Filing a Claim for Life Insurance Benefits involves submitting necessary documents such as the death certificate and policy details to the insurance company. The insurer reviews the claim to verify the policyholder's coverage and processes the payment to the designated beneficiaries. Timely submission and accurate information ensure a smooth and efficient claim settlement.

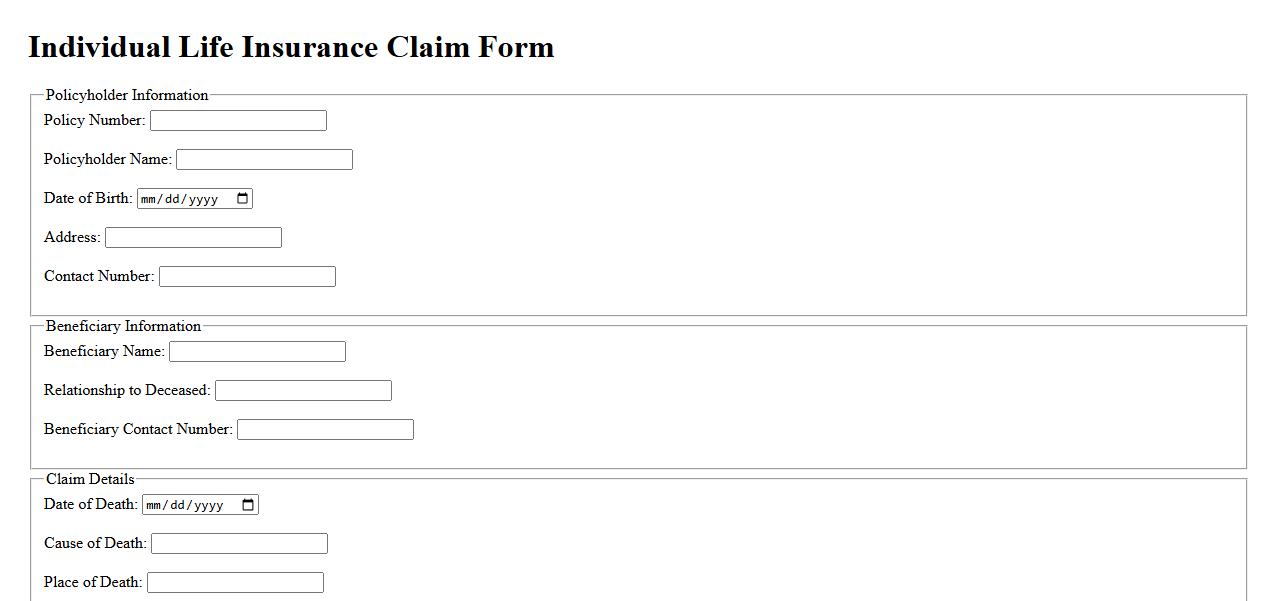

Individual Life Insurance Claim Form

The Individual Life Insurance Claim Form is a crucial document required to request the benefits from a life insurance policy after the policyholder's death. It collects essential information about the deceased, the claimant, and the circumstances of the claim. Timely and accurate submission ensures prompt processing and disbursement of the insurance payout.

