A Claim for Income Protection involves submitting a request to your insurance provider to receive financial support when you are unable to work due to illness or injury. This process typically requires medical evidence and proof of income loss. Timely and accurate documentation ensures a smoother claims assessment and quicker benefit payments.

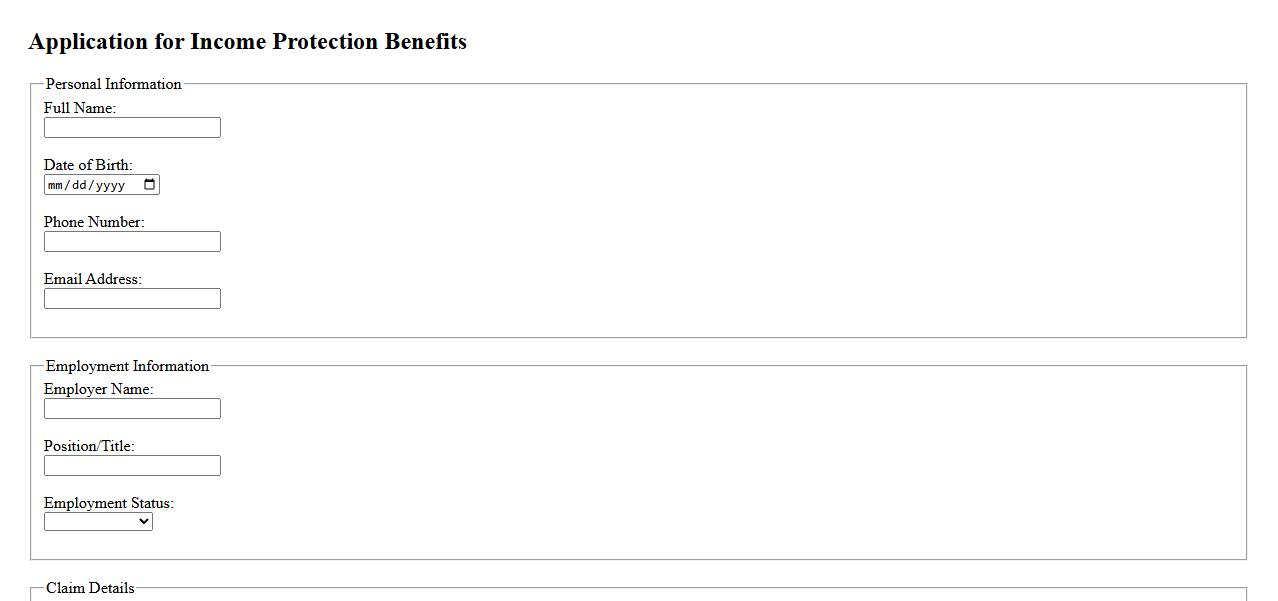

Application for Income Protection Benefits

An Application for Income Protection Benefits is a formal request submitted to secure financial support during periods of lost income due to illness or injury. This process ensures individuals can maintain their livelihood while recovering. Timely and accurate submission of the application is essential for uninterrupted benefit access.

Request for Income Support Coverage

A Request for Income Support Coverage is a formal application submitted by individuals seeking financial assistance due to loss of income. This request usually includes necessary documentation to verify eligibility and the extent of support needed. Proper submission ensures timely evaluation and potential approval for income support benefits.

