Submitting a claim for pet insurance reimbursement involves providing proof of veterinary expenses to your insurance provider for coverage review. Accurate documentation, including receipts and medical records, is essential to ensure timely processing and approval of your reimbursement. Understanding policy terms and keeping detailed records can significantly streamline the reimbursement process for pet healthcare costs.

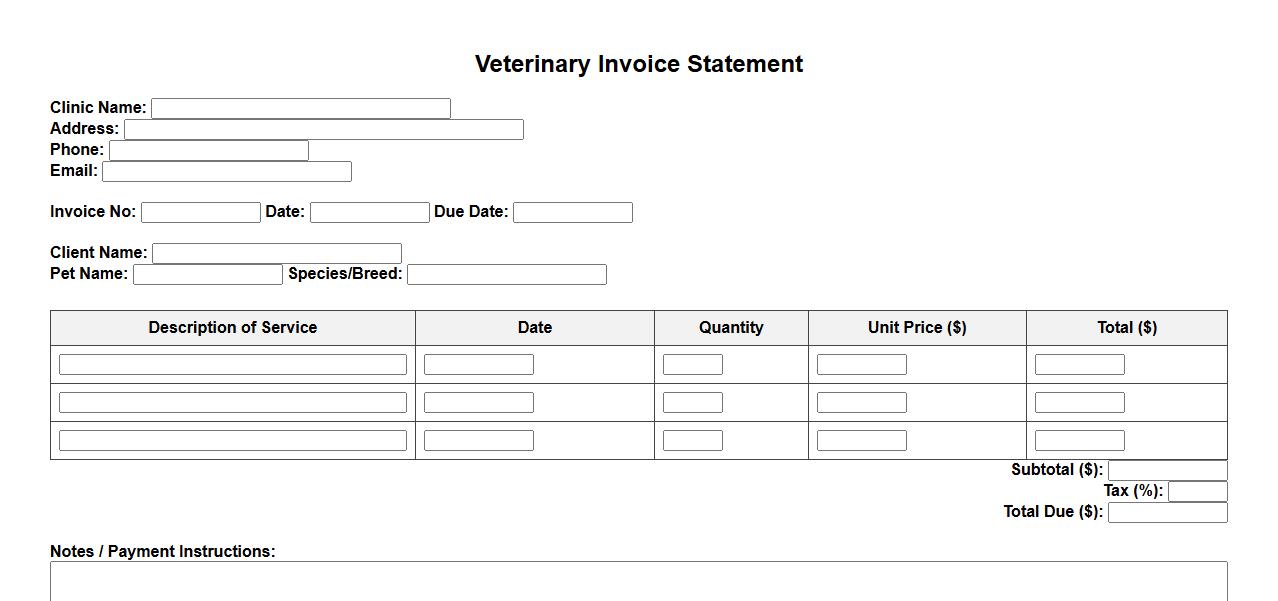

Veterinary Invoice Statement

A Veterinary Invoice Statement details the costs associated with pet medical services and treatments. It provides a clear summary of charges, including consultations, medications, and procedures. This document helps pet owners keep track of their veterinary expenses accurately.

