A Claim for Refund of Overpayment occurs when a payer requests the return of money paid in excess of the correct amount. This process involves submitting proof of the overpayment and relevant documentation to the responsible party or organization. Timely filing of the claim ensures a faster resolution and recovery of the funds.

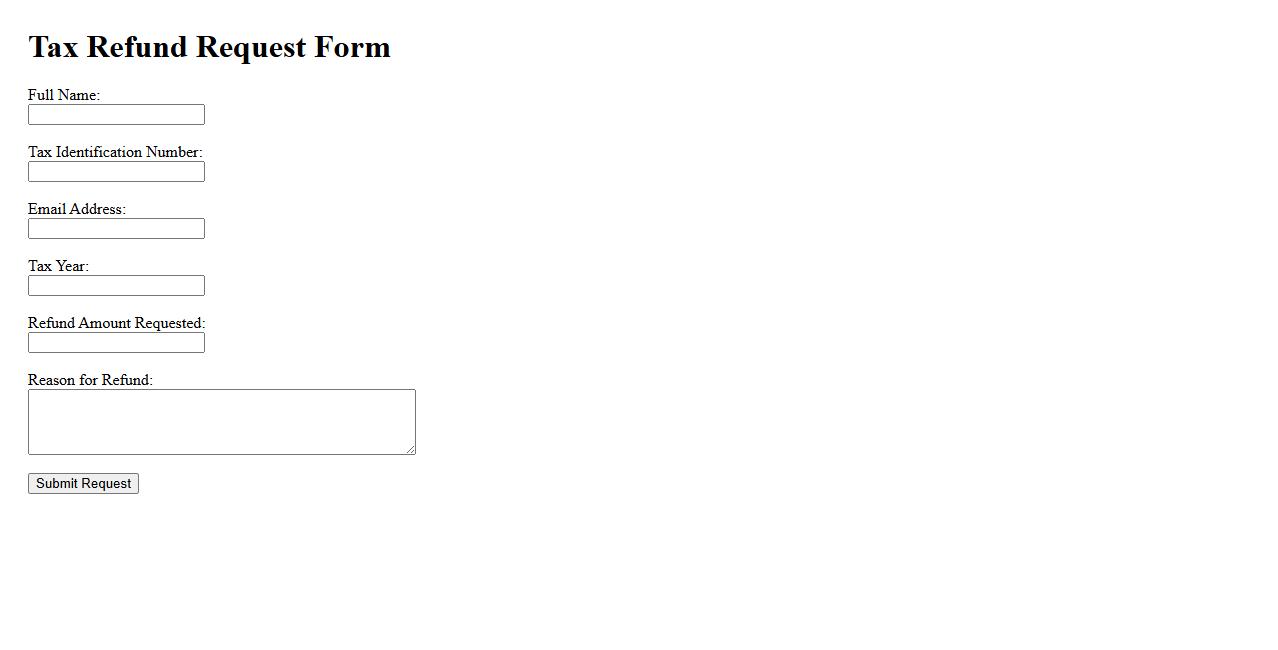

Tax Refund Request Form

The Tax Refund Request Form is an essential document used to claim a refund on overpaid taxes. It ensures a smooth and accurate process for taxpayers to recover their funds from the tax authorities. Proper completion and submission of this form are crucial for timely reimbursement.

