A claim for theft loss insurance involves submitting documentation to an insurance company to recover financial losses resulting from stolen property. Policyholders must provide proof of ownership, a police report, and an inventory of the stolen items to support their claim. Timely filing and accurate documentation are crucial for a successful resolution.

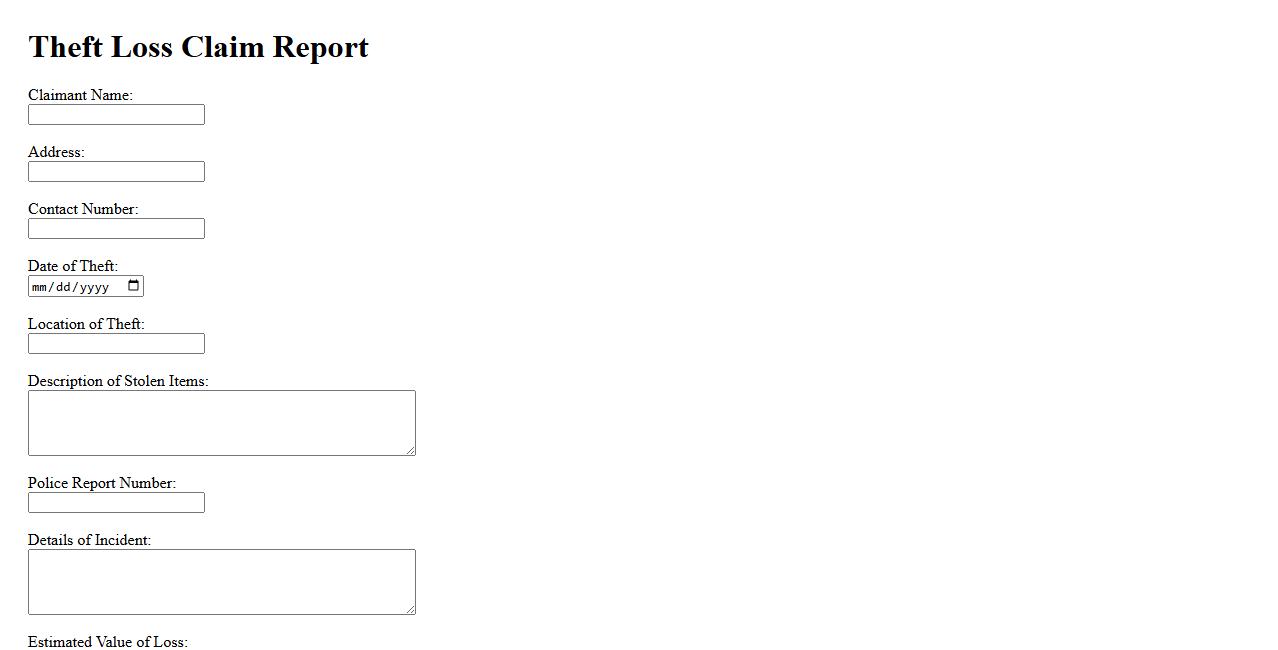

Theft Loss Claim Report

A Theft Loss Claim Report provides a detailed account of stolen property for insurance purposes. It documents the items lost, their value, and the circumstances of the theft. This report is essential to support claims and facilitate compensation.