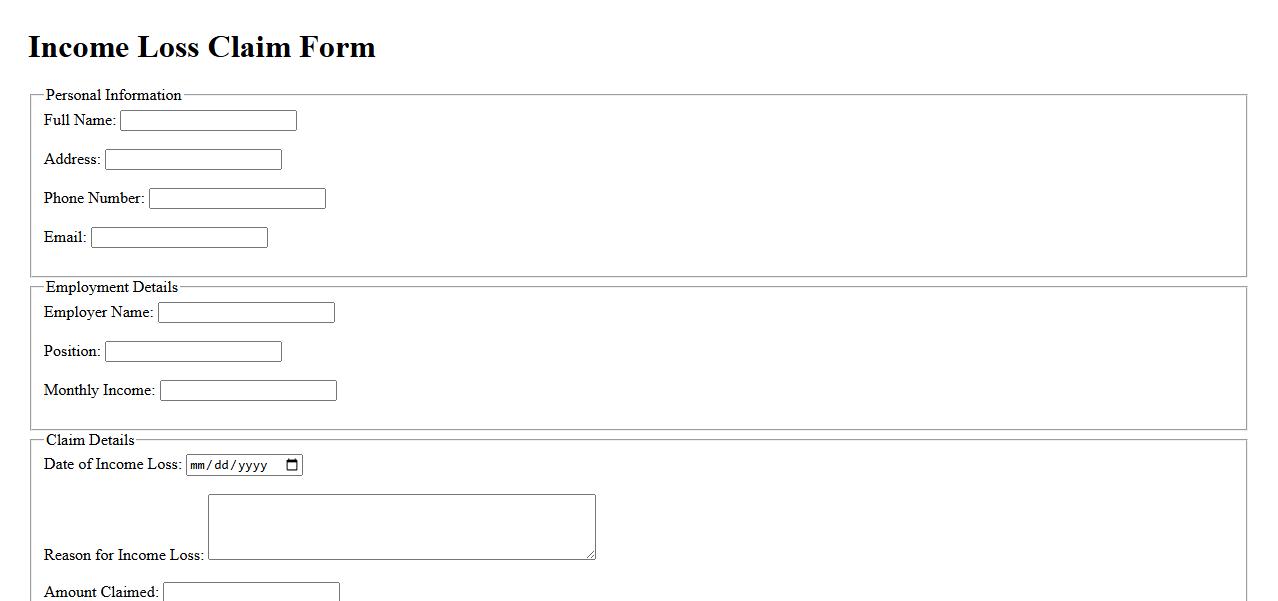

Income Loss Claim Form

The Income Loss Claim Form is a vital document used to report and request compensation for lost earnings due to unforeseen circumstances. It ensures that individuals receive financial support by providing accurate details of their income loss. Completing this form promptly helps streamline the claim process and secure timely reimbursement.

