Filing a claim for renters insurance benefits involves notifying your insurance company about the damage or loss to your personal property. You must provide detailed documentation, including photos, receipts, and a list of damaged items, to support your claim. Prompt communication and accurate information increase the likelihood of a smooth and timely benefits payout.

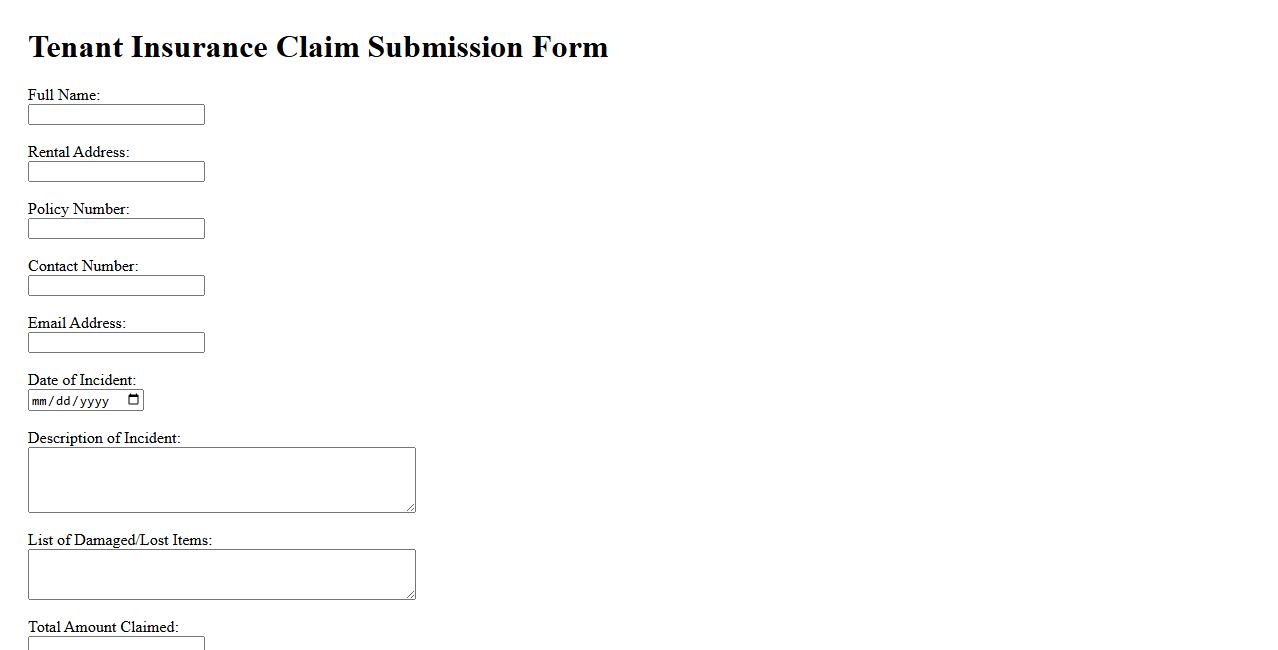

Tenant Insurance Claim Submission Form

The Tenant Insurance Claim Submission Form simplifies the process of reporting damages or losses covered under your rental insurance policy. This form ensures all necessary details are collected accurately, helping to expedite your claim approval. Fill out the form promptly to protect your tenant rights and receive timely assistance.

