A claim for refund of taxes involves requesting the government to return excess taxes paid due to errors or overpayments. This process requires submitting proper documentation and proof of payment to validate the refund request. Timely filing and accurate records are essential to ensure successful recovery of the paid amount.

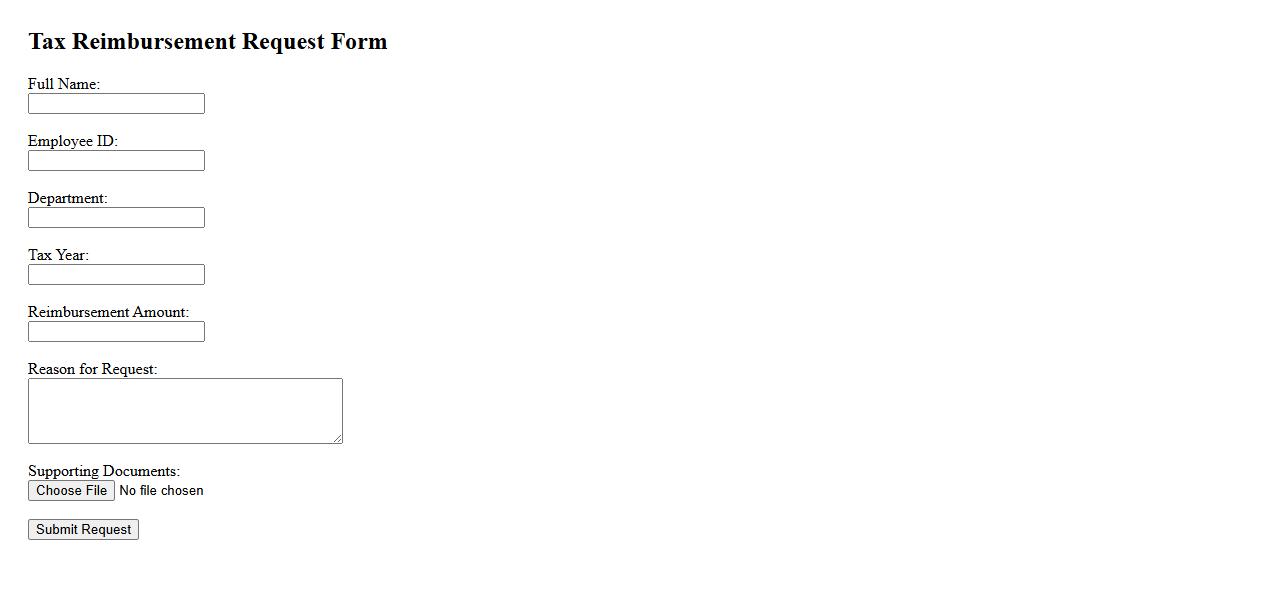

Tax Reimbursement Request Form

The Tax Reimbursement Request Form is designed to facilitate the refund process for eligible tax payments. It ensures accurate documentation and expedites the reimbursement cycle. Using this form helps individuals and businesses recover overpaid taxes efficiently.

