Filing a claim for health insurance benefits involves submitting necessary documentation to your insurance provider to receive coverage for medical expenses. The process typically requires providing detailed medical records, billing information, and proof of eligibility to ensure the claim is valid. Understanding policy terms and deadlines helps expedite approval and prevents claim denials.

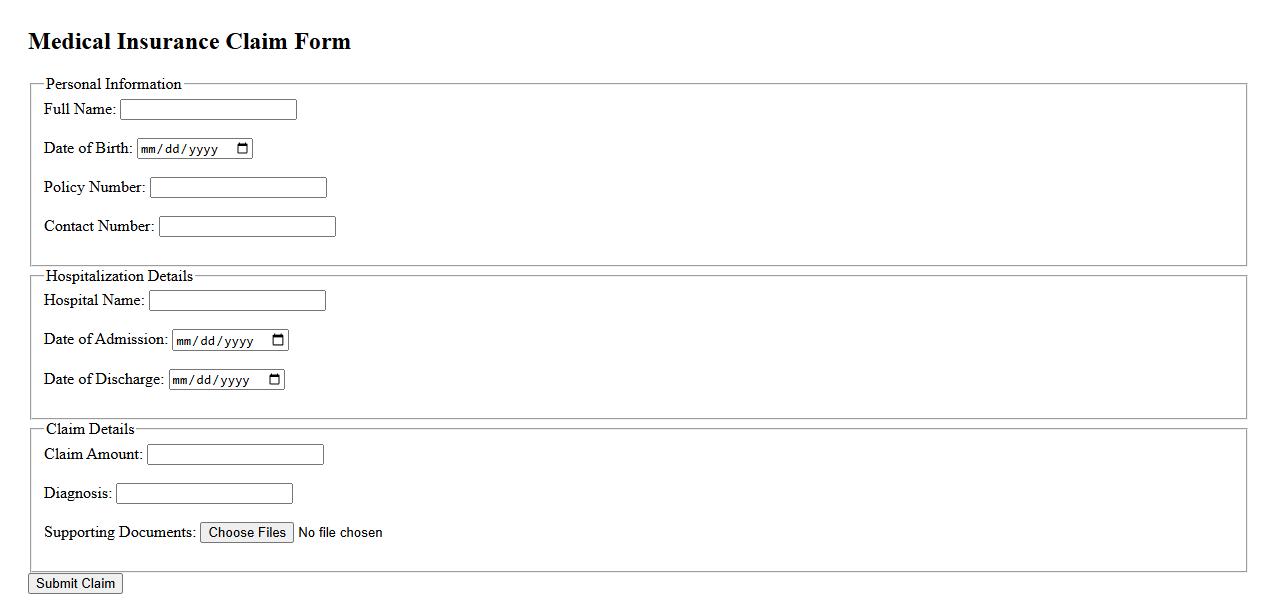

Medical Insurance Claim Form

The Medical Insurance Claim Form is a crucial document used to request reimbursement for medical expenses from an insurance provider. It contains detailed information about the insured individual, the treatment received, and the costs incurred. Properly completing this form ensures timely and accurate processing of the insurance claim.

