Filing a claim for property damage involves notifying your insurance company about the harm caused to your property and providing necessary documentation to support your case. This process typically requires submitting photos, estimates, and proof of ownership to ensure accurate compensation. Timely reporting and thorough evidence help expedite the resolution and maximize the reimbursement you receive.

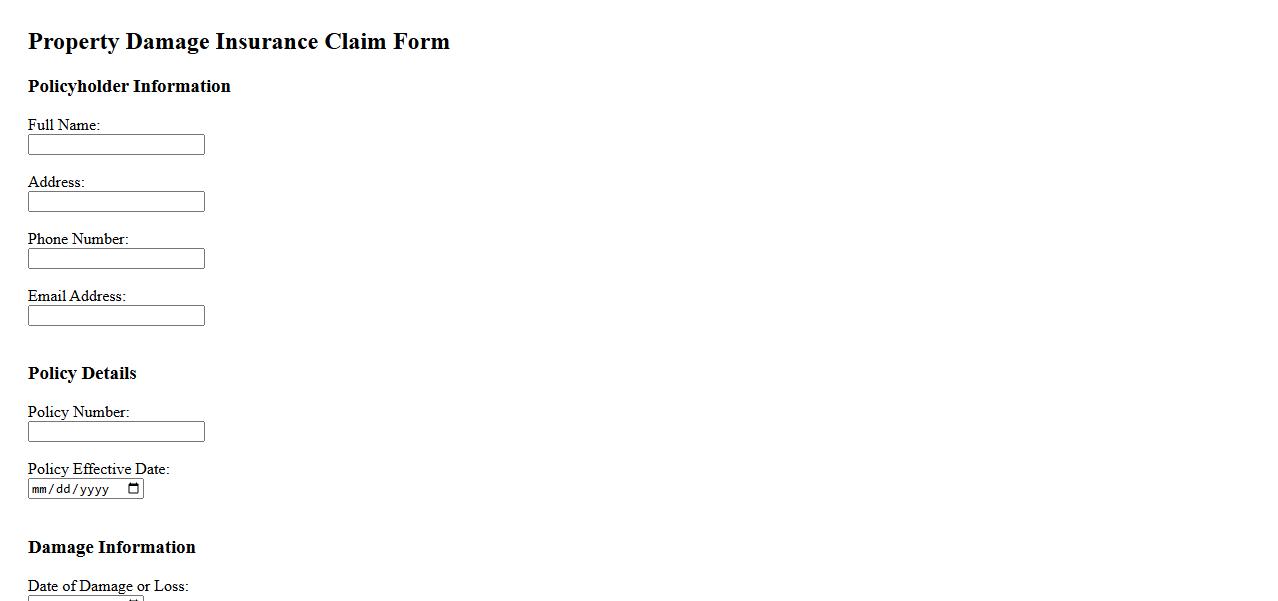

Property Damage Insurance Claim Form

The Property Damage Insurance Claim Form is a crucial document used to report and request compensation for damages to insured property. It helps streamline the claim process by providing detailed information about the incident and the extent of the damage. Accurate completion of this form ensures faster and more efficient settlement of your insurance claim.