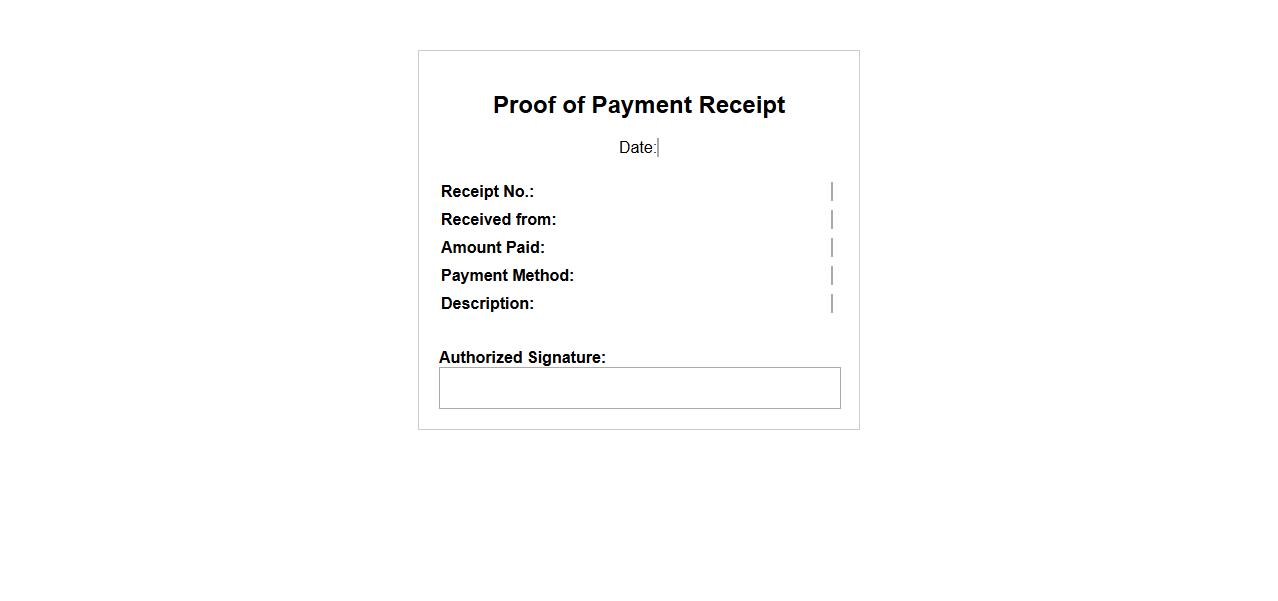

Proof of Payment Receipt

A Proof of Payment Receipt serves as official confirmation that a transaction has been successfully completed. It typically includes details such as the payment amount, date, and method used. This receipt is essential for record-keeping and resolving any future payment disputes.

Completed Claim Form

The Completed Claim Form is an essential document used to request reimbursement or benefits from an insurance provider. It contains detailed information about the claimant, policy details, and specifics of the claim. Submitting a fully completed form ensures a faster and more accurate processing of your claim.