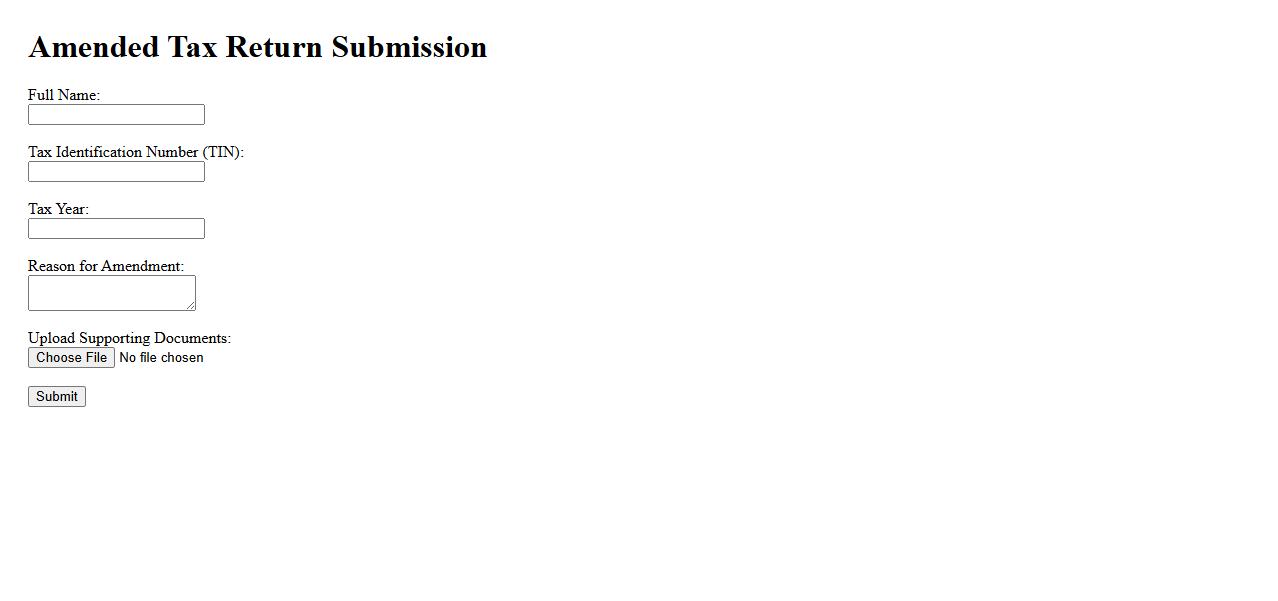

Amended Tax Return Submission

Submitting an Amended Tax Return allows taxpayers to correct errors or update information on a previously filed tax return. This process is crucial for ensuring accurate tax records and avoiding potential penalties. It is important to follow IRS guidelines carefully when submitting an amended return.

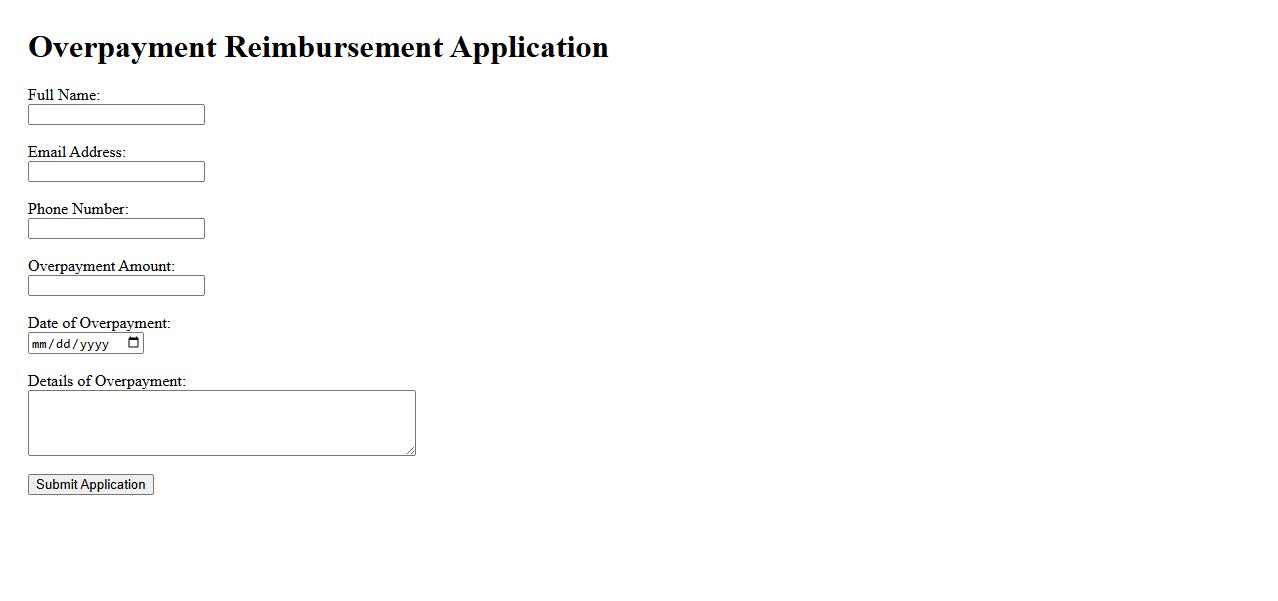

Overpayment Reimbursement Application

The Overpayment Reimbursement Application allows individuals or businesses to request a refund for excess payments made. It streamlines the process by collecting necessary information and supporting documents. This ensures a timely and accurate review of reimbursement claims.

