Submitting a claim for retirement benefits involves providing necessary documentation such as proof of age, employment history, and contribution records to the relevant pension or social security authority. Accurate completion of the application ensures timely processing and receipt of monthly payments or lump-sum amounts. Understanding eligibility criteria and deadlines is crucial to maximize the retirement benefits one can receive.

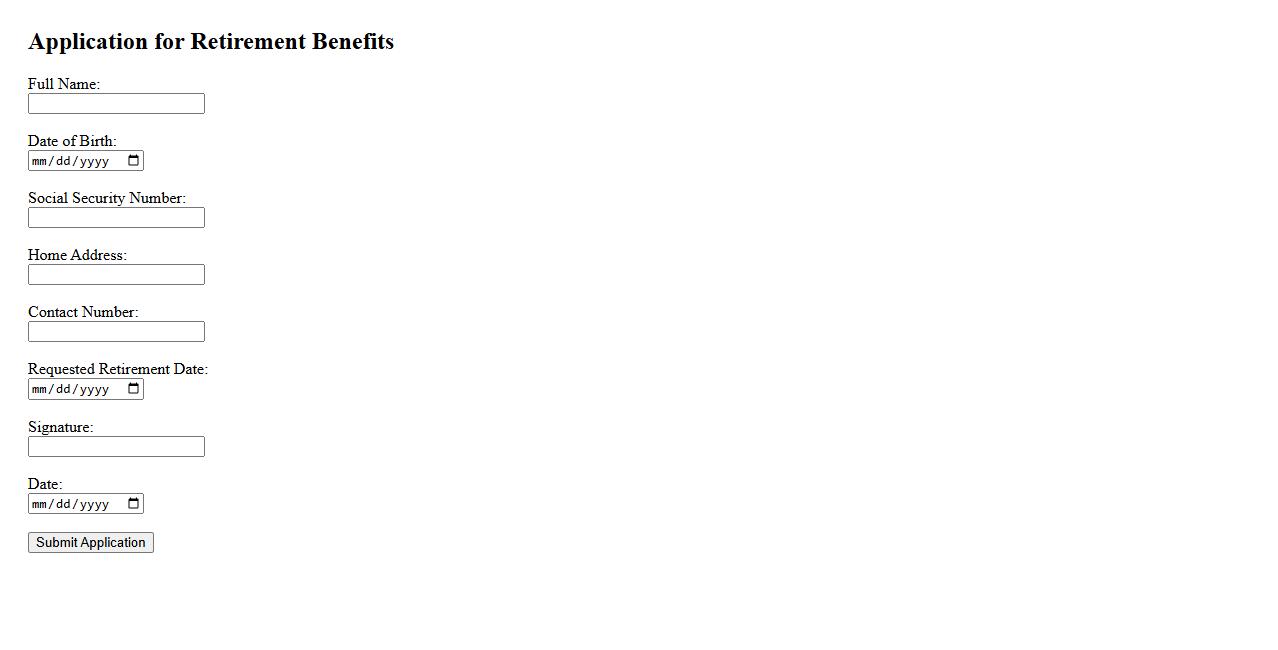

Application for Retirement Benefits

The Application for Retirement Benefits is a formal request submitted by individuals seeking to access their pension or retirement funds. It ensures that retirees receive their entitled financial support promptly and securely. This application typically requires personal identification and proof of eligibility to process the benefits efficiently.