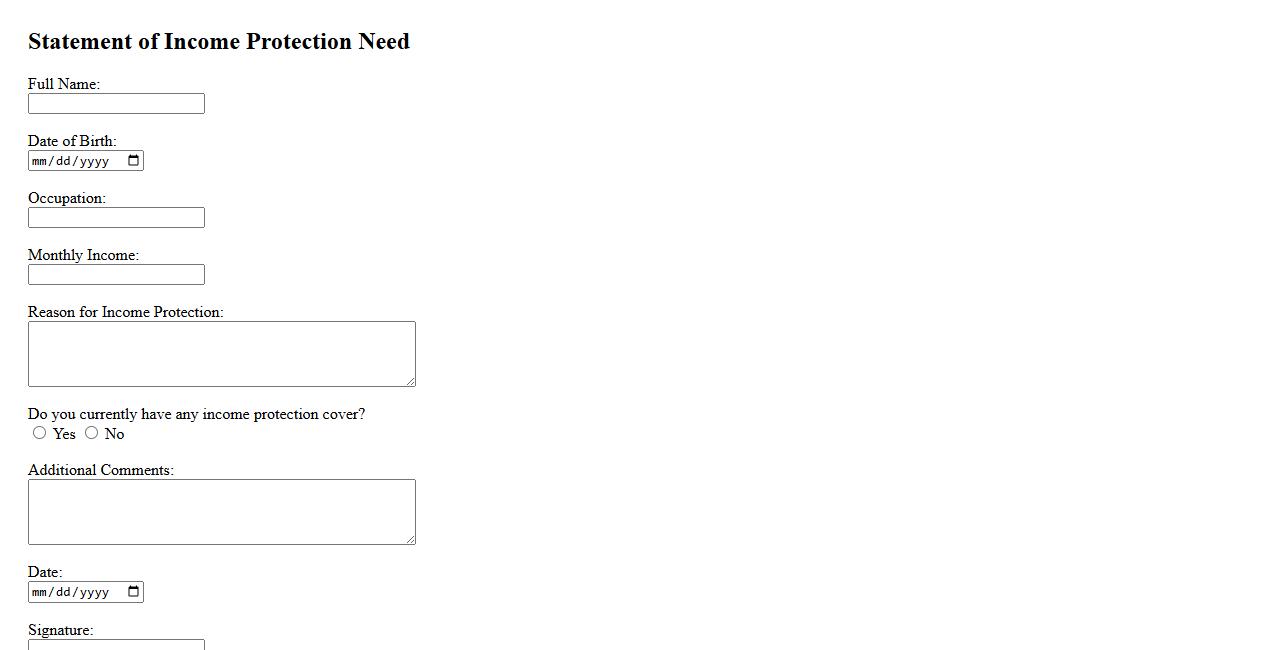

Statement of Income Protection Need

The Statement of Income Protection Need outlines the essential reasons why safeguarding your earnings is crucial. It highlights potential financial risks due to unforeseen events that could impact your ability to work. This statement helps in planning effective insurance coverage to maintain financial stability.

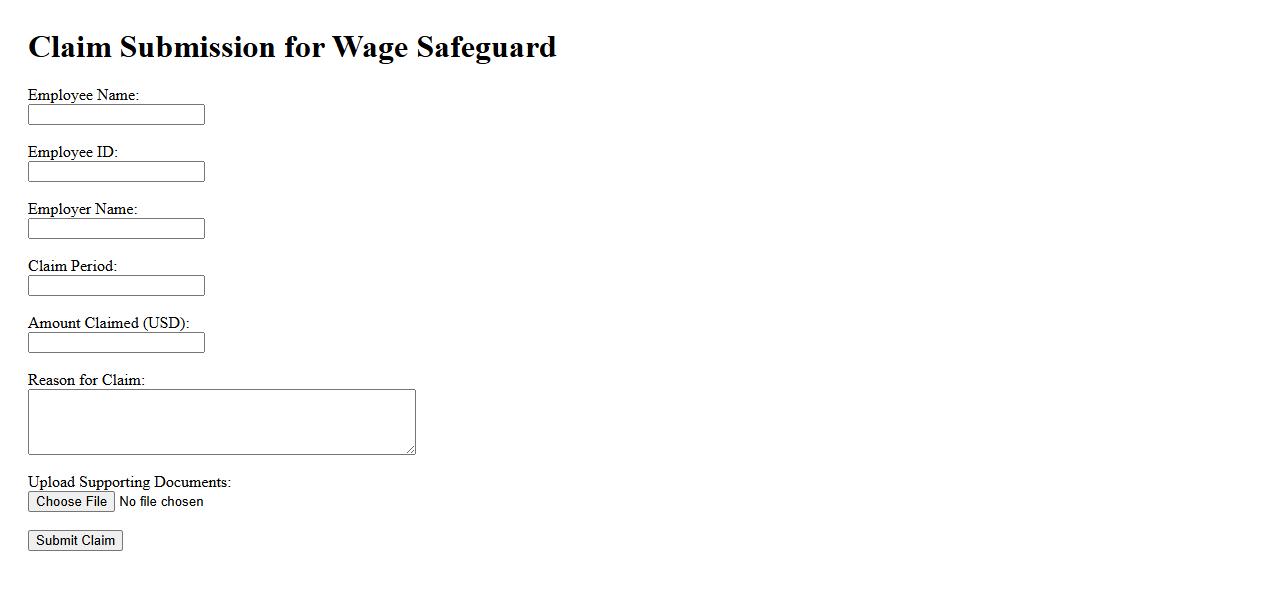

Claim Submission for Wage Safeguard

The Claim Submission for Wage Safeguard process ensures employees receive timely compensation during wage disruptions. Submitting a claim accurately and promptly helps protect workers' financial stability. This safeguard is essential for maintaining trust between employers and employees.