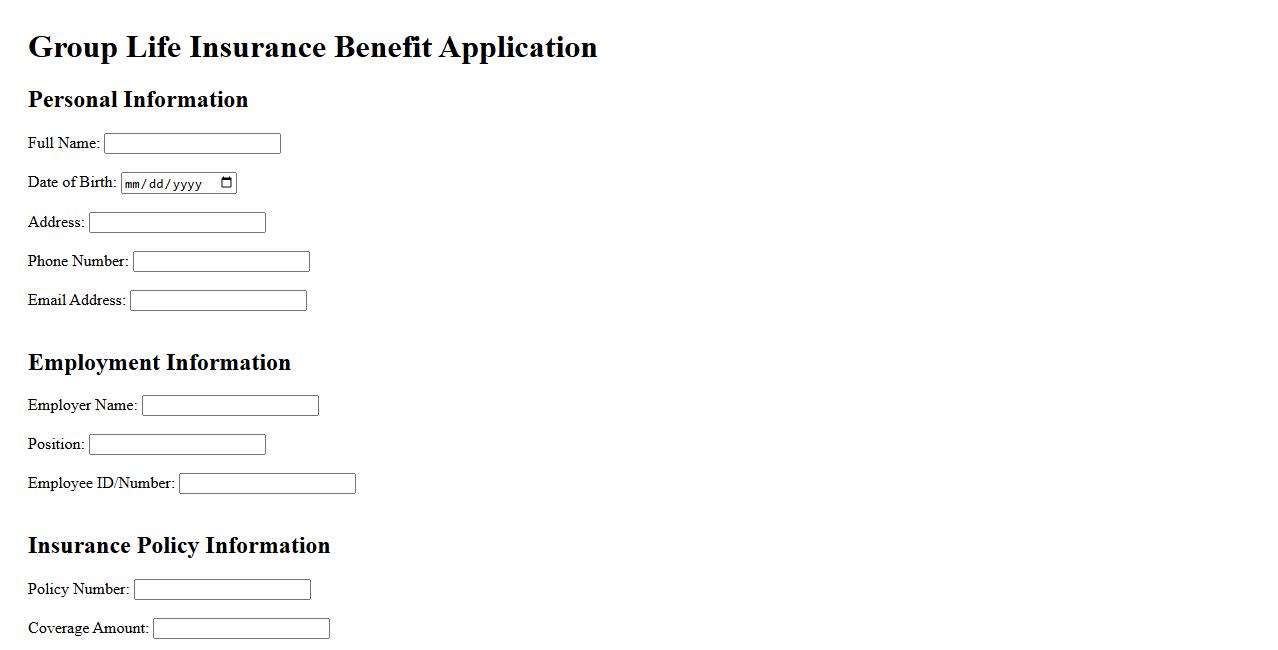

Group Life Insurance Benefit Application

The Group Life Insurance Benefit Application is a crucial form used to enroll employees in a collective life insurance plan offered by an employer. It ensures that members receive financial protection and security for their beneficiaries in the event of untimely death. Completing this application accurately helps streamline the process of securing life insurance coverage for the group.

