A Claim for Refund of Premiums involves requesting the return of paid insurance premiums when the coverage is canceled or if the policyholder is entitled to a refund due to overpayment or policy adjustments. This process requires submitting proof of payment and a formal request to the insurer, who will review and verify the claim's validity. Successfully claiming a refund ensures that policyholders recover funds owed to them without unnecessary delays.

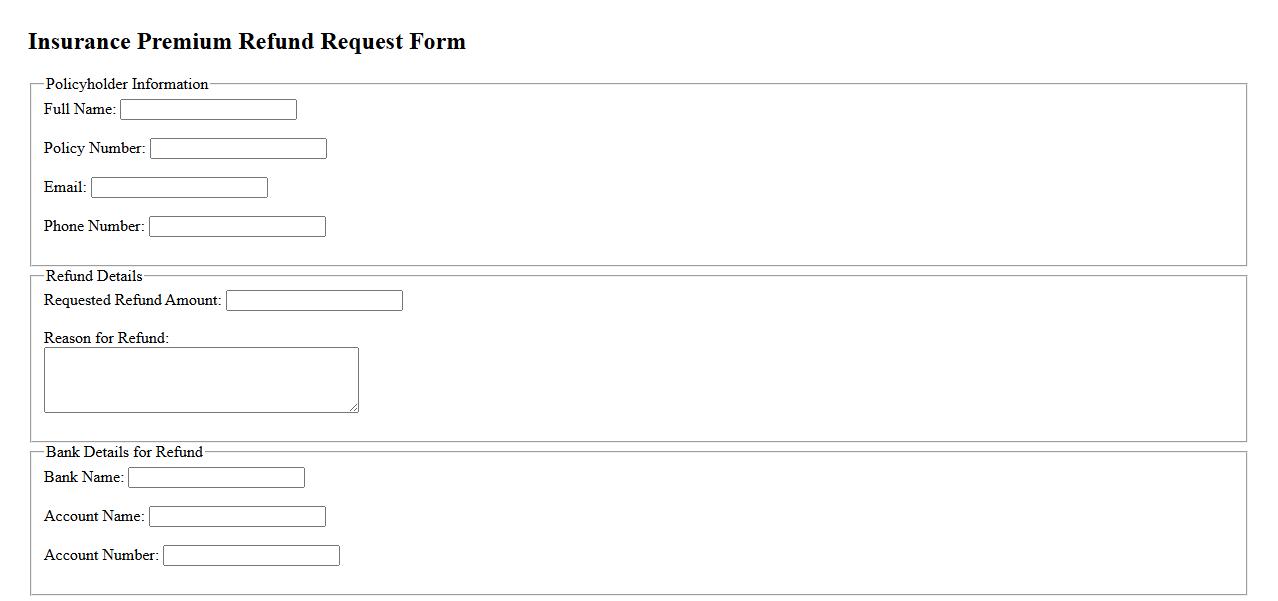

Insurance Premium Refund Request Form

The Insurance Premium Refund Request Form is used to apply for a refund on overpaid or canceled insurance premiums. This form requires accurate policy details and payment information to process the refund efficiently. Submitting the form promptly ensures a faster resolution and return of funds.

