Filing a claim for refund of state taxes involves submitting a formal request to the state tax authority to recover overpaid taxes. This process requires accurate documentation of the tax payments and supporting evidence to justify the refund. Timely filing is crucial to ensure the claim is processed within the state's statute of limitations.

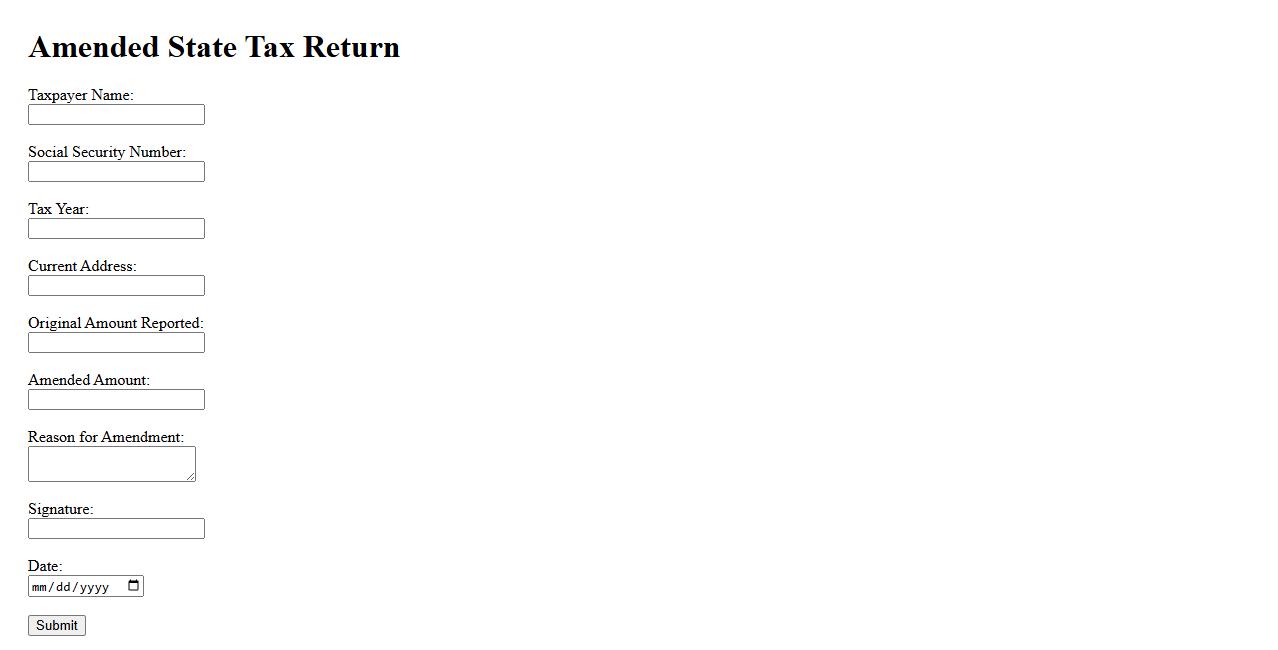

Amended State Tax Return

An Amended State Tax Return allows taxpayers to correct errors or update information on a previously filed state income tax return. This process is essential for ensuring accurate tax records and receiving any additional refunds or paying the correct amount owed. Always file the amended return promptly to avoid penalties or interest charges.