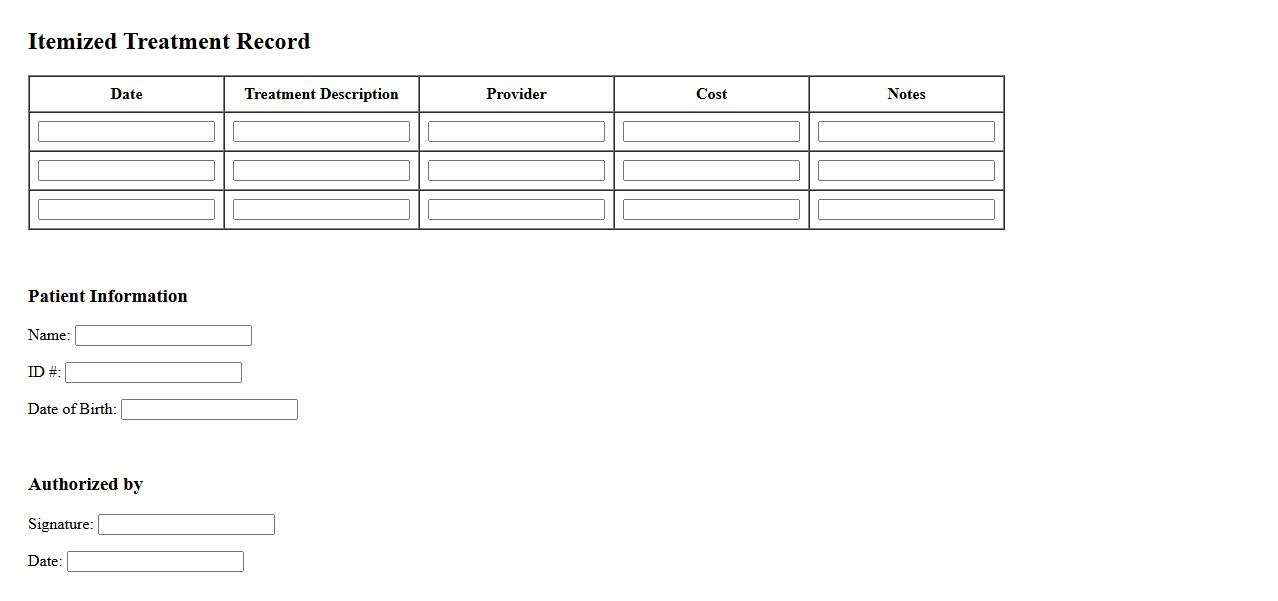

Itemized Treatment Record

An Itemized Treatment Record provides a detailed account of all medical treatments and services rendered to a patient. It includes dates, procedures, and associated costs, ensuring transparency and accuracy in healthcare documentation. This record is essential for insurance claims and patient medical history.

Medical Records for Pet

Medical records for pets are essential documents that detail the health history, vaccinations, treatments, and diagnoses of your animal companion. These records help veterinarians provide accurate care and make informed decisions during check-ups or emergencies. Keeping organized and up-to-date medical records ensures your pet receives the best possible healthcare.

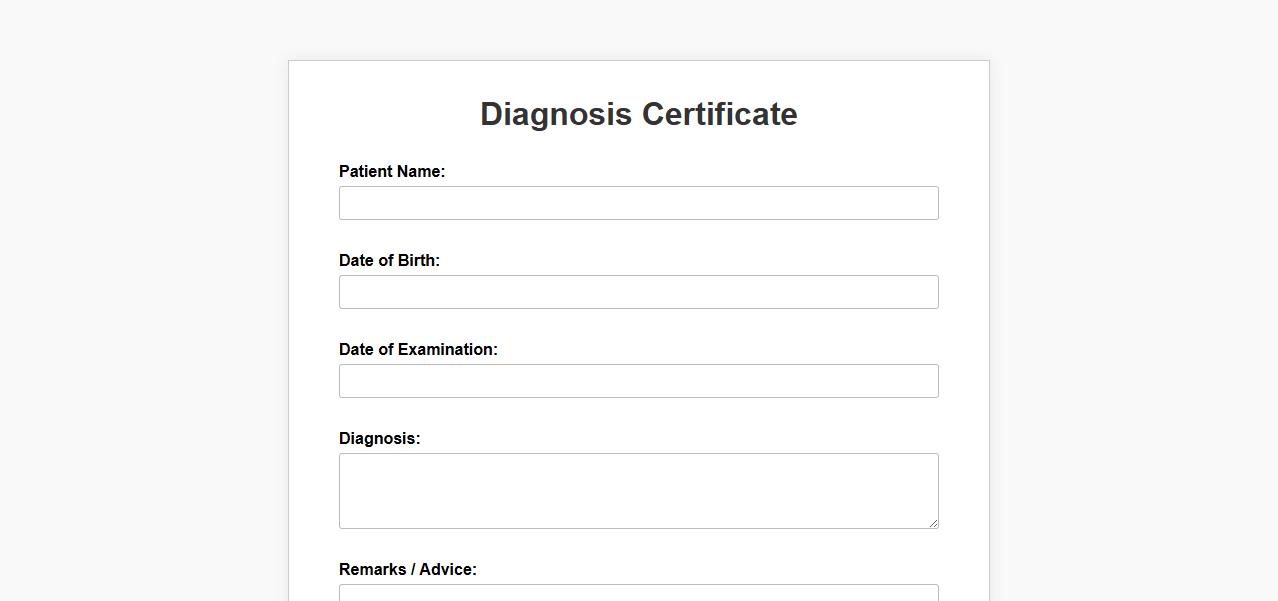

Diagnosis Certificate

A Diagnosis Certificate is an official document issued by a medical professional that confirms the identification of a specific illness or condition. It serves as verifiable evidence for treatment, insurance claims, and legal purposes. This certificate plays a crucial role in ensuring accurate medical records and patient care management.

