Filing a claim for life insurance involves submitting the required documentation, such as the death certificate and completed claim forms, to the insurance company. The insurer reviews the claim to verify the policyholder's coverage and circumstances before approving the payout. Timely and accurate submission ensures a smoother process for beneficiaries to receive the death benefit.

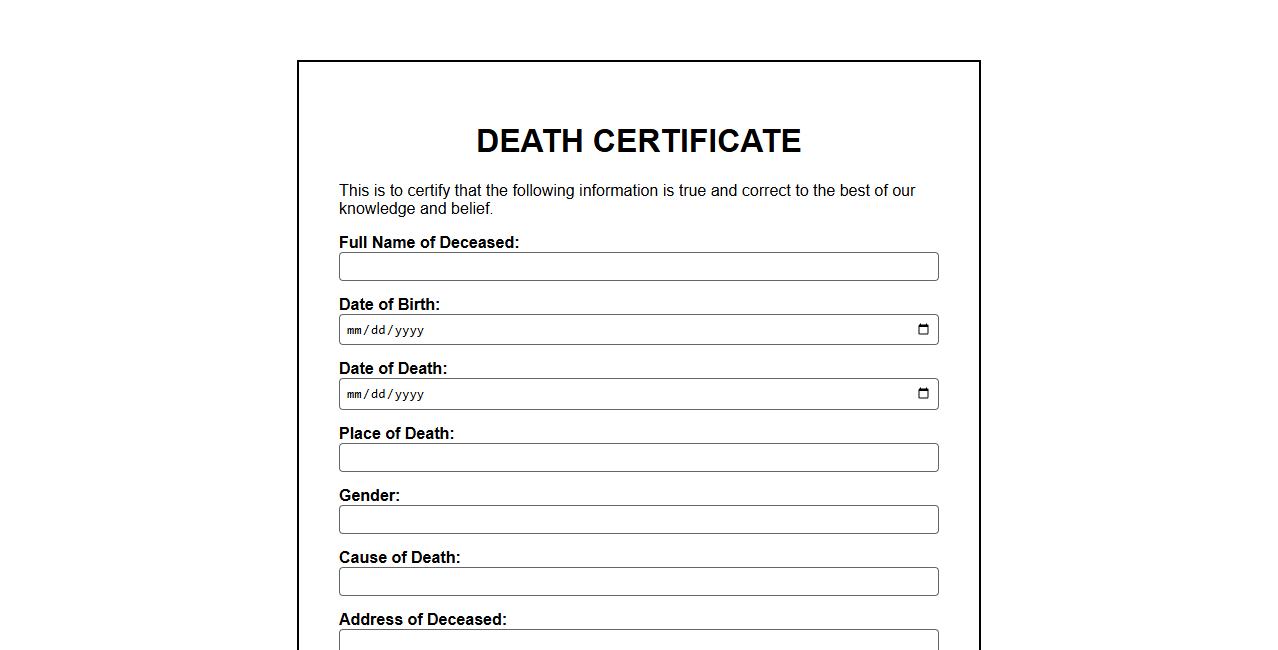

Death Certificate

A death certificate is an official document issued by a government authority that records the details of a person's death. It typically includes information such as the date, time, cause of death, and personal details of the deceased. This certificate is essential for legal processes, estate settlement, and obtaining benefits or insurance claims.

