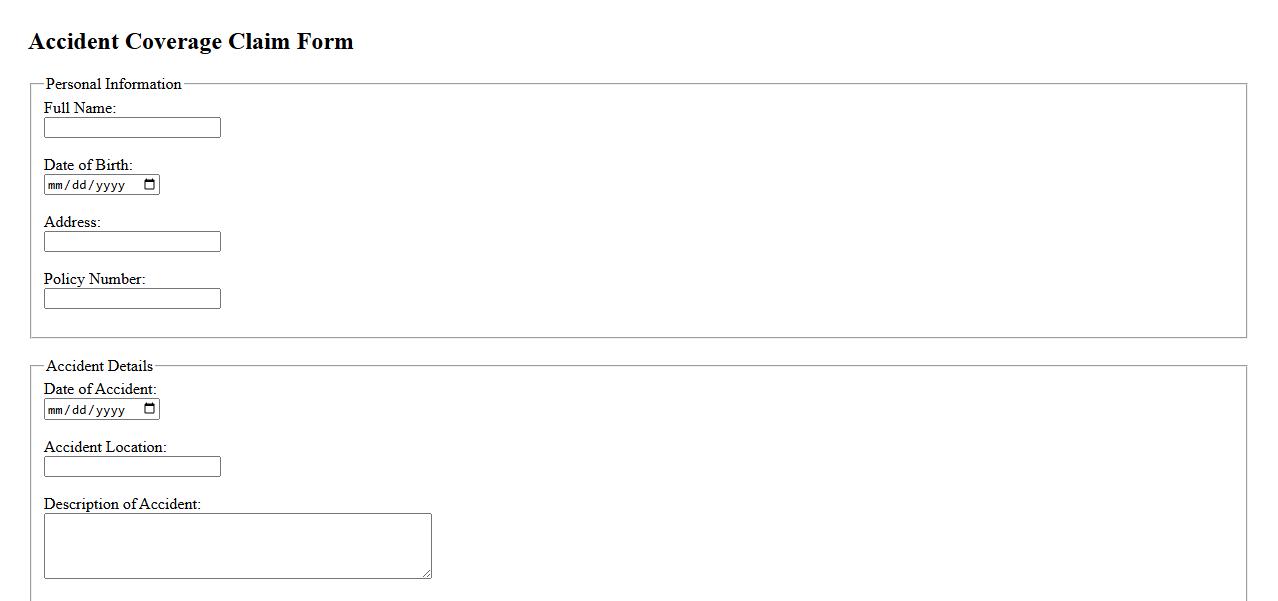

Accident Coverage Claim Form

The Accident Coverage Claim Form is a crucial document used to report incidents and request compensation efficiently. It ensures all necessary details are accurately recorded to facilitate a smooth claims process. Submitting this form promptly helps in timely assessment and resolution of accident-related claims.

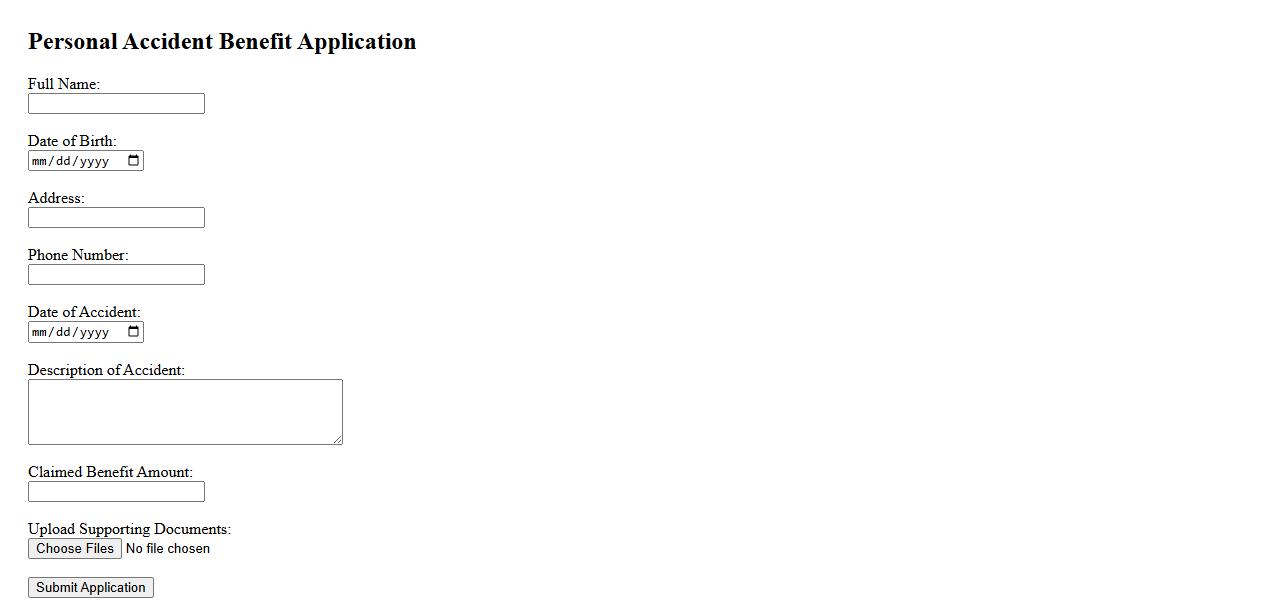

Personal Accident Benefit Application

The Personal Accident Benefit Application is a crucial form used to request compensation following an accidental injury. It ensures that individuals receive financial support promptly and efficiently. Completing this application accurately helps expedite the claim process for accident-related benefits.