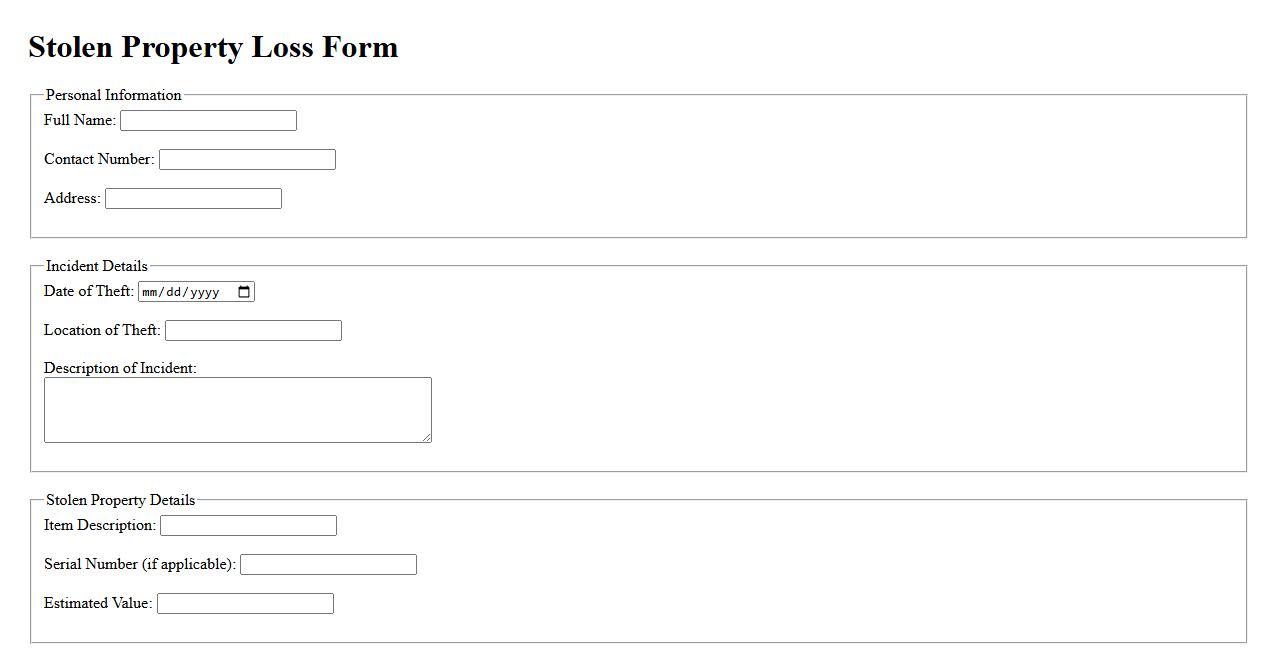

Stolen Property Loss Form

The Stolen Property Loss Form is a crucial document used to report and claim compensation for stolen items. It helps individuals provide detailed information about the lost property to insurance companies or authorities. Properly completing this form ensures a smoother recovery process and accurate loss assessment.

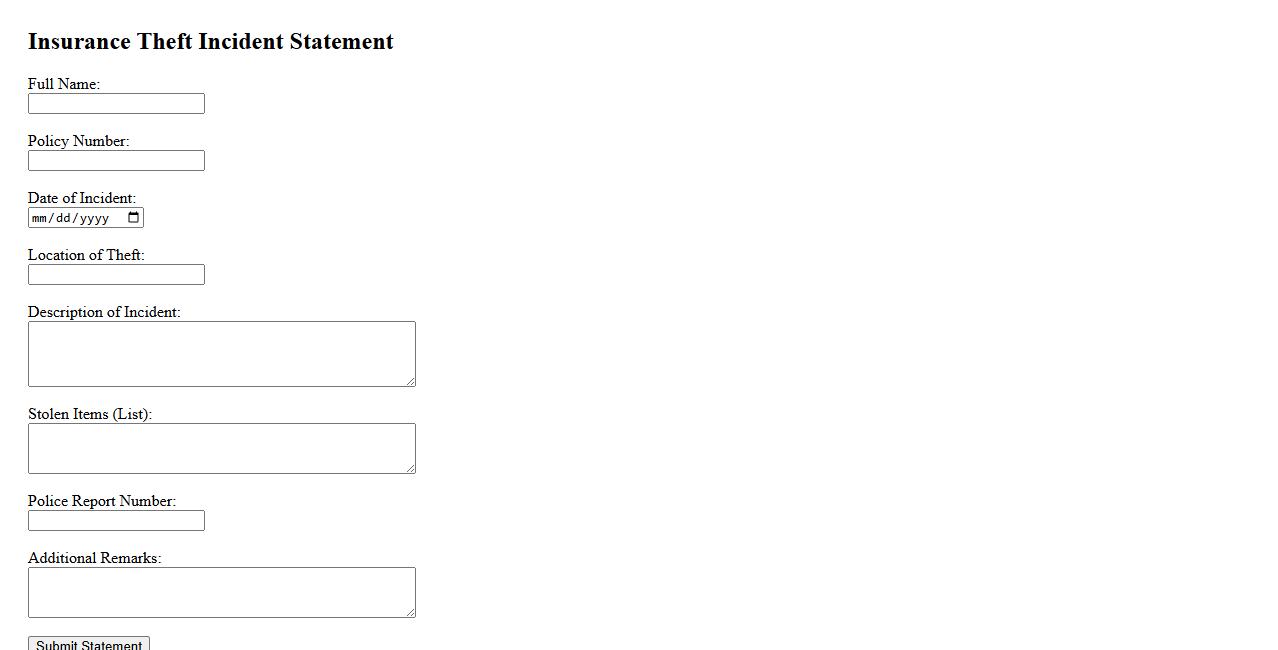

Insurance Theft Incident Statement

An Insurance Theft Incident Statement is a detailed account provided by the policyholder describing the circumstances surrounding a theft. This statement is crucial for the insurance company to assess the claim accurately and expedite the settlement process. Providing clear and precise information helps ensure a smooth investigation and timely compensation.