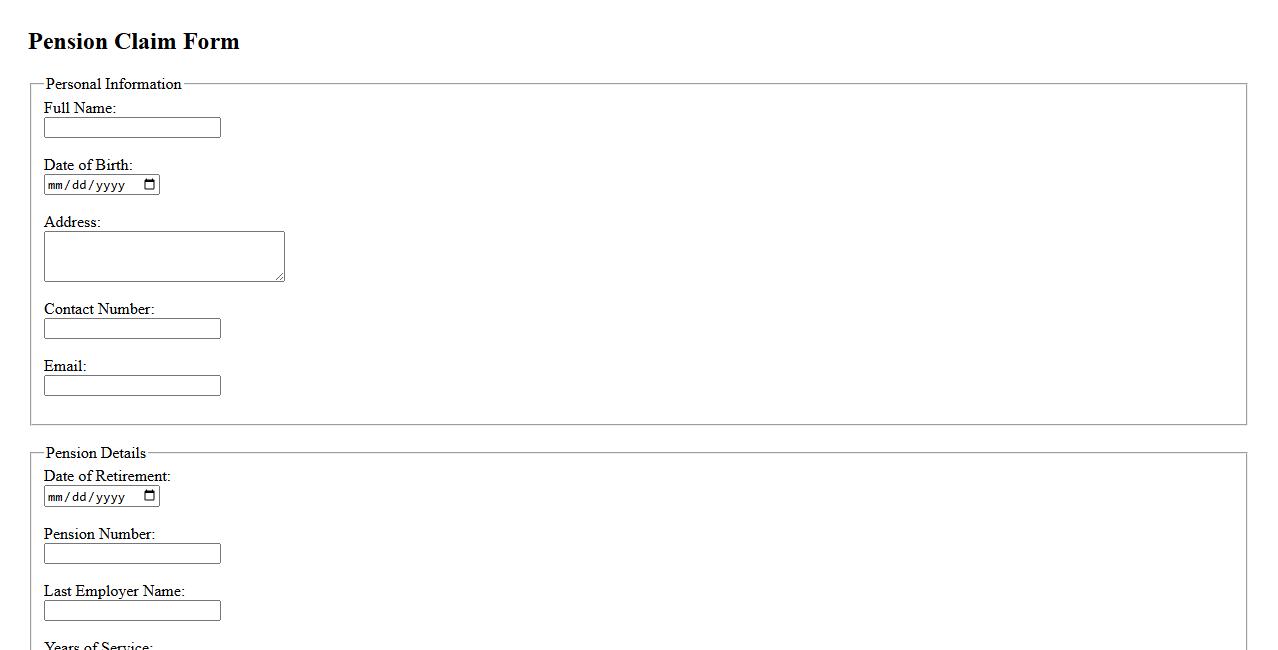

Pension Claim Form

The Pension Claim Form is an essential document used to apply for retirement benefits. It collects personal and employment information to process the pension payout efficiently. Submitting this form accurately ensures timely receipt of your entitled pension funds.

