Filing a claim for travel insurance involves submitting proof of covered losses such as medical expenses, trip cancellations, or lost luggage to the insurance provider. Detailed documentation including receipts, police reports, and travel itineraries helps expedite the approval process. Understanding the policy terms ensures a smoother resolution of the claim.

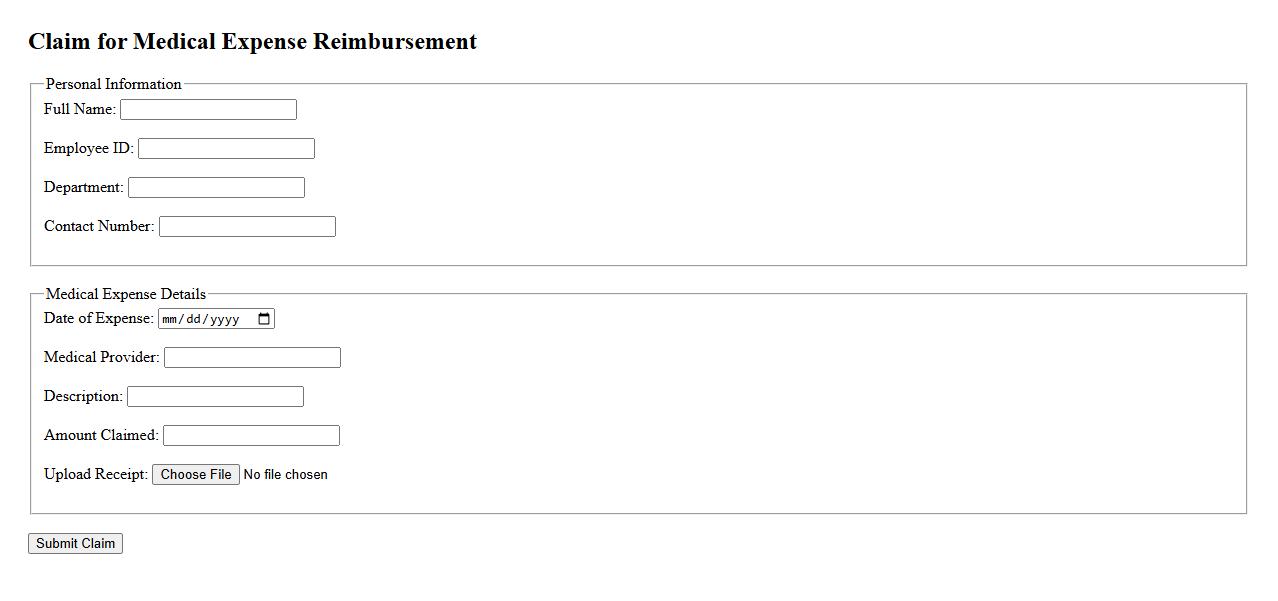

Claim for Medical Expense Reimbursement

A Claim for Medical Expense Reimbursement is a formal request submitted to an insurance provider or employer to recover costs incurred from medical treatments. It typically requires detailed documentation such as receipts and medical reports to validate the expenses. Timely and accurate submission ensures prompt reimbursement and financial relief for the policyholder.

