A Claim for Unclaimed Property involves the process of an individual or entity recovering assets, such as forgotten bank accounts, insurance benefits, or uncashed checks, that have been turned over to the state due to inactivity. To file a claim, the rightful owner must provide proof of ownership and complete the necessary documentation as required by the state's unclaimed property office. Successfully claiming unclaimed property helps individuals regain property that rightfully belongs to them and prevents permanent loss.

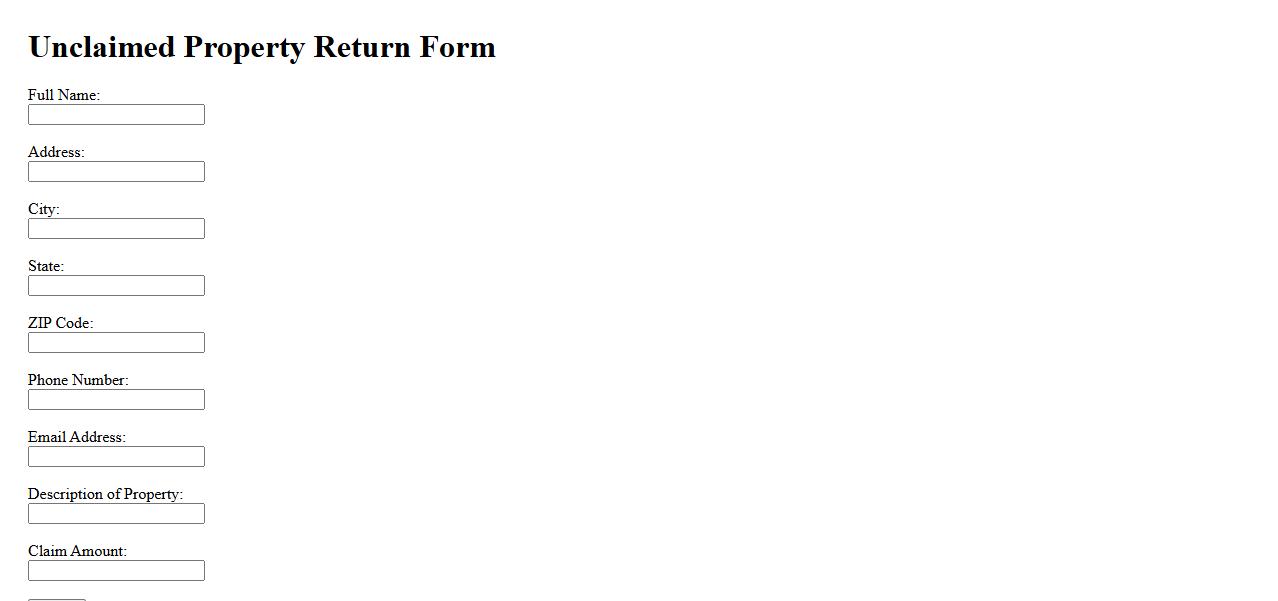

Unclaimed Property Return Form

The Unclaimed Property Return Form is a vital document used to report and remit unclaimed assets to the appropriate state authority. This form ensures compliance with legal requirements and helps reunite owners with their lost or forgotten property. Timely submission of the form prevents penalties and facilitates accurate record-keeping.