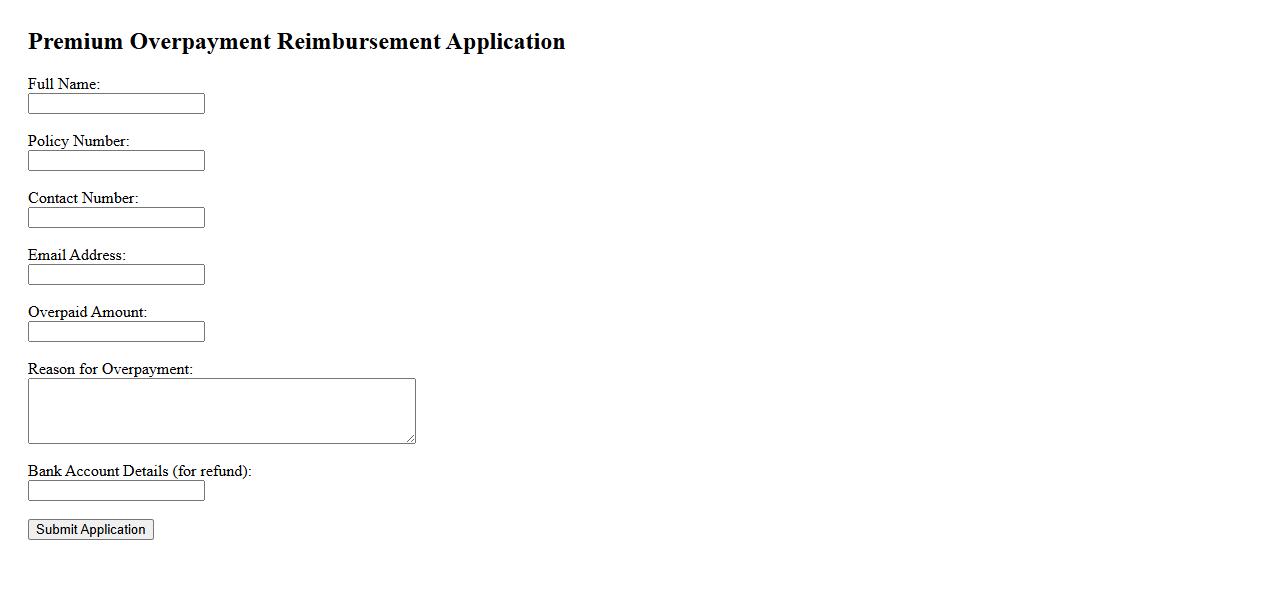

Premium Overpayment Reimbursement Application

The Premium Overpayment Reimbursement Application allows users to efficiently claim refunds for any excess insurance premiums paid. This streamlined process ensures quick verification and reimbursement, reducing financial discrepancies. It is designed to enhance user experience with clear guidelines and timely responses.

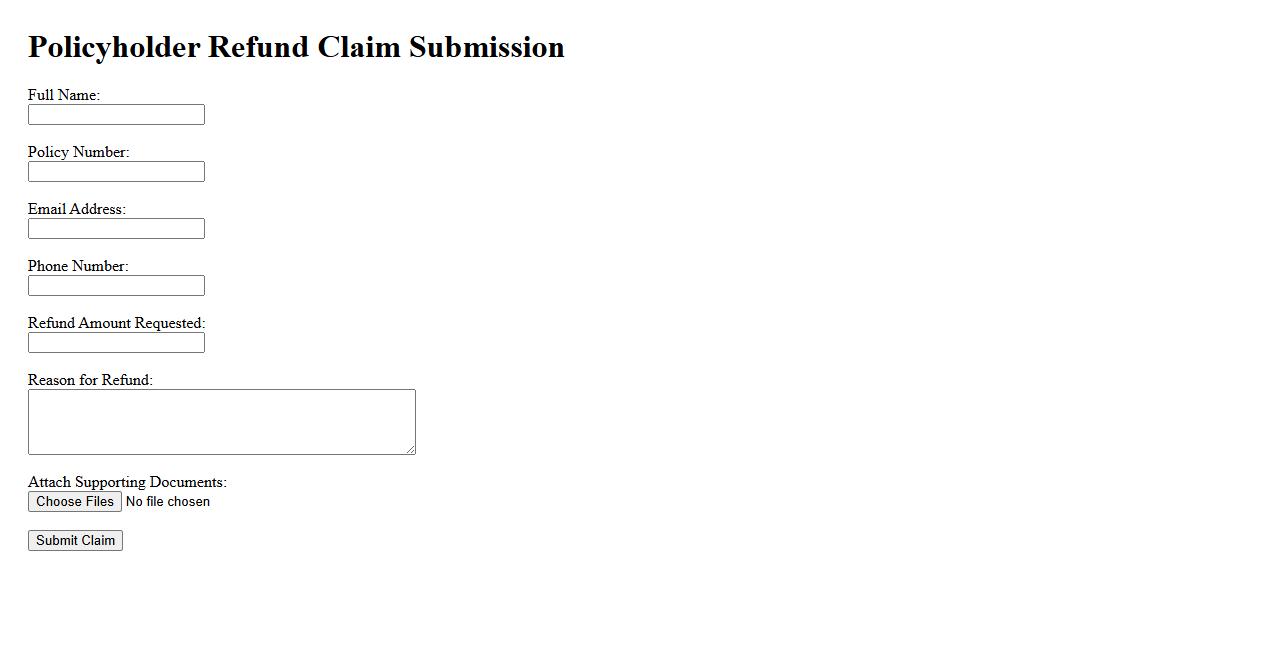

Policyholder Refund Claim Submission

Submitting a Policyholder Refund Claim involves providing necessary documentation and proof of payment to request a refund from your insurance provider. Ensure all forms are accurately completed to avoid delays. Timely submission helps expedite the processing and reimbursement of eligible amounts.