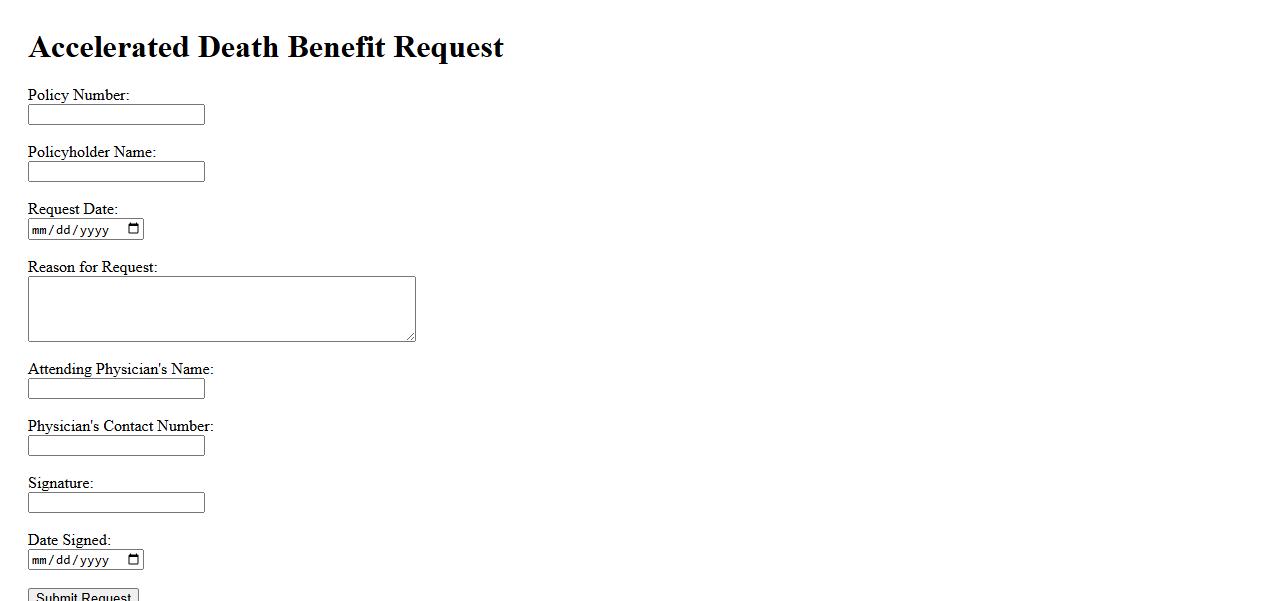

Accelerated Death Benefit Request

An Accelerated Death Benefit Request allows policyholders to access a portion of their life insurance benefits early if diagnosed with a terminal illness. This option provides financial support during critical times without waiting for the policy's maturity. It helps cover medical expenses and other urgent needs efficiently.

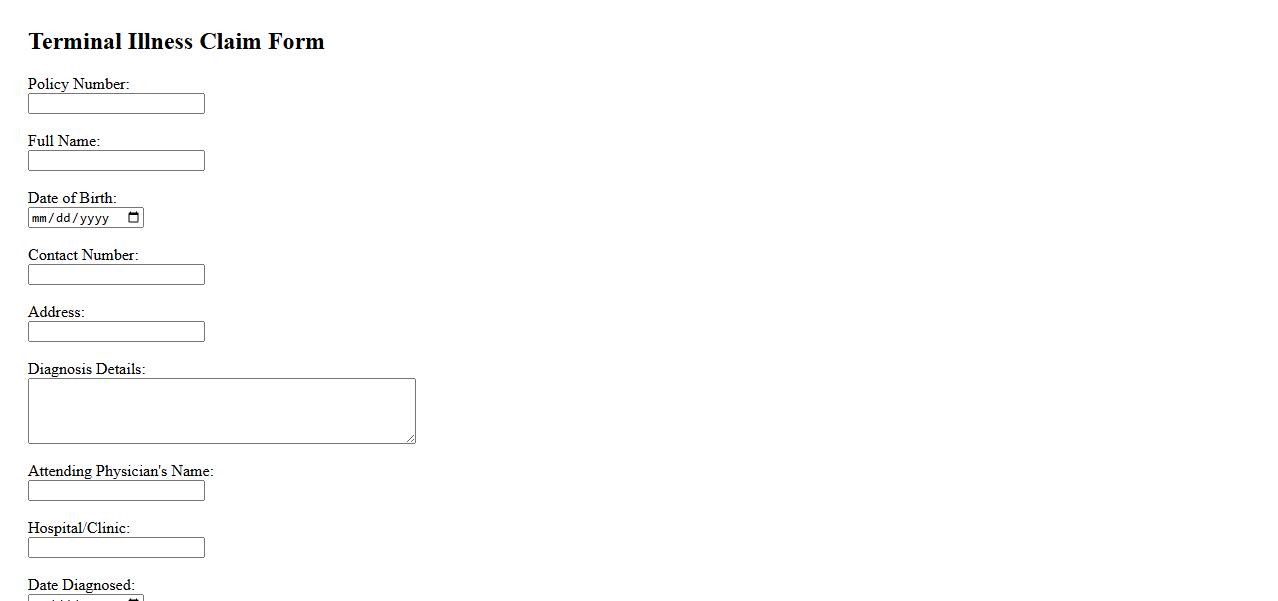

Terminal Illness Claim Form

The Terminal Illness Claim Form is a critical document used to request benefits when a insured individual is diagnosed with a terminal condition. It ensures timely processing of claims by providing essential medical and personal information. Submitting this form promptly helps expedite financial support during challenging times.