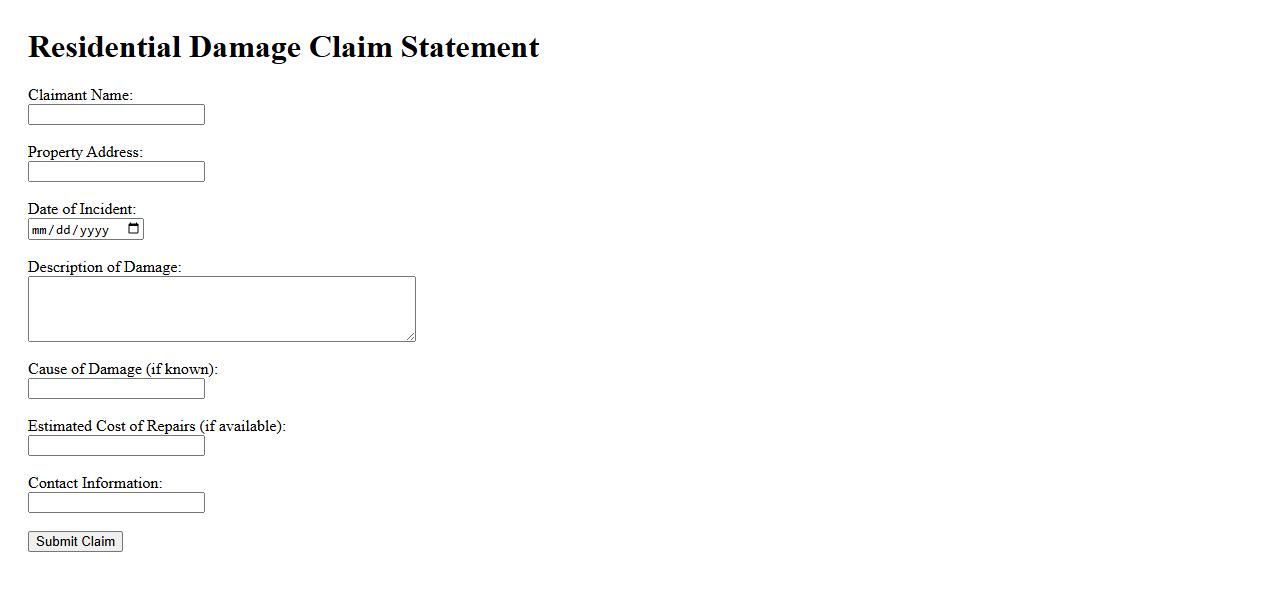

Residential Damage Claim Statement

A Residential Damage Claim Statement is a formal document used to report and detail damages to a home for insurance purposes. It outlines the nature, cause, and extent of the damage to assist in processing the claim efficiently. This statement ensures accurate assessment and timely compensation from the insurance provider.

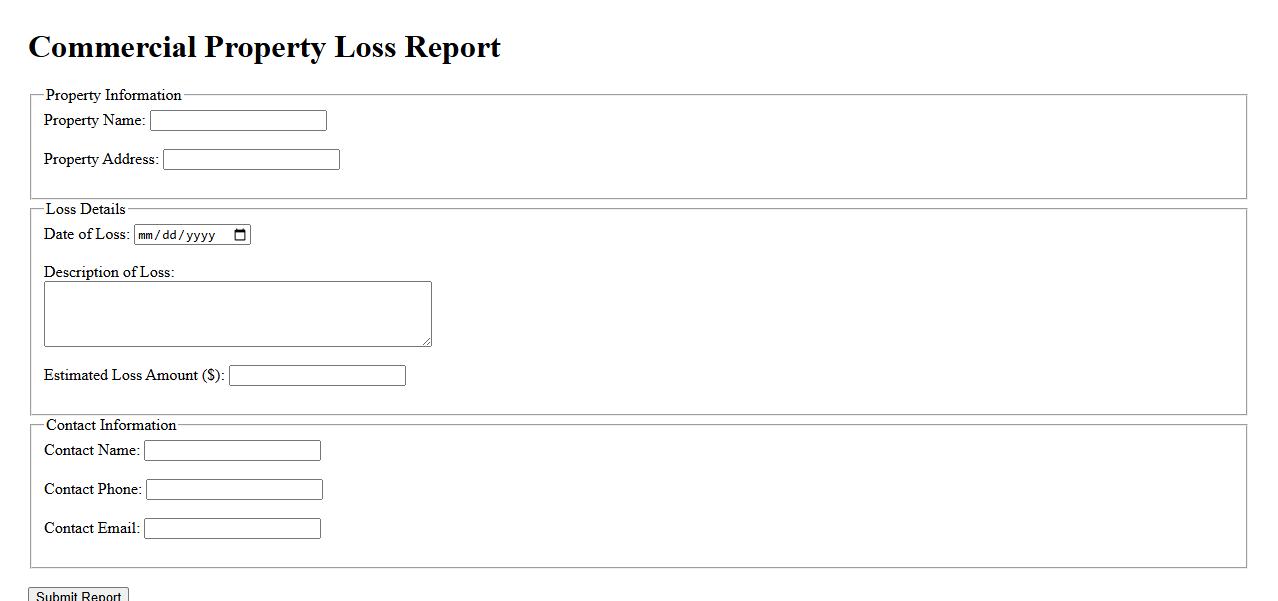

Commercial Property Loss Report

The Commercial Property Loss Report is a detailed document that outlines damages and financial impacts resulting from incidents affecting business properties. It serves as a critical tool for insurance claims and risk management. Accurate reporting ensures timely recovery and compensation processes.