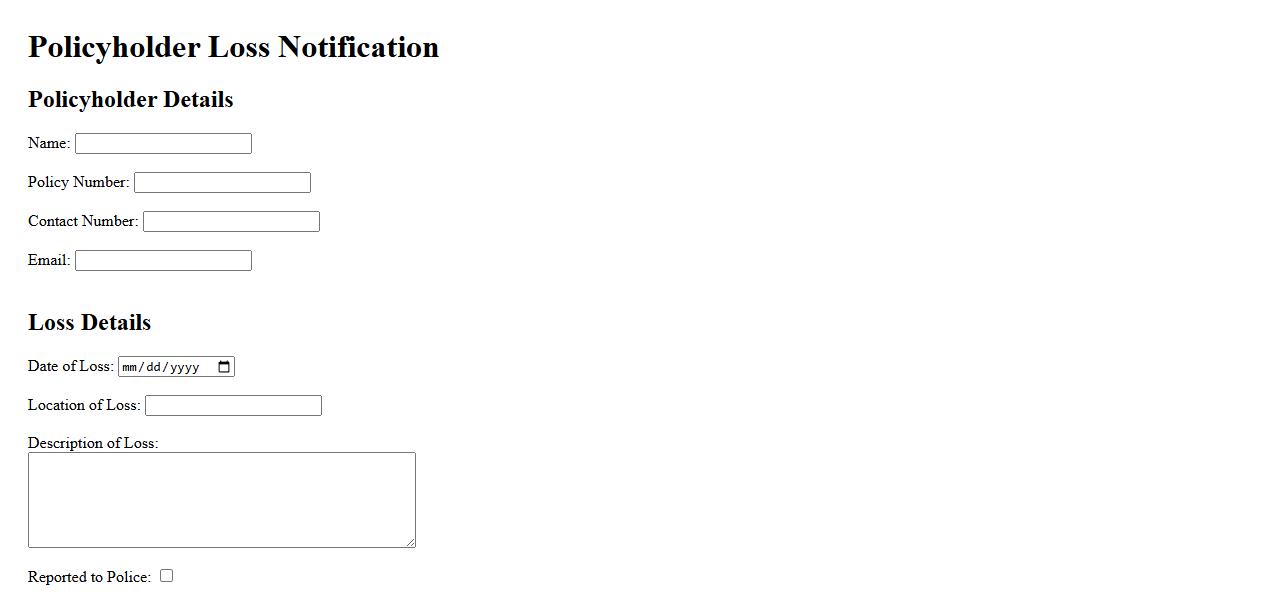

Policyholder Loss Notification Document

The Policyholder Loss Notification Document is a formal statement submitted by the insured party to report a loss or damage to their insurance provider. This document initiates the claims process and provides essential details about the incident. Accurate and timely completion ensures efficient handling and resolution of the claim.

Rental Property Damage Report

A Rental Property Damage Report is an essential document used to assess and record any damages in a rental unit. It helps landlords and tenants maintain transparency and resolve disputes efficiently. This report ensures that property conditions are clearly documented before and after a tenancy.

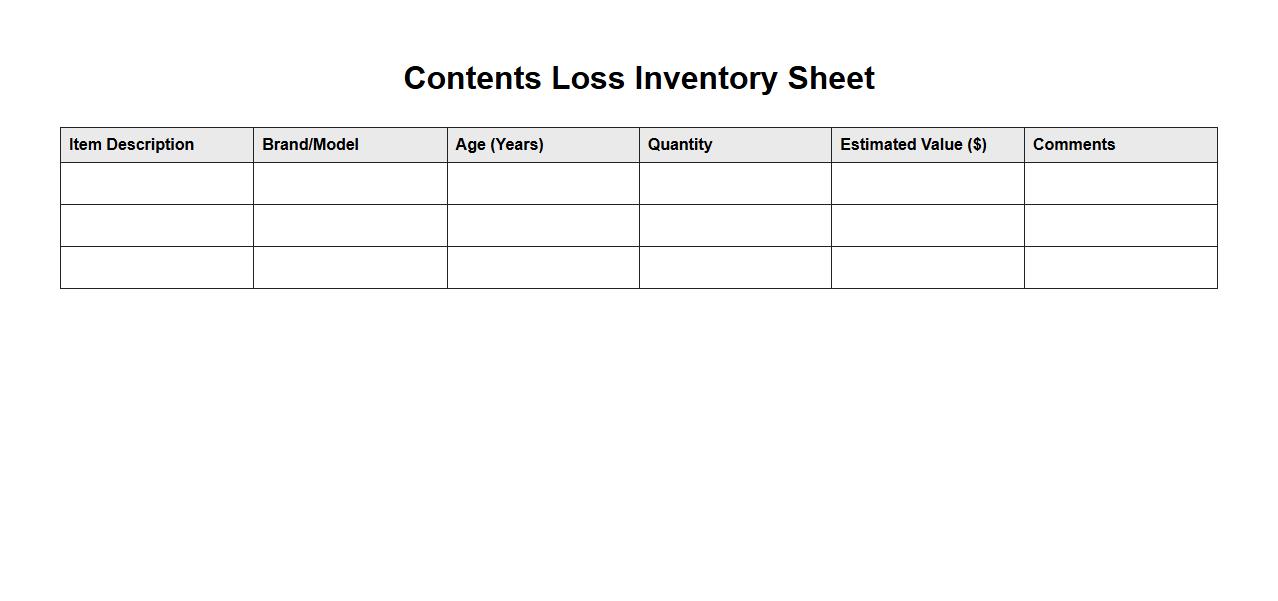

Contents Loss Inventory Sheet

The Contents Loss Inventory Sheet is a detailed document used to itemize and track personal property damaged or lost in an incident. It helps individuals and insurance companies assess the extent of loss for claims processing. Keeping an accurate inventory ensures a smoother and faster compensation process.