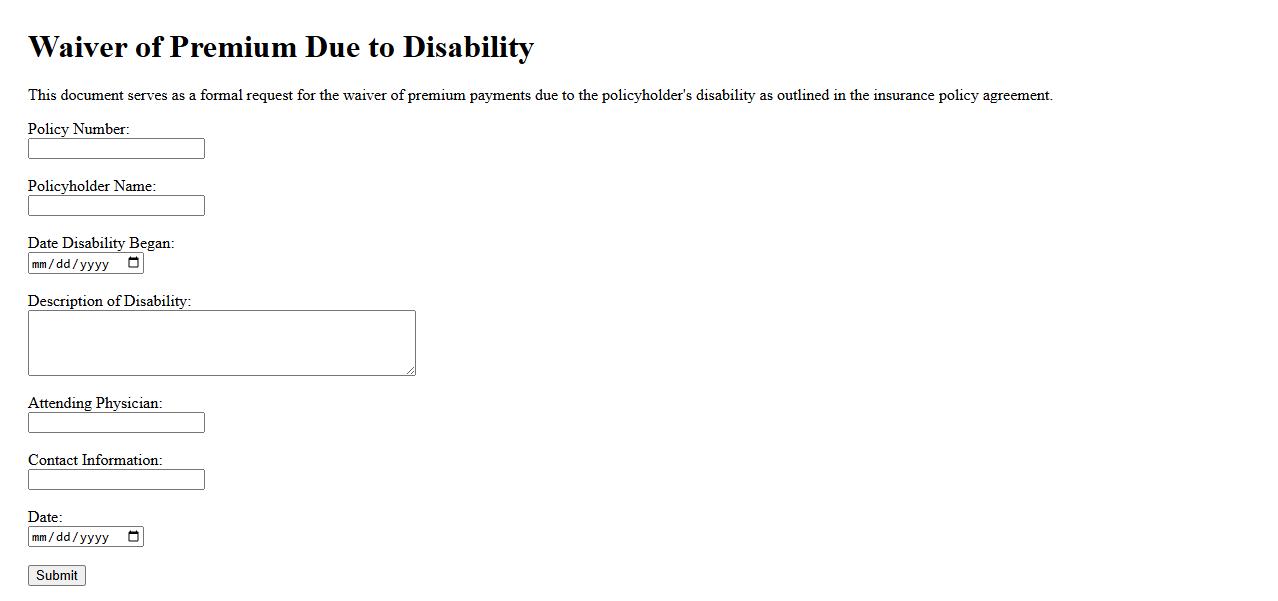

Waiver of Premium Due to Disability

The Waiver of Premium Due to Disability is a valuable insurance feature that allows policyholders to pause premium payments if they become disabled. This benefit ensures continued coverage without financial strain during periods of inability to work. It provides peace of mind by protecting both the policy and the insured's financial future.

Death Claim Statement

A Death Claim Statement is a formal document submitted to an insurance company to initiate the process of claiming life insurance benefits after the policyholder's death. It typically includes essential details about the deceased and the claimant to verify eligibility. Timely and accurate submission of this statement ensures a smooth and efficient claim settlement.