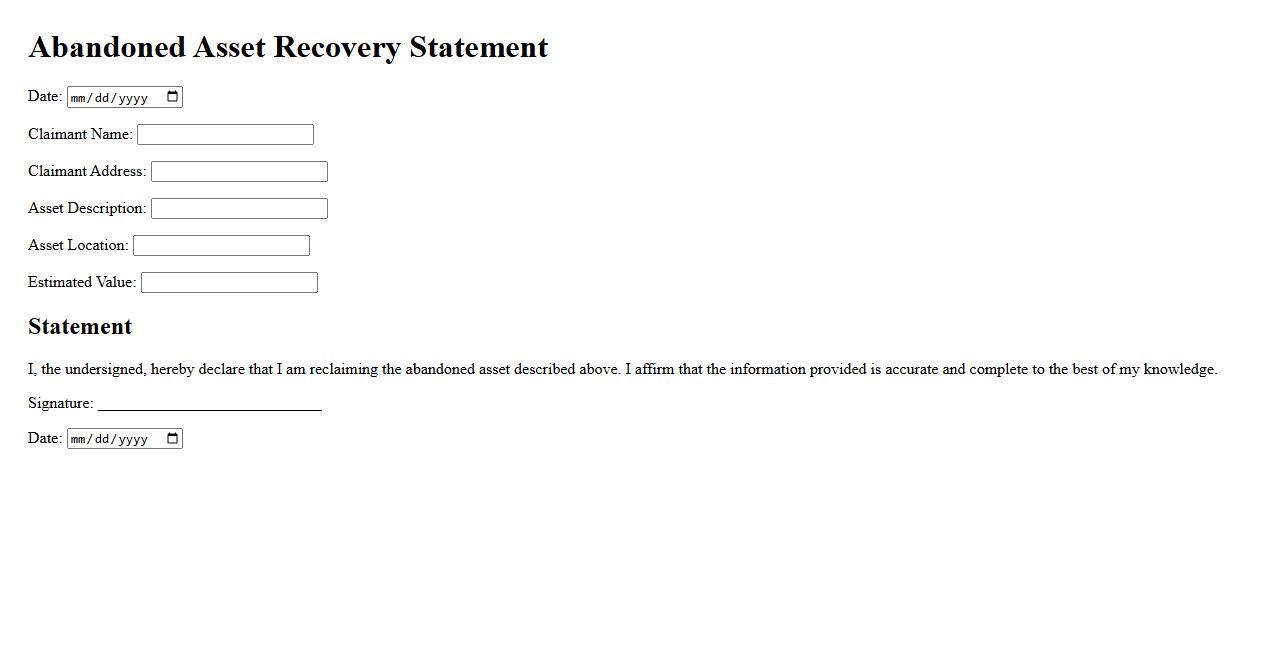

Abandoned Asset Recovery Statement

The Abandoned Asset Recovery Statement provides a detailed overview of unclaimed or forgotten assets held by an organization. It outlines the processes for identifying, recovering, and properly managing these assets to ensure compliance and transparency. This statement is essential for maintaining accurate financial records and safeguarding unutilized resources.