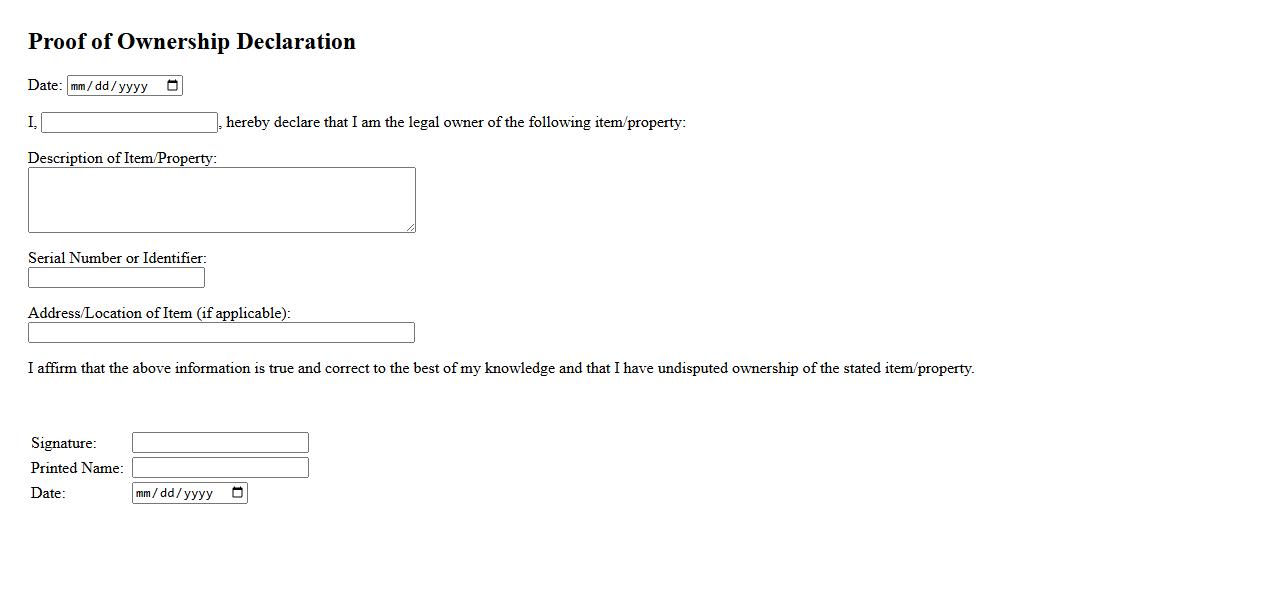

Proof of Ownership Declaration

The Proof of Ownership Declaration is a legal document that confirms an individual's or entity's rightful ownership of a property or asset. It serves as official evidence to validate ownership claims in transactions or disputes. This declaration is essential for ensuring clear and undisputed property rights.

Incident Description Statement

An Incident Description Statement provides a clear and concise account of an event or situation, detailing what occurred, when, and the parties involved. It serves as a critical document for understanding the incident's context and impact. This statement is essential for investigations and resolution processes.