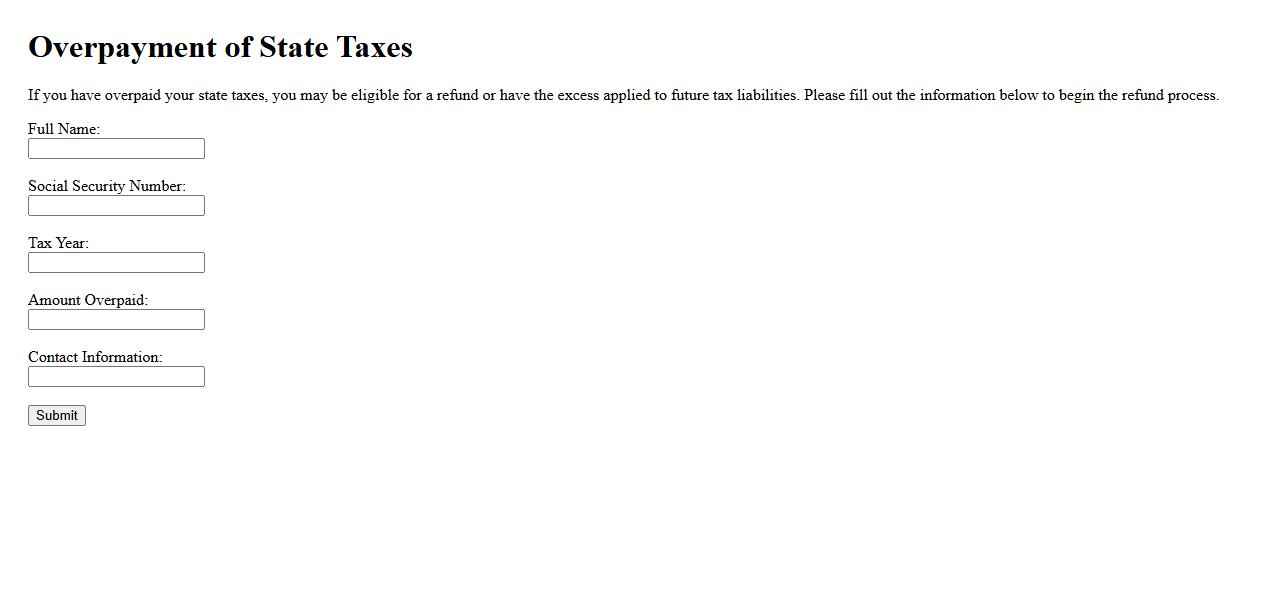

Overpayment of State Taxes

An Overpayment of State Taxes occurs when a taxpayer pays more than the required amount to state tax authorities. This can result from miscalculations, incorrect withholding, or filing errors. Taxpayers may be eligible for a refund or credit to adjust the excess payment.

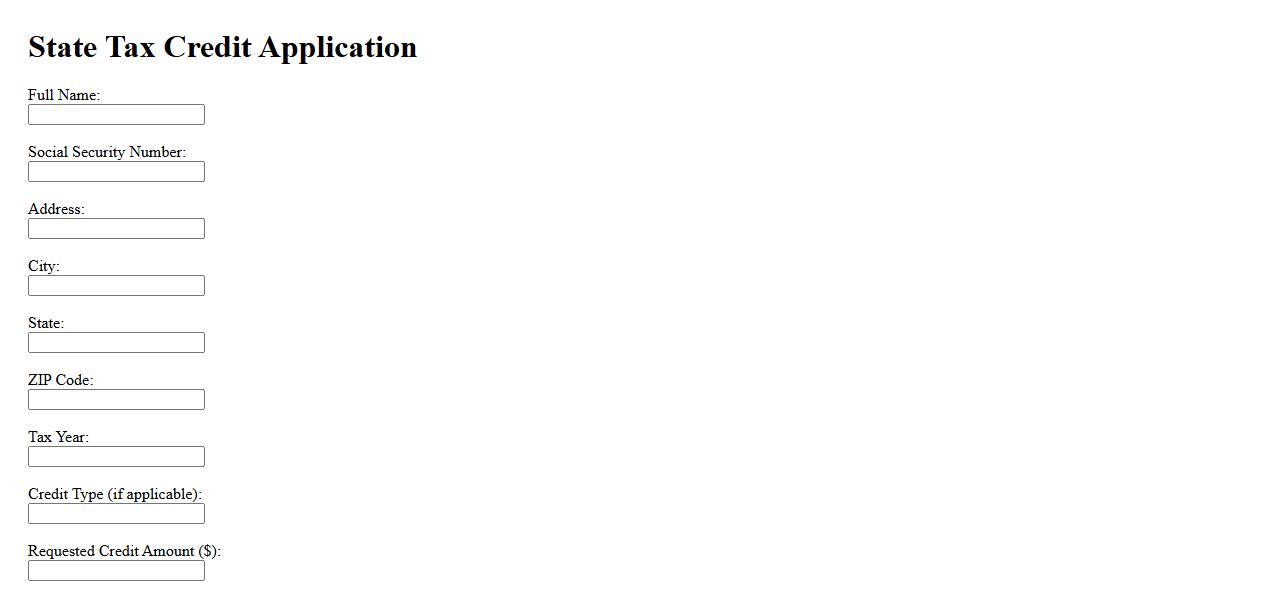

State Tax Credit Application

The State Tax Credit Application is a crucial document for taxpayers seeking to reduce their state tax liability. It ensures eligible individuals or businesses can claim applicable credits efficiently. Proper completion and submission of the application can maximize financial benefits and compliance.