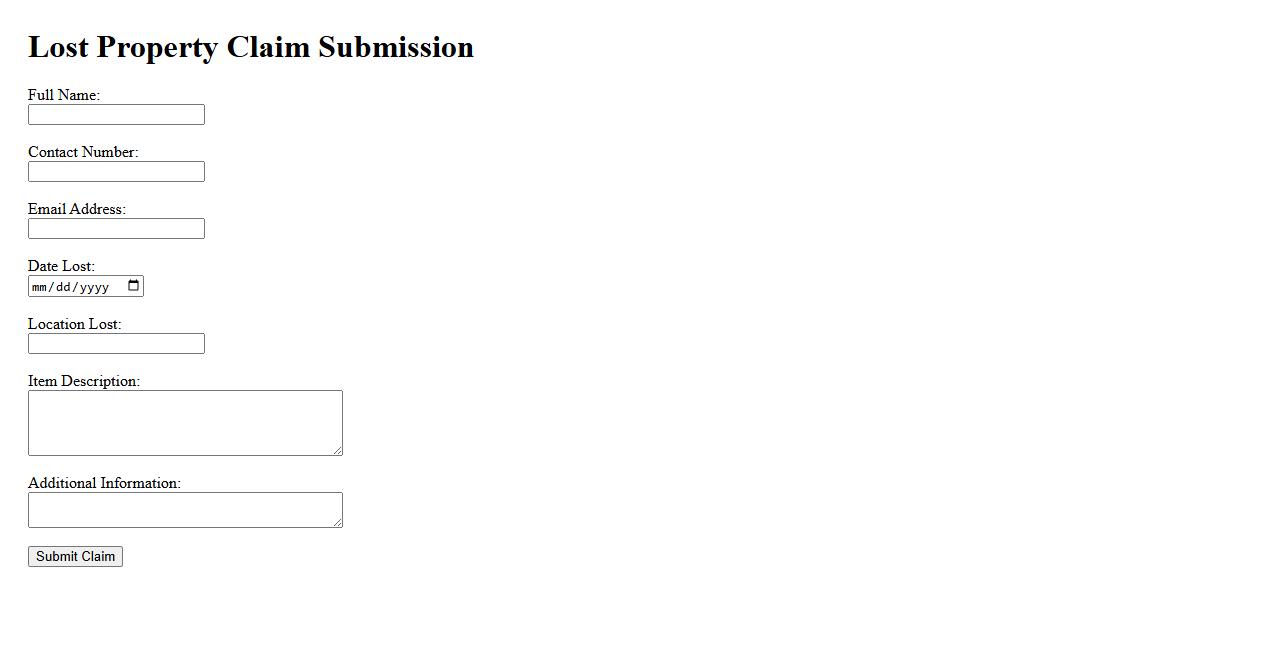

Lost Property Claim Submission

Submitting a Lost Property Claim ensures that you can recover items misplaced or lost during travel or events. The process involves providing detailed information about the lost item to facilitate its identification and return. Timely and accurate claim submission increases the chances of successful recovery.

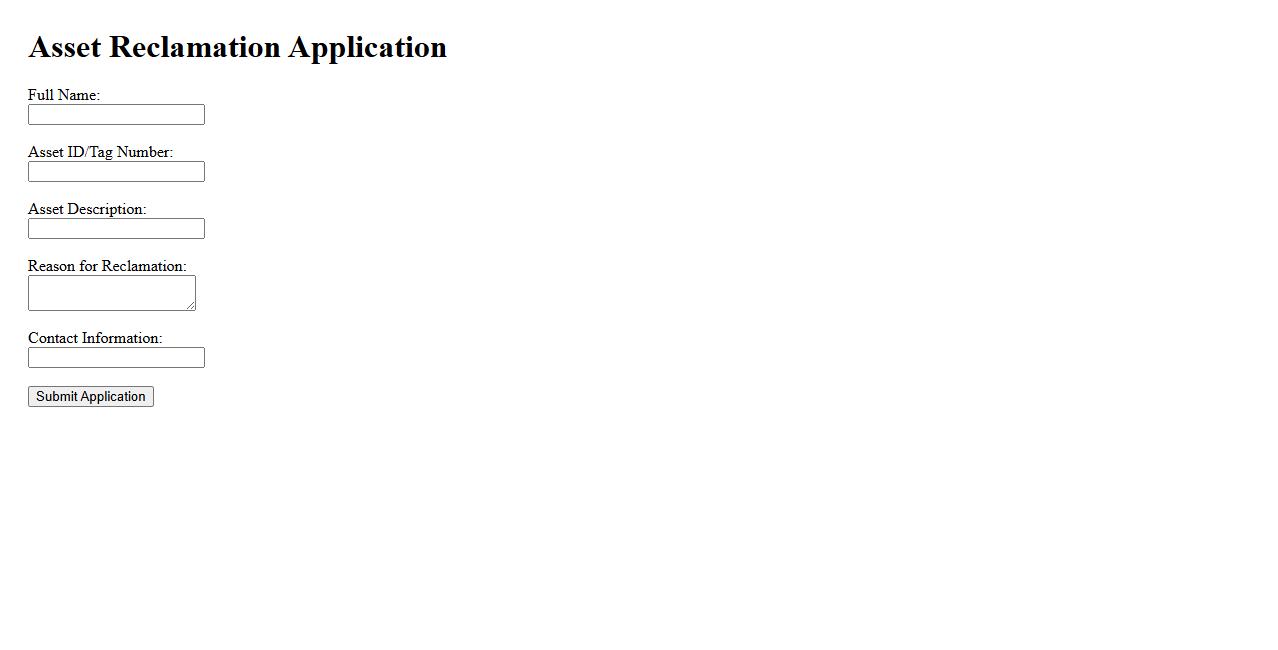

Asset Reclamation Application

The Asset Reclamation Application streamlines the process of recovering valuable resources from obsolete or unused materials. It enhances efficiency by automating asset tracking and recovery workflows. This application supports sustainable practices by minimizing waste and maximizing resource reutilization.