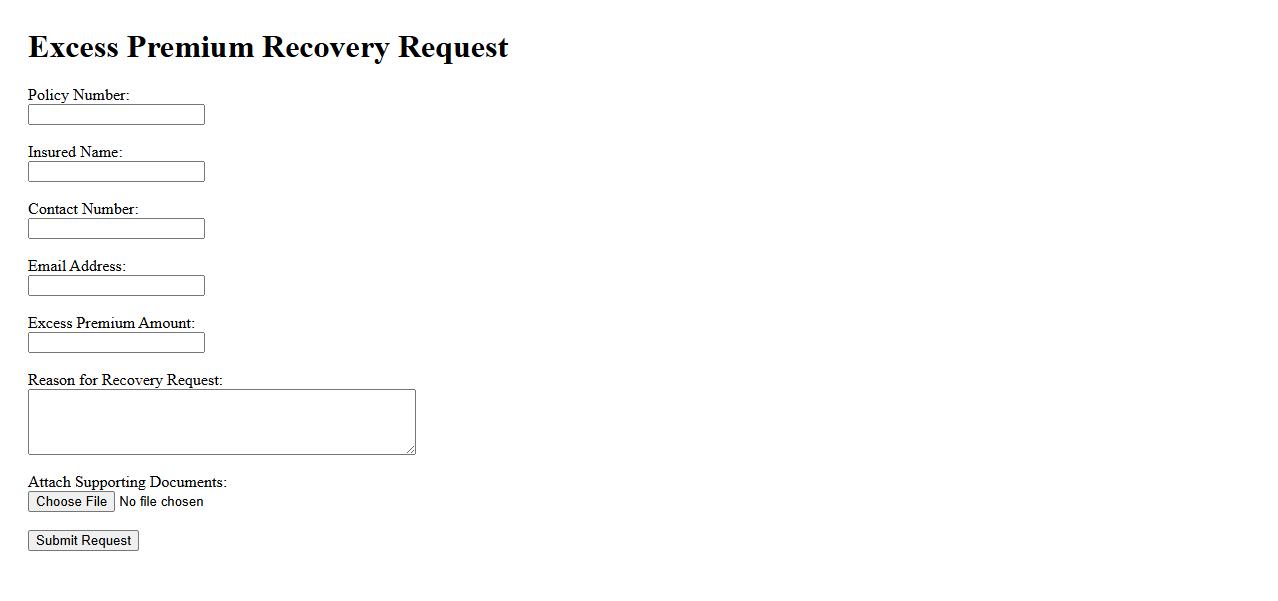

Excess Premium Recovery Request

The Excess Premium Recovery Request process allows clients to claim back premiums that were overpaid. This ensures accurate billing and timely refunds, maintaining trust between the insurer and policyholder. Proper documentation and verification are essential for a smooth recovery procedure.