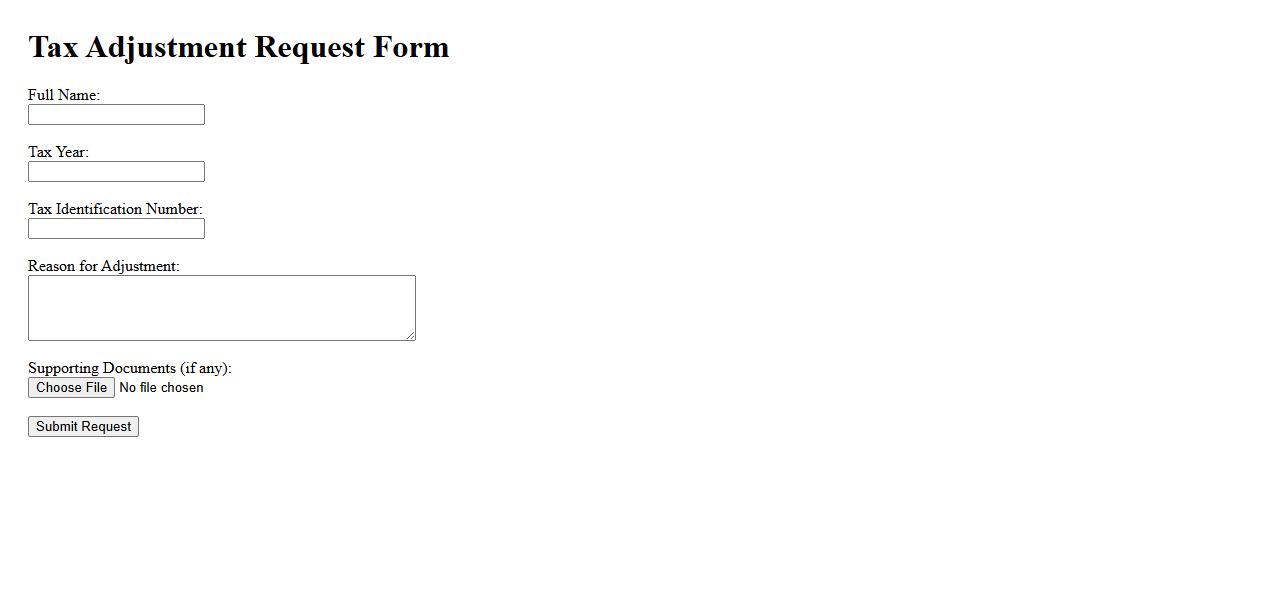

Tax Adjustment Request

A Tax Adjustment Request is a formal application submitted to revise previously reported tax amounts due to errors or changes in financial information. This process ensures accurate tax liabilities and compliance with regulations. Timely filing of the request can prevent penalties and interest charges.