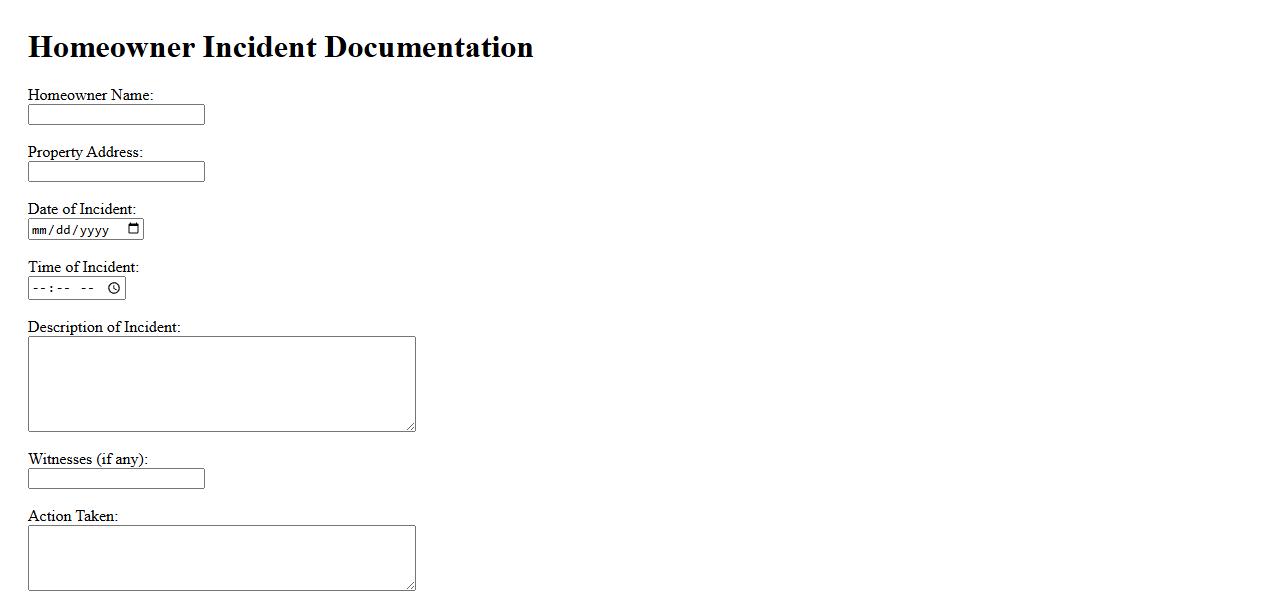

Homeowner Incident Documentation

Homeowner Incident Documentation is essential for accurately recording events such as accidents, damages, or unexpected occurrences at your property. This detailed documentation helps in insurance claims, legal matters, and ensures clear communication with professionals involved. Keeping organized records safeguards your interests and supports swift resolution of incidents.