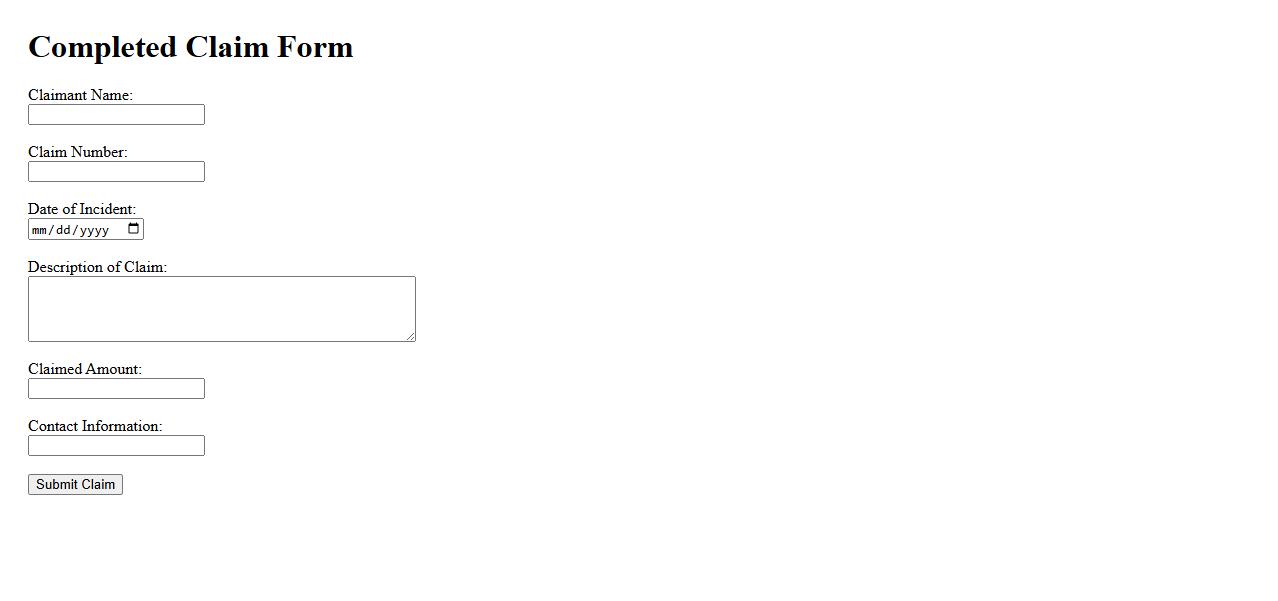

Completed Claim Form

A Completed Claim Form is a document filled out by an individual to request compensation or benefits from an insurance company or organization. It includes all necessary details required to process the claim accurately and efficiently. Submitting a fully completed claim form ensures faster approval and reimbursement.

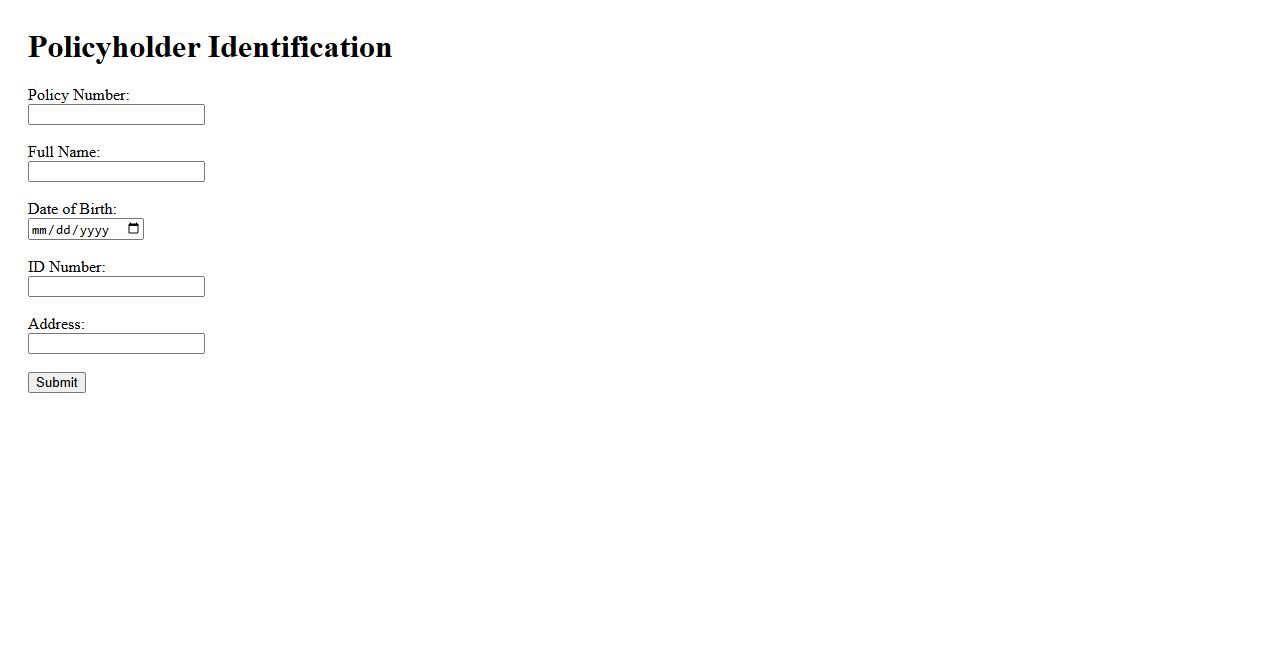

Policyholder Identification

Policyholder Identification is the process of verifying the identity of an individual who holds an insurance policy. This step ensures accurate record-keeping and prevents fraud. Proper identification is crucial for claims processing and policy management.

