Filing a claim for accident insurance involves submitting necessary documentation to prove the occurrence of an accident and the resulting damages or injuries. Insurers typically require detailed evidence such as medical reports, accident reports, and proof of expenses to process the claim efficiently. Timely and accurate submission of these documents ensures faster compensation under the policy terms.

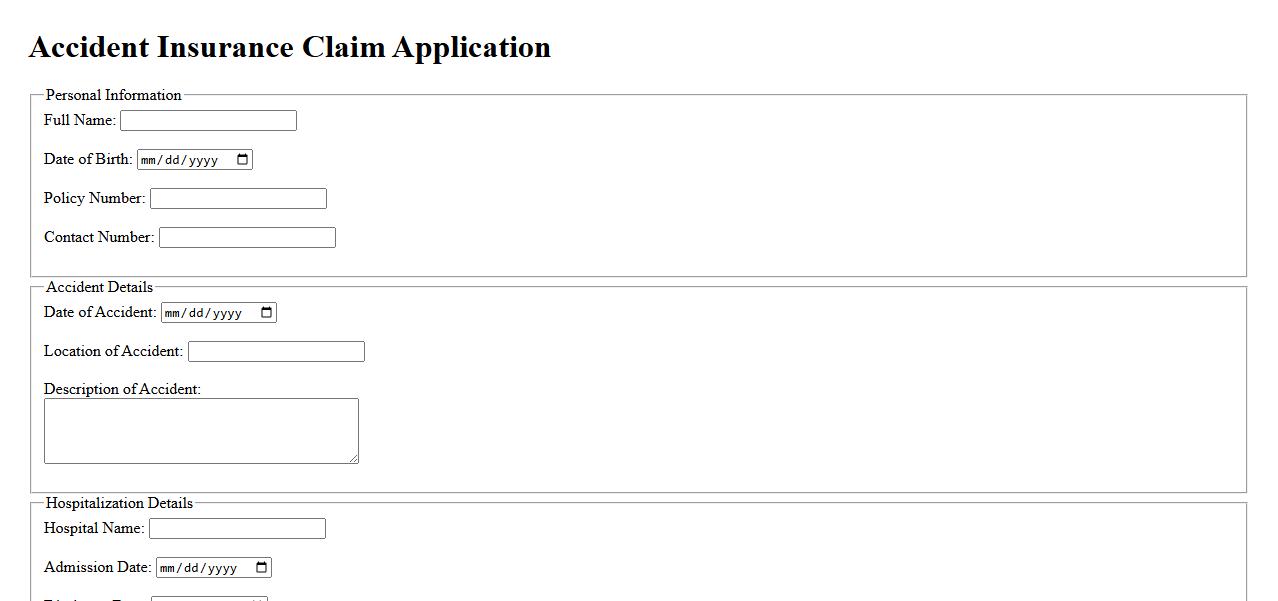

Accident Insurance Claim Application

Filing an Accident Insurance Claim Application is essential to receive financial support after an unforeseen incident. This process involves providing detailed information about the accident and submitting relevant documentation to the insurance provider. Timely and accurate claims help ensure swift compensation and peace of mind.

