Submitting a Claim for Dependent Care Benefit allows employees to request reimbursement for eligible expenses incurred while caring for dependents. This claim typically requires proper documentation, such as receipts or proof of payment, to ensure compliance with company policies and IRS regulations. Accurate filing of your claim helps maximize your benefit and supports tax advantages related to dependent care.

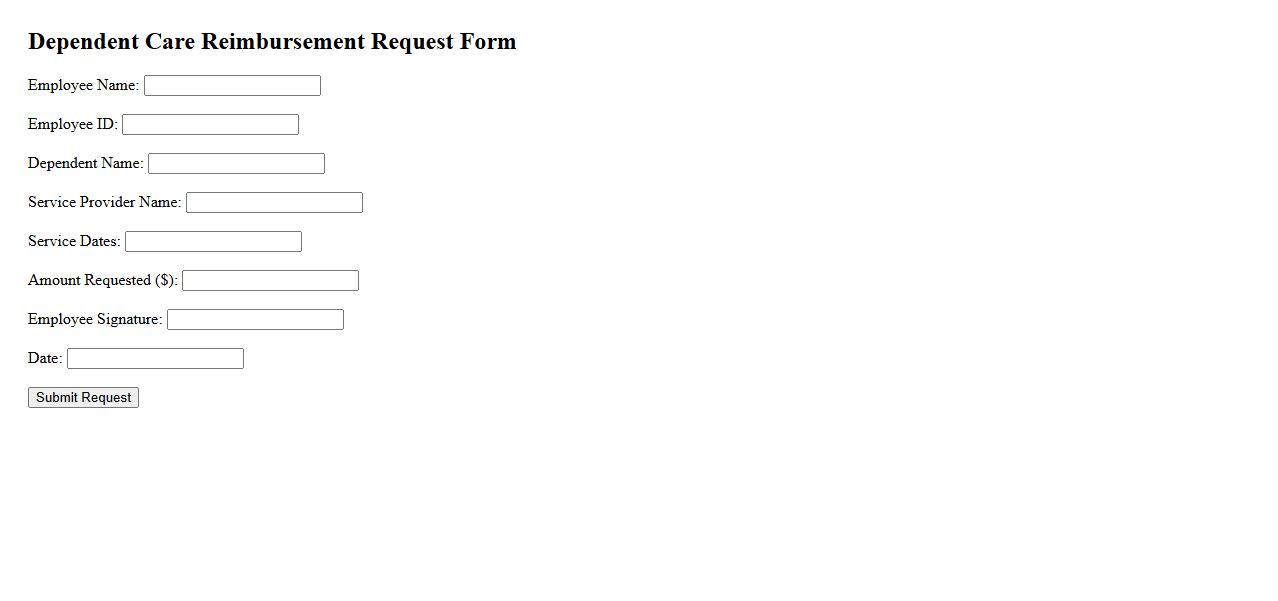

Dependent Care Reimbursement Request

The Dependent Care Reimbursement Request allows employees to claim expenses incurred for the care of dependents while they work. This process helps in reimbursing eligible costs, making it easier to manage work-life balance. Timely submission of the request ensures smooth processing and prompt reimbursement.