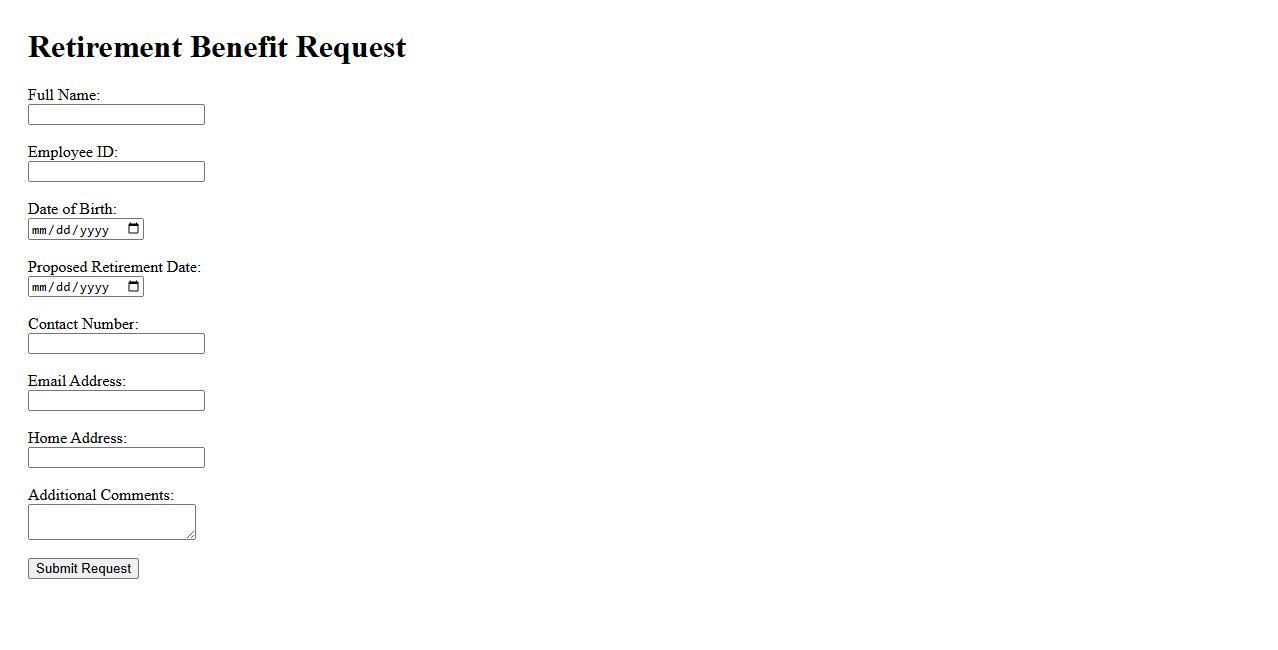

Retirement Benefit Request

A Retirement Benefit Request is a formal application submitted by an employee to claim their entitled benefits upon retirement. This process ensures that retirees receive their pension, healthcare, and other related benefits promptly. Proper documentation and timely submission are essential for a smooth and efficient approval.

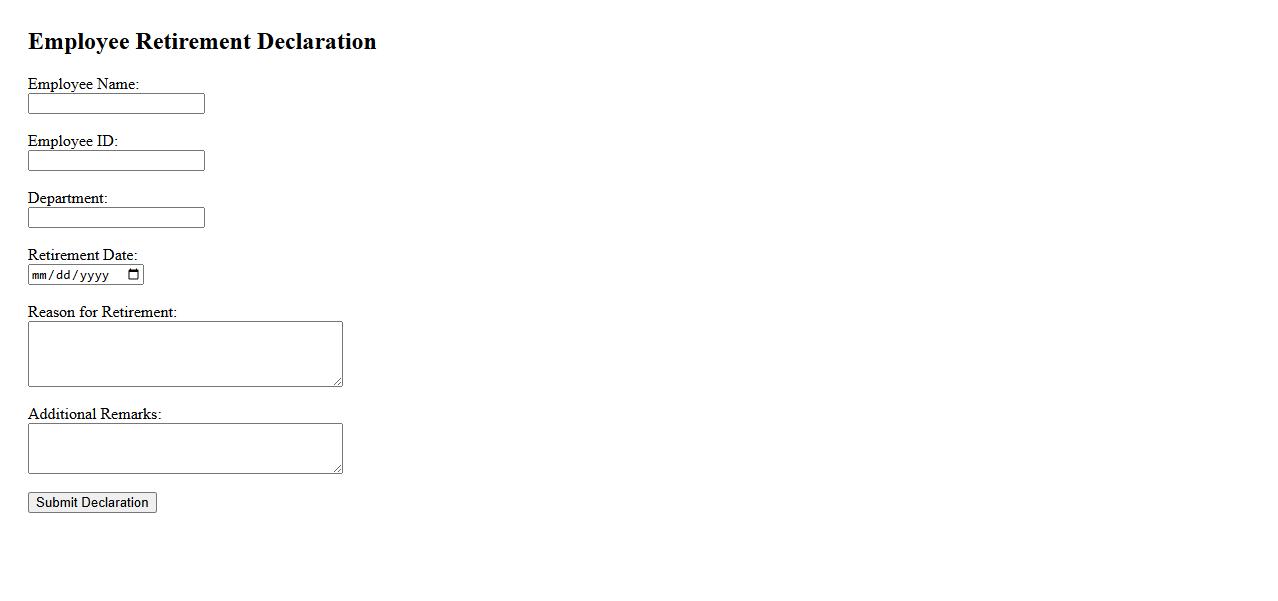

Employee Retirement Declaration

The Employee Retirement Declaration is a formal document submitted by an employee to announce their intention to retire from their position. It outlines the planned retirement date and serves as an official notice to the employer. This declaration ensures a smooth transition and proper planning for workforce changes.