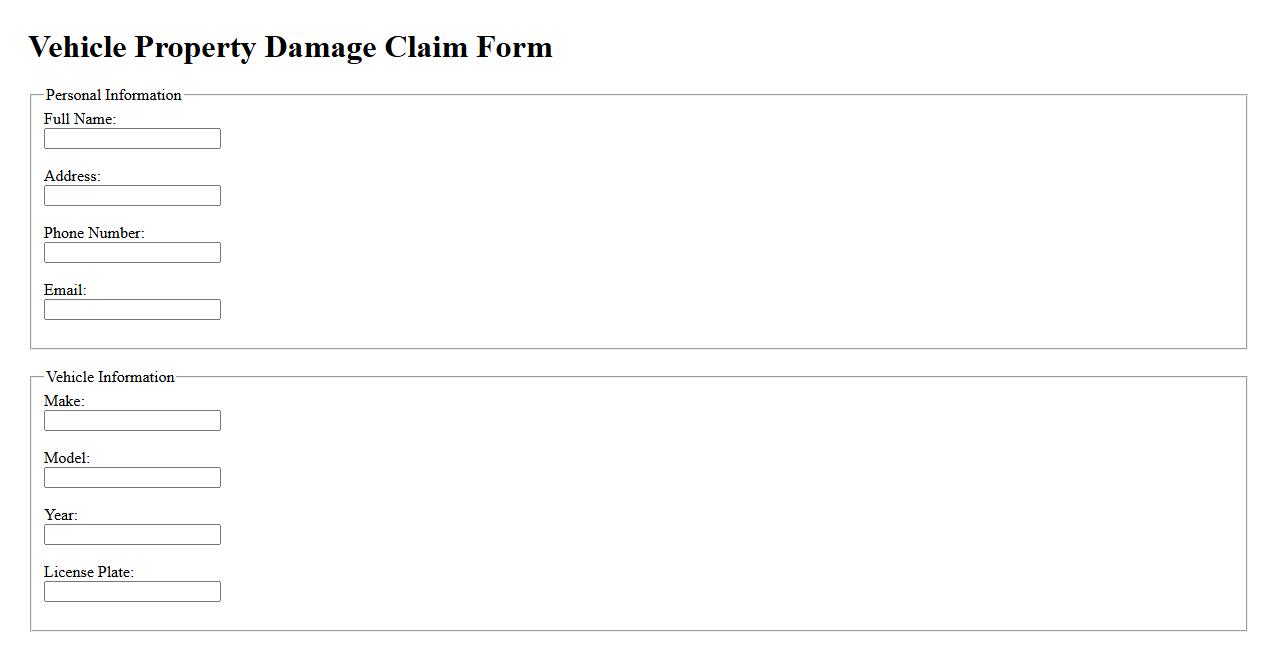

Vehicle Property Damage Claim

Filing a Vehicle Property Damage Claim is essential when your car sustains damage due to an accident or other incidents. This process helps you recover the repair costs from the responsible party or your insurance provider. Promptly reporting and documenting the damage ensures a smoother claim settlement.

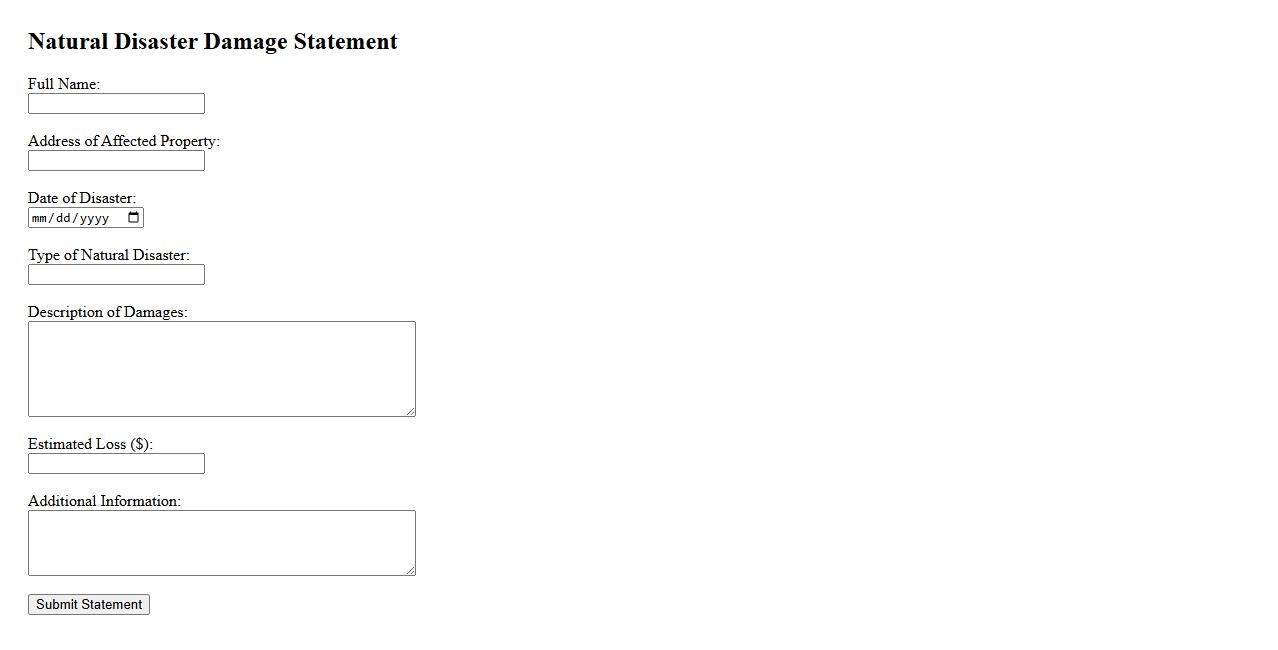

Natural Disaster Damage Statement

The Natural Disaster Damage Statement is a crucial document used to report and assess the impact of events like hurricanes, earthquakes, or floods on properties. It helps insurance companies evaluate the extent of damage for claims processing. Accurate statements ensure timely support and aid for affected individuals and communities.