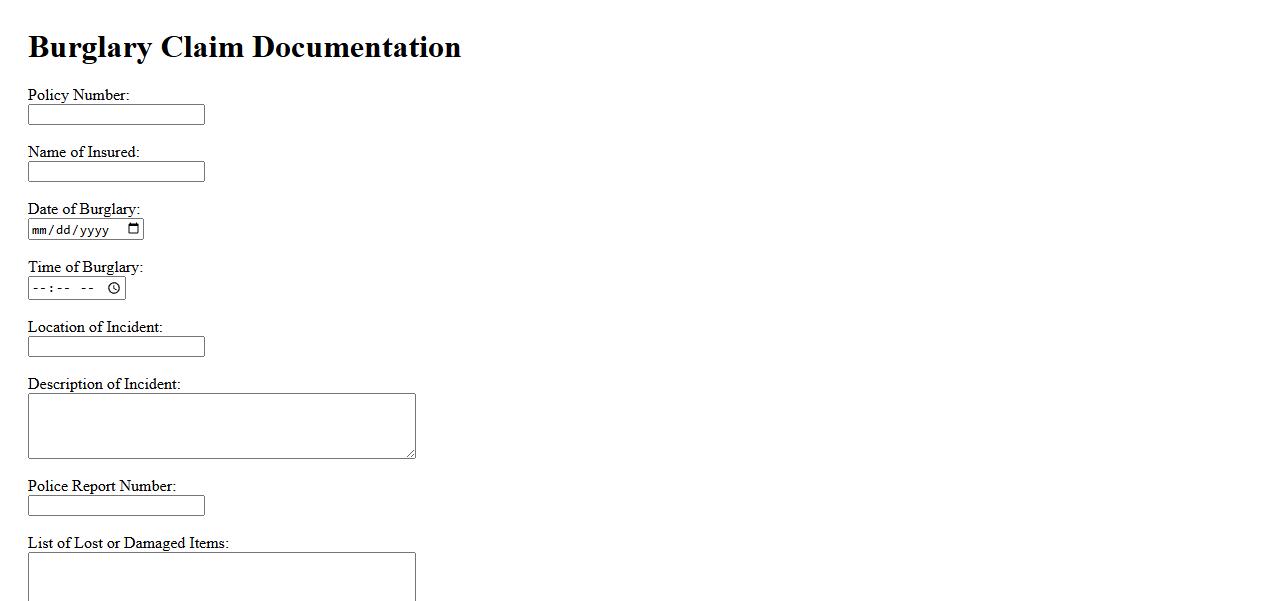

Burglary Claim Documentation

Proper Burglary Claim Documentation is essential for a smooth insurance claim process. It includes detailed records of stolen items, police reports, and photographic evidence. Accurate documentation helps expedite claim approval and ensures fair compensation.