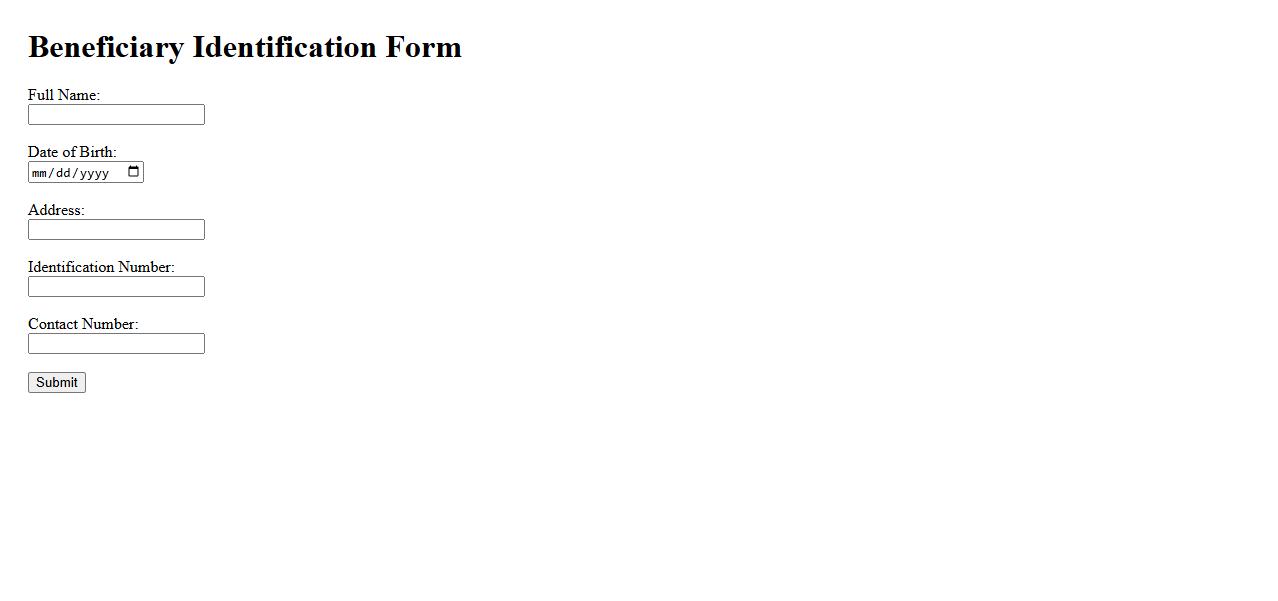

Beneficiary Identification

Beneficiary Identification is the process of accurately verifying the identity of individuals entitled to receive benefits or services. This ensures that resources are distributed fairly and securely to the rightful recipients. Proper identification helps prevent fraud and enhances the efficiency of benefit programs.

Medical Records

Medical Records are comprehensive documents that detail an individual's health history and treatments. They ensure accurate communication between healthcare providers and support effective patient care. Proper management of these records is essential for diagnosis and ongoing medical treatment.

Police Report (if applicable)

A Police Report is an official document prepared by law enforcement detailing an incident or crime. It provides essential information for legal and insurance purposes. Submit this report if applicable to support your case.

