A Claim for Short-Term Disability involves submitting a request to an insurance provider or employer for benefits that replace a portion of your income during a temporary period of medical inability to work. This process typically requires medical documentation and proof of eligibility. Timely filing and accurate information are crucial to ensure a smooth approval.

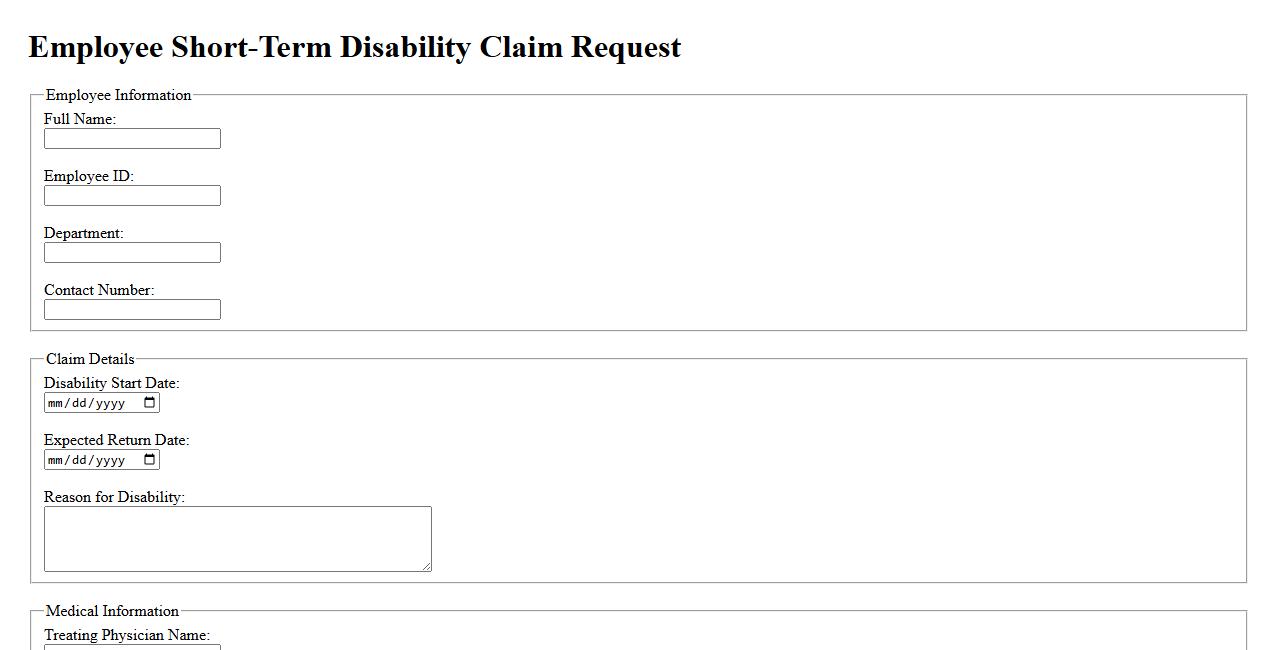

Employee Short-Term Disability Claim Request

Filing an Employee Short-Term Disability Claim Request ensures timely financial support during temporary medical leave. Employees must submit necessary documentation to initiate the evaluation process. This claim helps maintain income stability while recovering from illness or injury.