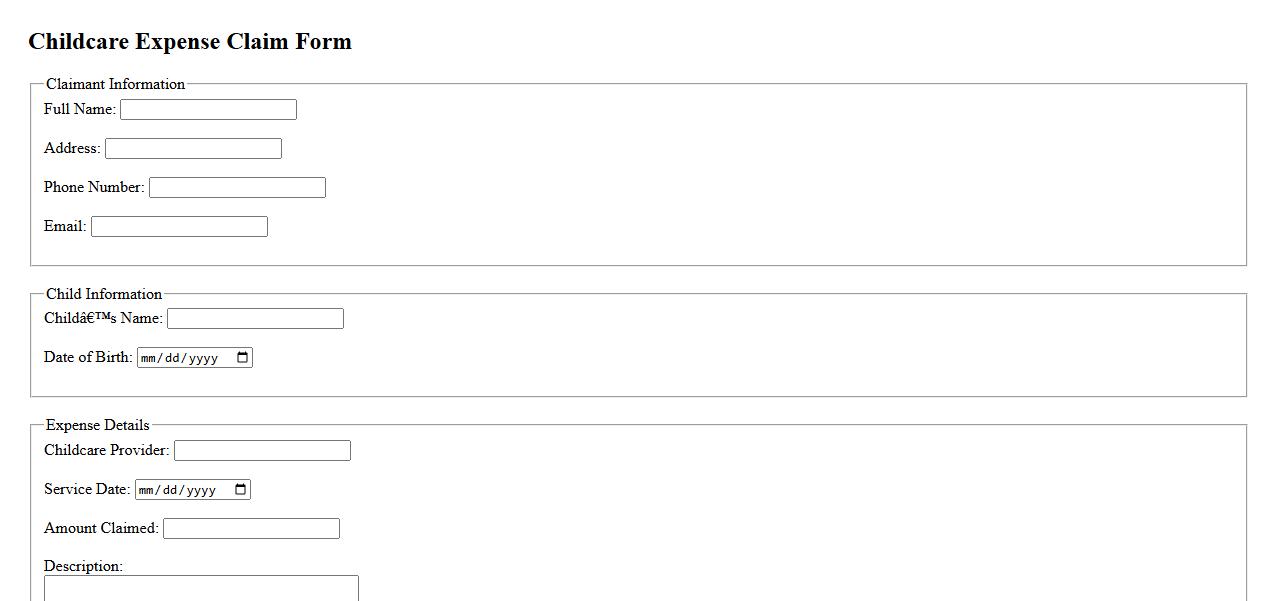

Childcare Expense Claim Form

The Childcare Expense Claim Form is a crucial document used by parents to request reimbursement for eligible childcare costs. It ensures accurate reporting and helps in calculating tax benefits related to childcare. Completing this form correctly is essential for maximizing your financial support.