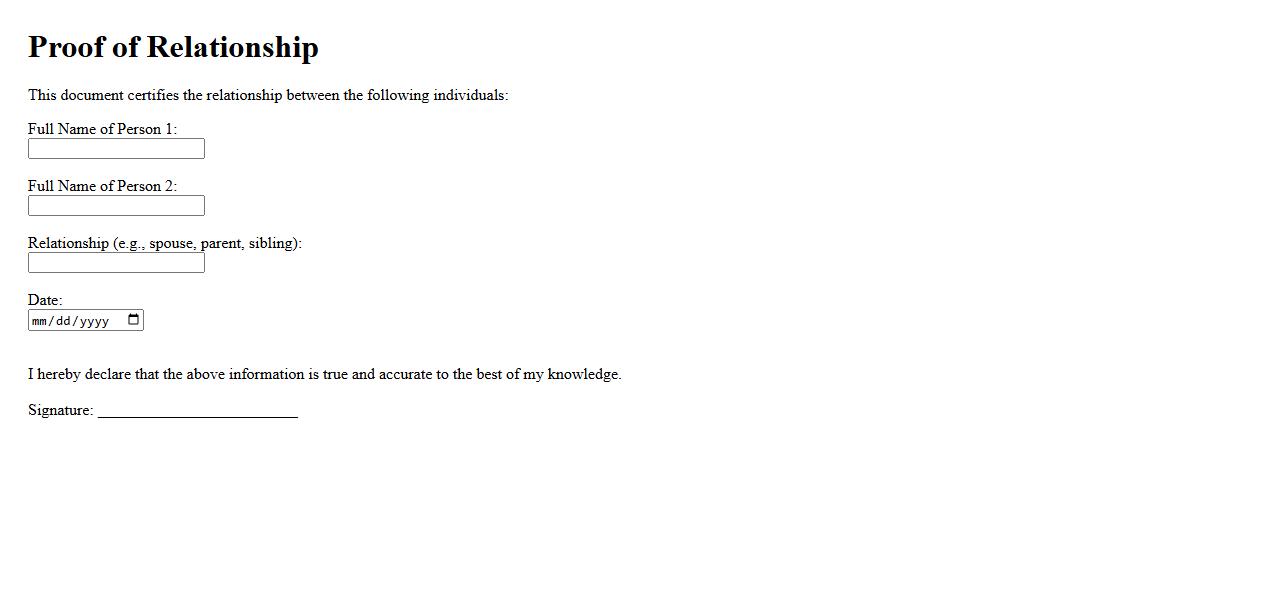

Proof of Relationship

Proof of Relationship is essential documentation that verifies the connection between individuals for legal or administrative purposes. It often includes marriage certificates, birth certificates, or affidavits. Providing accurate proof ensures smooth processing in matters like visas, inheritance, and benefits.

Policy Document

A policy document serves as a formal guideline outlining organizational rules and procedures. It ensures consistency and compliance across all departments by clearly defining responsibilities and expectations. Properly maintained policy documents help mitigate risks and support informed decision-making.

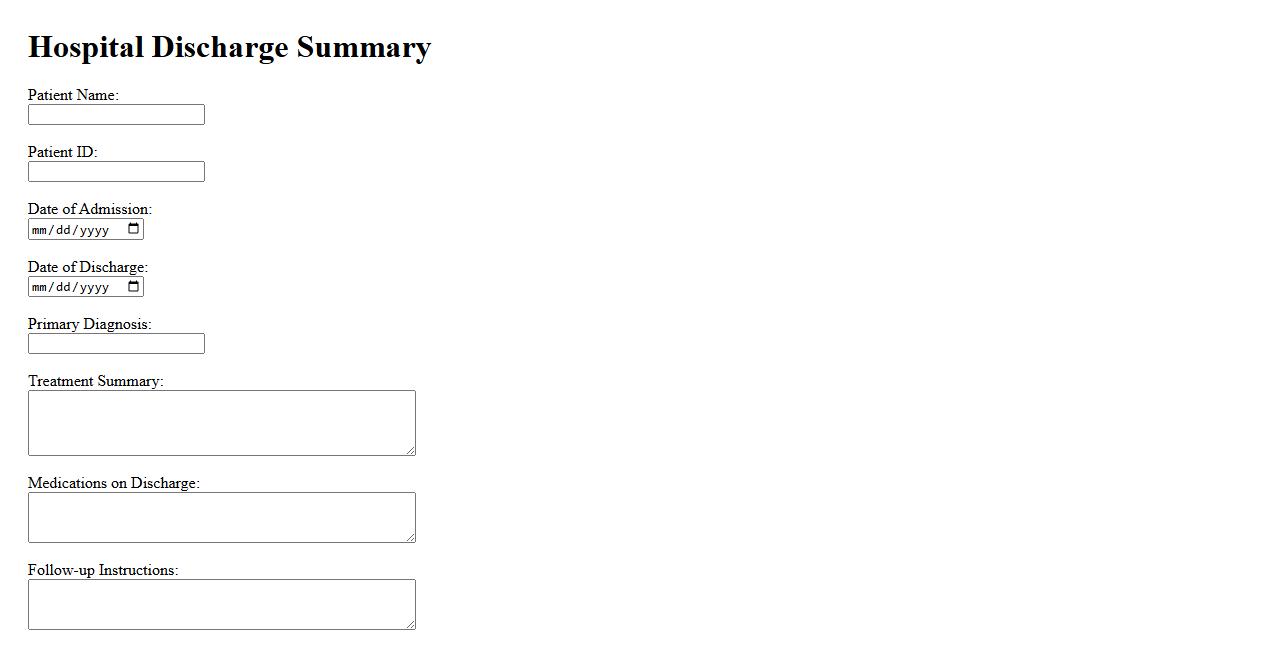

Hospital Discharge Summary

The Hospital Discharge Summary is a vital document that outlines a patient's diagnosis, treatment, and care instructions upon leaving the hospital. It provides essential information for follow-up care and ensures continuity between healthcare providers. This summary helps patients and medical teams manage recovery effectively.