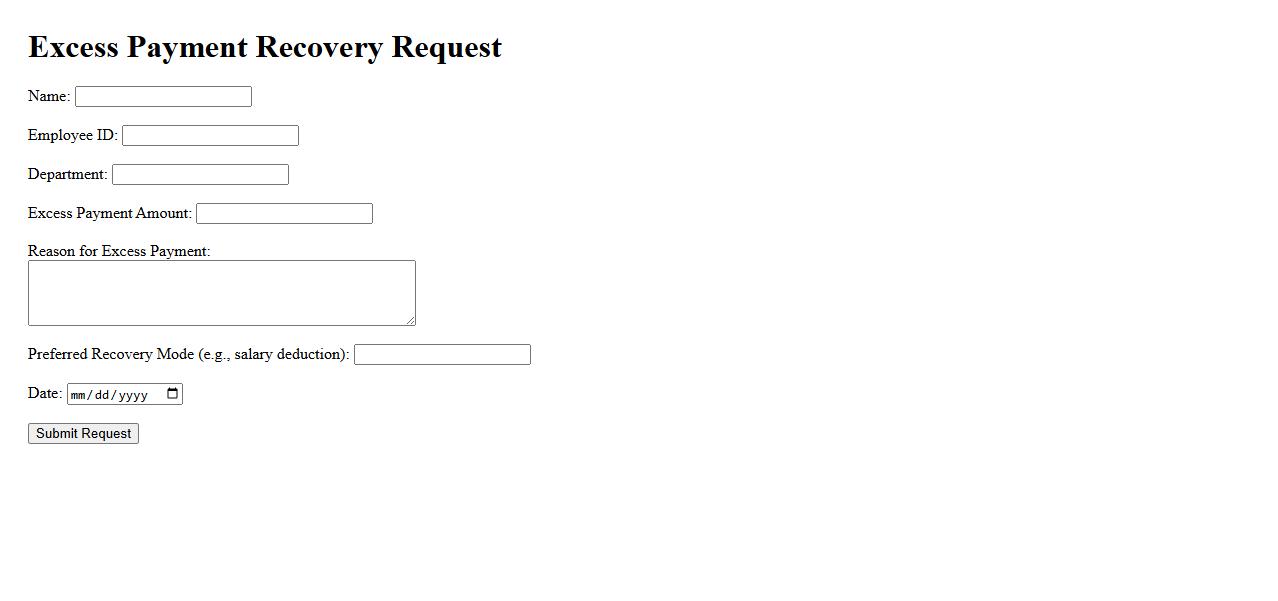

Excess Payment Recovery Request

An Excess Payment Recovery Request is initiated to reclaim funds paid beyond the required amount. This process ensures accurate financial records and prevents overpayment. Timely submission of such requests aids in maintaining budget compliance and financial integrity.