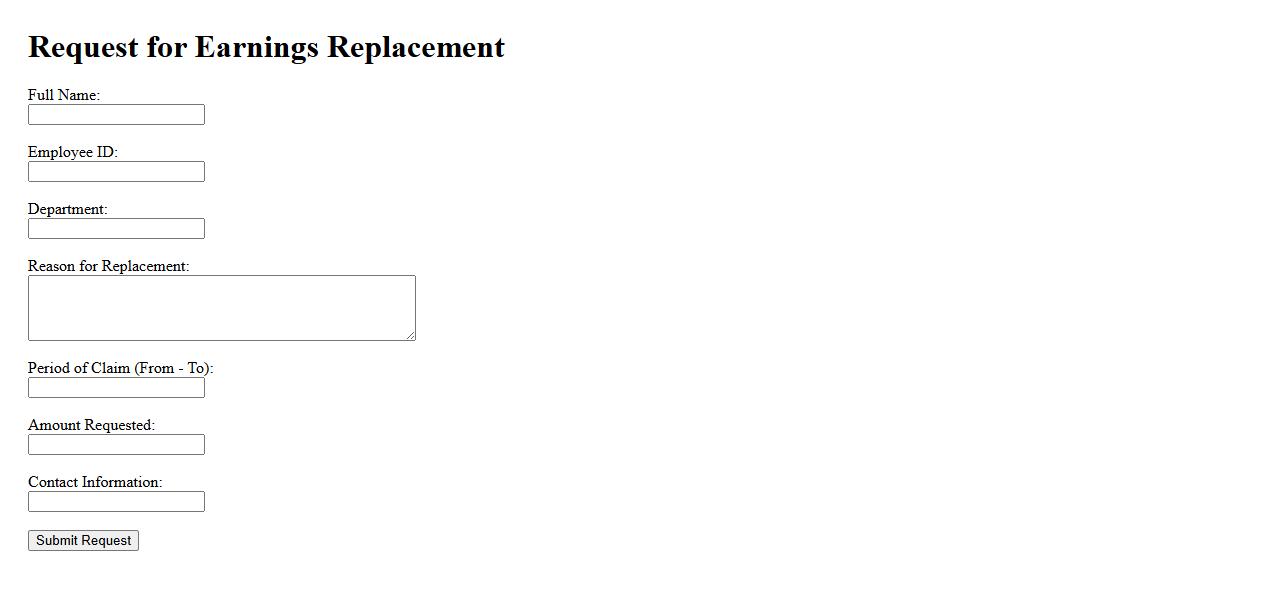

Request for Earnings Replacement

A Request for Earnings Replacement is a formal application submitted to claim financial support during periods when an individual cannot work due to illness or injury. This request helps ensure continuity of income by replacing lost earnings. It is essential to provide accurate documentation to process the claim efficiently.