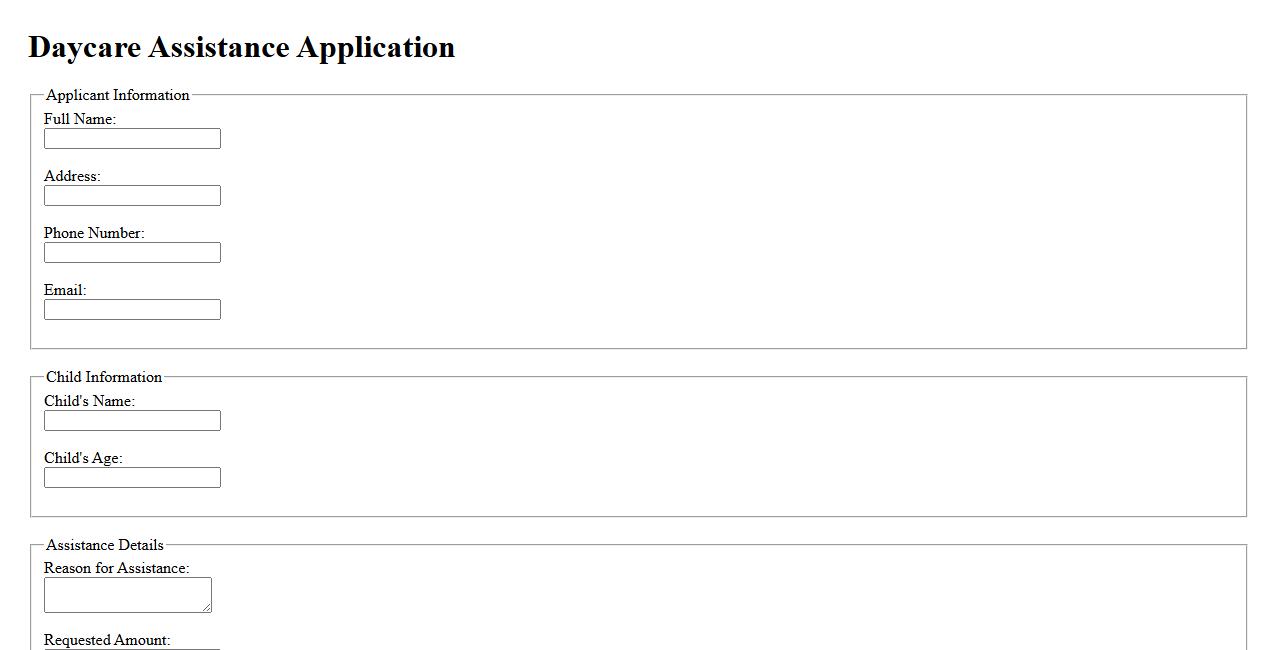

Daycare Assistance Application

The Daycare Assistance Application allows families to apply for financial support to help cover childcare costs. This program is designed to make quality daycare more accessible and affordable for eligible parents. Completing the application accurately ensures timely processing and potential benefits.

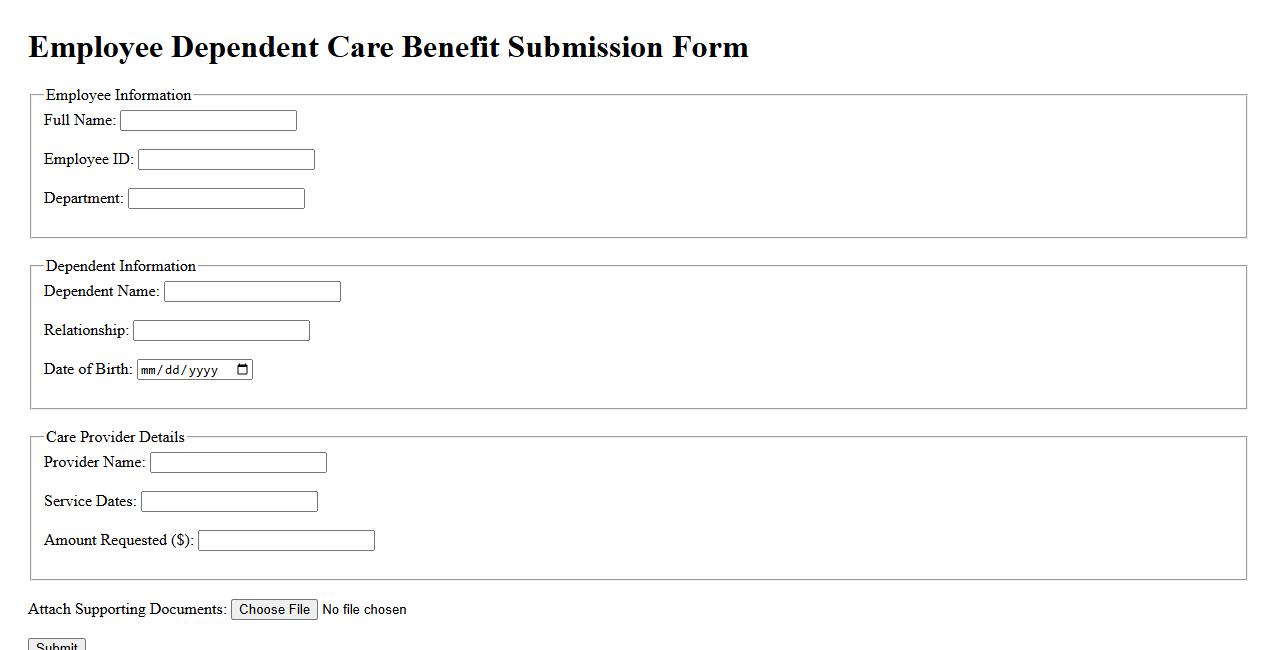

Employee Dependent Care Benefit Submission

The Employee Dependent Care Benefit Submission process allows employees to claim reimbursements for eligible dependent care expenses. This benefit supports working parents by reducing the financial burden of childcare or eldercare. Proper submission ensures timely processing and maximizes employee satisfaction.