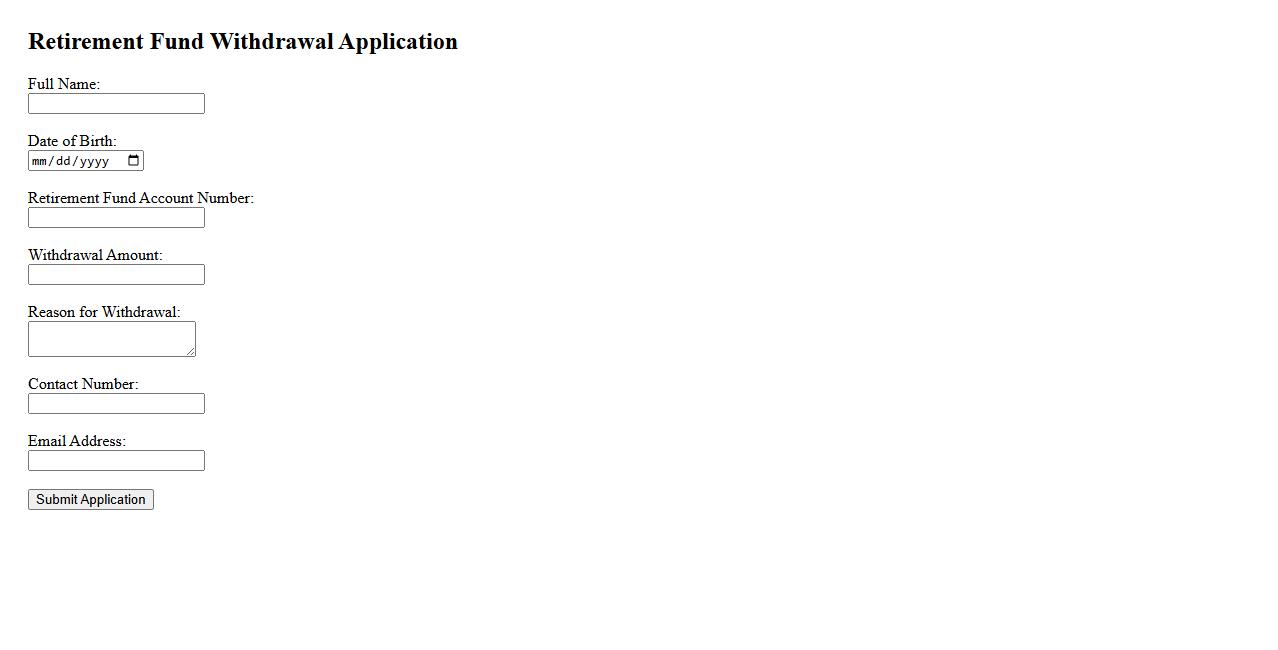

Retirement Fund Withdrawal Application

The Retirement Fund Withdrawal Application is a formal process used to request funds from your retirement savings. It ensures that withdrawals are handled securely and in compliance with relevant regulations. Submitting this application allows you to access your retirement benefits efficiently.