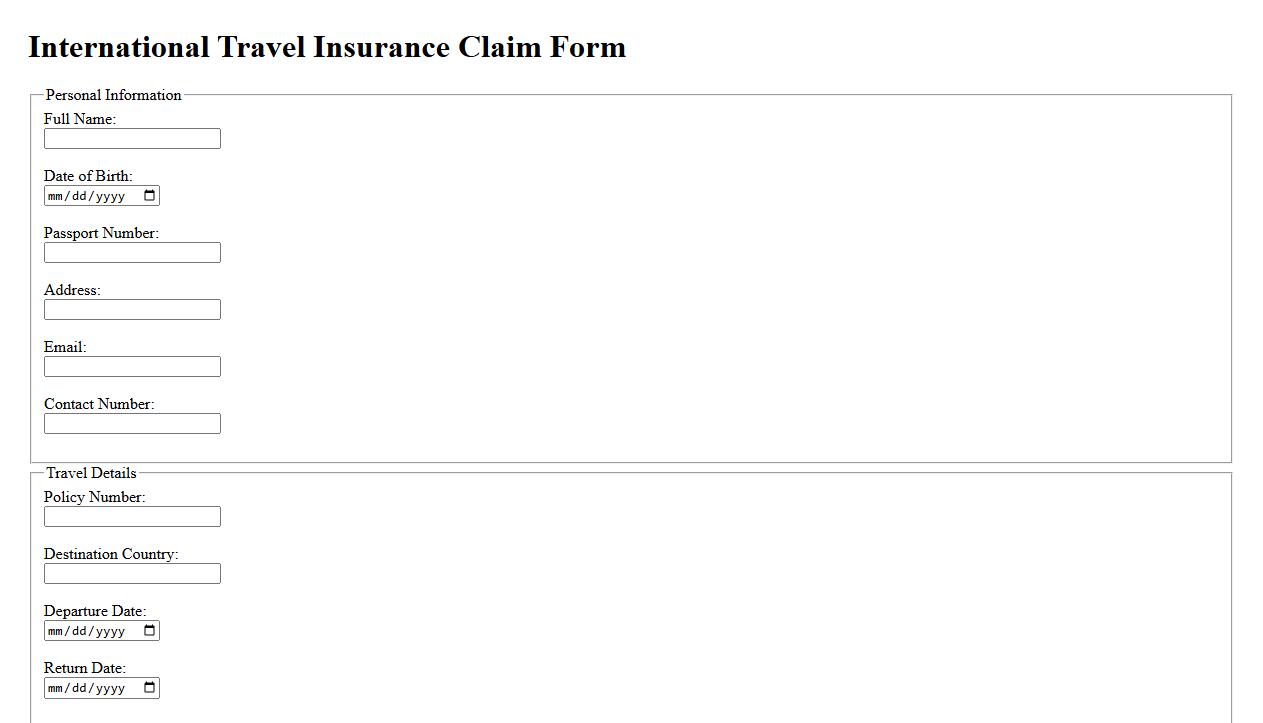

International Travel Insurance Claim Form

The International Travel Insurance Claim Form is a crucial document for travelers seeking reimbursement for medical expenses, trip cancellations, or lost belongings. It requires accurate details about the incident and relevant travel information to process claims efficiently. Timely submission of this form ensures a smooth resolution and compensation from the insurance provider.