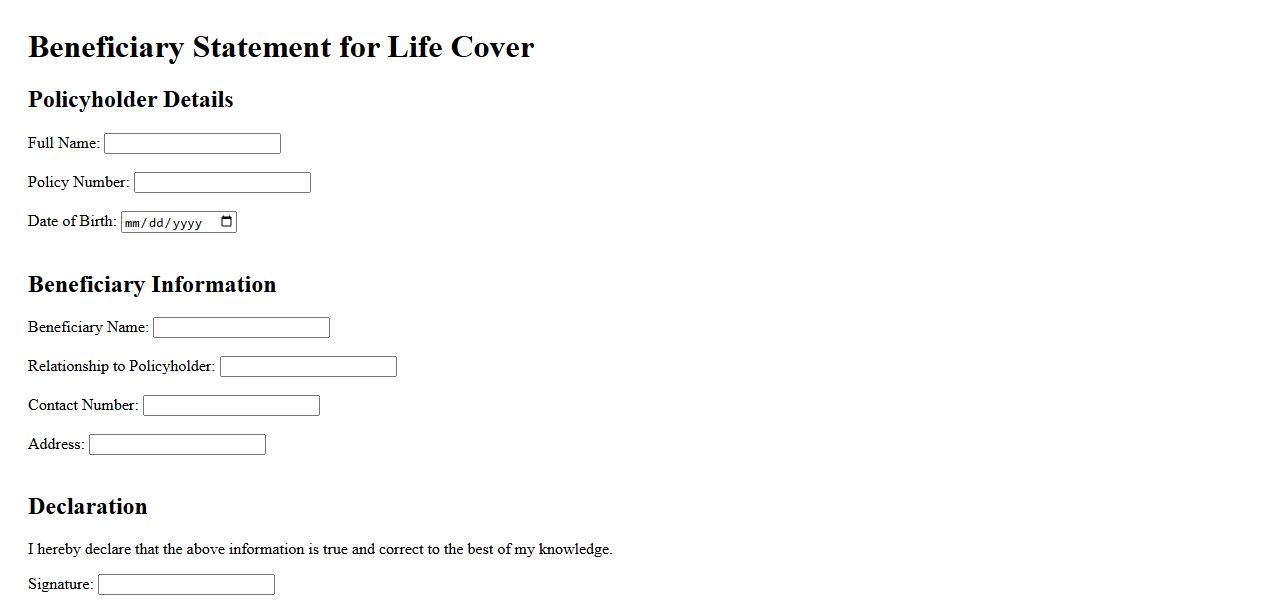

Beneficiary Statement for Life Cover

A Beneficiary Statement for Life Cover is a crucial document that specifies the individuals or entities entitled to receive the life insurance payout upon the policyholder's death. It ensures that the benefits are distributed according to the insured's wishes, providing financial security to loved ones. Properly updating this statement helps avoid disputes and delays in claim processing.