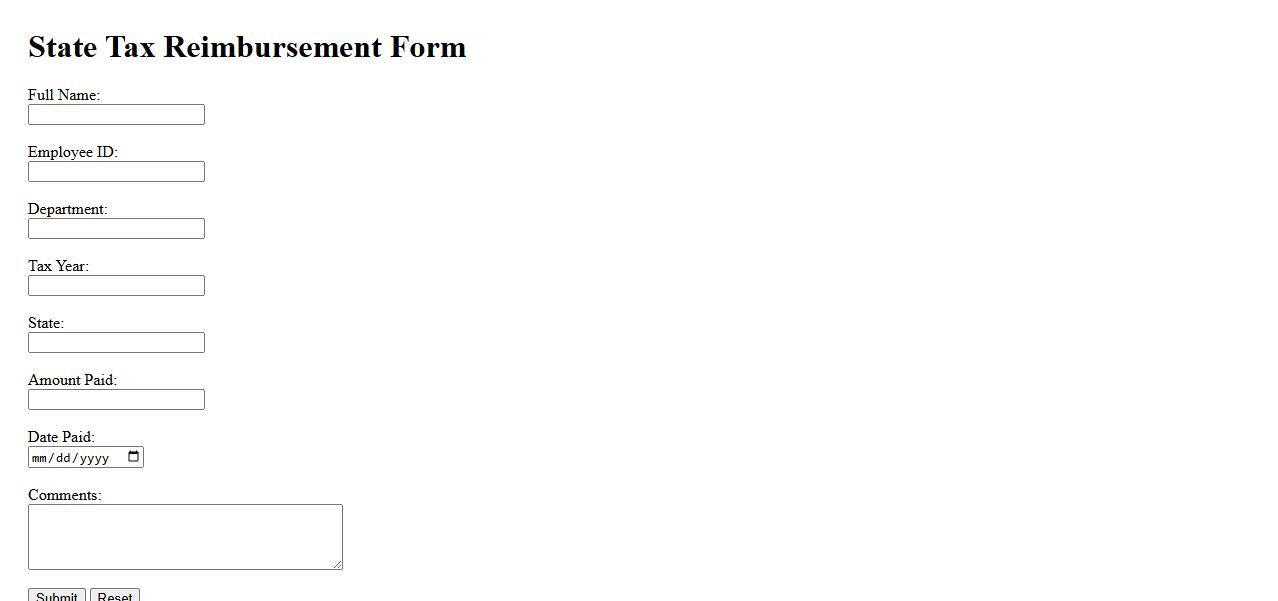

State Tax Reimbursement Form

The State Tax Reimbursement Form is used to claim refunds for overpaid state taxes. It ensures taxpayers receive accurate reimbursements based on their submitted income and deductions. Proper completion of this form is essential for timely processing by state tax authorities.

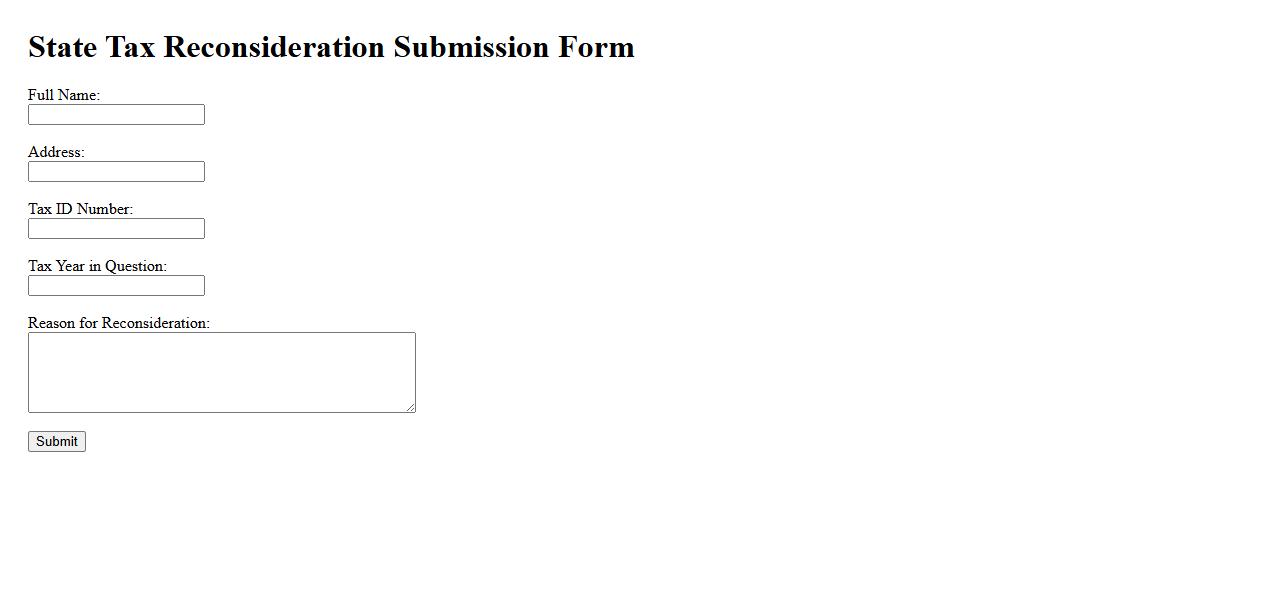

State Tax Reconsideration Submission

The State Tax Reconsideration Submission process allows taxpayers to formally request a review and adjustment of their state tax assessments. This procedure helps ensure accurate tax calculations and resolves disputes efficiently. Timely submission is crucial to avoid penalties and maximize potential refunds.