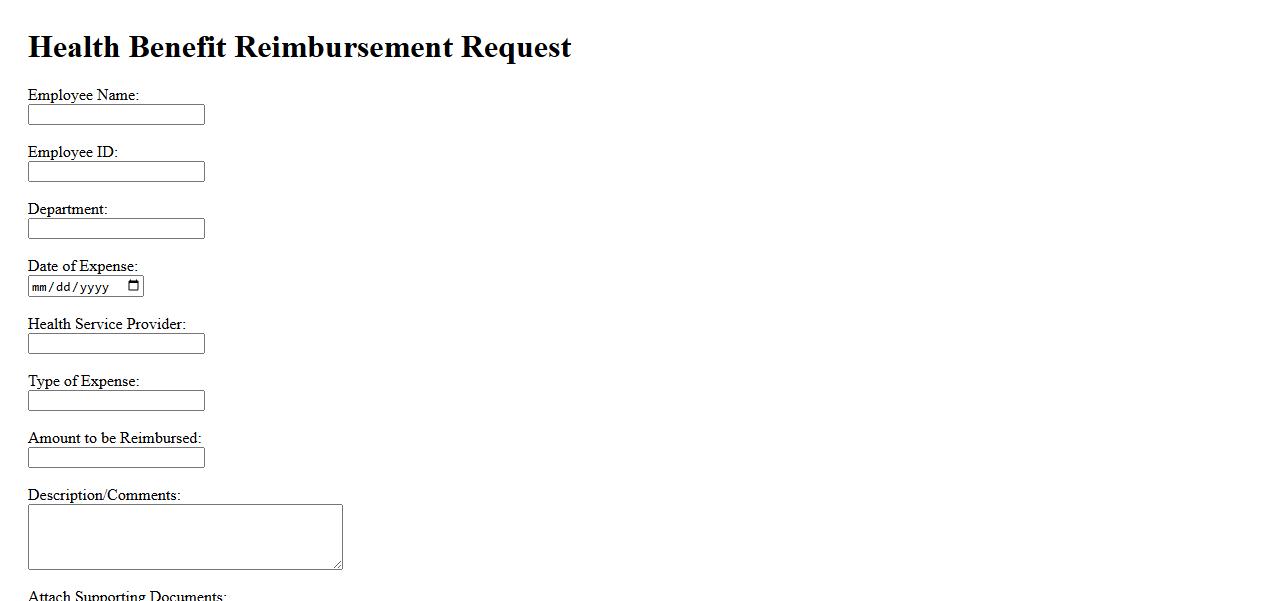

Health Benefit Reimbursement Request

The Health Benefit Reimbursement Request allows employees to claim expenses for eligible medical costs. This process ensures timely repayment and helps manage healthcare expenses effectively. Submitting accurate documentation is essential for a smooth reimbursement experience.