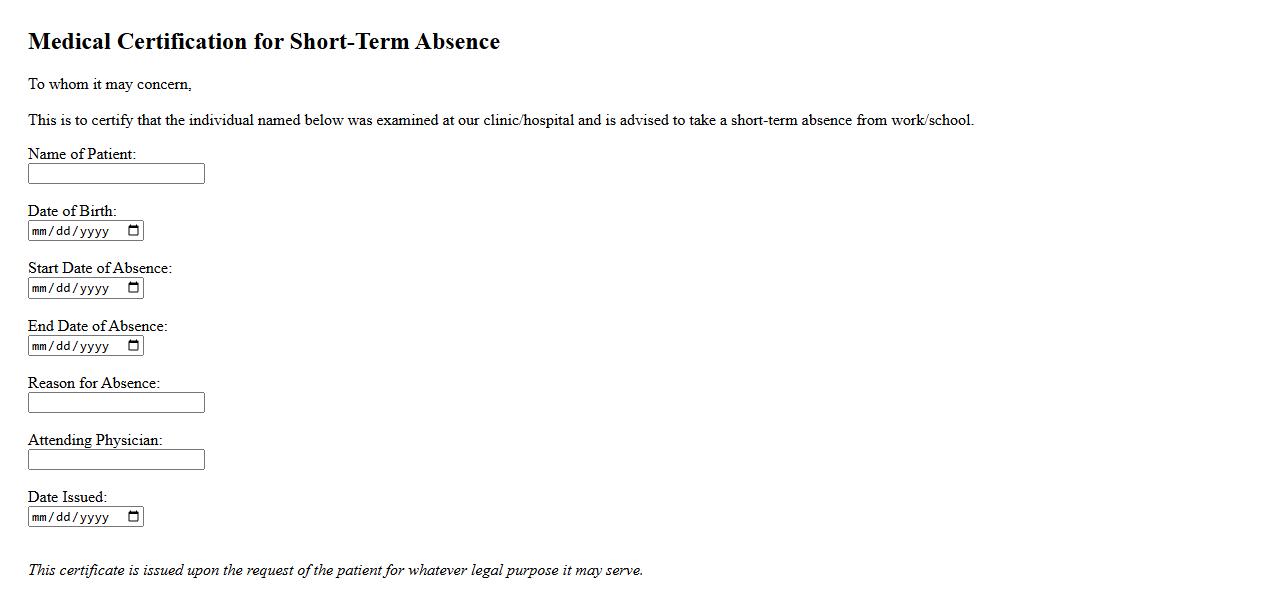

Medical Certification for Short-Term Absence

Obtaining medical certification for short-term absence ensures proper documentation of an employee's health condition. This certification validates the need for leave due to illness and supports compliance with company policies. It helps employers manage attendance while safeguarding employee rights.

Employer Statement for Disability Benefits

An Employer Statement for Disability Benefits is a crucial document that verifies an employee's job status and medical condition to facilitate their disability claim. It provides detailed information about the employee's duties, work history, and the impact of their disability on job performance. This statement helps insurance providers or government agencies make informed decisions regarding benefit eligibility.