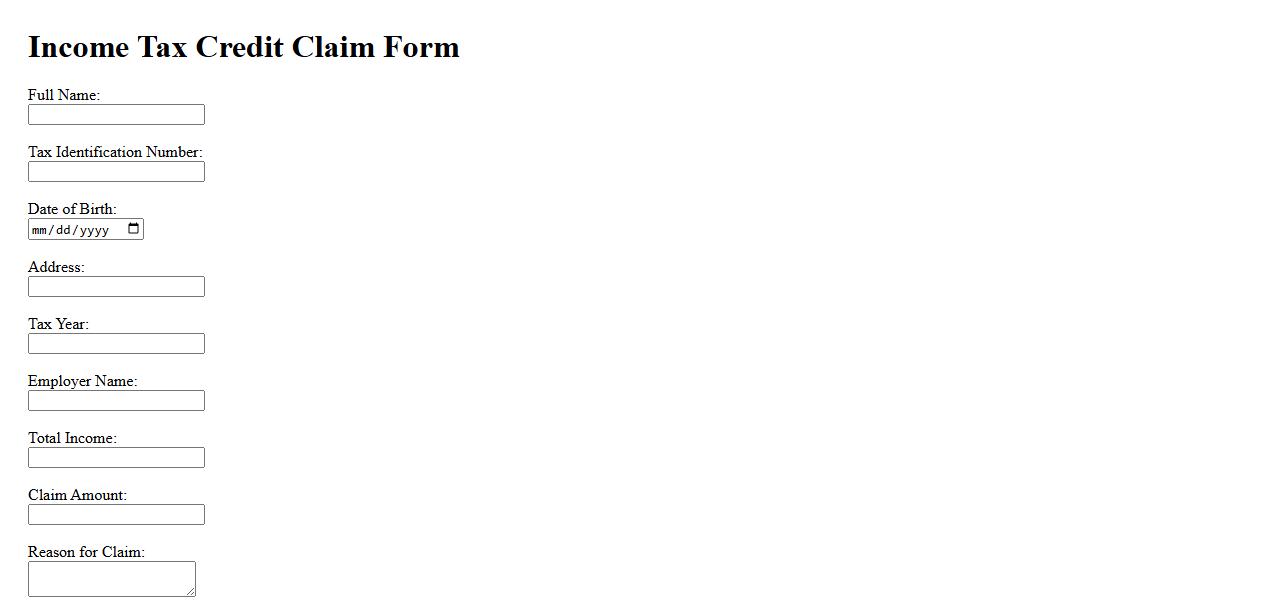

Income Tax Credit Claim

The Income Tax Credit Claim allows individuals to reduce their tax liability by applying eligible credits against the amount owed. It is essential to accurately report all qualifying expenses and incomes to maximize the benefits. Filing this claim can result in significant savings on your annual tax bill.

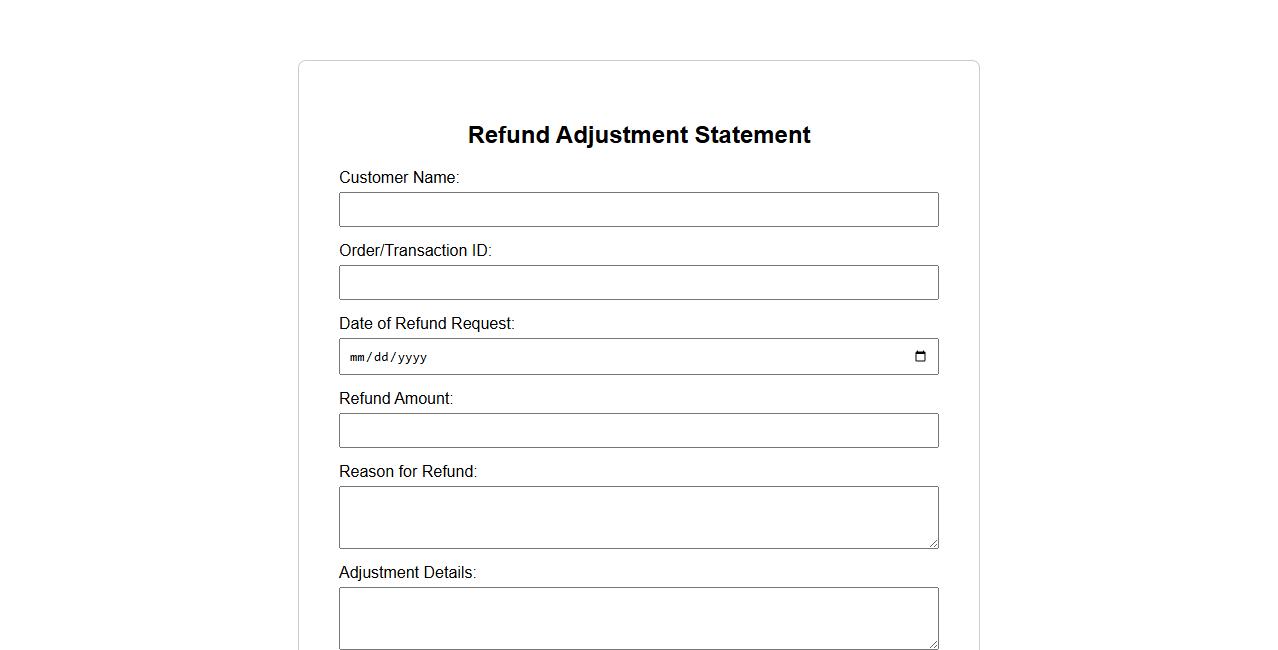

Refund Adjustment Statement

The Refund Adjustment Statement provides a detailed summary of changes made to a customer's refund amount. It outlines the original refund, any deductions or additions, and the final adjusted total. This document ensures transparency and clarity in financial transactions.