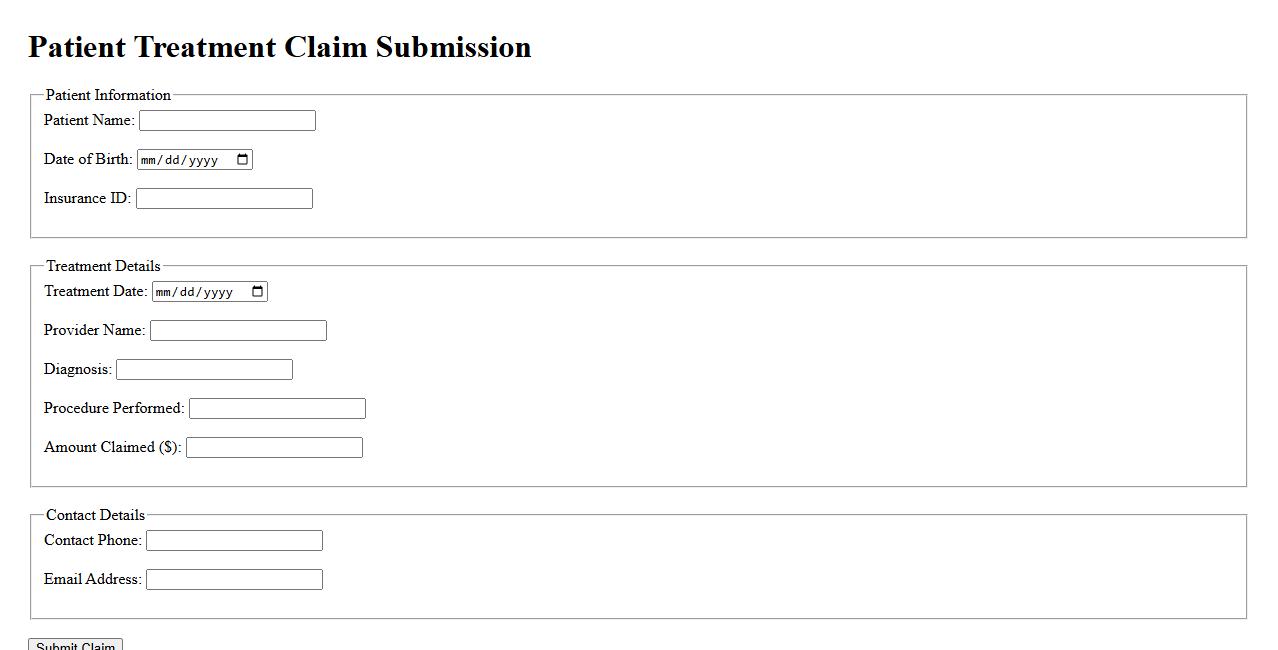

Patient Treatment Claim Submission

The Patient Treatment Claim Submission process ensures healthcare providers efficiently submit claims for services rendered. This system streamlines documentation, reducing errors and speeding up reimbursement. Accurate claim submission is essential for timely patient care and financial management.

Hospitalization Benefit Application

The Hospitalization Benefit Application simplifies the process of claiming medical expenses incurred during hospital stays. This application ensures quick and efficient reimbursement for eligible treatments, minimizing financial stress. Applying for hospitalization benefits helps secure necessary medical support without delay.

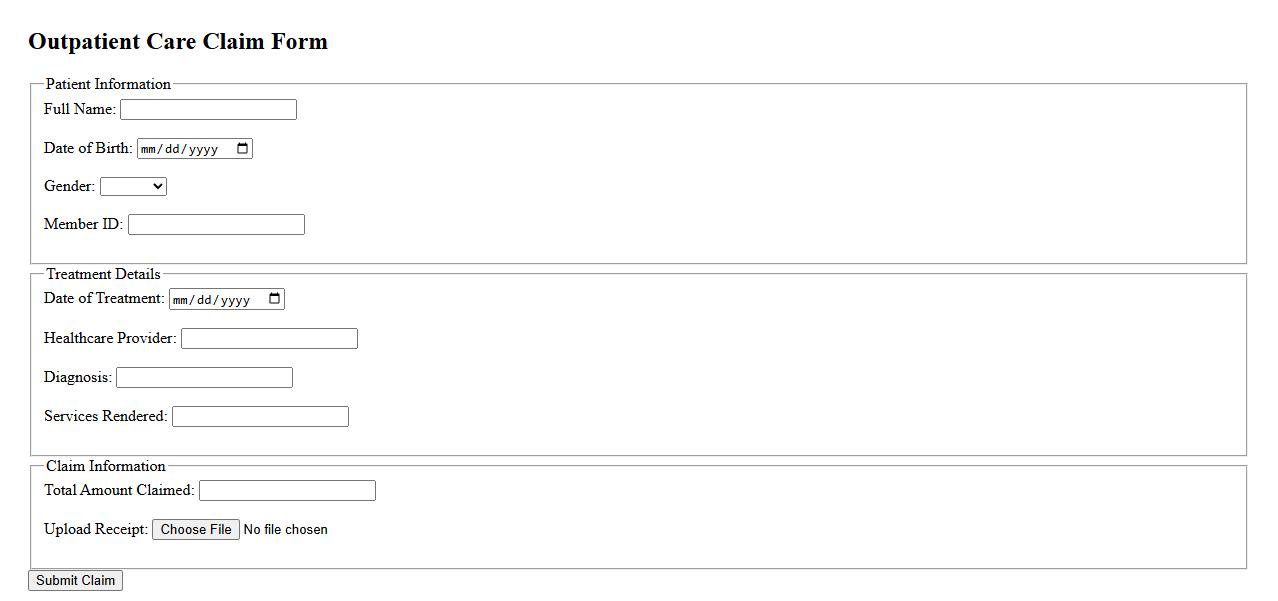

Outpatient Care Claim Form

The Outpatient Care Claim Form is a vital document used to request reimbursement for medical expenses incurred during outpatient treatments. It ensures accurate processing by providing detailed information about the patient, healthcare provider, and services rendered. Submitting this form promptly helps streamline insurance claims and expedite payment.