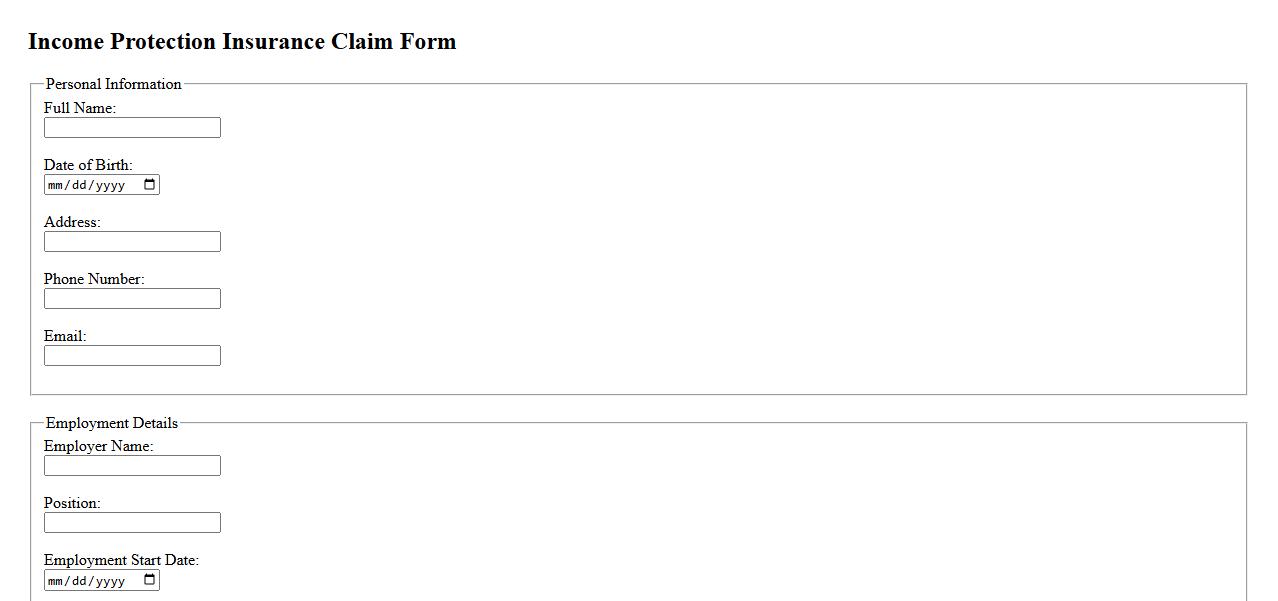

Income Protection Insurance Claim

Filing an Income Protection Insurance Claim ensures financial stability when illness or injury prevents you from working. This type of insurance provides regular payments to cover living expenses during your recovery. Understanding the claim process helps you receive timely support and peace of mind.