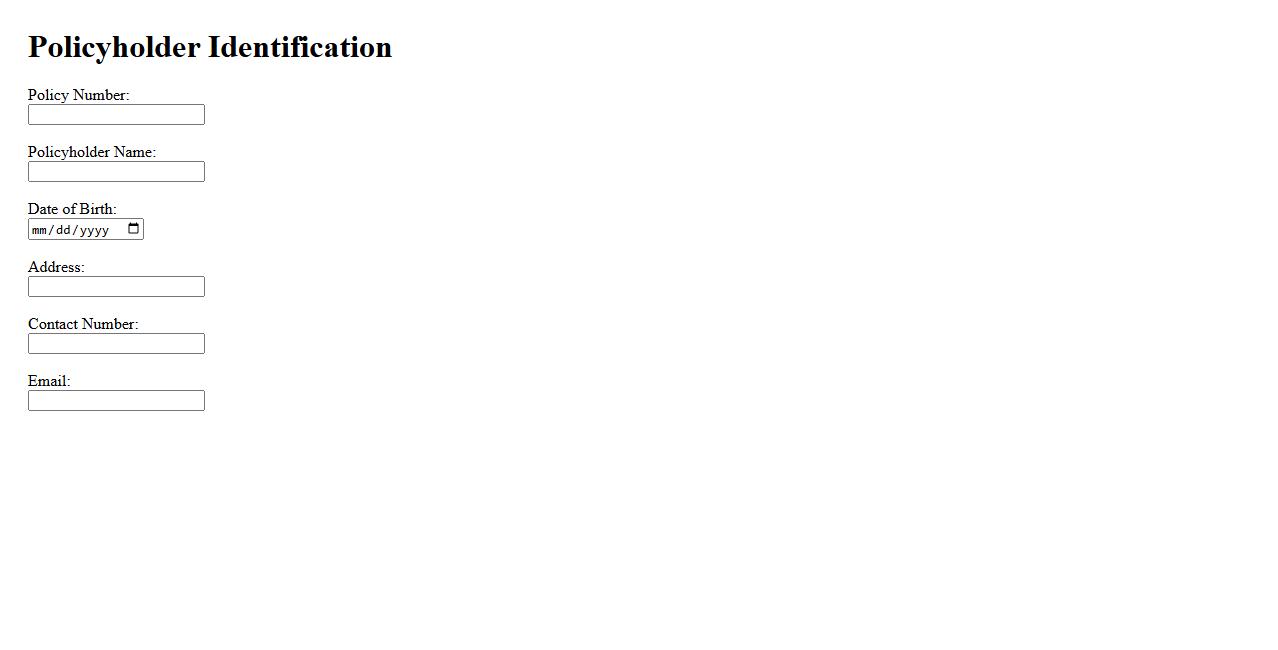

Policyholder Identification

Policyholder Identification is the process of verifying the identity of an individual who holds an insurance policy. This ensures accurate record-keeping and facilitates smooth communication between the insurer and the policyholder. Proper identification safeguards against fraud and helps in claim processing.

Prescription Details

Prescription Details provide critical information about a patient's prescribed medication, including dosage, frequency, and duration. Accurate documentation ensures proper treatment and helps prevent medication errors. This information is essential for both healthcare providers and patients to follow the prescribed therapy safely and effectively.

Referral Letter (if applicable)

A Referral Letter is a formal document provided by a healthcare professional or organization to recommend a patient for specialized treatment or consultation. It includes relevant medical history and reasons for the referral, ensuring continuity of care. This letter is essential when transferring patient care to another provider or specialist.