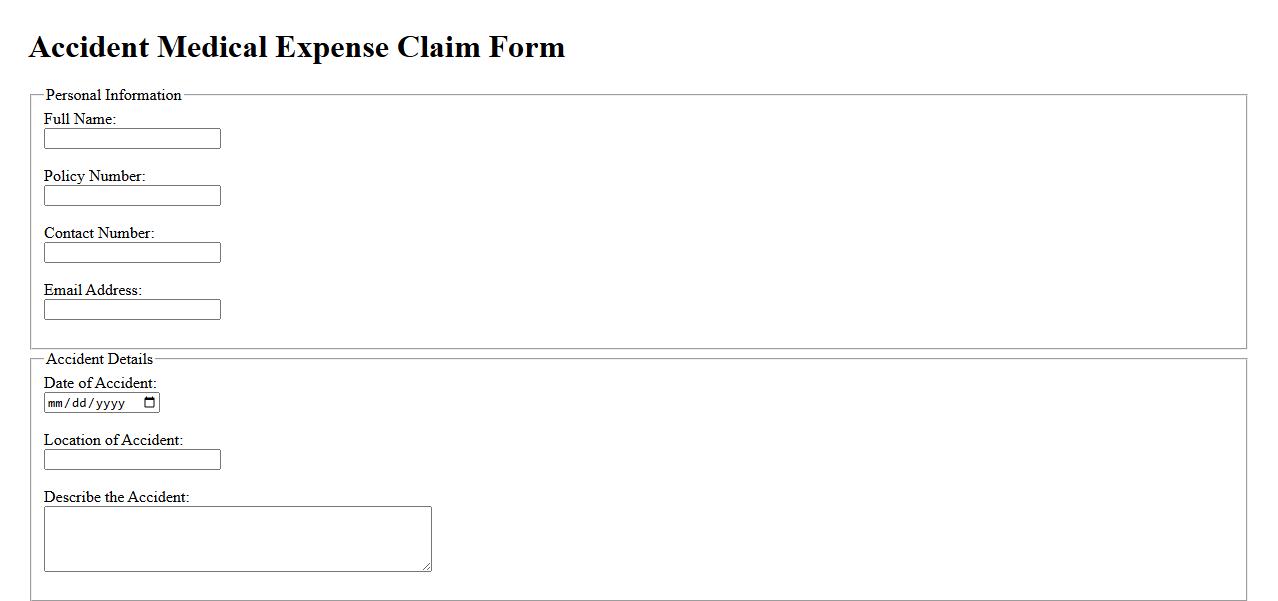

Accident Medical Expense Claim

An Accident Medical Expense Claim covers the costs incurred for medical treatment following an accident. It ensures that policyholders receive financial support for hospital stays, doctor visits, and related medical expenses. Timely submission of necessary documents is crucial for quick claim processing.