Holder Remittance Declaration

The Holder Remittance Declaration is a formal document used to confirm the transfer of funds or assets by the holder. It provides detailed information about the remittance, ensuring transparency and compliance with regulatory requirements. This declaration is essential for accurate financial record-keeping and auditing purposes.

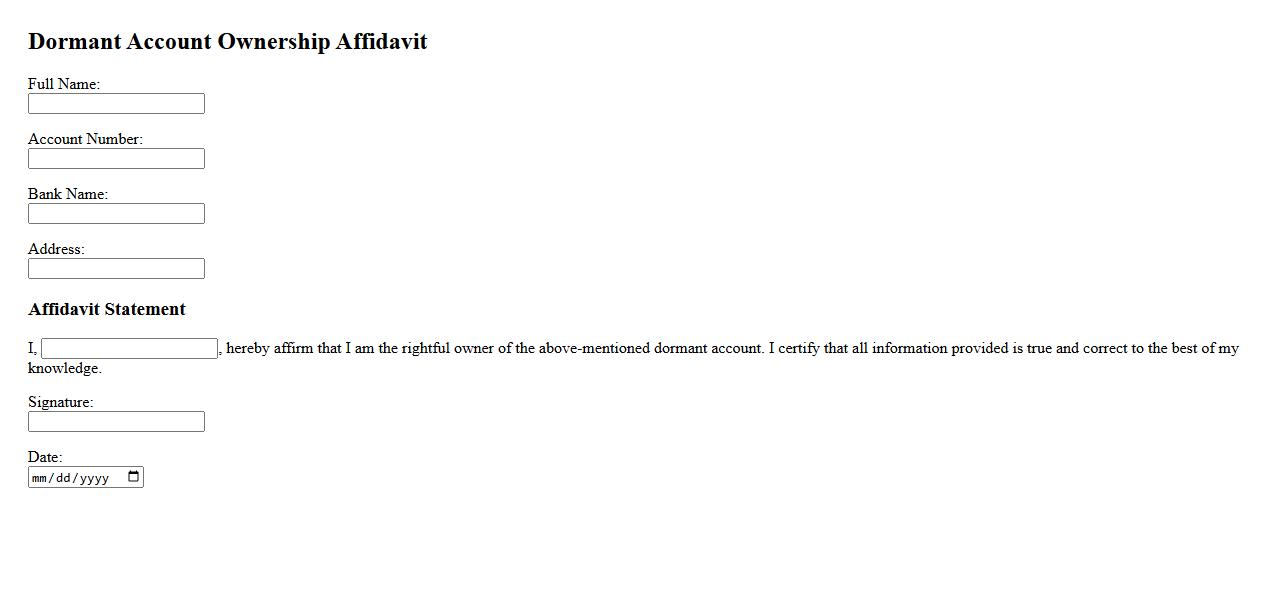

Dormant Account Ownership Affidavit

The Dormant Account Ownership Affidavit is a legal document used to verify the rightful owner of an inactive bank or financial account. This affidavit helps reactivate or reclaim account access by confirming ownership through sworn statements and supporting identification. It is essential for resolving issues related to dormant or unclaimed accounts efficiently.