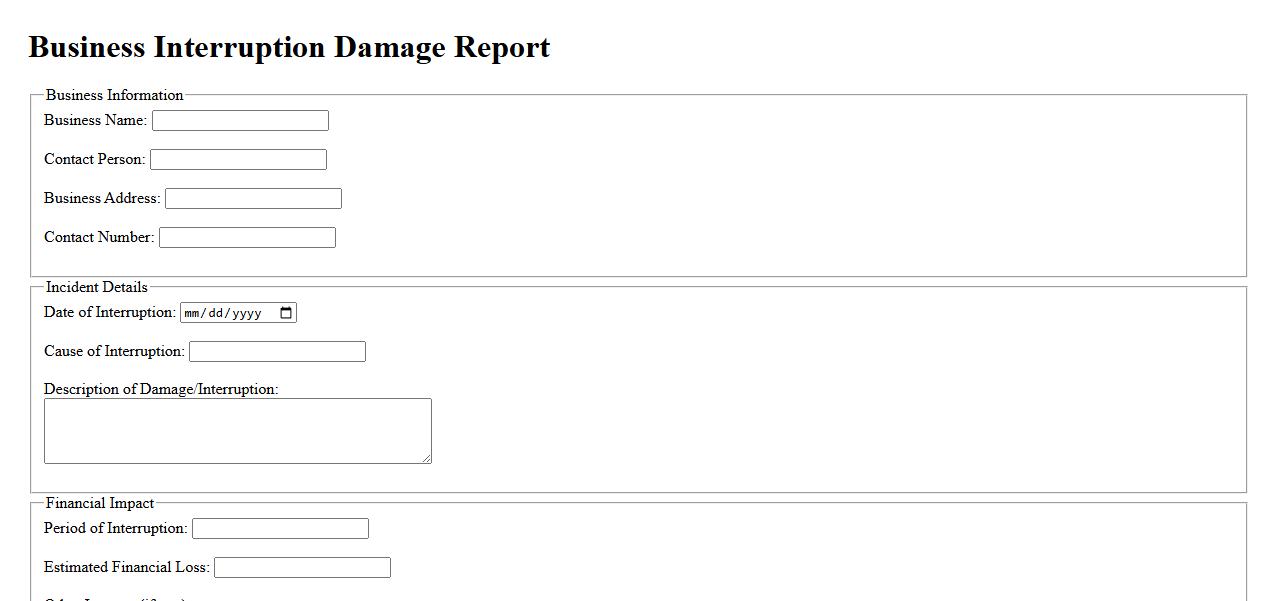

Business Interruption Damage Report

The Business Interruption Damage Report provides a detailed analysis of financial losses caused by disruptions to normal business operations. It helps organizations quantify the impact of unexpected events, such as natural disasters or equipment failures. This report is essential for insurance claims and strategic recovery planning.