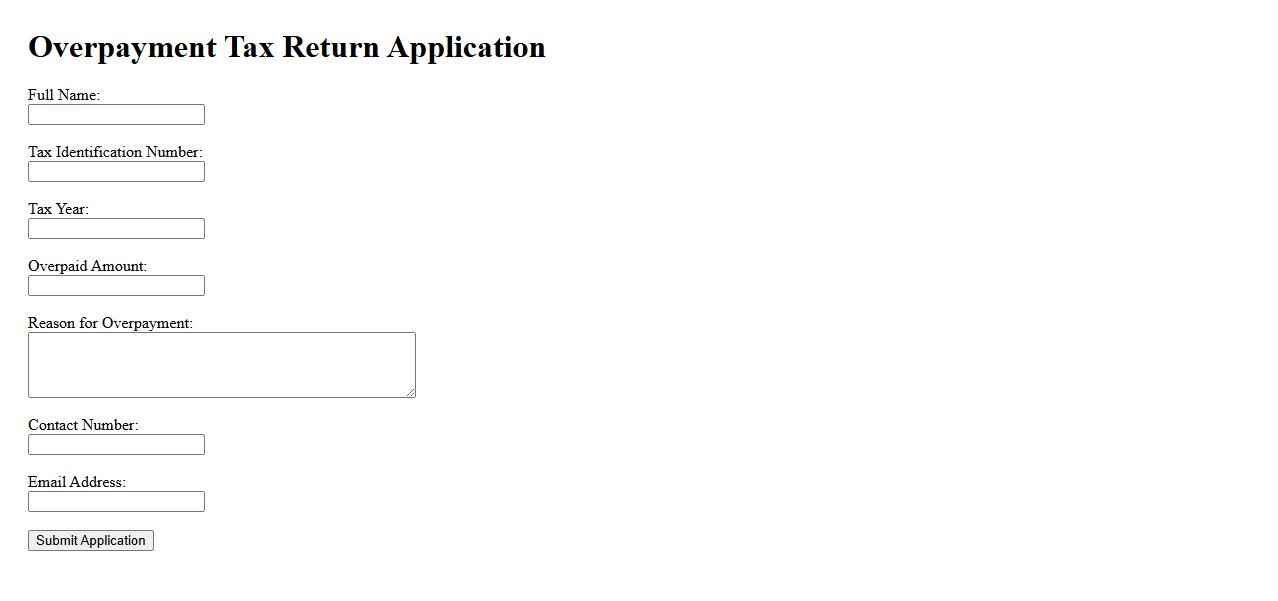

Overpayment Tax Return Application

The Overpayment Tax Return Application is a formal process that allows individuals or businesses to request a refund for any excess taxes paid to the government. This application ensures that taxpayers receive the correct amount they are entitled to without undue delay. Submitting this form accurately helps maintain compliance and avoid penalties.