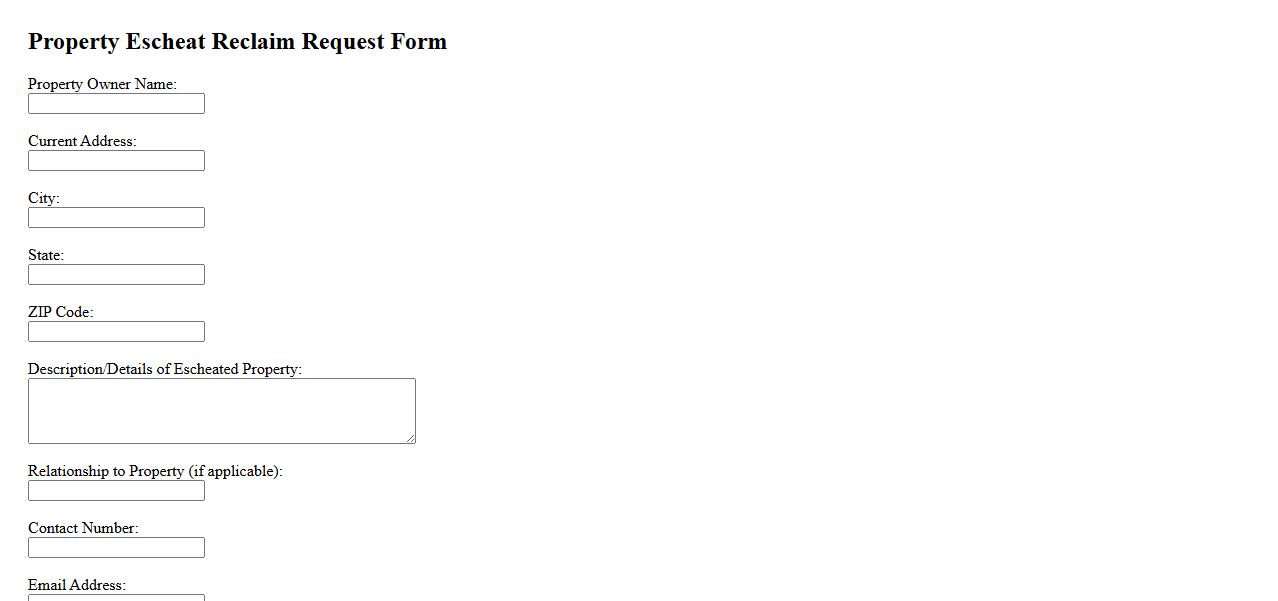

Property Escheat Reclaim Request

A Property Escheat Reclaim Request is a formal process used to recover assets or property that have been transferred to the state due to inactivity or abandonment. This request allows rightful owners or heirs to claim their property before it is permanently retained by governmental authorities. Understanding the escheat reclaim procedure ensures that owners can recover lost assets efficiently and legally.