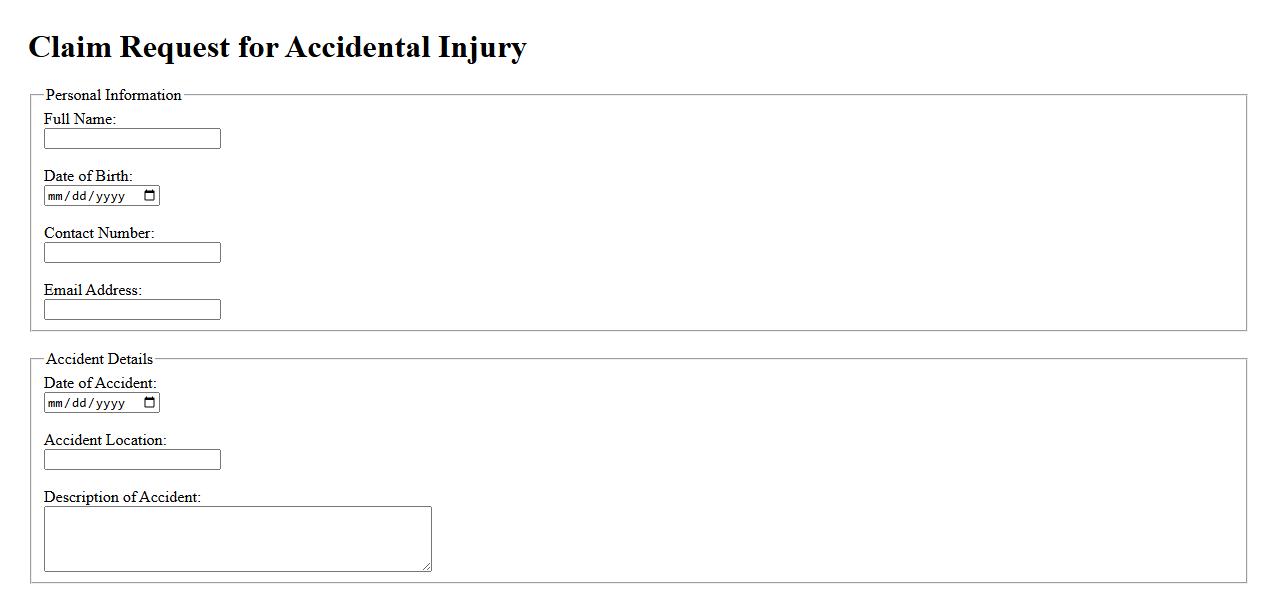

Claim Request for Accidental Injury

If you have experienced an accidental injury, submitting a Claim Request for Accidental Injury is essential to receive appropriate compensation. This process involves providing detailed information about the incident and supporting medical documentation. Timely and accurate claim submission ensures a smoother approval and quicker reimbursement.

What type of accident does the policy cover under "Claim for Accident Insurance Benefits"?

The policy covers accidents causing bodily injury that occur unexpectedly and unintentionally. It includes injuries resulting from sudden incidents such as falls, collisions, or other unforeseen mishaps. The coverage extends to injuries sustained both on and off the job, as specified in the policy terms.

Who is eligible to file a claim for accident insurance benefits according to this document?

Eligibility to file a claim is limited to the policyholder or their designated beneficiaries. Individuals must have an active insurance policy at the time of the accident to qualify. Additionally, the claimant must be directly affected by the accident as outlined in the insurance contract.

What documentation is required to support an accident insurance claim?

To support a claim, the insured must submit a completed claim form along with medical reports and hospital records documenting the injury. Proof of accident, such as police reports or eyewitness statements, may also be required. Detailed bills and receipts for medical expenses must accompany the claim for verification.

What are the time limits for submitting an accident insurance claim after the incident?

Claims must be submitted within a specific time frame stated in the policy, typically within 30 to 90 days from the date of the accident. Late submissions might result in claim denial unless there is a justified reason. It is essential to file as soon as possible to ensure timely processing and benefit eligibility.

Which exclusions or limitations apply to benefits under this accident insurance policy?

Exclusions include injuries from self-inflicted harm, participation in illegal activities, or accidents under the influence of drugs or alcohol. The policy also limits coverage for pre-existing conditions and injuries caused by extreme sports depending on the contract terms. Understanding these limitations is crucial to avoid denied claims and unexpected financial burdens.