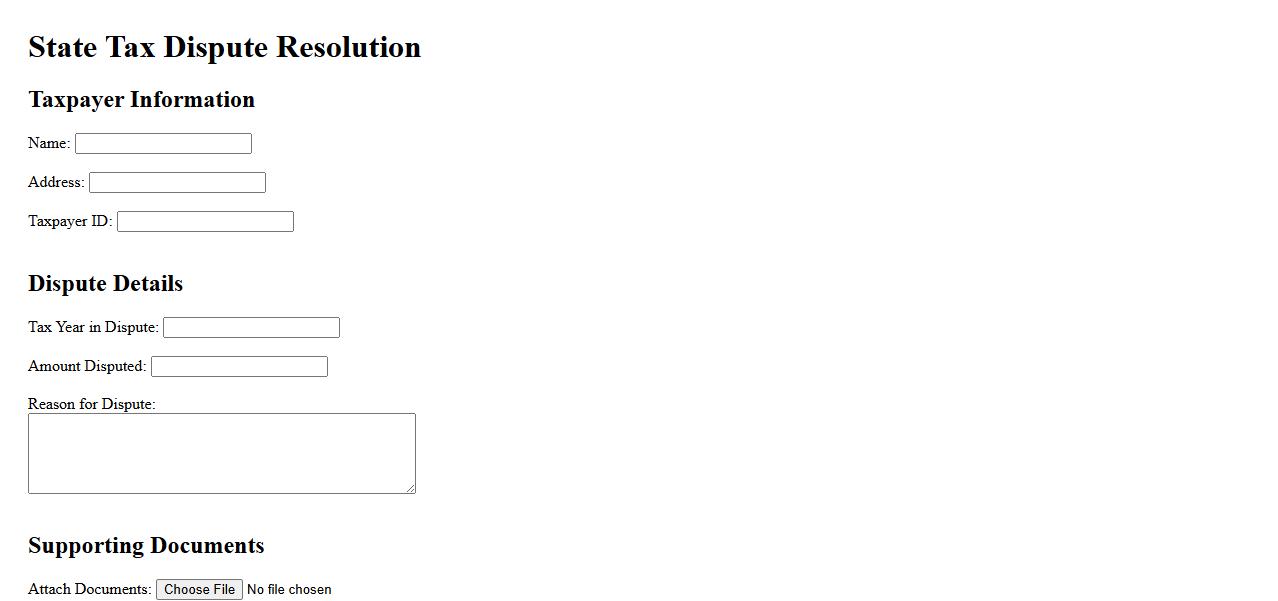

State Tax Dispute Resolution

State Tax Dispute Resolution involves the process of addressing disagreements between taxpayers and state tax authorities. This includes negotiation, mediation, or litigation to resolve issues such as tax assessments or penalties. Effective resolution ensures compliance and minimizes financial impact for both parties.