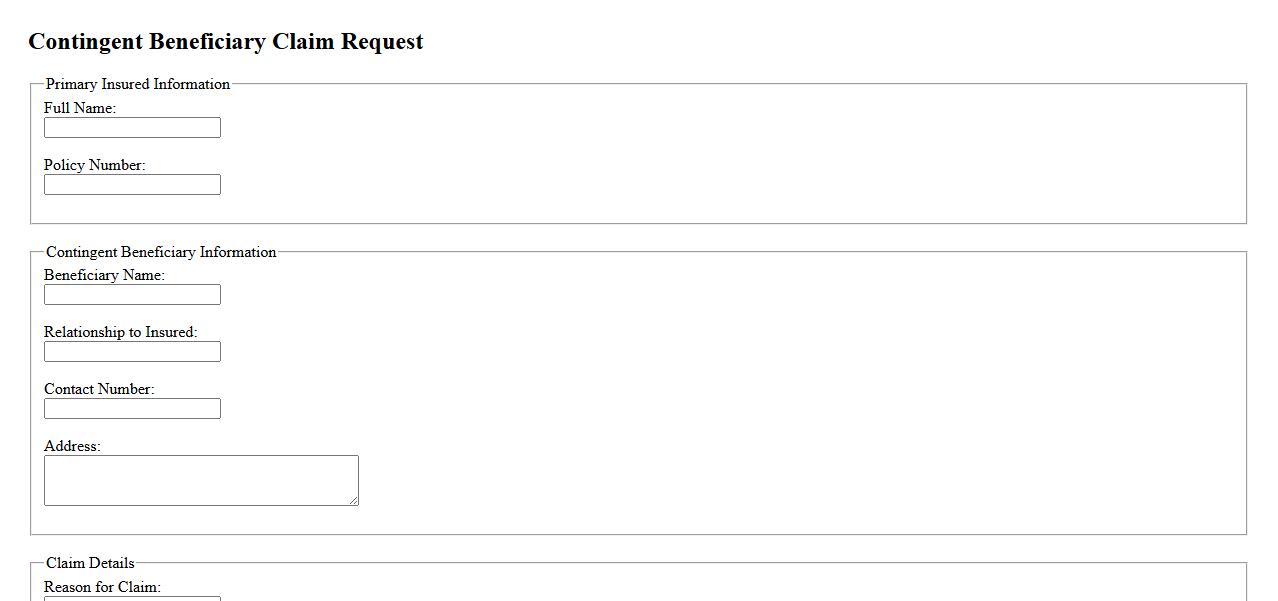

Contingent Beneficiary Claim Request

A Contingent Beneficiary Claim Request is a formal process initiated when the primary beneficiary cannot claim the benefits. It ensures that the contingent beneficiary receives the designated assets or benefits according to the policy or legal agreement. This request protects the interests of secondary beneficiaries in estate planning and insurance policies.

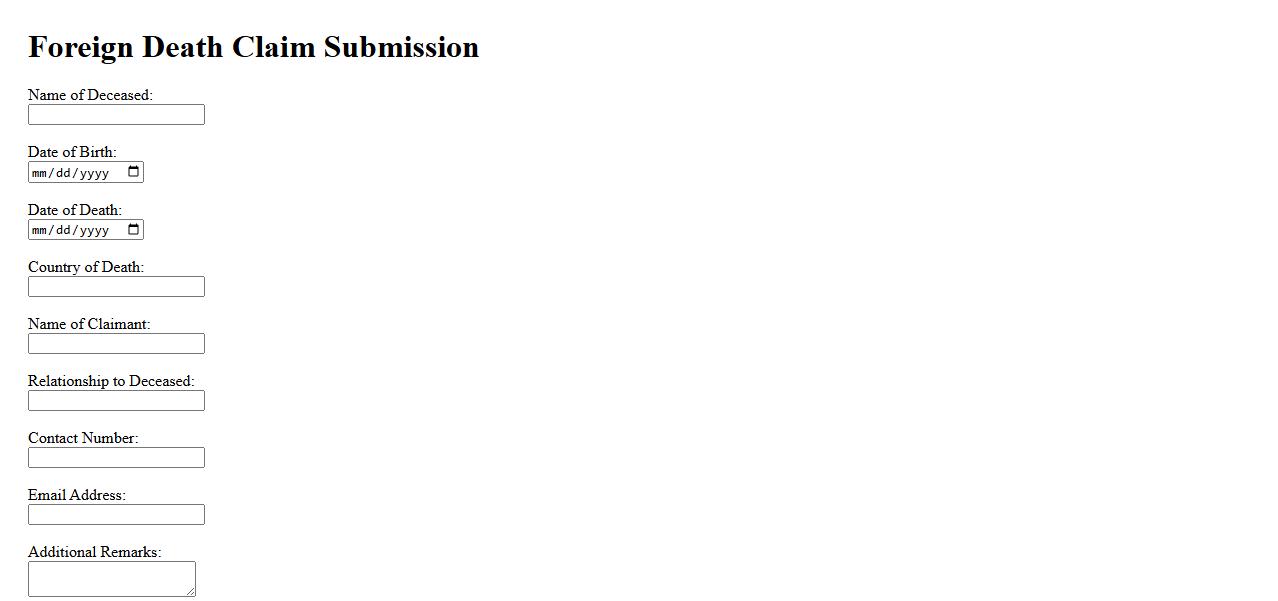

Foreign Death Claim Submission

Submitting a foreign death claim involves providing necessary documentation to authorities or insurance companies to process benefits for a deceased individual who passed away abroad. It ensures rightful beneficiaries receive any owed assets or compensation. Timely and accurate submission helps avoid delays in claim processing.