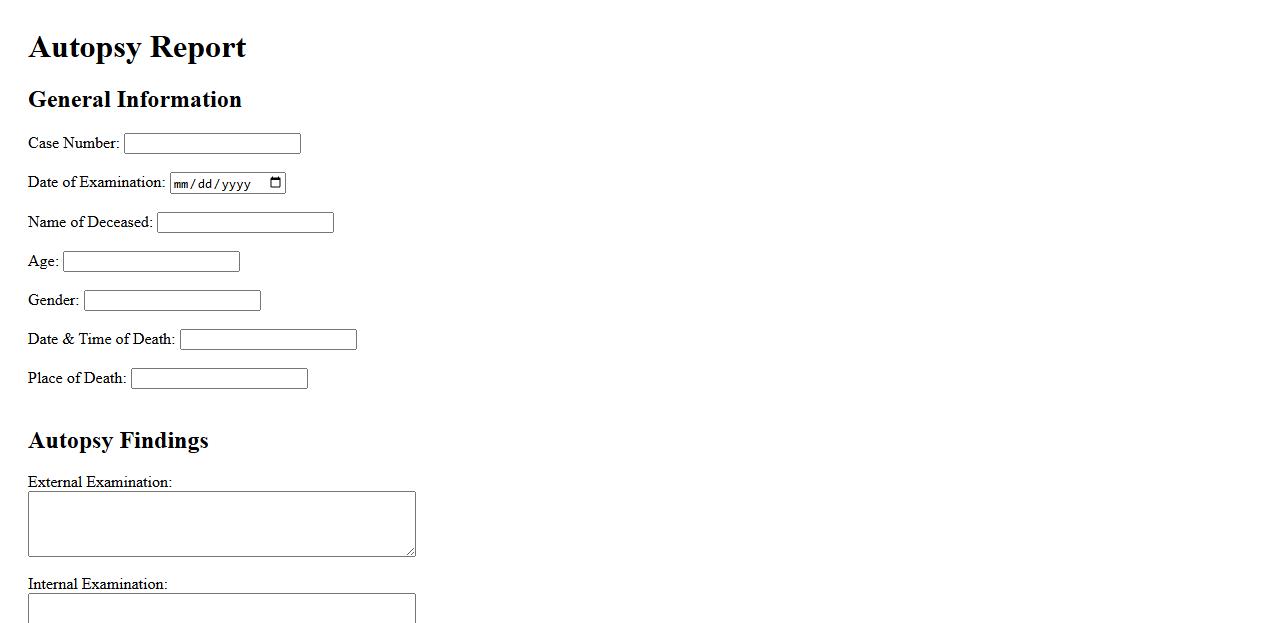

Autopsy Report (if required)

An Autopsy Report provides a detailed medical examination of a deceased individual to determine the cause and manner of death. It is prepared by a qualified medical examiner or forensic pathologist when an investigation is necessary. This report is crucial for legal, medical, and insurance purposes.

What essential documents are required to file a claim for life insurance?

Filing a life insurance claim requires submitting a death certificate, which serves as official proof of the policyholder's passing. Additionally, the claimant must provide a completed claim form issued by the insurance company. Other important documents may include the original life insurance policy and proof of identity for the claimant.

Who is eligible to submit a claim for a life insurance policy?

The beneficiary named in the policy is eligible to submit a claim for life insurance benefits. In cases where no beneficiary is designated, the legal representative or next of kin may file the claim. Eligibility is strictly verified through documents proving the claimant's relationship to the deceased.

What are the primary reasons a life insurance claim might be denied?

Claims can be denied if there is non-disclosure of critical information or misrepresentation on the application. Another common reason is if the policyholder died during the contestability period without meeting policy terms. Additionally, if the cause of death is excluded under the policy terms, the claim may be rejected.

How does the policyholder's cause of death impact the claim process?

The cause of death must be verified to ensure it complies with the insurance policy's terms. If the death results from excluded conditions such as suicide within the contestability period, the claim may be denied. Accurate and detailed medical reports or autopsy details can speed up claim approval if the cause of death aligns with policy coverage.

What is the typical timeline for processing and settling a life insurance claim?

Most life insurance claims are processed within 30 to 60 days after submission of all required documents. Delays can occur if additional investigation or documentation is needed. Once approved, the insurer typically disburses the claim amount promptly to the beneficiary.