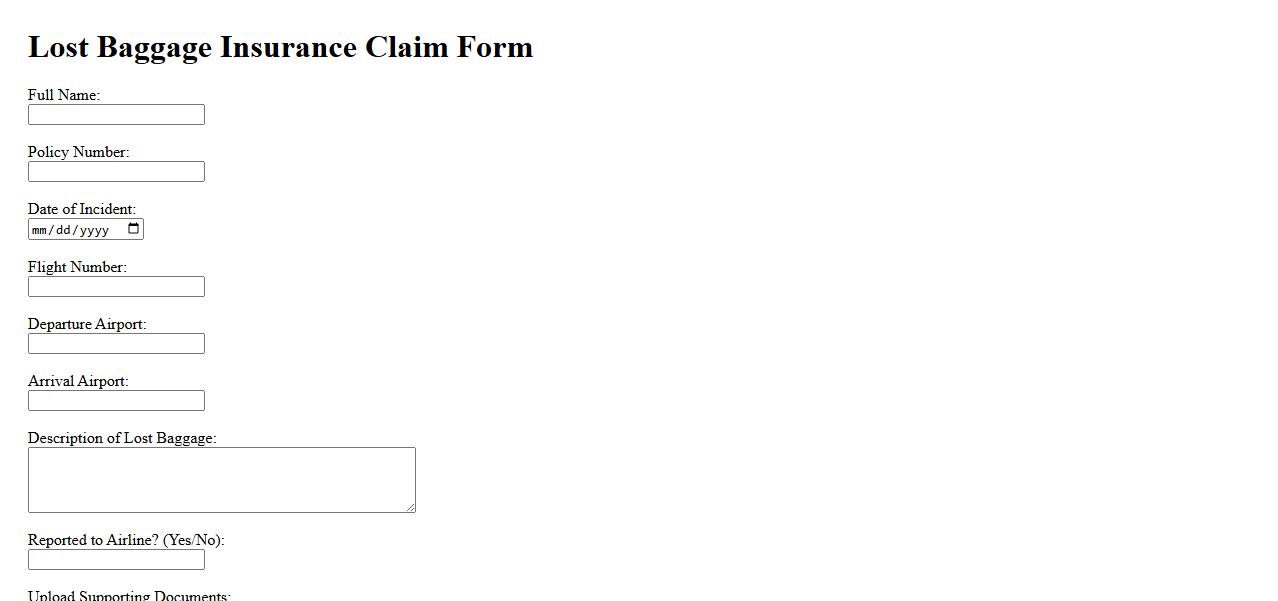

Lost Baggage Insurance Claim

Filing a Lost Baggage Insurance Claim helps travelers recover the value of their missing belongings during a trip. This process typically requires submitting proof of loss and receipts for the items lost. Ensuring prompt notification to the insurer increases the chances of a successful claim.

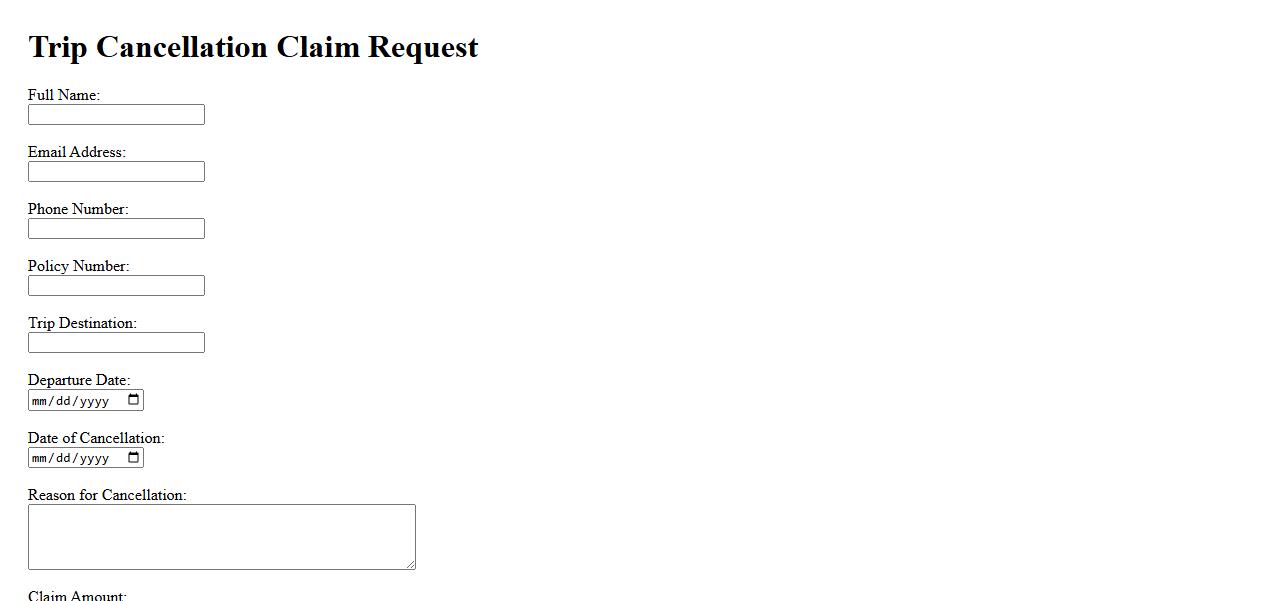

Trip Cancellation Claim Request

Filing a Trip Cancellation Claim Request allows travelers to seek reimbursement for non-refundable expenses when unforeseen events force them to cancel their plans. This process ensures protection against financial loss due to emergencies, illness, or other covered reasons. Prompt submission of required documents accelerates claim approval and settlement.