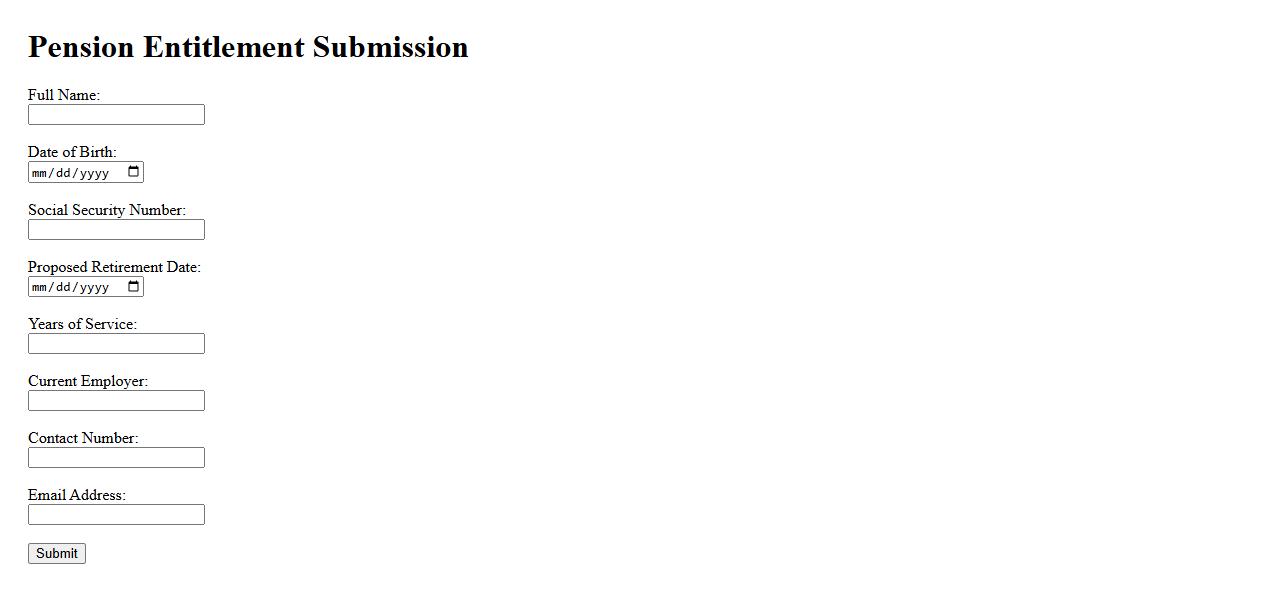

Pension Entitlement Submission

Submitting your pension entitlement ensures you receive the benefits you are eligible for upon retirement. Accurate and timely submission is crucial to avoid delays in processing. Make sure to provide all necessary documents to facilitate a smooth evaluation of your claim.

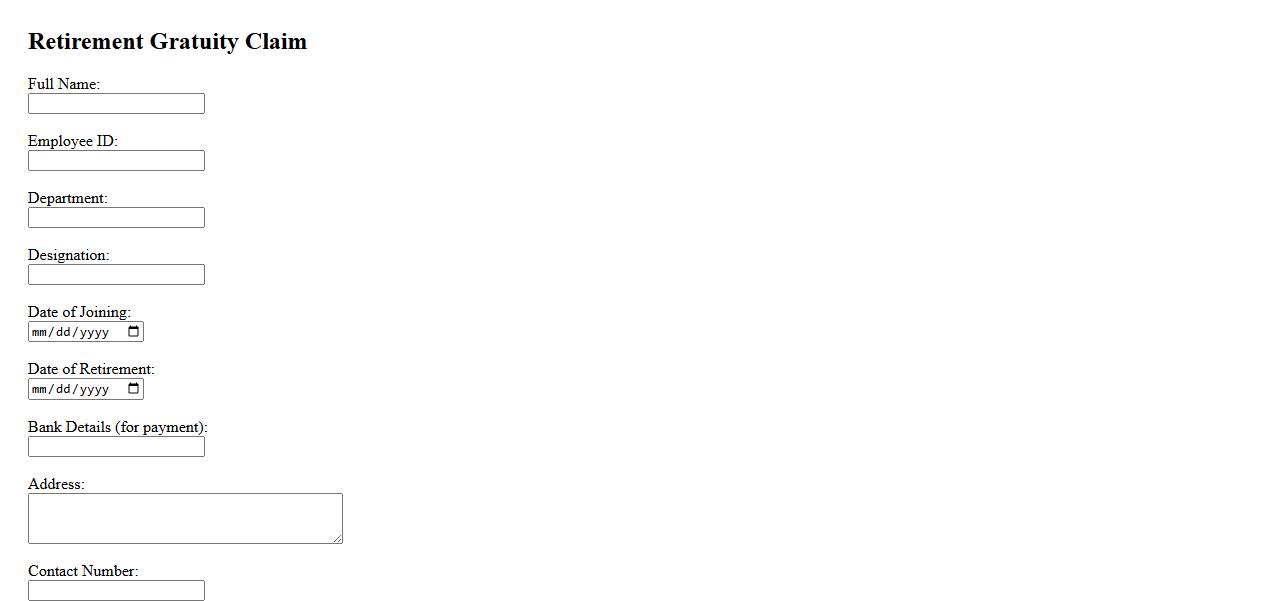

Retirement Gratuity Claim

The Retirement Gratuity Claim is a financial benefit provided to employees upon retirement as a token of appreciation for their dedicated service. It is a lump sum payment calculated based on the employee's tenure and last drawn salary. Filing this claim ensures a smooth transition into retirement with financial security.