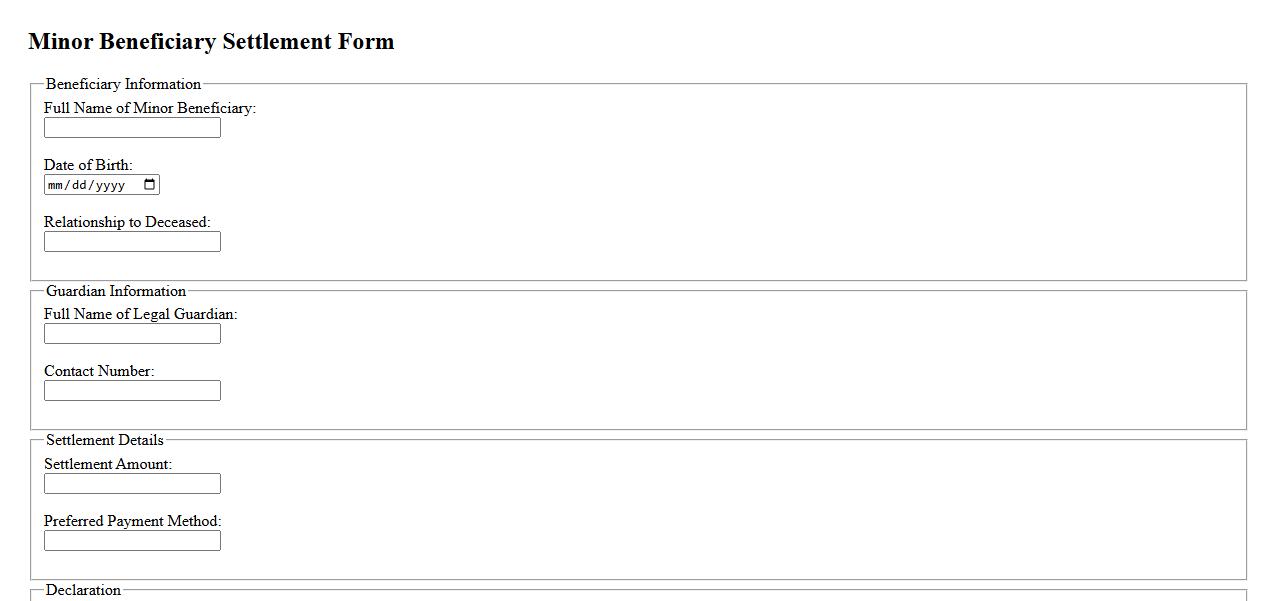

Minor Beneficiary Settlement Form

The Minor Beneficiary Settlement Form is a legal document used to manage and distribute assets to a minor beneficiary. It ensures that the settlement is handled appropriately until the minor reaches the age of majority. This form helps protect the interests of the minor in financial or legal settlements.

What is the primary purpose of a life insurance claim document?

The primary purpose of a life insurance claim document is to formally request the payment of the life insurance benefits. It serves as official evidence that the insured individual has passed away, triggering the insurer to process the payout. The document ensures that the claimant's right to the death benefit is validated and recognized.

Which parties are typically required to provide information on a life insurance claim form?

Typically, the beneficiary or claimants must provide personal details and proof of their relationship to the deceased. Additionally, the insurer may require information from the policyholder's family members or legal representatives. Medical professionals may also need to submit pertinent details regarding the cause of death.

What key documentation must accompany a life insurance claim submission?

A vital component is the death certificate, which verifies the deceased's passing. The insurer also requires the original insurance policy and a fully completed claim form. Supporting documents, such as proof of identity and proof of beneficiary status, often accompany the claim for verification.

How does the beneficiary's relationship to the policyholder impact claim processing?

The nature of the beneficiary's relationship to the policyholder affects the documentation required and the speed of claim approval. Close family members typically receive priority and streamlined verification processes. Non-family beneficiaries may face additional scrutiny to confirm their eligibility for the payout.

What are the common reasons for delay or denial of life insurance benefit claims?

Delays often occur due to incomplete documentation or discrepancies in the submitted information. Claims may be denied if the cause of death is excluded under the policy terms, such as suicide clauses or fraud. Insufficient proof of beneficiary status or contested claims also contribute to processing setbacks.