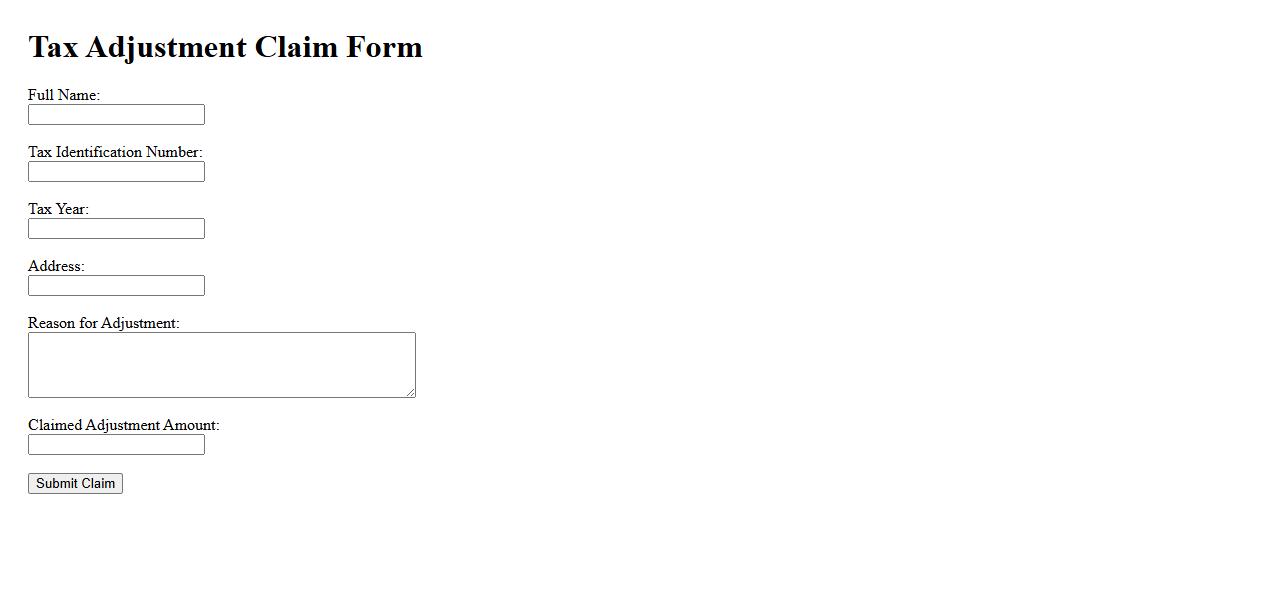

Tax Adjustment Claim Form

The Tax Adjustment Claim Form is used to request corrections for errors or overpayments in previously filed tax returns. It simplifies the process of rectifying discrepancies with tax authorities. Submitting this form ensures accurate tax records and appropriate refunds or additional charges.

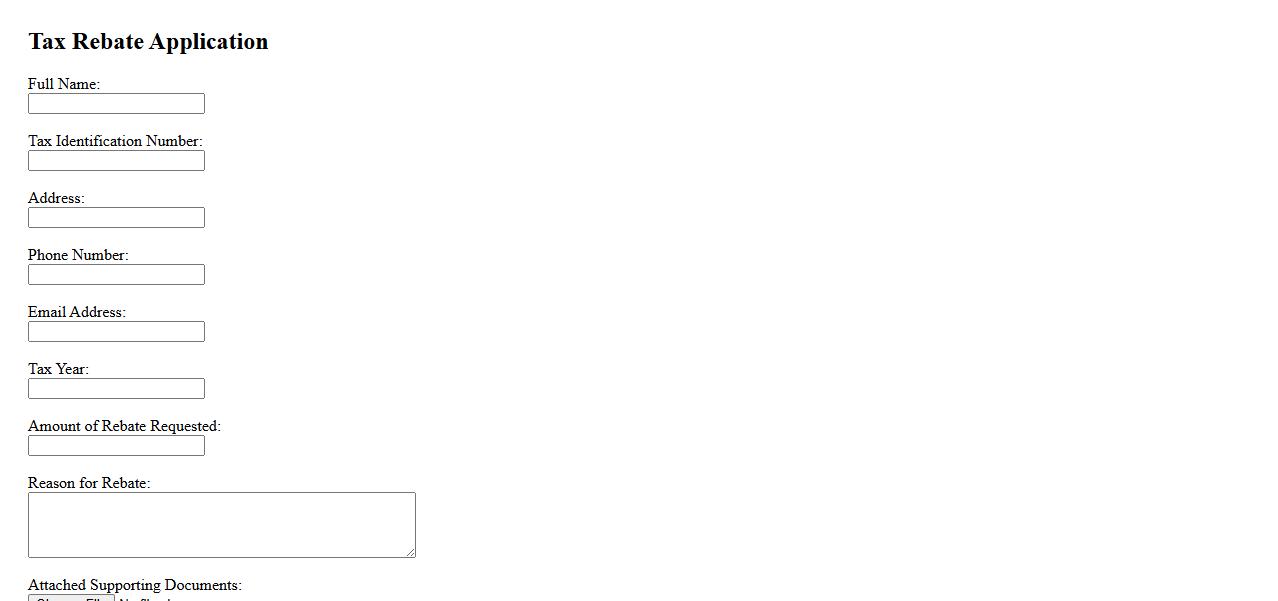

Tax Rebate Application

Submitting a Tax Rebate Application allows individuals and businesses to claim eligible refunds on overpaid taxes. This process ensures compliance with tax laws while maximizing financial returns. Timely and accurate applications are essential for a successful rebate claim.