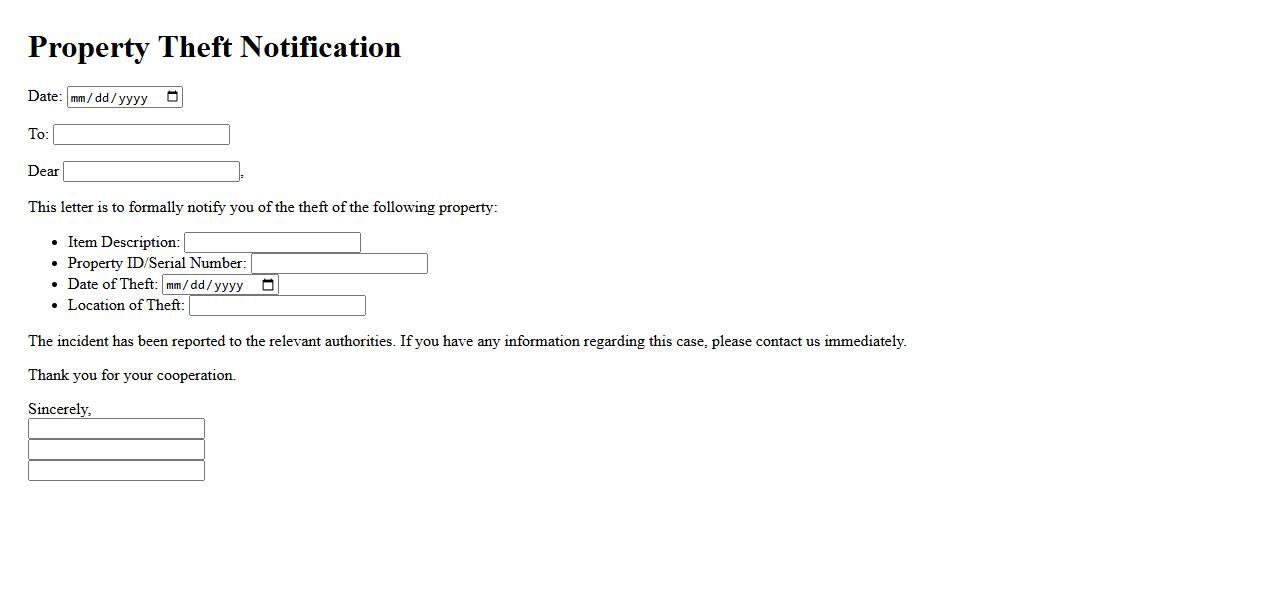

Property Theft Notification

Property Theft Notification is an essential alert system that informs property owners or authorities immediately when a theft occurs. This notification helps in prompt action and recovery of stolen items. Implementing such a system enhances security and peace of mind.

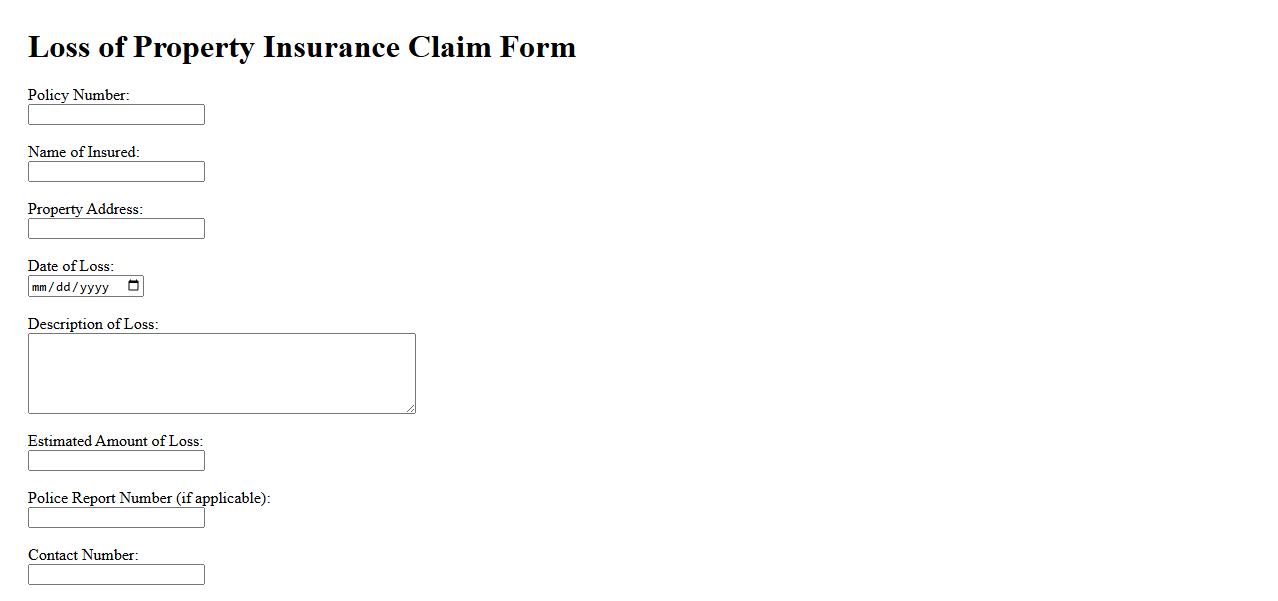

Loss of Property Insurance Claim

Loss of Property Insurance Claim is a formal request filed by a policyholder to receive compensation for damages or loss of insured property. This claim involves submitting proof of the loss and documentation to the insurance company for evaluation. Prompt filing and accurate reporting are crucial to ensure timely reimbursement and recovery.