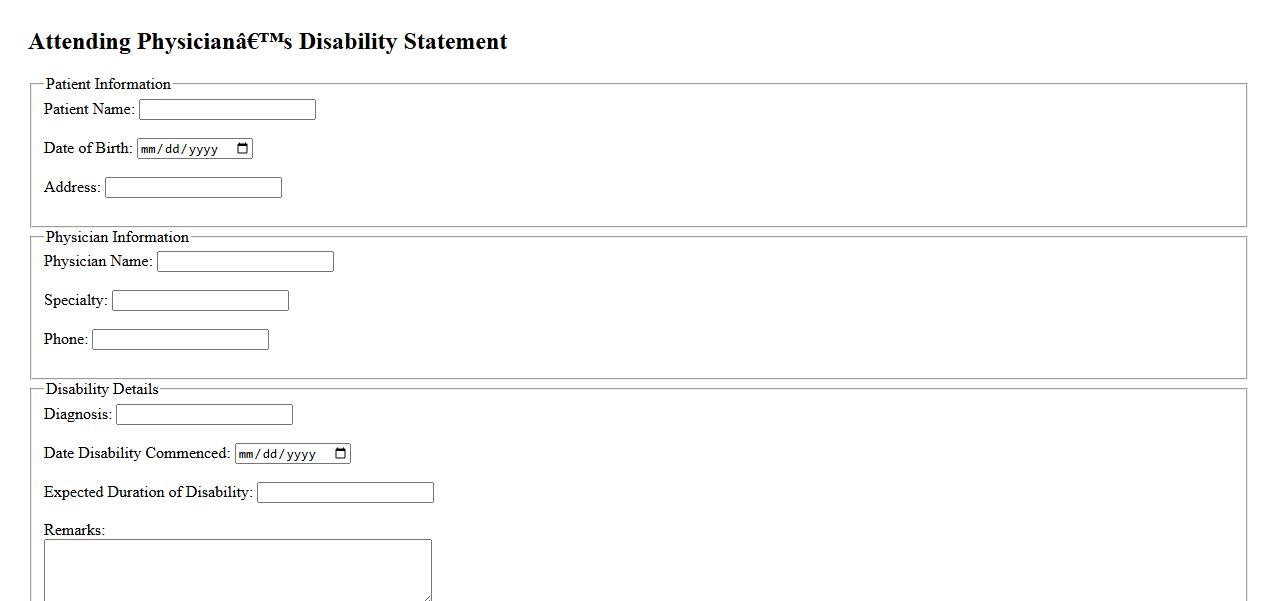

Attending Physician’s Disability Statement

The Attending Physician's Disability Statement is a critical medical document that certifies an individual's disability status based on a physician's evaluation. It provides necessary details for employers, insurance companies, or government agencies to validate disability claims. Accurate completion of this statement ensures appropriate support and benefits for the disabled person.

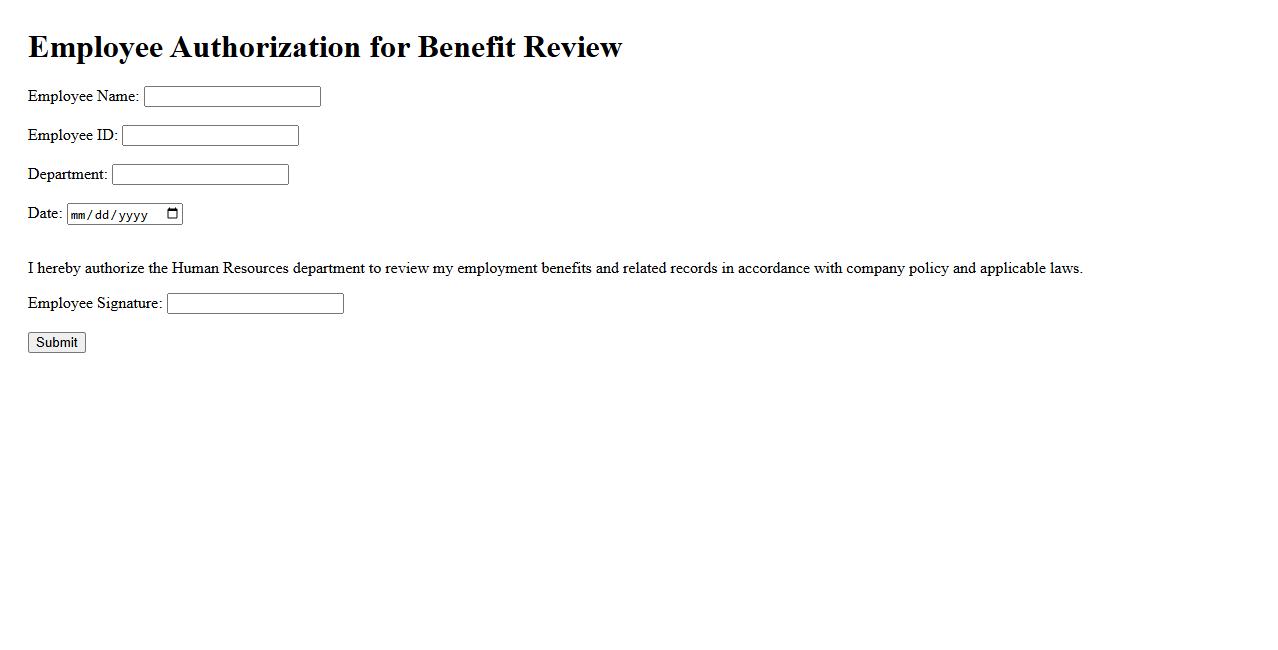

Employee Authorization for Benefit Review

Employee Authorization for Benefit Review ensures that employees give consent for their personal information to be accessed and evaluated. This process is critical for maintaining transparency and compliance with company policies. It allows authorized personnel to accurately assess and manage employee benefits.