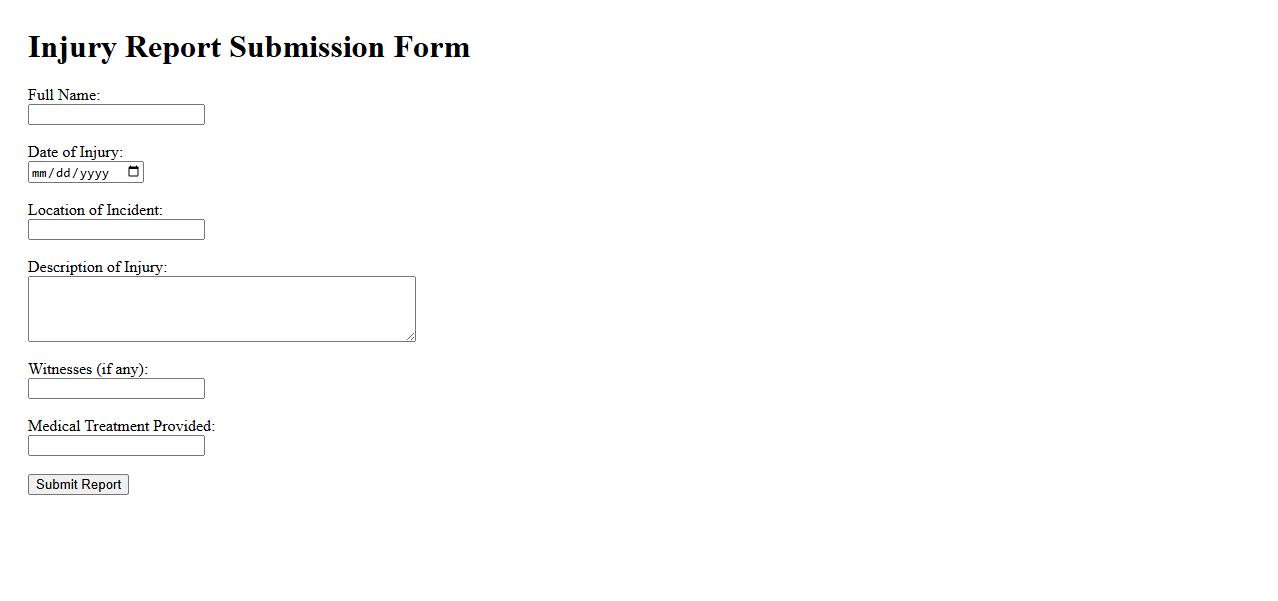

Injury Report Submission Form

The Injury Report Submission Form is designed to streamline the process of documenting workplace accidents efficiently. This form ensures accurate and timely reporting, helping organizations maintain safety compliance and initiate necessary follow-up actions. Utilizing a standardized template reduces errors and supports injury tracking and prevention efforts.

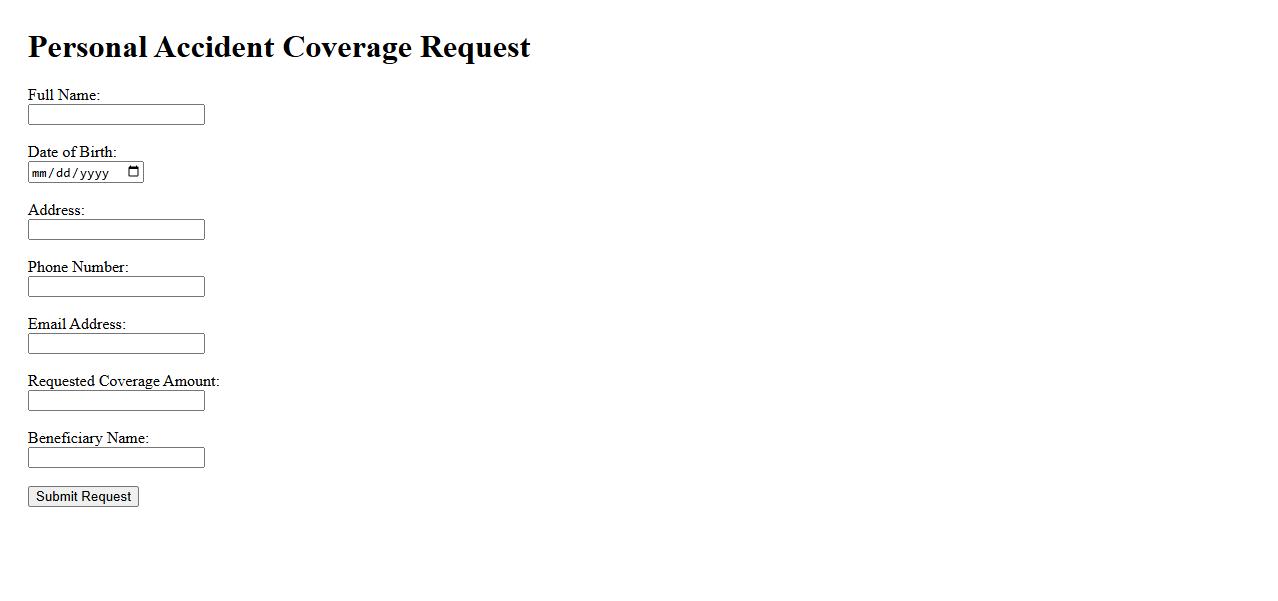

Personal Accident Coverage Request

Personal Accident Coverage Request is a formal application made by individuals seeking protection against financial losses resulting from accidental injuries or death. This coverage ensures timely compensation to the insured or their beneficiaries, providing peace of mind in unforeseen circumstances. Submitting a thorough and accurate request facilitates a smooth claims process and swift assistance.