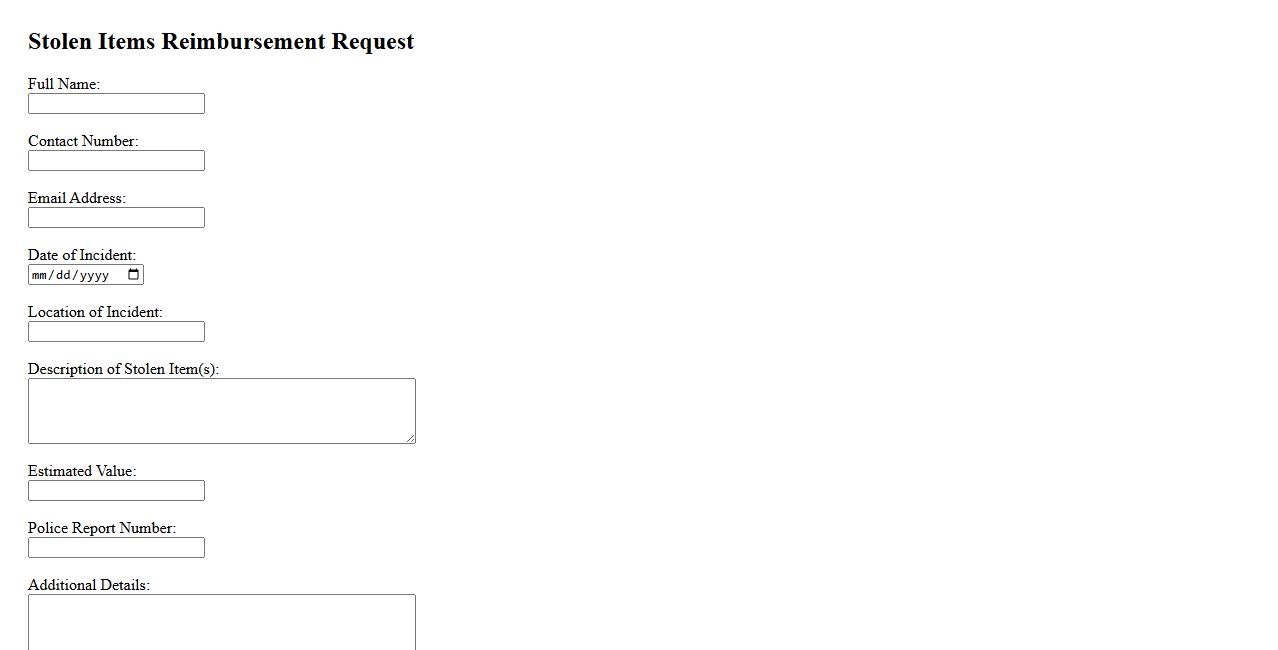

Stolen Items Reimbursement Request

If you have experienced a loss due to theft, you can submit a Stolen Items Reimbursement Request to recover the value of your stolen belongings. This process involves providing proof of ownership and any relevant documentation to support your claim. Timely reporting and accurate information will help ensure a smooth reimbursement experience.