Retirement Account Settlement Form

The Retirement Account Settlement Form is a crucial document used to initiate the distribution or transfer of funds from a retirement account. It ensures accurate processing and compliance with relevant regulations, providing clear instructions for settling the account. Completing this form correctly helps facilitate a smooth and timely settlement of retirement benefits.

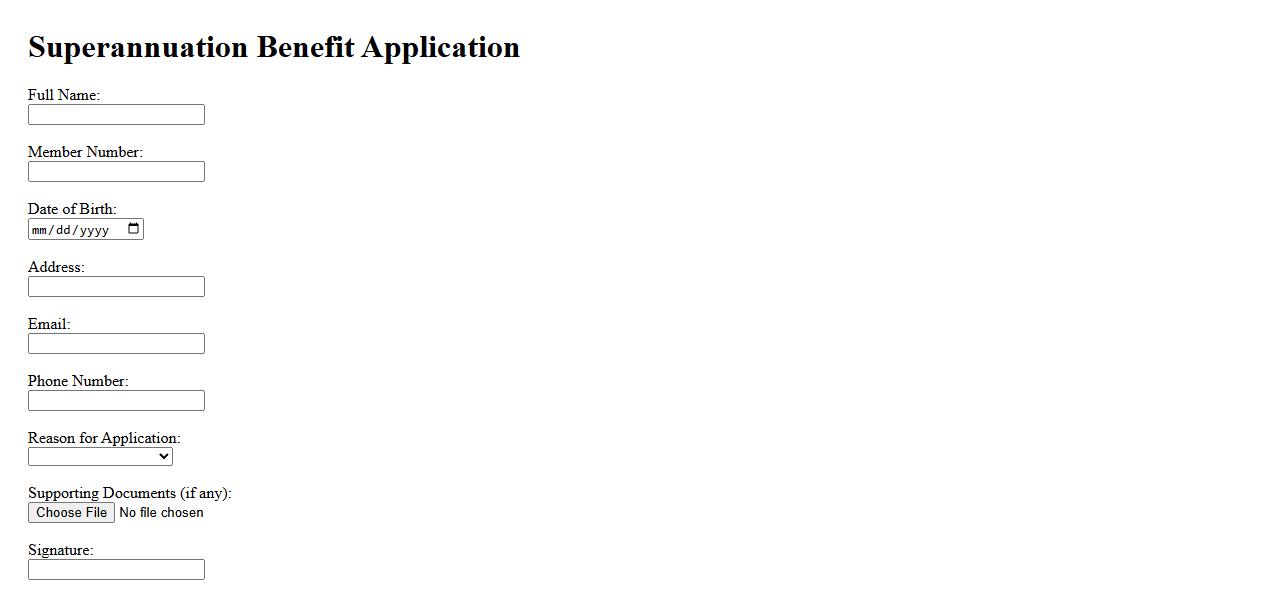

Superannuation Benefit Application

The Superannuation Benefit Application is a formal process for claiming the funds accumulated in a superannuation account. It ensures that individuals can access their retirement savings efficiently and in accordance with legal requirements. Proper submission of this application is essential to receive the entitled benefits without delay.