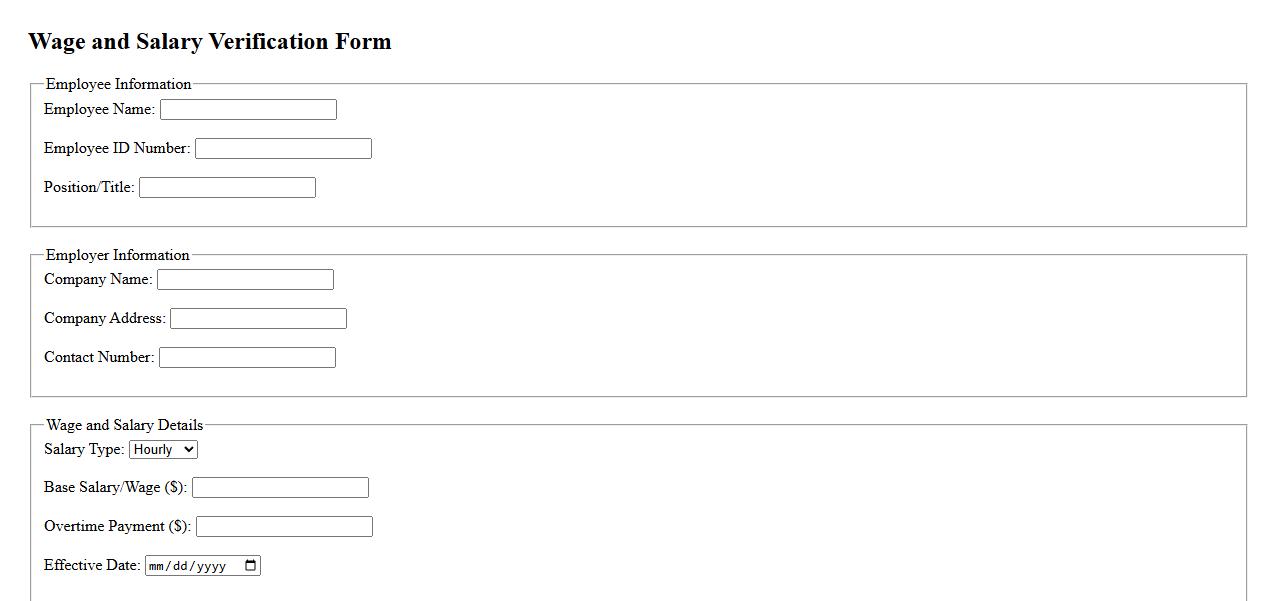

Wage and Salary Verification Form

The Wage and Salary Verification Form is an essential document used by employers to confirm an employee's income details. It provides accurate information about wages, salary history, and employment status for various financial and legal purposes. This form ensures transparency and aids in processes such as loan applications and background checks.