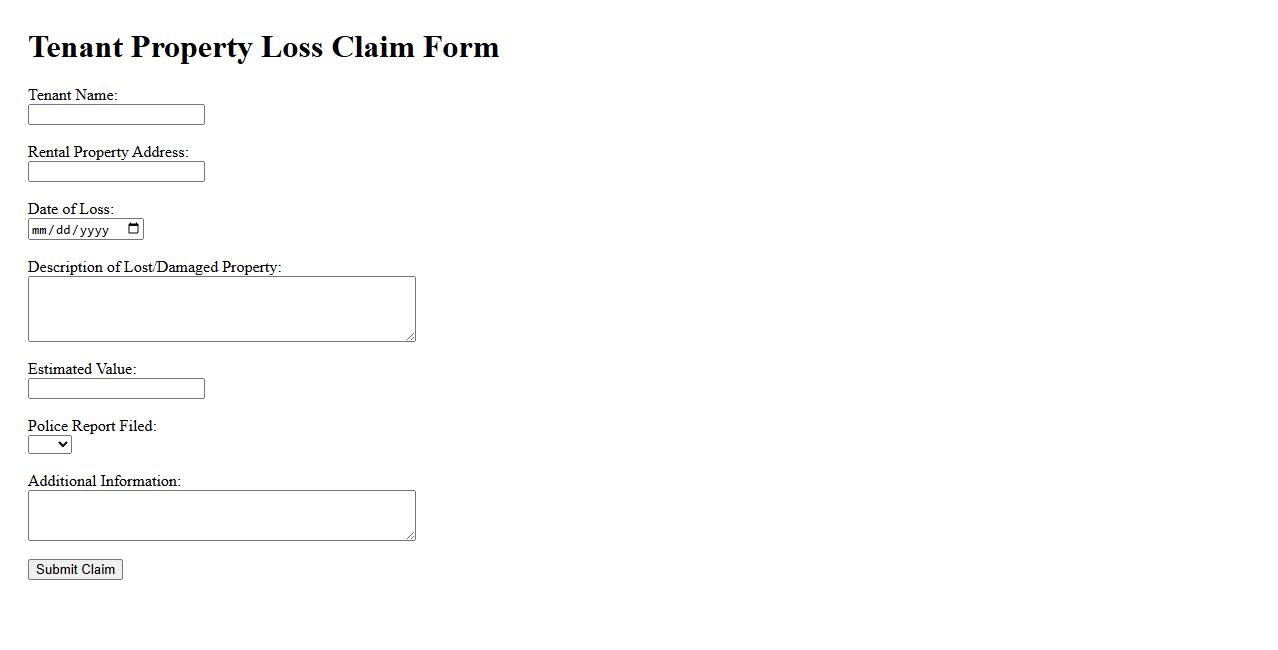

Tenant Property Loss Claim

A Tenant Property Loss Claim is a request made by renters to recover damages or losses to their personal belongings due to events like theft, fire, or water damage. It is essential for tenants to document the damage thoroughly and provide evidence to support their claim. Prompt filing ensures a smoother process and accountability from landlords or insurance providers.

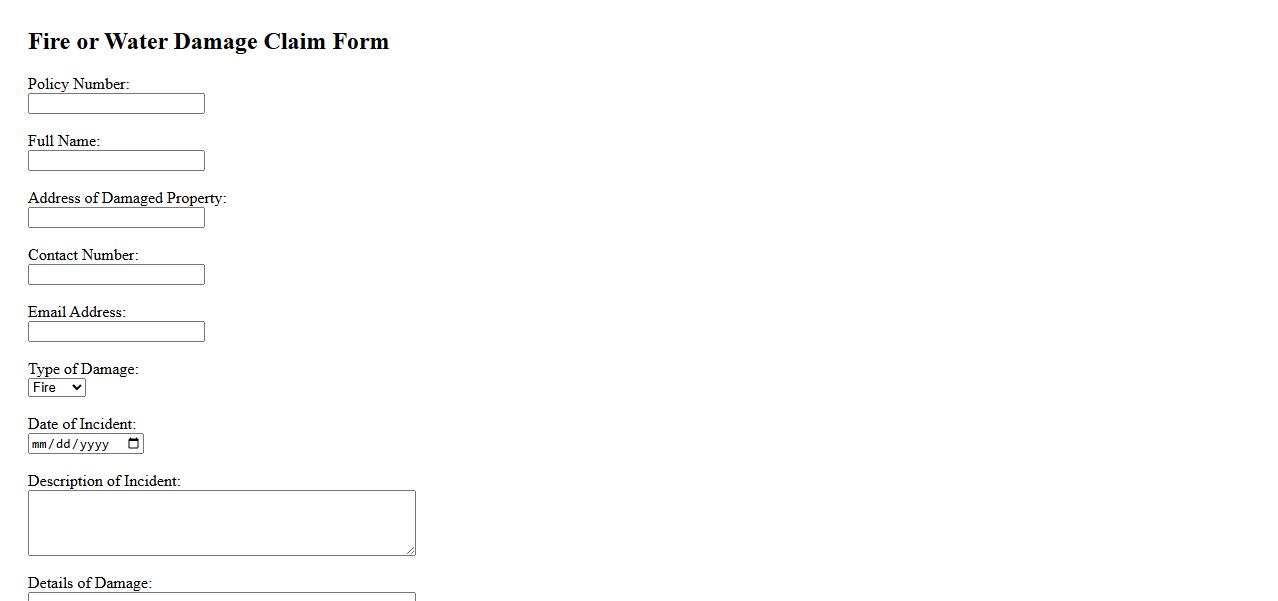

Fire or Water Damage Claim Form

Filing a Fire or Water Damage Claim Form is essential to document and report any losses caused by fire or water incidents. This form helps expedite the insurance process by providing accurate details of the damage. Prompt submission ensures faster assessment and compensation for affected property owners.

