A claim for critical illness insurance involves submitting medical evidence that confirms a diagnosis of a covered serious illness. The insurer reviews the documentation to assess the validity of the claim based on the policy terms. Once approved, the policyholder receives a lump sum benefit to help cover medical expenses and financial obligations during recovery.

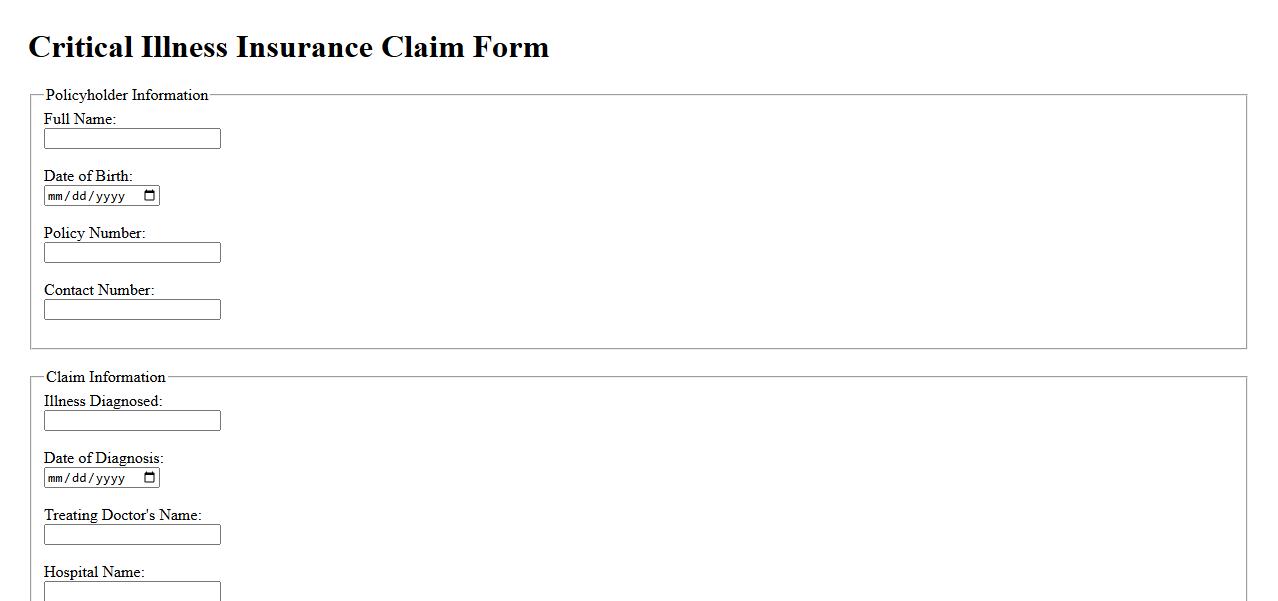

Critical Illness Insurance Claim Form

The Critical Illness Insurance Claim Form is a crucial document used to initiate the claims process after diagnosis of a covered illness. It requires detailed information about the insured's medical condition and treatment to verify eligibility. Submitting this form promptly ensures timely evaluation and settlement of the insurance benefit.

Statement of Diagnosis

A Statement of Diagnosis is a clear and concise summary of a patient's medical condition based on clinical evaluation and diagnostic tests. It helps healthcare providers communicate the nature of the illness and guides treatment decisions. Accurate documentation of this statement is essential for effective patient care and medical records.

Attending Physician's Statement

The Attending Physician's Statement is a critical document completed by a patient's medical doctor to provide detailed information about the patient's health condition. This statement helps insurance companies and healthcare providers assess the severity of an illness or injury. It ensures accurate evaluation for claims and treatment planning.