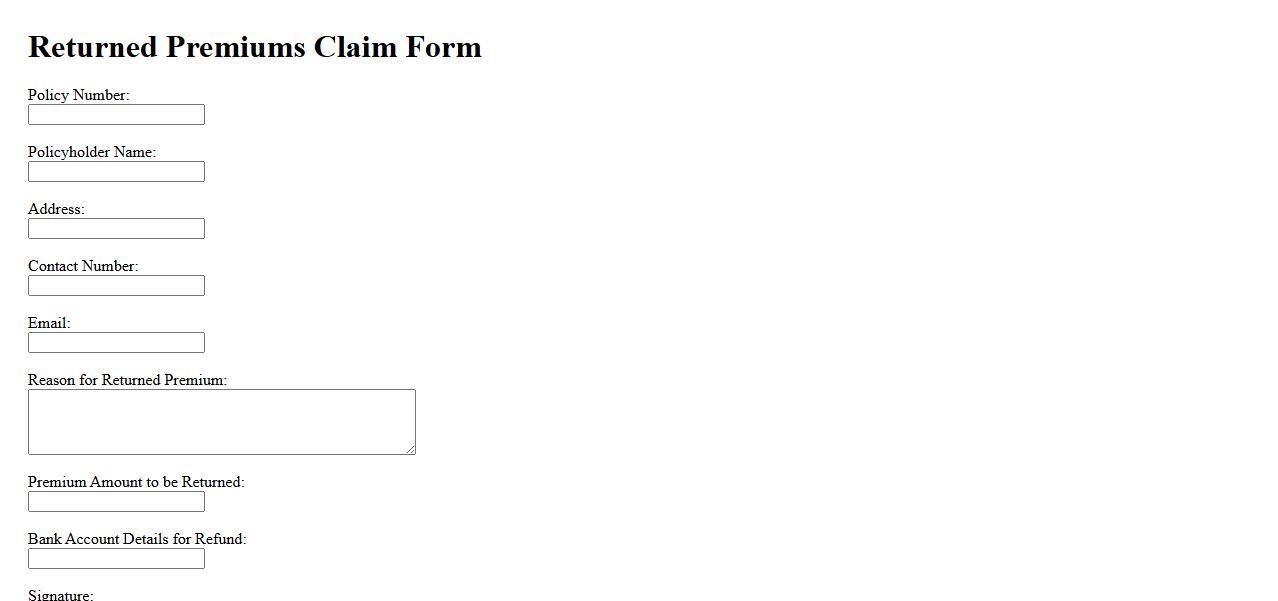

Returned Premiums Claim Form

The Returned Premiums Claim Form is essential for customers seeking reimbursement of unused insurance premiums. This form ensures a streamlined process for verifying and approving claims promptly. Submitting the completed form accurately helps expedite the refund and maintain transparent communication with the insurer.

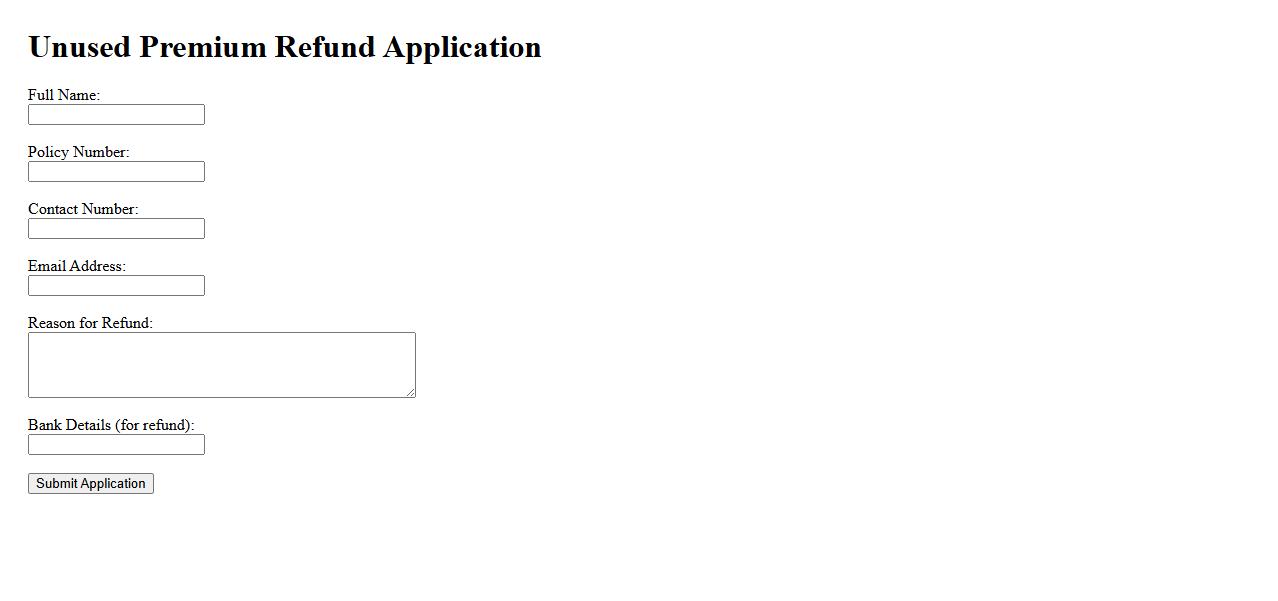

Unused Premium Refund Application

The Unused Premium Refund Application allows policyholders to request a refund for premiums paid on insurance policies that were not utilized. This process ensures that customers are reimbursed promptly and accurately for any unused coverage period. Applying is simple and helps maintain transparency between insurers and insured parties.