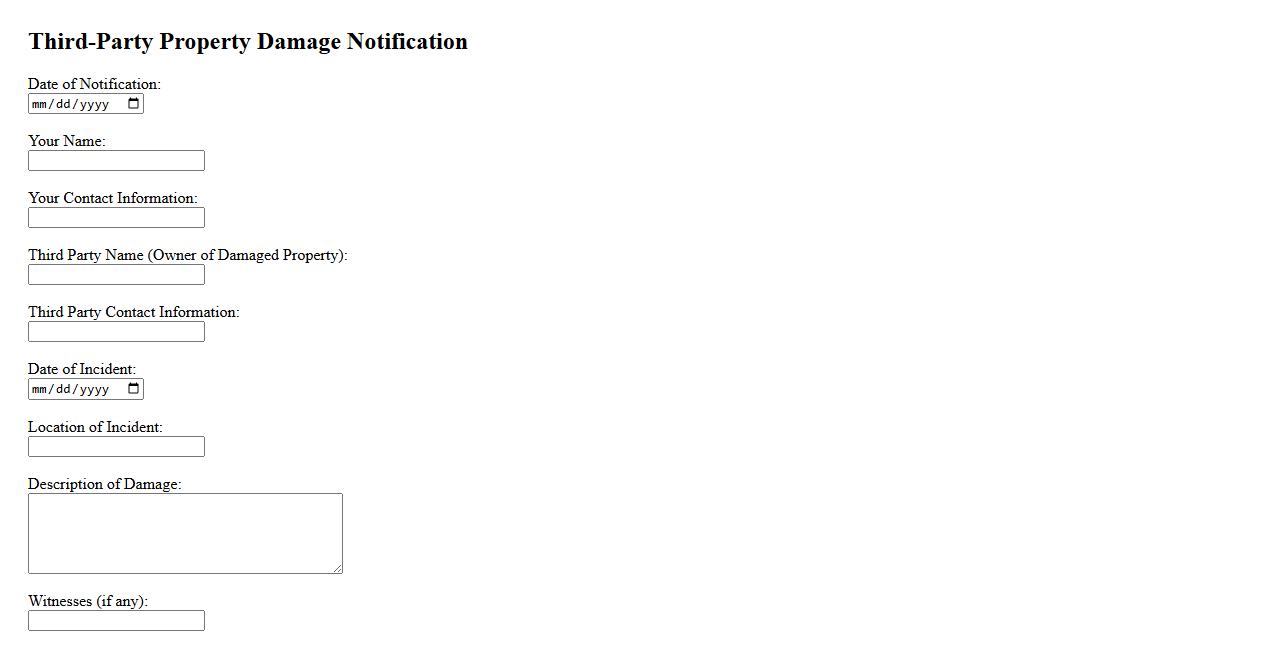

Third-Party Property Damage Notification

When incidents involving property damage occur due to third parties, it is crucial to promptly file a Third-Party Property Damage Notification. This document ensures that all relevant parties are informed and can take appropriate action for claims and repairs. Timely notification helps streamline the resolution process and protect the rights of those affected.

What specific type of property was damaged according to the claim?

The claim specifies that the residential property was the primary asset affected. This includes both the building structure and any attached fixtures. No other types of property, such as vehicles or personal belongings, were mentioned as damaged.

When and where did the property damage incident occur?

The incident took place on a specific date and time clearly outlined in the claim documents. The location was the claimant's home address, situated in a designated residential area. This temporal and spatial information helps establish the context for the damage.

What is the estimated monetary value of the claimed damages?

The estimate for the damage repair is provided as a specific dollar amount based on a professional assessment. This figure encompasses material costs, labor, and any necessary permits. It serves as the basis for the insurance claim payout.

What was the reported cause or source of the property damage?

The damage was attributed to a clearly defined cause, such as natural events or accidental factors outlined in the claim. Understanding the source is critical for validating the claim's legitimacy. This also affects the insurance policy's coverage determination.

Were any preventative measures or insurance protections in place at the time of damage?

According to the claim, preventative measures and insurance coverage were in effect to mitigate potential losses. These may include security systems, maintenance routines, and active insurance policies. Such provisions can influence the claim's approval and compensation levels.