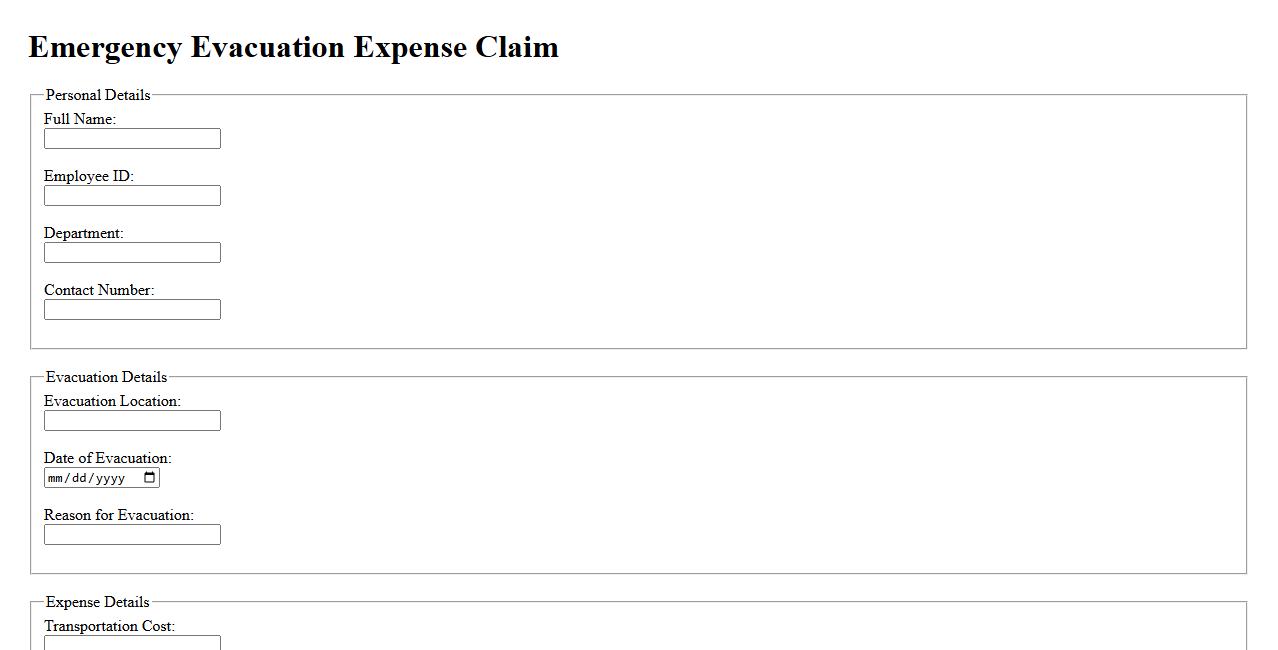

Emergency Evacuation Expense Claim

An Emergency Evacuation Expense Claim allows individuals to request reimbursement for costs incurred during urgent evacuations due to unforeseen events. This claim typically covers transportation, accommodation, and other necessary expenses related to the emergency. Filing such a claim ensures financial relief in times of crisis.