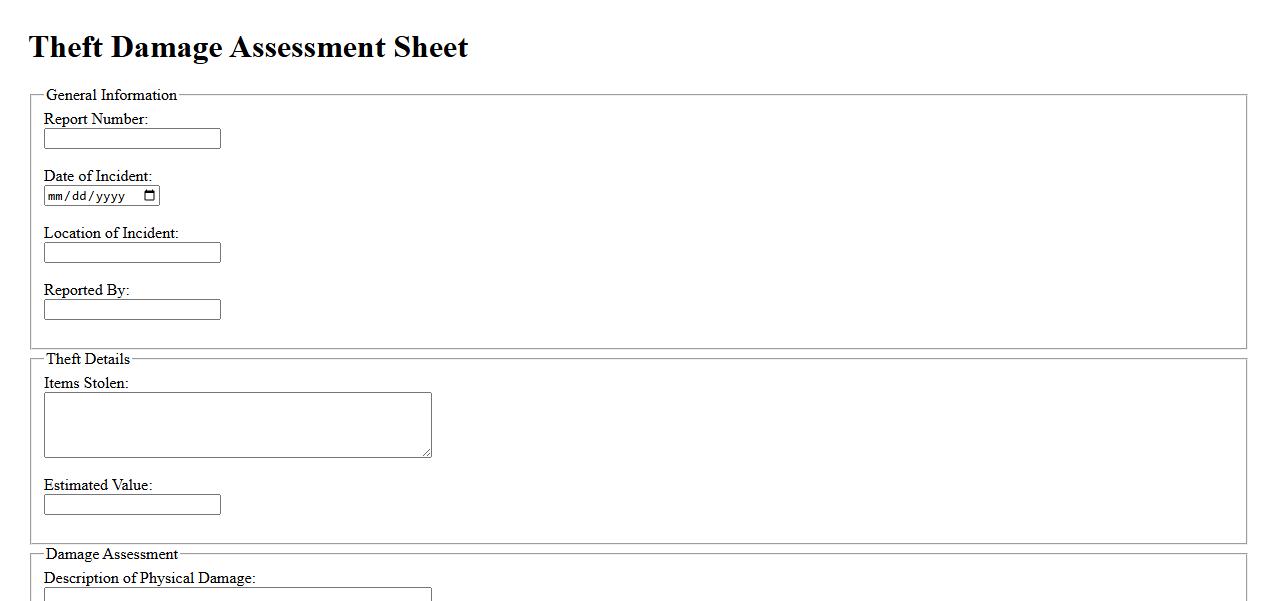

Theft Damage Assessment Sheet

The Theft Damage Assessment Sheet is a crucial document used to evaluate and record the extent of damage caused by theft incidents. It ensures accurate and thorough documentation for insurance claims and legal purposes. This sheet helps streamline the investigation and recovery process by providing clear details of stolen items and related damages.

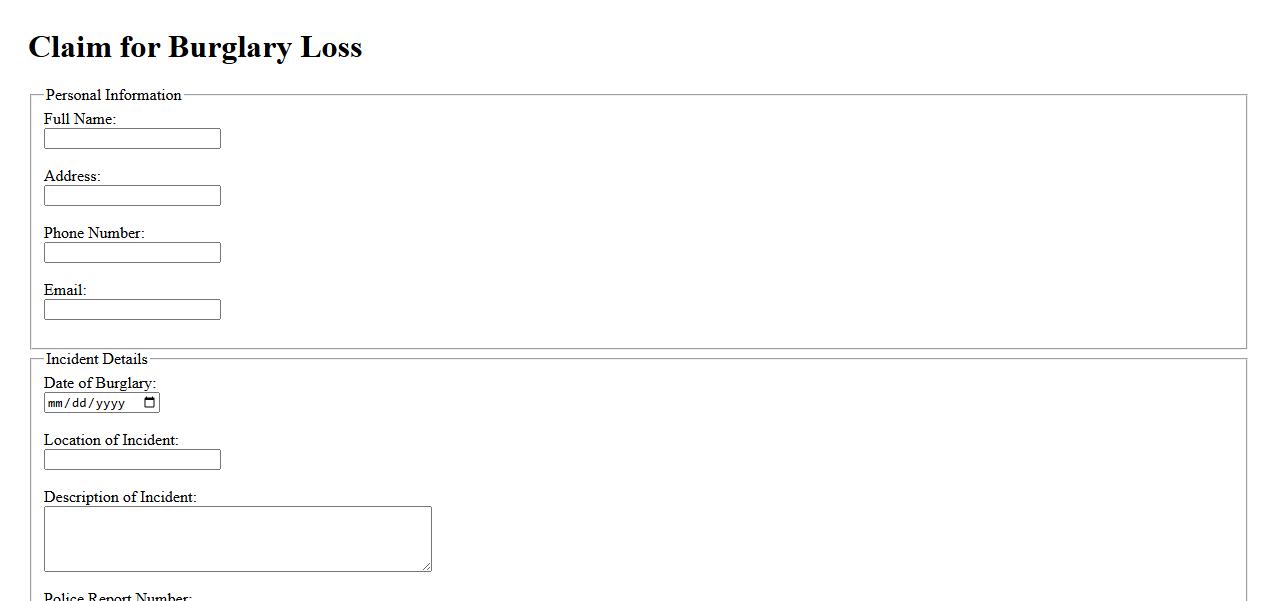

Claim for Burglary Loss

A Claim for Burglary Loss involves reporting stolen or damaged property due to a break-in. It requires providing evidence such as police reports and inventory of lost items. Timely filing ensures quicker compensation and support during recovery.