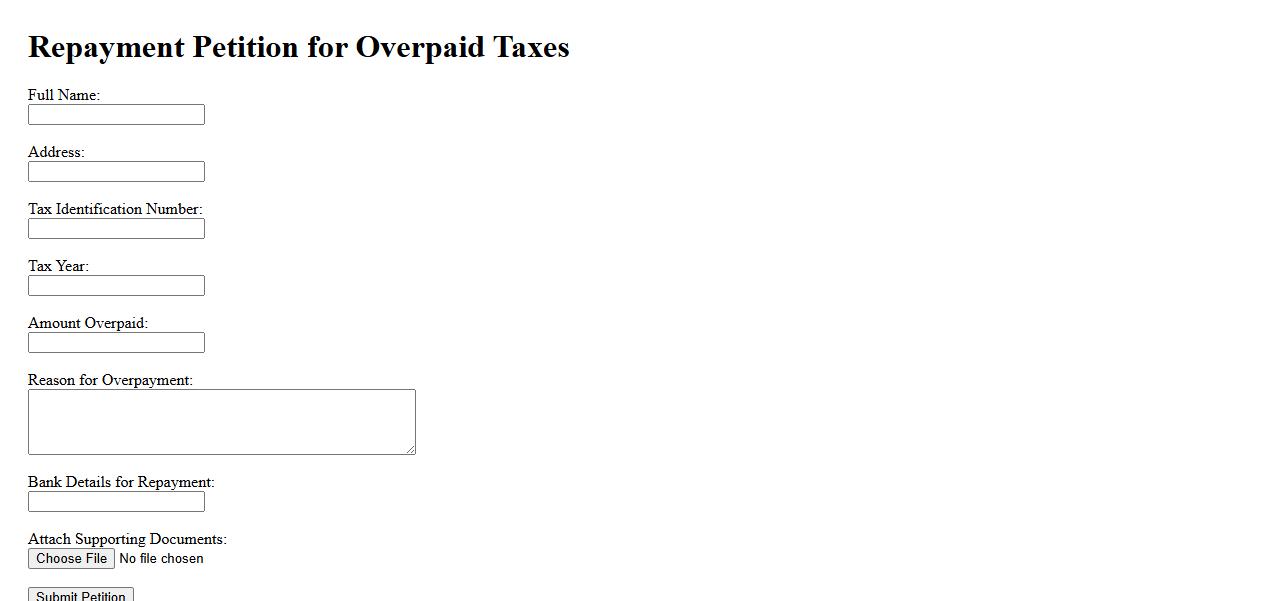

Repayment Petition for Overpaid Taxes

A Repayment Petition for Overpaid Taxes is a formal request submitted to tax authorities seeking the refund of excess taxes paid. This petition must include proof of payment and accurate calculation of the overpaid amount. Timely submission ensures prompt processing and reimbursement by the tax department.