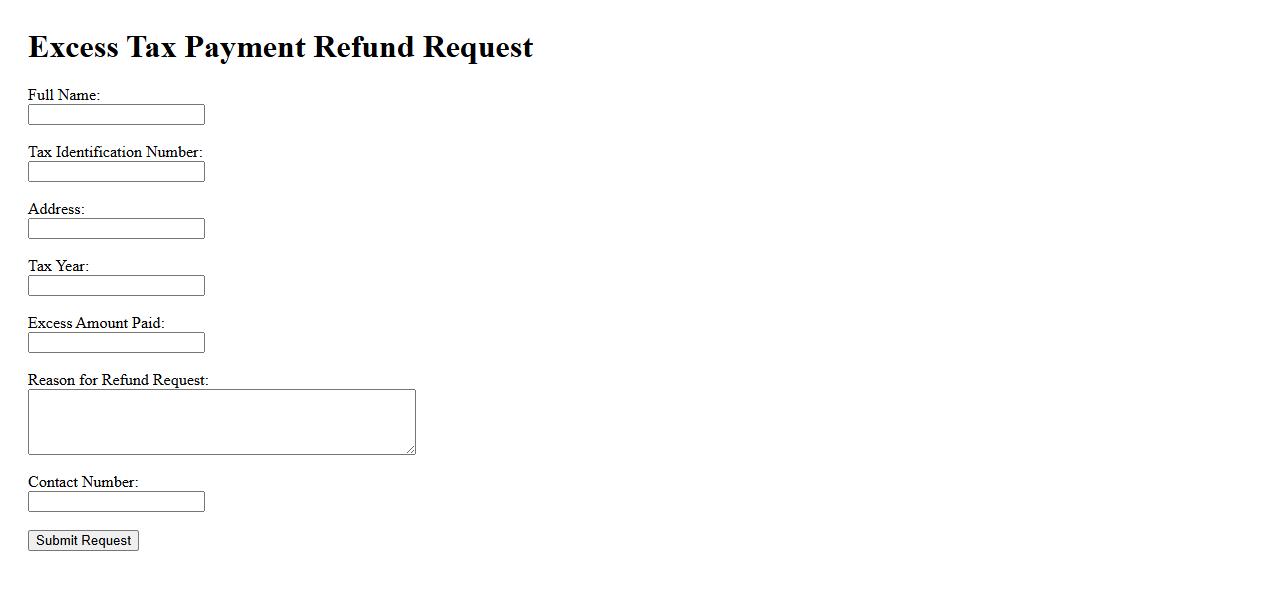

Excess Tax Payment Refund Request

If you have made an excess tax payment, you are entitled to request a refund from the tax authority. This process involves submitting a formal claim along with supporting documentation to verify the overpayment. Timely filing ensures you receive your refund without unnecessary delays.

Tax Reclamation Form

The Tax Reclamation Form is a crucial document used to recover overpaid taxes from government authorities. It ensures that individuals or businesses can claim back eligible tax amounts efficiently and legally. Proper submission of this form helps in maintaining financial accuracy and compliance with tax regulations.