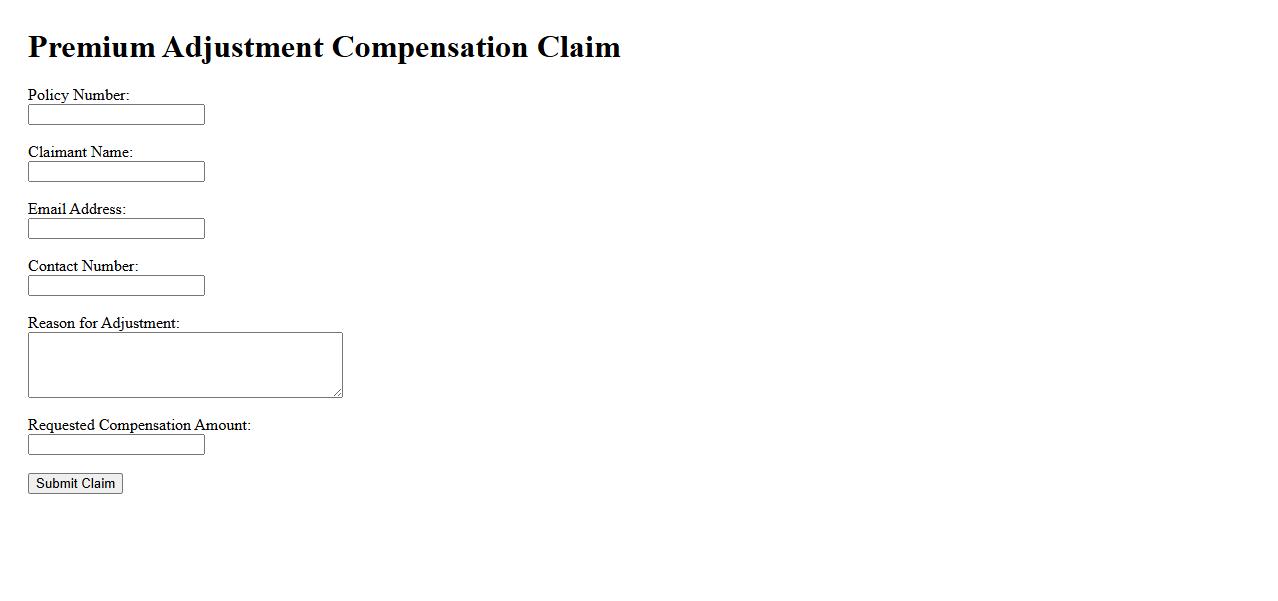

Premium Adjustment Compensation Claim

Filing a Premium Adjustment Compensation Claim ensures you receive the correct reimbursement for overpaid insurance premiums. This process helps rectify billing errors and protects your financial interests. Timely submission of the claim maximizes the chances of a swift resolution.