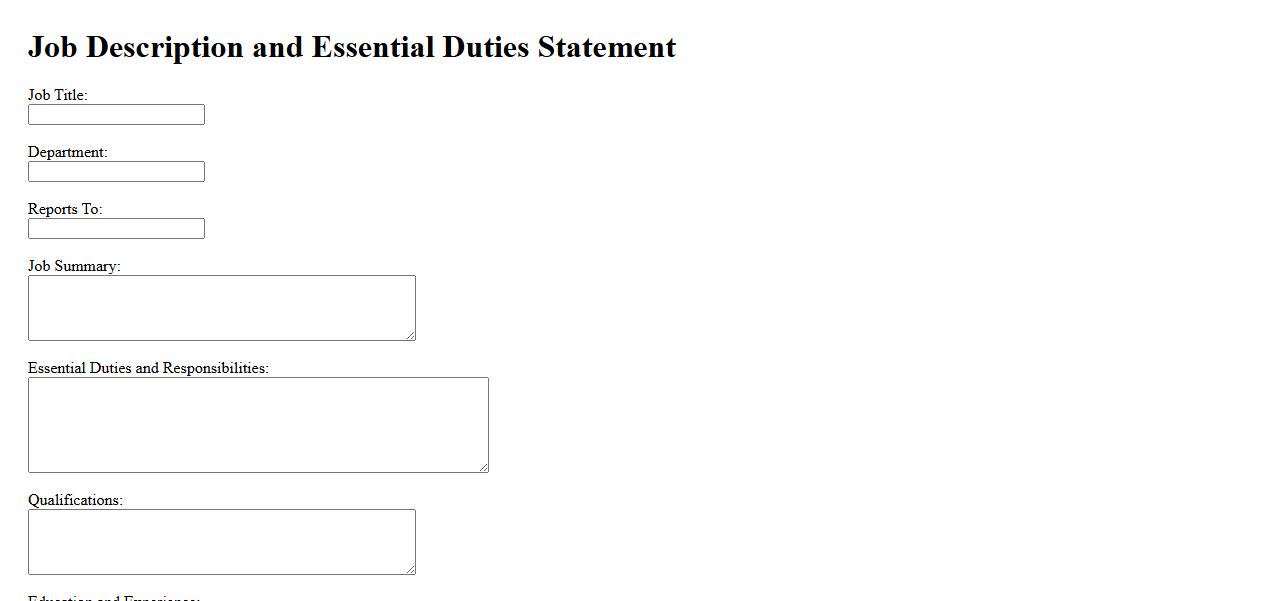

Job Description and Essential Duties Statement

The Job Description and Essential Duties Statement outlines the primary responsibilities and tasks required for a specific role within an organization. It provides clear expectations and helps ensure that employees understand their key duties. This document is essential for performance evaluations and recruitment processes.