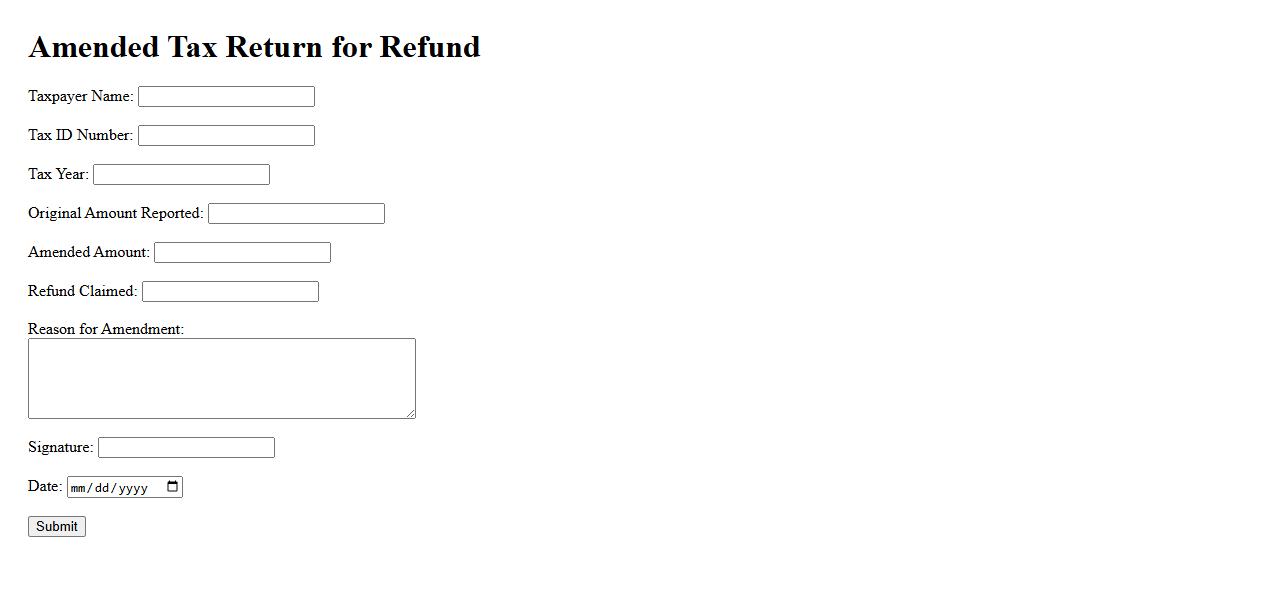

Amended Tax Return for Refund

An Amended Tax Return for Refund allows taxpayers to correct errors on their original tax filing to claim a refund. This process involves submitting Form 1040X with the corrected information to the IRS. It is essential to file promptly to ensure timely processing and receipt of the refund due.

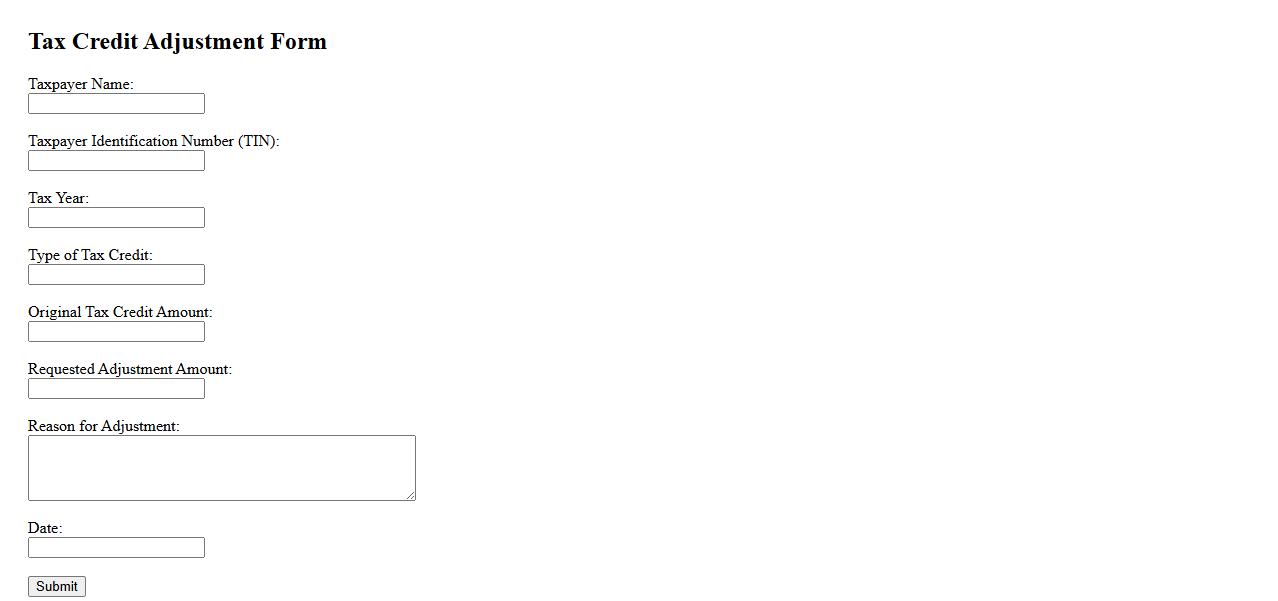

Tax Credit Adjustment Form

The Tax Credit Adjustment Form is used to modify or update tax credit information reported on previous filings. It ensures accurate calculation of tax benefits and compliance with government regulations. Submitting this form helps prevent errors and potential penalties.