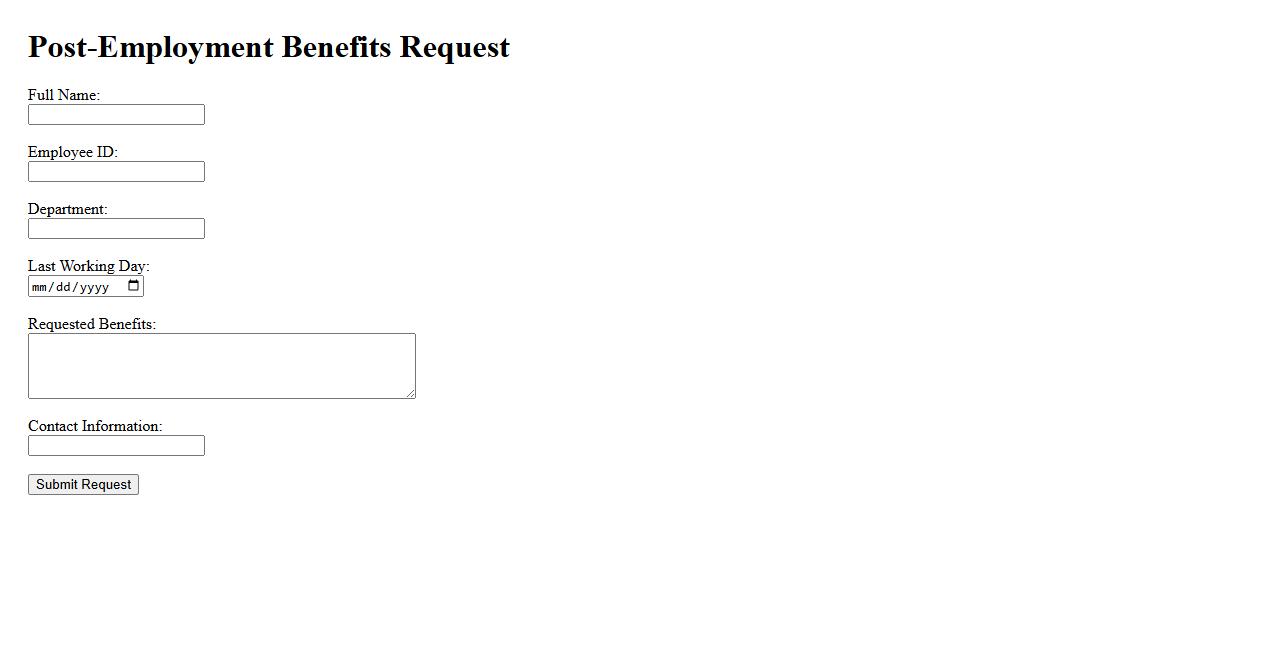

Post-Employment Benefits Request

Post-Employment Benefits Request refers to the formal application process employees use to claim benefits entitled to them after leaving an organization. These benefits may include pensions, health insurance, and other retirement-related compensations. Ensuring timely and accurate submission of these requests helps secure rightful post-employment advantages.

What personal identification information is required on the Claim for Retirement Benefits document?

The Claim for Retirement Benefits document requires essential personal identification details such as full name, date of birth, and Social Security Number. Including these identifiers ensures accurate processing of the retirement claim. Contact information, including address and phone number, is also mandatory for correspondence purposes.

Which types of retirement benefits can be selected or claimed on this form?

This form allows applicants to select from multiple types of retirement benefits, including monthly pension, lump-sum payments, and survivor benefits. Applicants can customize their claim based on their eligibility and preferences. Clear options facilitate timely processing and proper benefit allocation.

What documentation must be submitted alongside the Claim for Retirement Benefits application?

Supporting documents such as a valid government-issued ID, Social Security card, and proof of income or employment history must accompany the application. Additionally, marriage certificates or birth certificates may be required to verify dependent or beneficiary claims. Submitting these documents ensures validation of the claim and expedites approval.

How are eligibility criteria for retirement benefits verified within the document?

The document contains sections where applicants must attest to meeting eligibility criteria, including age, length of service, and contribution history. Verification often involves cross-checking submitted documentation against institutional records. This ensures that only qualified individuals receive retirement benefits.

What instructions are provided for updating beneficiary or dependent details in the retirement claim?

Clear instructions guide the applicant to update beneficiary or dependent information by submitting a written request along with the required supporting documentation. The form specifies acceptable document types such as marriage licenses or birth certificates. Accurate updates are crucial for the correct disbursement of benefits.