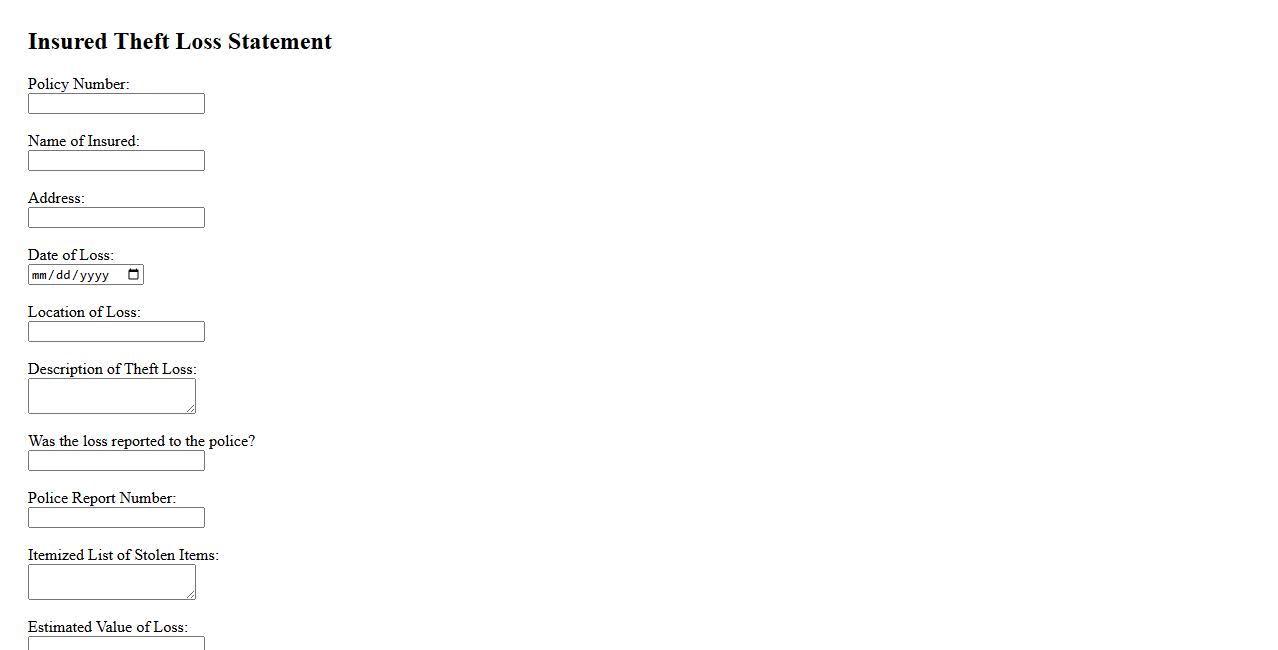

Insured Theft Loss Statement

An Insured Theft Loss Statement is a formal document used to report stolen property to an insurance company. It provides essential details about the incident, including the items stolen and their estimated value. This statement helps expedite the claims process and supports the insured's request for compensation.

What specific items or property are being claimed as stolen in the theft loss insurance document?

The theft loss insurance document details various items claimed as stolen, including electronics, jewelry, and personal valuables. Each item is described with specific attributes such as brand, model, and serial number for clear identification. Additionally, the document categorizes the stolen property to ensure comprehensive coverage claims.

On what date and at what location did the alleged theft occur according to the claim?

The claim states that the alleged theft occurred on March 15, 2024. The location specified is the insured property at 1234 Elm Street, Springfield. This information is crucial for validation and helps the insurance company assess the claim effectively.

What evidence or documentation is provided to support the occurrence of the theft?

The claim includes photographic evidence of the damaged entry point and missing items. A detailed inventory list with purchase receipts and appraisals supports the ownership and value of the stolen property. Furthermore, witness statements and correspondence with law enforcement enhance the credibility of the claim.

What is the estimated value or replacement cost of the stolen property claimed?

The total estimated value of the stolen items listed in the claim amounts to $25,000. This valuation is based on recent purchase prices and professional appraisals attached to the document. The replacement cost figures help the insurer determine the appropriate compensation.

Has a police report been filed and included as part of the claim documentation for the theft loss?

Yes, a police report has been filed with the Springfield Police Department and is included in the claim documents. The report number and officer contact information are provided for verification purposes. Including the police report is essential for validating the authenticity of the theft claim.