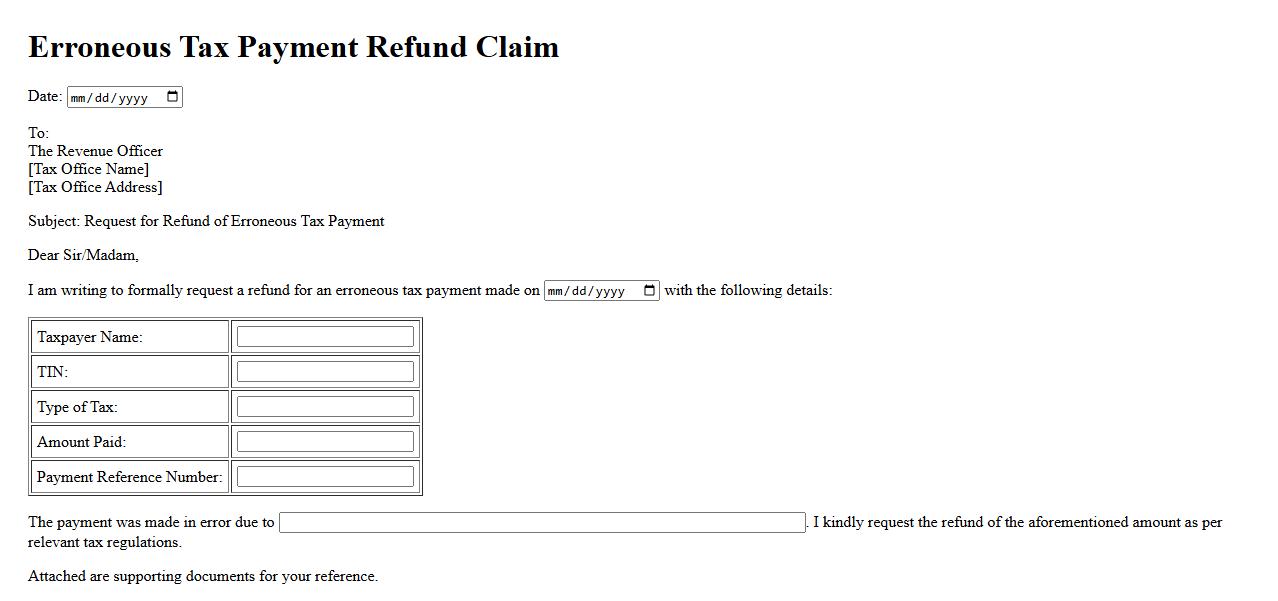

Erroneous Tax Payment Refund Claim

An Erroneous Tax Payment Refund Claim refers to the process of requesting a refund for taxes paid in error. This typically occurs when an individual or business has overpaid or mistakenly paid taxes that were not legally owed. Proper documentation and timely submission of the claim are essential to ensure a successful refund.