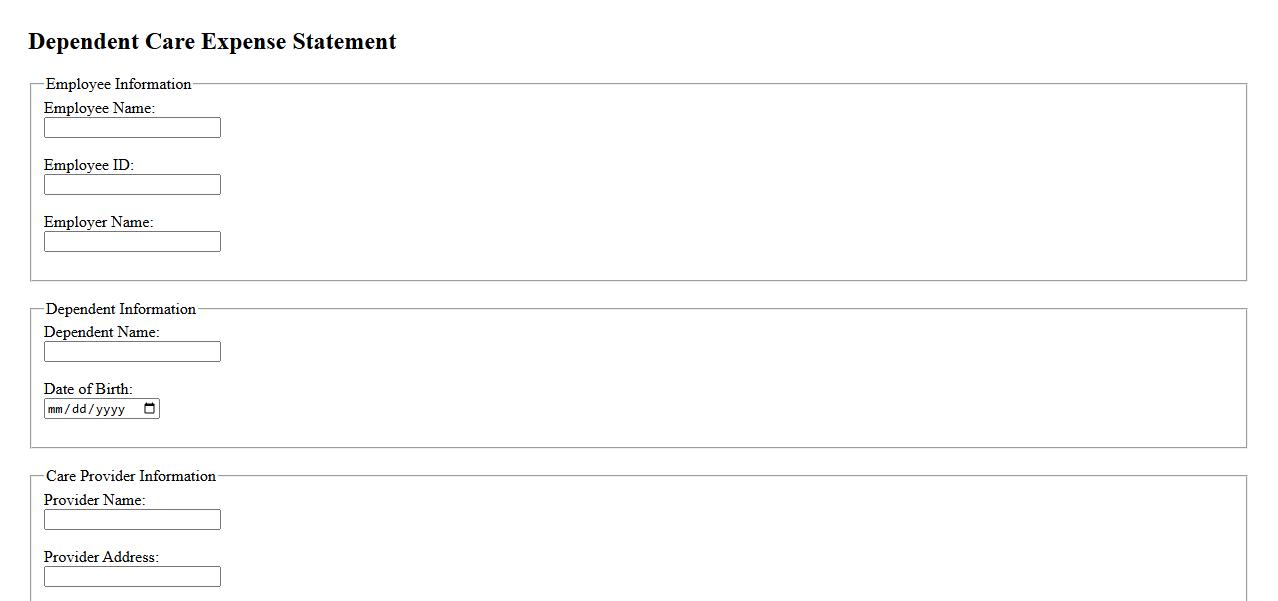

Dependent Care Expense Statement

The Dependent Care Expense Statement is a document used to itemize and verify expenses related to the care of dependents, such as children or elderly family members. It helps employees claim reimbursement or tax benefits for eligible dependent care costs. Accurate completion of this statement ensures compliance with employer policies and tax regulations.