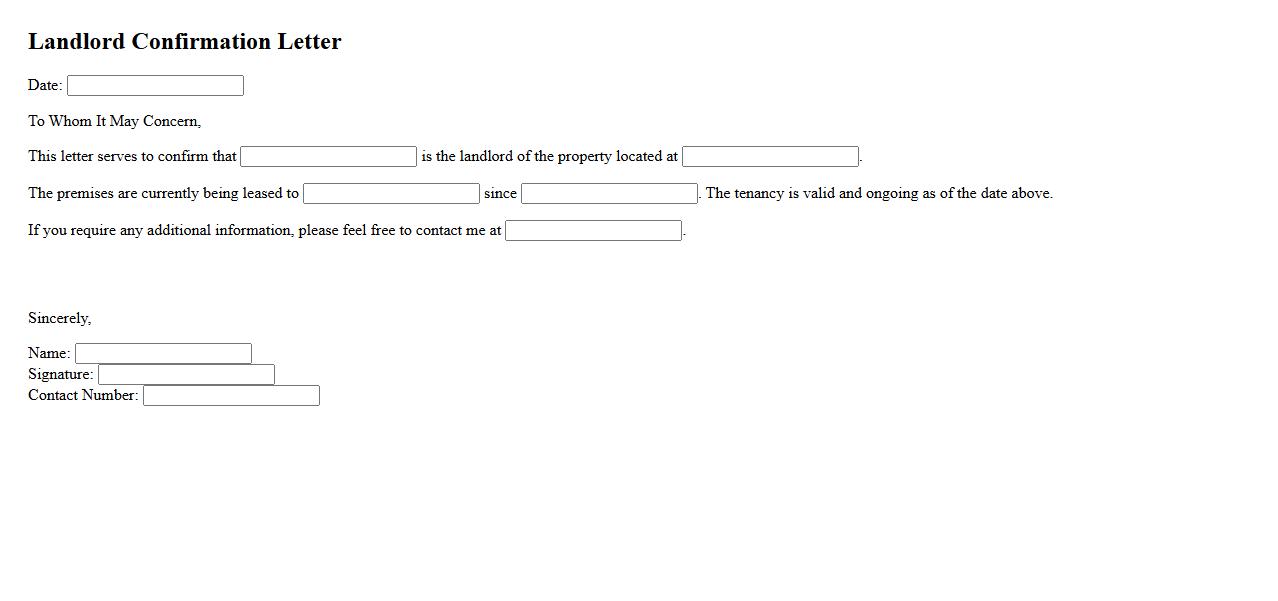

Landlord Confirmation Letter

A Landlord Confirmation Letter is a formal document used to verify tenancy details such as rental payments, lease duration, and property conditions. It serves as proof of residence and agreement between the landlord and tenant. This letter is often required for legal, financial, or administrative purposes.

Police or Fire Department Incident Record

The Police or Fire Department Incident Record is a detailed report documenting the specifics of an emergency event or crime. It includes vital information such as the nature of the incident, involved parties, and response actions taken by first responders. This record is essential for legal, insurance, and investigative purposes.

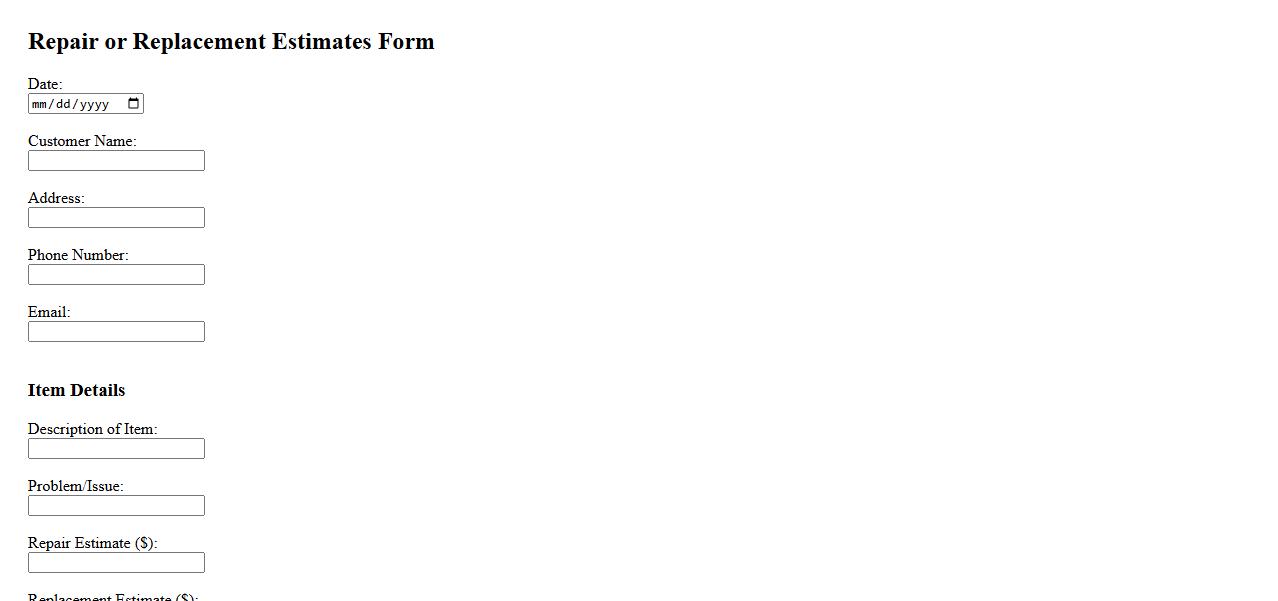

Repair or Replacement Estimates Form

Use our Repair or Replacement Estimates Form to quickly provide all necessary details for an accurate assessment. This form ensures a smooth process by capturing essential information about your damaged items. Submit your request today to receive a timely and precise estimate.