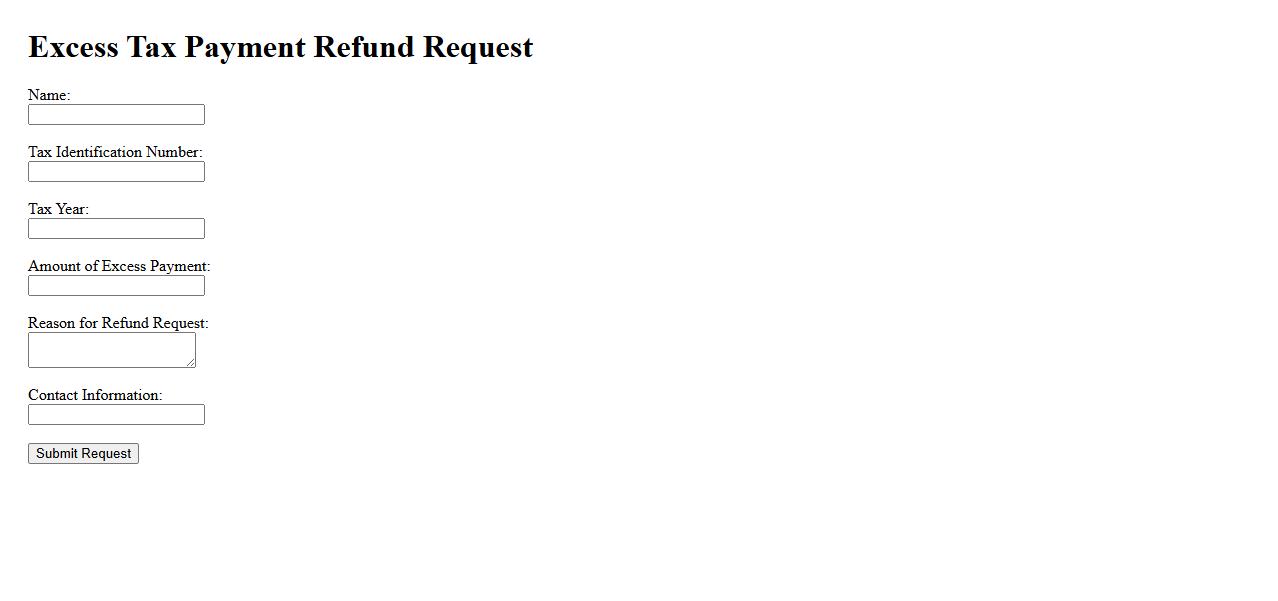

Excess Tax Payment Refund Request

If you believe you have made an excess tax payment, you can request a refund from the tax authorities. This process involves submitting the necessary documentation proving the overpayment. Timely refunds help ensure you receive the correct amount owed without delays.

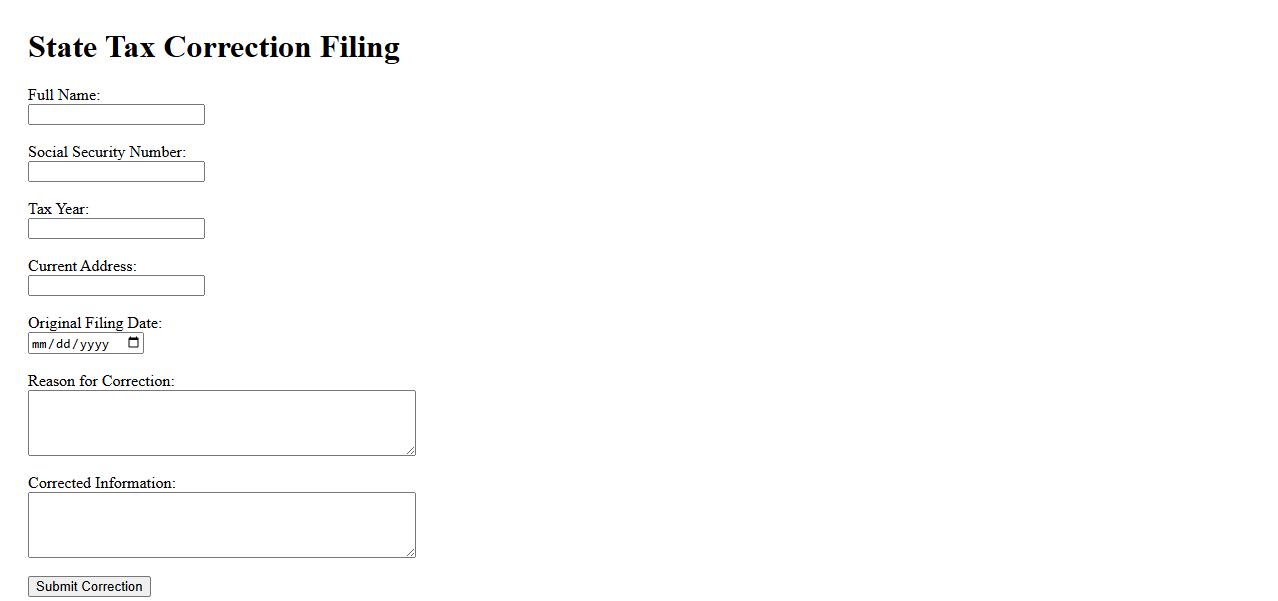

State Tax Correction Filing

State Tax Correction Filing involves the process of amending state income tax returns to rectify errors or omissions. This ensures compliance with state tax laws and helps avoid potential penalties or interest charges. Accurate correction filings maintain proper financial records and streamline tax reporting.