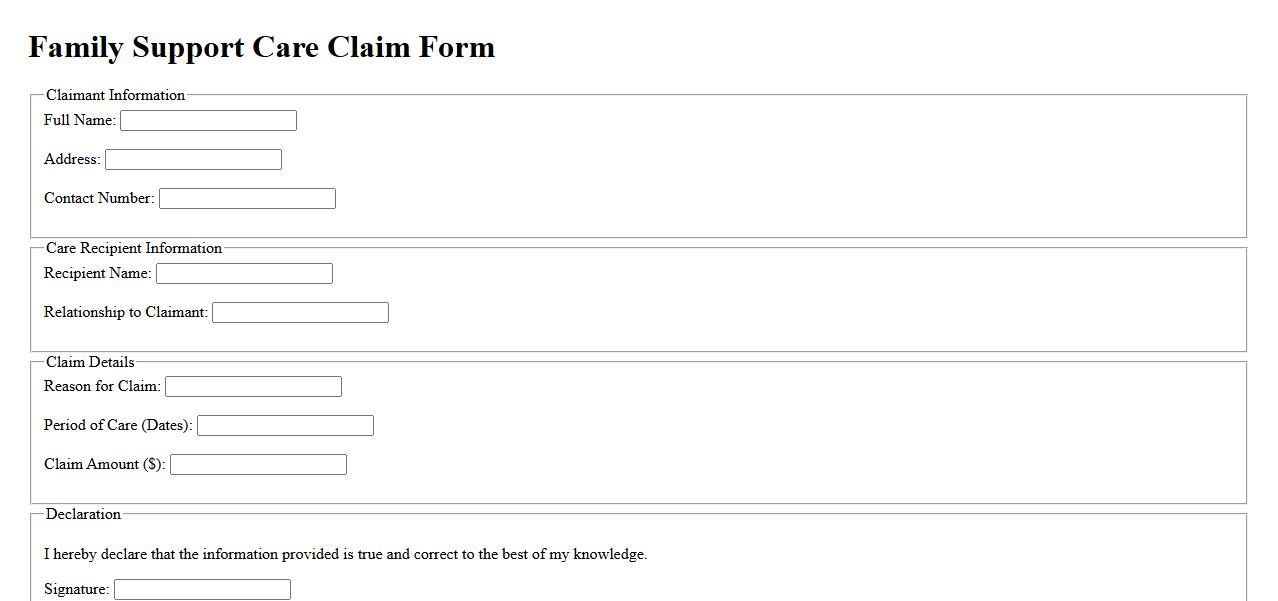

Family Support Care Claim

Family Support Care Claim provides financial assistance to families caring for a dependent member due to illness or disability. This claim helps ease the burden by covering expenses related to in-home care and support services. It ensures that families receive the necessary resources to maintain quality care and comfort for their loved ones.