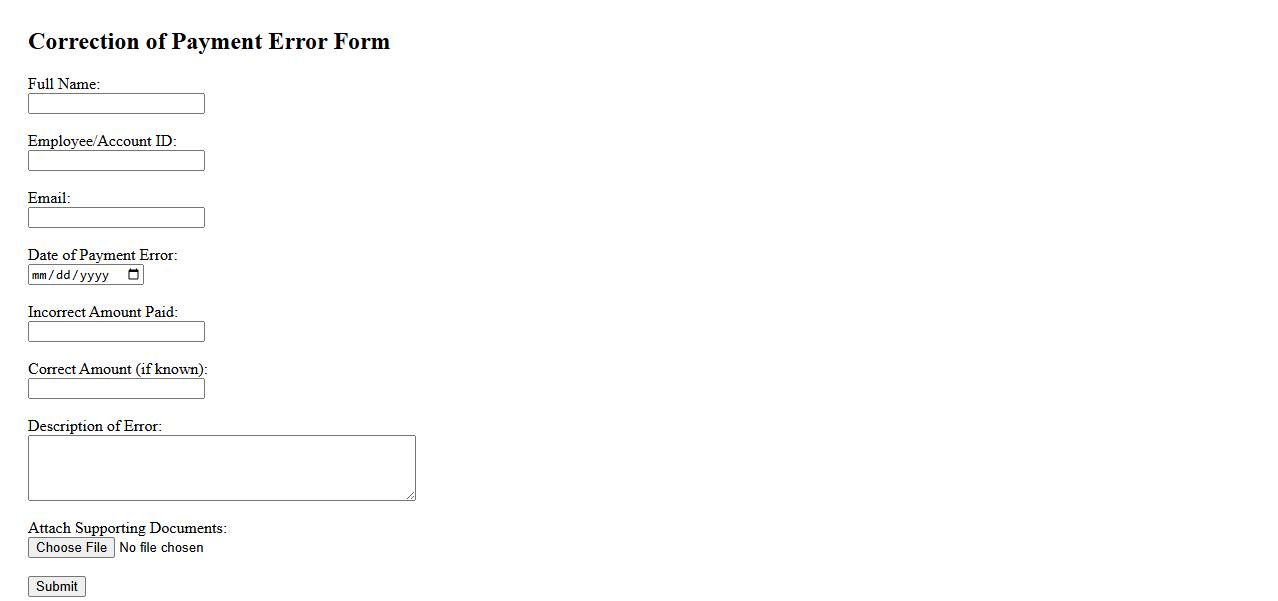

Correction of Payment Error Form

The Correction of Payment Error Form is designed to rectify discrepancies in financial transactions. It ensures accurate accounting and timely adjustments. This form is essential for maintaining transparent and error-free payment records.

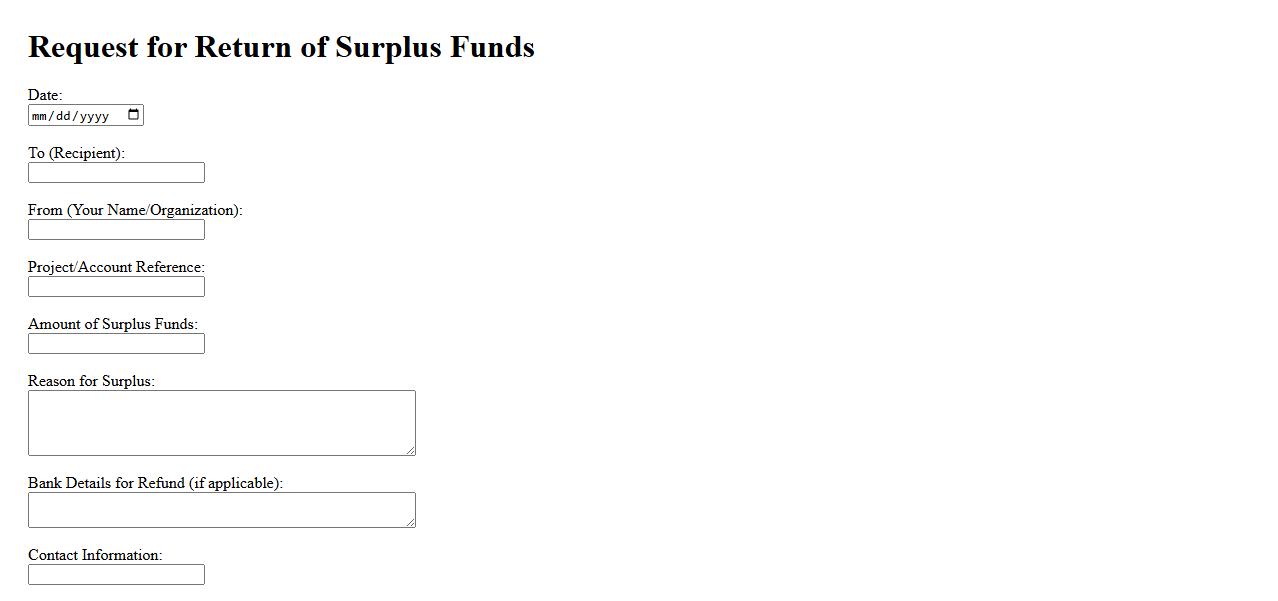

Request for Return of Surplus Funds

A Request for Return of Surplus Funds is a formal application submitted to recover excess money held after a financial transaction or settlement. This process ensures that any overpaid or remaining funds are rightfully returned to the payer. Timely handling of such requests is crucial for maintaining transparent financial records.