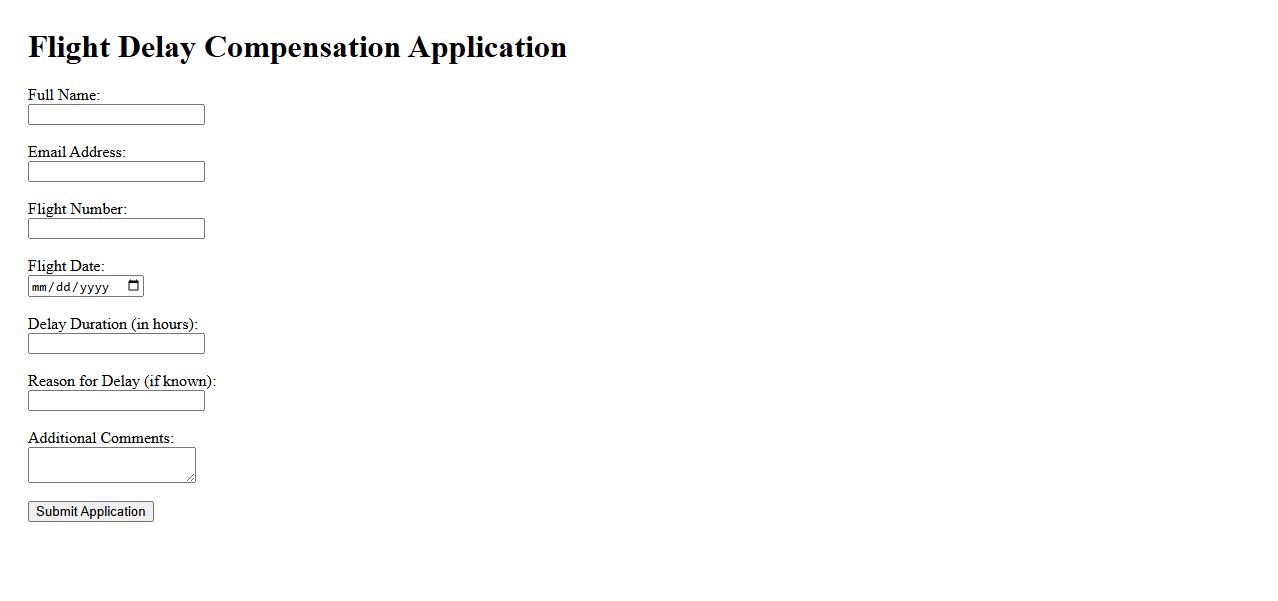

Flight Delay Compensation Application

Our Flight Delay Compensation Application helps passengers claim reimbursement easily and quickly. It guides users through the process of assessing eligibility and filing claims with airlines. This tool simplifies compensation retrieval for delayed or canceled flights.