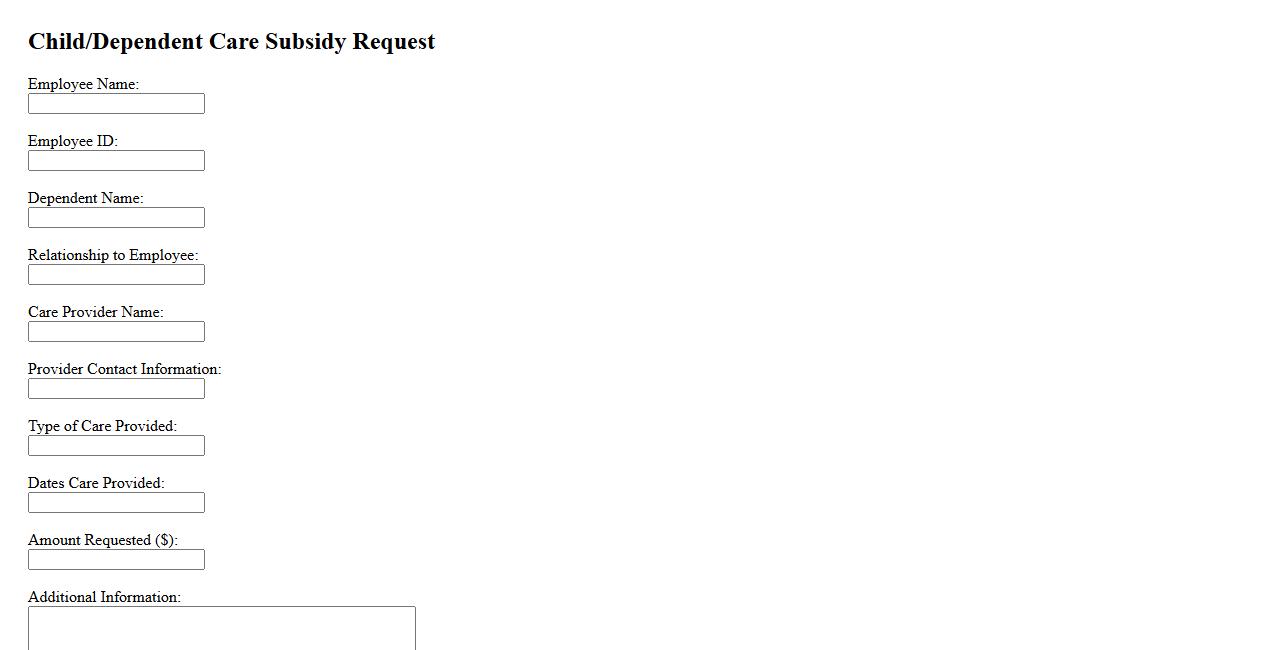

Child/Dependent Care Subsidy Request

The Child/Dependent Care Subsidy Request form allows employees to apply for financial assistance to help cover the costs of caring for dependents while they work. This subsidy supports families by easing the burden of childcare or dependent care expenses. Timely submission of the request ensures proper evaluation and potential approval of benefits.

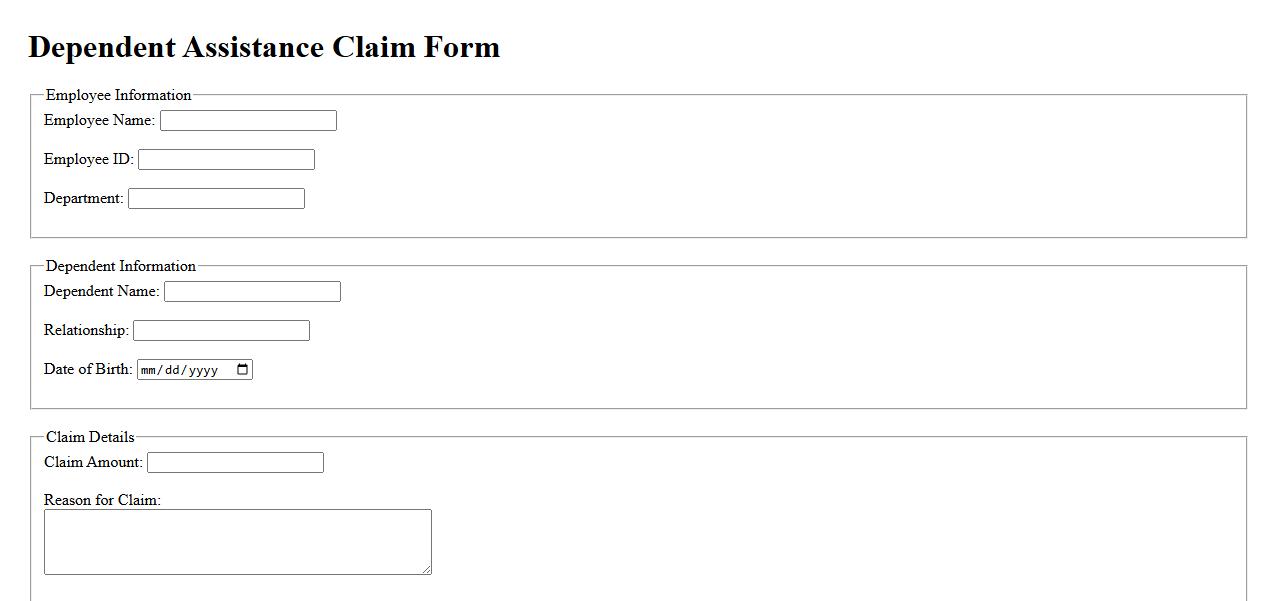

Dependent Assistance Claim Form

The Dependent Assistance Claim Form is used to request reimbursement for expenses related to the care of dependents. This form ensures that eligible individuals receive financial support for dependent care costs. Properly completing and submitting the form is essential for timely claims processing.