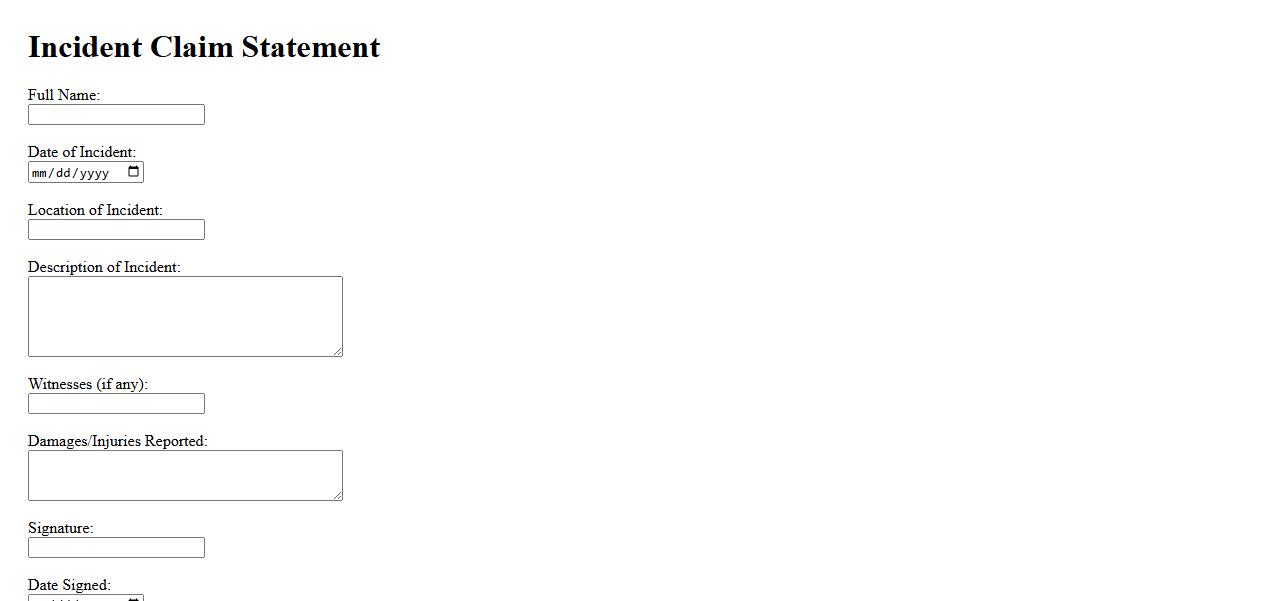

Incident Claim Statement

An Incident Claim Statement is a detailed account of events surrounding an incident, used to support insurance or legal claims. It provides essential information such as what happened, when, where, and who was involved. This statement helps in the accurate assessment and resolution of the claim.