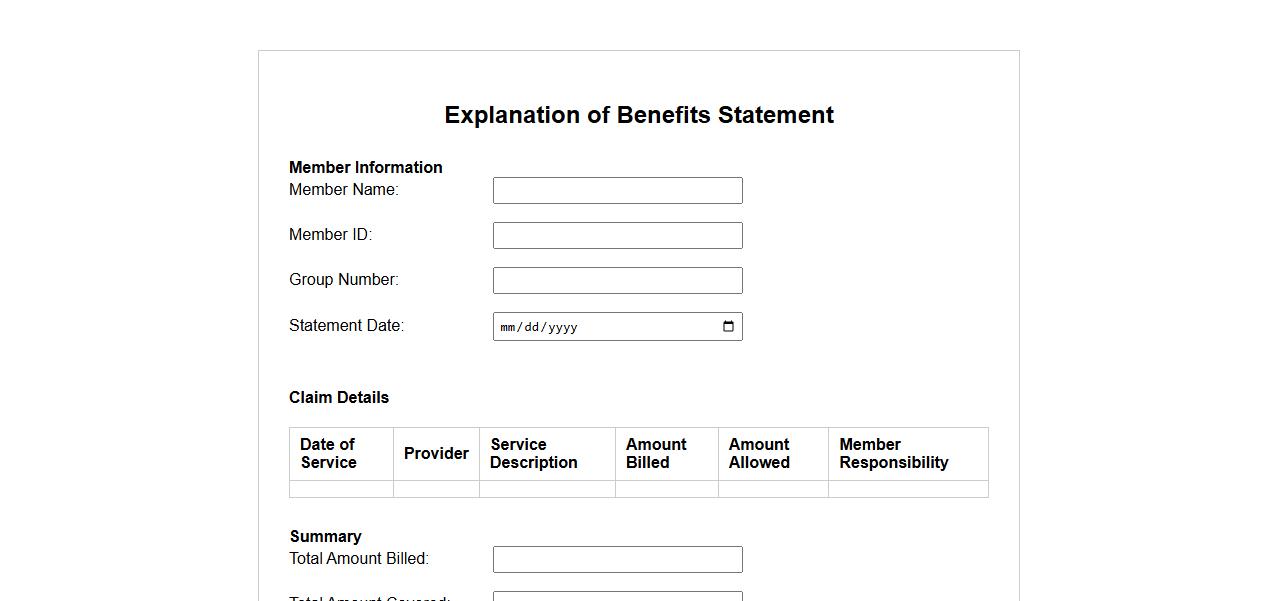

Explanation of Benefits Statement

An Explanation of Benefits Statement is a detailed report provided by insurance companies that outlines the services billed, the amount covered, and any patient responsibility. It helps policyholders understand how their claims were processed and what payments were made. This statement is crucial for verifying healthcare expenses and ensuring accurate billing.

What information is required to accurately complete a pet insurance reimbursement claim form?

To accurately complete a pet insurance reimbursement claim form, you must provide your policy number and pet's details, including name and breed. Additionally, detailed information about the veterinary treatment, such as the date of service and itemized description of procedures performed, is essential. Accurate completion ensures timely processing and reduces the risk of claim denial.

Which supporting documents must be attached when submitting a claim for pet insurance reimbursement?

Supporting documents typically required are the original veterinary invoices and payment receipts to verify expenses. A detailed medical report or treatment summary from your veterinarian may also be requested to confirm the necessity of care. Including all relevant documents helps substantiate your claim and speeds up approval.

How does the coverage limit or deductible affect the reimbursement amount in a pet insurance claim?

The coverage limit determines the maximum amount your insurer will pay for claims within a specified period. Your deductible is the portion of the expense you must pay out-of-pocket before the insurance reimbursement begins. Both factors directly influence the total reimbursement you receive, with higher deductibles reducing payouts and limits capping the overall coverage.

What types of veterinary treatments or expenses are typically eligible for reimbursement under a standard pet insurance policy?

Standard pet insurance policies usually cover accident-related injuries and illnesses, including surgeries, diagnostics, and prescribed medications. Preventive care like vaccinations may not be covered unless included in a wellness plan. It's important to review your policy to understand the scope of eligible veterinary expenses.

What are common reasons for the denial of a pet insurance reimbursement claim?

Claims are commonly denied due to pre-existing conditions that were not disclosed during policy enrollment. Filing incomplete forms or missing required documentation can also lead to rejection. Understanding policy terms and providing thorough, accurate claim information helps avoid denials.