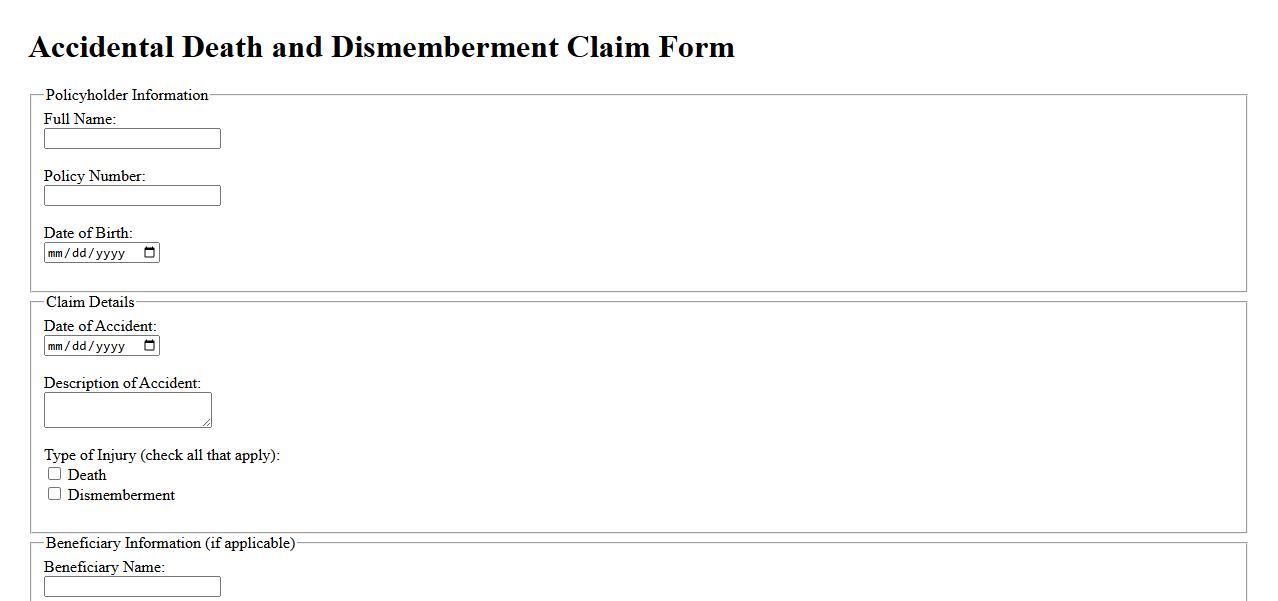

Accidental Death and Dismemberment Claim

An Accidental Death and Dismemberment Claim provides financial protection by offering benefits to individuals or their beneficiaries in case of accidental death or severe injury. This type of claim helps cover medical expenses, loss of income, and other related costs following unexpected accidents. It is essential for securing peace of mind in uncertain situations.

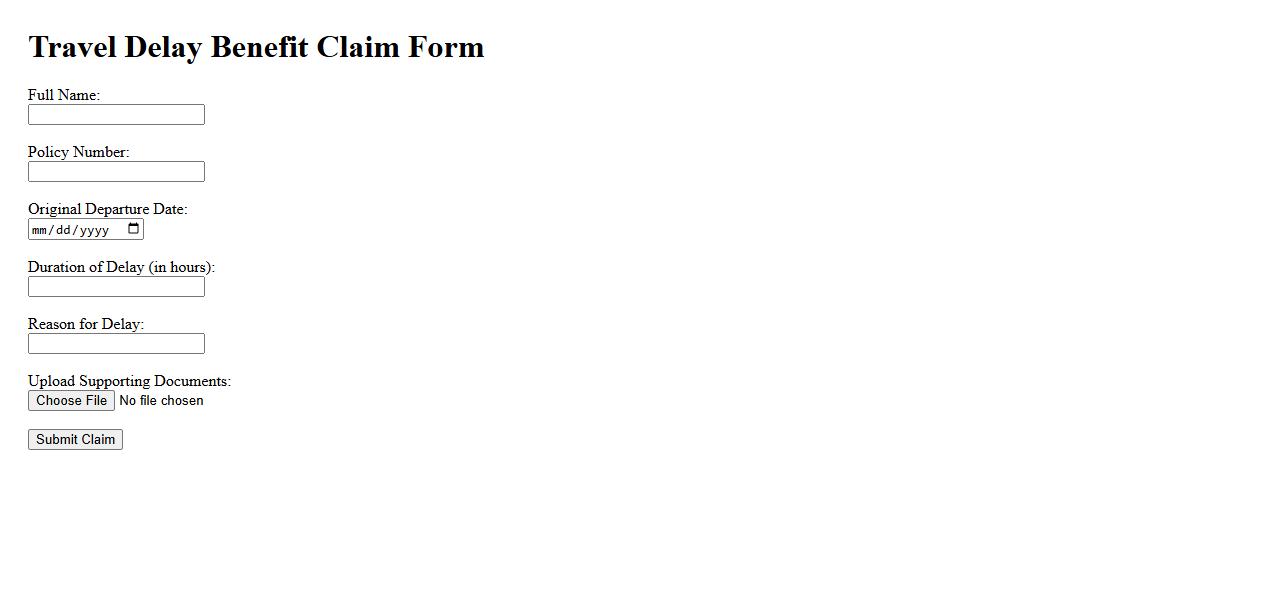

Travel Delay Benefit Claim

The Travel Delay Benefit Claim provides compensation for unexpected delays during your journey, helping cover additional expenses like meals and accommodations. This benefit ensures travelers are supported when unforeseen circumstances disrupt their travel plans. Filing a timely and accurate claim is essential to receive the benefits promptly.