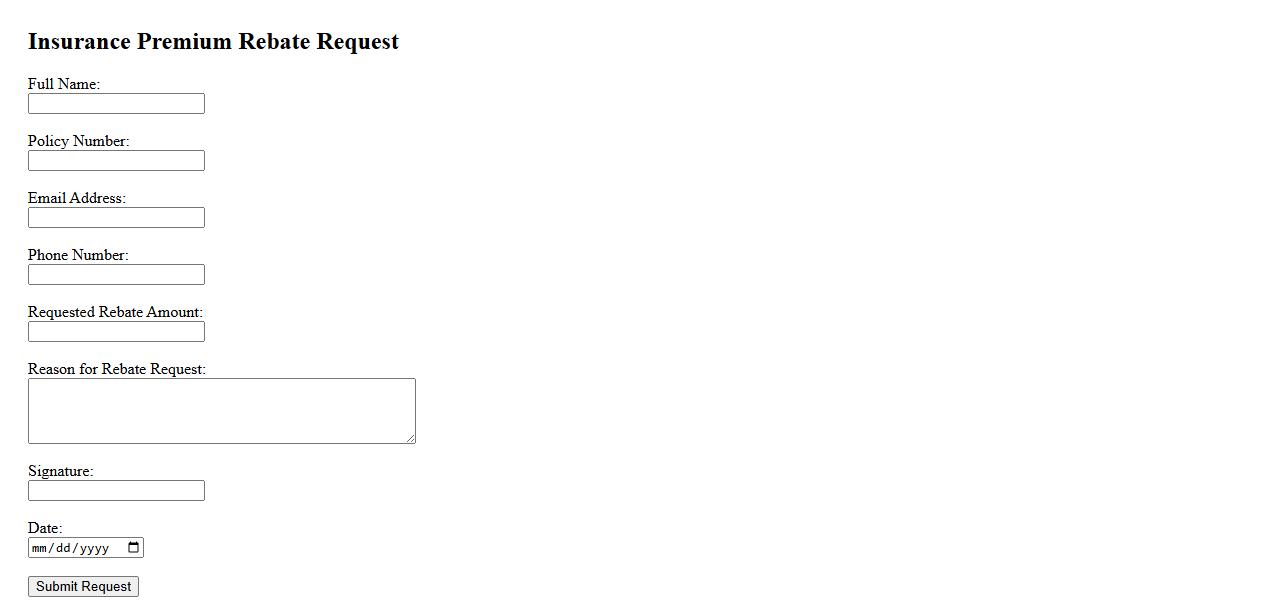

Insurance Premium Rebate Request

Submitting an Insurance Premium Rebate Request allows policyholders to seek refunds on overpaid premiums or qualify for rebates based on specific policy terms. This process ensures customers receive fair compensation when eligible, promoting transparency and trust between insurers and clients. Timely requests can help recover funds and improve overall satisfaction with insurance services.

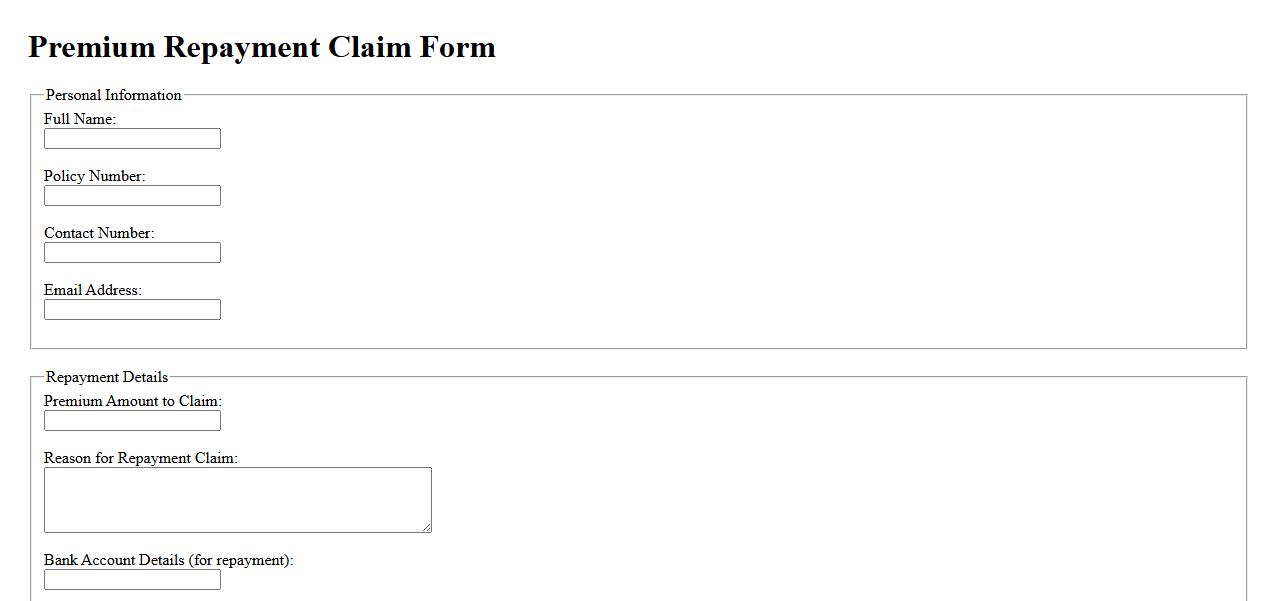

Premium Repayment Claim Form

The Premium Repayment Claim Form is a crucial document used to request the reimbursement of paid premiums under specific conditions. It ensures a streamlined process for claimants to recover their funds efficiently. Proper completion of this form is essential to avoid delays in repayment.