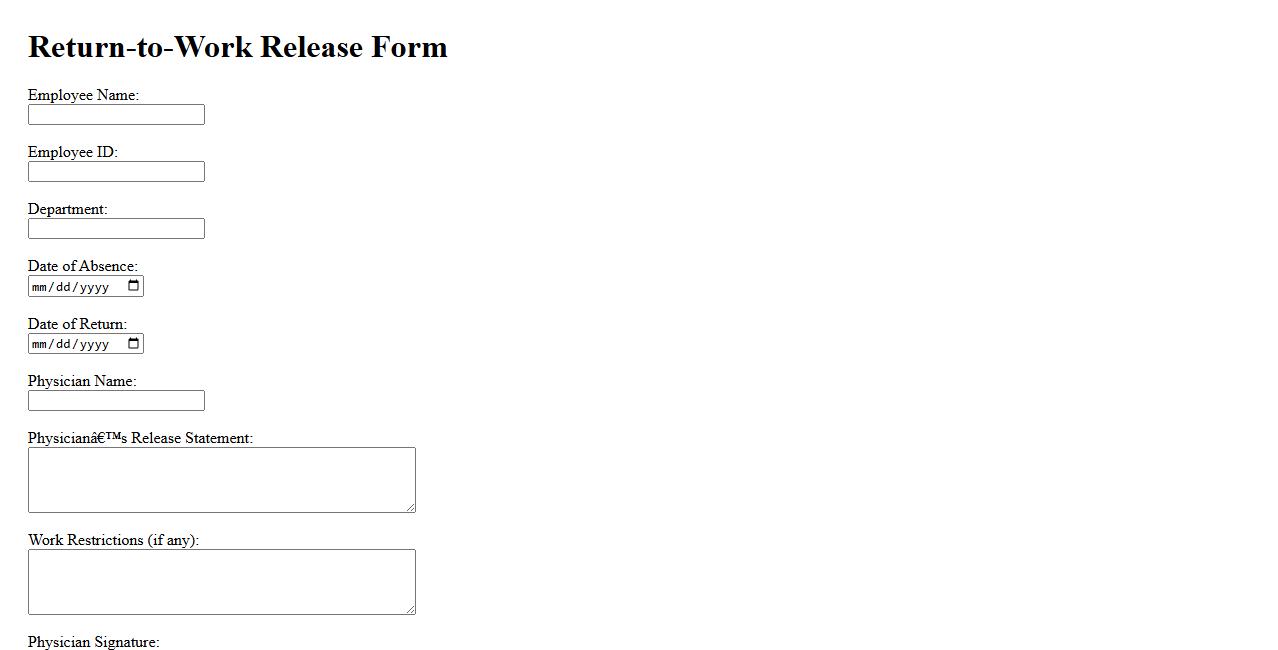

Return-to-Work Release Form

The Return-to-Work Release Form is a crucial document that certifies an employee's fitness to resume duties after an illness or injury. It ensures workplace safety by confirming the individual's health status through professional medical clearance. Employers use this form to comply with health regulations and support a smooth transition back to work.

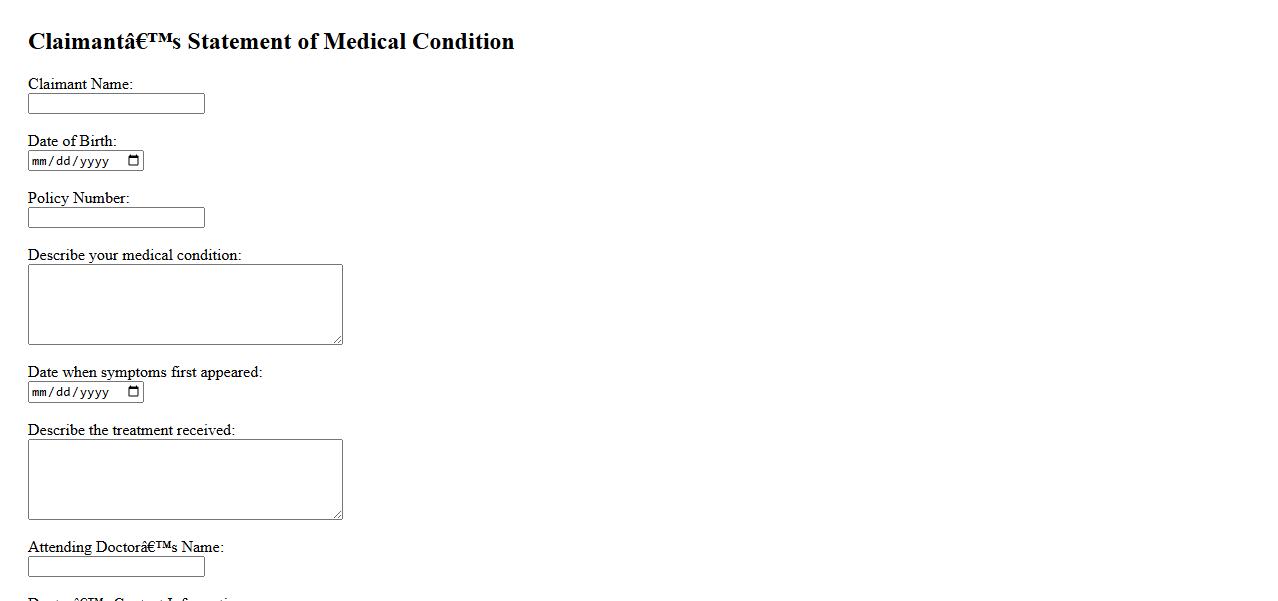

Claimant’s Statement of Medical Condition

The Claimant's Statement of Medical Condition is a crucial document detailing the individual's health status and medical history. It serves as essential evidence in insurance and legal claims to support the extent of injury or illness. Accurate and comprehensive information in this statement ensures proper evaluation and processing of the claim.