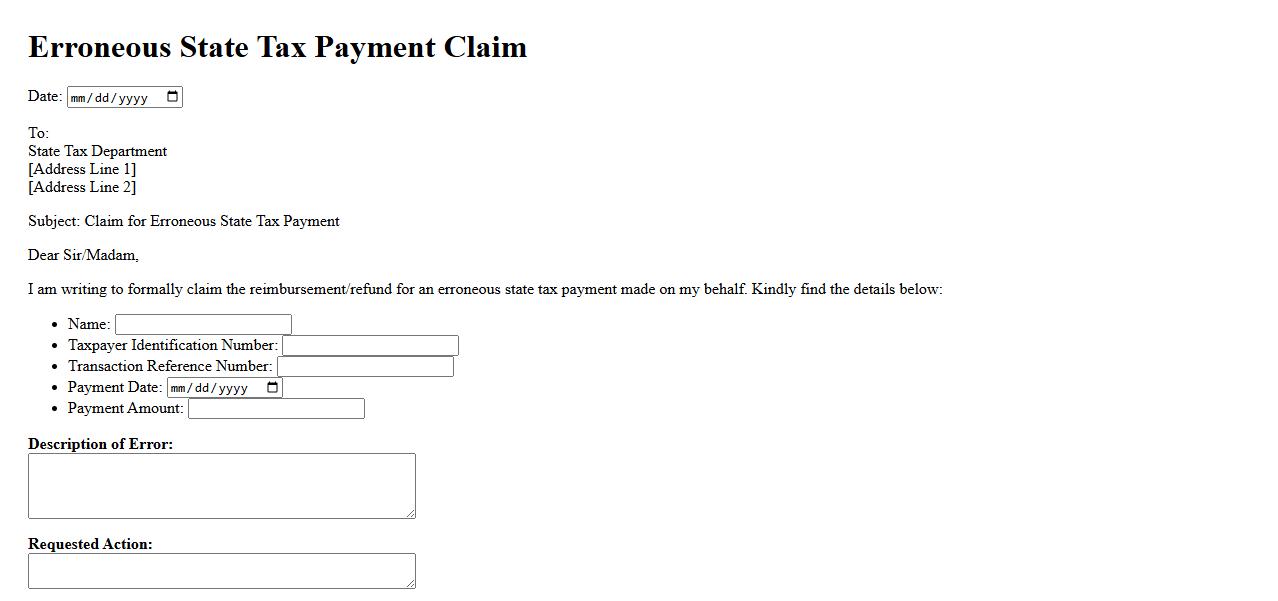

Erroneous State Tax Payment Claim

An Erroneous State Tax Payment Claim occurs when a taxpayer mistakenly overpays or incorrectly pays state taxes. This claim allows individuals or businesses to request a refund or adjustment from the state tax authority. Timely filing and accurate documentation are essential for successful resolution.

What specific state tax(s) are you requesting a refund for?

Please specify the exact state tax type for which you are requesting a refund. Common examples include income tax, sales tax, or property tax. Clear identification ensures prompt and accurate processing of your refund request.

What is the tax year or period covered by this refund claim?

Indicate the precise tax year or period relevant to your refund claim. This information is critical for verifying the claim against state tax records. Accurate period identification helps avoid delays in your refund processing.

What is the exact reason or basis for your state tax refund request?

Provide a detailed explanation of the reason or basis for your refund request, such as overpayment, tax credit, or error correction. This clarity supports the validation of your claim. Strong justification is key to a successful refund application.

Have you included all relevant supporting documents with your claim for refund?

Ensure you attach all relevant supporting documents, including receipts, tax returns, and correspondence. These documents substantiate your refund claim and facilitate review. Complete documentation is essential for efficient processing.

Has a similar claim for this tax period been filed or resolved previously?

Confirm whether a similar claim for the same tax period has been filed or resolved prior. This helps prevent duplicate processing and confusion. Transparency about previous claims improves administrative accuracy.