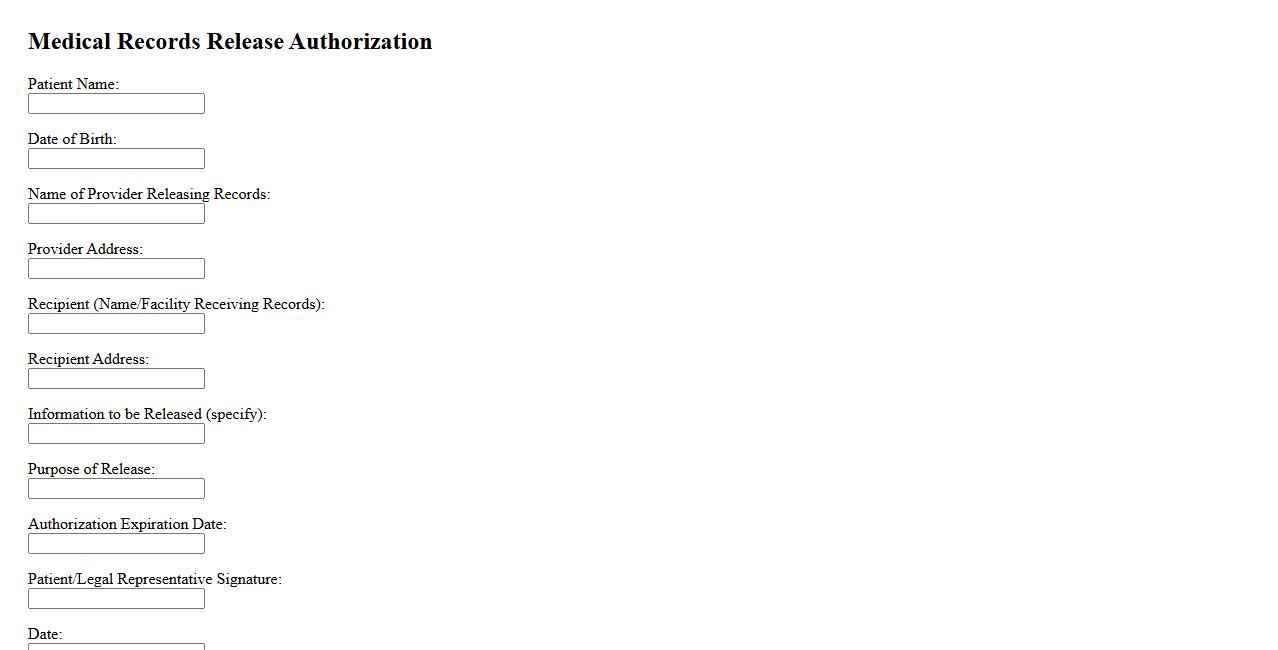

Medical Records Release Authorization

The Medical Records Release Authorization is a crucial document that allows healthcare providers to share a patient's medical information with authorized parties. This ensures continuity of care and facilitates communication between multiple medical professionals. Proper authorization safeguards patient privacy while enabling timely access to essential health data.

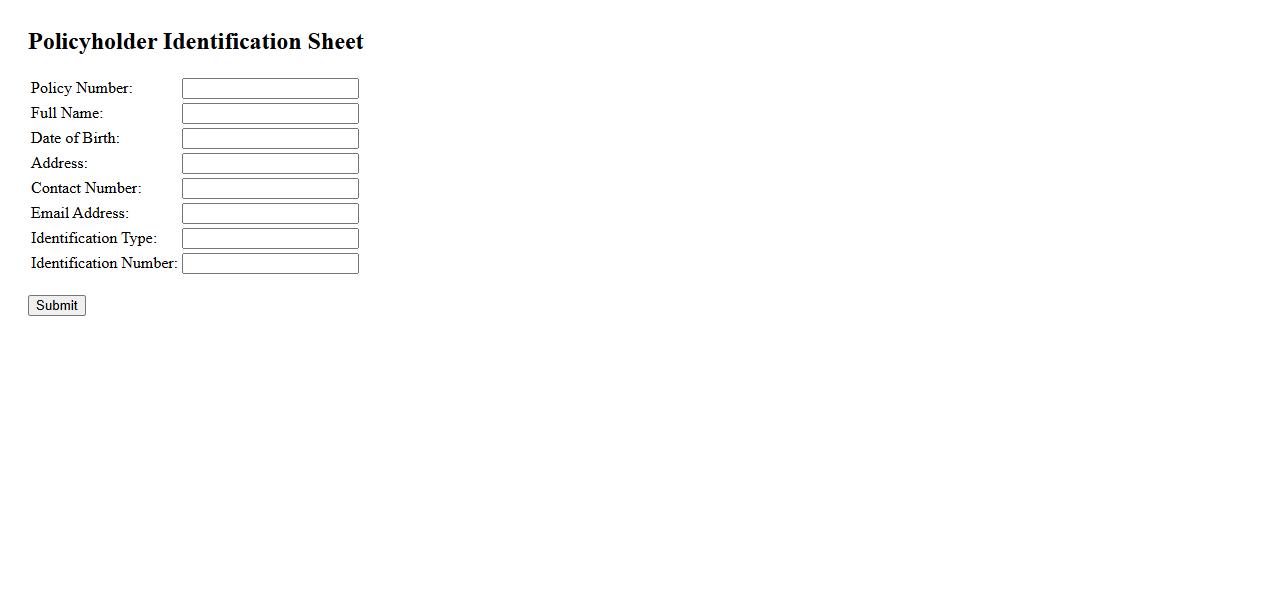

Policyholder Identification Sheet

The Policyholder Identification Sheet is a crucial document that verifies the identity of an insurance policyholder. It contains essential personal information to ensure accurate record-keeping and claims processing. This sheet helps maintain security and trust between the insurer and the insured.