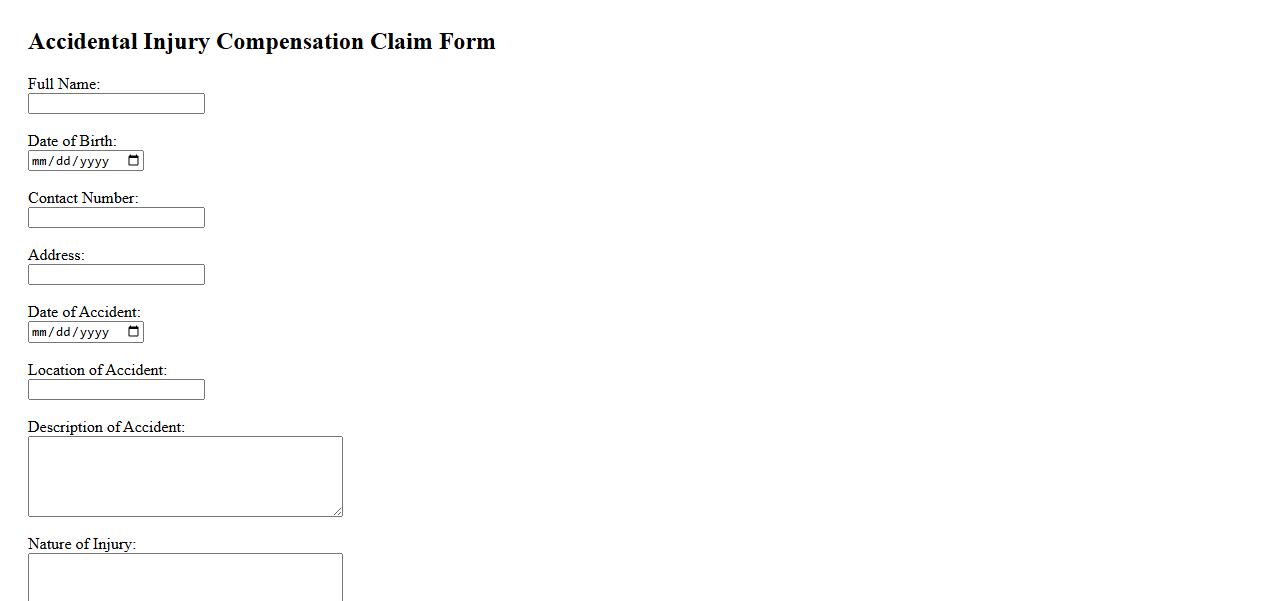

Accidental Injury Compensation Claim

An Accidental Injury Compensation Claim involves seeking financial reimbursement for injuries sustained due to someone else's negligence or accident. This legal process helps victims cover medical expenses, lost wages, and pain caused by the incident. Timely filing of claims ensures rightful compensation and support during recovery.

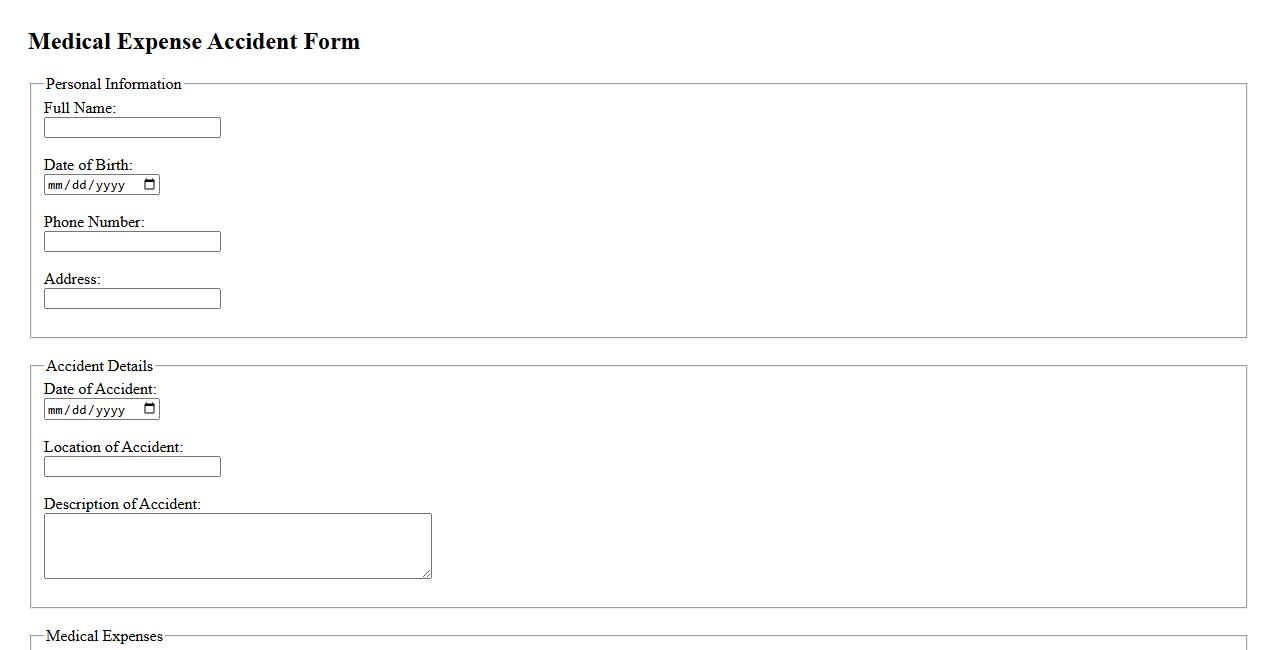

Medical Expense Accident Form

The Medical Expense Accident Form is a crucial document used to report and claim medical expenses resulting from an accident. It ensures that all relevant treatment costs are recorded accurately for insurance processing. Timely submission of this form helps in securing appropriate financial reimbursement for medical care.