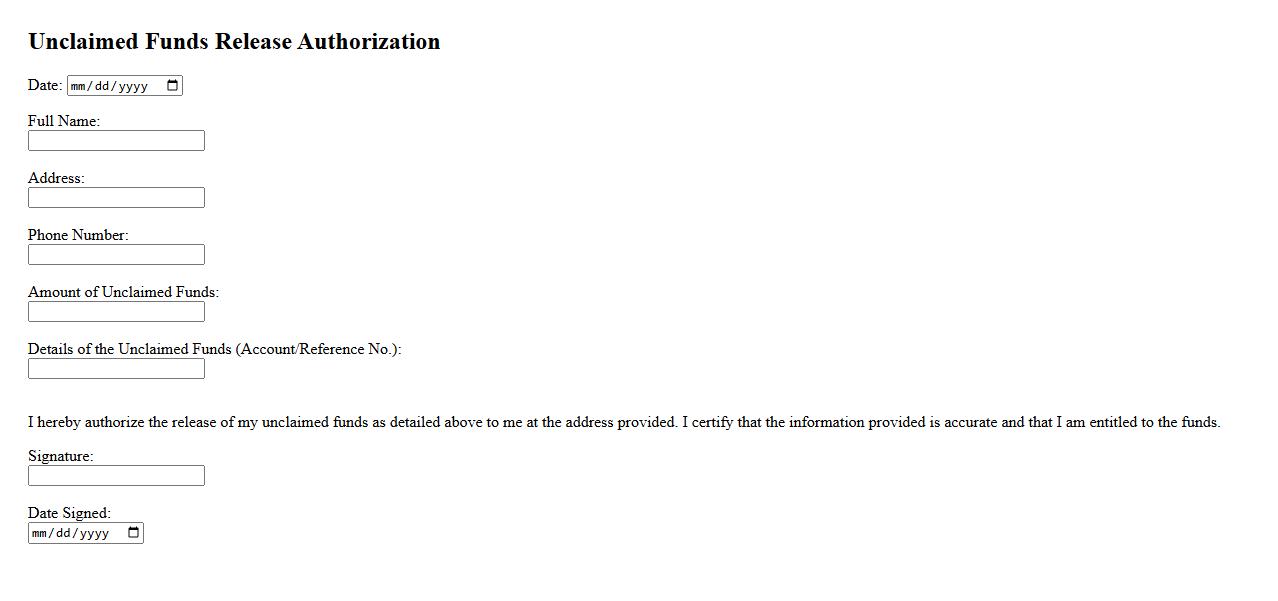

Unclaimed Funds Release Authorization

The Unclaimed Funds Release Authorization is a formal document that allows individuals or entities to claim funds that have been held by an organization due to inactivity or lost ownership. This authorization ensures a secure and verified process for the rightful owner to receive their money. It is essential for releasing dormant or unclaimed financial assets efficiently and legally.

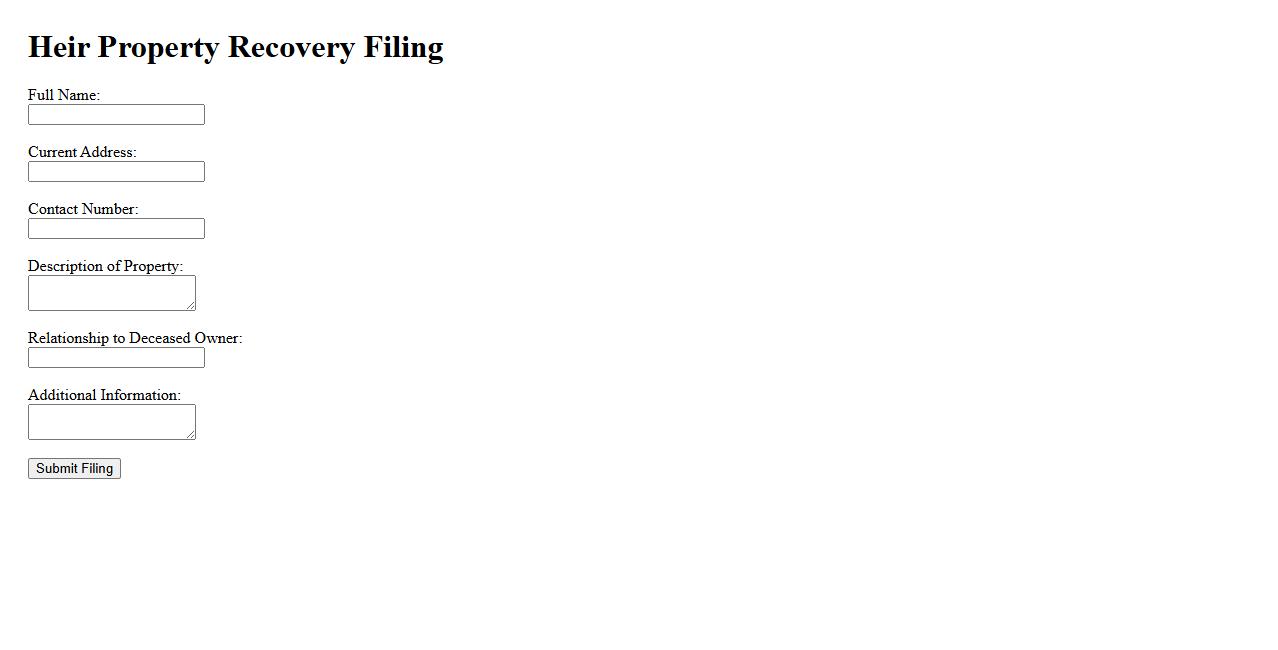

Heir Property Recovery Filing

Heir Property Recovery Filing is a legal process that helps descendants reclaim ownership rights to property inherited without a formal will. This filing ensures rightful heirs can secure their interest and protect the property from unauthorized claims. It is essential for maintaining clear title and preventing potential disputes among family members.