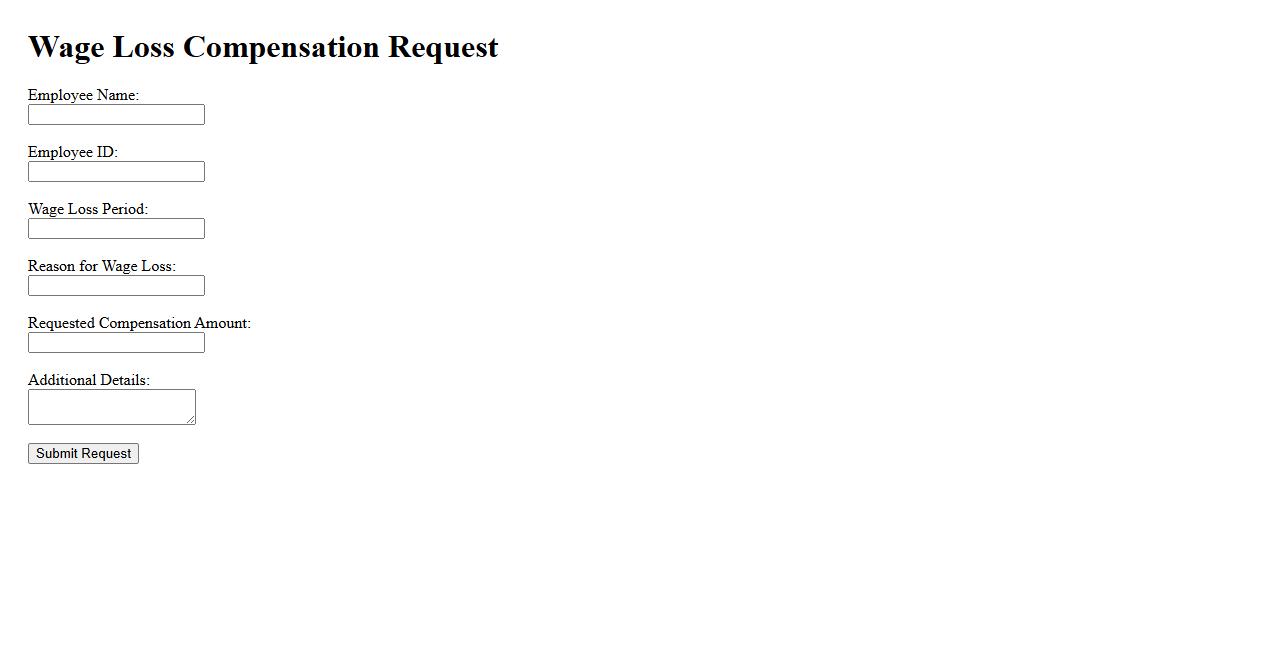

Wage Loss Compensation Request

If you have experienced reduced income due to an injury or workplace incident, submitting a wage loss compensation request is essential to recover lost earnings. This process involves providing documentation to prove the financial impact of your absence from work. Timely and accurate requests ensure you receive the benefits you are entitled to during your recovery period.

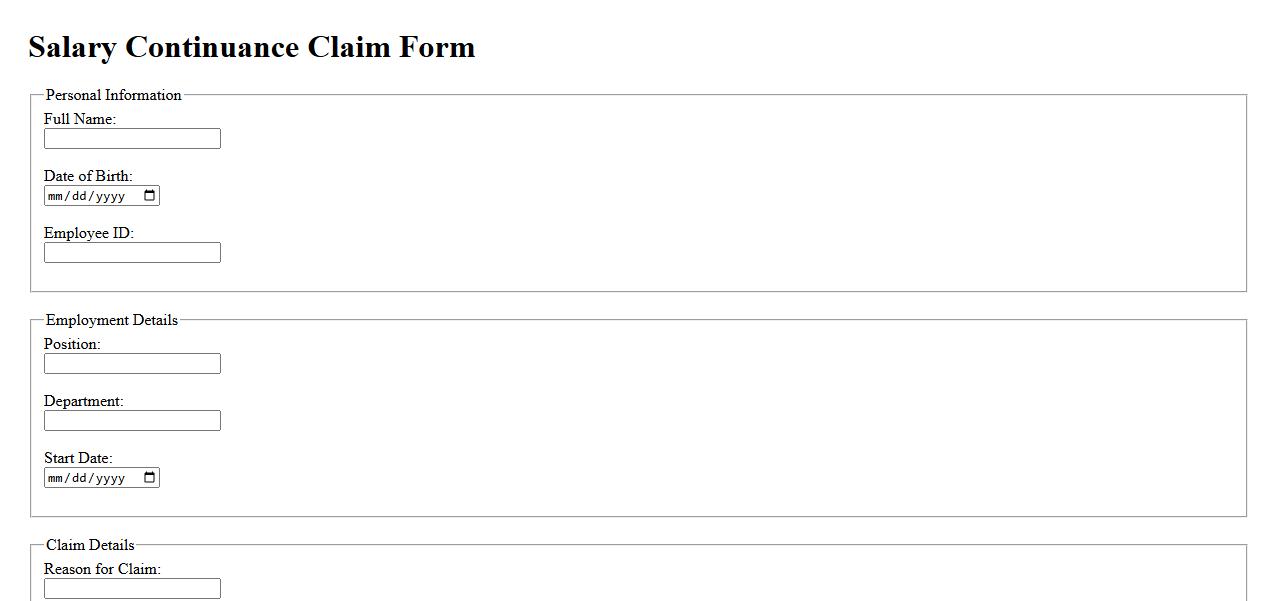

Salary Continuance Claim Form

The Salary Continuance Claim Form is a crucial document used to request ongoing salary payments during periods of absence due to illness or injury. It ensures employees receive financial support without disruption while their employment status is maintained. Timely submission of this form is essential for smooth processing and uninterrupted benefits.