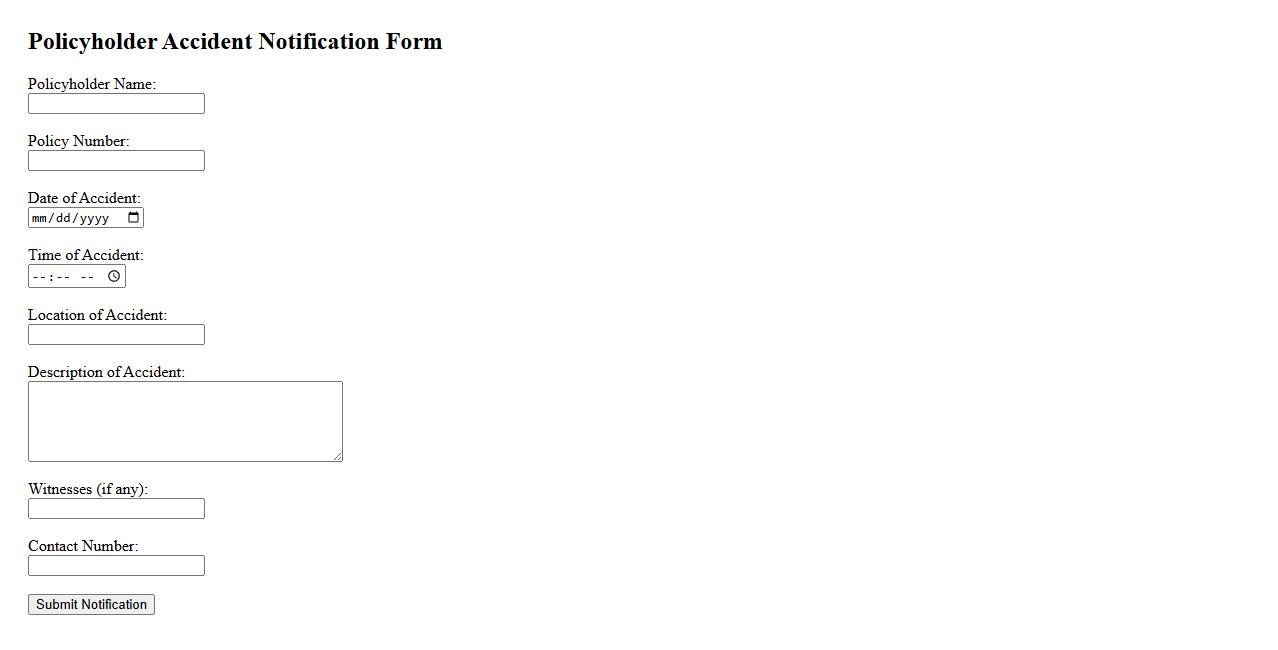

Policyholder Accident Notification

The Policyholder Accident Notification is a crucial process that allows insured individuals to promptly report any accidents to their insurance provider. Timely notification ensures efficient claim processing and helps maintain transparency between the policyholder and the insurer. This procedure protects both parties by documenting the incident details accurately and facilitating swift support.