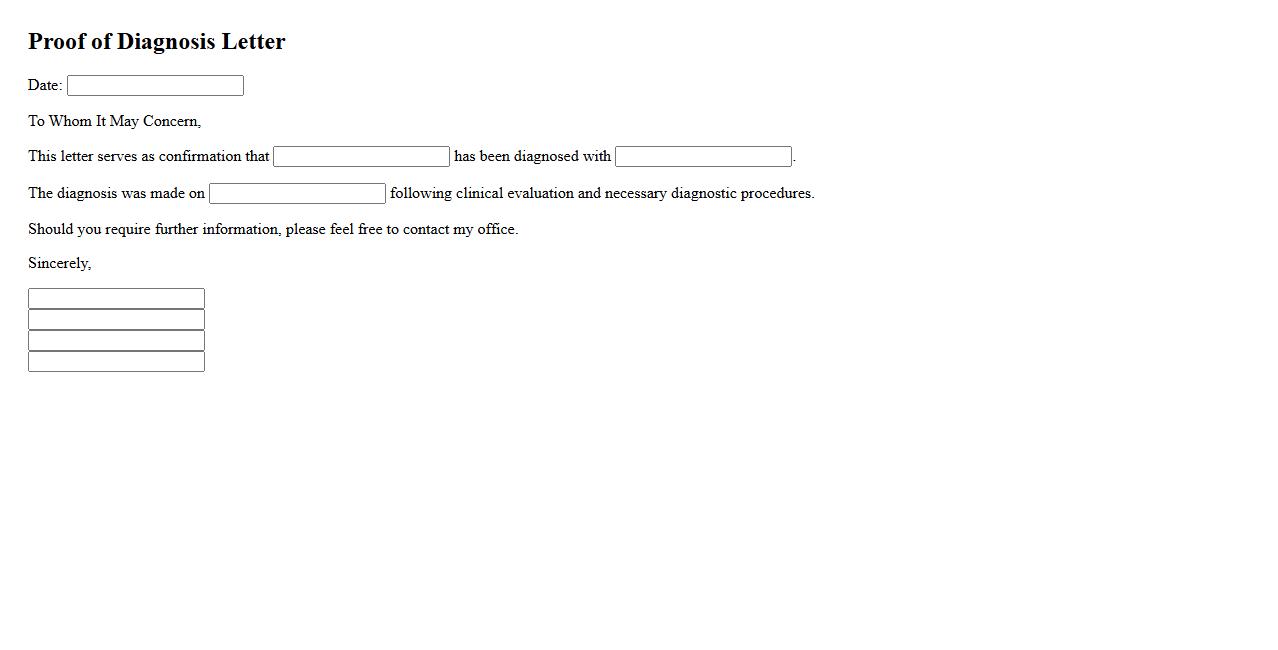

Proof of Diagnosis Letter

A Proof of Diagnosis Letter is an official document provided by a healthcare professional that confirms a patient's medical condition. It is often required for insurance claims, workplace accommodations, or legal purposes. This letter ensures that the diagnosis is verified and recognized by relevant authorities.