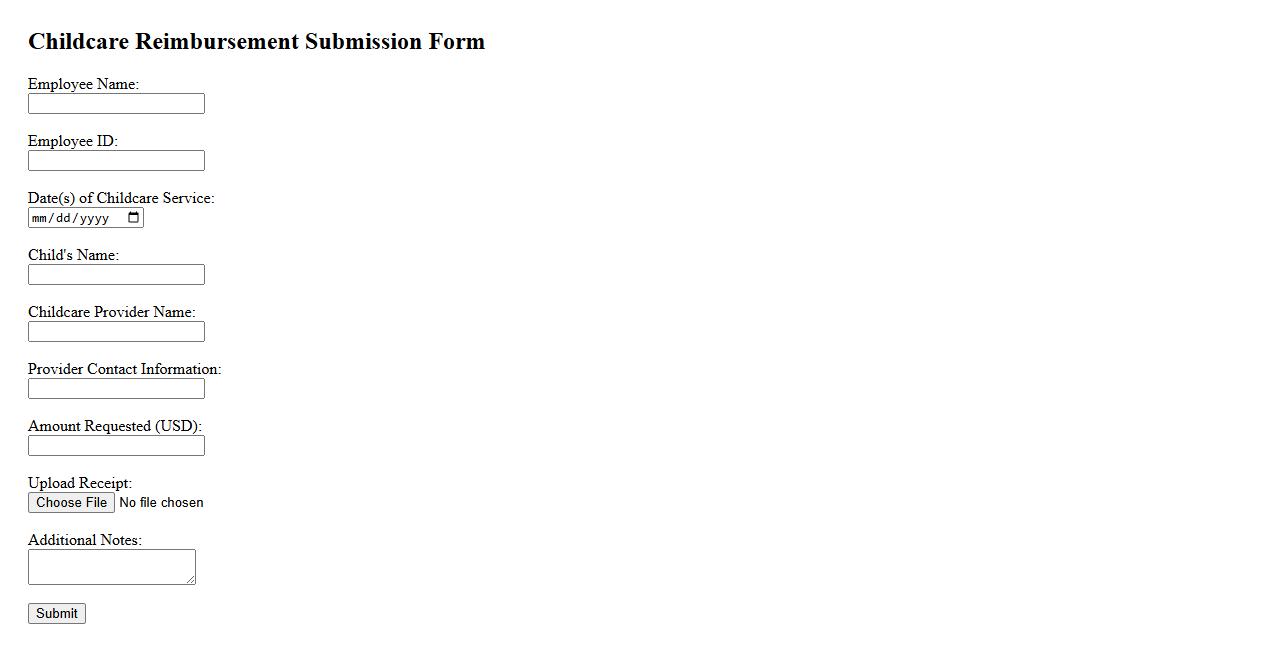

Childcare Reimbursement Submission

Childcare Reimbursement Submission is the process of providing necessary documentation to receive financial compensation for childcare expenses. Employees typically submit receipts or proof of payment to their employer or benefits provider. This ensures timely reimbursement and helps manage childcare costs efficiently.