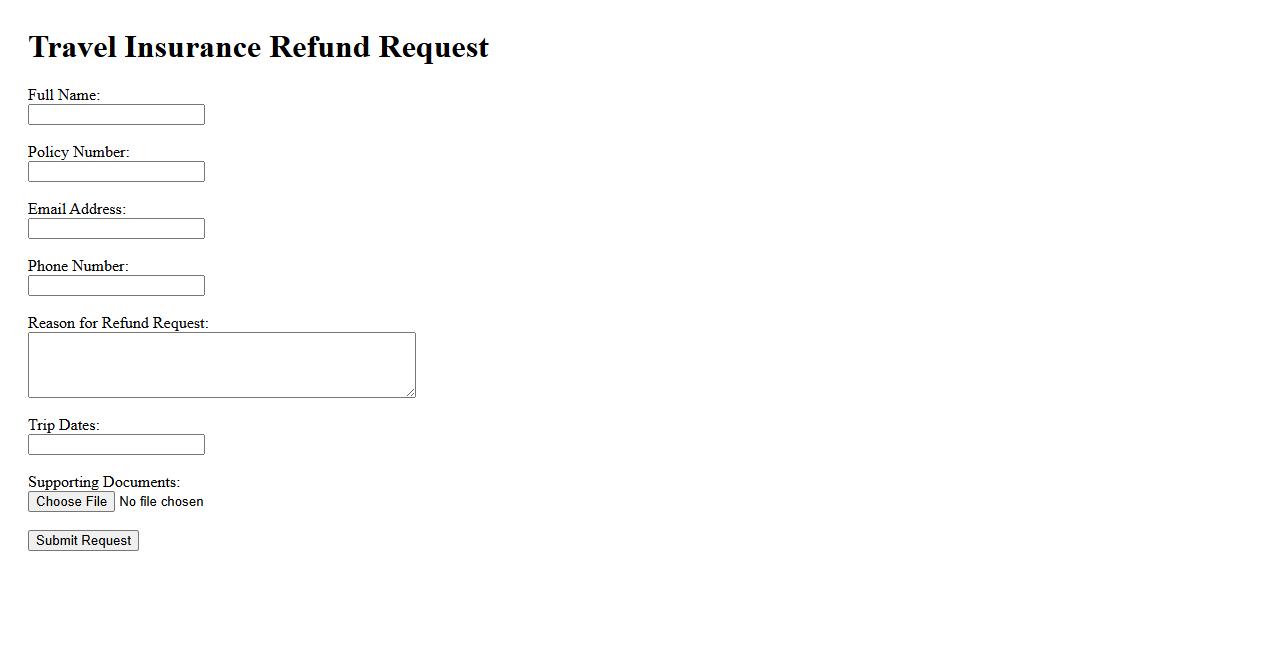

Travel Insurance Refund Request

Filing a Travel Insurance Refund Request ensures reimbursement in case of trip cancellations or unforeseen events. It is essential to submit all required documents promptly to facilitate the process. Understanding the policy terms can help maximize your refund benefits.