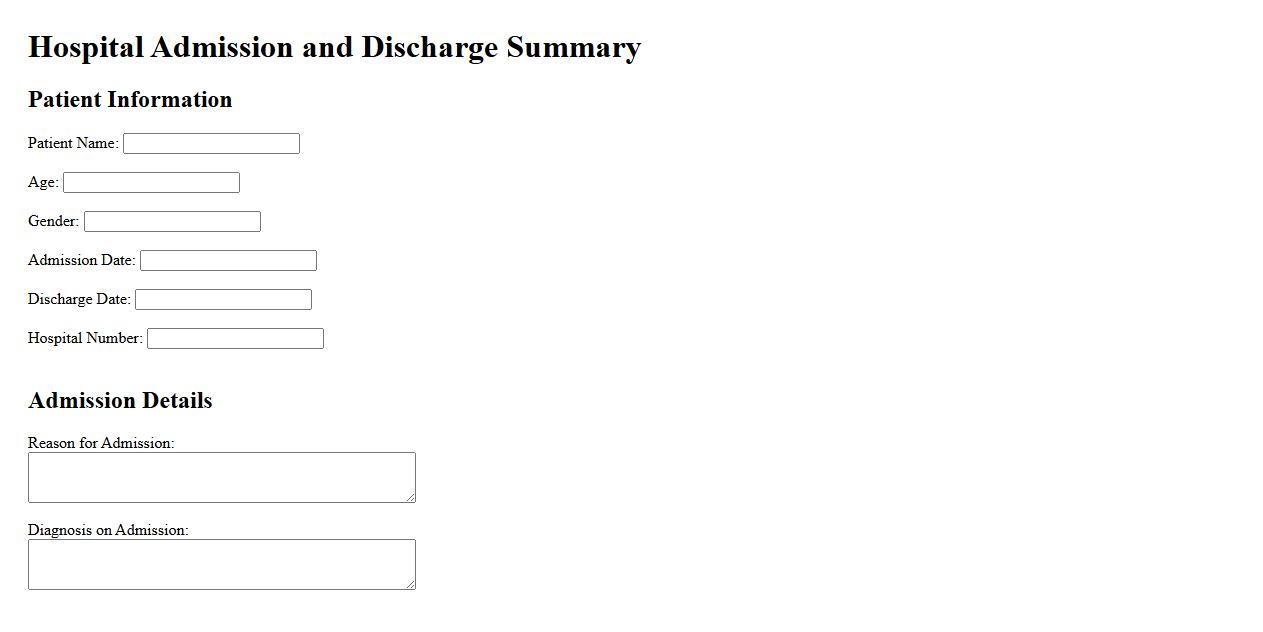

Hospital Admission and Discharge Summary

The Hospital Admission and Discharge Summary provides a concise record of a patient's stay, including reasons for admission, treatments received, and condition upon discharge. This document ensures clear communication among healthcare providers for continued care. It is essential for maintaining accurate medical history and supporting patient recovery.

Supporting Laboratory Test Results

Supporting Laboratory Test Results provide crucial evidence that validates medical diagnoses and treatment plans. These results, derived from various tests and analyses, offer accurate and objective data to guide healthcare decisions. Supporting Laboratory Test Results ensure reliability and precision in patient care management.

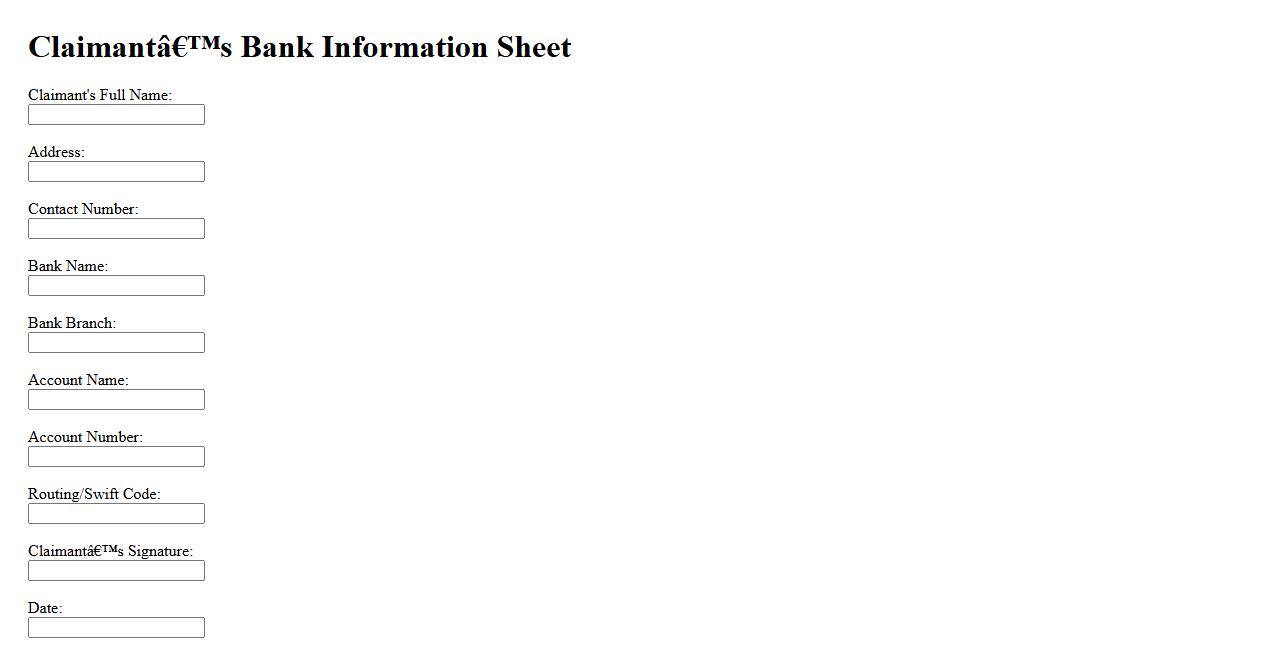

Claimant’s Bank Information Sheet

The Claimant's Bank Information Sheet is a vital document used to provide accurate banking details for claim processing. It ensures efficient transfer of funds directly to the claimant's account. Proper completion of this sheet helps avoid delays in payment disbursement.