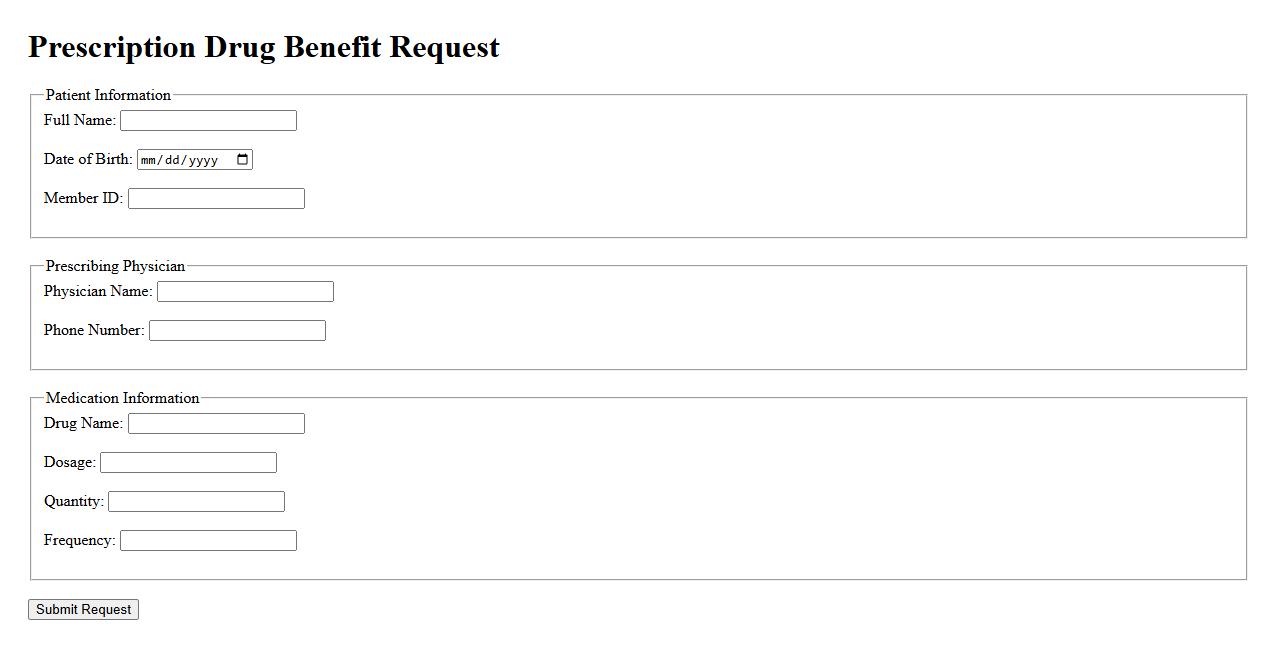

Prescription Drug Benefit Request

A Prescription Drug Benefit Request is a formal application submitted to an insurance provider or employer to obtain coverage for specific medications. This process helps patients access necessary prescription drugs under their health plan benefits. Timely approval ensures affordable access to essential treatments and improved health outcomes.