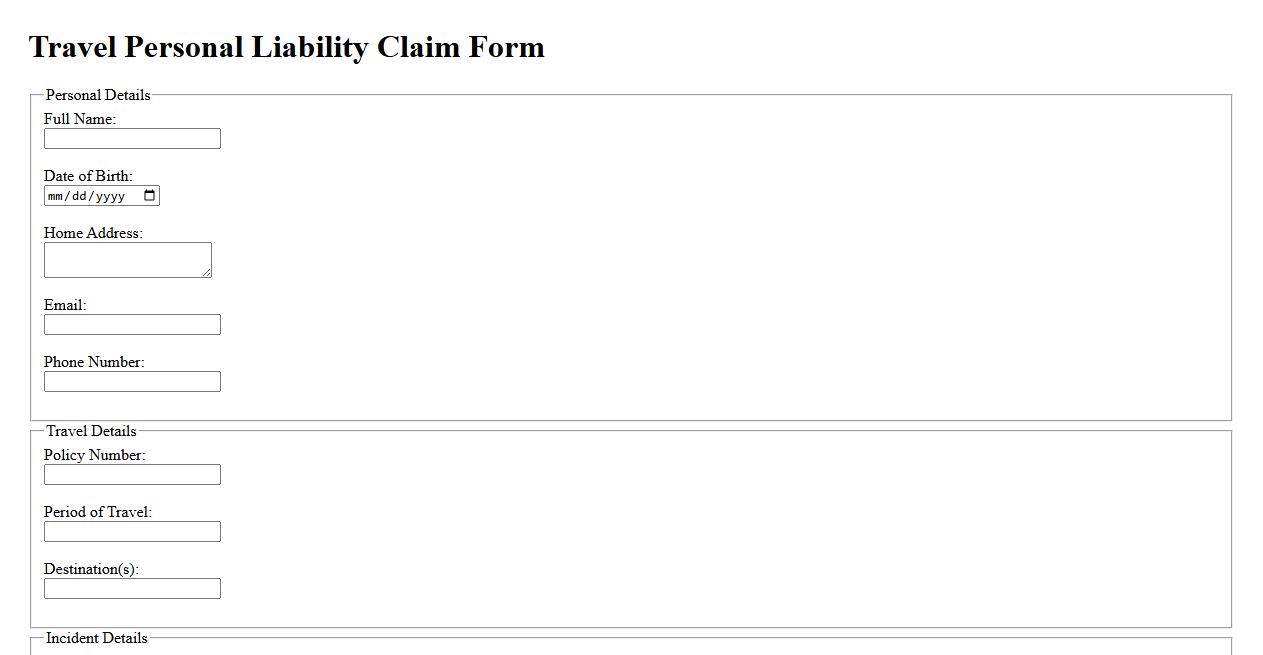

Travel Personal Liability Claim Form

The Travel Personal Liability Claim Form is used to report incidents where you are held responsible for injury or damage during your trip. This document helps insurance companies assess and process your claim efficiently. Completing the form accurately ensures timely resolution and coverage of your liability expenses.

What is the purpose of a travel insurance claim document?

The primary purpose of a travel insurance claim document is to formally request reimbursement or compensation from the insurance provider. It serves as official evidence of the incident or loss that occurred during the trip. This document initiates the claims process, enabling policyholders to recover costs related to unforeseen travel issues.

Which essential information must be included in a travel insurance claim?

A travel insurance claim must include the policy number, detailed description of the incident, and date of occurrence. It should also provide personal identification and contact details of the claimant. Including accurate and comprehensive information ensures a smoother claim approval process.

What types of incidents are typically covered under travel insurance claims?

Travel insurance claims commonly cover lost luggage, trip cancellations, and medical emergencies abroad. It may also include coverage for flight delays, missed connections, and personal liability during travel. Understanding the coverage scope is essential to utilize the insurance effectively.

How should supporting documents be organized for a travel insurance claim submission?

Supporting documents should be clearly organized, labeled, and submitted in chronological order. Important items include receipts, medical reports, police reports, and travel itineraries. Proper organization of documentation accelerates the verification and approval process.

What are the common reasons for denial of a travel insurance claim?

Claims are often denied due to incomplete information, non-covered events, or pre-existing conditions not disclosed. Submission after the deadline and lack of proper documentation are also frequent reasons. Understanding these denial causes helps prevent claim rejection.