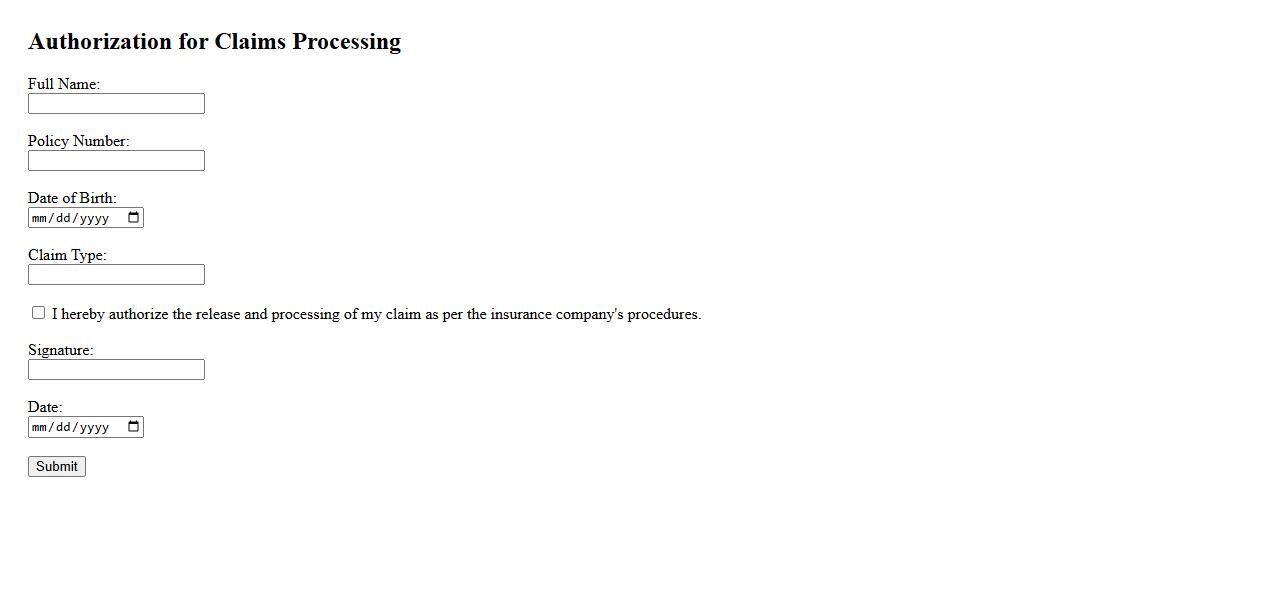

Authorization for Claims Processing

Authorization for Claims Processing is a crucial document that grants permission to handle and process insurance claims on behalf of the claimant. It ensures that the authorized party can act efficiently in managing claim-related communications and transactions. This authorization streamlines the claims procedure, reducing delays and errors.

What is the primary purpose of submitting a renters insurance claim document?

The primary purpose of submitting a renters insurance claim document is to request financial compensation for losses incurred due to covered events. This document initiates the insurer's review process to validate the claim. It ensures that the policyholder receives reimbursement or repair costs as stipulated in the insurance policy.

Which specific events or damages are typically covered under renters insurance policies?

Renters insurance policies usually cover damages caused by fire, theft, vandalism, and certain natural disasters such as wind or hail. They also often provide coverage for water damage resulting from plumbing issues or burst pipes. Personal property loss and liability protection for injuries occurring on the rental property are commonly included.

What documentation is required to support a renters insurance benefits claim?

To support a renters insurance claim, policyholders must provide a detailed inventory of damaged or stolen items, including receipts or photographs. Additionally, a police report is often required for theft or vandalism claims. Estimates or invoices for repair or replacement costs are essential to verify the financial loss.

How does the policyholder's deductible impact the claim payout?

The deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. It reduces the total claim payout by the deductible value. Higher deductibles generally result in lower premium costs but increase the policyholder's initial expense in a claim situation.

What are common reasons for denial of renters insurance claims?

Common reasons for claim denial include lack of coverage for the specific event, insufficient documentation, or policy lapses due to missed payments. Claims filed for damages caused by neglect or intentional acts are typically rejected. Failure to report the incident promptly also often leads to denial.