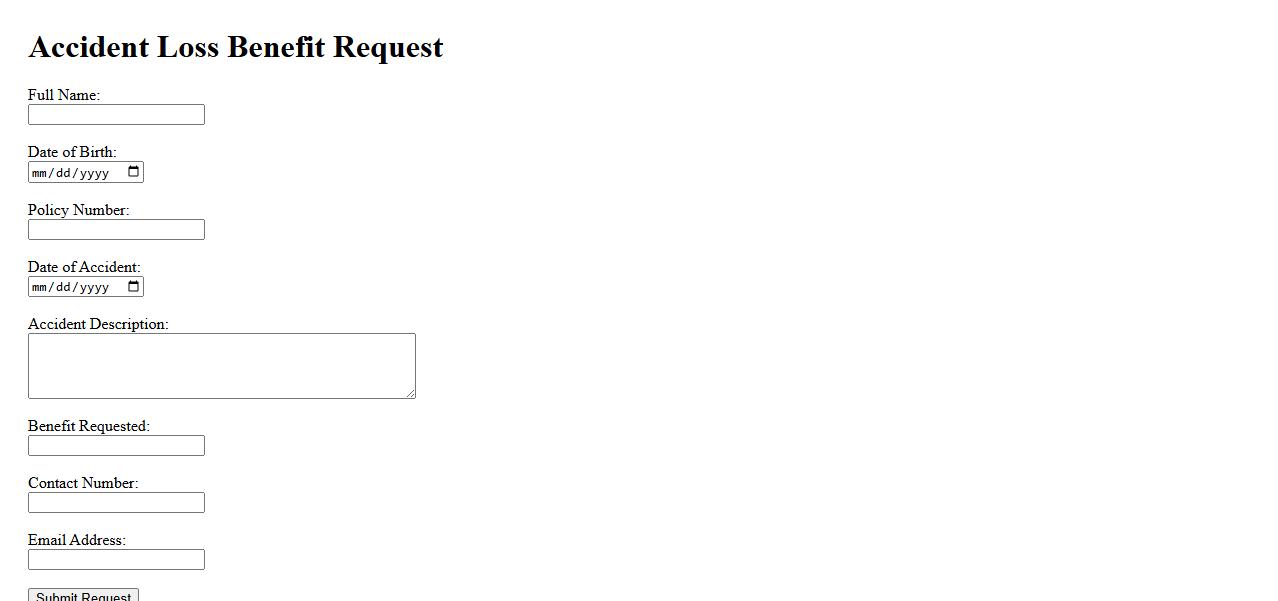

Accident Loss Benefit Request

An Accident Loss Benefit Request is a formal claim submitted to an insurance company to recover financial losses resulting from an accident. This request typically includes details of the incident, proof of damages, and any supporting documentation. It helps policyholders receive compensation for medical expenses, lost wages, and other related costs.

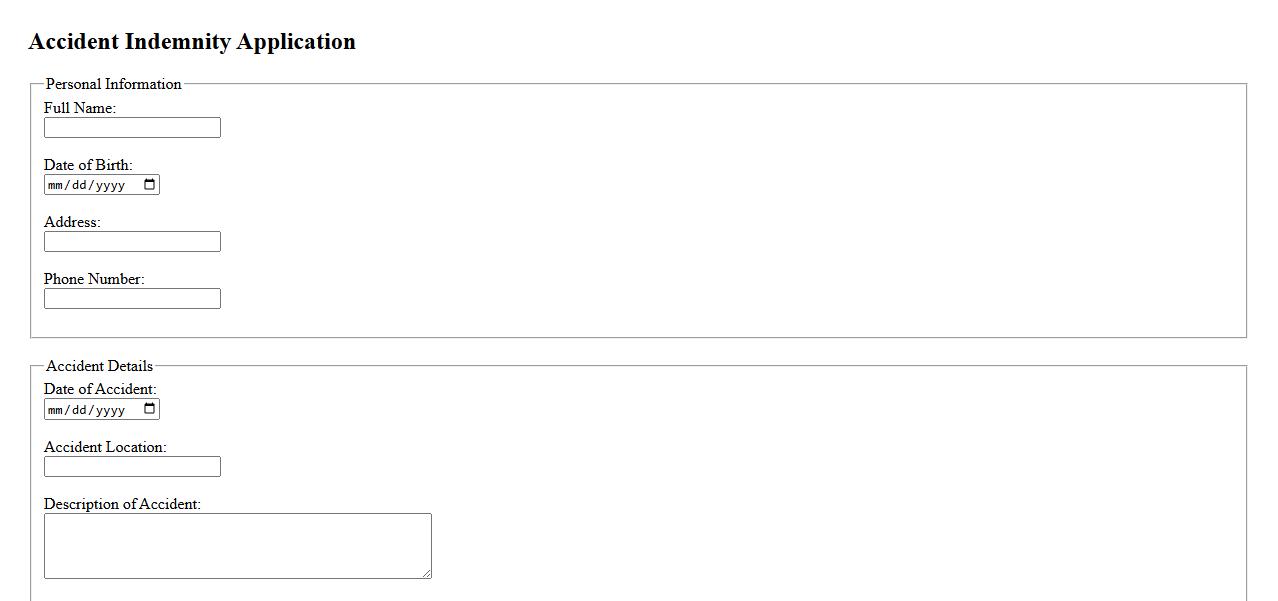

Accident Indemnity Application

The Accident Indemnity Application is designed to provide financial protection in the event of an accident. It allows individuals to claim compensation for injuries or damages sustained. This application streamlines the process for quick and easy claim submission.