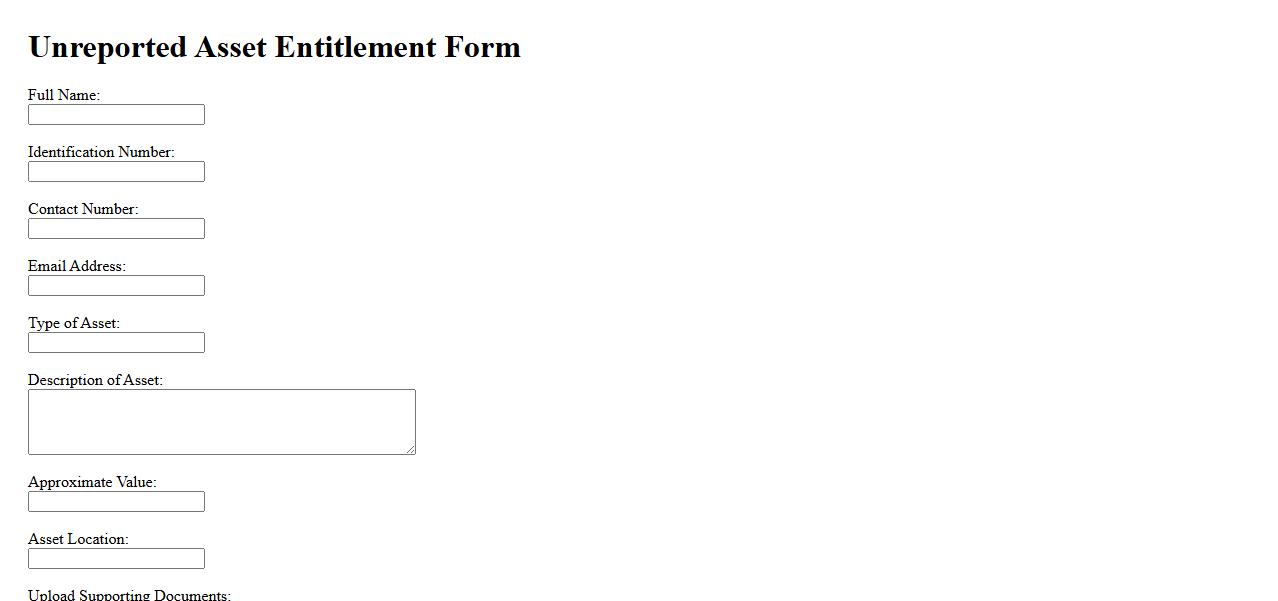

Unreported Asset Entitlement Form

The Unreported Asset Entitlement Form is a crucial document used to disclose any assets not previously reported. It ensures transparency and compliance with relevant financial or legal regulations. Completing this form accurately helps in maintaining proper entitlement records and avoiding potential disputes.

What types of property qualify as unclaimed in this claim process?

Unclaimed property generally includes financial assets such as dormant bank accounts, uncashed checks, and forgotten stocks. Other types of property may include utility deposits, insurance payments, and safe deposit box contents that have had no activity for a specified period. These assets remain under the custody of a government or financial institution until they are claimed by the rightful owner.

Who is eligible to file a claim for the listed unclaimed property?

Any individual or entity who can demonstrate legal ownership or entitlement to the unclaimed property is eligible to file a claim. This typically includes the original owner, heirs, or authorized agents with proper documentation. The claimant must provide sufficient proof that establishes a valid relationship to the property in question.

What documentation is required to prove ownership of the unclaimed property?

Claimants must submit official documents such as a valid government-issued ID, proof of address, and documents that show ownership, like account statements or asset certificates. In cases involving inheritance, legal documents such as wills or court orders may be necessary. The documentation must effectively verify the claimant's identity and connection to the property.

What is the deadline for submitting a claim for unclaimed property?

The deadline for filing a claim for unclaimed property varies depending on jurisdiction and specific rules governing the assets. Often, there is no strict deadline, but prompt submission is encouraged to expedite recovery. Claimants should consult the relevant authority's guidelines to ensure timely filing.

How will the claimant be notified about the status or approval of the claim?

After submitting a claim, the claimant will typically receive a notification via email, postal mail, or an online portal confirming receipt and updates on the claim status. The approval process may involve verification checks, and the claimant will be informed once the claim is approved or if additional information is needed. These communication methods ensure transparency and keep the claimant informed throughout the process.