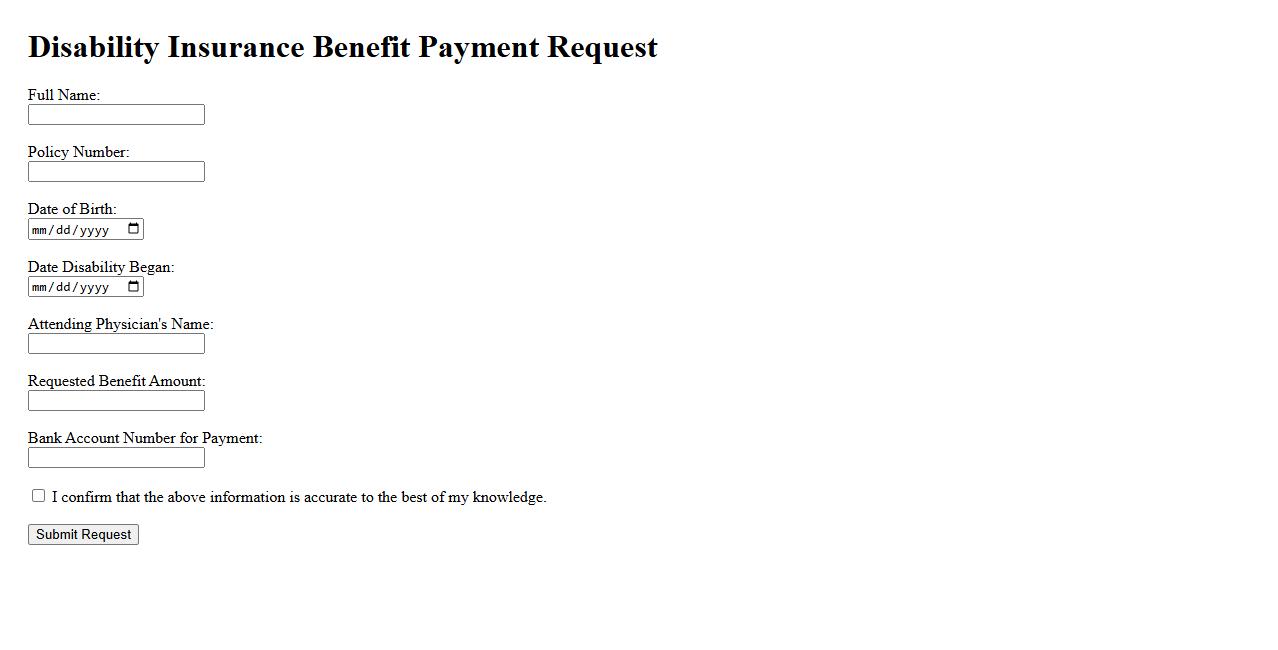

Disability Insurance Benefit Payment Request

The Disability Insurance Benefit Payment Request is a formal application submitted by individuals seeking financial support due to temporary or permanent disability. This request initiates the process of claiming monthly benefit payments to assist with living expenses during the disability period. Timely submission and accurate documentation ensure quick approval and continuous support.

Medical Condition or Injury Basis for Short-Term Disability Claim

The basis for the short-term disability claim typically involves a medical condition or injury that significantly impairs an individual's ability to perform their job. Common conditions include musculoskeletal injuries, severe illnesses, or recovery from surgery. The claimant must provide detailed medical documentation to support the severity and impact of the condition.

Impact on Performing Regular Job Duties

The medical condition must prevent the individual from carrying out essential job functions safely and effectively. This includes limitations in physical activity, cognitive function, or endurance required for regular tasks. The restriction is often assessed through a physician's evaluation and work capacity report.

Expected Start and End Dates of Work Absence

The work absence period is defined by a start date when the disability begins impacting job performance and an estimated end date based on the expected recovery timeline. These dates are usually determined by the treating healthcare provider. Accurate dates help in planning for benefits and potential return-to-work scenarios.

Verification and Documentation by a Licensed Healthcare Provider

Verification by a licensed healthcare provider is essential to authenticate the disability claim. This documentation typically includes diagnostic information, treatment plans, and prognosis. Without proper verification, the claim may not be approved by short-term disability insurers.

Other Income Sources or Benefit Claims During Disability

Disclosure of any other income sources or benefit claims is crucial to ensure accurate benefit coordination. This may include workers' compensation, unemployment benefits, or other disability insurance. Identifying overlapping benefits helps prevent duplication of payments and ensures compliance with policy terms.