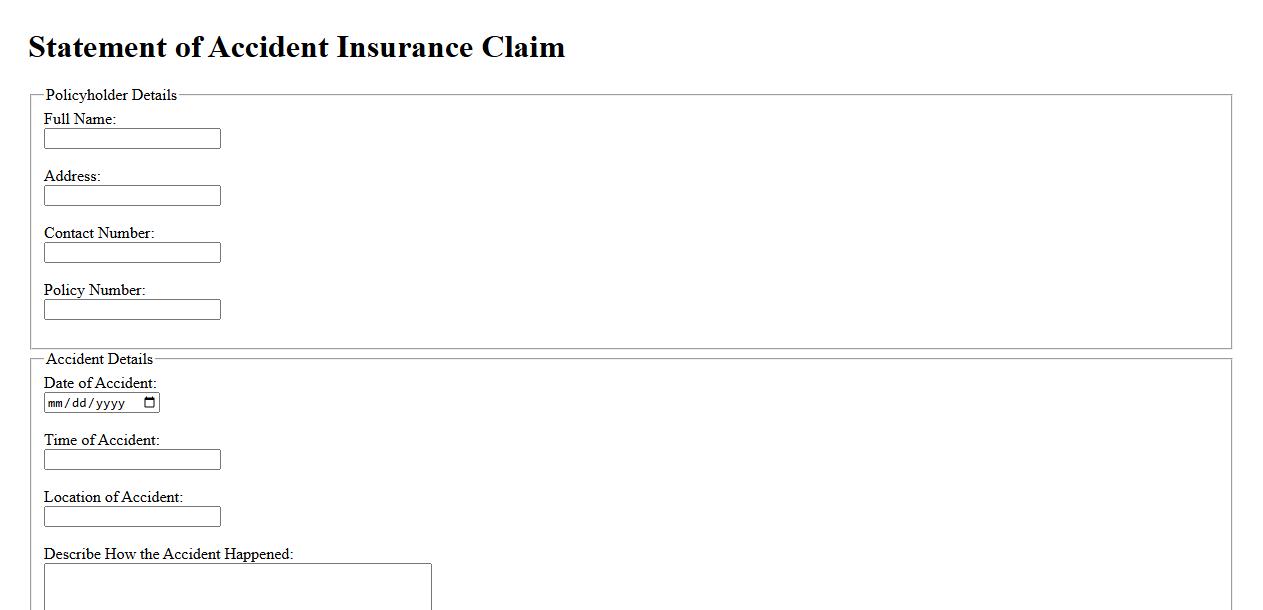

Statement of Accident Insurance Claim

A Statement of Accident Insurance Claim is a formal document submitted to an insurance company detailing the circumstances of an accident. This statement is crucial for initiating the claims process and ensuring accurate assessment. It provides essential information needed to evaluate the validity and extent of the claim.

What is the purpose of a Claim for Accident Insurance document?

The Claim for Accident Insurance document serves as the formal request for financial compensation following an accident. It initiates the process of evaluating the insured individual's eligibility for benefits. This document ensures that the insurance company has all necessary information to begin claim assessment.

Which essential details must be provided to complete a claim for accident insurance?

To complete a claim, essential details include the policyholder's identification, accident description, and date of occurrence. Accurate personal and insurance policy information must be submitted. These details enable the insurer to verify coverage and validate the claim promptly.

Who are the parties involved in submitting and processing an accident insurance claim?

The primary parties involved are the insured individual, insurance company, and sometimes medical professionals. The insured submits the claim, while the insurer reviews and processes it. Medical experts may provide reports to support the claim's validity.

What types of accidents or incidents are typically covered under accident insurance policies?

Accident insurance policies generally cover incidents such as falls, vehicle collisions, and workplace injuries. They also may include coverage for accidental death and dismemberment. Coverage specifics vary by policy but focus on unforeseen physical injuries.

Which supporting documents are usually required when filing a claim for accident insurance?

Supporting documents typically include a medical report, police report, and proof of expenses. These documents substantiate the claim and assist in claim approval. Accurate documentation ensures a smoother and faster claim process.