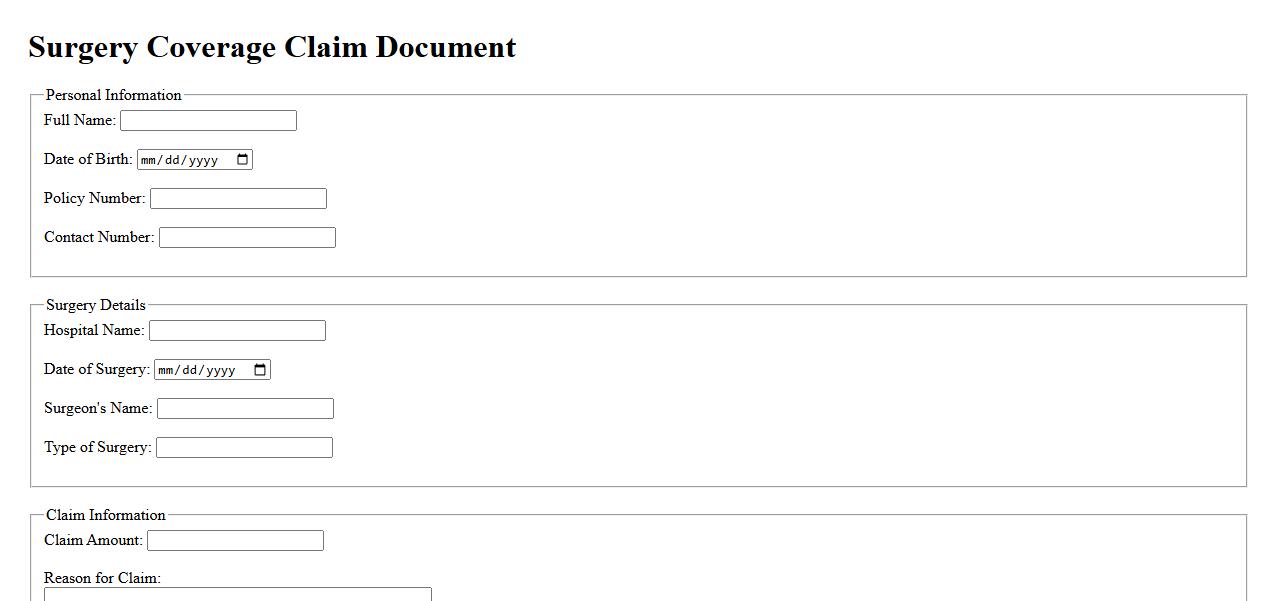

Surgery Coverage Claim Document

The Surgery Coverage Claim Document is essential for processing your medical insurance claims related to surgical procedures. It provides detailed information about the surgery, including the type of operation, dates, and associated costs. Submitting this document accurately ensures timely reimbursement and smooth claim settlement.

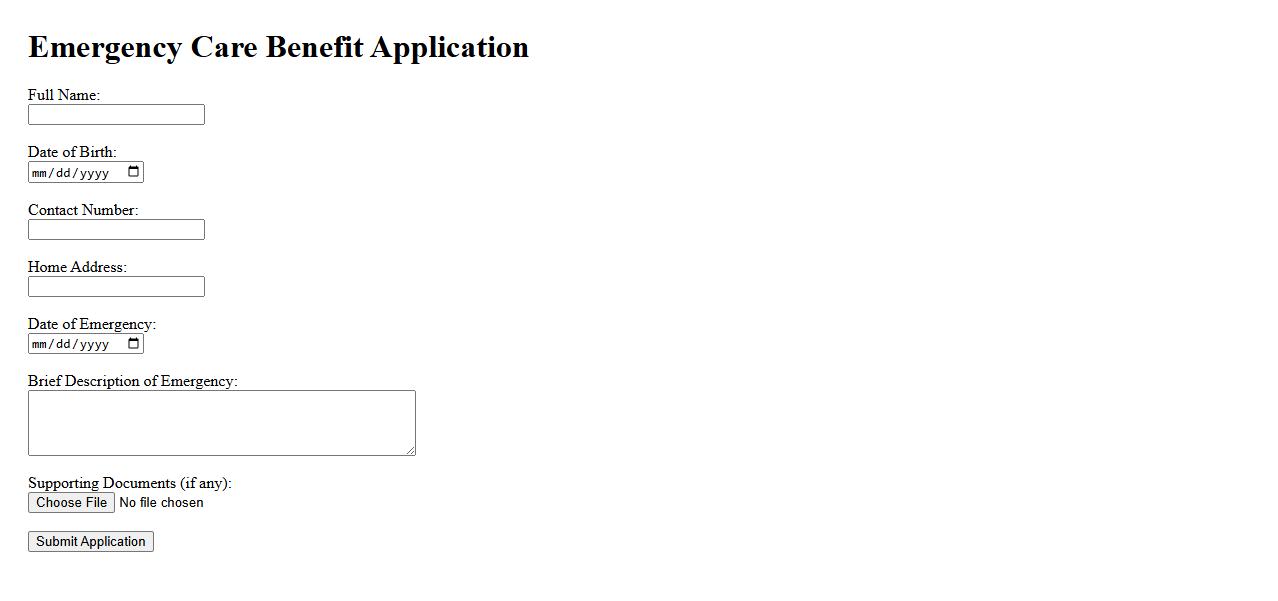

Emergency Care Benefit Application

The Emergency Care Benefit Application provides financial support during unexpected medical situations. This application process ensures timely assistance to those facing urgent health emergencies. Quick submission can help secure essential benefits without delay.