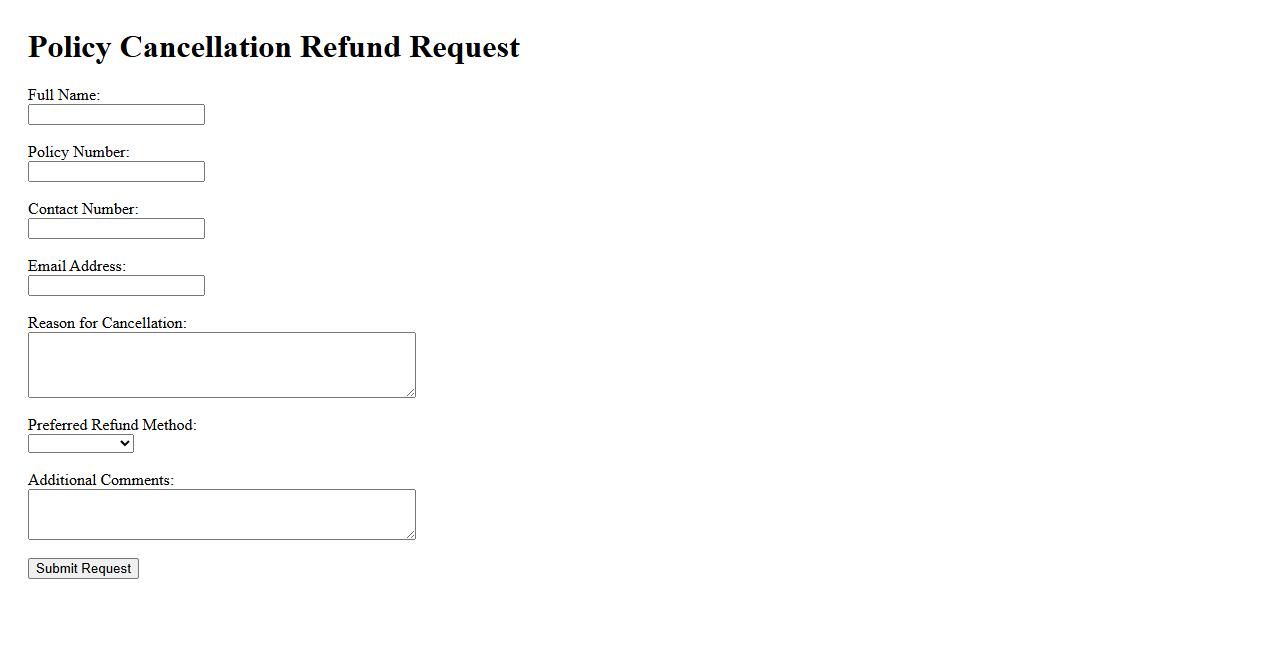

Policy Cancellation Refund Request

Submitting a Policy Cancellation Refund Request helps you recover unused premiums after ending your insurance coverage. Ensure your request includes all relevant policy details for a smooth refund process. Prompt submission accelerates refund approval and processing times.

What specific policy types are eligible for a Claim for Refund of Premiums?

Eligible policy types for a Claim for Refund of Premiums typically include life insurance, health insurance, and certain types of property insurance. Refund claims are usually accepted only for policies that have been fully or partially paid but are later canceled or terminated. It is important to verify the policy type with the insurer to confirm eligibility for premium refund.

What evidence or documentation is required to support the refund claim?

To support a refund claim, you must provide a completed claim form along with the original policy documents. Additional documentation may include payment receipts, proof of policy cancellation, and a valid identification for the policyholder. Submitting complete and accurate documentation ensures timely processing of the refund request.

What are the valid reasons for requesting a premium refund under this form?

Valid reasons for requesting a premium refund include policy cancellation, overpayment, or policy termination before the coverage period ends. Changes in coverage terms or discrepancies in premium charges can also justify a refund claim. It is essential to clearly state the reason for the refund on the claim form to avoid delays.

What is the timeframe for submitting a claim for a premium refund after policy cancellation or termination?

The timeframe for submitting a refund claim usually ranges from 30 to 90 days after policy cancellation or termination. Submissions after the deadline may result in denial of the refund request by the insurer. Always adhere to the specified timeframe indicated in the policy or claim instructions.

Who is authorized to file a Claim for Refund of Premiums on behalf of the policyholder?

The policyholder is primarily authorized to file a Claim for Refund of Premiums, but it can also be submitted by a legal representative or beneficiary. In cases of minors or incapacitated individuals, a guardian or power of attorney holder may file the claim. Proper authorization documentation must accompany the claim to validate the filer's authority.