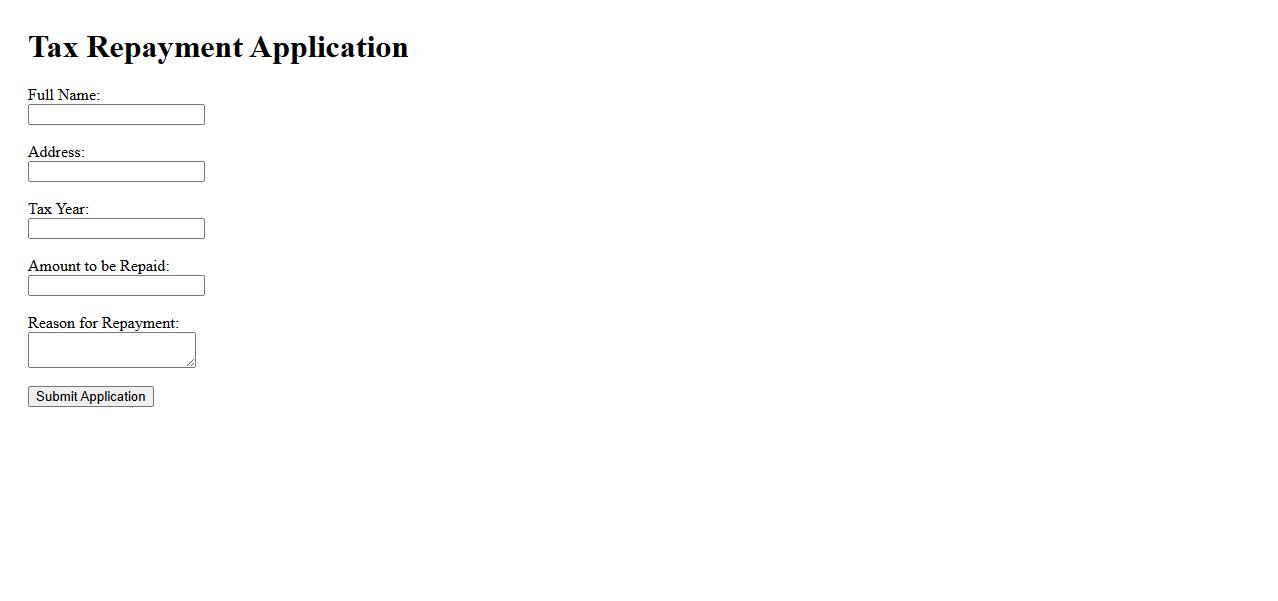

Tax Repayment Application

The Tax Repayment Application streamlines the process of requesting refunds from tax authorities. It ensures accuracy by capturing all necessary financial information efficiently. This application helps users avoid delays and errors in tax refund claims.

What specific tax type and period does the refund claim pertain to?

The tax type involved in the refund claim must be clearly identified, such as income tax, VAT, or excise duty. The claim should specify the exact tax period, which could be a fiscal year, quarter, or month, relevant to the refund request. Precise period identification ensures accurate processing and compliance with tax authority regulations.

What legal basis or provision justifies the claim for tax refund?

The claim for a tax refund relies on specific legal provisions found in tax laws or regulations that grant taxpayers refund rights. This basis often includes conditions such as overpayment, erroneous tax calculation, or exemptions applicable to the taxpayer. Referencing the correct statutory articles strengthens the validity and enforceability of the refund claim.

Has the tax in question already been paid, and what supporting documents prove payment?

To substantiate the refund, the claimant must verify that the tax has been paid, typically demonstrated through official receipts or payment confirmations. Supporting documents may include tax payment slips, bank statements, or electronic payment acknowledgments. These proofs are essential for the tax authority to validate the refund request.

Are all procedural requirements (e.g., timelines, forms, attachments) for claiming a refund satisfied?

Compliance with procedural requirements is crucial, including submitting the refund claim within prescribed deadlines and using the correct forms. All mandatory attachments, such as payment evidence and identification documents, must be included to avoid processing delays. Meeting these requirements ensures the claim is considered valid and eligible for review.

Is there any evidence that the tax subject to refund has not been previously refunded or credited?

It is important to confirm that the tax amount requested for refund has not been previously refunded or credited against other liabilities. Documentation or certifications from tax authorities may serve as evidence to prevent duplicate refund claims. This verification protects against fraud and maintains the integrity of the tax refund process.