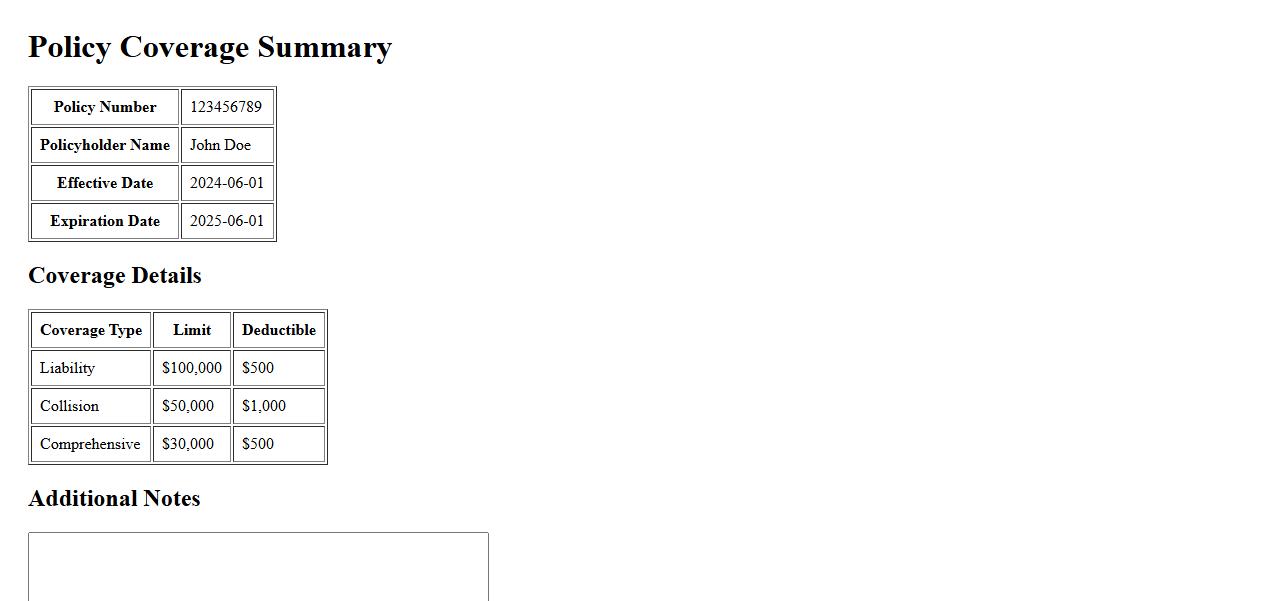

Policy Coverage Summary

The Policy Coverage Summary provides a concise overview of the key protections and limits included in an insurance policy. It highlights essential details such as coverage types, deductible amounts, and claim procedures. This summary helps policyholders quickly understand their insurance benefits and obligations.

What specific critical illness is being claimed under this insurance policy?

The claimant must clearly identify the specific critical illness they are claiming under the insurance policy. Commonly covered illnesses include cancer, heart attack, and stroke among others. Ensuring the illness matches the policy's list is crucial for claim approval.

Does the claimant's diagnosis meet the policy's definition of a covered critical illness?

The claimant's diagnosis must strictly adhere to the policy's definition of a covered critical illness. Each policy outlines precise medical criteria that must be fulfilled for the illness. Only diagnoses meeting these criteria will qualify for coverage.

What is the date of diagnosis and does it fall within the policy's coverage period?

The exact date of diagnosis needs to be documented to verify coverage eligibility. The diagnosis must occur during the active period of the policy's coverage. Claims submitted for illnesses diagnosed outside this period may be denied.

Has the claimant previously submitted a claim for any critical illness under this policy?

It is important to check if the claimant has made prior claims under the same policy for critical illnesses. Some policies limit the number of claims or payouts for critical illness coverage. Repeated claims could affect the current claim's approval.

Are all required supporting medical documents and evidence provided for this claim?

Submitting complete and accurate medical documentation is essential for claim processing. Required documents typically include diagnostic reports, medical records, and physician statements. Incomplete evidence may delay or result in claim denial.