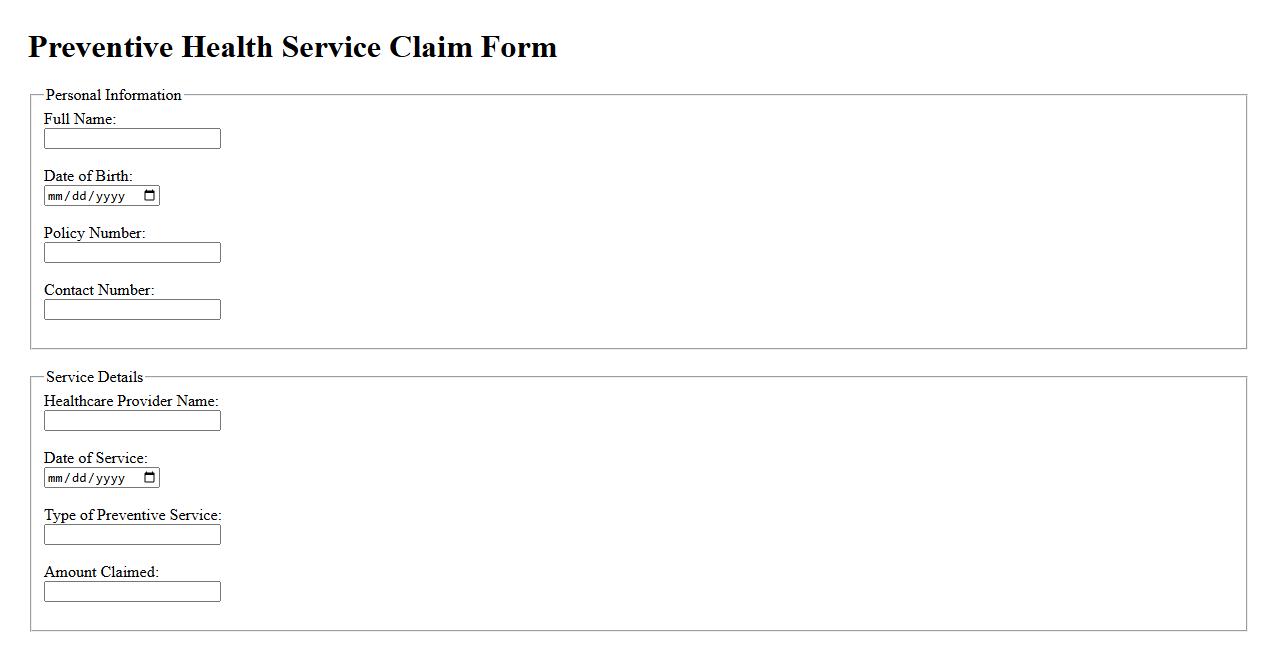

Preventive Health Service Claim Form

The Preventive Health Service Claim Form is designed to facilitate the reimbursement process for preventive healthcare services. This form ensures individuals can easily claim benefits for routine check-ups, screenings, and vaccinations. Timely submission of this claim form helps maintain overall health and reduces long-term medical costs.

What types of medical services are covered under this health insurance claim document?

The health insurance claim document outlines coverage for inpatient and outpatient hospital services, including surgeries and emergency care. It also covers diagnostic services such as laboratory tests and imaging studies. Additionally, prescription medications and preventive care services are included under the coverage.

Who is eligible to submit a health insurance benefits claim according to this document?

Eligible claimants typically include the insured individual or policyholder who is covered under the health insurance plan. In some cases, healthcare providers can also submit claims on behalf of the insured. Dependents listed on the policy may also submit claims if they incurred the medical expenses.

What required documentation must accompany a health insurance benefits claim?

A valid claim must be accompanied by itemized medical bills detailing the services provided and their costs. The document also requires a completed claim form and proof of payment or receipt. Additionally, any necessary physician reports or prescriptions related to the claim should be attached.

How does the document define allowable expenses for reimbursement?

Allowable expenses are defined as those medically necessary costs directly related to the diagnosis, treatment, or prevention of illness or injury. These expenses must be covered under the terms of the health insurance policy. Expenses outside of the policy guidelines or considered cosmetic are typically excluded from reimbursement.

What is the process outlined for appealing a denied health insurance benefits claim?

The document describes a formal appeal process where the claimant must submit a written request for review within a specified timeframe. This request should include any additional supporting documentation justifying the claim. Following submission, the insurance company will re-evaluate the claim and provide a final decision.