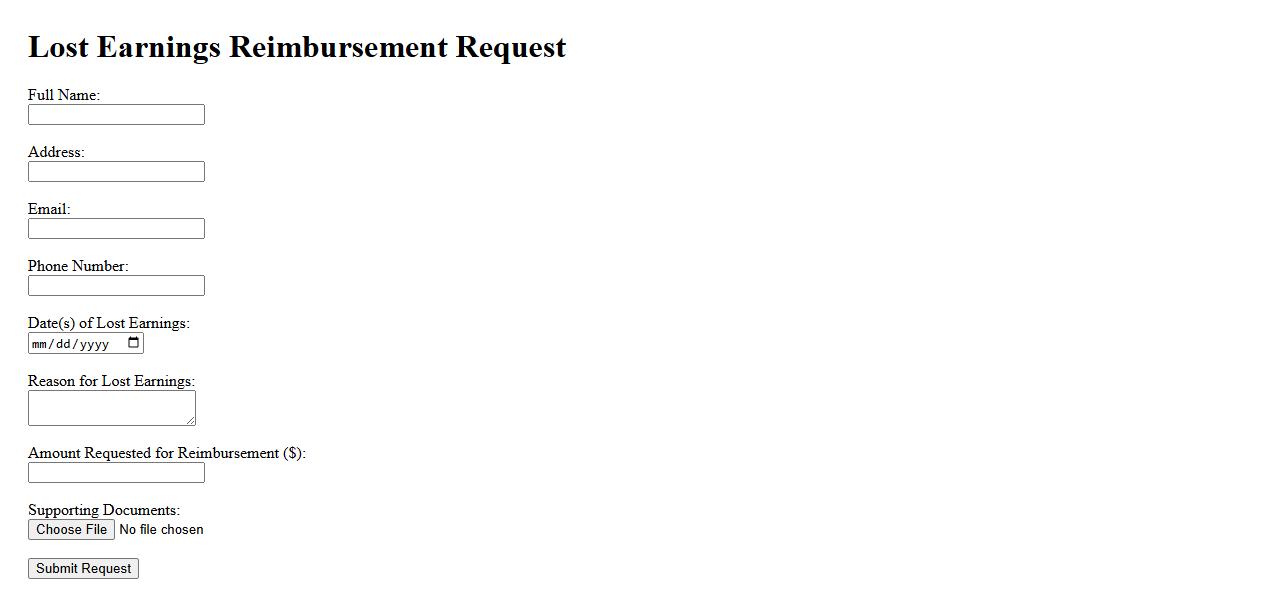

Lost Earnings Reimbursement Request

When filing a Lost Earnings Reimbursement Request, it is essential to provide accurate documentation of income lost due to an incident or injury. This process ensures that individuals receive compensation for wages missed during recovery or absence from work. Timely submission and detailed records support a smoother reimbursement experience.

What is the primary purpose of an Income Protection claim document?

The primary purpose of an Income Protection claim document is to formally notify the insurer of the claimant's inability to work. It serves as the official record used to assess the validity of the claim. This document initiates the process for the claimant to receive financial support during their period of incapacity.

Which details about the claimant's employment and earnings are required?

The claim document requires detailed information about the claimant's current employment status and job role. Accurate records of the claimant's earnings, including salary and any additional income, must be provided. These details help the insurer calculate the appropriate benefit amount.

What documentation is needed to support the inability to work due to illness or injury?

Claimants must submit medical reports from certified healthcare professionals verifying their condition. Evidence such as hospital records, specialist assessments, and treatment plans may also be required. This documentation substantiates the claim by confirming the claimant's incapacity to perform their job.

How does the policy define eligible conditions for claiming income protection?

The policy outlines specific medical conditions and disabilities that qualify for income protection benefits. Typically, it includes illnesses or injuries that prevent the claimant from working in their own occupation. The definition ensures only valid claims related to genuine incapacity are approved.

What are the key steps in the claims assessment and approval process?

The process begins with a thorough review of the submitted claim documents and medical evidence. Next, the insurer may conduct interviews or request additional information to verify the claimant's condition. Finally, a decision is made regarding approval or denial of the income protection benefits based on the policy terms.