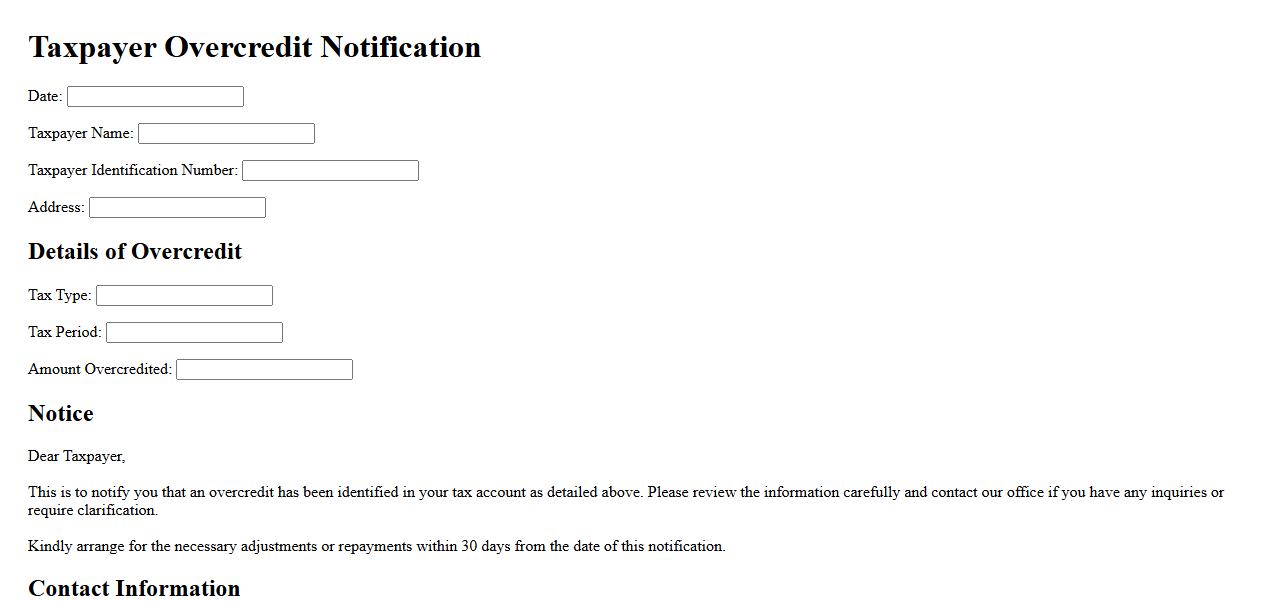

Taxpayer Overcredit Notification

The Taxpayer Overcredit Notification is an important document issued to inform taxpayers about an excess credit applied to their account. This notification helps ensure accurate tax records and provides guidance on how to address the overcredit. Timely attention to this notice can prevent future complications with tax filings.

Reason for the Overpayment

The overpayment claimed in the document arises from a discrepancy in the reported tax amounts. It is usually due to excess tax withheld or an error in the calculation of taxable income. Identifying this overpayment ensures compliance with tax regulations and initiates the refund process.

Tax Period or Fiscal Year Pertaining to the Refund Claim

The refund claim pertains specifically to the tax period or fiscal year stated in the document. This period is clearly defined to align with the applicable tax return or financial statement. Accurate identification of this timeframe is critical for validating and processing the refund.

Documentation Supporting the Overpayment Amount

The amount of overpayment stated in the claim is supported by detailed documentation such as tax returns, payment receipts, and official tax calculations. These documents provide evidence of the excess payment made during the relevant period. Proper documentation ensures the legitimacy and accuracy of the refund claim.

Authorized Claimant Requesting the Refund

The authorized claimant is typically the taxpayer or their legally designated representative. Their identification and authorization are verified through official forms and signatures included in the document. This step safeguards the refund process and ensures the claim is legitimate.

Preferred Method or Account for Receiving the Refund

The document specifies the preferred method or account for receiving the refund, often a designated bank account for direct deposit. This method provides a secure and efficient way to transfer the refund to the claimant. Clearly stating this information helps facilitate prompt disbursement of funds.