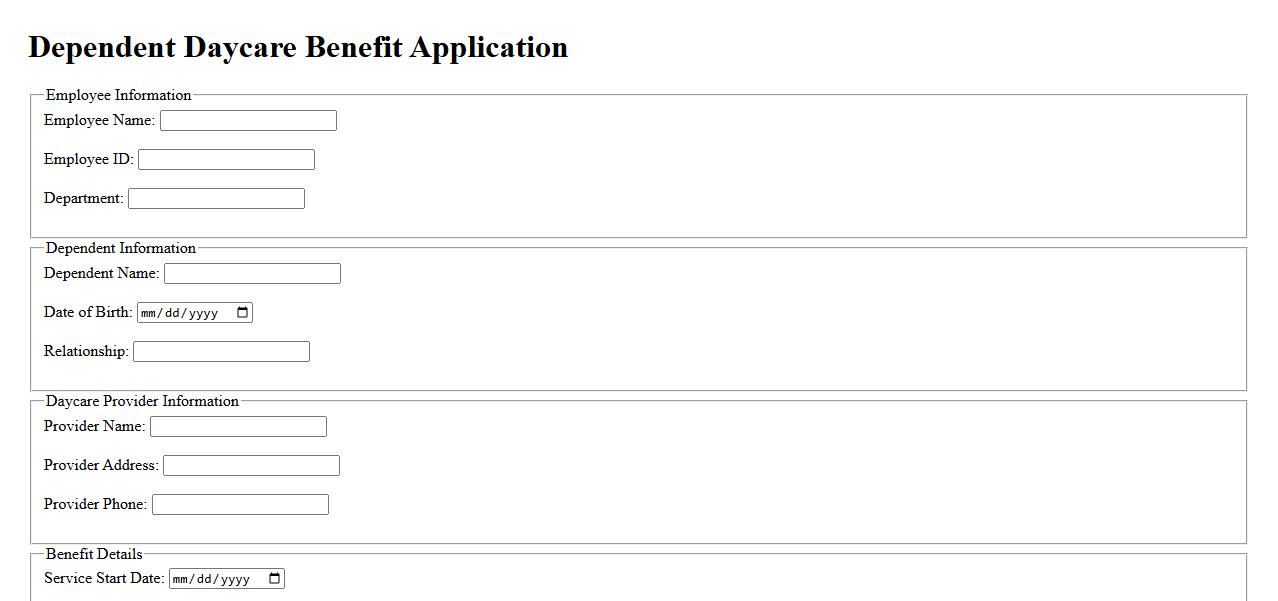

Dependent Daycare Benefit Application

The Dependent Daycare Benefit Application allows parents to request financial assistance for childcare expenses. This benefit supports working families by helping cover the costs associated with caring for dependents. Applying for this benefit ensures access to necessary resources for affordable and quality daycare services.

What is the definition of a dependent under the Claim for Dependent Care Benefit policy?

A dependent under the Claim for Dependent Care Benefit policy typically refers to a child or adult who relies primarily on the policyholder for care. This person must meet specific age or disability criteria as defined by the policy. The dependent must require care to enable the policyholder to work or perform daily activities.

Which types of expenses are considered eligible for reimbursement in a Dependent Care Benefit claim?

Eligible expenses generally include costs directly related to the care of the dependent, such as daycare, babysitting, or adult care services. Expenses must be necessary to allow the policyholder to maintain employment or attend work. Only care services provided during working hours or equivalent times qualify for reimbursement.

What documentation is required to validate a dependent care expense claim?

To validate a claim, submission of official receipts detailing the care dates, provider information, and amounts paid is mandatory. Proof of the provider's identity and tax identification may also be necessary. Additionally, claim forms completed by the policyholder customarily support the verification process.

What is the maximum claimable amount per calendar year for Dependent Care Benefits?

The maximum claimable amount per calendar year varies by policy but is usually capped at a set monetary limit. This limit is intended to cover reasonable expenses incurred for dependent care. Policyholders should review their benefit details to confirm the exact amount eligible for reimbursement.

Who qualifies as an authorized care provider for the purposes of a dependent care claim?

An authorized care provider is typically an individual or organization licensed or recognized to provide dependent care services. Providers may include licensed daycare centers, nannies, or qualified adult care facilities. Family members might be eligible providers only if they meet specific policy criteria, such as not being a dependent themselves.